|

市场调查报告书

商品编码

1272678

氢氧化铝市场 - 增长、趋势、COVID-19 影响和预测 (2023-2028)Aluminum Hydroxide Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

预计在预测期内,氢氧化铝(三水合物)市场的复合年增长率将超过 4.5%。

主要亮点

- COVID-19 对行业增长产生了一定程度的影响,暂时停止了生产。 不过,疫情过后,氢氧化铝在各行业的消费量逐渐增加。

- 市场研究的主要推动力包括增加聚合物在应用中的使用(主要用作阻燃剂)以及提高建筑物的安全标准。 主要由于暴露于氢氧化铝而增加的健康风险预计将阻碍市场增长。

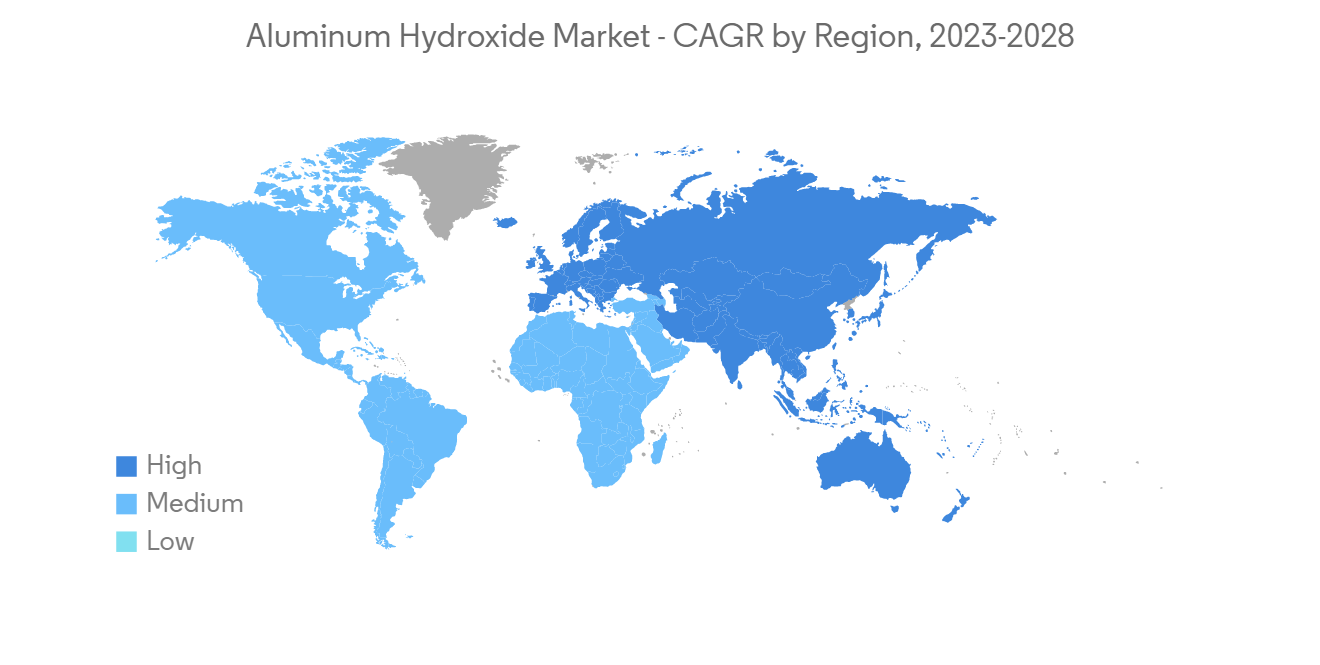

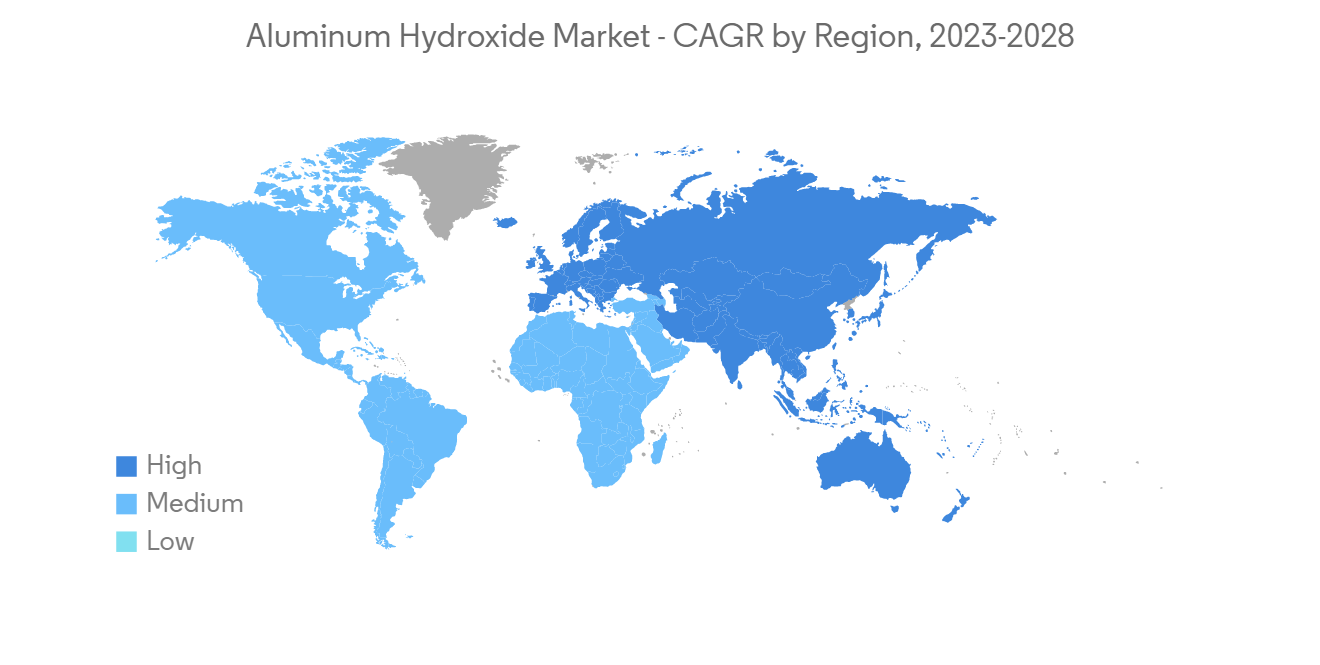

- 在预测期内,电池和化学品使用量的增加预计将成为所研究市场的增长机会。 由于塑料需求激增,亚太地区主导着全球氢氧化铝行业,尤其是在中国和印度等国家。

氢氧化铝行情

塑料细分市场占主导地位

- 三水合氧化铝主要用作塑料的阻燃剂。 近 40% 的三水氧化铝用于塑料工业。 在热塑性塑料中,阻燃剂在挤出过程中以熔融状态添加到聚合物基体中,而在热固性塑料中,阻燃剂通过缩聚或接枝作用添加到聚合物结构中。

- 由于塑料具有成本低、重量轻、耐用和防水等优点,因此被广泛用于各种最终用户行业。 主要的最终用户行业包括汽车/运输、建筑和电气/电子。

- 为了提高效率和设计灵活性,汽车行业对轻质和耐火材料的需求不断增加,这是推动塑料市场增长的主要因素。 高性能塑料为製造商提供了设计优势和可与钢材媲美的强度。 因此,它有助于减轻整体重量并减少温室气体 (GHG) 排放。

- 出于健康、安全和回收方面的考虑,电气行业正在寻找阻燃剂的替代品,而不是使用卤素作为阻燃剂。 为满足这些需求而开发的无卤素材料将广泛用于电气设备应用,例如断路器、接触器、变压器、电机等的绝缘体和外壳。

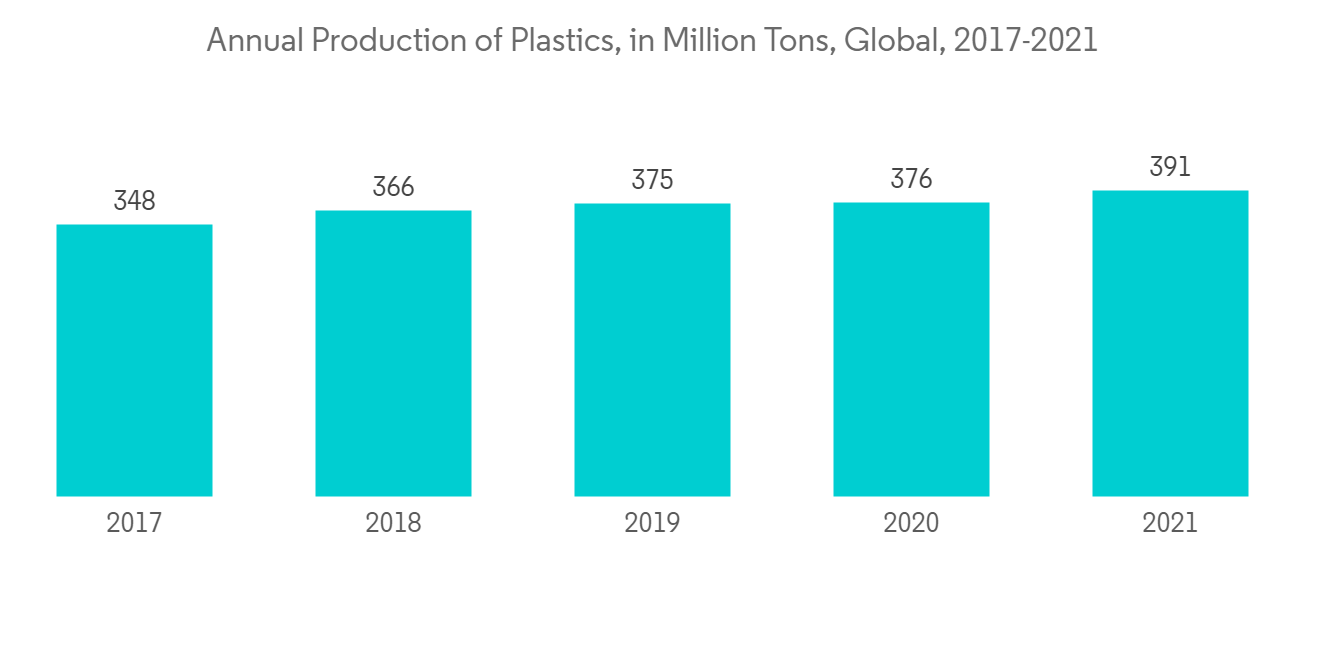

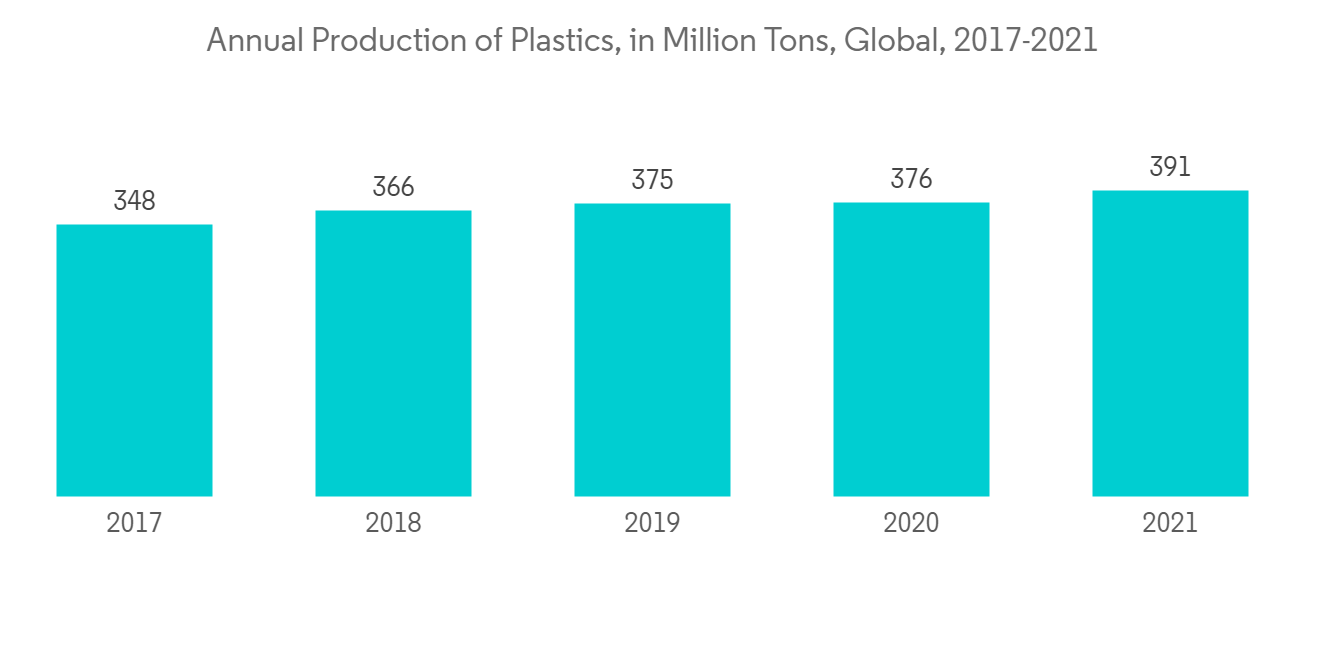

- 到 2021 年,全球塑料产量将达到约 3.907 亿吨,年增长率为 4%。 在可预见的未来,塑料的需求将持续增长,预计到 2050 年产量将达到 5.89 亿吨。 预计对可持续塑料包装等环保解决方案的需求也会增长。

- 中国是塑料的主要生产国,约占全球产量的 32%。 儘管大流行对经济造成影响,但中国塑料製品的产量在 2020 年有所增加。 中国目前每月生产 6 至 800 万吨塑料製品。

- 此外,印度塑料工业自成立以来发展迅速,现已成为全球塑料生产的主要参与者,拥有 20,000 多个加工单位。 它是一个价值数十亿美元的产业,为印度经济做出了重大贡献,僱用了约 400 万人。 它还是全球供应商,2021 年印度聚合物出口量约为 150 万吨。

- 亚太和欧洲地区聚合物生产活动的增加可能会在预测期内推动氢氧化铝市场。

中国主导亚太

- 亚太市场以中国为主。 中国是全球最大的化工市场之一,对区域市场影响重大。 近年来,国有和民营企业的跨境併购以及海外绿地投资快速增长。

- 在正在进行的“十三五”规划中,中国化工行业有望进入以绿色发展、产业升级和结构发展为特征的新阶段。 中国的医疗保健行业也在快速增长。 作为北京“中国製造 2025”工业计划的一部分,习近平主席宣布了重点关注医药创新和本土研发的计划。

- 2021 年,中国的医疗总支出将超过 7.7 万亿元人民币(1.1 万亿美元)。 总体而言,医疗保健支出预计将增长至 2.53 万亿美元,复合年增长率为 8.4%。 医疗支出占中国GDP的比重预计将从2022年的6.6%增加到2035年的9.1%。

- 印度约占世界塑料消费量的 6%,是仅次于中国和美国的第三大消费国。 预计经济增长和人口增长将在未来几十年推动塑料消费,预计到 2060 年印度的塑料消费量将超过 1.6 亿吨。 预计这些因素将在预测期内推动中国氢氧化铝市场。

氢氧化铝行业概况

氢氧化铝市场本质上是分散的,全球有多家製造商。 主要公司包括中国铝业股份有限公司(中国铝业)、Nabaltec AG、TOR Minerals International Inc.、Huber Engineered Materials 和 LKAB Minerals AB。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 调查先决条件

- 本次调查的范围

第二章研究方法论

第 3 章执行摘要

第四章市场动态

- 主持人

- 更多地使用聚合物作为阻燃剂

- 提高建筑物的安全标准

- 约束因素

- 接触氢氧化铝会增加健康风险

- 其他抑製剂

- 工业价值链分析

- 波特的五力分析

- 供应商的议价能力

- 消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第 5 章市场细分(市场规模:基于数量)

- 产品类型

- 工业级

- 医药级

- 其他产品类型

- 最终用户行业

- 塑料

- 医药

- 涂层剂、粘合剂、密封剂、弹性体

- 其他最终用户行业

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 德国

- 英国

- 意大利

- 法国

- 其他欧洲

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙特阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章竞争格局

- 併购、合资、合作、合同等。

- 市场份额 (%)/排名分析

- 主要公司采用的策略

- 公司简介

- Almatis

- Alteo

- ALUMINA-CHEMICALS & CASTABLES

- Aluminum Corporation of China Ltd(Chalco)

- MAL-Magyar Alumnium

- Nabaltec AG

- Sumitomo Chemical Co. Ltd

- Huber Materials

- Sibelco

- LKAB Minerals AB

- TOR Minerals International, Inc.

- Akrochem Corporation

- Hindalco(Aditya Birla Management Corporation Pvt. Ltd)

第七章市场机会与未来趋势

- 增加在电池和化学品中的使用

简介目录

Product Code: 48013

The market for aluminum hydroxide (Alumina Trihydrate) is anticipated to register a CAGR of over 4.5% during the forecast period.

Key Highlights

- COVID-19 moderately impacted industry growth and temporarily halted production. However, post-pandemic, the consumption of aluminum hydroxide is increasing gradually in various industries.

- Major factors driving the market study include increasing usage in polymer applications, primarily as fire retardants, and a rise in safety standards in building construction. Increasing health risks, primarily due to exposure to aluminum hydroxide, are expected to hinder the market's growth.

- The rising usage of batteries and chemicals is expected to act as a growth opportunity for the market studied over the forecast period. Asia Pacific dominates the global aluminum hydroxide industry due to the surging plastic demand, especially in countries such as China and India.

Aluminum Hydroxide Market Trends

Plastics Segment to Dominate the Market

- Alumina trihydrate is majorly used in plastics as a flame retardant. Almost 40% of the alumina trihydrate produced is being used in the plastics industry. In thermoplastics, flame-retardant substances are added to the polymer matrix in a molten state during extrusion, while in thermosetting plastics, the flame-retardant materials are added to the polymer structure using polycondensation or grafting.

- Plastics are being used in different end-user industries owing to their advantages, such as low cost, less weight, durability, water-resistant, etc. Some of the major end-user industries include automotive and transportation, construction, and electrical and electronics, among others.

- Growing demand for lightweight and fire-resistant materials in the automotive industry to provide increased efficiency and design flexibility is primarily responsible for the growth of the plastics market. High-performance plastics offer manufacturers the advantages of design and comparable strength to steel. Thus, this helps in reducing the overall weight and controlling greenhouse gas emissions (GHG).

- The electrical industry is seeking alternatives to the use of halogens as flame retardants for health, safety, and recycling reasons. Created specifically to address these needs, the non-halogenated material will see widespread use in electrical applications such as insulating elements and housings for circuit breakers, contactors, transformers, and motors.

- Global plastics production was around 390.7 million metric tons in 2021, an annual increase of 4%. Plastic demand is set to continue growing for the foreseeable future, with production set to reach 589 million metric tons in 2050. The demand for eco-friendly solutions such as sustainable plastic packaging is also expected to experience growth.

- China is the leading producer of plastics, accounting for roughly 32% of global production. Despite the economic impacts of the pandemic, the production of plastic products in China increased in 2020. China currently produces 6-8 million metric tons of plastic products monthly.

- Furthermore, India's plastic industry has grown rapidly since its inception and is now a key player in global plastics production, comprising more than 20,000 processing units. It is a multi-billion dollar industry and a major contributor to India's economy, employing some four million people. It is also a global supplier, with India's polymer exports totaling some 1.5 million metric tons in 2021.

- The increase in polymer production activities in the Asia Pacific and European regions will likely drive the aluminum hydroxide market during the forecast period.

China to Dominate in Asia-Pacific

- China dominated the Asia-Pacific market. China has one of the world's largest chemical markets, significantly impacting the regional market. In recent years, there was a rapid growth in cross-border mergers and acquisitions by state-owned enterprises and private entities, as well as outbound greenfield investments.

- During the ongoing 13th five-year plan, China's chemical industry is expected to enter a new stage characterized by green development, industrial up-gradation, and structural developments. The Chinese healthcare sector is also growing at a rapid pace. As a part of Beijing's "Made in China 2025" industry plan, President Xi Jinping announced plans to focus on innovation and homegrown R&D concerning the pharmaceutical sector.

- In 2021, the total expenditure on health care in China reached over CNY 7.7 trillion (USD 1.1 trillion). Overall, healthcare spending is expected to increase to USD 2.53 trillion, representing a compound annual growth rate of 8.4%. The share of health spending in China's GDP will increase from 6.6%in 2022 to 9.1% in 2035.

- India accounts for approximately 6% of global plastics consumption, making it the third-largest consumer behind China and the United States. Economic growth and population growth are expected to drive plastics use in the coming decades, with projections showing that plastics consumption in India could rise to more than 160 million metric tons by 2060. Such factors are expected to drive the Chinese aluminum hydroxide market during the forecast period.

Aluminum Hydroxide Industry Overview

The aluminum hydroxide market is fragmented in nature, with several manufacturers across the world. The major companies include Aluminum Corporation of China Limited (Chalco), Nabaltec AG, TOR Minerals International Inc., Huber Engineered Materials, and LKAB Minerals AB, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Use in Polymer Applications as Fire Retardants

- 4.1.2 Rise in Safety Standards in Building Construction

- 4.2 Restraints

- 4.2.1 Increasing Health Risks due to Exposure to Aluminum Hydroxide

- 4.2.2 Other Restraints

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Product Type

- 5.1.1 Industrial Grade

- 5.1.2 Pharmaceutical Grade

- 5.1.3 Other Product Types

- 5.2 End-User Industry

- 5.2.1 Plastics

- 5.2.2 Pharmaceuticals

- 5.2.3 Coatings, Adhesives, Sealants & Elastomers

- 5.2.4 Other End-User Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.2.4 Rest of North America

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Almatis

- 6.4.2 Alteo

- 6.4.3 ALUMINA - CHEMICALS & CASTABLES

- 6.4.4 Aluminum Corporation of China Ltd (Chalco)

- 6.4.5 MAL - Magyar Alumnium

- 6.4.6 Nabaltec AG

- 6.4.7 Sumitomo Chemical Co. Ltd

- 6.4.8 Huber Materials

- 6.4.9 Sibelco

- 6.4.10 LKAB Minerals AB

- 6.4.11 TOR Minerals International, Inc.

- 6.4.12 Akrochem Corporation

- 6.4.13 Hindalco (Aditya Birla Management Corporation Pvt. Ltd)

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Usage in Batteries and Chemicals

02-2729-4219

+886-2-2729-4219