|

市场调查报告书

商品编码

1273341

基因转移系统市场——增长、趋势、COVID-19 的影响和预测 (2023-2028)Gene Delivery Systems Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

预测期内,基因转移系统市场的复合年增长率预计为 7.3%。

COVID-19 对基因递送系统市场产生了重大影响。 例如,Drug Discovery Today 于 2021 年 10 月发表的一篇文章指出,由于 COVID-19 大流行,研究、生产、临床开发和所有市场推介都严重中断。 在针对罕见、危及生命的疾病的 CGT 中,远程医疗已被证明是减少临床试验中后续损失的有力工具。 此外,Prime Therapeutics在美国COVID-19流行初期推出了基因治疗再保险产品PreserveRx,支持当时唯一可用的基因治疗药物Luxturna和Zolgensma。 Prime 已与製造商 Novartis Gene Therapy 达成协议,以在 2021 年取得基于价值的结果。 此外,2021 年 8 月,在美国监管机构解除限制后,Novartis将启动一项新的 3 期试验,以扩大 Zolgensma 的使用范围,单次治疗每名患者的费用为 210 万美元。 在市场参与者在大流行期间采取这些行动之后,预计市场将在预测期内復苏并呈现强劲增长。

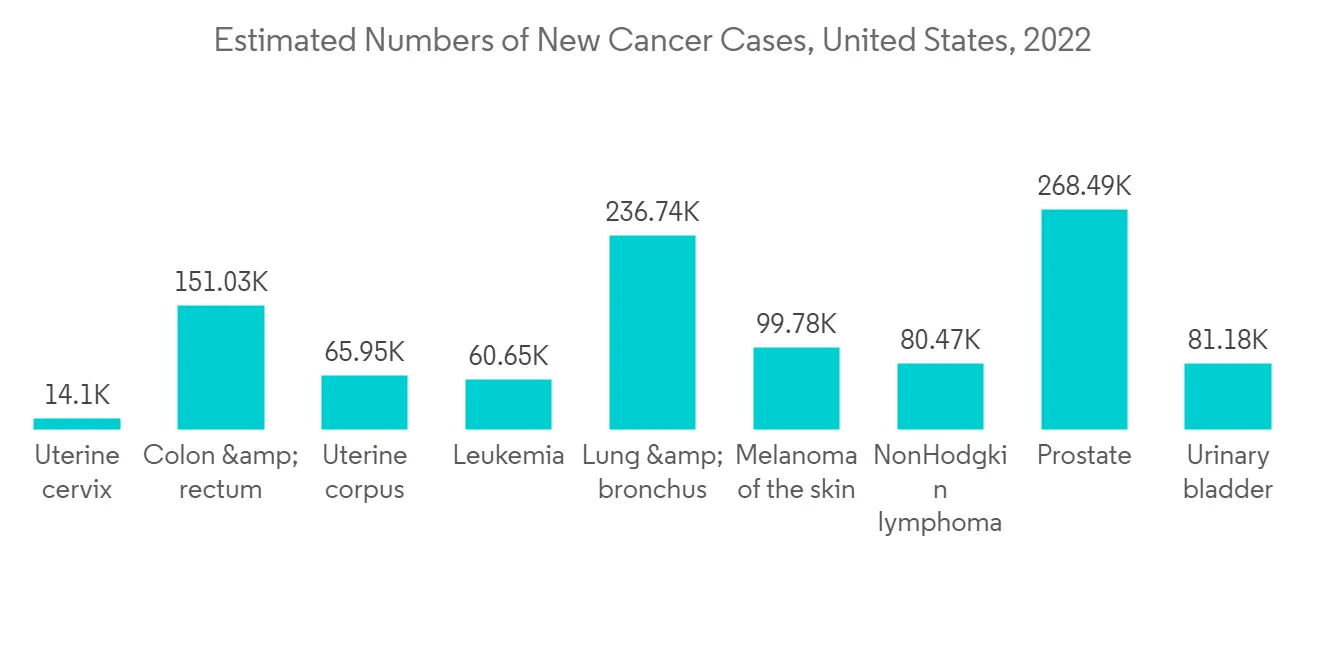

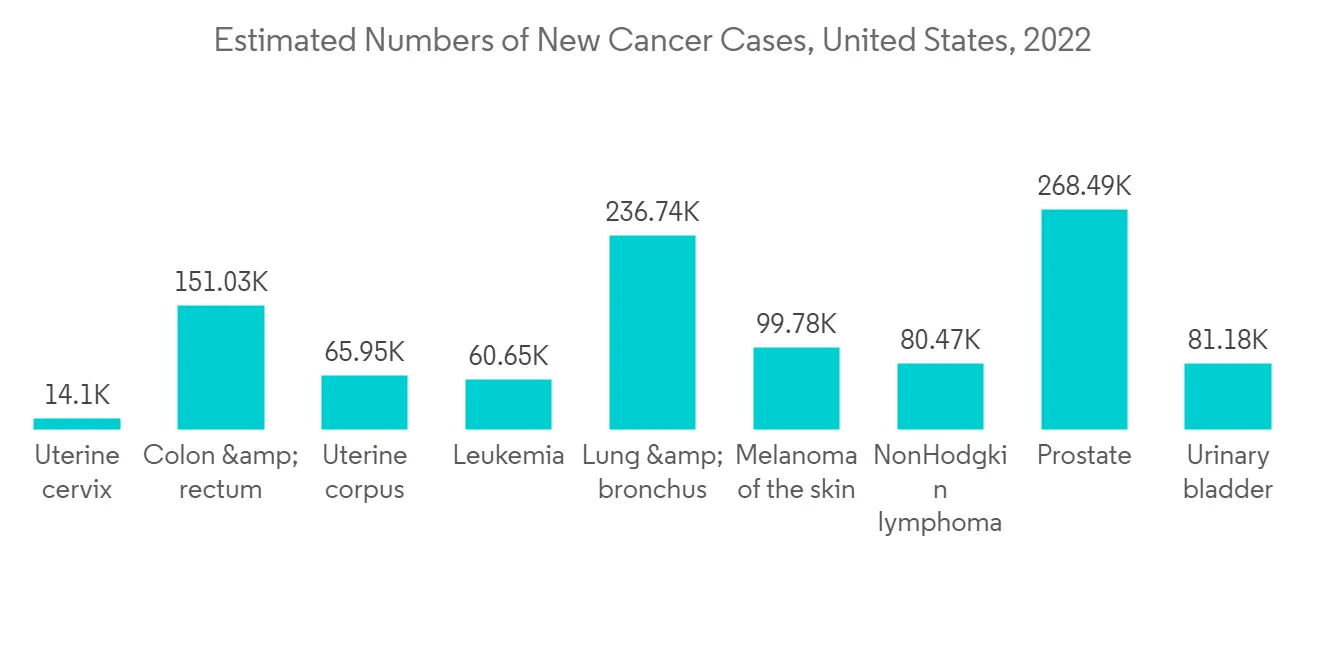

推动市场增长的主要因素是慢性病发病率和患病率的上升以及药物输送技术的不断进步。 美国等发达国家典型的慢性病包括心血管病、传染病、癌症和糖尿病等。 例如,根据美国癌症协会的 2023 年更新,2023 年美国可能诊断出 200 万新癌症病例。 此外,国家医学图书馆 2021 年 6 月发表的一篇论文指出,西班牙报告称,2021 年 2 型糖尿病患者的心血管疾病患病率在 6.9% 至 40.8% 之间。我来了。 数据显示,冠心病患病率从4.7%到37%,中风从3.5%到19.6%,外周动脉疾病从2.5%到13.0%,心力衰竭从4.3%到20.1%。 由于慢性病发病率高,对增强型诊断方法的需求不断增加,这被认为是推动市场发展的动力。

此外,预计在预测期内,全球基因组学领域不断增加的研究和开发也将有助于市场增长。 例如,2022 年 5 月,我们赞助了一项临床研究,评估接受 Pell Bio-Med Technology 製造的基于慢病毒的基因编辑免疫细胞的患者的安全性和有效性。 预计基因转移系统领域的此类研究举措将在预测期内推动市场增长。

产品发布、扩张和合作伙伴关係等主要市场参与者的各种举措预计将在预测期内推动市场增长。 例如,2021 年 6 月,VIVEbiotech 在西班牙开设了一家新的慢病毒载体製造工厂,扩大了其生产用于细胞和基因治疗的慢病毒载体的能力。 预计此类新兴市场的发展将在预测期内推动市场增长。

但是,高昂的治疗成本预计会在预测期内抑制所研究市场的增长。

基因转移系统市场趋势

病毒基因转移系统板块有望成为基因转移系统市场最大份额

病毒基因转移系统由不能复制的修饰病毒组成,它可以将基因传递到细胞中以提供表达。 腺病毒、逆转录病毒和慢病毒已被用作病毒基因转移系统。 病毒基因递送系统由于其长期和短期表达、治疗基因的功效以及过去几年技术进步不断增加等属性,在医疗保健行业呈现出许多增长机会,因此在预测期内预计将占据很大的市场份额。 此外,癌症和心血管疾病等慢性病患病率的增加也有助于市场增长。 例如,根据英国心臟基金会 England Factsheet 于 2022 年 1 月发布的数据,英国约有 640 万人患有心血管疾病。 根据疾病预防控制中心的数据,到 2021 年,美国约有 1820 万 20 岁及以上的成年人患有冠状动脉疾病 (CAD)。 在美国,心脏病是导致死亡的主要原因。 因此,慢性病的增加将显着推动被调查市场的增长。

由于各国政府更加关注治理并提高对这些疗法的认识,这些基因转移系统正在迅速获得全世界的认可。 例如,根据世界经济论坛 2022 年 9 月的报告,个性化基因治疗的独特性使其难以在传统框架内进行监管。 同一消息人士称,到 2030 年,预计美国将批准 60 多种基因疗法,FDA 将不得不迅速发展,以正确确定这些新疗法的安全性和有效性。 这些监管变化已波及全球,各国协调监管要求,使公司更容易将基因治疗药物更快地推向更多市场。 预计这种全球努力将促进基因治疗的引入和基因转移系统的利用,从而导致市场增长。

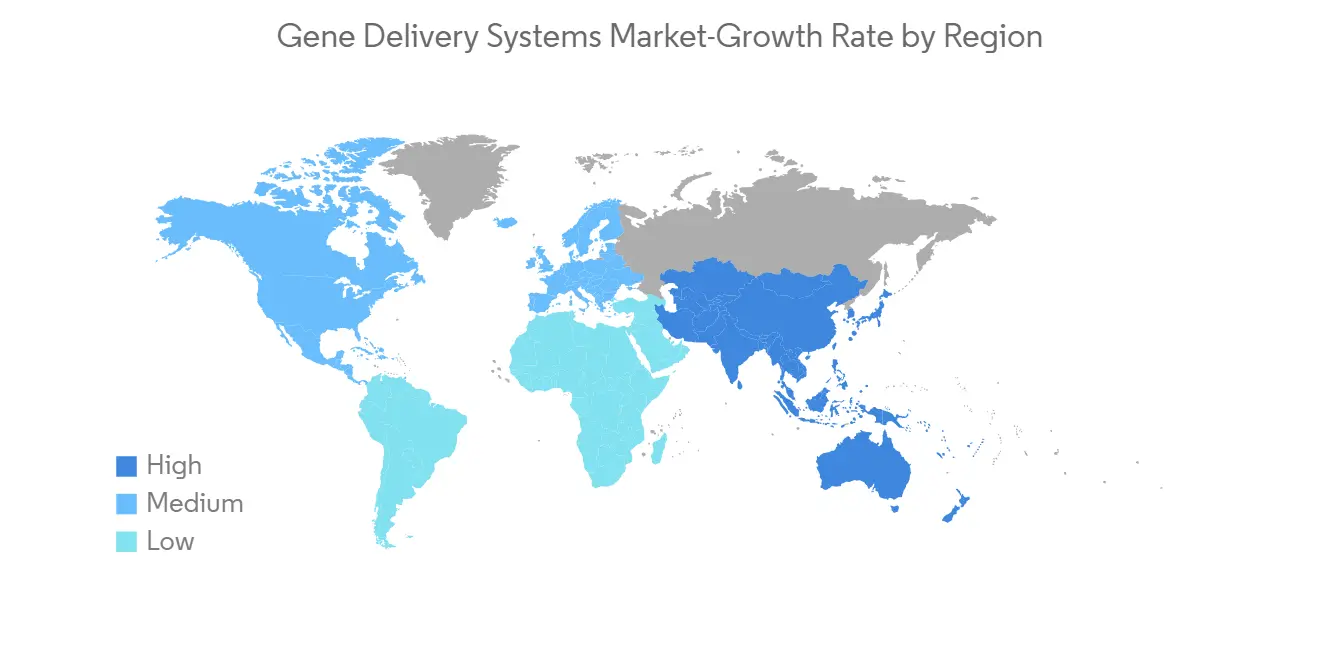

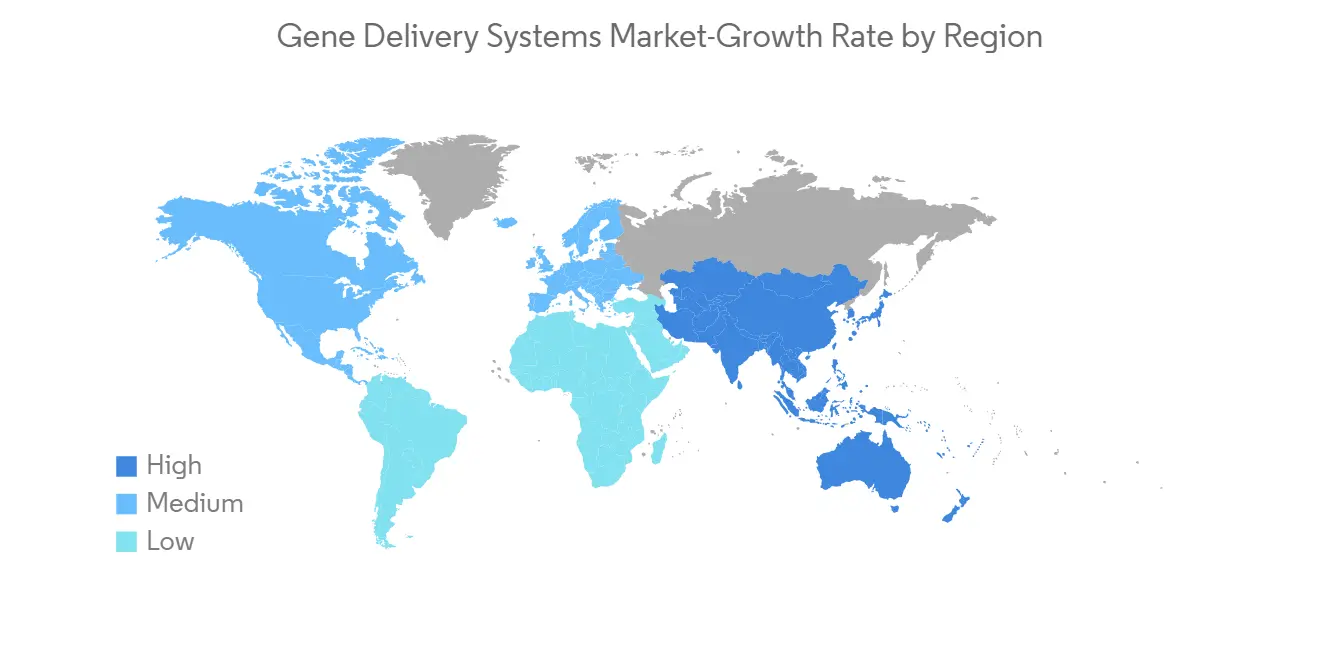

预计在预测期内北美市场将出现显着增长

在预测期内,预计北美将保持其在整个基因转移系统市场的主导地位。 慢性病患病率上升、技术进步以及大公司的强大影响力等因素正在推动该地区的市场增长。 例如,美国癌症协会2023年1月公布的数据估计,2023年美国将有1958310例癌症新确诊病例。 2019 年,美国 65 岁及以上人口有 5410 万人(占总人口的 16%),预计到 2040 年将增长到 21.6%。

此外,主要市场参与者的存在以及他们实施的关键战略(例如伙伴关係和协作)也有助于市场增长。 例如,根据 2021 年 6 月的新闻报导,加拿大卫生部已经批准了五种基因治疗药物(Kymriah、Yescarta、Spinraza、Luxturna 和 Abecma),还有更多药物正在研发中。 根据正在进行的临床试验的数量,未来几年每年可批准 10 至 20 种基因治疗药物。 此外,政府资助基因治疗领域的研究是该市场的主要增长动力之一。 例如,根据 2022 年 5 月发布的新闻报导,Virica Biotech 正在与加拿大政府合作,帮助製造 aav-lpl(脂蛋白脂肪□)基因疗法来治疗脂蛋白脂肪□缺乏症。 Bilika 从加拿大创新、科学和经济发展部 (ISED) 获得的 40,000 美元资金用于支持加拿大国家研究委员会 (NRC) 的细胞和基因治疗挑战计划的活动。

基因转移系统行业概况

基因转移系统市场具有整合性,多家公司在全球和区域开展业务。 竞争格局包括几个区域以及具有市场份额的知名国际参与者,例如Pfizer, Inc.、Becton, Dickinson and Company、Takara Bio、Novartis AG、F. Hoffmann-La Roche Ltd。我在这里。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 调查假设和市场定义

- 本次调查的范围

第二章研究方法论

第 3 章执行摘要

第四章市场动态

- 市场概览

- 市场驱动因素

- 慢性病和生活方式相关疾病的负担增加

- 生物製药公司的研究技术进步

- 市场製约因素

- 飙升的治疗费用

- 波特的五力分析

- 新进入者的威胁

- 买方/消费者议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

第 5 章市场细分

- 通过交付系统

- 病毒基因转移系统

- 腺病毒系统

- 慢病毒系统

- 逆转录病毒系统

- 其他病毒基因转移系统

- 非病毒基因转移

- 复合混合交付系统

- 病毒基因转移系统

- 通过使用

- 肿瘤科

- 感染

- 心血管疾病

- 糖尿病

- 呼吸系统疾病

- 其他用途

- 按给药途径

- 口语

- 注射

- 鼻内

- 其他给药途径

- 按地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 意大利

- 西班牙

- 其他欧洲

- 亚太地区

- 中国

- 日本

- 印度

- 澳大利亚

- 韩国

- 其他亚太地区

- 中东和非洲

- 海湾合作委员会

- 南非

- 其他中东和非洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美

第六章竞争格局

- 公司简介

- Pfizer Inc.

- Novartis AG

- F. Hoffmann-La Roche AG

- Becton, Dickinson and Company

- Takara Bio

- Shenzhen SiBiono GeneTech Co. Ltd

- Bayer AG

- Amgen Inc.

- Shanghai Sunway Biotech Co. Ltd

- Genezen

- GenScript ProBio

- Batavia Biosciences

- Sirion-Biotech GmbH

第七章市场机会与未来趋势

The gene delivery systems market is anticipated to register a CAGR of 7.3% over the forecast period.

COVID-19 had a significant impact on the gene delivery systems market. For instance, as per an article published by Drug Discovery Today in October 2021, the research, production, clinical development, and market introduction of cell and gene therapy (CGTs) for diseases unrelated to COVID-19 have all been significantly disrupted because of the COVID-19 pandemic. For CGTs with indications for rare, life-threatening conditions, telemedicine is found to be a potent tool to reduce the loss of follow-ups in clinical trials. Furthermore, Prime Therapeutics launched its PreserveRx gene therapy reinsurance product in the initial phase of COVID-19's spread across the United States to support the only two gene therapies available at the time, Luxturna and Zolgensma. Prime coordinated contracting with the manufacturer Novartis Gene Therapy for value-based outcomes in 2021. Further, in August 2021, Novartis launched a new phase three study to expand the use of Zolgensma, the one-time therapy at USD 2.1 million per patient treatment after the U.S. regulator lifted restrictions. Following these initiatives taken by the market players during the pandemic, the market has recovered and is expected to show robust growth over the forecast period.

The significant factors contributing to the market growth are the rising incidence and prevalence of chronic diseases and the increasing technological advancement in drug delivery. Some leading chronic diseases in developed countries, such as the United States, are cardiovascular diseases, infectious diseases, cancer, diabetes, and others. For instance, as per a 2023 update from the American Cancer Society, 2 million new cancer cases are likely to be diagnosed in the United States in 2023. Additionally, an article published by the National Library of Medicine, in June 2021 mentioned that in Spain, the reported prevalence of cardiovascular diseases among patients with type 2 diabetes ranged from 6.9% to 40.8% in 2021. According to the same source, the prevalence of coronary heart disease ranged from 4.7% to 37%, stroke from 3.5% to 19.6%, peripheral artery disease from 2.5% to 13.0%, and heart failure from 4.3% to 20.1%. The high incidence of chronic diseases is likely to increase the demand for substantial diagnostic procedures, which drives the market.

Moreover, the increasing ongoing research and development in the field of genomics worldwide are also expected to contribute to the market growth over the forecast period. For instance, in May 2022, Pell Bio-Med Technology Co., Ltd., sponsored a clinical study to evaluate the safety and efficacy in patients who have ever received lentiviral-based gene-edited immune cells manufactured by Pell Bio-Med Technology Co. Ltd. Such research initiatives in the field of gene delivery systems are anticipated to boost the market growth over the forecast period.

Various initiatives taken by the key market players such as product launches, expansion, and partnerships are expected to boost the market's growth during the forecast period. For instance, in June 2021, VIVEbiotech opened its new lentiviral vector manufacturing facilities in Spain, expanding the capacity for lentiviral vectors for use in cell and gene therapies. Such developments are expected to drive the market's growth over the forecast period.

However, the high cost of the treatment is expected to restrain the growth of the studied market over the forecast period.

Gene Delivery Systems Market Trends

Viral Gene Delivery Systems Segment is Expected to Hold the Largest Share in the Gene Delivery Systems Market

Viral gene delivery systems consist of viruses that are modified to be replication-deficient, which can deliver the genes to the cells to provide expression. Adenoviruses, retroviruses, and lentiviruses are used for viral gene delivery. Viral gene delivery systems are likely to hold a significant market share over the forecast period owing to attributes such as long-term expression and short-term expression, the efficacy of therapeutic genes, and the rising advancement in technology over the last few years which have opened up many opportunities for growth in the healthcare industry. The increase in the prevalence of chronic diseases, such as cancer and cardiovascular disorders, has also aided in market growth. For instance, according to the British Heart Foundation England Factsheet, published in January 2022, about 6.4 million people are living with cardiovascular diseases in England. Also, according to the CDC, in 2021, around 18.2 million adults aged 20 and older had coronary artery disease (CAD) in the United States. Heart disease is the leading cause of death among people in the United States. Thus, the rise in chronic diseases will significantly drive the growth of the studied market.

The growing emphasis on governing and raising awareness about these treatments by governments in different countries has resulted in the rapid acceptance of these gene delivery systems worldwide. For instance, as per the September 2022 report from World Economic Forum, the unique nature of personalized gene therapy treatments makes them difficult to regulate within traditional frameworks. The same source stated that, in the United States, over 60 gene therapies are expected to receive approval by 2030, forcing the FDA to quickly evolve to adequately judge the safety and efficacy of these novel treatments. These regulatory changes are creating ripple effects around the globe as countries seek to converge their regulatory requirements, making it easier and quicker for companies to bring their gene therapies to more markets sooner. Such initiatives around the globe are likely to adopt gene therapy and thereby utilize the gene delivery systems and leading to market growth.

North America is Likely to Show a Significant Market Growth Over the Forecast Period

North America is expected to maintain its overall gene delivery systems market supremacy throughout the forecast period. The factors such as the rising prevalence of chronic diseases, technological advancement, and the domicile presence of major players have been driving the market growth in the region. For instance, per the data published by the American Cancer Society in January 2023, an estimated 1,958,310 new cancer cases will be diagnosed in the United States in 2023. In addition, in the US, the population aged 65 or more was 54.1 million (16% of the total population) in 2019, which is estimated to be 21.6% by 2040.

Additionally, the presence of major market players and key strategies implemented by them, such as partnerships and collaborations, are also contributing to the market growth. For instance, as per the June 2021 news report, Health Canada approved five gene therapies (Kymriah, Yescarta, Spinraza, Luxturna, and Abecma), and there are more in the pipeline. Based on the number of clinical trials in progress, there are likely to be 10-20 gene therapy products approved every year for the next few years. Moreover, government funding in the field of gene therapy to conduct research is one of the primary growth factors of the studied market. For instance, as per a news report published in May 2022, Virica Biotech collaborated with the government of Canada to support the manufacturing of an aav-lpl (lipoprotein lipase) gene therapy to treat lipoprotein lipase deficiency. The USD 40,000 in funding from Innovation, Science and Economic Development Canada (ISED) received by Virica was used to support its work with the National Research Council (NRC) of Canada's Cell and Gene Therapy Challenge program.

Gene Delivery Systems Industry Overview

The gene delivery systems market is consolidated in nature due to the presence of a few companies operating globally as well as regionally. The competitive landscape includes an analysis of a few international as well as local companies which hold market shares and are well-known, including Pfizer, Inc., Becton, Dickinson and Company, Takara Bio, Novartis AG, and F. Hoffmann-La Roche Ltd, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Burden of Chronic Diseases and Lifestyle Disorders

- 4.2.2 Technological Advancements in Research by Biopharmaceutical Companies

- 4.3 Market Restraints

- 4.3.1 High Cost of Treatment

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD Million)

- 5.1 By Delivery Systems

- 5.1.1 Viral Gene Delivery Systems

- 5.1.1.1 Adenovirus Systems

- 5.1.1.2 Lentiviral Systems

- 5.1.1.3 Retroviral Systems

- 5.1.1.4 Other Viral Gene Delivery Systems

- 5.1.2 Non-viral Gene Delivery

- 5.1.3 Combined Hybrid Delivery Systems

- 5.1.1 Viral Gene Delivery Systems

- 5.2 By Application

- 5.2.1 Oncology

- 5.2.2 Infectious Diseases

- 5.2.3 Cardiovascular Disorders

- 5.2.4 Diabetes

- 5.2.5 Pulmonary Disorders

- 5.2.6 Other Applications

- 5.3 By Route of Administration

- 5.3.1 Oral

- 5.3.2 Injectable

- 5.3.3 Nasal

- 5.3.4 Other Routes of Administration

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Pfizer Inc.

- 6.1.2 Novartis AG

- 6.1.3 F. Hoffmann-La Roche AG

- 6.1.4 Becton, Dickinson and Company

- 6.1.5 Takara Bio

- 6.1.6 Shenzhen SiBiono GeneTech Co. Ltd

- 6.1.7 Bayer AG

- 6.1.8 Amgen Inc.

- 6.1.9 Shanghai Sunway Biotech Co. Ltd

- 6.1.10 Genezen

- 6.1.11 GenScript ProBio

- 6.1.12 Batavia Biosciences

- 6.1.13 Sirion-Biotech GmbH