|

市场调查报告书

商品编码

1273314

电活性聚合物市场 - 增长、趋势和预测 (2023-2028)Electroactive Polymer Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

预计在预测期内,电活性聚合物市场的复合年增长率将超过 5%。

主要亮点

- COVID-19 对 2020 年的市场产生了负面影响。 但市场将在2022年达到疫情前水平,有望继续稳步增长。

- 电气和电子行业的增长预计将推动预测期内的市场增长。 然而,电活性聚合物的提取很困难并且通常对环境有害。 然而,电活性聚合物产品的不当处置会危害环境,预计会减缓市场扩张。

- 仿生和假肌肉在使用电活性聚合物治疗复杂医学问题方面的重要性与日俱增,预计这将为未来五年的电活性聚合物市场提供机会。 预计北美地区将主导全球电活性聚合物市场。

电活性聚合物的市场趋势

执行器和传感器主导市场

- 执行器和传感器有望获得优势,因为它们广泛用于敏感的电气/电子和塑料部件。 这是为了防止灰尘吸附和静电放电。 本征导电聚合物包括聚塞吩、聚苯胺、聚□咯和聚乙炔。

- 导电聚合物因其电子导电性和相对较高的可逆离子存储容量而被用于传感器。 电活性聚合物允许在低电压下进行大的机电弯曲和拉伸。 此外,柔软灵活的结构也有助于您高效地工作。

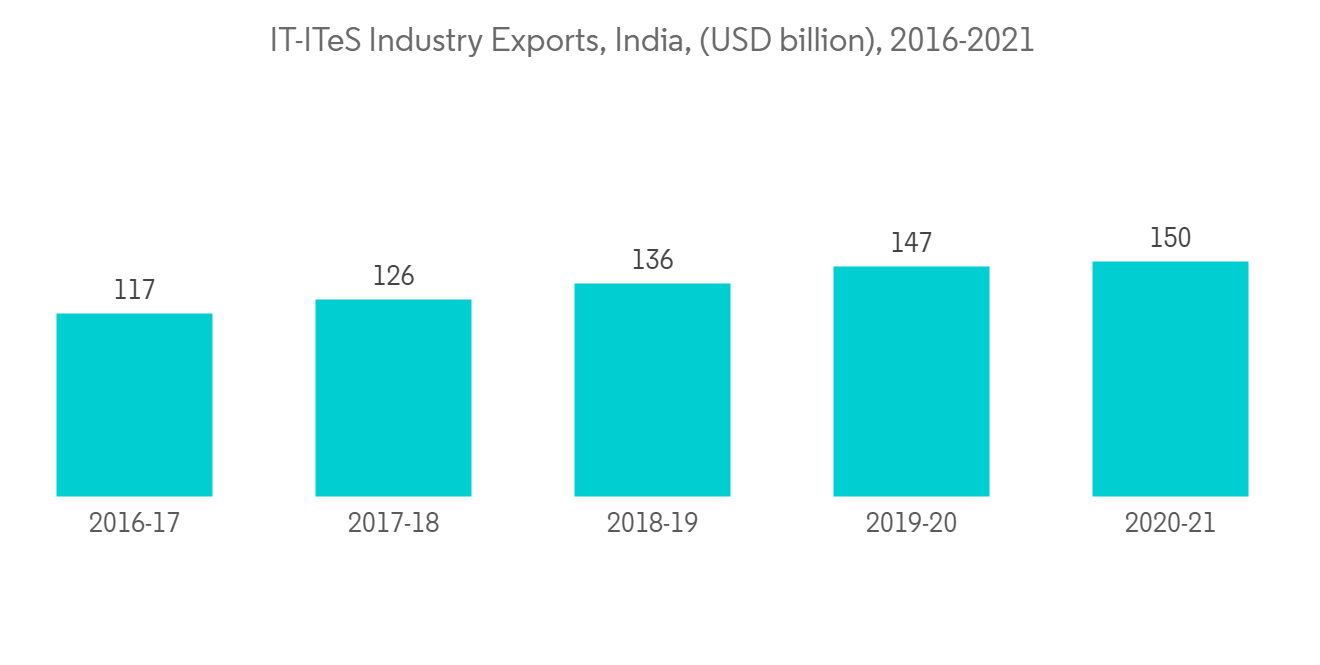

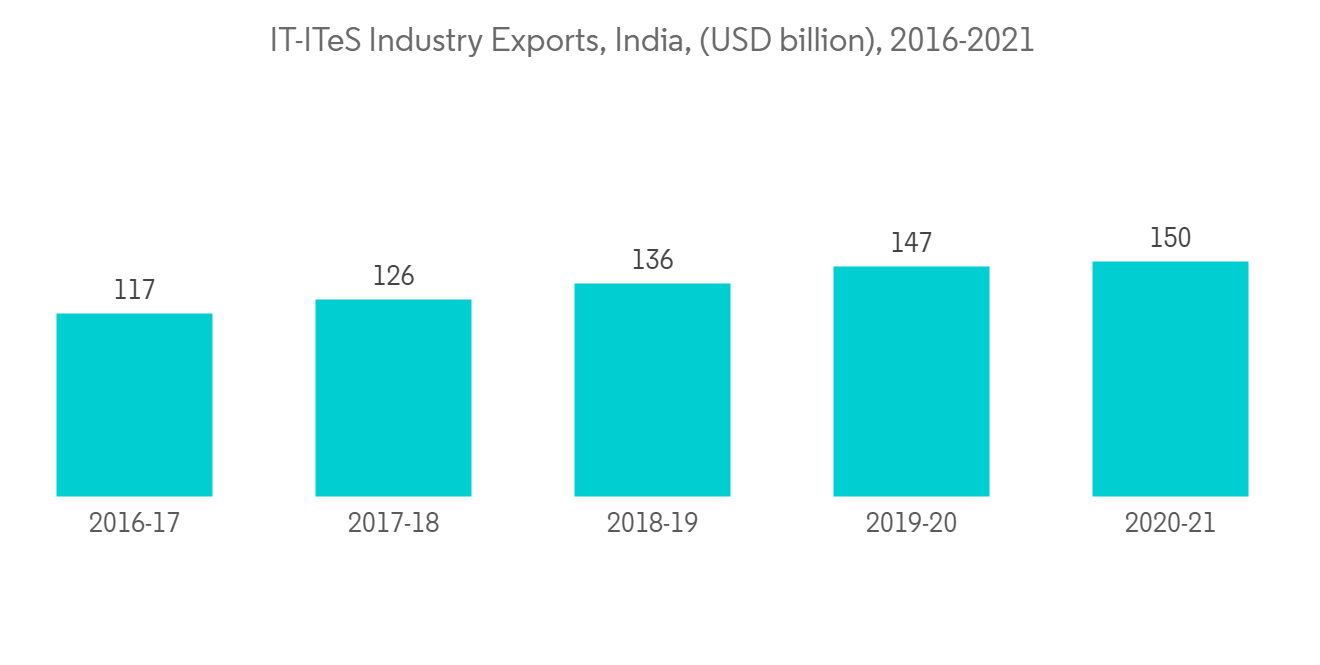

- 印度计划到 2026 年在电气和电子设备製造领域投资 3000 亿美元,根据电子和 IT 部的“扩大和深化电子製造的行动呼吁”研究预计将在 2026 年期间使电活性聚合物市场受益预测期。

- 根据印度品牌资产基金会 (IBEF) 的数据,印度在 2022 年 9 月出口了价值 20.907 亿美元的电子产品,同比增长 71.99%。 该行业的主要出口项目包括手机、消费电子产品(电视、音频)、IT硬件(笔记本电脑、平板电脑)、工业电子产品和汽车电子产品,这些产品正在推动市场的增长。

- 上述所有因素预计将在预测期内推动电活性聚合物市场。

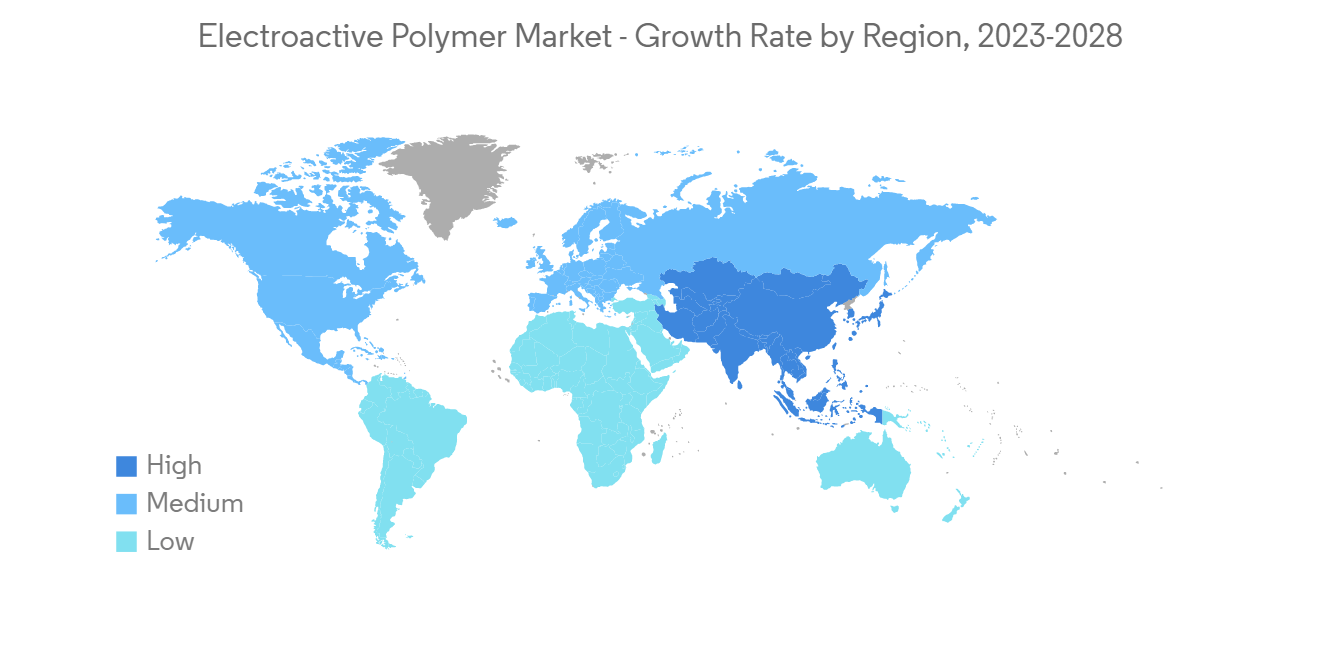

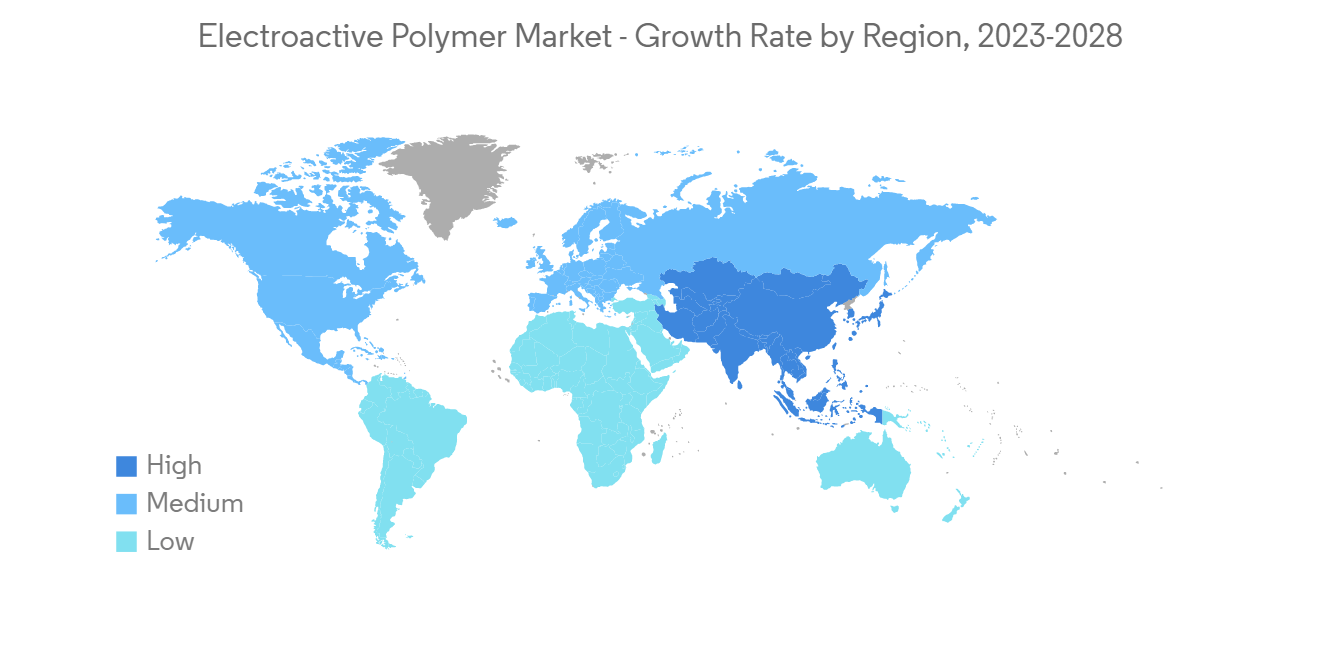

亚太地区主导市场

- 亚太地区是电活性聚合物的最大市场。 电子产品产量的增加以及消费者对日常电器和小工具小型化的偏好不断变化等因素正在推动该地区对电活性聚合物的需求。

- 就需求而言,该地区的电子产品在消费电子市场领域的增长率最高。 随着中产阶级可支配收入的增加,对电子产品的需求预计将稳步增长,从而推动所研究的市场。

- 中国是世界上最大的电子产品製造基地。 电线、电缆、计算设备和其他个人设备等电子产品的电子产品增长最快。 在预测期内,该国将服务于一个巨大的市场,因为它满足国内对电子产品的需求,并向其他国家出口电子产品。

- 根据中国国家统计局 (NBS) 的数据,2021 年中国电子製造业整体利润同比增长 38.9%,这对市场增长产生了积极影响。

- 此外,根据日本电子和信息技术产业协会 (JEITIA) 的数据,日本电子行业的总产值到 2021 年将增长近 10%,达到约 1000 亿美元。 该行业包括电子设备、组件、消费电子和工业电子产品。

- 因此,由于上述原因,亚太地区有望在预测期内主导所研究的市场。

电活性聚合物行业概况

全球电活性聚合物市场就其本质而言是部分整合的。 市场参与者包括 Solvay、The Lubrizol Corporation、Parker Hannifin Corp.、Premix Group 和 Arkema。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 调查先决条件

- 本次调查的范围

第二章研究方法论

第 3 章执行摘要

第四章市场动态

- 主持人

- 不断发展的电气和电子行业

- 其他司机

- 约束因素

- 因电活性聚合物产品处置不当造成的环境损害

- 工业价值链分析

- 波特的五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第 5 章市场细分(基于价值的市场规模)

- 类型

- 导电塑料

- 导电聚合物

- 固有耗散聚合物

- 用法

- 执行器/传感器

- 能源生产

- 汽车设备

- 电池

- 假肢

- 机器人

- 其他用途

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 意大利

- 其他欧洲

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙特阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章竞争格局

- 併购、合资、合作、合同等。

- 市场份额 (%)**/排名分析

- 主要公司采用的策略

- 公司简介

- Parker Hannifin Corp

- PolyOne Corporation

- 3M

- Kenner Material and System Co. Ltd.

- Solvay

- The Lubrizol Corporation

- Premix Group

- Arkema

- Merck

- NOVASENTIS, INC.

- Wacker Chemie AG

第七章市场机会与未来趋势

- 在生物信息学和人造肌肉中更多地使用电活性聚合物

简介目录

Product Code: 69496

The electroactive polymer market is projected to register a CAGR of more than 5% during the forecast period.

Key Highlights

- COVID-19 negatively impacted the market in 2020. However, the market reached pre-pandemic levels in 2022 and is expected to grow steadily in the future.

- The growing electrical and electronics industry is expected to drive market growth during the forecast period. However, it is difficult to extract the electroactive polymer, and it is usually harmful to the environment. However, improper disposal of electroactive polymer products could harm the environment, which is anticipated to slow the market's expansion.

- The rising significance of biomimetic and fake muscles for handling complex medical issues using electroactive polymer will likely provide opportunities for the electroactive polymer market over the next five years. The North American region is expected to dominate the global electroactive polymer market.

Electroactive Polymer Market Trends

Actuators and Sensors to Dominate the Market

- Actuators and sensors are expected to dominate due to their wide usage in electrical and electronic components of sensitive electronics and plastic parts. This is due to their ability to prevent dust attraction and electrostatic discharge. Inherently conductive polymers include polythiophenes, polyanilines, polypyrroles, and polyacetylenes.

- Conductive polymers are used in sensors as these are electronically conductive with relatively high and reversible ion storage capacity. The usage of electroactive polymers provides large electromechanical bending at low voltages. Moreover, their soft and flexible structures also help in working efficiently.

- According to the Ministry of Electronics and IT's 'A call to action for broadening and deepening electronics manufacturing' study, India intends to generate USD 300 billion in electrical and electronics manufacturing by 2026, benefiting the market for electroactive polymers during the forecast period.

- According to India Brand Equity Foundation (IBEF), India exported USD 2,009.07 million worth of electronics in September 2022, up 71.99% year over year. Key export items in this industry include mobile phones, consumer electronics (TV and audio), IT hardware (laptops, tablets), industrial electronics, and auto electronics, supporting the market growth.

- All the aforementioned factors are expected to drive the electroactive polymer market during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is the largest market for electroactive polymers. Factors such as increasing production of electronic devices and changing consumer preference towards miniaturization of daily use of consumer electronics and gadgets have been driving the electroactive polymer requirements in the region.

- Electronic products in the region have the highest growth rates in the consumer electronics segment of the market in terms of demand. With the increase in the disposable incomes of the middle-class population, the demand for electronic products is projected to increase steadily, thereby driving the market studied.

- China has the world's largest electronics production base. Electronic products, such as wires, cables, computing devices, and other personal devices, recorded the highest growth in electronics. The country serves the domestic demand for electronics and exports electronic output to other countries, thus, providing a huge market during the forecast period.

- According to the National Bureau of Statistics (NBS) of China, the overall profit of China's electronics manufacturing businesses increased by 38.9 percent year on year in 2021, thus positively impacting the market's growth.

- Furthermore, according to Japan Electronics and Information Technology Industries Association (JEITIA), the overall production value of the Japan electronics sector increased by almost 10% to around USD 100 billion in 2021. The sector includes electronic devices, components, and consumer and industrial electronic equipment.

- Hence, due to the above-mentioned reasons, Asia-Pacific is anticipated to dominate the market studied during the forecast period.

Electroactive Polymer Industry Overview

The global electroactive polymer market is partially consolidated in nature. Some of the major players in the market include Solvay, The Lubrizol Corporation, Parker Hannifin Corp., Premix Group, and Arkema, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Electrical and Electronics Industry

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Environmental Hazard Caused by Improper Disposal of Electroactive Polymer Products

- 4.3 Industry Value Chain Analysis

- 4.4 Porters Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Vlaue)

- 5.1 Type

- 5.1.1 Conductive Plastics

- 5.1.2 Inherently Conductive Polymer

- 5.1.3 Inherently Dissipative Polymer

- 5.2 Application

- 5.2.1 Actuators and Sensors

- 5.2.2 Energy Generation

- 5.2.3 Automotive Devices

- 5.2.4 Batteries

- 5.2.5 Prosthetics

- 5.2.6 Robotics

- 5.2.7 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Parker Hannifin Corp

- 6.4.2 PolyOne Corporation

- 6.4.3 3M

- 6.4.4 Kenner Material and System Co. Ltd.

- 6.4.5 Solvay

- 6.4.6 The Lubrizol Corporation

- 6.4.7 Premix Group

- 6.4.8 Arkema

- 6.4.9 Merck

- 6.4.10 NOVASENTIS, INC.

- 6.4.11 Wacker Chemie AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Use of Electroactive Polymer for Biometric and Artificial Muscles

02-2729-4219

+886-2-2729-4219

![可拉伸和共形电子产品中电活性聚合物的全球市场:趋势、机遇和竞争分析 [2023-2028]](/sample/img/cover/42/1272746.png)