|

市场调查报告书

商品编码

1273365

工业绝缘市场 - COVID-19 的增长、趋势、影响和预测 (2023-2028)Industrial Insulation Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

工业绝缘市场目前价值超过 72 亿美元,预计在预测期内将达到约 85 亿美元,在预测期内保持 5% 以上的复合年增长率。

COVID-19 大流行对工业绝缘市场产生了重大影响,因为它对全球大多数行业造成了限制。 然而,从 2021 年开始,该行业正在快速增长,增加了对绝缘的需求。 因此,预计市场在预测期内将遵循相同的路径。

主要亮点

- 不断发展的建筑和发电行业正在推动市场增长。 此外,提高能源效率的监管支持也在推动市场增长。

- 但是,绝缘棉的健康和环境风险可能会减缓所研究市场的增长。

- 中国、阿联酋、印度尼西亚和美国不断增加的勘探和生产活动,以及有机绝缘产品的使用,将为未来几年的工业绝缘市场带来机遇。

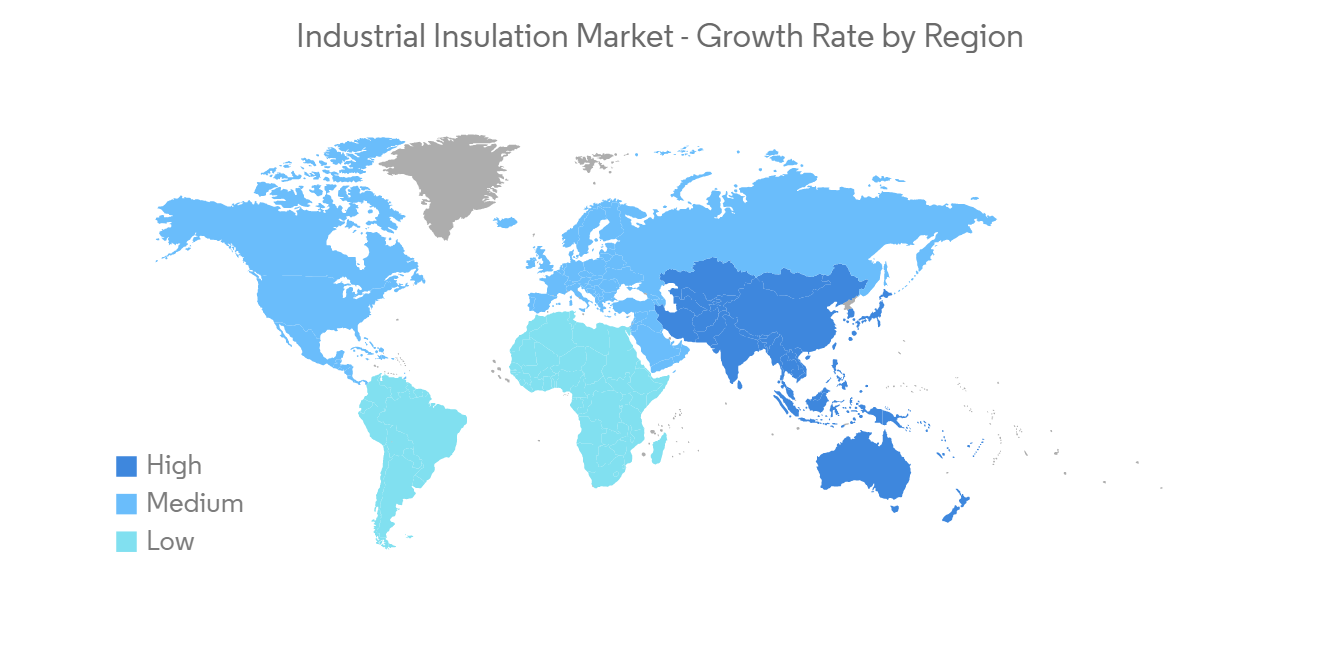

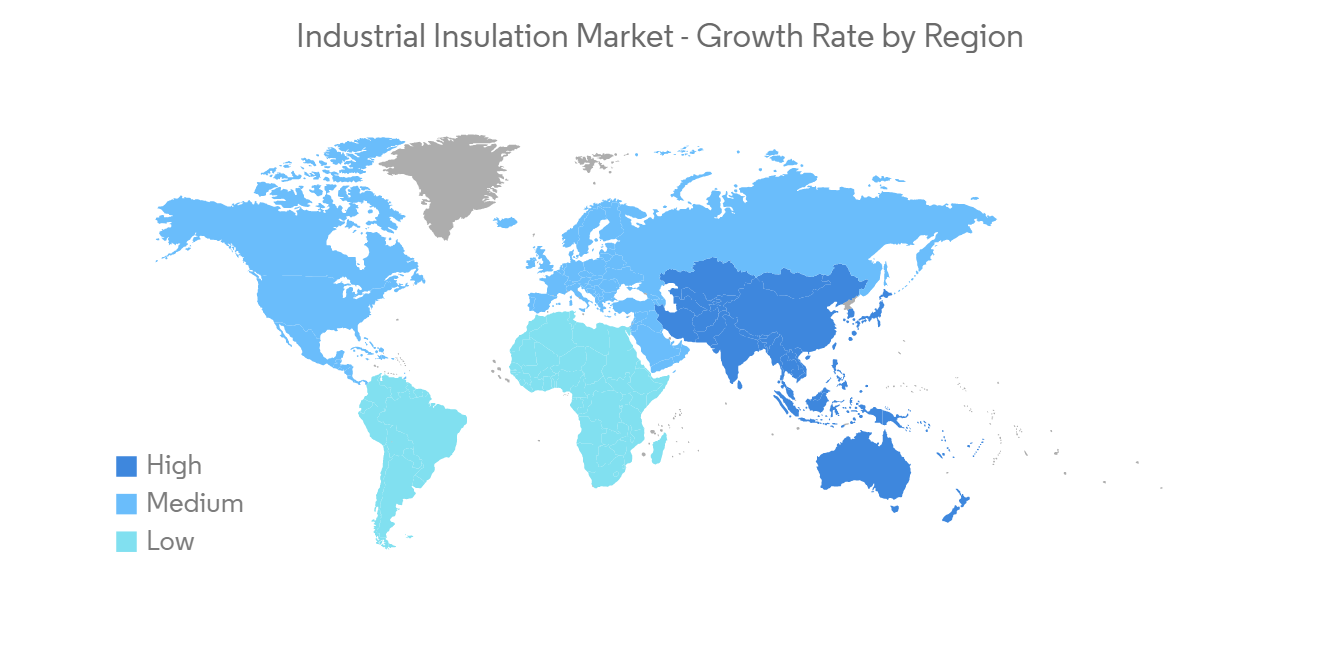

- 亚太地区在建筑和发电行业的应用越来越多,因此在工业绝缘市场占据主导地位。

工业绝缘市场趋势

发电行业主导市场

- 由于严格的法规要求使用工业绝缘材料来节约能源和提高运营效率,因此发电行业是市场的主导部分。

- 在发电行业,蒸汽管道、储热罐和锅炉等各种设备都使用工业隔热材料。 硅酸钙常用作发电厂的绝缘材料。 它用于高温管道和设备的绝缘,以及防火应用。

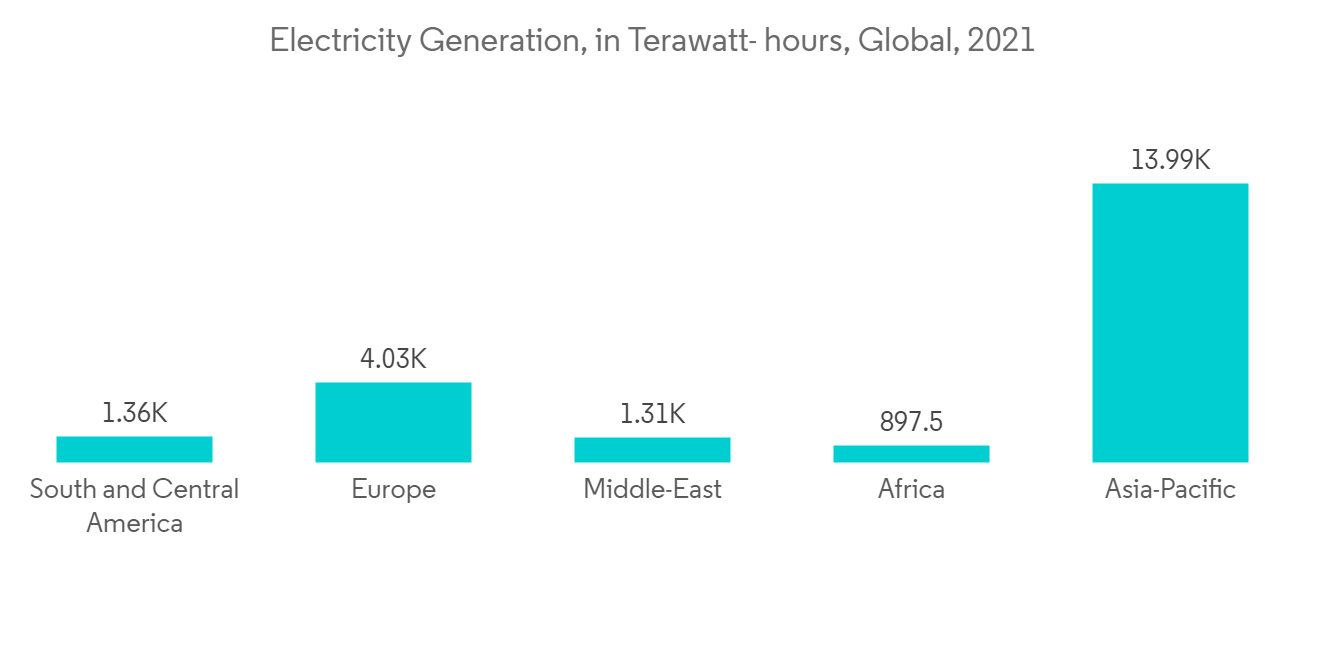

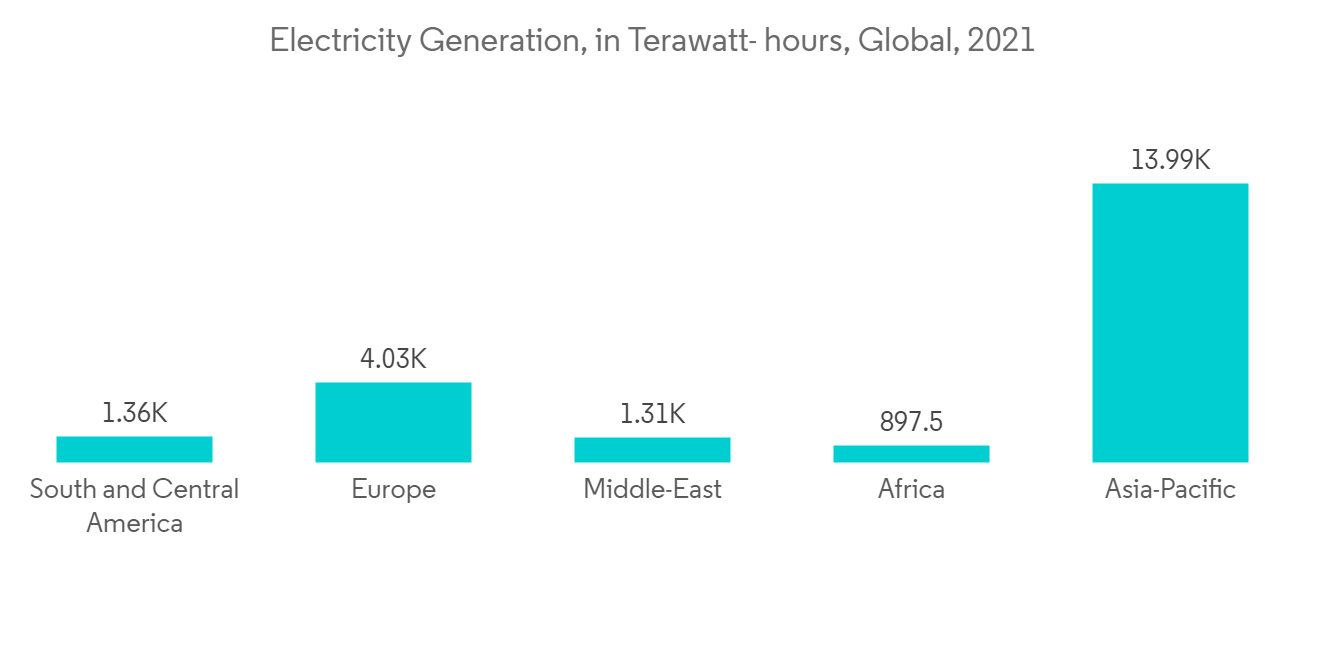

- 根据 BP 的《世界能源 2022》统计报告,2021 年全球总发电量预计约为 28,466 太瓦时,较上年增长约 6.5%。 美国是仅次于中国的第二大电力生产国,约占 4,406 太瓦时的电力。

- 由于每年都会产生如此多的电量,因此对绝缘材料的需求似乎正在大幅增加。 绝缘的主要用途之一是电力电缆和传输线。

- 根据 Power Technology 的数据,到 2021 年,世界上最长的前三条输电线路将位于巴西。 Belomonte-Rio de Janeiro 输电线路总长 2,543 公里,位居首位,其次分别是 Rio Madeira 和 Belomonte-Estrito 线路。

- 根据美国能源部的数据,到 2021 年,美国将铺设大约 200 英里的电力线。 当年完成的总扩建项目中约有 52% 是电压高达 230 千伏的项目。

- 许多项目都在建设电力线,以安全地将电力从一个地方输送到另一个地方。 例如,PacificCorp 的爱达荷州东南部项目将于 2022 年 4 月完工,旨在用新线路替换老化的输电线路,以满足该地区不断增长的电力需求。 该项目需要从爱达荷州弗斯附近的 Goshen 变电站到爱达荷州雷克斯堡的雷克斯堡变电站进行多级电气系统升级。

- 随着全球发电厂数量的增加,预计在预测期内对工业绝缘材料的需求也会加快。

亚太地区主导市场

- 亚太地区是建筑和发电行业规模最大、增长最快的市场。 对能源效率日益增长的需求以及通过国际绿色建筑规范 (IGCC) 标准确保严格的监管标准等因素正在推动亚太地区对该行业的绝缘要求。

- 根据《BP 世界能源统计年鑑 2022》,亚太地区 2021 年的发电量将接近 14,000 太瓦时,占世界总发电量的比例最高。 据英国石油公司称,中国是世界上最大的电力生产国,2021 年的总发电量为 8,534 太瓦时。

- 随着该地区发电量的增加,对电力电缆进行绝缘的需求也在增加。 截至2021年,中国有两条电力线跻身世界最长电力线前五名。 一是锦屏-苏南输电线路,全长2090公里,二是湘江坝-上海输电线路,全长约1980公里。

- 根据印度政府电力部的数据,到 2023 年 1 月,它将成为世界上最大的同步互连电网之一,拥有 4,63,758 公里的输电线路和 11,56,105 MVA 的变电站容量。

- 根据工业和经济事务部(泰国)的数据,截至 2022 年 2 月,泰国的电线销售额将超过 13.7 亿泰铢(约合 4200 万美元)和 12.6 亿泰铢(约合 3800 万美元)。 此外,当月产品总产量约为5,000吨。

- 此外,根据国土交通省的一份报告,日本 50 家主要建筑公司在 2021 财年收到了价值约 2583.6 亿日元(约合 23.5 亿美元)的电力线建设订单。

- 电气绝缘材料在电动汽车行业中也必不可少。 电气绝缘由非导电材料组成,用于控制电流和保护敏感元件。

- 绝缘体还可以保护电动汽车电池管理系统、电力电子控制器、直流充电站和车载充电器。 中国汽车工业协会数据显示,2022年新能源汽车销量较2021年增长93.4%。 2021年中国新能源汽车销量仅约350万辆,到2022年底应达到约680万辆。 毫无疑问,该国电动汽车销售和製造的增加将增加市场需求。

- 由于使用电力的行业数量不断增加以及许多电子设备和电气产品的生产,预计未来几年亚太地区的电气绝缘材料市场将会增长。

工业绝缘行业概况

工业绝缘市场具有部分整合的性质,一些主要参与者占据了市场需求的很大份额。 主要公司包括 Knauf Insulation、Rockwool A/S、Owens Corning、BASF SE 和 Solvay(排名不分先后)。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 调查先决条件

- 本次调查的范围

第二章研究方法论

第 3 章执行摘要

第四章市场动态

- 主持人

- 建筑和发电行业的增长

- 提高能源效率的监管支持

- 约束因素

- 环境问题

- 其他限制

- 工业价值链分析

- 波特的五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第 5 章市场细分(基于价值的市场规模)

- 绝缘

- 矿棉

- 玻璃纤维

- 泡沫塑料

- 硅酸钙

- 其他绝缘材料

- 产品

- 毯子

- 董事会

- 管道

- 其他产品

- 最终用户行业

- 汽车

- 化工/石化

- 建筑

- 电气/电子

- 石油和天然气

- 发电

- 其他最终用户行业

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 意大利

- 其他欧洲

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙特阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章竞争格局

- 併购、合资企业、合作、合同

- 市场份额(%)分析**/市场排名分析

- 主要公司采用的策略

- 公司简介

- Armacell

- BASF SE

- BNZ Materials

- Cabot Corporation

- INSUL-FAB

- Jays Refractory Specialists

- Johns Manville-Berkshire Hathway Company

- Knauf Insulation

- Owens Corning

- Rockwool A/S

- Solvay

- Temati Group

第7章市场机会与未来趋势

- 增加石油和天然气行业的勘探活动

- 使用有机产品进行绝缘

The industrial insulation market is valued at over USD 7,200 million currently and is expected to reach around USD 8,500 million during the forecast period, registering a CAGR of more than 5% over the forecast period.

The COVID-19 pandemic had a big effect on the market for industrial insulation because it caused restrictions in most industries around the world.But industries have grown faster since 2021, which has increased the need for insulation materials. The market is likely to stay on the same path during the forecast period because of this.

Key Highlights

- The growing construction and power generation industries have been driving the growth of the market. Moreover, regulatory support to increase energy efficiency is also driving market growth.

- But the health and environmental risks of insulation wool are likely to slow the growth of the market that was studied.

- The rising exploration and production activities in China, the UAE, Indonesia, and the United States and the use of organic products for insulation are likely to provide opportunities for the industrial insulation market over the upcoming years.

- The Asia-Pacific region dominates the industrial insulation market, owing to its increasing application in the construction and power generation sectors in the region.

Industrial Insulation Market Trends

Power Generation Industry to Dominate the Market

- The power generation industry stands to be the dominant segment, owing to stringent regulations mandating the use of industrial insulation to conserve energy and achieve efficiency in operations.

- In the power generation industry, industrial insulation is used to cover a variety of equipment, such as steam pipes, heat storage tanks, and boilers. Calcium silicate is one of the most common materials used to insulate power plants. It is used to insulate high-temperature pipes and equipment and for fire endurance applications.

- According to the BP statistical review of World Energy 2022, the total electricity generation in the world in 2021 was estimated to be around 28,466 terawatt-hours, approximately 6.5% more than the previous year's electricity generation. The United States accounted to be the second largest electricity-generating country after China, generating about 4,406 Terawatt-hours of electricity.

- Since so much electricity is made every year, it is likely that the need for insulation materials will also go up a lot. One of the main applications for insulation is in power cables or transmission lines.

- According to Power Technology, the top three longest power transmission lines in the world as of 2021 were in Brazil. With a length of 2,543 kilometers, the Belo Monte-Rio de Janeiro transmission line came in first, followed by the Rio Madeira transmission link and the Belo Monte-Estreito line, respectively.

- According to the United States Department of Energy, approximately 200 miles of electrical transmission lines were covered in the United States in 2021. About 52% of the total length done that year was for projects with voltages of up to 230 kilovolts.

- Many projects are underway to lay the transmission line for the safe transmission of power from one location to another. PacifiCorp's Southeastern Idaho project, for example, scheduled to be finished in April 2022, aimed to replace outdated transmission lines with newer ones to fulfill the region's rising demand for electrical power. The project required a multi-stage electrical system upgrade from Goshen Substation near Firth, Idaho, to Rexburg Substation in Rexburg, Idaho.

- With the rising number of power plants across the globe, the demand for industrial insulation materials is also expected to gain pace during the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific stands to be the largest and fastest-growing market for the construction and power generation industries. Factors, such as the increasing need for energy conservation and ensuring stringent regulatory norms by the International Green Construction Code (IGCC) standards, are driving the industry's insulation requirements in Asia-Pacific.

- According to the BP Statistical Review of World Energy 2022, the total electricity generation in the Asia-Pacific region in 2021 was close to 14,000 terawatt-hours, holding the largest share of the total electricity generated in the world. China was the largest electricity-generating country in the world with a total generation of 8,534 terawatt-hours of electricity in 2021, as stated by BP.

- As the amount of electricity made in the area went up, so did the need for power cables to insulate the electricity.As of 2021, two of China's electricity transmission lines are included in the top five longest transmission lines in the world. The first is the Jinping-Sunan transmission line, which is 2,090 km long, followed by the Xiangjiaba-Shanghai transmission line, which is about 1,980 km long.

- According to the Ministry of Power, Government of India, the country has become one of the largest synchronously interconnected electricity grids in the world with 4,63,758 circuit kilometers of transmission line and 11,56,105 MVA of transformation capacity as of January 2023.

- According to the Office of Industrial Economics (Thailand), electric wire sales in Thailand were valued at over THB 1.37 billion (~USD 42 million) as of February 2022, up from THB 1.26 billion (USD 38 million) in January 2022. Further, during the same month, the total production volume of such commodities was around 5,000 tons.

- In its report, the Ministry of Land, Infrastructure, Transport, and Tourism also said that 50 of Japan's largest builders received orders to build electric power lines worth about JPY 258.36 billion (~USD 2.35 billion) during the fiscal year 2021.

- Electric insulating materials are also essential in the electric vehicle industry. Electrical insulation is constructed of non-conductive materials and is used to control the flow of electricity and protect sensitive components.

- Insulators also protect the electric vehicle's battery management system, power electronics controllers, DC charging stations, and onboard chargers.According to the Chinese Association of Automobile Manufacturers, sales of new energy vehicles increased by 93.4% in 2022 over 2021. By the end of 2022, there would have been around 6.8 million new energy vehicle sales in China, up from only about 3.5 million sales for the entire year in 2021. Undoubtedly, the increase in EV sales and manufacturing in the nation will increase market demand.

- In the Asia-Pacific region, the market for electrical insulation material is expected to grow in the coming years because more industries are using electricity and more electronics and electrical goods are being made.

Industrial Insulation Industry Overview

The industrial insulation market is partially consolidated in nature, with a few major players dominating a significant share of the market's demand. Some of the major companies are Knauf Insulation, Rockwool A/S, Owens Corning, BASF SE, and Solvay, among others (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Construction and Power Generation Industry

- 4.1.2 Regulatory Support to Increase Energy Efficiency

- 4.2 Restraints

- 4.2.1 Environmental Hazards

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products or Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Insulation Material

- 5.1.1 Mineral Wool

- 5.1.2 Fiber Glass

- 5.1.3 Foamed Plastics

- 5.1.4 Calcium Silicate

- 5.1.5 Other Insulation Materials

- 5.2 Product

- 5.2.1 Blanket

- 5.2.2 Board

- 5.2.3 Pipe

- 5.2.4 Other Products

- 5.3 End-user Industry

- 5.3.1 Automotive

- 5.3.2 Chemical and Petrochemical

- 5.3.3 Construction

- 5.3.4 Electrical and Electronics

- 5.3.5 Oil and Gas

- 5.3.6 Power Generation

- 5.3.7 Other End-user Industries

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East & Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East & Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis ** / Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Armacell

- 6.4.2 BASF SE

- 6.4.3 BNZ Materials

- 6.4.4 Cabot Corporation

- 6.4.5 INSUL-FAB

- 6.4.6 Jays Refractory Specialists

- 6.4.7 Johns Manville-Berkshire Hathway Company

- 6.4.8 Knauf Insulation

- 6.4.9 Owens Corning

- 6.4.10 Rockwool A/S

- 6.4.11 Solvay

- 6.4.12 Temati Group

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Exploration Activities in the Oil and Gas Industry

- 7.2 Use of Organic Products for Insulation