|

市场调查报告书

商品编码

1272694

甜菜碱市场 - 增长、趋势、COVID-19 影响和预测 (2023-2028)Betaine Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

在预测期内,甜菜碱市场的复合年增长率预计将超过 6%。

2020 年,COVID-19 对市场产生了负面影响,但现在市场估计已达到大流行前的水平,预计未来将稳定增长。

主要亮点

- 由于越来越多的公司将其用作表面活性剂、在食品和饮料中的使用增加以及个人护理行业需要更多,因此市场正在增长。

- 另一方面,会导致皮肤和毛髮问题的合成化妆品可能会成为市场製约因素。

- 在预测期内,甜菜碱可用作动物的压力缓解剂。

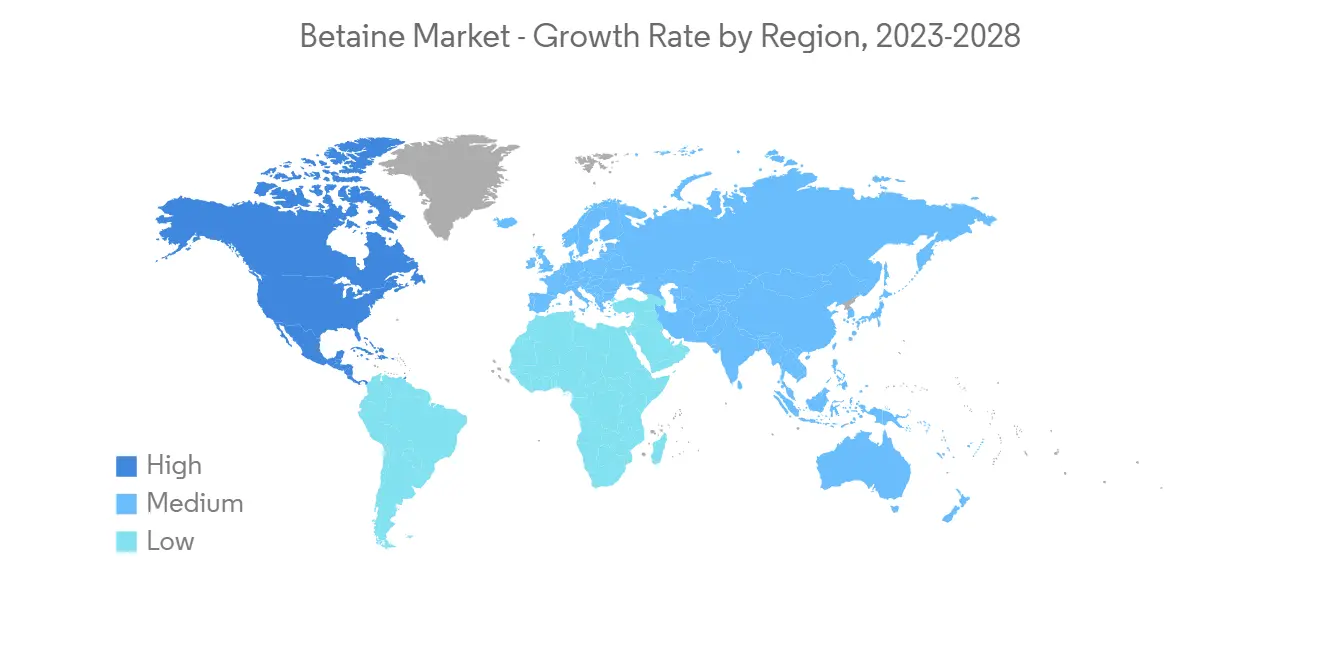

- 由于对个人护理产品、食品和饮料以及营养补充剂的高需求,北美在全球市场占据主导地位。

甜菜碱市场趋势

个人护理行业主导市场需求

- 甜菜碱通常用于个人护理行业,作为硫基表面活性剂的替代品。 它可有效缓解刺激,主要用于婴儿洗髮水和超温和的个人护理产品。

- 甜菜碱因其出色的保水性和保湿性而被广泛用作化妆品的原料。

- 它还广泛用作个人护理产品(例如乳液、洗髮水和皮肤清洁剂)中的表面活性剂、乳化剂和润肤剂。

- 在亚太和中东等地区,由于文化变迁、西方文化的影响、年轻人对化妆品的需求增加以及女性就业增加,对个人护理产品的需求显着增加。

- 在印度,美容和个人护理产品正在推动印度电子商务增长的需求。 根据电子商务数据,2022 财年电子商务销售额增长 69.4%,而 2021 财年为 44%,其中美容和个人护理品类的销售额同比增长 143%。

- 此外,根据印度尼西亚统计局 (BPS) 的数据,到 2022 年 12 月,化妆品行业将同比增长 9.61%。 主要平台是电子商务,个人护理行业在国内得到了发展。

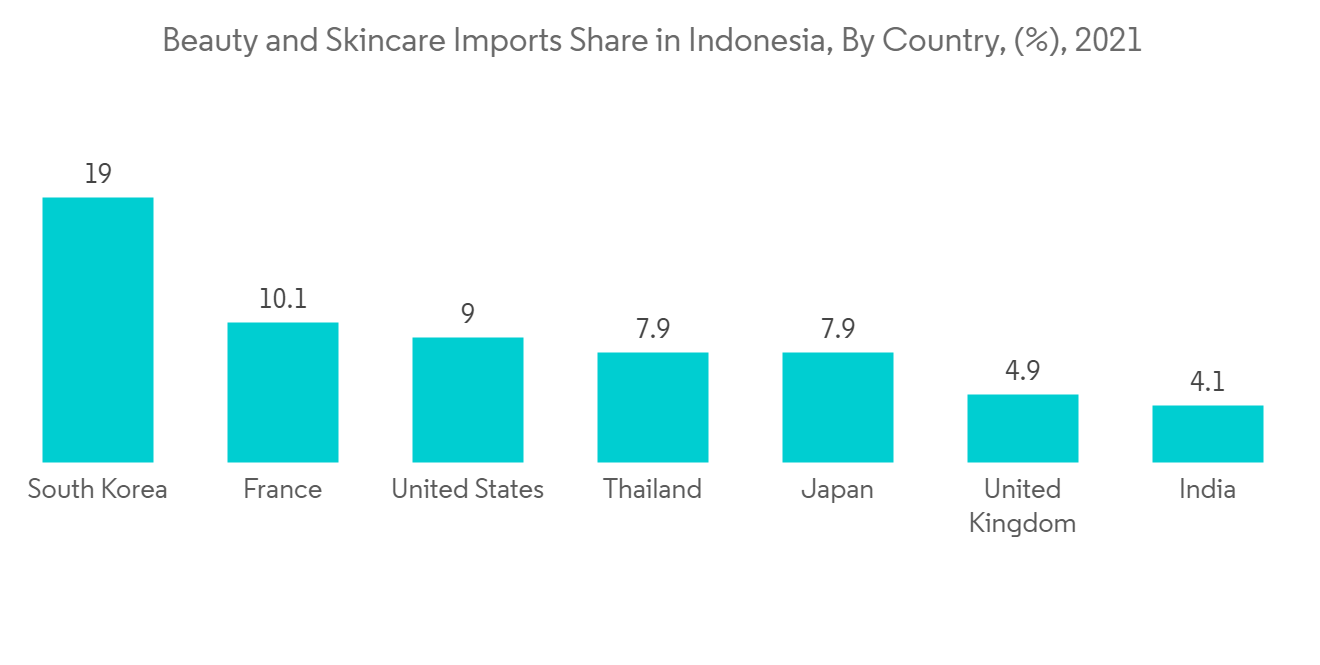

- 此外,根据贸易地图,印度尼西亚在 2021 年进口了价值超过 3.09 亿美元的化妆品和护肤品。 2021年,中国将占印尼美容护肤品进口市场的最大份额,为20.2%,其次是韩国,为19%。

因此,所有这些发展很可能会推动全球对个人护理产品的需求,进而推动预测期内对甜菜碱市场的需求。

北美主导市场

- 北美在全球市场占据主导地位。 该地区对甜菜碱的需求主要受到个人护理、动物饲料、营养补充剂和功能性饮料生产行业的强劲需求推动。

- 製药和个人护理行业不断增长的需求使美国成为该地区最大的市场。 美国已成为世界上最大的药品和个人护理产品生产国。

- 据 Happi Magazine 报导,仅在 2021 年,美国的护肤品市场规模就将超过 180 亿美元,其中面部护理占据了大部分。

- 国家投入巨资研发新型无硫个人护理产品。 展望未来,仿製药的发展也可能为甜菜碱市场提供新的机遇。

- 据 Happi Magazine 报导,2021 年,在美国,洗面奶的多店护肤品销售额最高。 该部门全年销售额总计超过 16.5 亿美元。 因此,支持市场的增长

- 因此,由于上述所有因素,预计预测期内同一地区市场对甜菜碱的需求将显着增加。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 调查先决条件

- 本次调查的范围

第二章研究方法论

第 3 章执行摘要

第四章市场动态

- 主持人

- 个人护理领域的需求不断扩大

- 扩大在食品和饮料行业的应用

- 扩大作为表面活性剂的商业用途

- 约束因素

- 合成化妆品引起的皮肤和头髮问题

- 其他约束

- 行业价值链分析

- 波特的五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第 5 章市场细分(市场规模:基于金额)

- 表格

- 无水甜菜碱

- 甜菜碱一水合物

- 甜菜碱盐酸盐

- 椰油□胺丙基甜菜碱

- 其他形式

- 类型

- 合成甜菜碱

- 天然甜菜碱

- 用法

- 饮料和膳食补充剂

- 动物饲料

- 个人护理

- 清洁剂

- 其他用途

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 意大利

- 其他欧洲

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙特阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章竞争格局

- 併购、合资、合作、合同等。

- 市场份额 (%)**/排名分析

- 主要公司采用的策略

- 公司简介

- AMINO GmbH

- BASF SE

- Dow

- Evonik Industries AG

- Kao Corporation

- Merck KGaA

- Nutreco

- Solvay

- Stepan Company

- Sunwin Biotech Shandong Co., Ltd.

第七章市场机会与未来趋势

- 甜菜碱作为动物抗应激剂的用途

The Betaine Market is projected to register a CAGR of more than 6% during the forecast period.

In 2020, COVID-19 had a detrimental effect on the market.However, the market has now been estimated to have reached pre-pandemic levels and is expected to grow steadily in the future.

Key Highlights

- The market that was looked at is growing because more businesses are using it as a surfactant, the food and beverage industry is using it more, and the personal care industry wants more of it.

- On the flip side, synthetic cosmetics leading to skin and hair problems are likely to act as restraints for the studied market.

- During the forecast period, the studied market is likely to have opportunities related to the use of betaine as a stress reliever for animals.

- North America dominated the market across the world, owing to the high demand for personal care products, food, beverages, and dietary supplements in the region.

Betaine Market Trends

Personal Care Segment to Dominate the Market Demand

- Betaine has been used a lot in the personal care industry instead of surfactants made from sulfur.It acts effectively as an irritation-mitigating agent and is mainly used in baby shampoos and ultra-mild personal care products.

- Water retention and moisturizing properties make betaine a widely useful raw material for the cosmetic industry.

- Besides, it is widely used as a surfactant, emulsifier, and emollient in personal care products such as lotions, shampoos, skin cleansers, etc.

- The demand for personal care products has been increasing at a noticeable rate in regions like Asia-Pacific and the Middle East, thanks to cultural change, the influence of western culture, increased cosmetic demand from the youth population, and rising women's employment.

- In India, beauty and personal care products are driving demand for India's e-commerce growth. According to the Unicommerce data, e-commerce sales volume grew 69.4% in FY22 compared to 44% in FY21, of which the beauty and personal care category posted a growth of 143% in volumes year-on-year.

- Additionally, according to the Indonesian Bureau of Statistics (BPS), until December 2022, the cosmetics industry grew by 9.61% compared to the same period in the previous year. The main platform is e-commerce, with which the country is experiencing growth in the personal care industry.

- Moreover, according to the trade map, Indonesia imported over 309 million dollars' worth of cosmetics and skincare in 2021. In 2021, China held the largest proportion of the beauty and skincare import market in Indonesia, at 20.2 percent, followed by South Korea at 19 percent.

Hence, all such trends are likely to drive the demand for personal care products across the world, which is further likely to drive the demand for the betaine market during the forecast period.

North America Region to Dominate the Market

- The North American region dominated the global market. Betaine's demand in the region is primarily driven by the strong demand from the industries engaged in the production of personal care, animal feed, dietary supplements, and functional drink products.

- Due to rising demand in the pharmaceutical and personal care industries, the United States is the largest market in the area.The country is the world's largest producer of pharmaceutical and personal care products.

- Happi Magazine says that the market for skin care products in the US alone was worth more than USD 18 billion in 2021, with face care making up most of that.

- The country has been putting a lot of money into research and development to come up with new personal care products that don't contain sulfur.In the coming years, the development of generic medicines is also likely to give the betaine market new chances.

- According to Happi Magazine, in the United States, face cleansers were the greatest multi-store skin care sales in 2021. Sales for this segment totaled over $1.65 billion in that year. Hence, supporting the growth of the market

- Hence, owing to all the above-mentioned factors, the demand for betaine in the market is expected to increase significantly in the region during the forecast period.

Betaine Industry Overview

The betaine market is highly fragmented in nature. Some of the major players in the market include BASF SE, Dow, Evonik Industries AG, Solvay, and Kao Corporation, among others (in no particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increased Demand from Personal Care Sector

- 4.1.2 Growing Usage in Food and Beverage Industry

- 4.1.3 Increased Commercial Usage as Surfactant

- 4.2 Restraints

- 4.2.1 Synthetic Cosmetics Leading to Skin and Hair Problems

- 4.2.2 Other Restraints

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Form

- 5.1.1 Betaine Anhydrous

- 5.1.2 Betaine Monohydrate

- 5.1.3 Betaine HCl

- 5.1.4 Cocamidopropyl Betaine

- 5.1.5 Other Forms

- 5.2 Type

- 5.2.1 Synthetic Betaine

- 5.2.2 Natural Betaine

- 5.3 Application

- 5.3.1 Food, Beverages, and Dietary Supplements

- 5.3.2 Animal Feed

- 5.3.3 Personal Care

- 5.3.4 Detergent

- 5.3.5 Other Applications

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AMINO GmbH

- 6.4.2 BASF SE

- 6.4.3 Dow

- 6.4.4 Evonik Industries AG

- 6.4.5 Kao Corporation

- 6.4.6 Merck KGaA

- 6.4.7 Nutreco

- 6.4.8 Solvay

- 6.4.9 Stepan Company

- 6.4.10 Sunwin Biotech Shandong Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Use of Betaine as Anti-stress Agent for Animals