|

市场调查报告书

商品编码

1273313

电气绝缘材料市场 - COVID-19 的增长、趋势、影响和预测 (2023-2028)Electrical Insulation Material Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

预计在预测期内,全球电气绝缘材料市场的复合年增长率将超过 6%。

由于影响大多数行业的全球限制,COVID-19 大流行对电绝缘材料市场产生了重大影响。 但2021年后,行业加速发展,对电绝缘材料的需求增加。 因此,预计市场在预测期内将保持类似的轨迹。

主要亮点

- 在预测期内,加强电气设备的安全措施推动了电气绝缘材料市场的增长。 此外,将电力传输和分配到世界各地的需求正在推动市场的增长。

- 相反,电绝缘材料的高成本是阻碍市场增长的主要因素。 此外,预计全球电绝缘材料市场将面临严峻形势。

- 新兴国家/地区发电活动的增加以及电动汽车对电气绝缘材料的需求增加可能会为所研究的市场带来机遇。

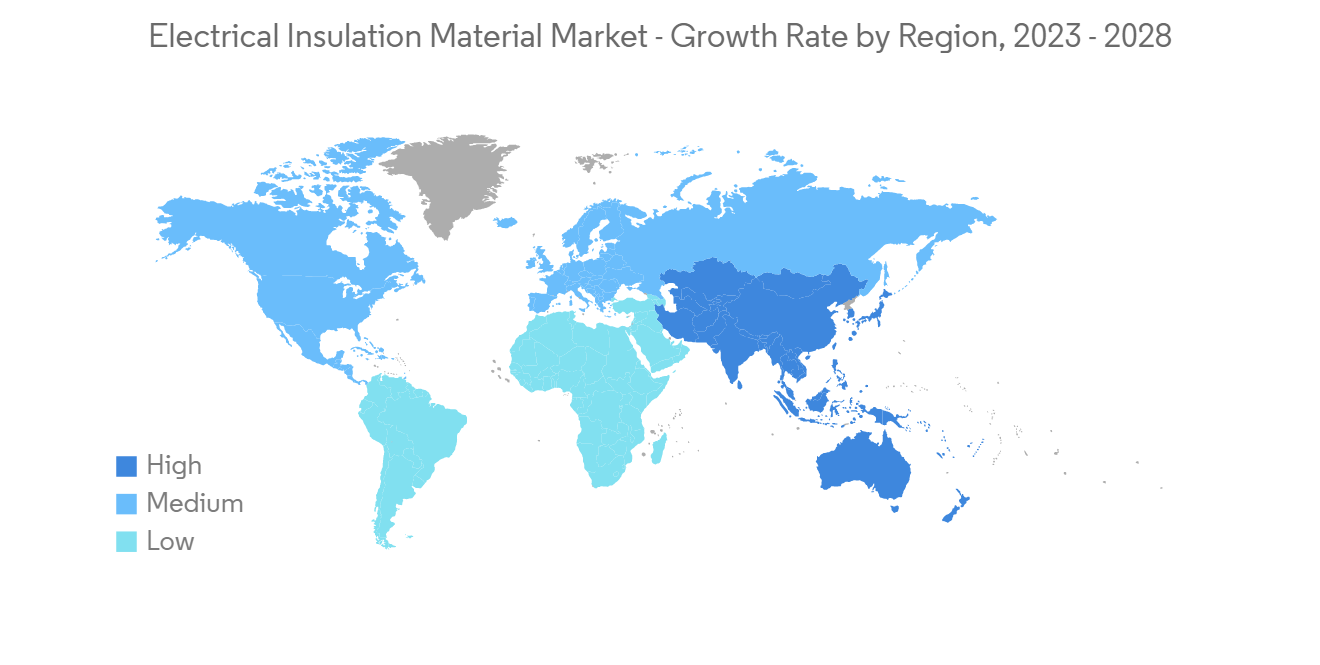

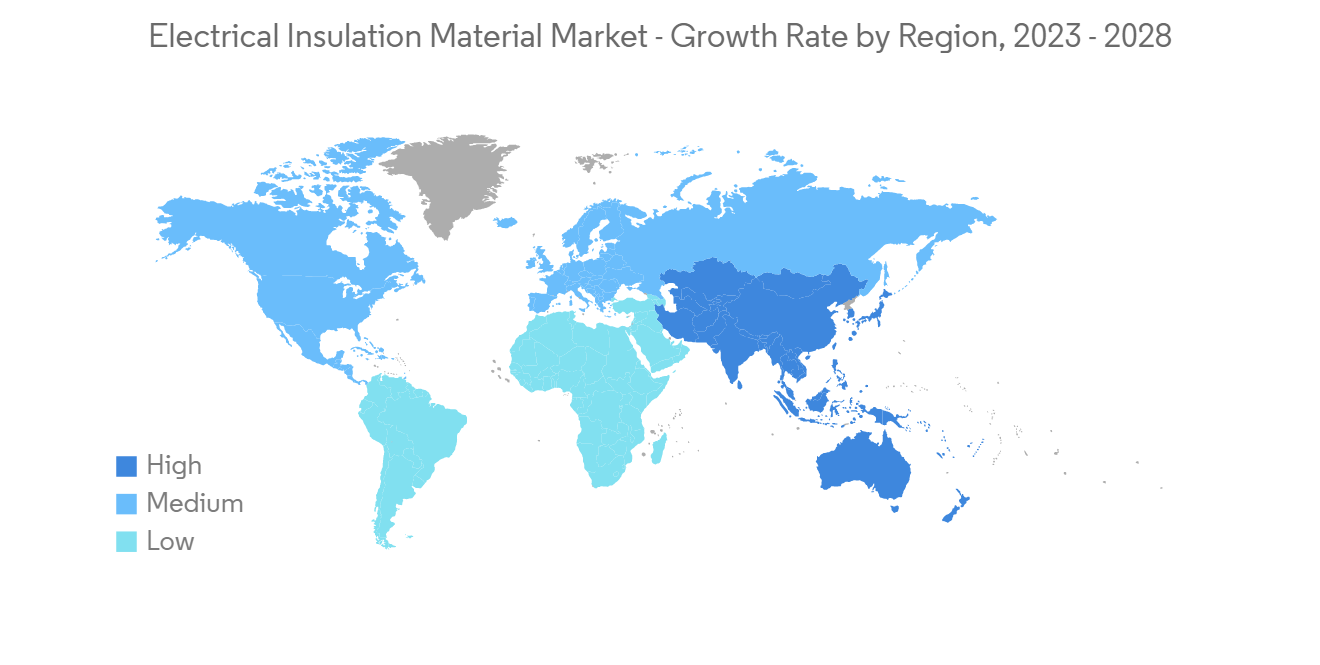

- 由于新兴经济体电力行业的先进改进和快速工业化,亚太地区在电气绝缘材料市场占据主导地位。 同时,预计亚太地区在预测期内仍将保持最高复合年增长率。

电绝缘材料的市场趋势

传输和电缆应用主导市场

- 电绝缘材料不导电。 电绝缘材料应用于输电和电缆线路、发电机、旋转电机、传动装置、变压器等。

- 输电线路将电力从发电厂输送到各个地方。 发电机、变压器和旋转机械是发电行业的一部分。 绝缘材料允许电力通过电力线和电缆而不会受到干扰或浪费能源。

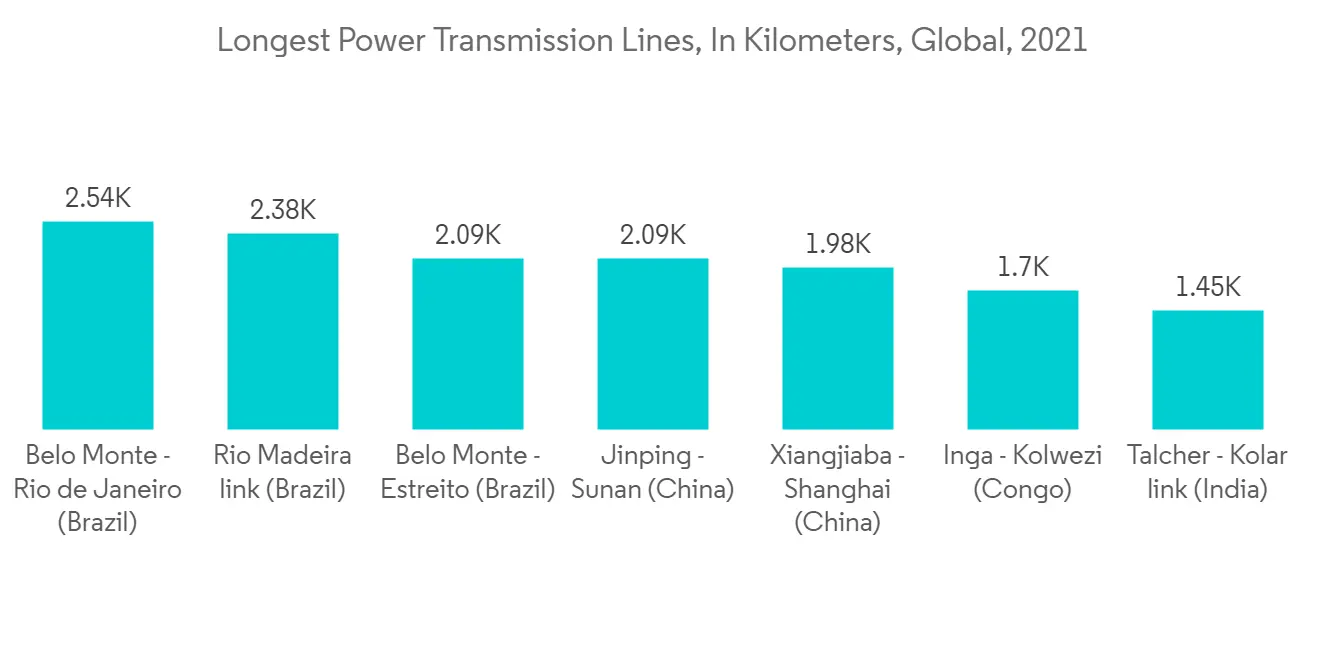

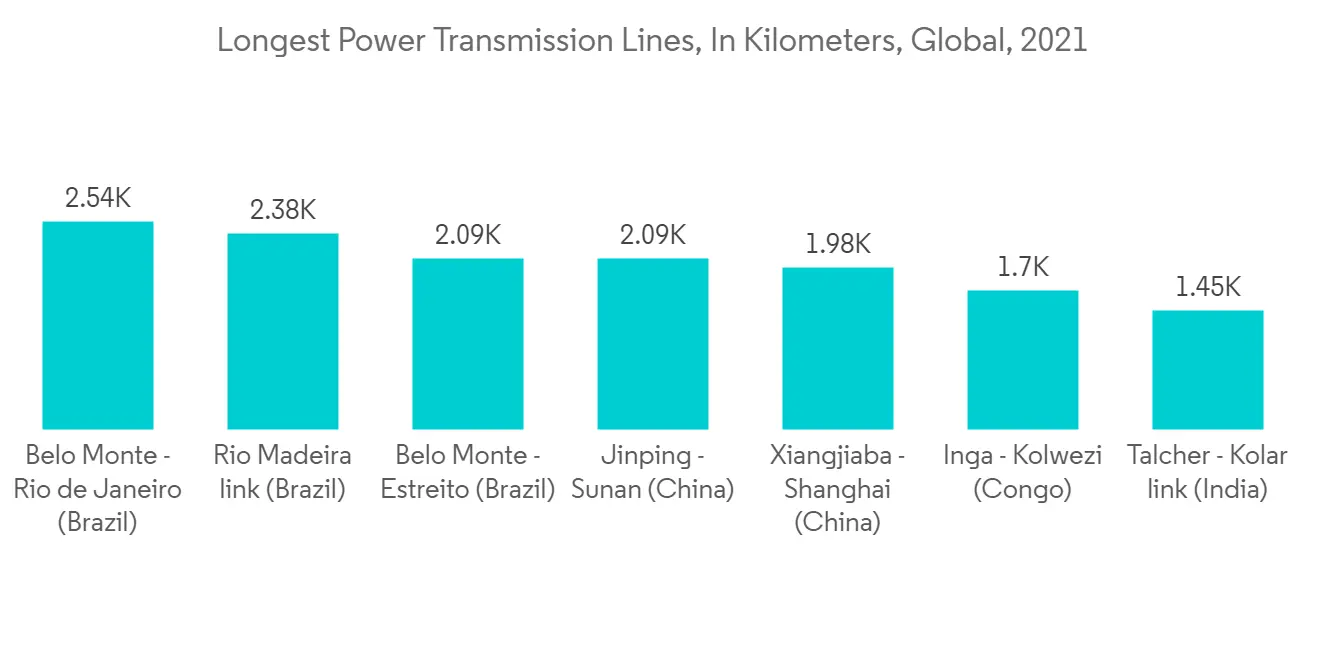

- 根据 Power Technology 的数据,到 2021 年,巴西将拥有世界上最长的三个输电线路。 2543公里长的贝洛蒙特-里约热内卢输电线路位居首位,其次是里约马德拉输电线路和贝洛蒙特-埃斯特里托输电线路。

- 据美国能源部估计,到 2021 年美国将拥有大约 200 英里的输电线。 年内竣工总长度中,230KV及以下工程占近52%。

- 电压高达 230KV 的项目跑了大约 101 英里。 其余 92 英里由电压在 230-345KV 之间的项目覆盖。

- 许多项目正在进行中,以铺设电力线以将电力从一个地方安全地输送到另一个地方。 例如,PacifiCorp 的爱达荷州东南部项目将于 2022 年 4 月完工,旨在用新的输电线路替换老化的输电线路,以满足该地区不断增长的电力需求。 该项目需要对电气系统进行多阶段扩展,从爱达荷州弗斯附近的戈森变电站到爱达荷州雷克斯堡的雷克斯堡变电站。

- 上述电力传输电缆的扩建和新建项目大大增加了对电绝缘材料的需求。

亚太地区主导市场

- 由于电力行业高度发达以及中国和印度在能源服务领域的快速工业化,预计亚太地区将主导全球市场。

- 随着家庭收入的增加和各种用途的电力消耗增加,该地区的电力需求预计会增加。 绝缘材料用于将电能转换为机械能的旋转电机,使电能在零件内部良好传导,而无需通过材料。

- 到 2021 年,中国的两条电力线将跻身世界最长延伸电力线前五名之列。 首先是 2,090 公里的锦屏-苏南输电线路,为世界第四大输电线路,其次是 1,980 公里的向家坝-上海输电线路。

- 根据印度政府电力部的数据,截至 2023 年 1 月,它将拥有 4,63,758 公里的输电线路和 11,56,105 MVA 的变电站容量,使其成为世界领先的大型同步电站之一互连电网。

- 此外,国土交通省在其报告中表示,2021 财年日本 50 家初级建筑公司收到的电力线施工订单金额约为 2583.6 亿日元(约合 23.5 亿美元)。说。 但是,与上一年相比下降了 6.6%。

- 电动汽车业务也需要电绝缘材料。 电绝缘材料是调节电流并保护敏感元件的非导电材料。 采用这些新技术更安全,因为它们有足够的电流保护、防止火灾并确保电能保持在正确的路径上并且不会与其他组件相互作用并且可能发生短路。

- 绝缘体还可以保护 EV 车载充电器、直流/直流转换器、电力电子控制器、直流充电站和电池管理系统。 根据中国汽车工业协会的数据,2022 年新能源汽车销量比 2021 年增长 93.4%。 2021年全年新能源汽车总销量仅为350万辆左右,但到2022年底达到约680万辆。 日本电动汽车产销量如此增长,无疑会增加市场需求。

- 因此,预计未来几年,工业用电量的增加和电动汽车生产中材料利用率的增加将推动亚太地区的电气绝缘材料市场。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 调查先决条件

- 本次调查的范围

第二章研究方法论

第 3 章执行摘要

第四章市场动态

- 主持人

- 输配电系统的需求不断扩大

- 其他司机

- 阻碍因素

- 电绝缘材料成本高

- 其他限制

- 工业价值链分析

- 波特的五力分析

- 供应商的议价能力

- 消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第 5 章市场细分(基于价值的市场规模)

- 类型

- 玻璃绝缘体

- 瓷绝缘体

- 聚合物绝缘体

- 电压

- 低电压

- 中压

- 高压

- 用法

- 变压器和套管

- 电缆和传输线

- 旋转机

- 电涌保护器断路器

- 其他

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 意大利

- 其他欧洲

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙特阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章竞争格局

- 併购、合资、合作、合同等。

- 市场份额 (%)/排名分析

- 主要公司采用的策略

- 公司简介

- ABB

- BASF

- Bharat Heavy Electricals Limited

- General Electric

- Huntsman

- Knauf Insulation Group

- Krempel GmbH

- NGK Insulators

- Owens Corning

- Siemens

- Toshiba

- Von Roll

第七章市场机会与未来趋势

- 新兴国家/地区的发电活动有所增加

- 电动汽车对电气绝缘材料的需求不断扩大

- 其他商业机会

The market for electrical insulation material is expected to register at a CAGR of more than 6% globally during the forecast period.

The COVID-19 pandemic significantly influenced the market for electrical insulation materials, owing to worldwide limitations that affected most industries. However, the industries accelerated from 2021, thus increasing the demand for electrical insulation material. Therefore, the market will likely maintain a similar trajectory during the forecast period.

Key Highlights

- The increasing safety precautions in electrical equipment are increasing the growth of the electrical insulation materials market throughout the forecast period. Moreover, the need for electricity transmission and distribution to various places in different regions worldwide is driving market growth.

- On the contrary, the high costs of electrical insulation materials are a significant factor hampering the market growth. It is also expected to be challenging for the global electrical insulation materials market.

- The increasing power generation activities in developing countries and the growing demand for electrical insulation materials in electric vehicles will likely be an opportunity for the market studied.

- Asia-pacific dominated the market for electrical insulation materials owing to the highly improved power sectors and rapid industrialization in emerging economies. At the same time, Asia-pacific is also expected to register the highest CAGR during the forecast period.

Electrical Insulation Material Market Trends

Transmission and Cable Lines Application to Dominate the Market

- Electrical insulation materials don't allow electricity to pass through them. Electrical insulation materials are applied in transmission and cable lines, generators, electrical rotating machines, transmissions, and transformers.

- Transmission cables transport electricity from power production areas to various locations. Generators, transformers, and spinning machinery are part of the power generation industry. Insulation materials allow electricity to travel through transmission or cable lines without disruption or energy wastage.

- According to Power Technology, the top three most extended power transmission lines in the world as of 2021 were in Brazil. With a length of 2,543 km, the Belo Monte-Rio de Janeiro transmission line came in first, followed by the Rio Madeira transmission link and the Belo Monte-Estreito line.

- According to the US Department of Energy estimation, approximately 200 miles of electrical transmission lines will be covered in the United States in 2021. Projects with voltages of up to 230 KV accounted for nearly 52% of the total length completed that year.

- Projects with voltages of up to 230 KV traveled around 101 miles. The remaining 92 miles were covered by projects with voltages ranging from 230 to 345 KV.

- Many projects are underway to lay the transmission line for safe power transmission from one location to another. For example, PacifiCorp's Southeastern Idaho project, scheduled to be finished in April 2022, aimed to replace outdated transmission lines with newer ones to fulfill the region's rising demand for electrical power. The project required a multi-stage electrical system upgrade from Goshen Substation near Firth, Idaho, to Rexburg Substation in Rexburg, Idaho.

- The expansions, as mentioned above, in the transmission cables and the new projects substantially increased the demand for electrical insulation materials.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is expected to dominate the global market owing to the highly developed power sector, and rapid industrialization witnessed in China and India in the energy services sector recently.

- The region's electricity demand is expected to rise as household incomes increase and power consumption in various applications rises. Rotating electric machines that convert electrical energy into mechanical energy use insulation materials for better electricity transmission inside the machine parts without passing through materials.

- Two of China's power transmission lines are among the world's top five most extended transmission lines as of 2021. The first is the 2,090 km long Jinping-Sunan transmission line, ranked fourth worldwide, followed by the 1,980 km long Xiangjiaba-Shanghai transmission line.

- According to the Ministry of Power, Government of India, the country became one of the world's most extensive synchronous interconnected electricity grids with 4,63,758 circuit km of transmission line and 11,56,105 MVA of transformation capacity as of January 2023.

- The Ministry of Land, Infrastructure, Transport, and Tourism also stated in its report that in the fiscal year 2021, the value of orders for the construction of electric power lines received by 50 primary constructors in Japan amounted to approximately JPY 258.36 billion (~USD 2.35 billion). It, however, represents a decrease of 6.6% compared to the previous year.

- Electric insulating materials are also necessary for the electric vehicles business. Electrical insulation comprises non-conductive materials that regulate the electricity flow and safeguard sensitive components. It enables the safer adoption of these new technologies since they are adequately protected from electrical currents, preventing fires and guaranteeing that the electric energy stays on the appropriate path and does not interact with other components, resulting in short-circuiting.

- In addition, insulators safeguard EV onboard chargers, DC/DC converters, power electronics controllers, DC charging stations, and the battery management system. According to the Chinese Association of Automobile Manufacturers, sales of New Energy Vehicles surged by 93.4% in 2022 over 2021. Overall sales of new energy vehicles were roughly 6.8 million by the end of 2022, compared to only about 3.5 million sales for the entire year in 2021. This growth in EV production and sales in the country will undoubtedly raise market demand.

- Therefore, the increasing electricity usage in industries and the usage of the increasing material in EV production are expected to drive the market for electrical insulation material through the years to come in the Asia-Pacific region.

Electrical Insulation Material Industry Overview

The electrical insulation material market is fragmented, with many players competing. Some major companies (not in particular order) are General Electric, Owens Corning, ABB, Siemens, and Huntsman.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from Transmission and Distribution Systems

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 High Costs of Electrical Insulation Materials

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Glass Insulator

- 5.1.2 Porcelain Insulator

- 5.1.3 Polymer Insulator

- 5.2 Voltage

- 5.2.1 Low Voltage

- 5.2.2 Medium Voltage

- 5.2.3 High Voltage

- 5.3 Application

- 5.3.1 Transformers and Bushings

- 5.3.2 Cables and Transmission Lines

- 5.3.3 Rotating Machines

- 5.3.4 Surge Protector and Circuit Breaker

- 5.3.5 Others

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)/Ranking Analysis**

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ABB

- 6.4.2 BASF

- 6.4.3 Bharat Heavy Electricals Limited

- 6.4.4 General Electric

- 6.4.5 Huntsman

- 6.4.6 Knauf Insulation Group

- 6.4.7 Krempel GmbH

- 6.4.8 NGK Insulators

- 6.4.9 Owens Corning

- 6.4.10 Siemens

- 6.4.11 Toshiba

- 6.4.12 Von Roll

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Power Generation Activities in Developing Countries

- 7.2 Growing Demand for Electrical Insulation Materials in Electric Vehicles

- 7.3 Other Opportunities