|

市场调查报告书

商品编码

1273308

多普勒超声系统市场——增长、趋势和预测 (2023-2028)Doppler Ultrasound Systems Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

预计在预测期内,多普勒超声系统市场的复合年增长率为 7.5%。

大流行的爆发影响了多普勒超声市场。 与 COVID-19 感染相关的高血栓事件发生率,例如深静脉血栓形成 (DVT) 和急性肺栓塞,促进了大流行期间多普勒超声的使用。 例如,2021 年 7 月 NCBI 的一篇文章指出,在大流行期间无症状 DVT 的发生率增加 (60.87%)。 此外,虽然彩色多普勒超声能够检测无症状患者的 DVT,但静脉多普勒超声现在被认为是对有血栓并发症风险的 COVID-19 患者的重要干预措施,允许医生做出决定。据说它对 因此,市场在大流行期间呈现正增长,预计在预测期内将继续保持上升趋势。

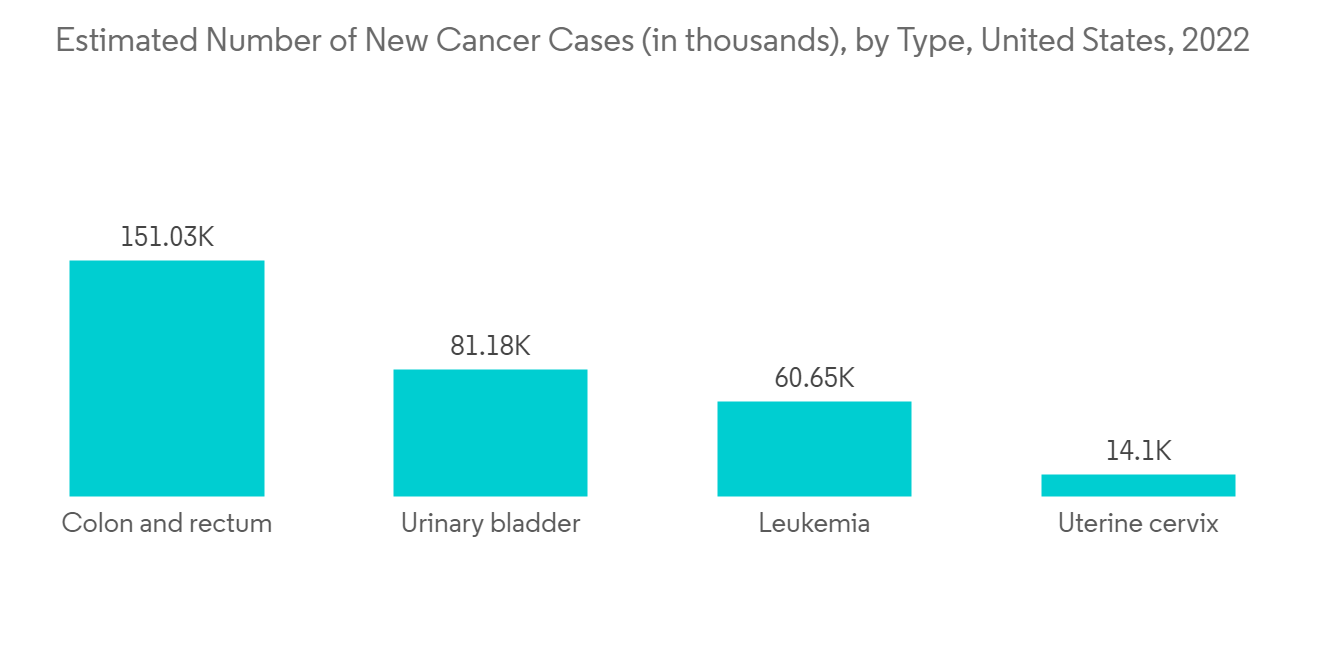

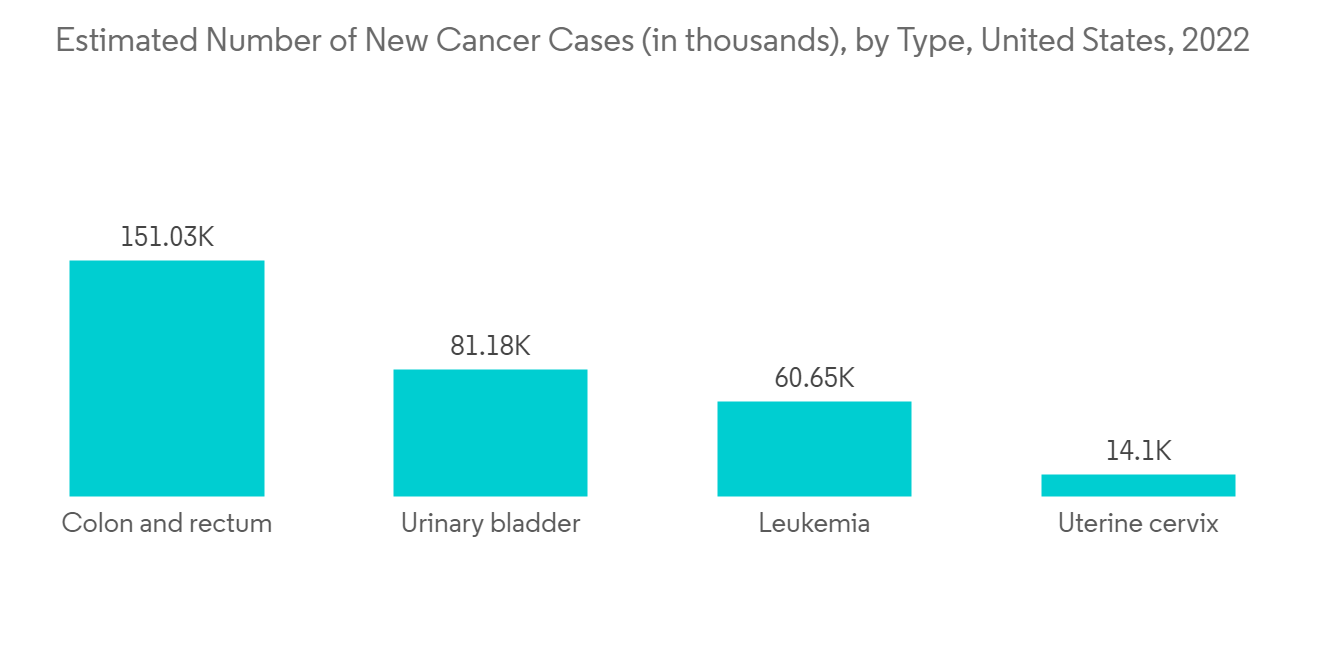

随着人口老龄化,慢性病的流行、新兴市场医疗保健支出的增加、医疗保健工作者数量的增加以及用于诊断的医疗保健支出的增加正在推动市场。 先进的多普勒超声诊断技术的发展也是推动市场增长的关键因素。 癌症、心血管疾病、胃肠道疾病和肾臟疾病等慢性病在全球范围内普遍存在。 例如,2022年,美国癌症协会(ACS)估计,2023年美国将有106180例结肠癌新病例和44850例直肠癌新病例。 此外,美国癌症协会 2021 年的一份报告发现,男性患结直肠癌的终生风险约为 23 分之一 (4.3%),女性约为 25 分之一 (4.0%)。 多普勒超声是癌症诊断的基本要求之一,此类病例数量的稳步增加将推动对多普勒超声机的需求。

此外,已经进行了大量研究来阐明多普勒超声在各种疾病中的诊断应用。 例如,2021 年 7 月,中国大连医科大学的一个研究团队开始了一项研究,调查多普勒超声在早期慢性肾脏病患者中的诊断用途。 此外,2022 年 4 月,加拿大温哥华不列颠哥伦比亚大学的另一个研究小组发现,多普勒成像经常用于评估肾移植以及评估肾血管流量和通畅性。我们正在宣布调查结果,它正在被使用。

市场进入者还关注多普勒超声系统,推动市场扩张。 例如,2021 年 1 月,EagleView ultrasound 推出了一款无线便携式超声设备,以实惠的价格提供准确的超声成像。 同样,由红杉印度和 EDBI 支持的新加坡医疗技术公司 Us2.ai 的全自动心臟超声工具 Us2.v1 已于 2021 年 9 月获得 FDA 批准,该工具可测量 2D 和多普勒。 多普勒超声系统的进步预计将在预测期内推动市场扩张。

但是,多普勒超声系统的严格监管政策和过高的成本预计会阻碍预测期内的市场增长。

多普勒超声系统市场趋势

预计手持设备市场在预测期内实现显着增长

手持设备是用于监测孕妇血流量的设备,还有许多其他用途。 手持设备易于使用,可以跟上要求苛刻和快节奏的医疗保健环境。 市场上的大多数手持设备都可以轻鬆扫描、顺畅地更改部门以及无缝地用于各种检查。 足病医生通常使用手持式多普勒成像作为一种无创血管评估方法。 由于对这些设备的高需求,主要参与者正在推出新的产品线,这可能对该细分市场的增长产生积极影响。 例如,2021 年 3 月,通用电气旗下的 GE Healthcare 发布了一款新型无线手持超声设备 Vscan Air。 一种名为 Vscan Air 的袖珍型彩色多普勒超声通过以客户为导向的创新为世界各地的患者提供更加个性化的护理。

此外,2022 年 2 月,皇家飞利浦通过为便携式超声“Lumify 脉搏波多普勒”添加改进的血液动力学评估和测量功能,扩展了其超声产品阵容。 诸如此类的改进有望促进该领域的市场扩张。 此外,外周动脉疾病和静脉血栓栓塞症发病率的上升有望很快支持该领域的扩展。 受深静脉血栓形成 (DVT) 或肺栓塞 (PE) 影响的确切人数尚不清楚,但根据 2022 年 4 月更新的 CDC 数据,美国每年有 90 万人受到 DVT 和 PE 的影响。

此外,根据世界卫生组织 2021 年 3 月的数据,到 2021 年底,将有 780 万名女性在过去五年中被诊断出患有乳腺癌,使其成为世界上最常见的癌症。我了解. 根据同一数据,2021 年全球将有约 230 万女性被诊断出患有乳腺癌。 随着慢性病患病率的上升,对用于实际诊断目的的便携式和手持式多普勒超声系统的需求正在增加。

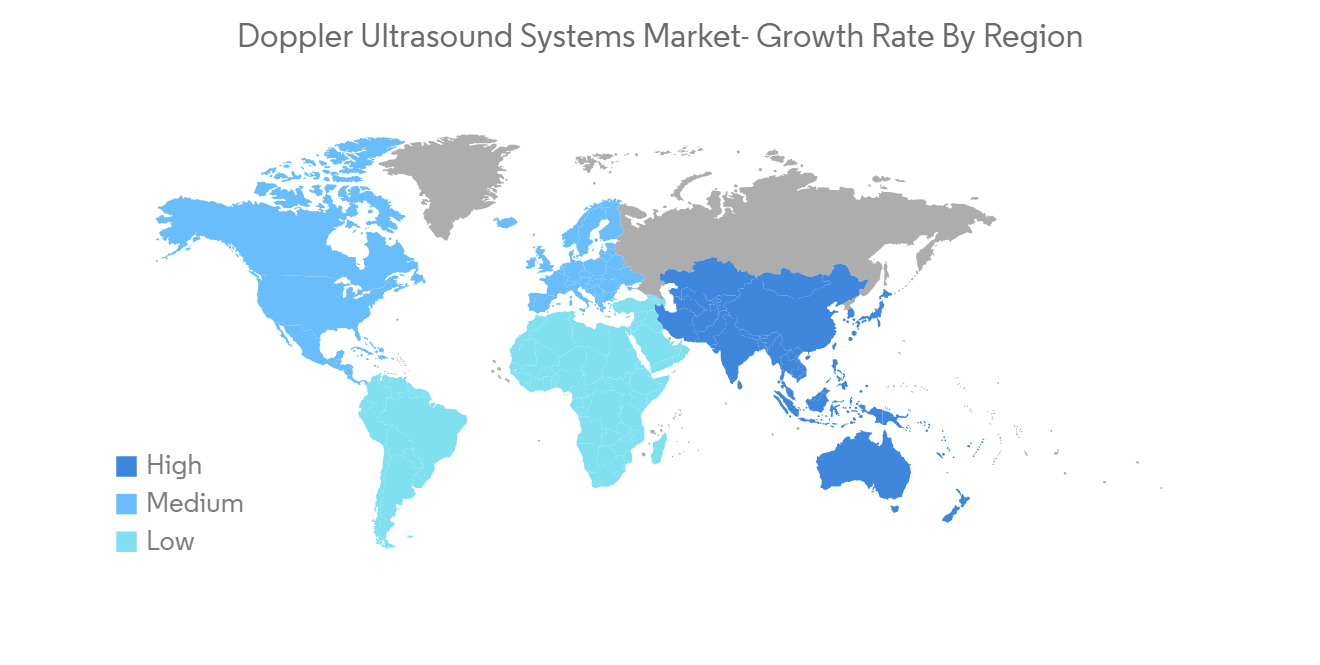

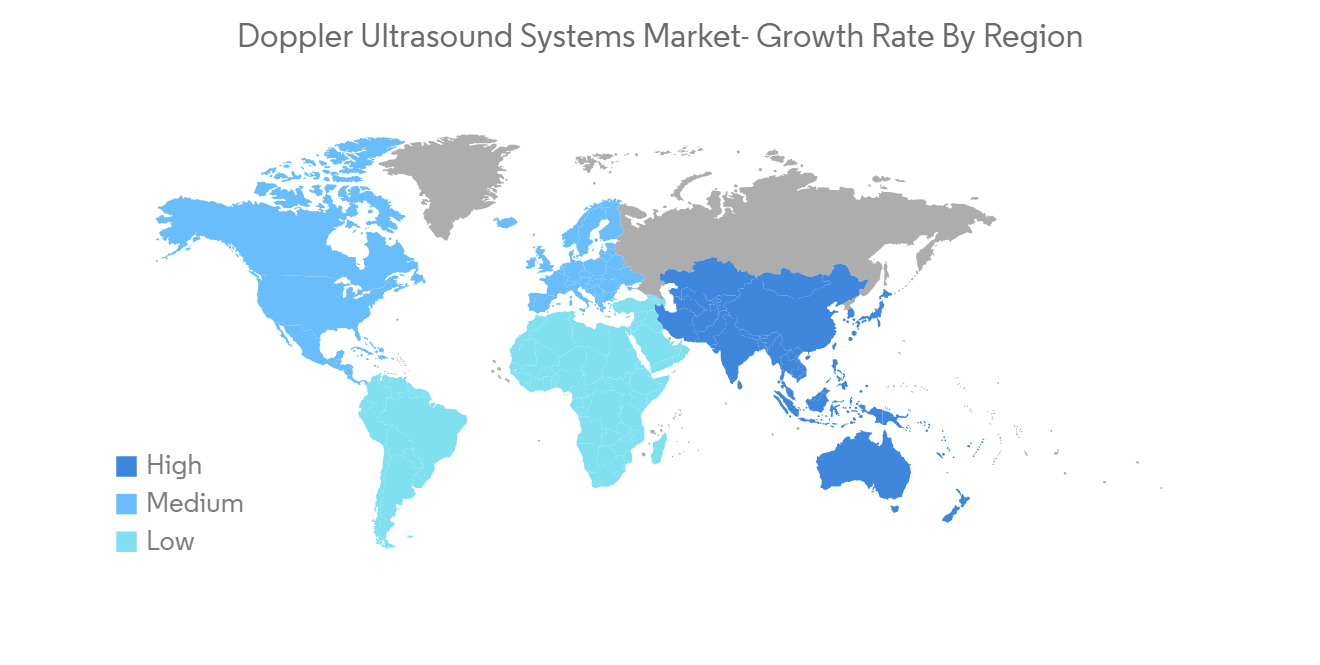

预计在预测期内北美将实现大幅增长

北美占多普勒超声系统市场的主要份额。 由于成像技术在疾病诊断和治疗中的应用越来越多,北美多普勒超声系统市场正在整体扩大。 例如,2022 年 3 月,加拿大初创公司 Flosonics Medical 宣布了一款可穿戴无线多普勒超声系统。 因此,该行业的市场扩张预计将由创新驱动。 此外,该地区越来越多的医院、诊所、门诊手术中心 (ACS) 以及对医疗保健项目的投资也为市场扩张做出了贡献。 例如,加拿大和魁北克政府共同投资了 209 个基础设施项目,以对魁北克的医院和其他护理中心等健康和社会服务机构进行现代化改造、重建和升级。 此信息是在加拿大政府于 2021 年 7 月发布的新闻稿中提供的。 联邦基础设施、社区、卫生和社会服务部长宣布,对这 209 个基础设施项目的投资将达到 1.883 亿美元。 这些投资应该能让医院获得最先进的医疗设备,如多普勒超声系统。 此外,作为取消基于走廊的医疗保健战略的一部分,加拿大安大略省于 2021 年 3 月宣布将支付高达 5300 万美元来设计和建造新的格雷布鲁斯医疗服务马克代尔医院。

主要产品发布、市场参与者和製造商的集中存在、主要参与者之间的收购和合作伙伴关係、美国医院数量的增加等是推动该国多普勒超声系统市场增长的一些因素. 是。 例如,根据美国医院协会 (AHA) 2022 年发布的数据,2021 年全国有超过 6093 家医院在运营。 同样,在 2022 年 9 月,飞利浦获得了 FDA 510(k) 许可,用于优化便携性和性能的超声紧凑型系统。

多普勒超声系统行业概览

由于市场上存在一些主要参与者,多普勒超声系统市场适度整合。 每家公司都专注于其设备的技术进步,以占领较大的市场份额。 市场参与者包括 Koninklijke Philips N.V.、通用电气公司(GE Healthcare)、Siemens Healthcare GmbH、Fujifilm Corporation、Samsung、Shenzhen Mindray Bio-Medical Electronics、Canon Inc.、Trivitron Healthcare Private Limited、BK Medical Holding Company, Inc、CIMON Medical AS、NOVASIGNAL CORPORATION、ESAOTE SPA、Clarius 等。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 调查假设和市场定义

- 本次调查的范围

第二章研究方法论

第 3 章执行摘要

第四章市场动态

- 市场概览

- 市场驱动因素

- 由于老龄化社会的到来,慢性病增加

- 超声诊断技术的进步

- 发达国家的医疗支出增加

- 市场製约因素

- 多普勒超声系统成本高

- 严格的监管程序

- 波特的五力分析

- 新进入者的威胁

- 买方/消费者议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

第 5 章市场细分(市场规模:百万美元)

- 按设备类型

- 手推车底座

- 手持设备

- 通过使用

- 放射科

- 妇产科

- 心脏病

- 其他用途

- 最终用户

- 医院

- 诊断中心

- 其他最终用户

- 按地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 意大利

- 西班牙

- 其他欧洲

- 亚太地区

- 中国

- 日本

- 印度

- 澳大利亚

- 韩国

- 其他亚太地区

- 中东和非洲

- 海湾合作委员会

- 南非

- 其他中东和非洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美

第6章竞争格局

- 公司简介

- Koninklijke Philips N.V.

- General Electric Company(GE Healthcare)

- Siemens Healthcare GmbH

- FUJIFILM Corporation(FUJIFILM VisualSonics, Inc.)

- Samsung

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- Canon Inc.

- Trivitron Healthcare Private Limited

- BK Medical Holding Company, Inc.

- CIMON Medical AS

- NOVASIGNAL CORPORATION

- ESAOTE SPA

- Clarius

第7章 市场机会与将来动向

The doppler ultrasound systems market is expected to register a CAGR of 7.5% over the forecast period.

The outbreak of the pandemic impacted the doppler ultrasound market. A high rate of thrombotic events was associated with the COVID-19 infection, such as deep vein thrombosis (DVT) and acute pulmonary embolism, which propelled the use of doppler ultrasound during the pandemic. For instance, as per a July 2021 NCBI article, during the pandemic, an increased incidence of asymptomatic DVT (60.87%) was noted. It also mentioned that color doppler ultrasound allowed detection of DVT in asymptomatic patients, but venous doppler ultrasound was accepted as a critical intervention for COVID-19 patients at risk of thrombotic complications, which helped physicians to make decisions. Thus, the market witnessed positive growth during the pandemic and is expected to continue the upward trend over the forecast period.

The rising prevalence of chronic diseases coupled with the aging population, growing healthcare spending in developed nations, an increase in healthcare providers, and healthcare spending on diagnosis are the major drivers for the market. The development of advanced doppler ultrasound diagnostic technologies is another important element fueling market growth. Chronic diseases like cancer, and cardiovascular, gastrointestinal, and kidney ailments are becoming more prevalent throughout the world. For instance, in 2022, the American Cancer Society (ACS) that there would be an estimated 106,180 new cases of colon cancer and 44,850 new cases of rectal cancer in the United States in 2023. Furthermore, according to a 2021 report by the American Cancer Society, the lifetime risk of developing colorectal cancer was about 1 in 23 (4.3%) for men and 1 in 25 (4.0%) for women. Doppler ultrasound is one of the essential requirements for the diagnosis of cancer and this steady increase in the number of cases will propel the demand for doppler ultrasound systems.

In addition, numerous studies are being conducted to determine the diagnostic use of the doppler ultrasound in various disorders. For instance, a team of researchers from Dalian Medical University in China began a study in July 2021 to investigate the diagnostic use of doppler ultrasound in patients with early chronic renal disease. Furthermore, in April 2022, a different team of researchers from the University of British Columbia in Vancouver, Canada, published a research study that states that doppler imaging is frequently used to evaluate transplanted kidneys and is utilized to evaluate renal vascular flow and patency.

The market participants are also concentrating on doppler ultrasound systems and driving market expansion. For instance, in January 2021, EagleView ultrasound launched its wireless portable ultrasound device, which provides accurate ultrasound imaging and is affordable as well. Similarly, Us2.ai, a Singapore-based medtech company supported by Sequoia India and EDBI, gained FDA approval for Us2.v1, a fully automated cardiac ultrasound tool to measure 2D and doppler, in September 2021. It is projected that during the course of the projection period, advances in the doppler ultrasound system will spur market expansion.

However, stringent regulatory policies and the excessive cost of doppler ultrasound systems are expected to hamper the market growth over the forecast period.

Doppler Ultrasound Systems Market Trends

The Handheld Devices Segment is Expected to Witness Considerable Growth Over the Forecast Period

Handheld devices are devices used to monitor blood flow in pregnant women and also have numerous other applications. Handheld gadgets are easy to use and can keep up with the demanding and fast-paced healthcare setting. The majority of commercially available handheld devices offer simple scanning, smooth departmental changes, and seamless use for a variety of tests. Podiatrists routinely use handheld doppler examinations as a non-invasive vascular assessment method. Owing to the high demand for these devices, the key players are launching new product lines, which may positively impact segment growth. For instance, In March 2021, GE Healthcare, a part of General Electric, introduced the Vscan Air, a new wireless handheld ultrasound instrument. A pocket-sized ultrasound with a color doppler called the Vscan Air uses customer-driven innovation to offer more individualized care for patients all around the world.

Furthermore, in February 2022, Royal Philips added improved hemodynamic assessment and measuring capabilities to its portable Lumify Pulse Wave Doppler ultrasound, expanding its ultrasound line. Improvements like these will fuel market expansion in the sector. Additionally, it is anticipated that the segment expansion will soon be supported by the rising incidence of peripheral artery disease and venous thromboembolism. Although the exact number of people affected by deep vein thrombosis (DVT) or pulmonary embolism (PE) is unknown, DVT and PE impact 900,000 people annually in the United States, according to data from the CDC updated in April 2022.

Moreover, according to March 2021 WHO data, there were 7.8 million women alive at the end of 2021 who had received a diagnosis of breast cancer in the previous five years, making it the most common cancer in the world. The same source also stated that there were approximately 2.3 million women worldwide who were diagnosed with breast cancer in 2021. The demand for portable and handheld doppler ultrasonography equipment for practical diagnosis purposes is rising as the prevalence of chronic diseases rises.

North America is Expected to Witness Considerable Growth Over the Forecast Period

North America holds a major share of the doppler ultrasound systems market. The market for doppler ultrasound systems in North America is expanding overall due to the rise in the application of imaging technologies for illness diagnosis and treatment. For instance, in March 2022, the wearable, wireless doppler ultrasound system was introduced by Canadian startup Flosonics Medical. Therefore, market expansion in the area is anticipated to be fueled by innovations. Additionally, a rise in the number of hospitals, clinics, and ambulatory surgery centers (ACSs) and investments in healthcare projects across the region is contributing to the market growth. For instance, the governments of Canada and Quebec worked together to invest in 209 infrastructure projects to modernize, redevelop, and upgrade health and social services institutions in Quebec, including hospitals and other care centers. This information was provided in a press release issued by the Canadian government in July 2021. The investment for these 209 infrastructure projects would total USD 188.3 million, according to announcements from the federal ministers of infrastructure, communities, and health and social services. Due to these investments, hospitals must have access to cutting-edge medical equipment like doppler ultrasound systems. Additionally, as part of its strategy to eliminate hallway health care, the Canadian province of Ontario announced in March 2021 that it would pay up to USD 53.0 million to finance the design and construction of the new Grey Bruce Health Services Markdale Hospital.

Key product launches, high concentration of market players or manufacturers' presence, acquisition and partnerships among major players, and an increasing number of hospitals in the United States are some of the factors driving the growth of the doppler ultrasound systems market in the country. For instance, according to American Hospital Association (AHA) data published in 2022, there were more than 6,093 operating hospitals in the country in 2021. Similarly, in September 2022, Philips received FDA 510(k) clearance for an ultrasound compact system to optimize portability and performance.

Doppler Ultrasound Systems Industry Overview

The doppler ultrasound systems market is moderately consolidated due to the presence of a few key players in the market. The companies are focused on the technological advancement of the devices to gain significant market shares. Some of the market players are Koninklijke Philips N.V., General Electric Company (GE Healthcare), Siemens Healthcare GmbH, Fujifilm Corporation, Samsung, Shenzhen Mindray Bio-Medical Electronics Co., Ltd., Canon Inc., Trivitron Healthcare Private Limited, BK Medical Holding Company, Inc., CIMON Medical AS, NOVASIGNAL CORPORATION, ESAOTE SPA, and Clarius, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Prevalence of Chronic Diseases Coupled with Increasing Aging Population

- 4.2.2 Advances in Ultrasound Diagnostic Technologies

- 4.2.3 Increasing Healthcare Expenditure in Developed Countries

- 4.3 Market Restraints

- 4.3.1 High Cost of Doppler Ultrasound Systems

- 4.3.2 Stringent Regulatory Procedures

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD Million)

- 5.1 By Device Type

- 5.1.1 Trolly-Based

- 5.1.2 Handheld

- 5.2 By Application

- 5.2.1 Radiology

- 5.2.2 Obstetrics and Gynecology

- 5.2.3 Cardiology

- 5.2.4 Other Applications

- 5.3 By End-User

- 5.3.1 Hospitals

- 5.3.2 Diagnostic Centers

- 5.3.3 Other End-Users

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle-East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle-East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Koninklijke Philips N.V.

- 6.1.2 General Electric Company (GE Healthcare)

- 6.1.3 Siemens Healthcare GmbH

- 6.1.4 FUJIFILM Corporation (FUJIFILM VisualSonics, Inc.)

- 6.1.5 Samsung

- 6.1.6 Shenzhen Mindray Bio-Medical Electronics Co., Ltd.

- 6.1.7 Canon Inc.

- 6.1.8 Trivitron Healthcare Private Limited

- 6.1.9 BK Medical Holding Company, Inc.

- 6.1.10 CIMON Medical AS

- 6.1.11 NOVASIGNAL CORPORATION

- 6.1.12 ESAOTE SPA

- 6.1.13 Clarius