|

市场调查报告书

商品编码

1273326

饲料益生菌市场——市场规模、份额和到 2029 年的预测Feed Probiotics Market - SIZE, SHARE, & FORECASTS UP TO 2029 |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

饲料益生菌市场预计将以 5.06% 的复合年增长率增长。

主要亮点

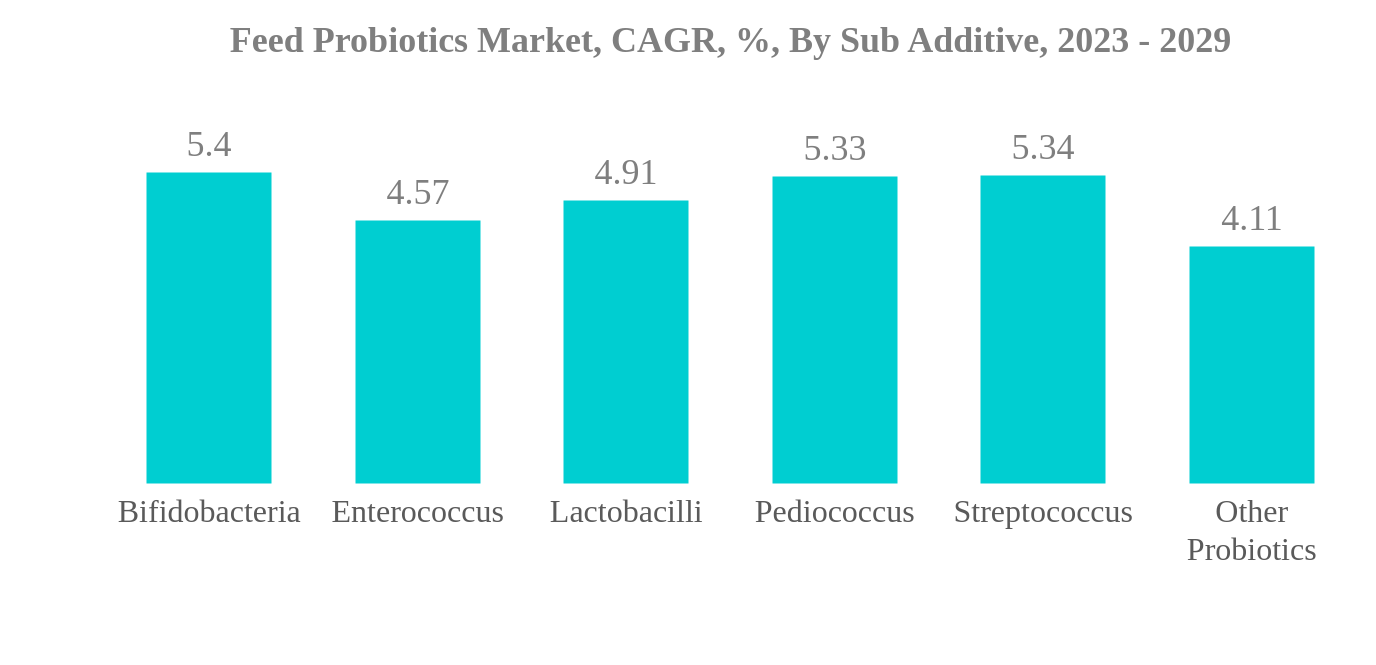

- 双歧桿菌是最大的副添加剂:由于对肉类和海鲜的需求不断增加以及减少动物胃肠道中有害微生物的生长,双歧桿菌是最大的部分。

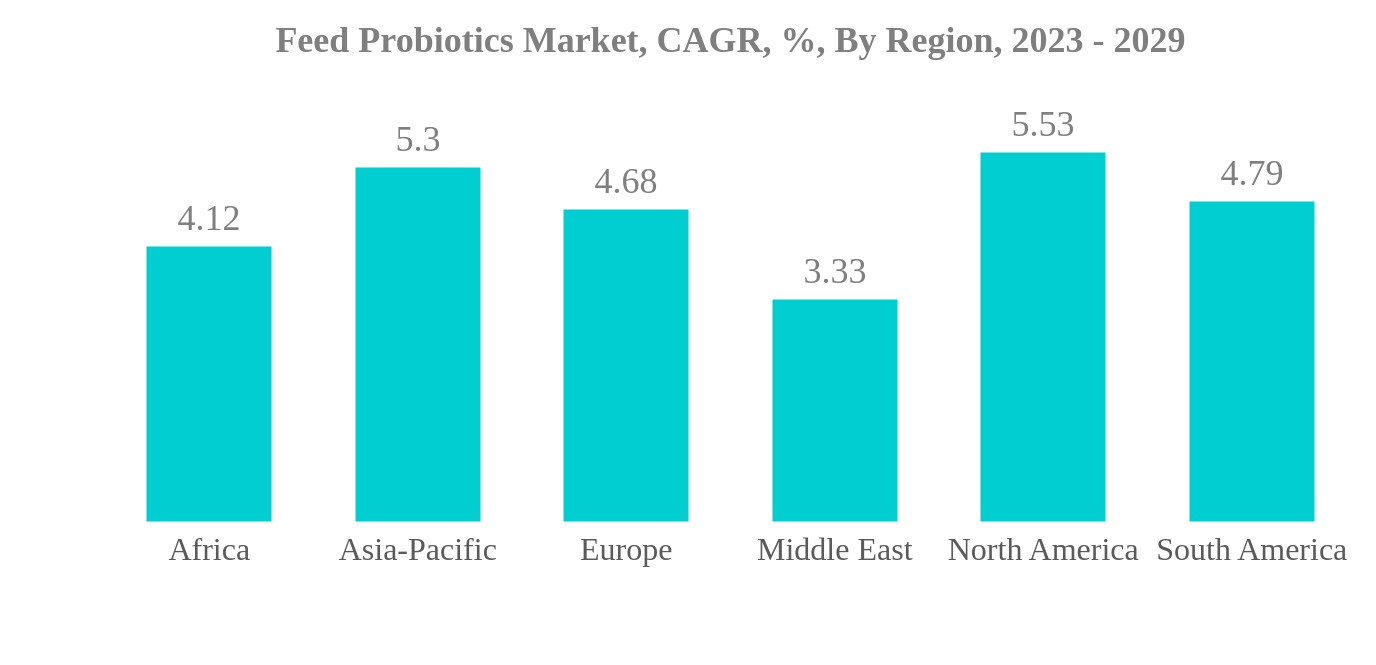

- 亚太地区是最大的地区:亚太地区是最大的地区,因为其家禽数量最多,饲料产量增加,对肉类和成品的需求量很大。

- 双歧桿菌是一种快速生长的辅助添加剂:双歧桿菌是一个快速生长的部分,因为它们在亚太地区的消费量很大,在该地区,它们可以控制弯曲桿菌病等疾病并帮助动物增加体重。

- 北美是一个快速增长的地区:北美是一个快速增长的地区,原因是饲料产量增加、美国主要饲料厂和对肉类产品的高需求。

饲料益生菌市场趋势

双歧桿菌是最大的二次添加剂

- 全球饲料添加剂市场的益生菌消费量显着增加。 2022年,益生菌市场份额将达到8.3%。 这是因为它可以促进动物的生长和生产、抵御病原体、提高骨骼强度、增强免疫系统和对抗寄生虫。 预计该市场将在预测期内增长,并保持在 5.1% 的复合年增长率。

- 双歧桿菌和乳酸桿菌是全球消耗的两种主要辅助添加剂,2022 年合计占全球饲料益生菌市场的 63.5%。 乳酸菌刺激消化系统,对抗致病细菌,并有助于维生素的产生。 双歧桿菌有助于体重增加和改善动物健康。

- 家禽是全球饲料益生菌市场中最大的动物类型细分市场,按价值计算,到 2022 年占市场份额的 46.8%。 饲料益生菌在家禽中的使用越来越多,这是因为它们能够促进生长性能和整体健康。

- 世界上最大的饲料益生菌消费者位于亚太地区和北美地区。 2022年,美国将占据最大的市场份额,占北美饲料益生菌市场的70.0%。 在亚太地区,中国是饲料益生菌的主要市场,按价值计算占该地区饲料益生菌市场的43.9%。 这是因为该国牲畜存栏量大,据称到2022年中国将占亚太地区家禽存栏量的41.0%。

- 因此,由于益生菌具有改善消化系统、预防疾病和提高饲料产量等作用,预计益生菌在饲料添加剂中的用途将会扩大。 这为製造商提供了扩展其产品供应的机会。

亚太地区是最大的地区

- 近年来,全球饲料益生菌市场出现了显着增长。 益生菌是促进动物生长发育同时增强免疫系统和保护动物免受疾病侵害的必需营养素。 2017-2022年,全球饲料益生菌市场规模将增长29.7%,占饲料添加剂市场总量的8.3%。

- 到 2022 年,由于亚太地区的高渗透率和商业化畜牧业,该地区将成为最大的饲料益生菌市场,价值 8.832 亿美元。 从国家来看,美国是最大的饲料益生菌市场,约占全球市场份额的18.5%,2022年市场规模为5.058亿美元。 美国因其高度发达的生产方式和商品化畜牧业而占据主导地位。

- 由于动物数量众多,中国是饲料益生菌的第二大市场,2022 年占全球市场份额的 14.2%。 然而,日本和美国是世界上增长最快的国家,饲料生产需求增加,饲料益生菌作为仔猪和犊牛原料的利用率增加,预计将增加预测 预计将以復合年增长率增长期内分别增长6.2%及6.0%。

- 由于对生产力增长、全球人口增长和城市化的日益关注,预计在预测期内,全球饲料益生菌市场将以 5.1% 的复合年增长率增长。 肉类和奶製品消费量的增加预计也将推动市场增长。

饲料益生菌行业概况

饲料益生菌市场正在缓慢整合,前五企业占比达51.79%。 这个市场的主要参与者是 Adisseo、Cargill Inc.、DSM Nutritional Products AG、Evonik Industries AG 和 IFF (Danisco Animal Nutrition)(按字母顺序排列)。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第 1 章执行摘要和主要发现

第 2 章提供报告

第 3 章介绍

- 调查假设和市场定义

- 调查范围

- 调查方法

第 4 章主要行业趋势

- 动物数量

- 饲料生产

- 监管框架

- 价值炼和分销渠道分析

第 5 章市场细分

- 添加剂

- 双歧桿菌

- 肠球菌

- 乳酸菌

- 片球菌属

- 链球菌

- 其他

- 动物

- 水产养殖

- 按类型

- 鱼

- 虾

- 其他

- 家禽

- 按类型

- 肉鸡

- 图层

- 其他

- 反刍动物

- 按类型

- 肉牛

- 奶牛

- 其他

- 猪

- 其他动物

- 水产养殖

- 按地区

- 非洲

- 按国家

- 埃及

- 肯尼亚

- 南非

- 其他非洲地区

- 亚太地区

- 按国家

- 澳大利亚

- 中国

- 印度

- 印度尼西亚

- 日本

- 菲律宾

- 韩国

- 泰国

- 越南

- 其他亚太地区

- 欧洲

- 按国家

- 法国

- 德国

- 意大利

- 荷兰

- 俄罗斯

- 西班牙

- 土耳其人

- 英国

- 其他欧洲

- 中东

- 按国家

- 伊朗

- 沙特阿拉伯

- 其他中东地区

- 北美

- 按国家

- 加拿大

- 墨西哥

- 美国

- 其他北美地区

- 南美洲

- 按国家

- 阿根廷

- 巴西

- 智利

- 其他南美洲

- 非洲

第 6 章竞争格局

- 重大战略举措

- 市场份额分析

- 公司情况

- 公司简介

- Adisseo

- Cargill Inc.

- CHR. Hansen A/S

- DSM Nutritional Products AG

- Evonik Industries AG

- IFF(Danisco Animal Nutrition)

- Kemin Industries

- Kerry Group Plc

- Lallemand Inc.

- MIAVIT Stefan Niemeyer GmbH

第 7 章 CEO 的关键战略问题

第 8 章附录

- 世界概览

- 概览

- 波特的五力模型

- 世界价值链分析

- 世界市场规模和 DRO

- 来源和参考资料

- 图表列表

- 主要见解

- 数据包

- 词彙表

简介目录

Product Code: 55743

The Feed Probiotics Market is projected to register a CAGR of 5.06%

Key Highlights

- Bifidobacteria is the Largest Sub Additive : Bifidobacteria is the largest segment due to the rising demand for meat and seafood and reducing the growth of harmful microorganisms in the gastrointestinal tract of animals.

- Asia-Pacific is the Largest Region : The Asia-Pacific region is the largest regional segment, having the highest poultry population, increased feed production, and high demand for meat and end-products.

- Bifidobacteria is the Fastest-growing Sub Additive : Bifidobacteria is the fastest-growing segment due to high consumption in Asia-Pacific, reducing diseases such as campylobacteriosis and helping animals to gain body weight.

- North America is the Fastest-growing Region : North America is the fastest-growing region because of increased feed production, major feed mills in the United States, and high demand for meat products.

Feed Probiotics Market Trends

Bifidobacteria is the largest Sub Additive

- The global feed additives market has seen a significant increase in the consumption of probiotics. In 2022, probiotics held a market share of 8.3%. This is due to their ability to enhance the growth and production of animals, protect against pathogens, improve bone strength, enhance the immune system, and fight parasitism. The market is expected to grow and register a CAGR of 5.1% during the forecast period.

- Bifidobacteria and lactobacilli are the two major sub-additives consumed globally, together accounting for 63.5% of the global feed probiotics market in 2022. Lactobacilli stimulate the digestive system, fight disease-causing bacteria, and help produce vitamins. Bifidobacteria helps in weight gain and improve animal health.

- Poultry birds were the largest animal type segment in the global feed probiotics market, accounting for 46.8% of the market share by value in 2022. The increased usage of feed probiotics in poultry birds is due to their ability to promote growth performance and overall health.

- The largest consumers of feed probiotics globally are Asia-Pacific and North America. In 2022, the United States held the largest market share, accounting for 70.0% of the North American feed probiotic market. In the Asia-Pacific region, China is the major market for feed probiotics, accounting for 43.9% of the region's feed probiotics market by value. This is due to the high livestock population in the country, with China accounting for 41.0% of the Asia-Pacific's poultry population in 2022.

- Therefore, the use of probiotics in feed additives is expected to grow due to their ability to improve the digestive system, prevent diseases, and increase feed production. This provides an opportunity for manufacturers to expand their offerings.

Asia-Pacific is the largest Region

- The global feed probiotics market experienced impressive growth in recent years. Probiotics are essential nutrients that help enhance animal growth and development while strengthening immune systems and protecting the animals from diseases. During 2017-2022, the global feed probiotics market grew by 29.7%, representing 8.3% of the overall feed additive market.

- In 2022, Asia-Pacific was the largest market for feed probiotics, with a value of USD 883.2 million due to the region's higher penetration rates and higher commercial cultivation of animals. At the country level, the United States was the largest market for feed probiotics, accounting for almost 18.5% of the global market share, with a value of USD 505.8 million in 2022. The United States occupied a dominant position due to its highly developed production practices and significant commercial animal cultivation.

- China was the second-largest market for feed probiotics, accounting for 14.2% of the global market share in 2022 due to its large animal headcount. However, Japan and the United States are the fastest-growing countries in the world, and they are expected to record a CAGR of 6.2% and 6.0%, respectively, during the forecast period due to the rising demand for feed production and increased usage of feed probiotics as ingredients for piglets and calves.

- The global feed probiotics market is expected to register a CAGR of 5.1% during the forecast period, driven by the growing concerns of rising productivity, increasing global population, and urbanization. The increased consumption of meat and dairy products is also expected to fuel the market's growth.

Feed Probiotics Industry Overview

The Feed Probiotics Market is moderately consolidated, with the top five companies occupying 51.79%. The major players in this market are Adisseo, Cargill Inc., DSM Nutritional Products AG, Evonik Industries AG and IFF(Danisco Animal Nutrition) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Animal Headcount

- 4.2 Feed Production

- 4.3 Regulatory Framework

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION

- 5.1 Sub Additive

- 5.1.1 Bifidobacteria

- 5.1.2 Enterococcus

- 5.1.3 Lactobacilli

- 5.1.4 Pediococcus

- 5.1.5 Streptococcus

- 5.1.6 Other Probiotics

- 5.2 Animal

- 5.2.1 Aquaculture

- 5.2.1.1 By Sub Animal

- 5.2.1.1.1 Fish

- 5.2.1.1.2 Shrimp

- 5.2.1.1.3 Other Aquaculture Species

- 5.2.2 Poultry

- 5.2.2.1 By Sub Animal

- 5.2.2.1.1 Broiler

- 5.2.2.1.2 Layer

- 5.2.2.1.3 Other Poultry Birds

- 5.2.3 Ruminants

- 5.2.3.1 By Sub Animal

- 5.2.3.1.1 Beef Cattle

- 5.2.3.1.2 Dairy Cattle

- 5.2.3.1.3 Other Ruminants

- 5.2.4 Swine

- 5.2.5 Other Animals

- 5.2.1 Aquaculture

- 5.3 Region

- 5.3.1 Africa

- 5.3.1.1 By Country

- 5.3.1.1.1 Egypt

- 5.3.1.1.2 Kenya

- 5.3.1.1.3 South Africa

- 5.3.1.1.4 Rest Of Africa

- 5.3.2 Asia-Pacific

- 5.3.2.1 By Country

- 5.3.2.1.1 Australia

- 5.3.2.1.2 China

- 5.3.2.1.3 India

- 5.3.2.1.4 Indonesia

- 5.3.2.1.5 Japan

- 5.3.2.1.6 Philippines

- 5.3.2.1.7 South Korea

- 5.3.2.1.8 Thailand

- 5.3.2.1.9 Vietnam

- 5.3.2.1.10 Rest Of Asia-Pacific

- 5.3.3 Europe

- 5.3.3.1 By Country

- 5.3.3.1.1 France

- 5.3.3.1.2 Germany

- 5.3.3.1.3 Italy

- 5.3.3.1.4 Netherlands

- 5.3.3.1.5 Russia

- 5.3.3.1.6 Spain

- 5.3.3.1.7 Turkey

- 5.3.3.1.8 United Kingdom

- 5.3.3.1.9 Rest Of Europe

- 5.3.4 Middle East

- 5.3.4.1 By Country

- 5.3.4.1.1 Iran

- 5.3.4.1.2 Saudi Arabia

- 5.3.4.1.3 Rest Of Middle East

- 5.3.5 North America

- 5.3.5.1 By Country

- 5.3.5.1.1 Canada

- 5.3.5.1.2 Mexico

- 5.3.5.1.3 United States

- 5.3.5.1.4 Rest Of North America

- 5.3.6 South America

- 5.3.6.1 By Country

- 5.3.6.1.1 Argentina

- 5.3.6.1.2 Brazil

- 5.3.6.1.3 Chile

- 5.3.6.1.4 Rest Of South America

- 5.3.1 Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Adisseo

- 6.4.2 Cargill Inc.

- 6.4.3 CHR. Hansen A/S

- 6.4.4 DSM Nutritional Products AG

- 6.4.5 Evonik Industries AG

- 6.4.6 IFF(Danisco Animal Nutrition)

- 6.4.7 Kemin Industries

- 6.4.8 Kerry Group Plc

- 6.4.9 Lallemand Inc.

- 6.4.10 MIAVIT Stefan Niemeyer GmbH

7 KEY STRATEGIC QUESTIONS FOR FEED ADDITIVE CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Global Market Size and DROs

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219