|

市场调查报告书

商品编码

1272689

汽车涂料市场 - 增长、趋势、COVID-19 影响和预测 (2023-2028)Automotive Coatings Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

在预测期内,汽车涂料市场预计将以 4% 左右的复合年增长率增长。

主要亮点

- 市场增长的主要驱动力之一是汽车行业产量的增加和对水基技术的需求增加。

- 但是,对 VOC 排放的严格监管可能会限制市场增长。

- 中东和非洲的投资机会有望成为未来市场增长的机会。

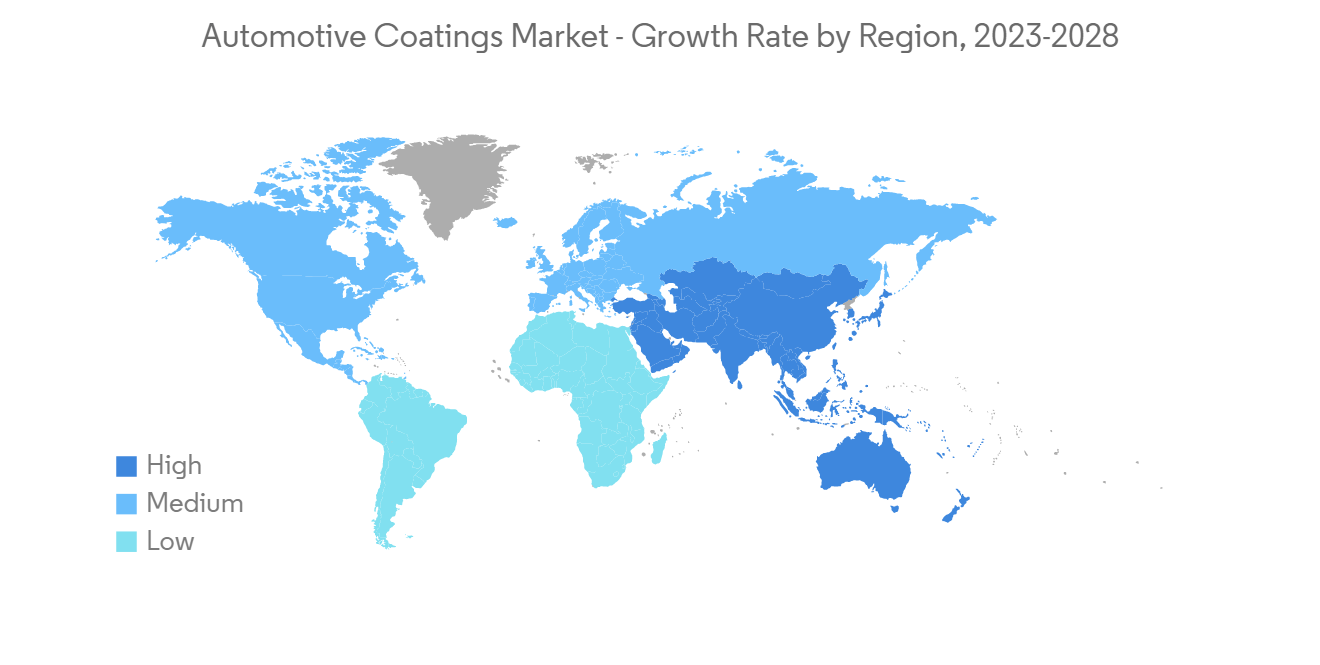

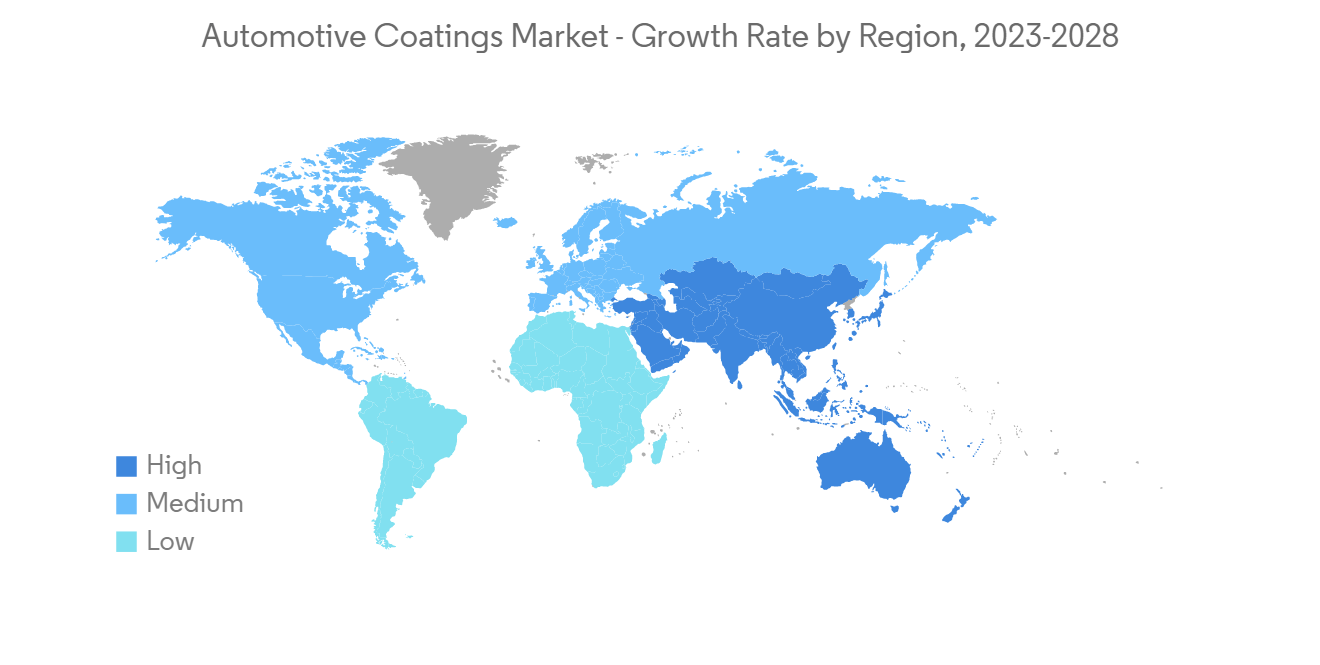

- 预计亚太地区在预测期内的增长率最快。

汽车涂料的市场趋势

OEM 有望显示显着的市场增长

- 在 COVID-19 期间,封锁、跨境运输减少和居家政策对汽车涂料市场产生了影响。

- 巴斯夫是全球最大的汽车 OEM 涂料製造商之一。 该公司提供电泳漆、底漆、底漆和清漆产品。

- 此外,丰田汽车公司是仅次于德国大众汽车公司的全球第二大汽车原始设备製造商。 我们製造和销售乘用车、卡车、公共汽车、摩托车、轻型商用车、原装零件、涡轮机械、大直径柴油发动机、推进零件、特殊齿轮装置、检查系统等。 我们还开发车辆和发动机。

- 涂料在汽车行业中用于防止腐蚀和保护车身免受损坏。 根据 OICA 的数据,2021 年全球汽车产量将达到 8010 万辆,比上年的 7760 万辆增长 4%。 推动市场增长的主要因素是越来越多的汽车被製造出来是因为人们想要它们。

- 汽车行业所用涂料的整体市场预计将受到轻型和商用车产量增加的推动。 据 LMC Automotive 预测,到 2023 年 1 月,全球小型车年销量将达到 8300 万辆。

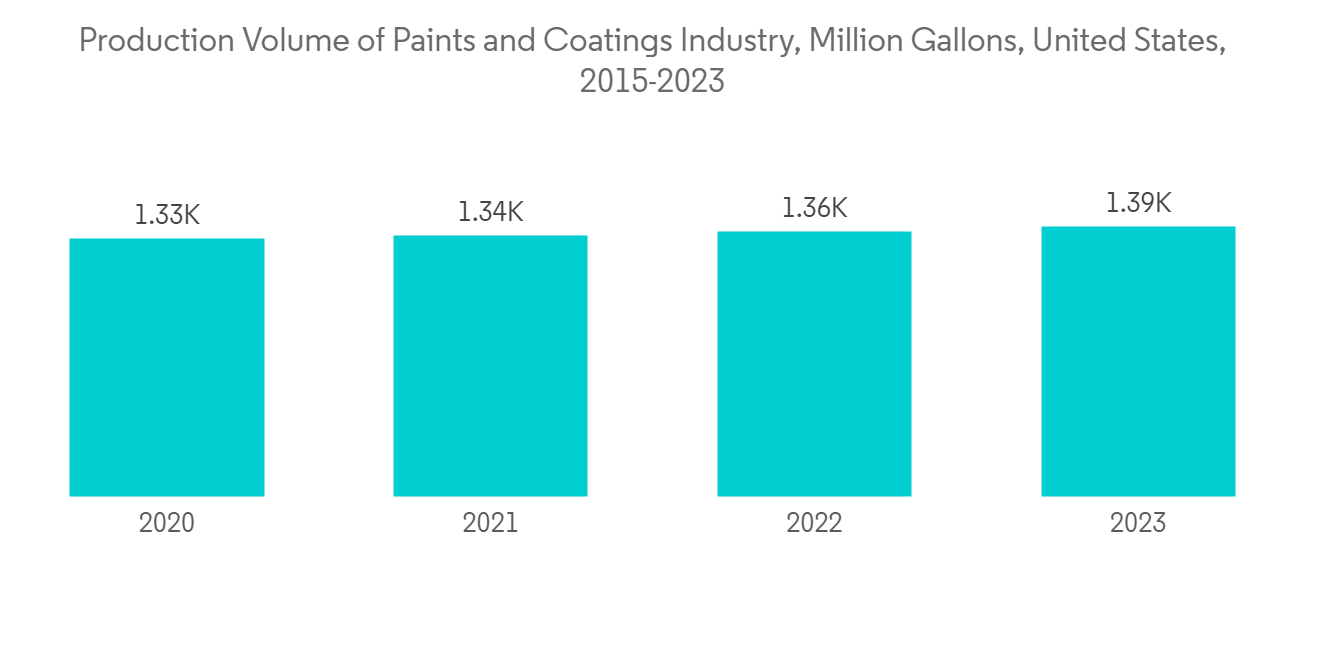

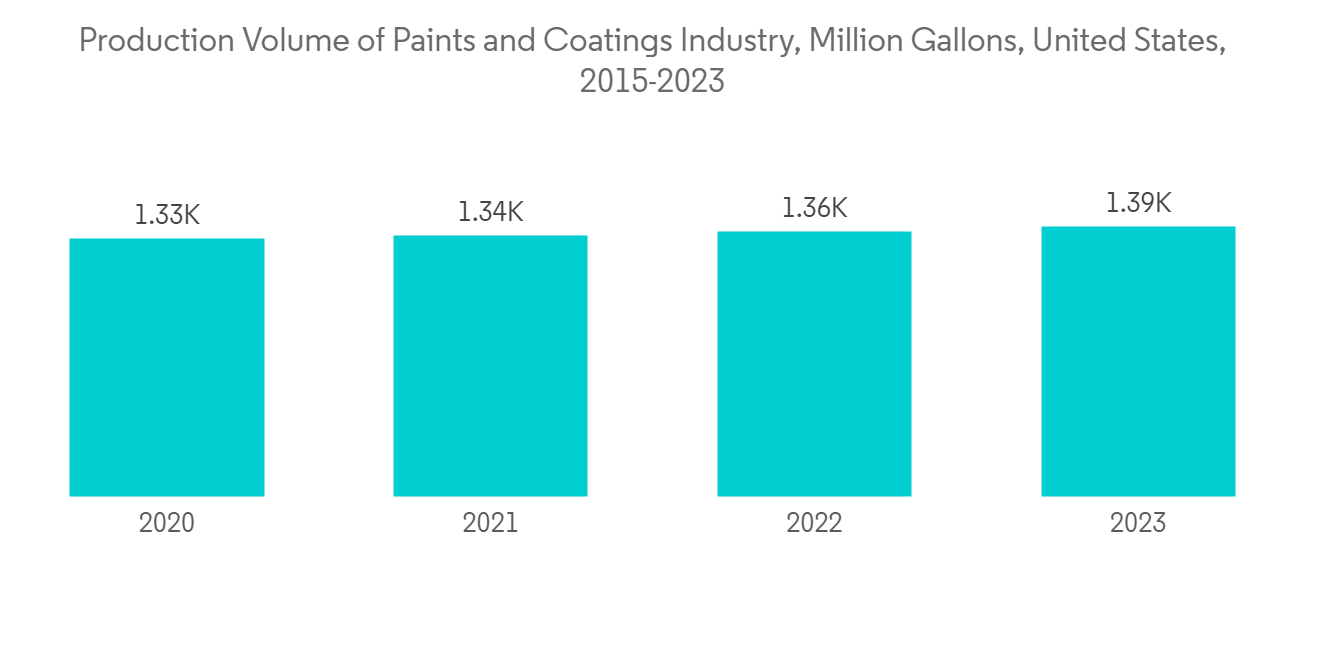

- 汽车油漆和涂料是为金属提供保护膜并改善汽车外观的表面处理剂。 到 2021 年,美国油漆和涂料行业的利润将达到 14 亿美元。

- 根据美国涂料协会的数据,2021 年美国将向加拿大出口 11 亿美元,向墨西哥出口 6.32 亿美元,总价值 170 亿美元的油漆和涂料。

- 所有这些因素都意味着水性技术将在未来几年内呈现出最高的增长速度。

预计亚太地区的增长率最高

- 亚太地区是最大的汽车涂料市场,其次是北美和欧洲。 印度和东盟国家的汽车生产有望拉动亚太地区对汽车涂料的需求。

- 随着亚洲越来越多的人购买二手车、越来越多的人乘坐出租车以及越来越多的汽车维修和车身修理场所,对汽车涂料的需求可能会增长。

- 中国的汽车製造业是世界上最大的。 然而,近年来该行业发展放缓,产销量双双下降。 根据中国汽车工业协会(CAAM)的数据,2022 年 12 月中国汽车销量同比下降 8.4% 至 256 万辆,而 2022 年全年销量增长至 2686 万辆。

- 根据印度品牌资产基金会的数据,到 2027 年,印度汽车市场的价值将达到 548.4 亿美元,复合年增长率超过 9%。 到 2026 年,印度汽车业希望出口的汽车数量是现在的五倍。 2022 年印度的汽车出口总量将达到 5,607,246 辆。

- 许多汽车製造商正在向该行业的不同领域投入大量资金。 例如,2022 年 11 月,印度玛鲁蒂铃木宣布将投资 8.6512 亿美元用于多个项目,包括建设新设施和製造新车型。

- 此外,亚太地区预计在此预测所涵盖的时期内增长最快。

汽车涂料行业概况

汽车涂料市场正在整合,因为大部分市场份额被几家公司瓜分。 市场参与者包括 Axalta Coating Systems Ltd.、BASF SE、Akzo Nobel NV、The Sherwin-Williams Company、PPG Industries Inc. 等公司。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 调查结果

- 本次调查的假设

- 本次调查的范围

第二章研究方法论

第 3 章执行摘要

第四章市场动态

- 主持人

- 对水溶性技术的需求不断扩大

- 其他

- 约束因素

- 针对 VOC 排放的严格环境法规

- 工业价值链分析

- 波特的五力分析

- 供应商的议价能力

- 消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第 5 章市场细分(市场规模:基于金额)

- 树脂类型

- 聚氨酯

- 环氧树脂

- 亚克力

- 其他树脂类型

- 技术信息

- 溶剂型

- 水溶性

- 粉末

- 图层

- 电子外套

- 底毛

- 底漆

- 透明涂层

- 申请

- 贴牌生产

- 优化

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳大利亚和新西兰

- 印度尼西亚

- 马来西亚

- 泰国

- 其他地区(东盟

- 其他亚太地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 法国

- 英国

- 意大利

- 西班牙

- 俄罗斯

- 其他欧洲

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙特阿拉伯

- 南非

- 埃及

- 其他中东和非洲 (MEA)

- 亚太地区

第六章竞争格局

- 併购、合资企业、合作、合同

- 市场份额分析

- 主要公司采用的策略

- 公司简介

- BASF SE

- Akzo Nobel NV

- Axalta Coating Systems Ltd.

- Beckers Group

- Bollig & Kemper

- Cabot Corporation

- Eastman Chemical Company

- HMG Paints Limited

- Jotun

- Kansai Nerolac Paints Limited

- KCC Corporation

- Lord Corporation

- Nippon Paint Holdings Co. Ltd.

- PPG Industries Inc.

- Shanghai Kinlita Chemical Co. Ltd.

- The Sherwin-Williams Company

第七章市场机会与未来趋势

简介目录

Product Code: 51942

During the time frame of the forecast, the automotive coatings market is expected to grow at a CAGR of about 4%.

Key Highlights

- One of the major factors driving market growth is increasing production in the automotive industry and growing demand for waterborne technology.

- However, stringent regulations regarding VOC emissions are likely to restrict market growth.

- Investment opportunities in the Middle East and Africa are expected to provide opportunities for market growth in the future.

- Asia-Pacific is expected to account for the fastest growth rate during the forecast period.

Automotive Coatings Market Trends

OEM is Likely to Show a Significant Market Growth

- The lockdown, the reduction of cross-border transportation, and the stay-at-home policies all had an effect on the automotive coatings market during COVID-19.

- One of the biggest companies in the world that makes OEM coatings for cars is BASF. The company offers e-coat, primer, basecoat, and clearcoat products.

- Additionally, Toyota Motor Corp. is the second-largest automotive OEM in the world, after Germany's Volkswagen AG. The company makes and sells passenger cars, trucks, buses, motorcycles, light commercial vehicles, genuine parts, turbomachinery, large-bore diesel engines, propulsion components, special gear units, and testing systems. It also develops vehicles and engines.For the year 2021, the company reported revenues of USD 295,850 million. The automotive original equipment manufacturer market is expected to reach around USD 50 million by 2030.

- Coatings are used in the automotive industry to protect against corrosion and protect the body from damage. According to OICA, in 2021, global vehicle production reached 80.1 million units, an increase of 4% from the previous year's production of 77.6 million units. The main thing that makes the market grow is that more cars are being made because people want them.

- The overall market for coatings used in the automotive industry is expected to be driven by the rise in the number of light and commercial vehicles being made.In January 2023, the global light vehicle sales rate stood at 83 million units per year, according to LMC Automotive.

- Automotive paints and coatings are the surface treatments that give the metal protective layers and improve the appearance of the car. The paint and coatings industry in the United States will have a positive surplus of USD 1.4 billion in 2021.

- According to the American Coatings Association, in 2021, the United States exported paint and coatings worth USD 1.1 billion to Canada and USD 632 million to Mexico, totaling USD 1,7 billion.

- Due to all of these factors, water-borne technology is likely to have the highest growth rate over the next few years.

Asia-Pacific is Expected to Witness the Highest Growth Rate

- Asia-Pacific is the largest market for automotive coatings, followed by North America and Europe. Automotive production in India and ASEAN countries is expected to boost Asia-Pacific demand for automotive coatings.

- Automotive coatings are likely to be in higher demand because more people are buying used cars, more people are using taxis, and there are more places in Asia that fix cars and do body work.

- The Chinese automotive manufacturing industry is the largest in the world. However, the industry witnessed a slowdown in recent years, as both production and sales declined. According to the China Association of Automobile Manufacturers (CAAM), automotive sales in China fell by 8.4% year over year to 2.56 million units in December 2022, whereas for the full year 2022, the sales grew to 26.86 million units.

- The India Brand Equity Foundation says that by 2027, the Indian car market will be worth USD 54.84 billion, with a CAGR of over 9%.By the year 2026, the Indian auto industry wants to export five times as many cars as it does now.In 2022, total automobile exports from India stood at 5,617,246.

- Many automakers are putting a lot of money into different parts of the industry. For example, in November 2022, Maruti Suzuki India said it would put USD 865.12 million into several projects, such as building a new facility and making new models.

- Also, the Asia-Pacific region is likely to grow the most during the period covered by the forecast.

Automotive Coatings Industry Overview

The automotive coatings market is consolidated, as the majority of the market share is divided among a few companies. Some of the key players in the market include Axalta Coating Systems Ltd., BASF SE, Akzo Nobel NV, The Sherwin-Williams Company, and PPG Industries Inc., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand for Water-borne technology

- 4.1.2 Others

- 4.2 Restraints

- 4.2.1 Stringent Environmental Regulations Regarding VOC Emissions

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Resin Type

- 5.1.1 Polyurethane

- 5.1.2 Epoxy

- 5.1.3 Acrylic

- 5.1.4 Other Resin Types

- 5.2 Technology

- 5.2.1 Solvent-borne

- 5.2.2 Water-borne

- 5.2.3 Powder

- 5.3 Layer

- 5.3.1 E-coat

- 5.3.2 Primer

- 5.3.3 Base Coat

- 5.3.4 Clear Coat

- 5.4 Application

- 5.4.1 OEM

- 5.4.2 Refinish

- 5.5 Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Australia & New-Zealand

- 5.5.1.6 Indonesia

- 5.5.1.7 Malaysia

- 5.5.1.8 Thailand

- 5.5.1.9 Rest of ASEAN

- 5.5.1.10 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 France

- 5.5.3.3 United Kingdom

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East & Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Egypt

- 5.5.5.4 Rest of Middle East & Africa (MEA)

- 5.5.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis**

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 Akzo Nobel NV

- 6.4.3 Axalta Coating Systems Ltd.

- 6.4.4 Beckers Group

- 6.4.5 Bollig & Kemper

- 6.4.6 Cabot Corporation

- 6.4.7 Eastman Chemical Company

- 6.4.8 HMG Paints Limited

- 6.4.9 Jotun

- 6.4.10 Kansai Nerolac Paints Limited

- 6.4.11 KCC Corporation

- 6.4.12 Lord Corporation

- 6.4.13 Nippon Paint Holdings Co. Ltd.

- 6.4.14 PPG Industries Inc.

- 6.4.15 Shanghai Kinlita Chemical Co. Ltd.

- 6.4.16 The Sherwin-Williams Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219