|

市场调查报告书

商品编码

1273363

室内分配市场 - 增长、趋势和预测 (2023-2028)Indoor Location Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

在预测期内,室内分配市场的复合年增长率将达到 21.7%。

主要亮点

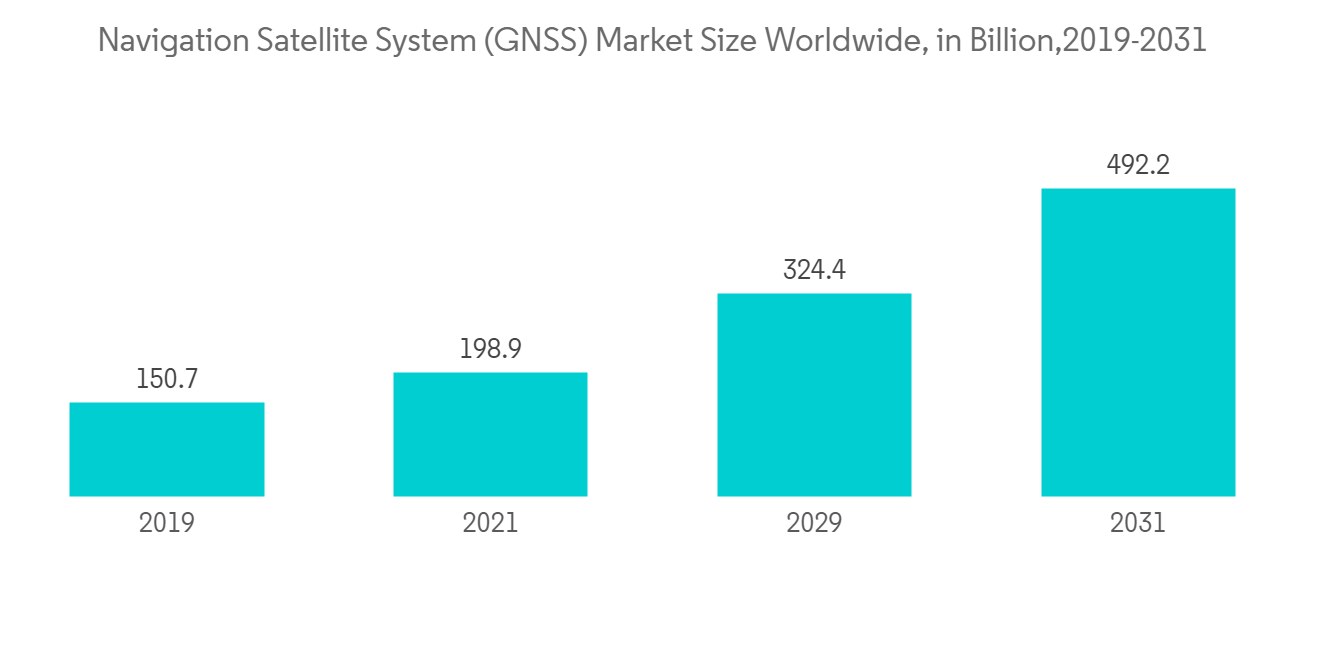

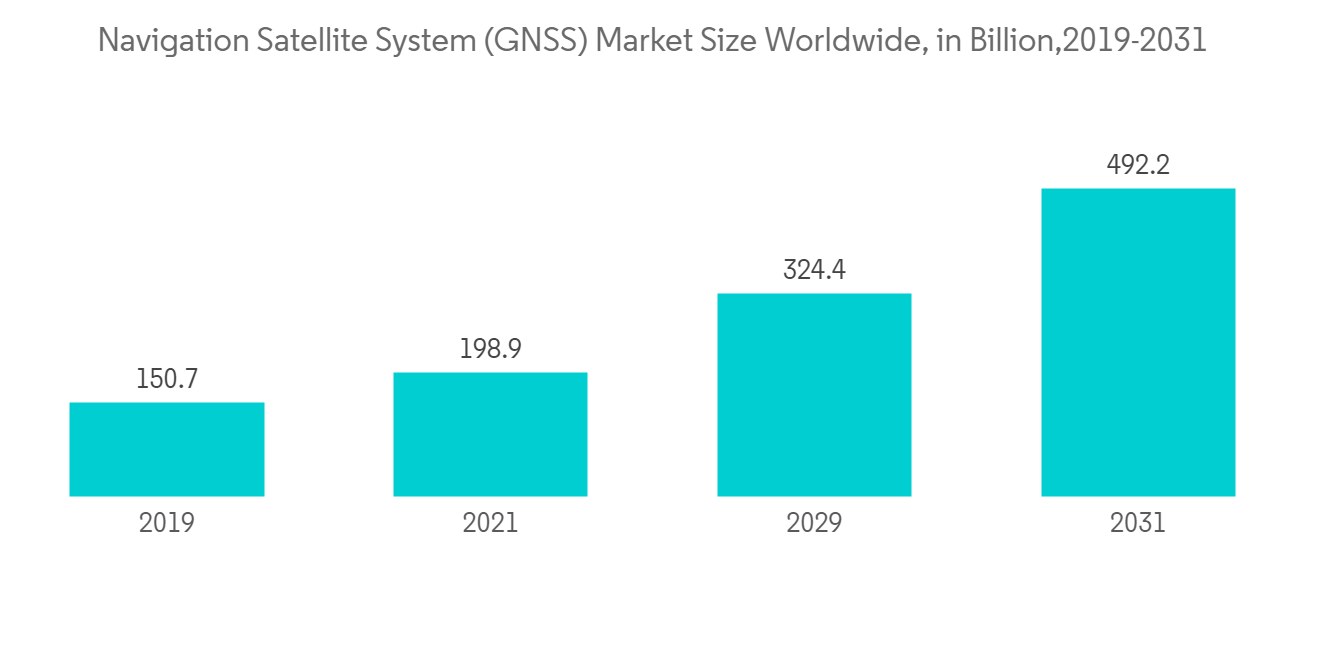

- 称为室内定位系统的设备网络用于在 GPS 和其他卫星技术不太准确或完全无效的环境(例如摩天大楼、机场、小巷、停车场、地下室等)中识别人和事物,用于

- 室内定位系统的发展使得在各种情况下提供更准确的位置信息成为可能,无论设施的大小和范围如何。此外,这种方法有助于有效管理许多生产设施中的地板水平。配备信标和蓝牙低功耗 (BLE) 标籤的应用的普及,以及信标在相机、LED 照明、POS 和数字标牌中的使用不断增加,是推动室内定位市场增长的因素。

- 企业正在使用云计算和物联网 (IoT) 系统实现大部分运营自动化。医疗保健行业正计划引入更多应用程序。由于考虑到医疗保健需求而开发的物联网应用程序数量不断增加,预计医疗保健行业将会出现增长。

- 此外,由于配备尖端移动应用程序的智能手机的普及、数字化的进步、移动商务和技术改进,预计室内定位市场将扩大。根据 GSMA 研究,全球约 41% 的人在过去一年拥有智能手机。

- 最终用户受到众多基础设施不兼容性和互操作性要求、数据和安全相关问题的阻碍,维护挑战可能会阻碍市场增长。

- 许多公司已经开始跟踪员工与 COVID-19 的互动和活动,以防止工作场所和行业成为该疾病的新震中。为了利用 COVID-19 大流行期间对接触者追踪解决方案的需求增加,一些室内定位解决方案提供商正在发布新产品或改进现有产品以满足客户需求。

室内分配市场趋势

运输/物流行业占有压倒性的市场份额

- 这种增长可归因于对移动协助的需求,以引导旅客在机场和火车站找到正确的就餐和购物场所。

- 使用室内定位解决方案有助于交通机构瞭解消费者行为。我们提供有用的数据,可用于扩展广告活动、选择合适的位置、优化服务等。而在运输行业,选择室内定位解决方案可以帮助您追踪丢失的设备、有效管理库存并节省审计成本。

- 物流行业室内定位解决方案的开发需要通过跟踪和识别资产位置来减少管理资产位置所需的时间。地理位置分析工具可帮助企业组织和破译复杂的计划、收集见解并快速参与。

- 成功的运输和物流行业需要复杂、持续的运营和资本密集型流程。物流行业对验证存储资产的下落很感兴趣。为了减少在资产定位上浪费的时间并推动内部定位解决方案,物流行业对跟踪和定位资产的要求也发生了变化。

- 通过使用位置分析工具来组织和解释复杂的计划,企业可以快速获得洞察力并与客户互动。

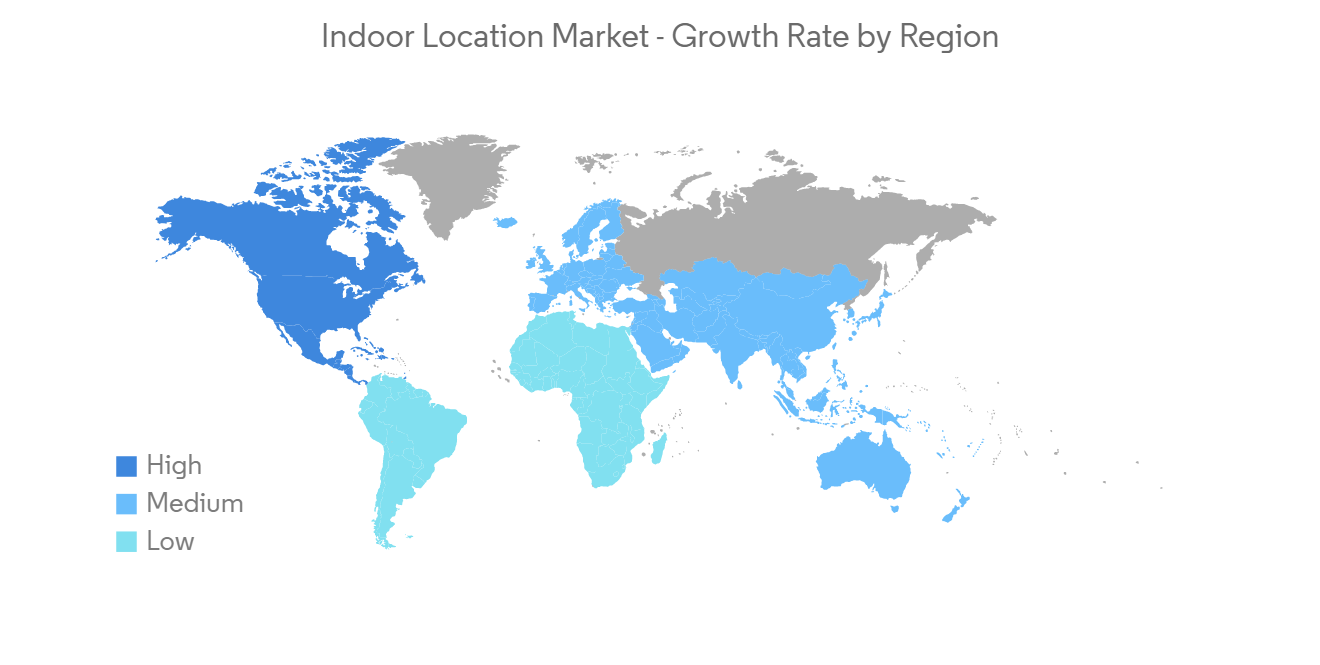

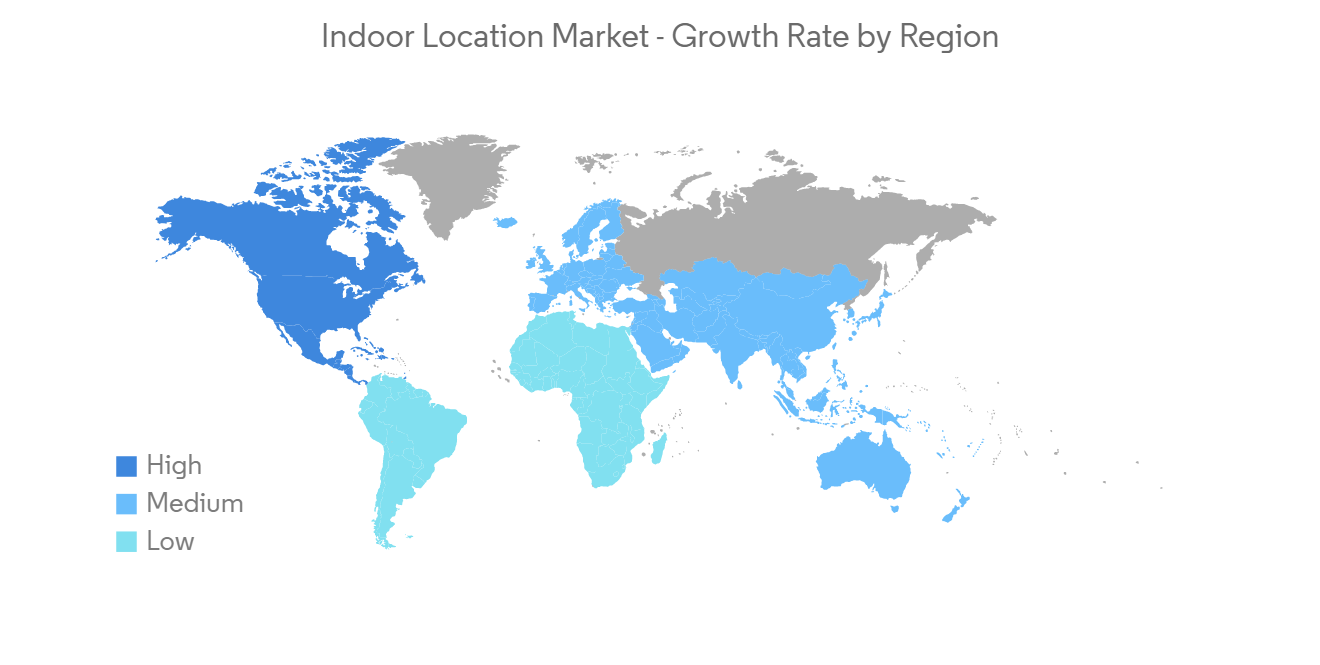

北美将在预测期内占据最高的市场份额

- 由于智能手机普及率的上升和物联网技术的发展,预计北美将占据室内定位市场的很大一部分。除了是最大的飞机製造商和航空航天和航海导航设备的领先製造商之一,北美地区还是平板电脑、智能手机和汽车导航系统的第二大市场。

- 美国在北美几乎每个终端用户行业都占有很大份额,尤其是消费电子市场。该国的智能手机市场渗透率和销量令人印象深刻。

- 例如,GSM 协会预测,北美移动行业将在 2025 年产生 3330 亿美元的收入,使美国成为全球最大的移动市场,增幅约为中国的 50%。随着该国打算过渡到 5G 服务,预计销售额将进一步增长。到今年年底,非洲大陆 24% 的连接将是 5G 网络,到 2025 年将上升到 46%,即 2 亿个 5G 连接。

- 此外,不断上升的智能手机普及率和不断变化的消费者移动购买行为正在推动初创企业和现有企业争先恐后地提供基于位置的服务,以吸引跨地域的室内用户。零售商正在部署室内定位技术,以改善客户体验并为产品和位置提供相关导航。

- 增加对开发新技术和利用室内定位解决方案的投资也是支持北美室内定位市场增长的关键因素。此外,各地区与室内定位相关的公司数量将增加,这有望成为市场扩张的推动力。

室内配电行业概况

室内定位市场可能会变得更有凝聚力。持续的研究和技术进步预计将成为市场的主要趋势。公司正在采用多种策略来扩大客户群并展示其市场地位。

2023 年 3 月,Impixon 宣布与矿山安全系统和设备的原始设备製造商 Schauenburg Systems 达成合作协议,向南非的矿业公司出售 Impixon 的实时定位技术。根据协议,双方旨在实现数十万颗 nanoLOC 芯片和其他 Inpixon 核心技术的销售,为采矿业提供实时跟踪、防撞和接近应用。

2022 年 12 月,Orient 室内定位服务宣布在 Google Cloud Marketplace 上可用。通过此产品,现有的 Google Cloud Marketplace 客户将受益于通过单一渠道进行的无缝采购和整合计费。该产品将使零售商能够通过更多数字接触点和客户旅程分析来增强店内购物体验,从而改善运营和收入。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 本次调查范围

第二章研究方法论

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 行业吸引力——波特五力分析

- 新进入者的威胁

- 买方/消费者议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 对室内定位市场的影响分析

第五章市场动态

- 市场驱动力

- 增加配备信标和 BLE 标籤的应用程序

- 室内 GPS 技术的低效

- 连接设备、智能手机和基于位置的应用程序的增长

- 市场製约因素

- 数据和安全问题

- 部署和维护挑战

- 严格的政府规章制度

第六章市场细分

- 按组件

- 解决方案

- 按服务

- 按申请

- 室内导航和地图

- 跟踪/追溯应用

- 远程监控/危机管理

- 其他应用

- 按终端用户行业

- 零售业

- 运输/物流

- 卫生保健

- 电信

- 石油、天然气和采矿

- 政府/公共机构

- 製造业

- 其他终端用户行业

- 区域信息

- 北美

- 欧洲

- 亚太地区

- 南美洲

- 中东/非洲

第七章竞争格局

- 公司简介

- Inpixon

- Hewlett Packard Enterprise Development LP

- Mist Systems Inc.

- HID Global Corporation

- Cisco Systems, Inc.

- Google LLC

- Microsoft Corporation

- Acuity Brands, Inc.

- Zebra Technologies Corporation

- CenTrak

- Ubisense Limited

- Sonitor Technologies AS

- Broadcom Corporation

- HERE Global BV

- IndoorAtlas Ltd.

第八章投资分析

第 9 章 市场机会和未来趋势

The indoor location market will register a CAGR of 21.7% during the forecast period.

Key Highlights

- A network of devices known as an indoor positioning system is used to identify people or things in environments where GPS and other satellite technologies are less accurate or completely ineffective, such as multistory buildings, airports, alleys, parking garages, and underground places.

- The development of indoor location systems has given businesses more accuracy in various settings, irrespective of the size and scope of the facility. In addition, the method has assisted numerous production facilities in effectively managing their floor level. The proliferation of applications powered by beacons and Bluetooth low energy (BLE) tags, as well as the growing incorporation of beacons into cameras, LED lighting, point of sale (PoS), and digital signage, are the main drivers of the indoor location market's growth.

- Businesses are automating most of their operations with cloud computing and Internet of Things (IoT) systems. A more significant number of applications are planned for the healthcare industry. The healthcare vertical is expected to rise due to the growing IoT applications developed with healthcare needs in mind.

- Also, the market for indoor locations is expected to expand due to the rising use of smartphones with cutting-edge mobile applications, the trend toward digitization, mobile commerce, and technological improvements. In the past year, roughly 41% of people worldwide used smartphones, according to GSMA research.

- End users are hampered by the incompatibility of numerous infrastructures and the need for interoperability along with data and security-related Issues; Maintenance Challenges might challenge the market growth.

- Numerous businesses have started tracking employee interactions and activities in response to COVID-19 to stop workplaces and industries from developing into new infection epicenters. To take advantage of the rising demand for contact-tracing solutions during the COVID-19 pandemic, several indoor location solution providers have released new products or improved existing products to fulfill the needs of their clients.

Indoor Location Market Trends

The Transportation and Logistics Vertical to Hold a Dominant Market Share

- The growth can be attributed to the demand for mobile assistance for travelers at airports and railway stations to direct them to the proper location for finding eateries and retailers in airports and trains.

- Use of indoor location solutions helps the transportation sector understand consumer behavior. It provides useful data that could be used to create enlarged advertising campaigns, choose appropriate locations, and optimize services. The transportation vertical may also trace missing equipment, effectively control inventory, and save audit expenses by choosing indoor location solutions.

- The development of indoor location solutions in the logistics vertical is driven by the requirement to track and recognize asset locations to save time lost in asset location management. With location analytics tools, a business may organize and decipher complicated plans, enabling it to gather insights and engage with them swiftly.

- For the transportation and logistics vertical to be successful, complex, ongoing operations and capital-intensive processes are required. The logistics industry is concerned with locating storage assets. To cut down on time wasted in managing asset locations and promote interior location solutions, the logistics industry also saw a change in the requirement to track and identify asset locations.

- A company may organize and interpret complex plans using location analytics tools, enabling it to gain insights quickly and interact with customers.

North America to Hold the Highest Market Share During the Forecast Period

- Due to the rising smartphone penetration and the development of IoT technology in the region, North America is predicted to account for a sizeable portion of the Indoor Location market. In addition to being the largest manufacturer of airplanes and one of the leading producers of aerospace and marine navigation equipment, the North American region is also the second-largest market for tablets, smartphones, and in-vehicle navigation systems.

- In nearly every end-user industry in North America, especially in the consumer electronics market, the United States holds a large market share. The market penetration and sales of smartphones are impressive in the nation.

- For instance, the GSM Association predicts that the North American mobile industry will generate USD 333 billion in revenue in 2025, making America the largest mobile market in the world - around 50% larger than China. With the country's intentions to transition to 5G services, sales are predicted to increase even higher. By the end of this year, 24% of connections on the continent will be on 5G networks, which will rise to 46% by 2025, or 200 million 5G connections.

- Also, startups and established companies are rushing to provide location-based services to engage indoor users across the region due to rising smartphone penetration and changing consumer mobile purchasing behavior. Retailers have enhanced their customer experiences and provided appropriate navigation for products or places by implementing indoor location technology.

- The increasing investments in creating new technologies and utilizing indoor location solutions are two other key factors supporting the growth of the indoor location market in North America. It is also projected that an increase in indoor location companies across regions will fuel market expansion.

Indoor Location Industry Overview

The indoor location market could be more cohesive. Continuous research and technological advancements are anticipated to be the principal trends in the market. The firms are adopting diverse strategies to increase their customer base and mark their presence in the market.

In March 2023, Inpixon announced a collaboration agreement with Schauenburg Systems, an original equipment manufacturer of mine safety systems and equipment, to sell Inpixon's real-time location technologies to mining companies in South Africa. Under the agreement, the parties will aim to achieve sales of hundreds of thousands of nanoLOC chips and other core technologies of Inpixon that provide real-time tracking, collision avoidance, and proximity applications for the mining industry.

In December 2022, Oriient Indoor Location Services announced its Available on Google Cloud Marketplace; through this offering, customers with an existing Google Cloud Marketplace commitment benefit from seamless procurement and consolidated billing through a single channel. This availability will help retailers improve the in-store shopping experience with more digital touch points and customer journey analytics to improve operations and the bottom line.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Analysis on the impact of COVID-19 on the Indoor Location Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Number of Applications Powered by Beacons and BLE Tags

- 5.1.2 Inefficiency of the GPS Technology in Indoor Premises

- 5.1.3 Growth of Connected Devices, Smartphones, and Location-based Applications

- 5.2 Market Restraints

- 5.2.1 Data and security related Issues

- 5.2.2 Deployment and Maintenance Challenges

- 5.2.3 Strict Rules and Regulations by Government

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Solutions

- 6.1.2 Services

- 6.2 By Application

- 6.2.1 Indoor Navigation & Maps

- 6.2.2 Tracking & Tracing Application

- 6.2.3 Remote Monitoring & Emergency Management

- 6.2.4 Other Applications

- 6.3 By End-User Industry

- 6.3.1 Retail

- 6.3.2 Transportation & Logistics

- 6.3.3 Healthcare

- 6.3.4 Telecom

- 6.3.5 Oil & Gas and Mining

- 6.3.6 Government & Public Sector

- 6.3.7 Manufacturing

- 6.3.8 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 South America

- 6.4.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Inpixon

- 7.1.2 Hewlett Packard Enterprise Development LP

- 7.1.3 Mist Systems Inc.

- 7.1.4 HID Global Corporation

- 7.1.5 Cisco Systems, Inc.

- 7.1.6 Google LLC

- 7.1.7 Microsoft Corporation

- 7.1.8 Acuity Brands, Inc.

- 7.1.9 Zebra Technologies Corporation

- 7.1.10 CenTrak

- 7.1.11 Ubisense Limited

- 7.1.12 Sonitor Technologies AS

- 7.1.13 Broadcom Corporation

- 7.1.14 HERE Global BV

- 7.1.15 IndoorAtlas Ltd.