|

市场调查报告书

商品编码

1273316

脑电图测量系统/设备市场——增长、趋势、COVID-19 的影响和预测 (2023-2028)Electroencephalography Systems/Devices Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

在预测期内,脑电图系统设备市场预计将以 8% 的复合年增长率註册。

COVID-19 的情况要求对医疗服务进行重大重组,包括神经科服务。 根据 2021 年 1 月发表的论文“COVID-19 大流行对神经系统疾病患者的影响:迫切需要提高医疗保健系统的准备”,来自西班牙,尤其是马德里地区的数据显示,95% 的医院重新分配神经科医生来帮助 COVID-19 患者,导致神经病房床位减少 89%。 大流行暴露了对神经系统疾病患者的护理不足,尤其是在已经缺乏医院-社区整合的地方。 COVID-19 患者医疗保健资源的变化以及社会疏远措施正在影响门诊、住院和家庭护理环境中的神经康復。 然而,由于心脏病的增加,脑电图系统的使用在全球范围内显着增加,市场现在正在获得发展势头。

脑电图是唯一可以确认阿尔茨海默病患者大脑活动并反映皮层神经元功能的临床诊断仪器。 此外,阿尔茨海默氏症、多发性硬化症、痴呆症、帕金森病和中风的高发病率是采用这种脑电图仪的主要驱动因素,进一步刺激了市场。 例如,根据帕金森基金会2020年3月更新的统计数据,到2020年,美国将有超过100万人同时患有帕金森病,每年将有近6万美国人被诊断出患有帕金森病,这一数字还在增加。 因此,由于全球神经系统疾病的高发病率,预计脑电图系统/设备市场在预测期内将显着增长。

此外,根据世界卫生组织(WHO)2021年10月公布的数据,人口老龄化的速度比以往快得多,到2030年,全球六分之一的人将活到60岁。据报导,更 此时,60 岁及以上人口的比例将增加,到 2050 年几乎翻一番,从 12% 增至 22%。 随着人口老龄化导致健康问题,尤其是神经系统疾病的增加,预计住院人数也会增加。 这种住院将导致对脑电图系统的需求,这有望推动脑电图系统设备市场。

此外,增加产品发布和产品开发推动了市场增长。 例如,2022 年 8 月,Myneurva 推出了 Starrbase,这是一个用于其高级神经网络分析 (ANNA) 的完全集成系统,包含 50 多个基于研究的大脑训练项目。 此外,2022 年 2 月,Masimo 宣布美国食品和药物管理局批准 SedLine 脑功能监测和 SedLine 儿科脑电图传感器用于儿科适应症。 这些因素可能会推动全球采用脑电图系统/设备的需求。

但是,脑电图系统的局限性预计会阻碍脑电图系统/设备市场的增长。

EEG 测量系统/设备的市场趋势

独立的脑电图系统未来有望实现健康成长

由于肿瘤、中风、脑瘫等脑部相关疾病等神经系统疾病的增加,单机系统有望在未来得到健康发展。 这些受试者更有可能被这些系统常用的医院收治。 独立式是由硬件和软件组成的固定在特定位置的系统,广泛应用于医院。 该系统使医生和医生能够有效地解释结果,重症监护的高覆盖率正在推动该领域的增长。

阿尔茨海默病的发病率在不断增加,预计在未来几十年内还会继续增加。 根据世界卫生组织 2021 年 9 月的报告,全球约有 5500 万人患有痴呆症,每年报告的病例近 1000 万例。 根据同一数据,阿尔茨海默氏痴呆症最为常见,约占所有痴呆症的 60-70%。 因此,阿尔茨海默病的高发病率预计将在预测期内促进该行业的大幅增长。

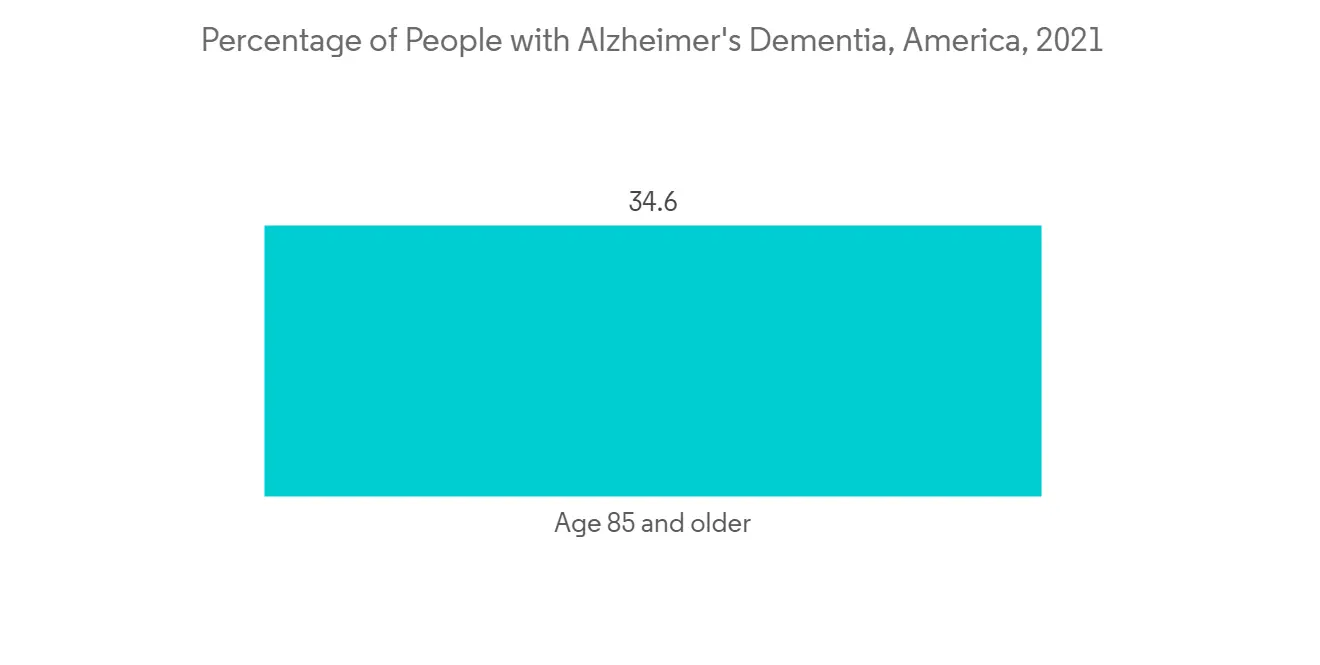

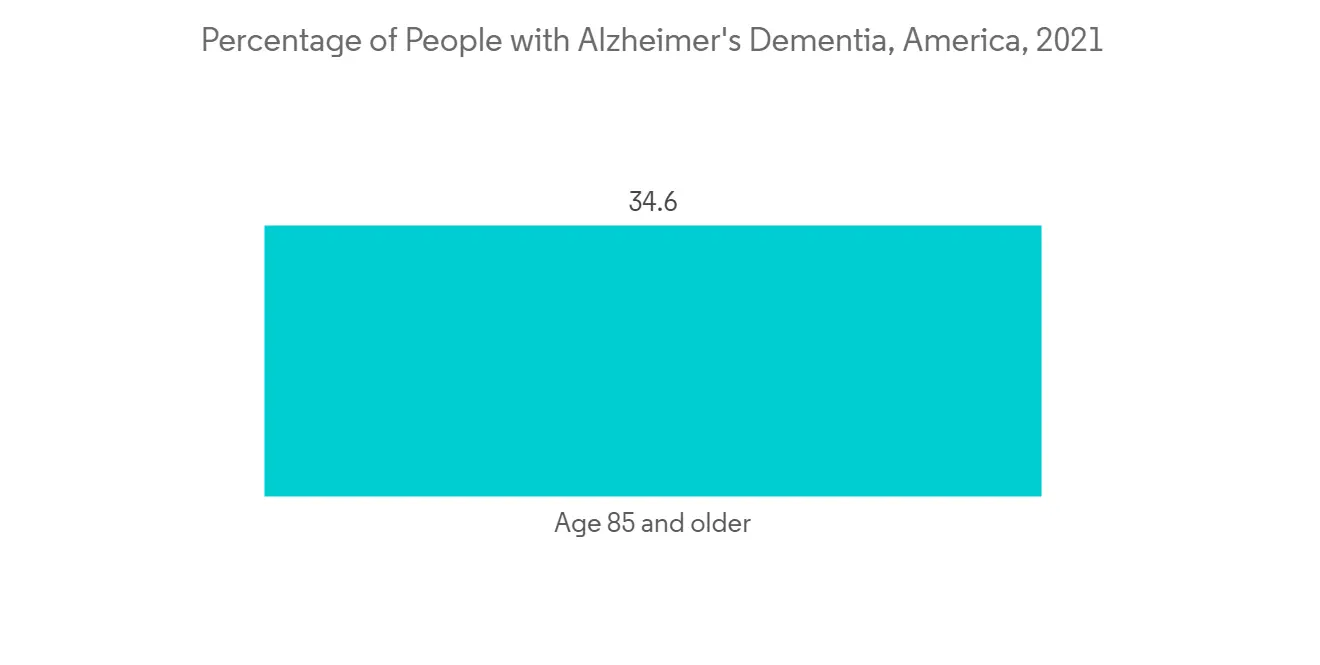

此外,根据阿尔茨海默氏症协会 2021 年 3 月的报告,美国约有 620 万 65 岁以上的人患有与阿尔茨海默氏症相关的痴呆症,到 2060 年这一数字将上升到 1380 万。预计在人类中还会增加。 此外,根据同一消息来源,在 COVID-19 大流行期间,美国与阿尔茨海默氏症和痴呆症相关的死亡人数增加了 16%。 到 2021 年,阿尔茨海默病和其他痴呆症的事故成本将达到约 3550 亿美元,到 2050 年,这一数额预计将超过 1.1 万亿美元。

因此,上述所有因素都有望在预测期内推动该细分市场的增长。

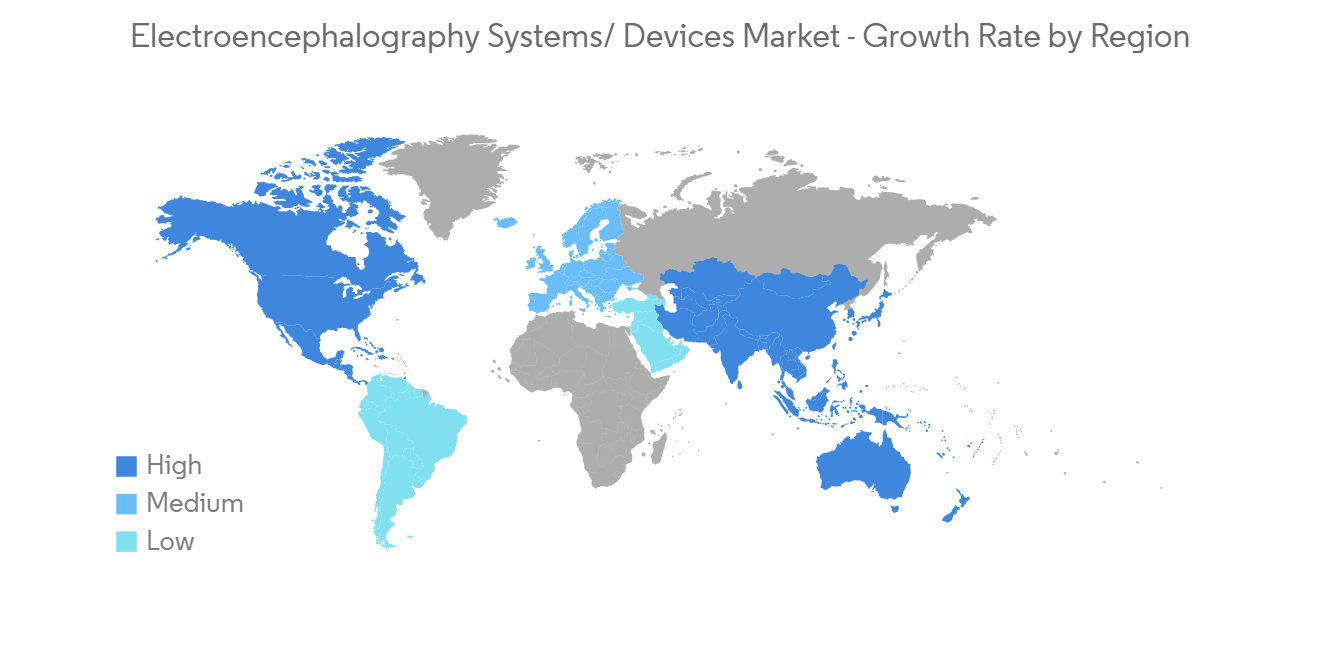

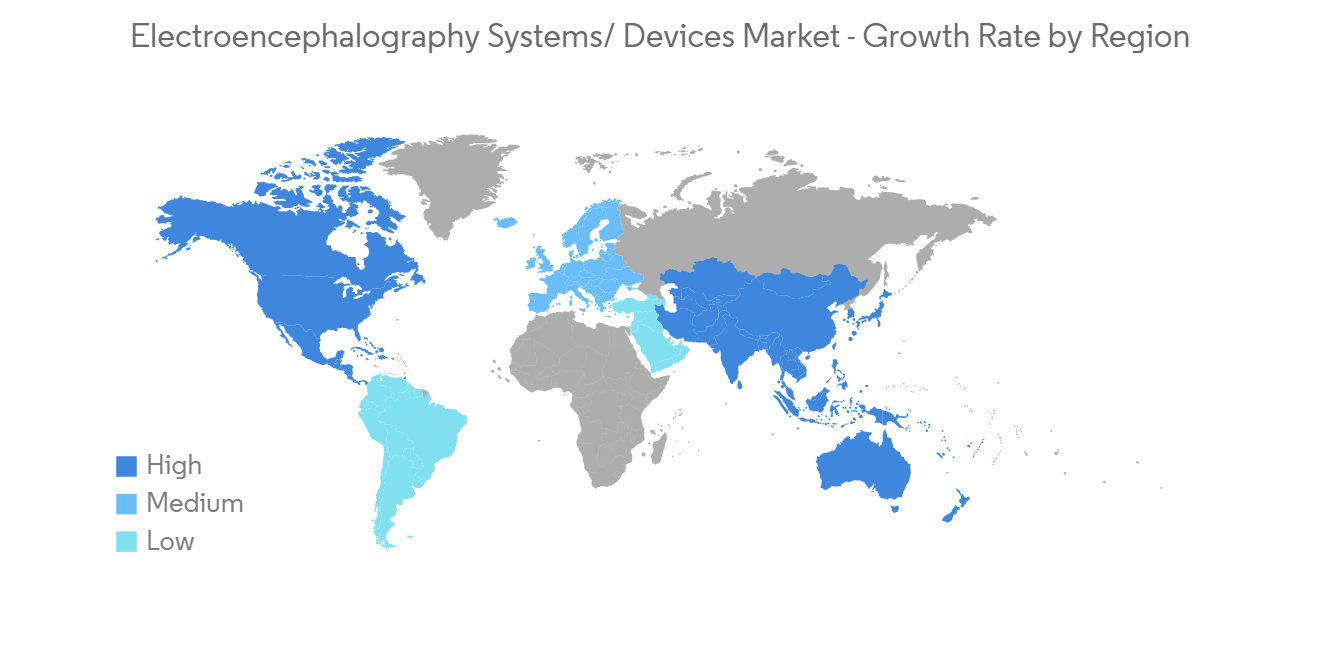

预计北美将占据很大的市场份额

由于神经系统疾病的增加和睡眠障碍患病率的上升,预计北美将占据全球脑电图设备市场的很大份额。

根据世界卫生组织 (WHO) 和泛美卫生组织 (PAHO) 2020 年的调查,超过一半的北美国家 (60.7%) 部分或全部心理治疗和咨询服务、诊断和实验室服务中断28 个国家中有 11 个国家 (39.3%) 的卫生设施服务中断。 研究表明,COVID-19 对整个美洲地区的精神、神经和物质使用 (MNS) 服务产生了重大影响。 然而,MNS 服务的类型及其中断程度差异很大。 大多数国家的门诊和社区服务(主要是家庭和日间护理服务)都受到了严重影响。

根据美国国家心理健康研究所 (NIMH) 2020 年版的数据,在特定年份,美国四分之一的成年人将患有可诊断的精神障碍,近 6% 的人将患有严重的残疾。它估计有 报告称,美国每年因严重精神疾病造成的总费用超过 3170 亿美元。

此外,预计美国食品和药物管理局批准的增加以及主要参与者推出的产品将提振市场。 例如,2021 年 11 月,Brain Scientific 宣布了一种先进的脑电图 (EEG) 电极阵列,用于在需要 STAT EEG 记录的常规临床和研究环境中获取快速脑电图。下一代 NeuroCap EEG 已获得美国食品和药物管理局的批准耳机。

此外,不断增长的医疗支出和完善的医疗基础设施也显着推动了该地区的整体市场增长。

脑电测量系统/设备行业概况

脑电图系统/设备市场是一个分散且竞争激烈的市场,由几家大型企业组成。 目前主导市场的公司包括 Natus Medical, Inc.、Cadwell Industries, Inc.、Medtronic 和 Nihon Kohden。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 调查假设和市场定义

- 本次调查的范围

第二章研究方法论

第 3 章执行摘要

第四章市场动态

- 市场概览

- 市场驱动力

- 研发费用增加

- 神经系统疾病的患病率增加

- 市场製约因素

- 脑电图的局限性

- 波特的五力分析

- 新进入者的威胁

- 买方/消费者议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

第 5 章市场细分

- 按类型

- 便携式设备

- 独立型

- 最终用户

- 医院

- 诊断中心

- 其他

- 按地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 意大利

- 西班牙

- 其他欧洲

- 亚太地区

- 中国

- 日本

- 印度

- 澳大利亚

- 韩国

- 其他亚太地区

- 中东和非洲

- 海湾合作委员会

- 南非

- 其他中东和非洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美

第6章竞争格局

- 公司简介

- Natus Medical, Inc.

- NeuroWave Systems, Inc

- Cadwell Industries, Inc.

- Medtronic

- Nihon Kohden Corporation

- Advanced Brain Monitoring, Inc.

- Cephalon A/S

- Compumedics Limited

- Fresenius SE & Co. KGaA

- General Electric Company(GE Healthcare)

- Koninklijke Philips N.V.(Philips Healthcare)

第7章 市场机会与将来动向

The electroencephalography systems devices market is expected to register a CAGR of 8% over the forecast period.

The COVID-19 situation necessitated significant rearranging of health services, including neurological services. According to an article published in January 2021 titled "The impact of the COVID-19 pandemic on people with neurological disorders: an urgent need to improve the health care system's preparedness," data from Spain, particularly the Madrid area, show that 95% of hospitals have re-allocated neurologists to assist COVID-19 patients, and the number of beds in neurology wards has been reduced by 89%. The pandemic has exposed the lack of sufficient health care for patients with neurological illnesses, particularly in locations where hospital-community integration is already lacking. The shift in health resources for COVID-19 patients, along with social distancing measures, has jeopardized neuro-rehabilitation in the outpatient context and inpatient and home care settings. However, the market is currently gaining traction due to the significant increase in the use of electroencephalography devices globally due to the increasing number of heart diseases.

Electroencephalography is the only clinical diagnostic instrument to see brain activity and reflect cortical neuronal functioning in Alzheimer's patients. Moreover, high incidences of Alzheimer's epilepsy, multiple sclerosis, dementia, Parkinson's disease, and stroke are the key driving factors for adopting this electroencephalography, further triggering the market. For instance, as per the Parkinson's Foundation Statistics updates from March 2020, more than one million people were living with Parkinson's disease in the United States by 2020, and nearly 60,000 Americans are diagnosed with Parkinson's disease every year. Thus, because of the high incidence of neurological disorders globally, the electroencephalography system/devices market is expected to grow significantly over the forecast period.

Moreover, the data published in October 2021 by World Health Organization (WHO) reported that the pace of population aging is much faster than in the past, and 1 in 6 people worldwide will be 60 years or over by 2030. At this time, the share of the population aged 60 years and over will increase and will nearly double from 12% to 22% by 2050. As the aging population creates an increase in health-related issues, especially neurological diseases, the hospitalization of patients is also expected to rise. This hospitalization is likely to lead to the requirement for electroencephalogram (EEG) systems, and this is expected to drive the electroencephalography systems devices market.

Moreover, increasing product launches and product development promotes market growth. For instance, in August 2022, Myneurva launched Starrbase, a fully integrated system of its Advanced Neural Network Analysis (ANNA), with over fifty research-based brain training programs. Moreover, in February 2022, Masimo announced the United States Food and Drug Administration clearance of pediatric indication for SedLine brain function monitoring and the SedLine pediatric EEG sensor. Such factors potentially drive the demand for adopting electroencephalography systems/devices worldwide.

However, the limitation of the electroencephalography system is expected to hamper the growth of the electroencephalography systems/devices market.

Electroencephalography Systems/Devices Market Trends

Standalone Electroencephalography System is Expected to Witness a Healthy Growth in Future

The standalone system is expected to witness healthy growth in the future owing to an increasing number of neurological disorders such as tumors, strokes, cerebral palsy, and other brain-related disorders. These target populations are more prone to admit to hospitals wherein these systems are commonly used. A standalone system is fixed at a particular place consisting of hardware and software and is widely used in hospitals. This system allows doctors and physicians to interpret the results efficiently and high application in critical care is boosting the segment growth.

The incidence of Alzheimer's has constantly been increasing, and it is expected to continue increasing in the coming decades. According to the September 2021 report of the World Health Organization, about 55 million people around the world are living with dementia, and nearly 10 million cases are reported every year. As per the same source, Alzheimer's is the most common form of dementia and constitutes about 60-70% of the total cases of dementia. Thus, the high incidence of Alzheimer's disease is expected to help in the significant growth of the segment over the forecast period.

Furthermore, according to the March 2021 report of the Alzheimer's Association, approximately 6.2 million people of age 65 years and more are living with Alzheimer's-related dementia in the United States, and it is projected that this number will increase to 13.8 million people by 2060. Further, as per the same source, Alzheimer's- and dementia-related deaths in the United States increased by 16% during the COVID-19 pandemic. It was estimated that in 2021, the country recorded about USD 355 billion in Alzheimer's and other dementia incurred costs, and it is expected that by 2050, this amount would rise to more than USD 1.1 trillion.

Thus, all aforementioned factors are expected to boost segment growth over the forecast period.

North America is Expected to Hold a Significant Share in the Market

North America is expected to hold a major market share in the global electroencephalography systems devices market due to increasing incidences of neurological disorders, and the rising prevalence of sleep disorders.

According to the World Health Organization's (WHO) and Pan American Health Organization's (PAHO) 2020 survey, psychotherapy and counseling services were partially or wholly disrupted in more than half of North American countries (60.7%), while diagnostic and laboratory services at mental health facilities were disrupted in 11 of 28 countries (39.3%). COVID-19 has had a considerable impact on mental, neurological, and substance use (MNS) services throughout the Region of the Americas, according to the survey. However, the types of MNS services and the extent to which they have been disrupted differ significantly. Outpatient and community-based services (mainly home and daycare services) were impacted considerably in most countries.

According to the United States National Institute of Mental Health (NIMH) 2020, it has been estimated that one in four American adults have a diagnosable mental disorder in any given year, and nearly 6% suffer from severe disabilities. The same source has also stated that the total cost of severe mental illness in the United States exceeds USD 317 billion per year.

Moreover, increasing approvals from the United States Food and Drug Administration and product launches by key players are expected to boost the market. For instance, in November 2021, Brain Scientific received the United States Food and Drug Administration clearance for the Next-Gen NeuroCap EEG Headset, an advanced Electroencephalogram (EEG) electrode array used to obtain rapid EEGs in routine clinical and research settings where the recording of STAT EEGs is desired.

Furthermore, increasing healthcare expenditure and the presence of well-established healthcare infrastructure are also fueling the growth of the overall regional market to a large extent.

Electroencephalography Systems/Devices Industry Overview

The Electroencephalography Systems Devices Market is fragmented and competitive, and consists of several major players. Some companies currently dominating the market are Natus Medical, Inc., Cadwell Industries, Inc., Medtronic, and Nihon Kohden Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising R&D Expenditure

- 4.2.2 Increasing Prevalence of Neurological Disorders

- 4.3 Market Restraints

- 4.3.1 Limitation of Electroencephalography System

- 4.4 Porter's Five Force Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Type

- 5.1.1 Portable Device

- 5.1.2 Standalone Device

- 5.2 By End User

- 5.2.1 Hospitals

- 5.2.2 Diagnostic Centers

- 5.2.3 Others

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle-East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle-East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Natus Medical, Inc.

- 6.1.2 NeuroWave Systems, Inc

- 6.1.3 Cadwell Industries, Inc.

- 6.1.4 Medtronic

- 6.1.5 Nihon Kohden Corporation

- 6.1.6 Advanced Brain Monitoring, Inc.

- 6.1.7 Cephalon A/S

- 6.1.8 Compumedics Limited

- 6.1.9 Fresenius SE & Co. KGaA

- 6.1.10 General Electric Company (GE Healthcare)

- 6.1.11 Koninklijke Philips N.V. (Philips Healthcare)