|

市场调查报告书

商品编码

1273340

纱布拭子市场 - COVID-19 的增长、趋势、影响和预测 (2023-2028)Gauze Swabs Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

在预测期内,纱布拭子市场的复合年增长率预计为 5.3%。

COVID-19 大流行不仅影响了医疗保健行业,还影响了纱布拭子市场,因为世界各国政府在早期阶段采取了社会疏远措施,导致医院和医疗服务萎缩。. COVID-19 大流行对综合医院对非 COVID-19 患者的执业能力产生了重大影响。 根据 American Journal of Managed Care 于 2021 年 9 月发表的一篇论文,在 COVID-19 大流行期间,很大一部分慢性伤口患者延迟了预防性和紧急伤口护理。 这种延误对市场增长产生了不利影响。 然而,在大流行后的情况下,外科手术已成为常态。 因此,预计在本研究的预测期内,市场将稳定增长。

市场增长的主要推动因素是经济高效、亲肤的纱布拭子和伤口护理技术的进步。 此外,交通流量上升、家庭和运动事故需要纱布拭子等因素也在一定程度上推动了市场。 例如,PubMed 于 2021 年 5 月发表的一项研究发现,西班牙的平均受伤率为每 1000 人 2.64 起。 三种接触性运动的受伤率最高:足球 (7.21)、柔道 (4.82) 和篮球 (4.31)。

此外,根据 PubMed Central 于 2022 年 7 月发表的一篇论文,在埃塞俄比亚进行的一项调查发现,在 354 名交通事故受害者中,骨折最为常见,占 71.1%,尤其是下肢骨折 (42.1%) 显示出流行。 超过一半的受害者(59.5%)有开放性伤口,其中 51.8% 的人报告在过马路或步行时遭遇交通事故。

敷料的高成本预计将成为预测期内製约市场增长的主要因素。

纱布拭子市场趋势

预计在预测期内,无菌纱布拭子部分将占据很大的市场份额

无菌纱布用于临时敷料,更受欢迎,因为它具有更快的癒合过程,并且不会粘在伤口上,使后续的换药程序更容易。 由于无菌纱布的这些优点,在该领域比非无菌纱布具有相对较高的声誉。 此外,医院和诊断实验室已将这种无菌纱布用于多项手术,这推动了该领域的增长。

根据道路、运输和公路部2021年公布的数据,2021年印度将发生412432起道路交通事故,造成384448人受伤。 受交通意外影响最大的年龄组别为 18 至 45 岁。

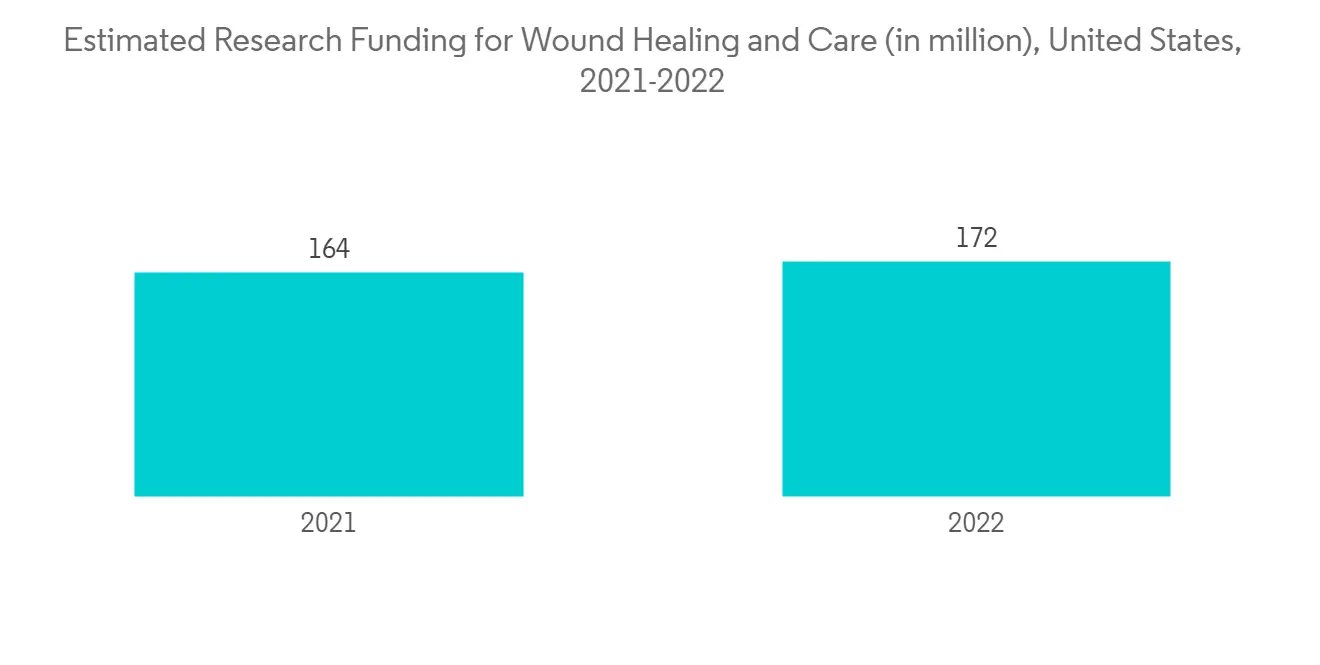

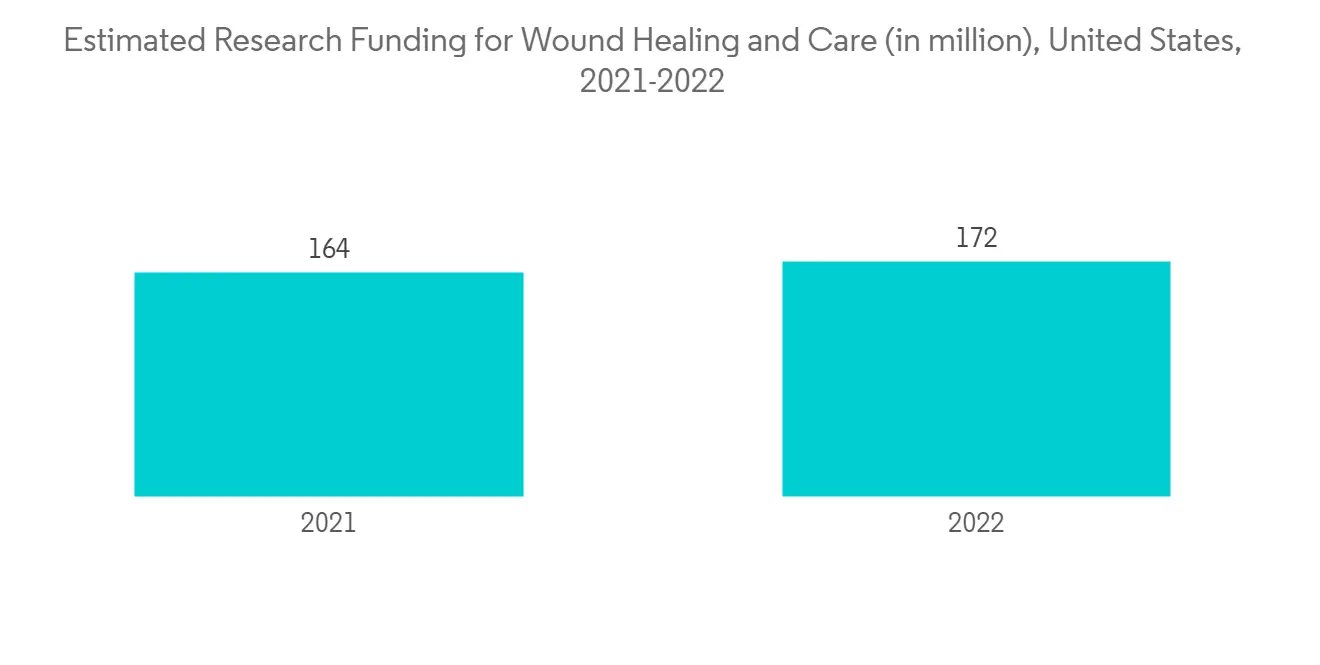

此外,糖尿病足溃疡患病率上升等因素是推动该细分市场增长的主要因素之一。 根据 Frontiers 于 2022 年 10 月发表的一篇文章,在巴基斯坦进行的一项研究表明,到 2022 年,糖尿病足溃疡的患病率将增加到近 19.54%。 此外,增加对伤口护理和癒合的研究也有望促进手术纱布拭子在外科手术中的采用。

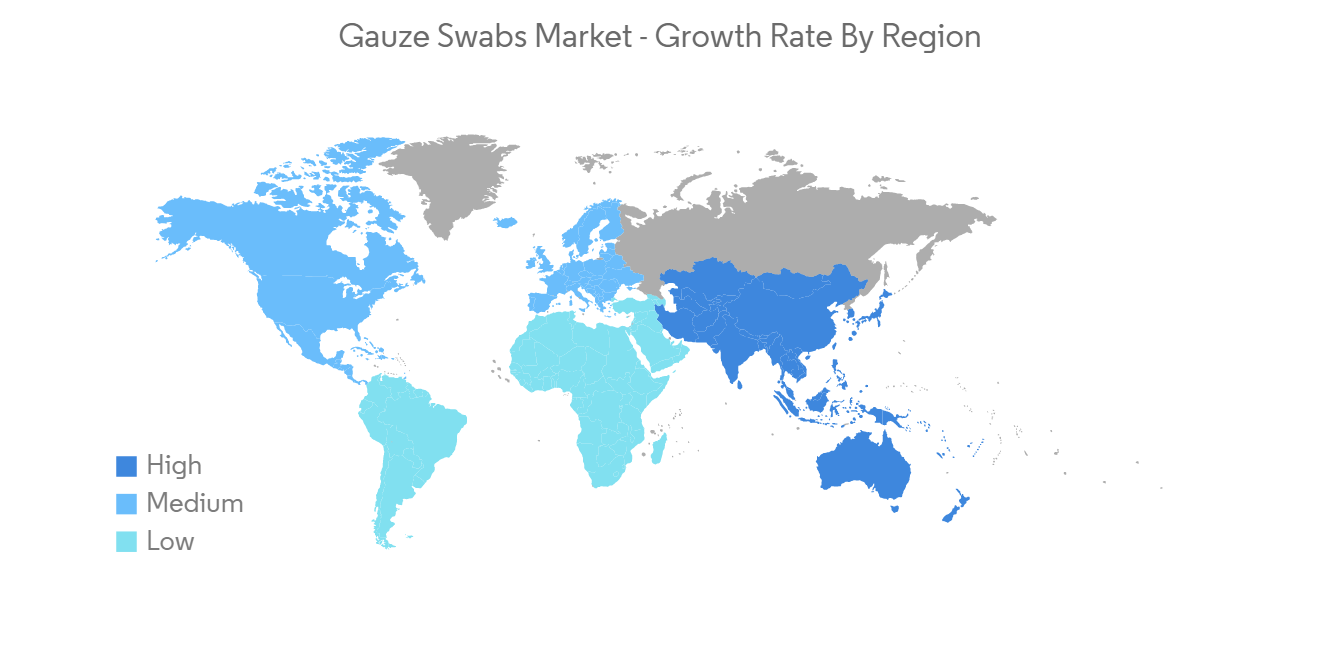

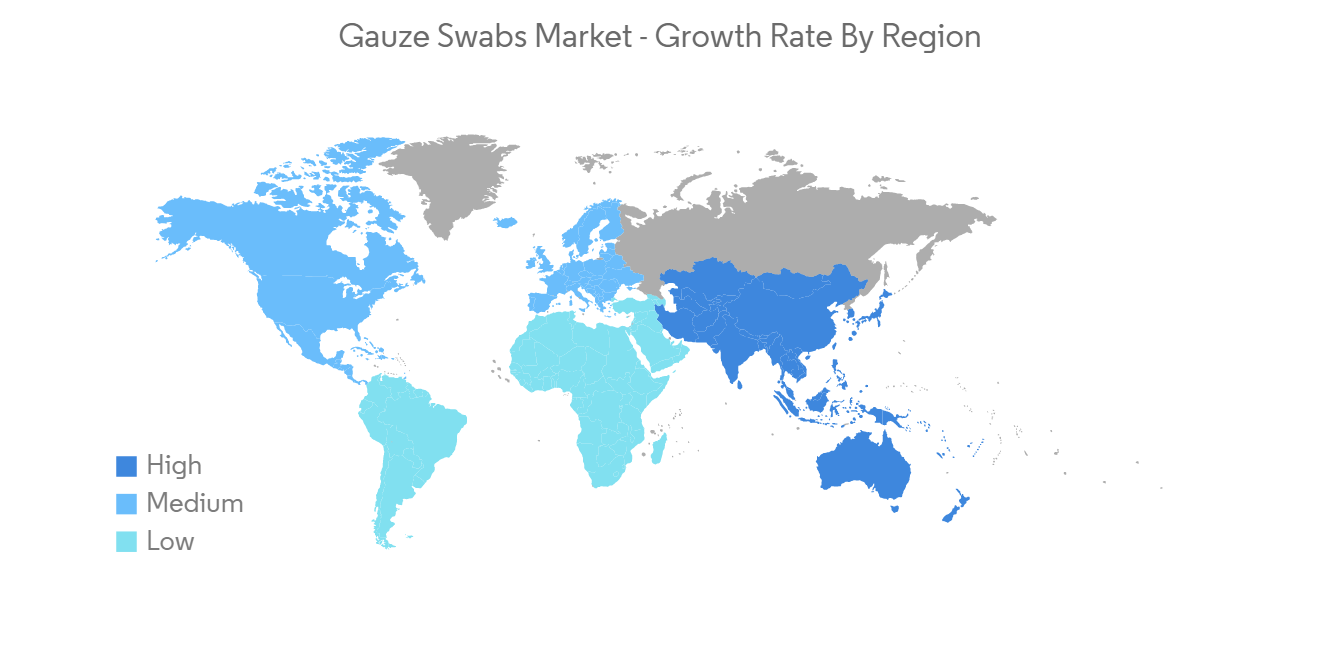

预计在预测期内北美将占据很大的市场份额

由于医疗成本上升、医疗基础设施改善以及美国人口老龄化,预计北美将占据全球纱布和拭子市场的很大份额。 在老龄化社会中,进行心、肺、腹等各种手术,因此该产品被广泛使用。 此外,事故的增加也推动了纱布的采用,极大地推动了整个区域市场的增长。

根据国家安全委员会的数据,到 2021 年,美国将有 320 万人因与运动和娱乐设备相关的伤害而在急诊室接受治疗。 最常与受伤相关的活动是锻炼、骑自行车和打篮球。 此外,脑损伤研究所 2021 年的统计数据显示,美国每年大约发生 160 万至 380 万起与娱乐和运动相关的脑震盪。 随着运动损伤的增加,为治疗这些损伤而去医院和就诊的人数增加,推动了对纱布拭子的需求。

此外,加拿大有很多运动损伤案例,有望推动该地区的市场增长。 例如,根据 SpringerLink 在 2022 年 9 月发表的一篇文章,根据一项在加拿大进行的调查,橄榄球每年的受伤率为每 100 人 12.7 人,冰球每年每 100 人有 33.1 人受伤。事实证明,

此外,根据加拿大统计局2022年7月公布的数据,加拿大约有7,330,605人年龄在65岁或以上,占总人口的18.8%。 此外,该地区老年人口的增加预计将推动市场增长,因为老年人通常与糖尿病足溃疡等疾病有关。

纱布拭子行业概况

由于多家公司在全球和区域开展业务,纱布拭子市场呈分散状态。 目前主导市场的公司包括 Cardinal Health、3M、Johnson & Johnson、Medline Industries Inc.、Winner Medical Group Inc.、BSN Medical、Aero Healthcare 和 Baxter International。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 调查假设和市场定义

- 本次调查的范围

第二章研究方法论

第 3 章执行摘要

第四章市场动态

- 市场概览

- 市场驱动因素

- 交通事故、家庭事故和运动事故增加

- 全球手术数量增加

- 市场製约因素

- 着装成本高

- 波特的五力分析

- 新进入者的威胁

- 买方/消费者议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

第 5 章市场细分(基于价值的市场规模)

- 按类型

- 无菌纱布拭子

- 非无菌纱布拭子

- 最终用户

- 医院

- 医务室

- 家庭护理

- 按地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 意大利

- 西班牙

- 其他欧洲

- 亚太地区

- 中国

- 日本

- 印度

- 澳大利亚

- 韩国

- 其他亚太地区

- 中东和非洲

- 海湾合作委员会

- 南非

- 其他中东和非洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美

第六章竞争格局

- 公司简介

- Cardinal Health

- 3M Company

- JOHNSON & JOHNSON

- Medline Industries Inc

- Winner Medical Group Inc.

- BSN medical

- Aero Healthcare

- AdvaCare Pharma

- Narang Medical Limited

- K.S. SURGICAL PVT. LTD.

- SUNDARAM SURGICAL

- Baxter International

第七章市场机会与未来趋势

The gauze swabs market is expected to register a CAGR of 5.3% over the forecast period.

The COVID-19 outbreak impacted the healthcare sector as well as the gauze swabs market since hospitals and healthcare services were reduced due to social distancing measures taken by governments worldwide during the initial phase. The COVID-19 pandemic greatly impacted the functioning of general hospital care for non-COVID-19 patients globally. According to an article published by the American Journal of Managed Care in September 2021, a significant percentage of patients with chronic wounds delayed preventative and emergent wound care during the COVID-19 pandemic. Such delays impacted the growth of the market adversely. However, in the post-pandemic scenario, surgical procedures are normally taking place. Thus, the market is expected to have stable growth during the forecast period of the study.

The major factors responsible for the market's growth are cost-effective, skin-friendly gauze swabs and technological advancements in wound care. Moreover, factors such as increasing road, household, and sports accidents requiring gauze swabs are driving the market to a certain extent. For instance, as per the study published by PubMed in May 2021, the average injury rate was found to be 2.64 per 1000 in Spain. Three contact sports presented the highest injury rate: soccer (7.21), judo (4.82), and basketball (4.31).

Moreover, according to an article published by PubMed Central in July 2022, a study was conducted in Ethiopia which showed that out of 354 victims of road traffic accidents, fracture was the most common one with 71.1% prevalence, particularly lower limb fracture (42.1%). The article also stated that more than half victims (59.5%) had open wounds, and that 51.8% of the people experienced road traffic accidents while crossing or walking along the way.

The high cost of dressings is the major factor that is expected to impede the market's growth over the forecast period.

Gauze Swabs Market Trends

Sterile Gauze Swabs Segment is Expected to Hold a Significant Market Share Over the Forecast Period

Sterile gauze swabs are used for temporary dressing and are more popular as the healing process is much faster and they do not stick to the wound, making further dressing change procedures much easier. These advantages of sterile gauze swabs make this segment comparatively higher than non-sterile gauze swabs. Moreover, hospitals and diagnostic laboratories adopt these sterile gauze swabs for several surgeries, which promotes segment growth.

According to data published by the Ministry of Road Transport and Highways in 2021, 412,432 road accidents took place in India in 2021, which caused injuries to 384,448 persons. The worst affected age group in road accidents was 18-45 years.

Moreover, factors such as the increased prevalence of diabetic foot ulcers are one of the major factors responsible for the market segment's growth. According to an article published by Frontiers in October 2022, a study was performed in Pakistan, which showed that the prevalence of diabetic foot ulcers increased to almost 19.54% in 2022. Moreover, increasing research on wound care and healing is also expected to boost the adoption of surgical gauze swabs in surgical procedures.

North America is Expected to Hold a Significant Share in the Market Over the Forecast Period

North America is expected to hold a significant market share in the global gauze swabs market attributed to increasing healthcare expenditure, the presence of well-established healthcare infrastructure, and the aging population in the United States. The aging population is more prone to various types of surgeries, such as those related to cardiac, pulmonary, and abdominal diseases, among many more, where these products are widely used. Furthermore, the increasing incidence of accidents is also promoting the adoption of gauze swabs and fuelling the growth of the overall regional market to a large extent.

According to the data from the National Safety Council, in 2021, 3.2 million people were treated in emergency departments for injuries involving sports and recreational equipment in the United States. The activities most frequently associated with injuries are exercise, cycling, and basketball. Additionally, according to 2021 statistics by the Brain Injury Research Institute, about 1.6 million to 3.8 million recreation and sports-related concussions occur yearly in the United States. With rising sports injuries, the incidence rate of visiting hospitals and doctors for the treatment of these injuries is increasing, subsequently boosting the demand for gauze swabs.

Moreover, a higher number of sports injuries in Canada is also expected to enhance the market growth in the region. For instance, according to an article published by SpringerLink in September 2022, a questionnaire-based survey was conducted in Canada which showed that the rates of injury ranged from 12.7 injuries per 100 participants per year in rugby, and to 33.1 injuries per 100 participants per year in ice hockey.

Furthermore, according to the data published by Statistics Canada in July 2022, around 7,330,605 people are aged 65 years or older in Canada, and this accounts for 18.8% of the total population. The increasing geriatric population in the region is also expected to enhance the market growth, as old age is often associated with diseases such as diabetic foot ulcers.

Gauze Swabs Industry Overview

The gauze swabs market is fragmented due to the presence of several companies operating globally and regionally. Some companies currently dominating the market are Cardinal Health, 3M, Johnson & Johnson, Medline Industries Inc., Winner Medical Group Inc., BSN Medical, Aero Healthcare, and Baxter International.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Road, Households, and Sports Accidents

- 4.2.2 Rising Number of Surgeries across the Globe

- 4.3 Market Restraints

- 4.3.1 High Cost of Dressings

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Type

- 5.1.1 Sterile Gauze Swabs

- 5.1.2 Non-Sterile Gauze Swabs

- 5.2 By End User

- 5.2.1 Hospitals

- 5.2.2 Clinics

- 5.2.3 Homecare

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Cardinal Health

- 6.1.2 3M Company

- 6.1.3 JOHNSON & JOHNSON

- 6.1.4 Medline Industries Inc

- 6.1.5 Winner Medical Group Inc.

- 6.1.6 BSN medical

- 6.1.7 Aero Healthcare

- 6.1.8 AdvaCare Pharma

- 6.1.9 Narang Medical Limited

- 6.1.10 K.S. SURGICAL PVT. LTD.

- 6.1.11 SUNDARAM SURGICAL

- 6.1.12 Baxter International