|

市场调查报告书

商品编码

1273334

食品润滑油市场 - COVID-19 的增长、趋势、影响和预测 (2023-2028)Food Grade Lubricants Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

预计在预测期内,全球食品级润滑油市场的复合年增长率将超过 5%。

COVID-19 疫情对食品润滑剂市场产生了负面影响。 生产设施的关闭和临时停工对某些应用造成了相当大的损害,并减少了食品级润滑剂的使用。 然而,从 2020 年开始,由于对关键终端用户类别的持续努力,市场出现温和增长。

主要亮点

- 市场研究的一个主要驱动因素是食品安全法规的收紧。 预计对加工食品的需求增加也将推动市场向前发展。

- 相反,製造商缺乏意识和培训阻碍了市场增长。

- 在预测期内,人们对食品和饮料安全日益关注可能会带来机遇。

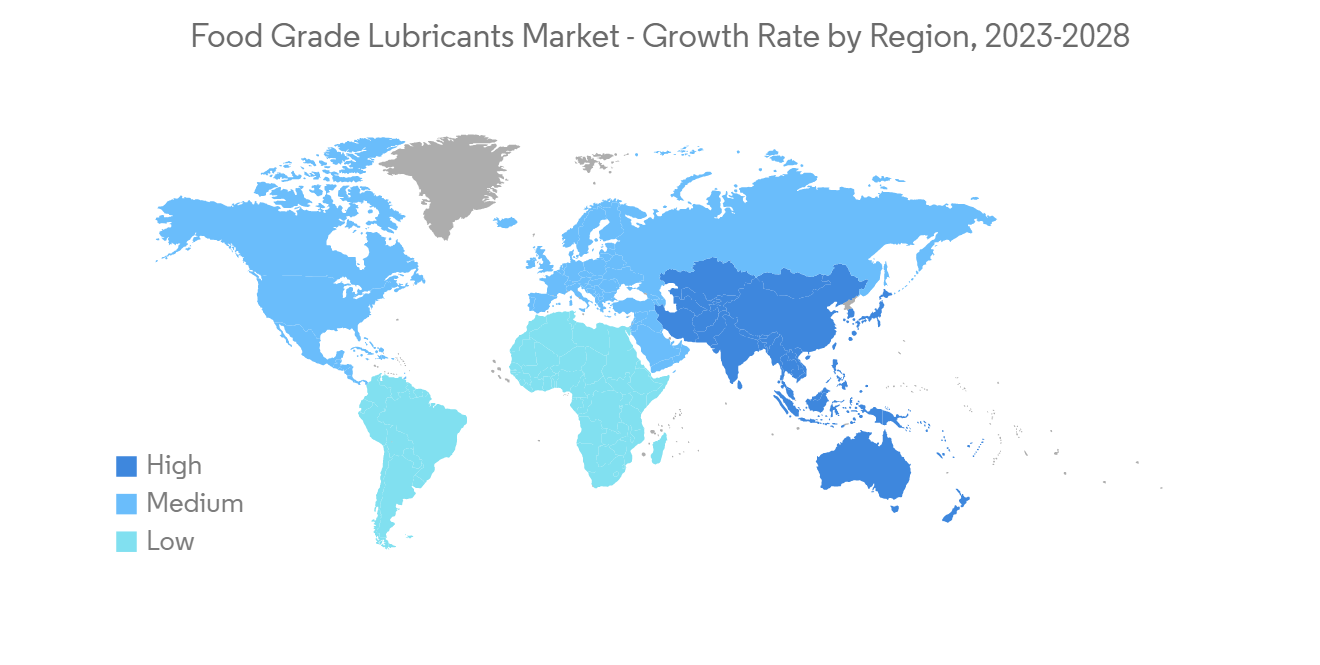

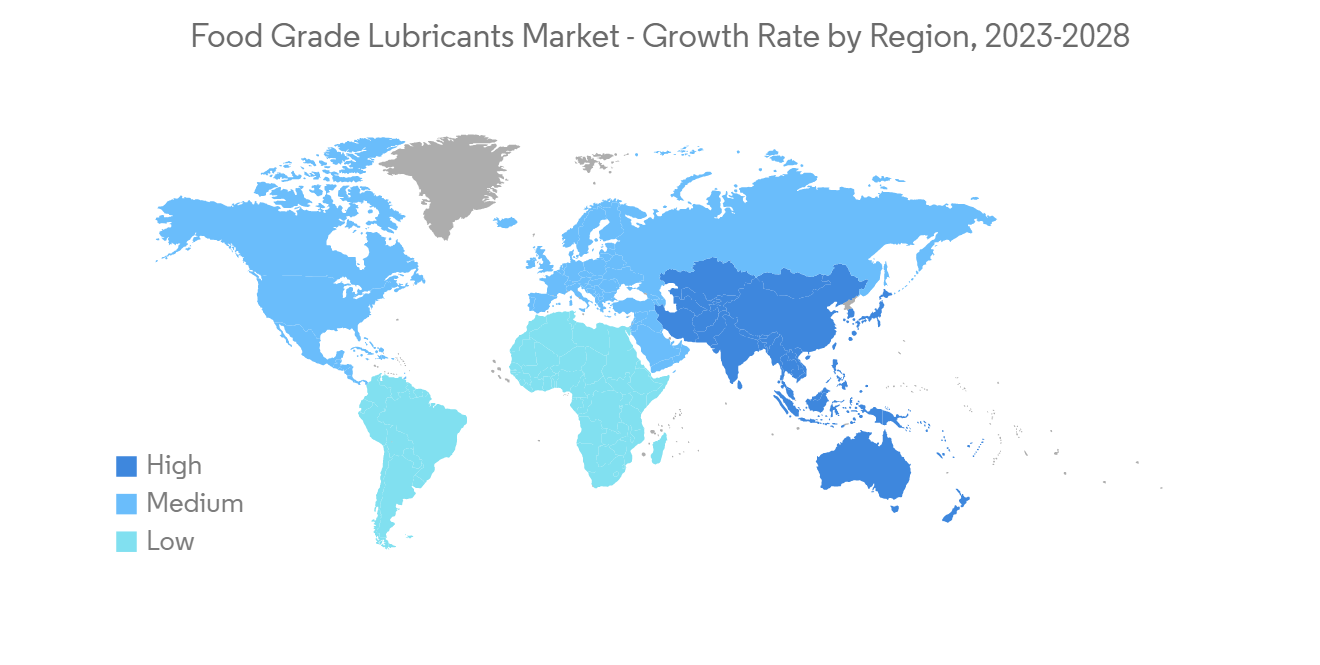

- 预计欧洲将主导全球市场,德国、英国和法国等国家/地区的消费量最高。

食品润滑油市场趋势

扩大在食品饮料行业的应用

- 专为工业机械製造的合成润滑剂被称为食品级润滑剂,在这些工业机械中可能会偶然发生食品与润滑剂的接触。

- 这些油具有生理惰性、无味、无臭且得到国际认可。 它还符合食品、健康和安全要求。

- 润滑剂洩漏、溢出或润滑故障可能导致润滑剂意外接触机器产生的食物或饮料。 中性质量的食品级润滑剂在这里发挥着重要作用。

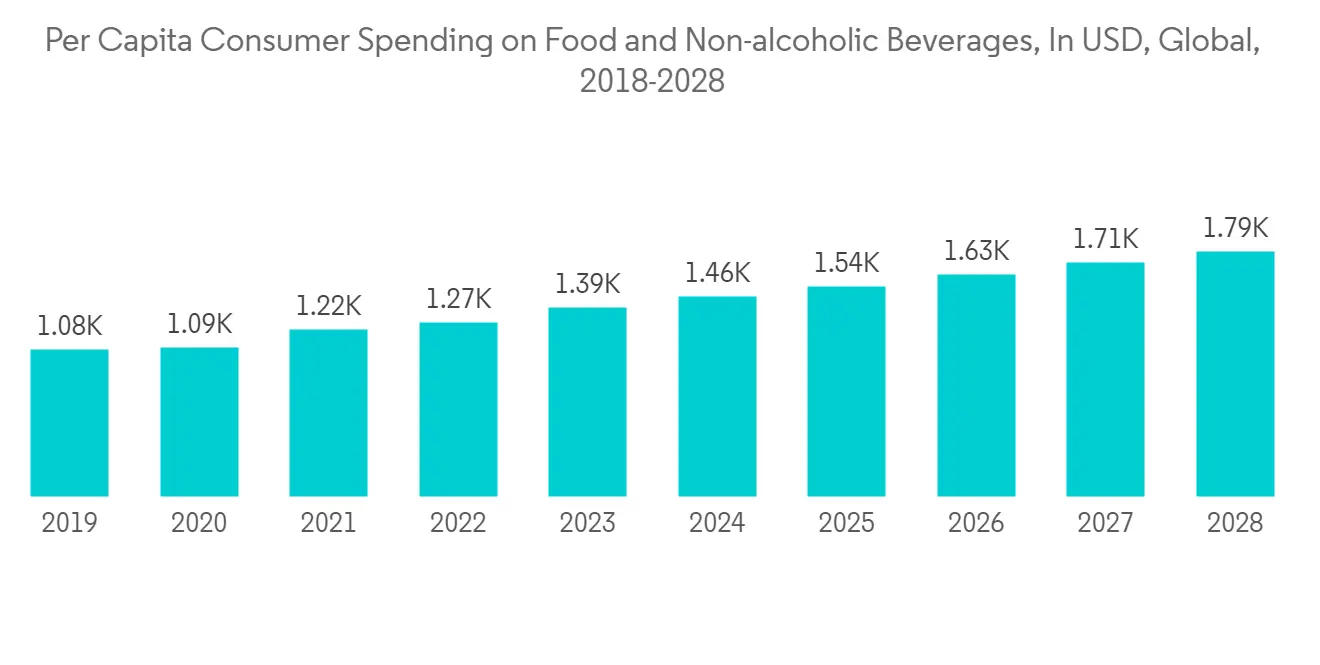

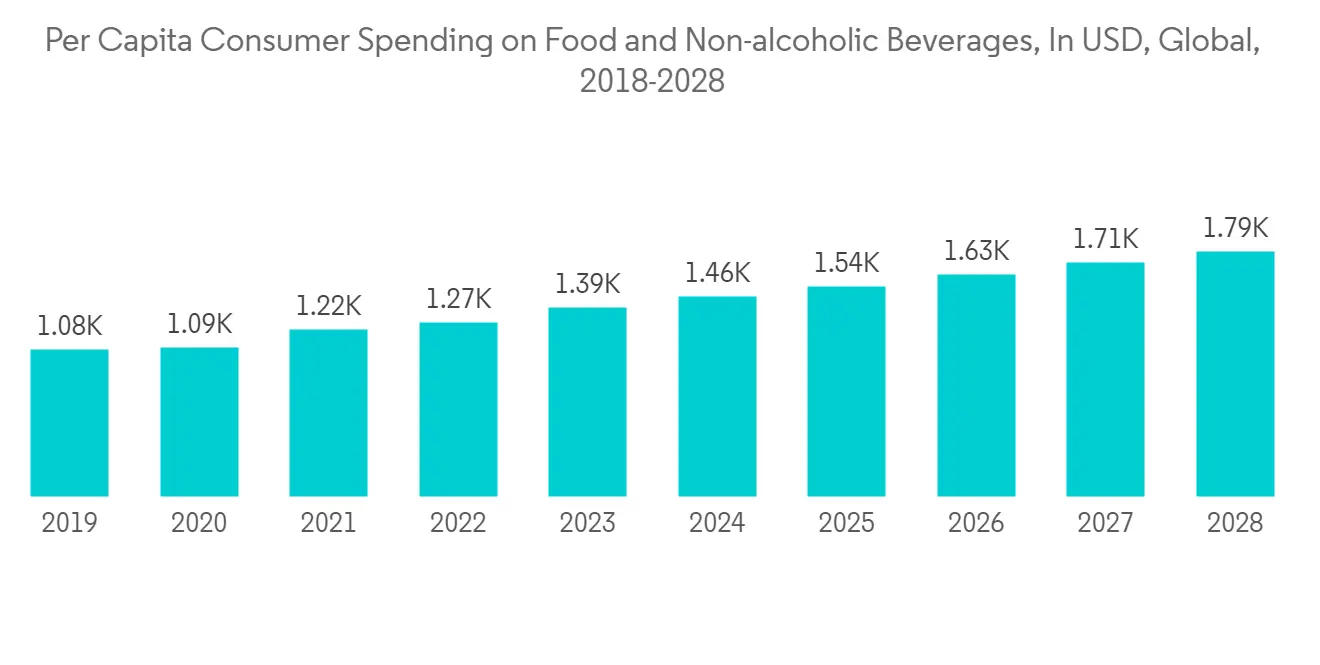

- Statista 预计全球食品和饮料业务销售额到 2022 年将达到 7400 亿美元。 预计2022年至2027年復合年增长率为7.14%,当年市场规模为11亿美元。

- 根据经济分析局的数据,美国食品和饮料行业在 2022 年前三季度贡献了约 9676 亿美元,比去年同期增长 1.3%。

- 作为欧洲最重要的製造业之一,到 2022 年,食品和饮料行业将僱用约 460 万人,产生 1.1 万亿欧元(11.59 亿美元)的收入和 2300 亿欧元的收入。欧元(美元)的附加值2423.7 亿美元)。 因此,它正在推动该地区的食品和饮料行业。

- 印度品牌资产基金会进一步表示,到 2025 年,印度的加工食品行业将达到 4700 亿美元。 根据 2022-23 年的联邦预算,食品、饮料和公共分配部已收到 21596 亿(278.2 亿美元)的预算,用于扩大食品和饮料行业。

- 因此,由于食品和饮料製造业的扩张,尤其是在亚太地区和欧洲地区,预计在预测期内对食品级润滑油的需求将会增加。

欧洲将主导市场

- 预计在预测期内,欧洲将主导食品级润滑油市场。 由于德国、英国和法国等国家对应用的高需求,食品级润滑油市场正在增长。

- 欧洲是食品级润滑剂使用最广泛的地区。 在欧洲,康达特集团、Matrix Specialty Lubricants、Dow 和 Clearco Products Co. Inc. 是食品级润滑剂的领先製造商。

- 到 2022 年,作为欧洲最大製造业之一的食品和饮料行业将增加 2300 亿欧元(2423.7 亿美元)的产值,僱用约 460 万人,创造 1.1 万亿欧元(11590 亿美元)的产值。 所以我们正在加强当地的餐饮业。

- 根据 Cosmetics Europe 的数据,2021 年欧洲化妆品和个人护理市场的规模估计约为 800 亿欧元(约合 940 亿美元)。 欧洲最大的化妆品和个人护理产品国家市场是德国(136 亿欧元(约 160 亿美元))、法国(120 亿欧元(约 140 亿美元))和意大利(106 亿欧元(约 1220 亿美元) .bill USD)), 英国(99 亿欧元(约 118 亿美元)),西班牙(70 亿欧元(约 80 亿美元))。

- 在欧洲,护肤品(232 亿欧元(约 270 亿美元))和洗浴用品(206 亿欧元(约 240 亿美元))所占份额最大,其次是护髮产品、香水/香水和装饰化妆品。继续。

- 上述因素以及政府的支持预计将在预测期内推动食品级润滑油市场需求的增长。

食品润滑油行业概况

食品级润滑油市场较为分散,参与者占据的市场份额很小。 重要的公司包括 Dow、The Chemours Company、The Lubrizol Corporation、CONDAT Group 和 Matrix Specialty Lubricants(排名不分先后)。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 调查先决条件

- 本次调查的范围

第二章研究方法论

第 3 章执行摘要

第四章市场动态

- 主持人

- 加强食品安全法规

- 对加工食品的需求增加

- 约束因素

- 缺乏意识和培训

- 其他抑製剂

- 工业价值链分析

- 波特的五力分析

- 供应商的议价能力

- 消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第 5 章市场细分

- 食品级

- H1

- H2

- H3

- 产品类型

- 润滑脂

- 液压油

- 齿轮油

- 其他产品类型

- 最终用户行业

- 食物和饮料

- 化妆品

- 食用油

- 其他最终用户行业

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 其他欧洲

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙特阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章竞争格局

- 併购、合资、合作、合同等。

- 市场份额 (%)/排名分析

- 主要公司采用的策略

- 公司简介

- Calumet Specialty Products Partners, L.P.

- CITGO Petroleum Corporation

- Clearco Products Co., Inc.

- CONDAT Group

- Dow

- Elba Lubes

- Engen Petroleum Ltd

- Lubrication Engineers

- Matrix Specialty Lubricants

- Petrelplus Inc.

- Suncor Energy Inc.(Petro Canada)

- The Chemours Company

- The Lubrizol Corporation

- Ultrachem Inc.

第七章市场机会与未来趋势

- 扩大在食品和饮料行业的应用

The market for food-grade lubricants is expected to register a CAGR of over 5% globally during the forecast period.

The COVID-19 epidemic negatively impacted the market for food-grade lubricants. The lockdown and temporary suspensions in production facilities caused considerable damage to several applications, reducing food-grade lubricants' usage. Yet, beyond 2020, the market grew moderately due to ongoing initiatives in the main end-user categories.

Key Highlights

- The primary factor driving the market studied is increasing food safety regulations. Also, the increased processed food demand is expected to drive the market forward.

- Conversely, awareness shortage and lack of training among manufacturers are hindering the market's growth.

- The increasing concern over food and beverage safety will likely be an opportunity during the forecast period.

- Europe is expected to dominate the global market with the most substantial consumption from countries such as Germany, the United Kingdom, and France.

Food Grade Lubricants Market Trends

Increasing Application in Food and Beverage Industry

- Synthetic lubricants created explicitly for industrial machinery where accidental contact between food and lubricants may occur are known as food-grade lubricants.

- These oils are physiologically inert, tasteless, odorless, and accepted internationally. They also adhere to food/health/safety requirements.

- Following a leak, overflow, or lubrication malfunction, the lubricants are prone to coming into touch accidentally with the food and beverages generated by the machinery. It is where these food-grade lubricants serve a crucial role, thanks to their neutral quality.

- Statista projects that the global food and beverage business will bring in USD 740 billion in revenue in 2022. The market is anticipated to expand at a CAGR of 7.14% between 2022 and 2027, with a projected market size of USD 1.10 billion by that year.

- According to the Bureau of Economic Analysis, the value contributed by the food and beverage sector in the United States during the first three quarters of 2022 was around USD 967.6 billion, 1.3% more than it was during the same time last year.

- One of Europe's most significant manufacturing sectors in 2022, the food and beverage industry employed almost 4.6 million people, brought in EUR 1.1 trillion (USD 1.159 trillion) in revenue, and added EUR 230 billion (USD 242.37 billion) in value. It is, thus, boosting the food and beverage sector in the area.

- The India Brand Equity Foundation further stated that by 2025, India's processed food sector is anticipated to reach USD 470 billion. According to the Union Budget for FY 2022-23, the Department of Food and Public Distribution has received a budget of INR 215 960 crores (USD 27.82 billion) considering the expanding food and beverage sector.

- Hence, due to the growing food and beverage manufacturing, especially in the Asia-Pacific and European regions, the demand for food-grade lubricants is expected to increase over the forecast period.

Europe Region to Dominate the Market

- Europe is expected to dominate the market for food-grade lubricants during the forecast period. Due to the high demand for applications from countries like Germany, the United Kingdom, and France, the market for food-grade lubricants is growing.

- Europe is where food-grade lubricants are used most extensively. In Europe, the CONDAT Group, Matrix Specialty Lubricants, Dow, and Clearco Products Co. Inc. are some of the top producers of food-grade lubricants.

- The food and beverage business, one of the largest manufacturing industries in Europe in 2022, added EUR 230 billion (USD 242.37 billion) in value, employed about 4.6 million people, and generated EUR 1.1 trillion (USD 1.159 trillion) in income. It is, thus, enhancing the local food and beverage industry.

- Cosmetics Europe said the European cosmetics and personal care market was valued at about EUR 80 billion (~USD 94 billion) in 2021. The largest national markets for cosmetics and personal care products within Europe are Germany (EUR 13.6 billion (~USD 16 billion)), France (EUR 12.0 billion (~USD 14 billion)), Italy (EUR 10.6 billion (~USD 12.2 billion)), the UK (EUR 9.9 billion (~USD 11.8 billion)) and Spain (EUR 7 billion (~USD 8 billion)).

- Skincare (EUR 23.2 billion (~USD 27 billion)) and toiletries (EUR 20.6 billion (~USD 24 billion)) include the most significant market share in Europe, followed by hair-care products, fragrances/perfumes, and decorative cosmetics.

- The abovementioned factors and government support will likely contribute to the increasing demand for the food-grade lubricants market during the forecast period.

Food Grade Lubricants Industry Overview

The food-grade lubricants market is fragmented, with players accounting for a marginal market share. Some of the significant companies include (not in any particular order) Dow, The Chemours Company, The Lubrizol Corporation, CONDAT Group, and Matrix Specialty Lubricants, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Food Safety Regulations

- 4.1.2 Increase in Demand for Processed Food

- 4.2 Restraints

- 4.2.1 Lack of Awareness and Shortage of Training

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Food Grade

- 5.1.1 H1

- 5.1.2 H2

- 5.1.3 H3

- 5.2 Product Type

- 5.2.1 Grease

- 5.2.2 Hydraulic Fluid

- 5.2.3 Gear Oil

- 5.2.4 Other Product Types

- 5.3 End-user Industry

- 5.3.1 Food & Beverage

- 5.3.2 Cosmetics

- 5.3.3 Edible Oil

- 5.3.4 Other End-user Industries

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Russia

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)/Ranking Analysis**

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Calumet Specialty Products Partners, L.P.

- 6.4.2 CITGO Petroleum Corporation

- 6.4.3 Clearco Products Co., Inc.

- 6.4.4 CONDAT Group

- 6.4.5 Dow

- 6.4.6 Elba Lubes

- 6.4.7 Engen Petroleum Ltd

- 6.4.8 Lubrication Engineers

- 6.4.9 Matrix Specialty Lubricants

- 6.4.10 Petrelplus Inc.

- 6.4.11 Suncor Energy Inc. (Petro Canada)

- 6.4.12 The Chemours Company

- 6.4.13 The Lubrizol Corporation

- 6.4.14 Ultrachem Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Applications in the Food and Beverage Industry