|

市场调查报告书

商品编码

1273359

免疫组织化学市场 - 增长、趋势和预测 (2023-2028)Immunohistochemistry Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

在预测期内,免疫组织化学市场预计将以 7.3% 左右的复合年增长率增长。

SARS-CoV-2 爆发对早期市场增长产生了重大影响,因为实验室和研究机构因全球封锁而面临试剂供应短缺。 例如,根据 ASCP 2022 年 2 月的更新,对标本管和其他常见实验室耗材的需求威胁到在大流行期间进行诊断测试的各个方面。 试剂短缺对市场增长产生了重大影响,因为一些研究机构和生物製药公司正在评估免疫荧光分析,以将其开发为 COVID-19 的有效诊断工具。 SARS-CoV-2 也可以使用 dsRNA 抗体通过 IHC 方法检测。 由于在大流行后情况下越来越多地使用免疫组织化学来诊断各种慢性疾病,预计未来几年市场将会增长。

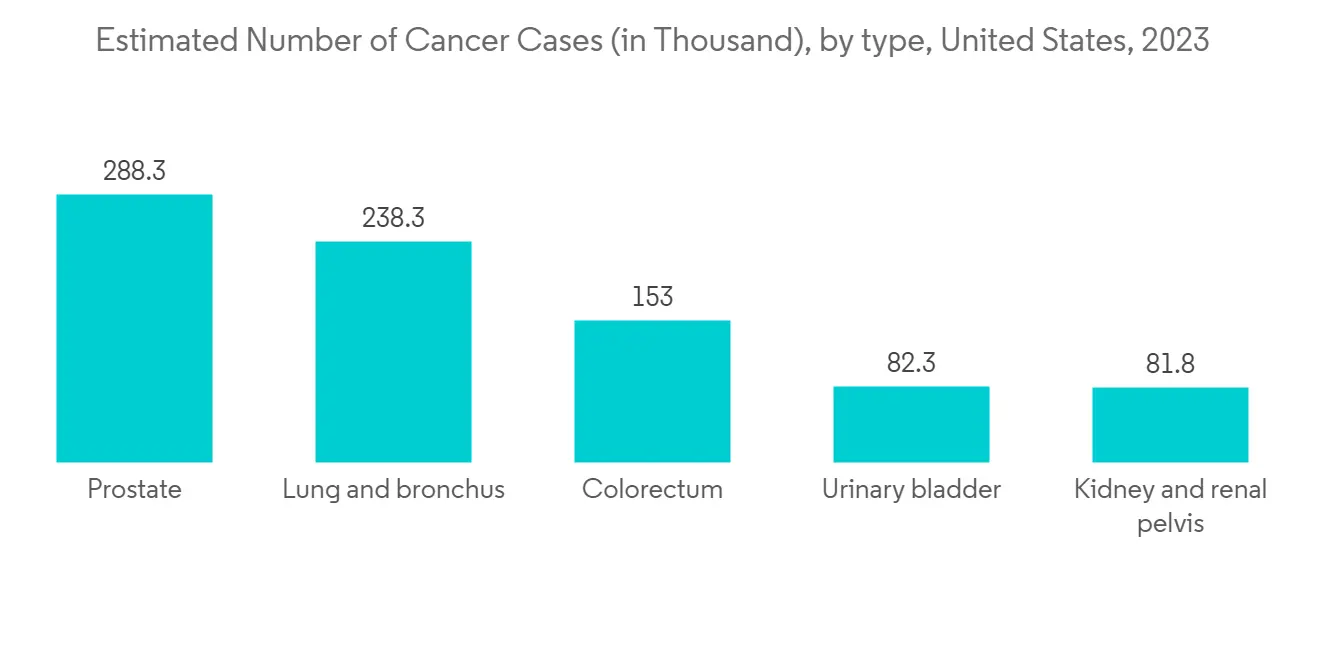

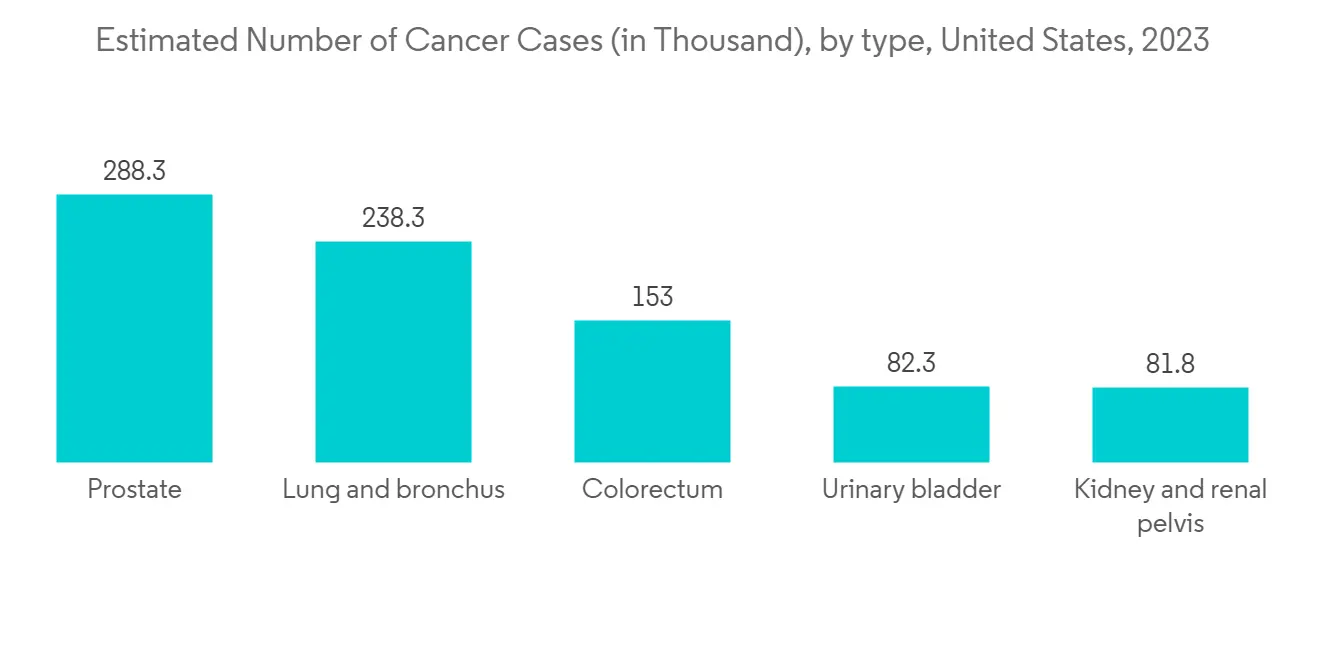

免疫组织化学用于诊断癌症和其他涉及抗原抗体反应的疾病,因此癌症发病率的增加是市场增长的主要驱动力。 例如,根据美国癌症协会 2023 年癌症统计数据,2021 年美国将诊断出 189 万新癌症患者,而 2023 年将诊断出约 196 万新癌症患者。 因此,随着癌症负担的增加和人们对癌症认识的提高,对早期诊断的需求有望增加,从而推动市场的增长。

此外,免疫组化产品的技术进步有望提高现有产品的效率和有效性,预计这将对预测期内的免疫组化产品需求产生有利影响。 例如,2022 年 7 月,NextCure 发表了一篇论文,使用新开发的抗 Siglec-15 (S15) 抗体和免疫组织化学 (IHC) 测定法研究实体瘤中 S15 的表达。 本文介绍了与耶鲁大学医学院病理学系的研究人员合作进行的一项研究的数据摘要。

此外,预计在预测期内,人口迅速老龄化以及慢性病和传染病的高负担将进一步推动对用于诊断和检测应用的 IHC 产品的需求。 例如,根据联合国一份2022年的报告,世界老年人口增长迅速,65岁及以上人口占世界人口的比例预计将从2022年的10%上升到2050年的16%。事实已经如此。 由于老年人口更容易患上慢性病,因此相信更多地使用检测来解决这一问题将导致市场增长。

然而,有限的报销政策和 IHC 产品的高价格预计会抑制市场增长。

免疫组织化学的市场趋势

在预测期内,诊断领域预计将占据免疫组化市场的很大份额

促进诊断领域增长的关键因素是多个市场进入者推出新产品、增加即时诊断以及快速发展的技术。 此外,在全球病毒流行病和慢性病中使用诊断技术,以及个性化医疗的开发和后续管理,可能会推动市场增长。 例如,根据疾病预防控制中心 2023 年 1 月的更新,全球已诊断出 85,100 例 Salmodoki 病例。

这一细分市场的巨大份额源于各种慢性疾病的日益突出以及免疫组织化学在传染病、心血管疾病和其他疾病诊断中的广泛应用。 例如,根据 2022 年 2 月的一篇 PubMed 论文,波形蛋白免疫染色作为心肌重塑和所有非心肌细胞类型动力学的标誌物,目前用于诊断缺血性心脏病。一些研究表明它可能作为传统染色的补充有用技巧。 缺血性心脏病和中风是主要原因,占 CVD 死亡的 80% 以上。

根据 2022 年 8 月发表在 JACC 上的一篇论文,在美国国家健康和营养调查中,中风(33.8% → 1500 万)和心力衰竭(33.4% → 1300 万),其次是缺血性心脏病(30.7% → 2900 万)和心脏病发作(16.9% → 1600 万)。 因此,使用免疫染色诊断心脏病的应用有望增加对 IHC 产品的需求。

此外,主要参与者的新产品发布、合作伙伴关係、併购以及研究活动的增加等战略活动预计将进一步推动该细分市场的增长。 例如,2021年6月,Amoy Diagnostics、Riken Genesis和Precision Medicine Asia向市场推出了AmoyDx Pan Lung Cancer PCR Panel。 该面板已获厚生劳动省批准在日本销售和製造。 同样,2021 年 1 月,Thermo Fisher Scientific 收购了一家私营分子诊断公司 Mesa Biotech。 Mesa Biotech 的创新平台将能够在护理点加速提供具有高可靠性和准确性的先进分子诊断。

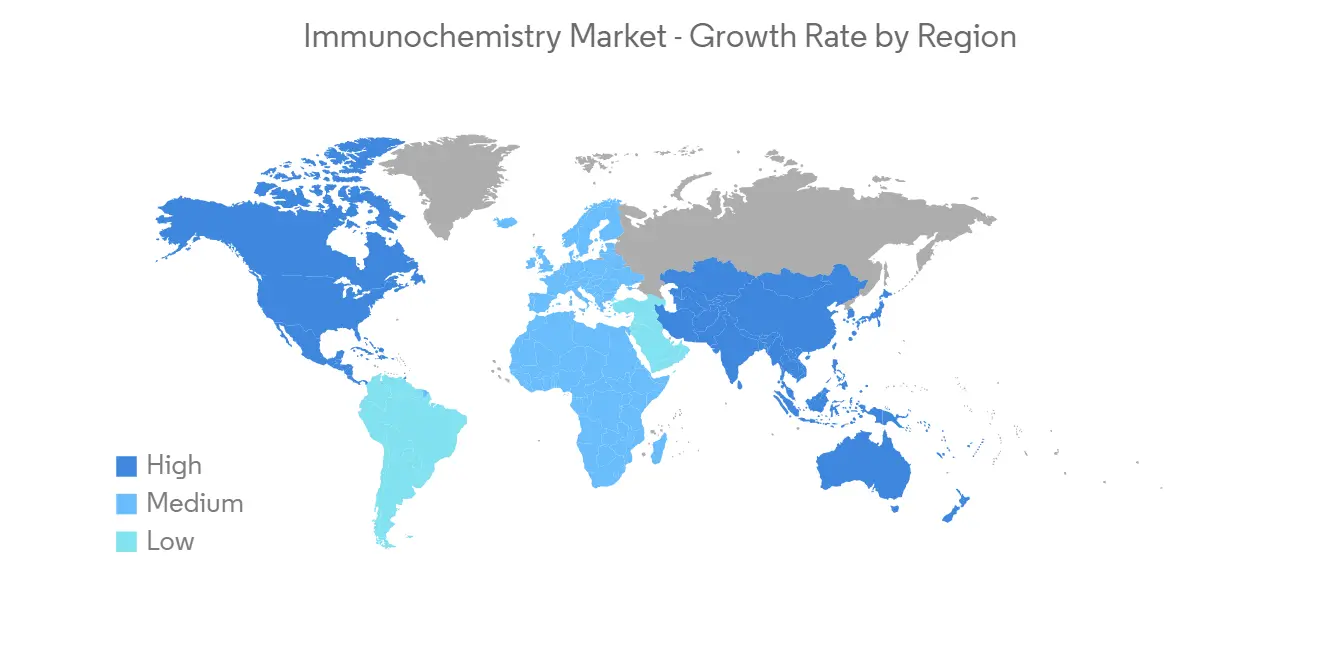

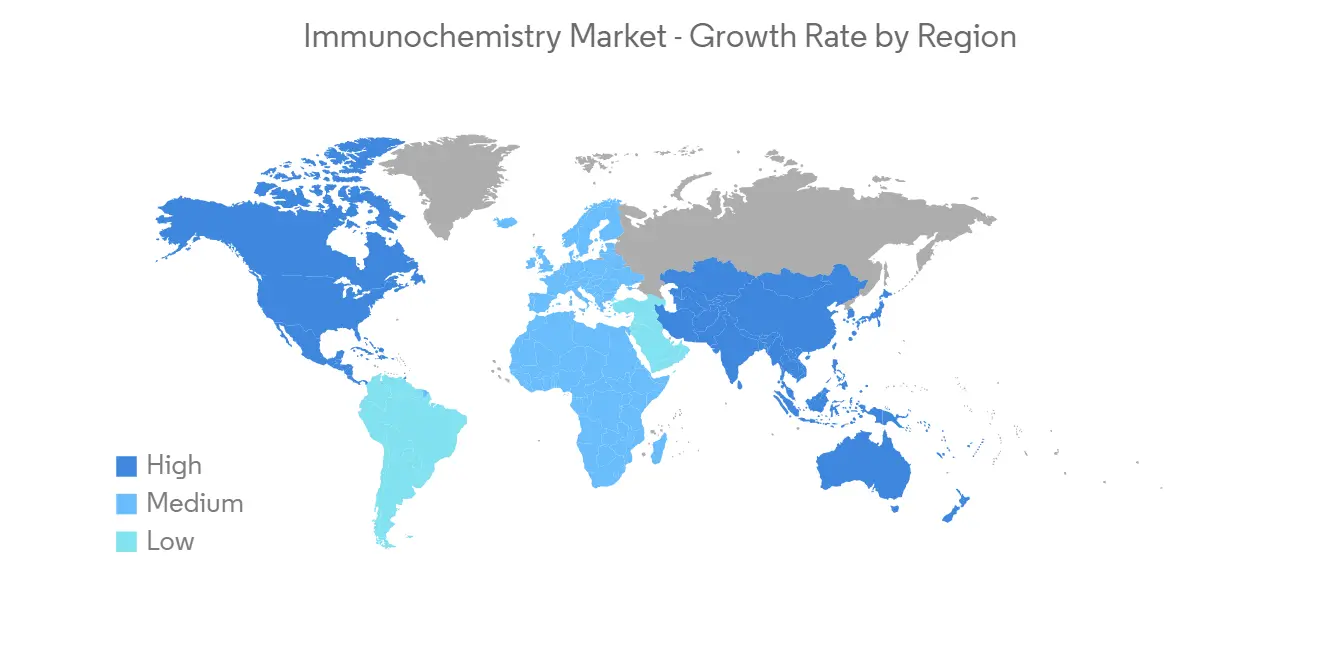

预计在预测期内北美将占据很大的市场份额

由于主要参与者的存在、癌症和其他慢性病的高患病率以及完善的医疗保健基础设施等因素,预计在整个预测期内,北美将保持显着的市场份额。 例如,根据美国心臟协会 2021 年期刊,估计到 2035 年,美国将有超过 1.3 亿成年人患有某种形式的心脏病。 同样,根据加拿大统计局 2022 年的更新,预计加拿大将有 233,900 人被诊断出患有癌症。 对有效诊断解决方案以接受心脏病和癌症充分治疗的需求不断增长,预计将推动北美市场的增长。

此外,根据加拿大对 2022 年的人口预测,近五分之一的加拿大人(占人口的 18.8%,即 7,329,910 人)将年满 65 岁。 因此,慢性病的流行以及该国老年人口的增加预计将在预测期内增加免疫化学工具的开发机会。

此外,增加与研究市场相关的新产品发布将促进市场增长。 例如,2021 年 12 月,癌症诊断自动化染色解决方案提供商 BioGenex 宣布了三种用于癌症诊断的新型初级免疫组织化学 (IHC) 抗体。 此外,2021 年 3 月,罗氏将推出 DISCOVERY Green HRP 显色剂检测试剂盒,用于癌症研究中的扩展免疫组织化学多重分析。

免疫组织化学工业概况

免疫组织化学市场竞争激烈,由多家大型企业组成。 市场参与者包括 F. Hoffmann-LA Roche、Agilent Technologies, Inc.、Thermo Fisher Scientific Inc.、Merck Millipore、Abcam PLC、Bio-Rad Laboratories, Inc、PerkinElmer, Inc、Cell Signaling Technology, Inc.、Bio I have an SB .

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 调查假设和市场定义

- 本次调查的范围

第二章研究方法论

第 3 章执行摘要

第四章市场动态

- 市场概览

- 市场驱动力

- 癌症患病率增加

- 老年人口激增,慢性病和传染病负担加重

- IHC 的技术进步和生物学研究的增加

- 市场製约因素

- 高成本 IHC 产品

- 缺乏适当的报销政策

- 波特的五力分析

- 新进入者的威胁

- 买方/消费者议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

第 5 章市场细分

- 按产品分类

- 抗体

- 设备

- 试剂盒和试剂

- 通过使用

- 诊断

- 药物测试

- 最终用户

- 医院和诊断中心

- 学术和研究机构

- 其他最终用户

- 按地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 意大利

- 西班牙

- 其他欧洲

- 亚太地区

- 中国

- 日本

- 印度

- 澳大利亚

- 韩国

- 其他亚太地区

- 中东和非洲

- 海湾合作委员会

- 南非

- 其他中东和非洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美

第6章竞争格局

- 公司简介

- F. Hoffmann-LA Roche AG

- Agilent Technologies, Inc.

- Thermo Fisher Scientific Inc.

- Merck KGaA

- Abcam PLC

- Bio-Rad Laboratories, Inc.

- PerkinElmer, Inc.

- Cell Signaling Technology, Inc.

- Bio SB

- Danaher Corporation

- Takara Bio

第7章 市场机会与将来动向

The immunohistochemistry market is projected to grow at a CAGR of nearly 7.3% over the forecast period.

The SARS-CoV-2 outbreak significantly impacted the market's growth during the initial phase since laboratories, and research institutes faced shortages of reagent supply due to the global lockdown. For instance, as per the ASCP February 2022 update, during the pandemic, the need for specimen tubes and other common laboratory consumables threatened access to all aspects of diagnostic testing. As several research organizations and biopharmaceutical companies evaluated immunofluorescence assay to develop it as an effective diagnostic tool for COVID-19, the reagent shortages hugely impacted the market growth. Moreover, SARS-CoV-2 can also be detected by IHC using a dsRNA antibody. In the post-pandemic situation, the market is expected to rise in the coming years due to the rising utilization of immunohistochemistry in the diagnosis of various chronic diseases.

The major factor contributing to the market's growth is the increase in cancer incidence, as immunohistochemistry is used to diagnose cancer and other diseases including antigen-antibody reactions. For instance, according to the American Cancer Society 2023 Cancer Statistics, it is estimated that about 1.96 million new cases of cancer would be diagnosed in the United States in 2023, as compared to 1.89 million in 2021. Hence, with the increasing burden of cancer and awareness about it, the demand for early diagnostics is expected to increase, thereby boosting growth in the market.

Also, the technological advancements in immunohistochemistry products are likely to improve the efficiency and effectiveness of existing products which is anticipated to have a positive impact on the demand for immunohistochemistry products over the forecast period. For instance, in July 2022, NextCure published a paper that utilized a newly developed antibody to Siglec-15 (S15) and an immunohistochemical (IHC) assay to investigate S15 expression in solid tumors. The publication outlines data from a study conducted in collaboration with researchers in the Department of Pathology at Yale School of Medicine.

Moreover, the rapidly increasing geriatric population and high burden of chronic & infectious diseases are further expected to drive the demand for IHC products for diagnostics and testing applications over the forecast period. For instance, as per a United Nations 2022 report, the global geriatric population is increasing rapidly and the share of the global population aged 65 years or above is projected to rise from 10% in 2022 to 16% in 2050. Since the geriatric population is more prone to chronic diseases, a corresponding rise is likely to increase the utilization of tests and thereby lead to market growth.

However, limited reimbursement policies and the high cost of IHC products are anticipated to restrain the market growth.

Immunohistochemistry Market Trends

The Diagnostics Segment is Expected to Hold a Significant Share in the Immunohistochemistry Market Over the Forecast Period

Major factors contributing to the growth of the diagnostic segment are new product launches by several market players, increasing point-of-care diagnostics, and rapidly evolving technology. Furthermore, viral epidemics and chronic diseases worldwide and the use of diagnostic techniques to develop and subsequently administer personalized medicine are likely to boost market growth. For instance, as per the January 2023 update by CDC, 85.1 thousand cases of monkeypox are diagnosed globally.

The large share of this segment is credited to the growing predominance of various chronic diseases and the wide application of immunohistochemistry in the diagnosis of infectious diseases, cardiovascular diseases, and other diseases. For instance, as per an article published in February 2022 in PubMed, a study indicated that immunostaining of vimentin as a marker for myocardial remodeling and the dynamics of all non-myocardial cell types might be useful for supplementing conventional staining techniques currently used in the diagnosis of ischemic heart disease. Ischemic heart disease and stroke are the predominant causes and are responsible for more than 80% of CVD fatalities.

As per an article published in August 2022 in JACC, the United States National Health and Nutrition Examination Survey found that stroke (33.8% to 15 million) and heart failure (33.4% to 13 million) have the highest projected increases in cardiovascular disease rates, followed by ischemic heart disease (30.7% to 29 million) and heart attack (16.9% to 16 million) for the projected years 2025 to 2060. Hence, applications to diagnose heart disease using immunostaining are expected to increase the demand for IHC products.

In addition, new product launches, strategic activities like collaborations, mergers, and acquisitions by the key players, and an increase in research activities are further expected to add to the segment's growth. For instance, in June 2021, Amoy Diagnostics Co. Ltd, Riken Genesis Co. Ltd, and Precision Medicine Asia Co. Ltd introduced the AmoyDx Pan Lung Cancer PCR Panel in the market. The panel was approved by the Ministry of Health, Labour, and Welfare (MHLW) for marketing and production in Japan. Similarly, in January 2021, Thermo Fisher Scientific acquired Mesa Biotech, a privately held molecular diagnostic company. Mesa Biotech's innovative platform will enable the company to accelerate the availability of reliable and accurate advanced molecular diagnostics at point-of-care.

North America is Anticipated to Hold a Significant Market Share in the Market Over the Forecast Period

North America is expected to hold a notable market share throughout the forecast period due to the factors such as the presence of key players, the high prevalence of cancer and other chronic diseases in the region, and the established healthcare infrastructure. For instance, as stated by the American Heart Association 2021 journal, it is estimated that by the year 2035, more than 130 million adults in the United States will have some type of heart disease. Similarly, as per the Statistics Canada 2022 update, an estimated 233.9 thousand people in Canada are expected to be diagnosed with cancer. The growing demand for effective diagnostic solutions to obtain proper treatment for heart disease and cancer is expected to drive the growth of the market in North America.

In addition, as per Canada's population estimates for 2022, almost one in five Canadians (18.8% of the population; 7,329,910 people) were at least 65 years of age. Hence, the prevalence of chronic diseases coupled with the increasing geriatric population in the country is anticipated to create more opportunities for the development of immunochemistry tools during the forecast period.

Furthermore, an increase in new product launches relating to the market studied boosts the growth of the market. For instance, in December 2021, BioGenex, an automated staining solution provider for cancer diagnostics launched three new primary immunohistochemistry (IHC) antibodies for cancer diagnosis. Furthermore, in March 2021, Roche launched the DISCOVERY Green HRP chromogen detection kit to expand immunohistochemistry multiplexing in cancer research.

Immunohistochemistry Industry Overview

The immunohistochemistry market is highly competitive and consists of several major players. Some of the key companies in the market are F. Hoffmann-LA Roche, Agilent Technologies, Inc., Thermo Fisher Scientific Inc., Merck Millipore, Abcam PLC, Bio-Rad Laboratories, Inc., PerkinElmer, Inc., Cell Signaling Technology, Inc., and Bio SB.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Prevalence of Cancer

- 4.2.2 Rapidly Increasing Geriatric Population and High Burden of Chronic & Infectious Diseases

- 4.2.3 Technological Advancement in IHC and Growing Biological Research

- 4.3 Market Restraints

- 4.3.1 High Cost IHC Products

- 4.3.2 Lack of Proper Reimbursement Policies

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size - Value in USD million)

- 5.1 By Product

- 5.1.1 Antibodies

- 5.1.2 Equipment

- 5.1.3 Kits and Reagents

- 5.2 By Application

- 5.2.1 Diagnostics

- 5.2.2 Drug Testing

- 5.3 By End-User

- 5.3.1 Hospitals and Diagnostics Centers

- 5.3.2 Academic & Research Institutes

- 5.3.3 Other End-users

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 F. Hoffmann-LA Roche AG

- 6.1.2 Agilent Technologies, Inc.

- 6.1.3 Thermo Fisher Scientific Inc.

- 6.1.4 Merck KGaA

- 6.1.5 Abcam PLC

- 6.1.6 Bio-Rad Laboratories, Inc.

- 6.1.7 PerkinElmer, Inc.

- 6.1.8 Cell Signaling Technology, Inc.

- 6.1.9 Bio SB

- 6.1.10 Danaher Corporation

- 6.1.11 Takara Bio

![仪器免疫组织化学市场:趋势、机会与竞争分析 [2023-2028]](/sample/img/cover/42/1342061.png)

![抗体免疫组织化学市场:趋势、机会与竞争分析 [2023-2028]](/sample/img/cover/42/1342059.png)