|

市场调查报告书

商品编码

1273364

工业涂料市场 - COVID-19 的增长、趋势、影响和预测 (2023-2028)Industrial Coatings Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

在预测期内,工业涂料市场预计将以超过 4% 的复合年增长率增长。

到 2020 年,COVID-19 将对全球工业涂料行业的增长产生适度影响。 然而,石油和天然气、化工和采矿等各个工业部门对工业涂料的需求正在飙升。

主要亮点

- 受长效产品需求增加和粉末涂料使用增加等因素的推动,工业涂料市场预计将以多种方式增长。

- 溶剂型涂料对环境的有害影响预计会阻碍市场增长。

- 在未来,我们相信市场也将有机会受益于对持久产品不断增长的需求。

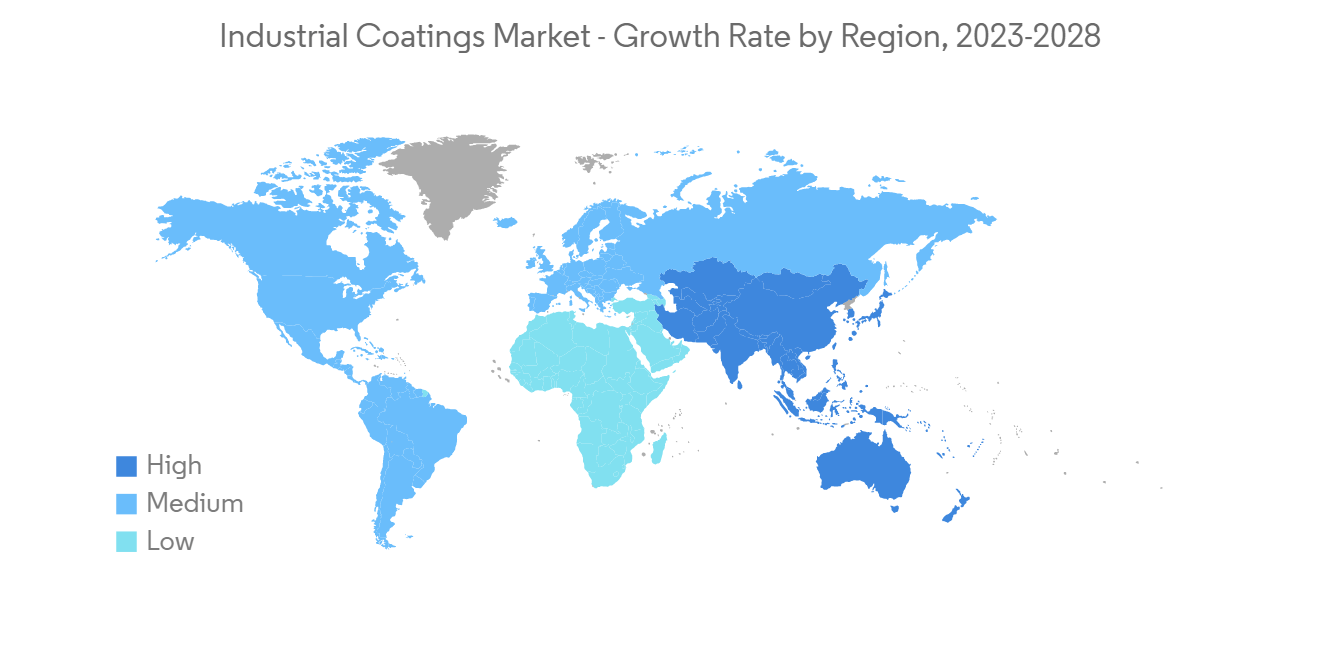

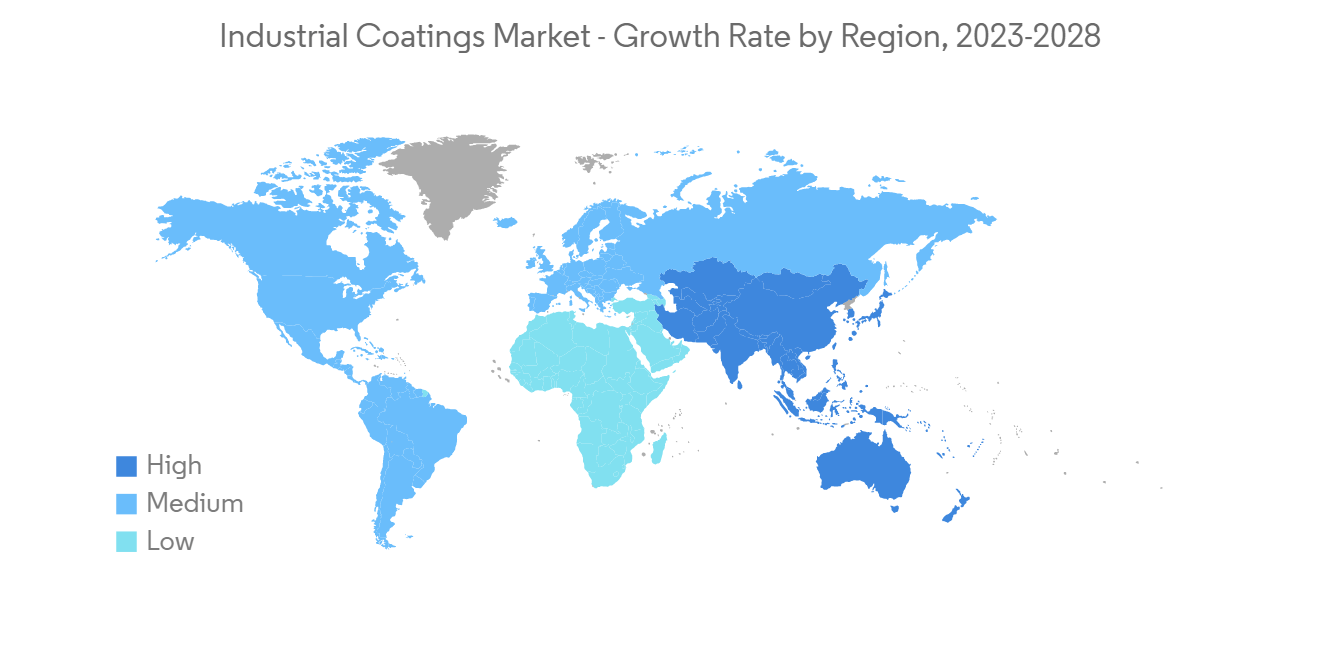

由于印度和中国等新兴国家的工业涂料使用激增,亚太地区引领全球工业涂料市场。

工业涂料市场趋势

在石油和天然气行业的应用扩展

- 石油和天然气行业包括用于石油和天然气勘探、生产和精炼的海上和陆上平台、炼油厂、管道、天然气管道、石化设备和储存终端。 石油和天然气行业在上游和下游使用保护涂层将石油和天然气输送到炼油厂。 该行业使用各种类型的保护涂层,包括防腐蚀、耐热、耐磨和防火。

- 该行业正在寻找减少资本的方法。 这与遵守严格的环境法规的需要相结合,需要能够有效保护资产的持久涂层系统。

- 此外,海上石油和天然气生产处于最恶劣的条件下。 因此,那里使用的涂层系统也需要类似的设备。 在海上,长时间暴露在紫外线下以及不断接触波涛汹涌的海水会增加对保护膜的需求。 管道上还贴了一层保护膜。 如果没有管道腐蚀保护,每年因生产时间损失和设备故障造成的石油和天然气腐蚀损害的成本是惊人的。

- 此外,美国、沙特阿拉伯、俄罗斯、中国、加拿大等都是支持石油和天然气行业发展的主要力量。

- 由于 COVID-19 大流行,美国的能源使用量在 2020 年有所下降,但在 2021 年再次增加。 到 2021 年底,美国已探明的原油和凝析油储量从 382 亿桶增加到 444 亿桶,增加了 62 亿桶,增幅为 16%。

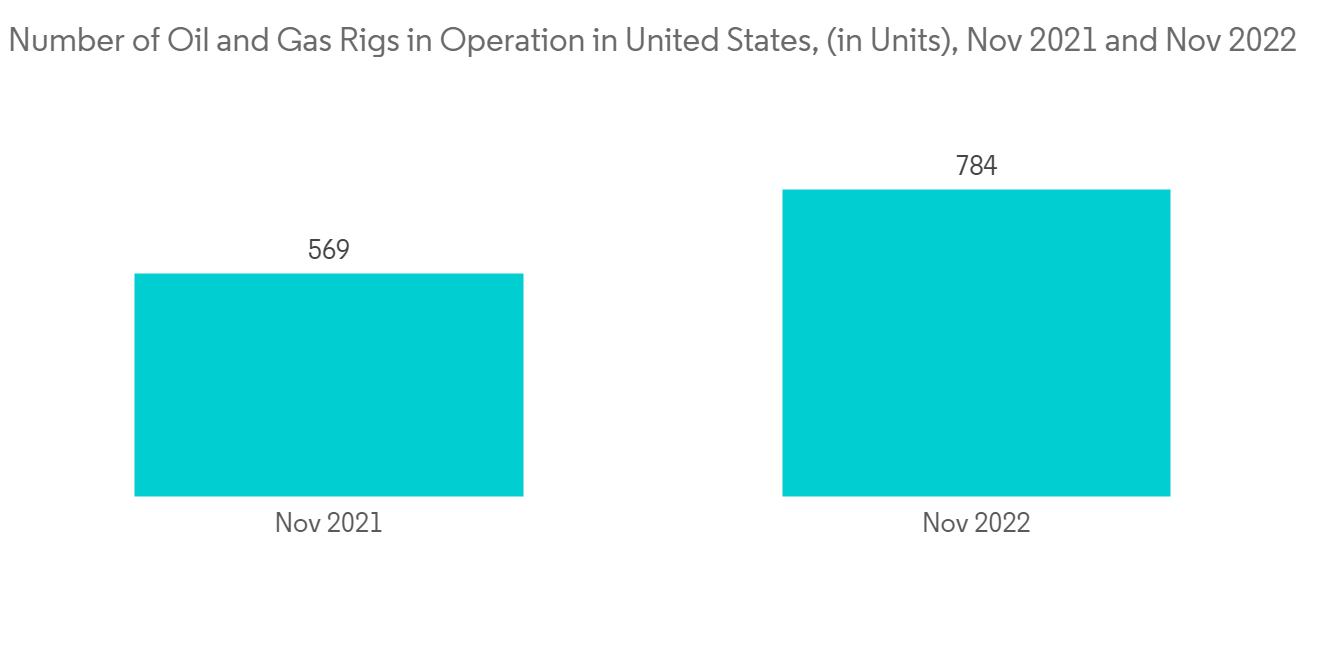

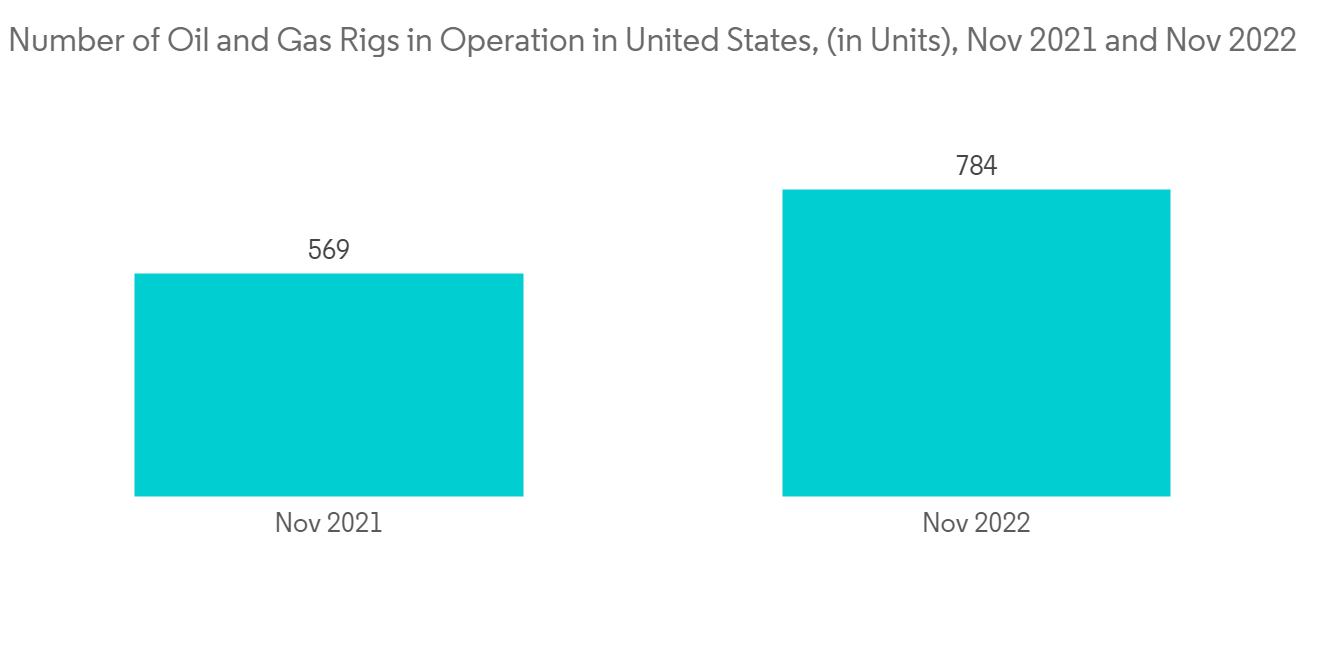

- 2021 年,石油和天然气的需求比 2020 年增长了 5%,价格上涨,这两种燃料的探明储量都增加了,天然气创下了美国的新纪录。 石油钻井平台是美国数量最多的钻井平台。 截至 2021 年底,约有 480 座石油钻井平台在运营,而天然气钻井平台约为 106 座。

- 在中国,苏里格油田新开发天然气井 1,204 口,2022 年日产量飙升至 1,625 万立方米。 据国家统计局数据,今年前10个月,我国生产天然气1785亿立方米,同比增长6%。

- 在预测期内,全球工业涂料市场预计将受到上述所有因素的推动。

亚太地区主导工业涂料市场

- 在亚太地区,印度是主导国家之一。 该地区廉价劳动力、低原材料成本和不断增长的城市人口正在推动市场。

- 此外,在政府对基础设施开发投资的支持下,印度的建筑业正在以更快的速度增长。 地铁、桥樑和建筑等新项目正在全国各地兴建。

- 印度的建筑业是该国第二大产业,也是 GDP 的主要贡献者。 随着大流行的拖累,印度的建筑业增长急剧下降。 然而,2021 年该行业的公共和私人投资都出现了繁荣。 未来六到七年,中国住宅投资将达到约 1.3 万亿美元,将新建 6000 万套住宅,这对所研究的市场是一个重大推动。。

- 政府的“印度製造”政策增加了对该国製造业的外国直接投资 (FDI)。 这导致了许多行业的增长和改善,并振兴了该国的工业涂料市场。

- 作为其发电部门改革计划的一部分,印度希望更新其能源基础设施并使用新技术来提高其电力供应的可靠性和弹性。 在预测期内,这可能耗资约 2.5 万亿印度卢比(350 亿美元)。 预计发电行业新设备的製造和投资将有助于该国保护膜市场的需求。

- 此外,更多的人用上电、人均用电量增加以及人口增长都可以振兴经济。 截至2022年10月,印度电力装机容量为408.71GW。 结果,该国已成为世界第三大电力生产国和消费国。

- 电力部发现 81 座火力发电厂将在 2026 年之前停止使用煤炭并开始使用可再生能源。 这将使印度实现500GW的可再生能源目标,解决每年煤炭供不应求的问题。 此外,为了让印度在2030年之前实现450GW的可再生能源目标,英国政府在2021年9月宣布将通过公共和私人投资向绿色项目和可再生能源投资12亿美元。

- 因此,上述因素推动了对保护膜的需求。 这反过来又提振了该国油漆和涂料市场的需求。

工业涂料行业概况

全球工业涂料市场是一个整合市场,龙头企业占据较大份额。 主要公司包括 Jotun、Akzo Nobel NV、PPG Industries、The Sherwin-Williams Company、Axalta Coating Systems 和 Nippon Paint (NIPSEA GROUP)(排名不分先后)。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 调查结果

- 本次调查的假设

- 本次调查的范围

第二章研究方法论

第 3 章执行摘要

第四章市场动态

- 主持人

- 对保护膜的需求不断扩大

- 石油和天然气行业的应用增加

- 约束因素

- 溶剂型涂料对环境的负面影响

- COVID-19 爆发的影响

- 工业价值链分析

- 波特的五力分析

- 供应商的议价能力

- 消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第 5 章市场细分

- 树脂

- 环氧树脂

- 聚氨酯

- 亚克力

- 涤纶

- 其他树脂

- 技术信息

- 水性涂料

- 溶剂型涂料

- 其他技术

- 最终用户行业

- 一般工业用途

- 保护漆

- 石油和天然气行业

- 矿业

- 电力

- 基础设施

- 其他保护膜

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 意大利

- 法国

- 俄罗斯

- 其他欧洲

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙特阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章竞争格局

- 併购、合资、合作、合同等。

- 市场份额/排名分析

- 主要公司采用的策略

- 公司简介

- AkzoNobel N.V.

- Axalta Coating Systems

- BASF SE

- Beckers Group

- Chugoku Marine Paints, Ltd.

- Hempel A/S

- Jotun

- Kansai Paint Co.,Ltd.

- Nippon Paint(NIPSEA GROUP)

- PPG Industries

- RPM International, Inc.

- Sika AG

- The Sherwin-Williams Company

- Wacker Chemie AG

第七章市场机会与未来趋势

- 对高度耐用产品的需求不断增长

During the time frame of the forecast, the industrial coatings market is expected to grow at a CAGR of more than 4%.

COVID-19 had a moderate impact on the global industrial coatings industry's growth by 2020. However, there is an upsurge in demand for industrial coatings in various industrial sectors, including oil and gas, chemical, and mining industries,

Key Highlights

- The industrial coatings market is expected to grow in many ways, thanks to factors like the growing demand for products that last a long time and the increased use of powder coatings.

- The harmful environmental impact of solvent-borne coatings is likely to hinder the market's growth.

- In the future, the market is likely to have a chance to benefit from the rising demand for products that last a long time.

Asia-Pacific led the world market for industrial coatings because their use in developing countries like India and China is growing quickly.

Industrial Coatings Market Trends

Increasing Applications in Oil and Gas Industry

- The oil and gas segment includes offshore and onshore platforms for oil and gas exploration, production, and refining, as well as refineries, pipelines, gas pipelines, petrochemical units, and storage terminals.The oil and gas industry uses protective coatings in both the upstream and downstream segments for the movement of oil and gas toward the refineries. In this industry, different kinds of protective coatings are used, such as those that stop corrosion, resist heat, wear, and fire, among others.

- The industry has been trying to find ways to cut capital charges. This, along with the need to adhere to strict environmental regulations, has led to a demand for a coating system with a long life that will be effective in the protection of the assets.

- Furthermore, offshore oil and gas production has some of the most demanding conditions. As a result, the coating systems used there must be similarly outfitted. Offshore, there is prolonged exposure to penetrating UV rays and constant contact with rough seawater, which increases the need for protective coatings. Also, protective coatings are applied to pipelines. Without pipeline corrosion protection, the annual cost of oil and gas corrosion damages, due to lost production time and equipment failure, can be stellar.

- Also, the United States, Saudi Arabia, Russia, China, and Canada, among others, are some of the biggest countries that help the oil and gas industry grow.

- The COVID-19 pandemic caused energy use in the United States to drop in 2020, but it went back up in 2021.At year's end 2021, proved reserves of U.S. crude oil and lease condensate increased by 6.2 billion barrels (16%), from 38.2 billion barrels to 44.4 billion barrels.

- In 2021, demand for petroleum and natural gas increased by 5% from 2020, prices rose, and proved reserves increased for both fuels, setting a new U.S. record for natural gas. Oil rigs are the most common rigs in the United States. At the end of 2021, there were some 480 active oil rigs, compared with roughly 106 gas rigs.

- In China, 1,204 new natural gas wells were developed in the Sulige field, ramping up daily output by 16.25 million cubic meters in 2022. According to the National Bureau of Statistics, China produced 178.5 billion cubic meters of natural gas in the first 10 months of this year, up 6 percent year-on-year.

- During the forecast period, the global market for industrial coatings is likely to be driven by all of the above factors.

Asia Pacific Dominates the Industrial Coatings Market

- In the Asia-Pacific region, India is one of the dominant countries. The availability of inexpensive labor, low raw material costs, and the expanding urban population in the area are the main market drivers.

- The construction sector has also been increasing in India at a faster rate, supported by government investments for infrastructure development; new projects like metros, bridges, and buildings are being constructed across the country.

- The construction industry in India is the second largest in the country and makes a big contribution to its GDP.During the spread of the pandemic, the Indian construction industry saw a big drop in growth. However, in 2021, both public and private investments in the sector grew sharply.The country is likely to witness around USD 1.3 trillion of investment in housing over the next six to seven years and is likely to witness the construction of 60 million new homes in the country, which is a major boosting factor for the market studied.

- The "Make in India" policy of the government has led to more foreign direct investment (FDI) in the manufacturing sector of the country. This has helped many industries grow and improve.This in turn has boosted the market for industrial coatings in the country.

- India wants to update its energy infrastructure and use new technology to improve the reliability and resilience of its electricity supply as part of its plan to reform its power generation sector. This could cost almost INR 2.5 trillion (USD 35 billion) over the forecast period. The manufacturing and investment of new facilities in the power generation sector are expected to contribute to the demand for the protective coatings market in the country.

- Also, more people getting electricity, more people using electricity per person, and more people will all give the economy a boost.As of October 2022, India had 408.71 GW of installed power capacity. This made it the third-largest electricity producer and consumer in the world.

- The Ministry of Power has found 81 thermal units that will stop using coal and start using renewable energy instead by 2026. This will help India reach its goal of 500 GW of renewable energy and fix the problem of coal supply not meeting demand every year. Additionally, in order to help India reach its goal of 450 GW of renewable energy by 2030, the United Kingdom government announced in September 2021 that it would invest USD 1.2 billion through public and private investments in green projects and renewable energy.

- Hence, the aforementioned factors are driving the demand for protective coatings. This, in turn, is increasing the demand for the paint and coatings market in the country.

Industrial Coatings Industry Overview

The global market for industrial coatings segment is a consolidated market among the top players accounting for a major share of the market. Major Players include Jotun, Akzo Nobel NV, PPG Industries, The Sherwin-Williams Company, Axalta Coating Systems, and Nippon Paint ( NIPSEA GROUP) among others (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Demand for Protective Coatings

- 4.1.2 Increasing Applications in Oil and Gas Industry

- 4.2 Restraints

- 4.2.1 Harmful Environmental Impact Of Solvent-borne Coatings

- 4.2.2 Impact of COVID-19 Outbreak

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Resin

- 5.1.1 Epoxy

- 5.1.2 Polyurethane

- 5.1.3 Acrylic

- 5.1.4 Polyester

- 5.1.5 Other Resins

- 5.2 Technology

- 5.2.1 Water-borne Coatings

- 5.2.2 Solvent-borne Coatings

- 5.2.3 Other Technologies

- 5.3 End-user Industry

- 5.3.1 General Industrial

- 5.3.2 Protective Coatings

- 5.3.2.1 Oil and Gas

- 5.3.2.2 Mining

- 5.3.2.3 Power

- 5.3.2.4 Infrastructure

- 5.3.2.5 Other Protective Coatings

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Russia

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East & Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East & Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AkzoNobel N.V.

- 6.4.2 Axalta Coating Systems

- 6.4.3 BASF SE

- 6.4.4 Beckers Group

- 6.4.5 Chugoku Marine Paints, Ltd.

- 6.4.6 Hempel A/S

- 6.4.7 Jotun

- 6.4.8 Kansai Paint Co.,Ltd.

- 6.4.9 Nippon Paint ( NIPSEA GROUP)

- 6.4.10 PPG Industries

- 6.4.11 RPM International, Inc.

- 6.4.12 Sika AG

- 6.4.13 The Sherwin-Williams Company

- 6.4.14 Wacker Chemie AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Demand For High Durable Products