|

市场调查报告书

商品编码

1273328

饲料加工机械市场-增长、趋势和预测 (2023-2028)Feed Processing Machinery Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

在预测期内,全球饲料加工机械市场预计将以 4.5% 的复合年增长率增长。

主要亮点

- 畜牧业产业化,特别是水产养殖业对优质饲料的需求,为机械製造商开拓市场铺平了道路。 高度自动化和先进的机械也在推动市场增长,以满足畜牧业者的需求。

- 对配合饲料和饲料添加剂的需求不断增长,这为机器製造商提供了提供更多设备和先进机器以满足需求的机会。 亚太地区饲料行业的崛起也是预测期内提振市场的一个因素。

- 各种定制服务的可用性、机械行业的技术进步、畜牧业者对饲料和饲料添加剂的重要性的认识不断提高、商业化畜牧场的数量不断增加等。这是推动机械行业发展的主要因素之一市场。

饲料加工机械市场趋势

畜牧业对优质饲料的需求不断增长

随着全球动物产品消费量的增加,预计饲料需求也会增加。 消费者对乳製品和肉类质量饮食习惯的改变有望促进饲料行业的增长并推动饲料加工机械市场。 然而,随着全球肉类消费量的增加,预计饲料行业对更高品质肉类的需求将增加。

世界各地的肉类消费量正在稳步增长。 人口增长、城市化、人口结构、收入、价格、环境和健康问题是影响肉类消费水平和类型的主要因素。 这增加了饲料市场的需求。

水产养殖业的兴起引起了全球水产饲料製造商的极大关注。 养分和饲料投入可能需要以类似的速度增长,水产养殖部门才能维持目前的增长率。 与此同时,海产品原料生产已经趋于平稳,其他行业也在争夺同样的饲料资源。 然而,随着水产养殖业的稳步增长和饲料需求的增长,尤其是罗非鱼和鲶鱼,许多小型生产商选择自己加工饲料,而不是购买完整的鱼饲料。 这鼓励小农引进饲料加工机械。 配合饲料成本的上升和农民对饲料加工机械好处的认识的提高正在推动对饲料加工机械的需求。

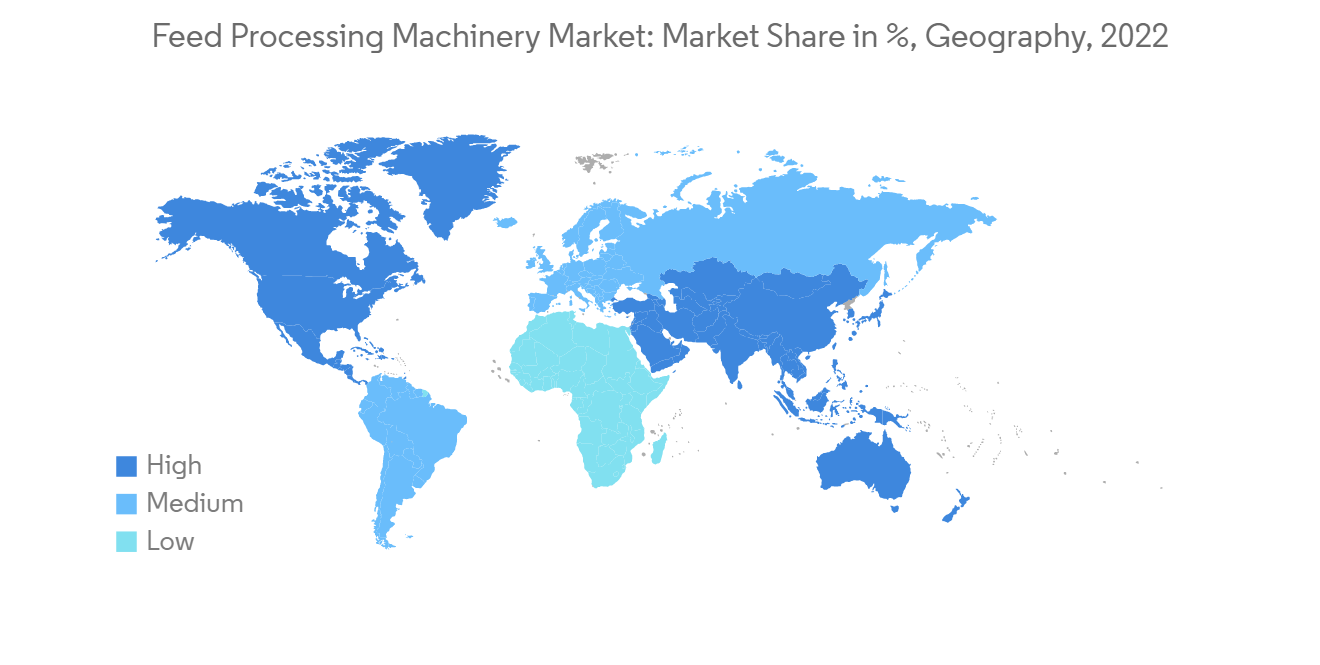

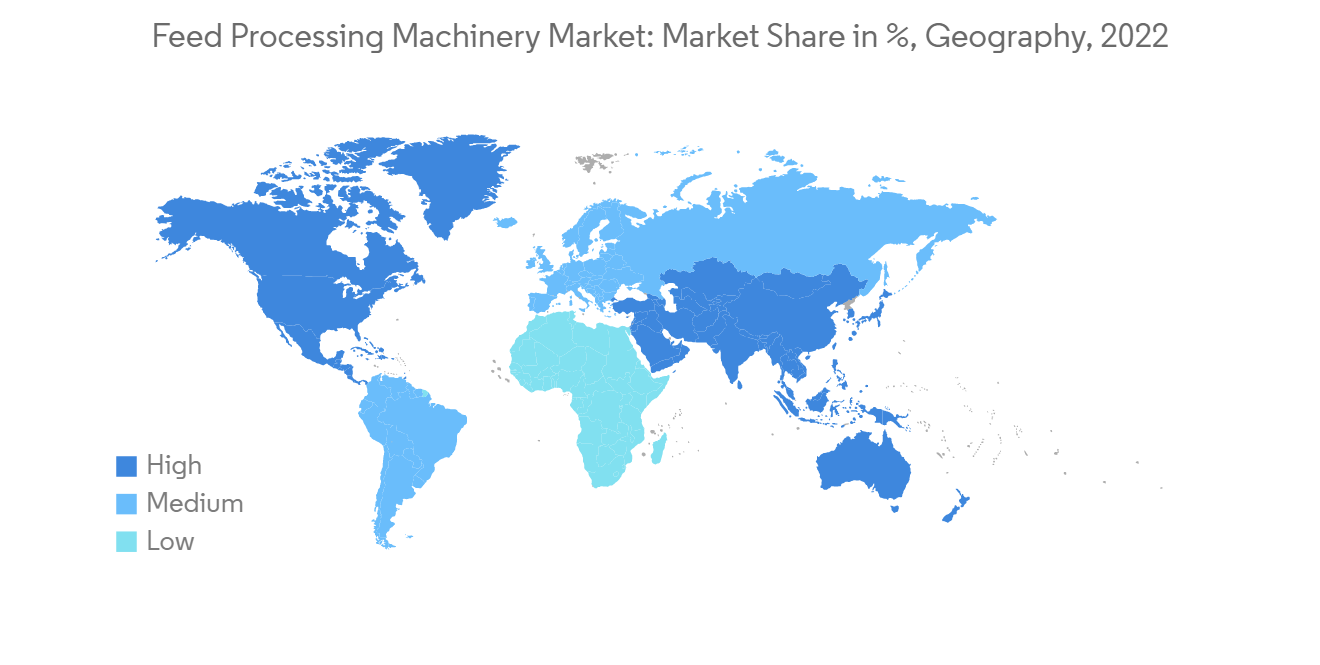

亚太地区主导全球市场

亚太地区拥有数量最多的饲料製造商和机械供应商,在市场上处于领先地位。 由于经济增长和快速城市化,中国在饲料产量和饲料加工机械的用户数量方面保持领先地位。 市场的主要驱动力是国内饲料加工机械製造商的集中、技术创新以及由于人口增长而增加的政府对机械化的补贴。

中国的商业饲料加工机械行业在支持国内畜牧业发展和创造出口到其他国家的机会方面发挥着关键作用。 由于非洲猪瘟(ASF)的广泛影响,2019年中国饲料行业出现了小幅空白。 然而,预计饲料生产将在预测期内重回正轨。

在亚太地区,从 2017 年到 2022 年,饲料总产量增长了 30.3%。 2022 年该地区的饲料总产量为 5.027 亿吨。 饲料需求的增加正在推动市场。

饲料加工机械行业概况

饲料加工机械市场具有综合性,主要参与者占据主要市场份额。 市场参与者包括 Buhler AG、Clextral、Dinnissen BV、Andritz AG 和 Bratney Companies。 大多数市场参与者都专注于新机器的开发、合作和合併,以获得相对于其他市场参与者的竞争优势。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 调查假设和市场定义

- 本次调查的范围

第二章研究方法论

第 3 章执行摘要

第四章市场动态

- 市场概览

- 市场驱动因素

- 市场製约因素

- 波特的五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第 5 章市场细分

- 特点

- 颗粒成型

- 製粒机

- 颗粒模具

- 护髮素

- 其他(冷却器、烘干机)

- 混合

- 混音器

- 注射/称重

- 其他(滤尘器)

- 打磨

- 锤磨机

- 粉碎机

- 其他(辊磨机、筛分设备)

- 挤压

- 挤出机

- 喷油器

- 其他(预调节剂)

- 颗粒成型

- 供稿类型

- 反刍动物饲料

- 家禽饲料

- 猪饲料

- 水产饲料

- 其他动物饲料

- 地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 其他北美地区

- 欧洲

- 德国

- 英国

- 法国

- 意大利

- 西班牙

- 其他欧洲

- 亚太地区

- 中国

- 日本

- 印度

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 南非

- 沙特阿拉伯

- 其他中东/非洲

- 北美

第六章竞争格局

- 最常采用的策略

- 市场份额分析

- 公司简介

- Andritz AG

- Buhler AG

- Clextral

- Bratney Companies

- Dinnissen BV

- HET Feed Machinery

- Muyang Group

- B.K. Allied Industries

- Henan Longchang Machinery Manufacturing Co., Ltd

第7章 市场机会未来动向

The Global Feed Processing Machinery Market is projected to register a CAGR of 4.5% during the forecast period.

Key Highlights

- Industrialization of livestock production and demand for high-quality feed, especially from aquaculture has paved the way for machinery manufacturers to explore the market. To meet the demand of livestock farmers the highly automated and advanced machinery has also augmented the growth of the market.

- Demand in the growth of compound feed and feed additives has created an opportunity for machinery manufacturers to supply a number of equipment and advanced machinery to meet the demands. Increasing feed-based industries in Asia-Pacific are also driving the market to spur during the forecast period.

- Availability of various customized services, technological advancement in the field of machinery, growing awareness about the importance of feed and feed additives among livestock farmers and increasing commercial livestock farms are some of the major factors to drive the global feed processing machienary market during the forecast period.

Feed Processing Machinery Market Trends

Increasing Demand for High Quality Feed from Livestock Industry

A rise in animal-based food product consumption all over the world is anticipated to boost the demand for feed. Changes in customer dietary habits toward the quality of dairy products and meat are expected to contribute to the growth of the feed industry which drives the feed processing machinery market. Nevertheless, with the rise in meat consumption across the world, the feed industry is estimated to witness a huge demand for better-quality meat.

The consumption of meat has been rising steadily across the world. The increasing population, urbanization, demographics, incomes, prices, and environmental and health concerns are key factors that influence the level and type of meat consumption. This is enhancing the demand for the feed market.

The rise of aquaculture has attracted a great deal of attention among aquafeed manufacturers, globally. For the aquaculture sector to maintain its current growth rate, the supply of nutrient and feed inputs may have to grow at a similar rate, while the production of aquatic ingredients remains static and other sectors are competing for the same feed resources. However, the steady growth of aquaculture and the demand for more feed, especially for tilapia and catfish, sparked the interest among most of the small scale producers to process their own feeds, rather than purchasing a complete fish feed. This, in turn, is encouraging small scale farmers to install feed processing machinery. The rise in compound feed costs and the rising awareness among farmers regarding the benefits associated with feed processing equipment are boosting the demand for feed processing machinery.

Asia Pacific Dominates the Global Market

The Asia Pacific is leading the market with the presence of the highest number of feed manufacturers and machinery suppliers. China remains top feed producer and user of feed processing machinery due to an increase in economic growth and rapid urbanization. The major driver for the market is increasing the concentration of domestic feed processing machinery companies, innovation in technology, government subsidies for mechanization as a result of the growing population.

China's commercial feed processing machinery industry plays a critical role in supporting the growth of the country's livestock sector and creating export opportunities for other countries. The Chinese feed industry experienced a minor blip in the year 2019 on account of the widespread influence of African Swine Fever (ASF). However, the feed production is expected to be back on track over the forecast period.

In the Asia-Pacific, the total feed production had increased by 30.3% from 2017 to 2022. The total feed production in the region accounted for 502.7 million metric ton in 2022. The increasing demand for feed drives the market.

Feed Processing Machinery Industry Overview

The feed processing machinery market is consolidated in nature with major players accounting for major market share. The major players in the market are Buhler AG, Clextral, Dinnissen BV, Andritz AG, and Bratney Companies, among others. Most of the major companies in the market are concentrating on developing new machinery, partnerships, and mergers, to achieve a competitive edge over other market players.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Function

- 5.1.1 Pelleting

- 5.1.1.1 Pellet Mills

- 5.1.1.2 Pellet dies

- 5.1.1.3 Conditioners

- 5.1.1.4 Others (Coolers and Dryers)

- 5.1.2 Mixing

- 5.1.2.1 Mixers

- 5.1.2.2 Dosing and Batching

- 5.1.2.3 Others (Dust-filters)

- 5.1.3 Grinding

- 5.1.3.1 Hammer mill

- 5.1.3.2 Fine Pulverizer

- 5.1.3.3 Others (Roller Mills and Screening Devices)

- 5.1.4 Extrusion

- 5.1.4.1 Extruders

- 5.1.4.2 Fat Sprayers

- 5.1.4.3 Others (Pre-conditioners)

- 5.1.1 Pelleting

- 5.2 Feed Type

- 5.2.1 Ruminant Feed

- 5.2.2 Poultry Feed

- 5.2.3 Swine Feed

- 5.2.4 Aquaculture Feed

- 5.2.5 Other Animal Feed

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East & Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Rest of Middle East & Africa

- 5.3.1 North America

6 Competitive Landscape

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Andritz AG

- 6.3.2 Buhler AG

- 6.3.3 Clextral

- 6.3.4 Bratney Companies

- 6.3.5 Dinnissen BV

- 6.3.6 HET Feed Machinery

- 6.3.7 Muyang Group

- 6.3.8 B.K. Allied Industries

- 6.3.9 Henan Longchang Machinery Manufacturing Co., Ltd