|

市场调查报告书

商品编码

1273372

血管内导管市场 - COVID-19 的增长、趋势、影响和预测 (2023-2028)Intravascular Catheter Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

预计在预测期内,血管内导管市场的复合年增长率为 9.0%。

COVID-19 大流行对所研究的市场产生了重大影响。 突然爆发的大流行最初对市场产生了短期的负面影响,因为到医院和诊所就诊的患者减少了。 然而,由于科学家和研究人员对静脉导管治疗的试验及其对 COVID-19 患者的相关益处,市场在大流行后阶段显示出相当大的增长。 根据 2022 年 3 月发表在《急诊护理杂誌》上的一篇研究论文,一项针对中国 COVID-19 感染者的非随机临床试验表明,外周静脉导管 (IC) 放置取得了令人满意的结果,且手术时间短。 因此,这些大流行晚期病例刺激了对静脉导管放置的需求,最终为最终用户创造了潜水机会。 因此,儘管市场最初因治疗 COVID-19 患者的令人满意的结果和临床意义而遭遇挫折,但对 IC 的需求仍在增加。 因此,对 IC 的需求预计将保持其强势地位并促进市场增长。

目标疾病病例的增加、IC 技术的快速改进以及导管室数量的增加等因素预计将在预测期内推动市场增长。

IC 可以方便地接触患者的血液,减少对静脉针的需求。 这使得 IC 成为管理严重慢性病患者的重要医疗设备。 血管疾病的增加以及具有更好性能和临床意义的技术先进产品的可用性是加速研究市场的其他一些因素。

例如,FDA 于 2023 年 1 月发布的数据显示,心脏病每年影响美国十分之一的成年人,即约 3000 万人,涵盖大多数种族和民族。是主要原因之一人的死亡。 此外,根据 2022 年 4 月发表在《化学工程杂誌》上的研究结果,与血管疾病患病率上升相关的住院率上升正在加速 IC 的使用。 IC 可以提供血管诊断、药物注射和其他手术设备。 因此,预计全球目标疾病的增加将增加对 IC 的需求,这有望进一步促进整体市场的增长。

此外,新产品的发布和技术进步预计将推动所研究市场的增长。 例如,2022 年 9 月,Wipro GE Healthcare 推出了“印度製造”、“人工智能驱动”的 Cath 实验室 Optima IGS 320,利用 GE 专有的 AutoRight 技术,推进印度的心臟护理。 AutoRight 是第一个由人工智能驱动的基于神经网络的介入图像链。 实时自动优化图像和剂量参数。 预计这种市场发展将推动市场的增长。

然而,与导管相关的并发症和副作用以及缺乏医疗报销预计会阻碍市场增长。

血管内导管市场趋势

短外周血管内导管 (PIVC) 预计在预测期内显着增长

一般来说,外周静脉导管 (PIVC) 是一根用针头插入静脉的细塑料管。 短 PIVC 是一种缩短的导管,其尖端插入前臂的小静脉中。 此外,短 PIVC 是一种套针导管,在导管内放置一根空心金属针,通常插入浅表静脉。 短 PIVC 通常称为插管、Benflon、点滴或点滴。 这些用于大多数临床环境。

与短 PIVC 相关的优势和好处预计会赢得最终用户的需求。 根据 2022 年 3 月发表在 NursingOpen Journal 上的一项研究,该研究开发了一种标准化的 PIVC 审核工具来审核需要插入 PIVC 的住院患者,大多数被审核的短 PIVC 是在病房(57.6%)、手术室(18.7%)中插入的) 和急诊科 (11.6%),无需在插入部位进行日常敷料。 因此,高设备采用率预计将有助于这一细分市场的增长。

此外,市场参与者正在致力于产品扩张,这也是预计在预测期内推动该细分市场增长的因素之一。 例如,市场上最短的 BD Insight-N Autoguard Straight IC 等产品的可用性为 14 毫米,可容纳小静脉并允许更多的插入部位选择。 它也被推荐用于脆弱的静脉和低静脉压的情况。 因此,此类产品在市场上的可用性预计会在参与者之间产生竞争,并有助于该细分市场的增长。

预计北美将占据很大的市场份额

预计北美将占据主要市场份额,预计在预测期内将继续保持类似的增长趋势。 慢性病患病率上升和产品批准数量增加是推动该地区市场增长的主要因素。

医疗保健疾病是造成医疗保健负担的主要原因之一。 根据加州大学 2023 年 1 月的更新,心血管或血管疾病是美国男性和女性残疾和死亡的主要原因。 此外,根据加拿大卫生部 2022 年 7 月公布的数据,每年 20 岁及以上的加拿大成年人中,约有十分之一(260 万)患有心脏病。 预计如此高的患病率将增加在血管导管插入术和静脉通路之后需要干预的医院入院率。 因此,预计它将推动该地区的市场增长。

此外,一些市场参与者正在实施产品创新等战略活动,这也有助于该地区的市场增长。 例如,2022 年 4 月,总部位于加利福尼亚州的 Shockwave Medical 在获得 CE 标誌和食品药品监督管理局 (FDA) 批准后推出了 Shockwave M5+ 外周血管内碎石术 (IVL) 导管。 同样在 2022 年 7 月,Intravascular Imaging Incorporated 宣布了用于人类冠状动脉成像的 3Fr NIRF-IVUS(近红外荧光血管内超声)成像导管。 该导管是与马萨诸塞州总医院合作设计的,已经在人体冠状动脉中进行了体外测试,并在临床前研究中进行了体内测试。 预计这种市场竞争将极大地促进该地区对 IC 的需求扩大。 因此,由于上述因素,预计市场在预测期内将出现显着增长。

血管内导管行业概况

市场竞争激烈,由从事医疗器械製造、原材料供应、销售、分销和其他服务等活动的众多参与者组成。 因此,投资新兴国家的企业数量不断增加,推动了新兴国家市场的增长。 此外,市场受到主要市场参与者之间正在进行的併购的影响。 Boston Scientific Corporation、Becton, Dickinson & Company (C. R. Bard, Inc)、B. Barun、Cook Medical 和 McKesson Corporation 是主要参与者。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 调查假设和市场定义

- 本次调查的范围

第二章研究方法论

第 3 章执行摘要

第四章市场动态

- 市场概览

- 市场驱动因素

- 心血管疾病和泌尿系统疾病等目标疾病病例增加

- 血管内导管技术的快速改进

- 增加导管实验室的数量

- 市场製约因素

- 导管相关的副作用

- 缺乏保险报销

- 波特五力

- 新进入者的威胁

- 买方/消费者议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

第 5 章市场细分

- 按产品分类

- 短外周血管内导管 (PIVC)

- 集成/封闭式 PIVC

- 通过使用

- 肿瘤科

- 胃肠病学

- 心脏病学

- 泌尿科

- 其他用途

- 最终用户

- 医院和诊所

- 家庭护理

- 其他

- 按地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 意大利

- 西班牙

- 其他欧洲

- 亚太地区

- 中国

- 日本

- 印度

- 澳大利亚

- 韩国

- 其他亚太地区

- 中东和非洲

- 海湾合作委员会

- 南非

- 其他中东和非洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美

第六章竞争格局

- 公司简介

- Boston Scientific Corporation

- Becton, Dickinson and Company(C. R. Bard, Inc)

- Medline Industries, Inc

- Cook Medical

- Edwards Life Sciences Corporation

- Johnson & Johnson

- McKesson Corporation

- Medtronic PLC

- Smiths Medical

- Terumo Corporation

- B. Barun

- Angiplast Pvt. Ltd.

第七章市场机会与未来趋势

The intravascular catheter market is expected to register a CAGR of 9.0% over the forecast period.

The COVID-19 pandemic significantly impacted the market studied. Due to the sudden onset of the pandemic, a short-term negative impact was initially seen on the market, owing to the decreased patient visits to hospitals and clinics. However, due to trials by scientists or researchers in intravenous catheterization and associated benefits among COVID-19 patients, the market witnessed considerable growth in the post-pandemic phase. As per a research article published in the Journal of Emergency Nursing in March 2022, when a nonrandomized clinical trial was conducted among COVID-19-infected patients in China, peripheral intravenous catheter (IC) placement using an infrared vein visualizer showed satisfactory results in a shortened procedure time. Thus, these instances during the later phases of the pandemic created a demand for intravenous catheterization, ultimately generating opportunities for the dives among end users. Therefore, even though the market experienced a setback initially due to its satisfactory outcome and clinical significance in the treatment of COVID-19 patients, the demand for the IC increased. Thus, the demand for ICs is expected to continue its stronghold and contribute to market growth over the coming years.

Factors such as increasing cases of target diseases, rapid improvement in IC technology, and a rising number of catheterization laboratories are anticipated to fuel the market growth during the forecast period.

The ICs allow access to the patient's bloodstream easily and reduce the need for needle sticks into the vein. Due to this, ICs have become vital medical devices for managing patients with severe and chronic diseases. The rise in vascular disease and the availability of technologically advanced products with better performance and clinical significance are a few other factors that are accelerating the studied market.

For instance, as per data released by FDA in January 2023, in the United States, heart disease affects more than 1 in 10 adults, or nearly 30 million, every year and is one of the major causes of mortality for people of most racial and ethnic groups. In addition, as per a research study published in Chemical Engineering Journal in April 2022, the increasing rate of hospitalization associated with the elevated prevalence of vascular diseases has accelerated the use of ICs. The ICs allow vascular diagnostics, injection of drug fluids, and delivery of other surgical devices. Hence, the increase in target disease globally is anticipated to increase the demand for ICs and is further expected to contribute to the overall market growth.

Furthermore, the launch of new products and technological advancements are predicted to drive the studied market growth. For instance, in September 2022, Wipro GE Healthcare launched its 'Made in India,' 'AI-powered' Cath lab-Optima IGS 320 to advance cardiac care in India and leverages the GE proprietary AutoRight technology. AutoRight is the first neural network-based interventional image chain featuring artificial intelligence. It automatically optimizes image and dose parameters in real time. Thus, such developments are likely to support market growth.

However, complications and side effects associated with catheters and a lack of reimbursements are predicted to hinder the market's growth.

Intravascular Catheter Market Trends

Short Peripheral Intravascular Catheters (PIVC) are Expected to Grow Significantly During the Forecast Period

Generally, a peripheral intravenous catheter (PIVC) is a thin plastic tube inserted into a vein using a needle. A short PIVC is a catheter of reduced length that is inserted in the forearm with its tip in a small-caliber vein. Additionally, short PIVCs are over-the-needle catheters that have a hollow metal needle positioned inside the catheter and are generally inserted in superficial veins. The short PIVCs are often called cannulas, venflons, IVs, or drips. These are used in most clinical settings.

The advantages and benefits associated with the short PIVC are anticipated to gain demand among the end users. As per a study published in NursingOpen Journal in March 2022, when a standardized PIVC audit tool was developed to audit hospitalized patients requiring a PIVC insertion, the majority of audited short PIVC were inserted in a ward (57.6%), operating theatre (18.7%) or Emergency Department (ED) (11.6%) without a need for daily dressing on the insertion site. Thus, the high adoption of the devices is anticipated to contribute to the segment's growth.

Additionally, the engagement of market players in product expansion is another factor that is expected to drive the growth of the segment over the forecast period. For instance, the availability of products such as BD Insyte-N Autoguard straight ICs, 14 mm long and the shortest on the market, accommodates small veins and provides a greater choice of insertion sites. Also, these are recommended for fragile veins and low venous pressure. Thus, the availability of such products in the market is anticipated to create competitiveness among the players and contribute to the segment's growth.

North America is Expected to Hold a Significant Share of the Market

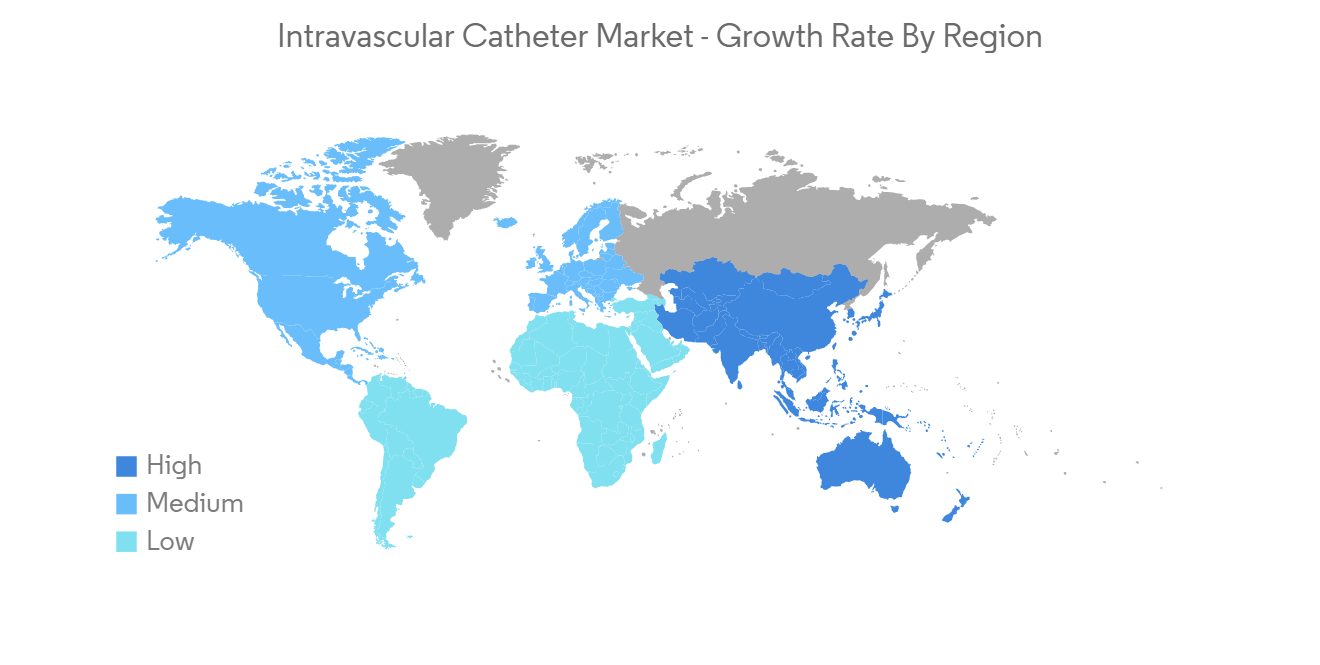

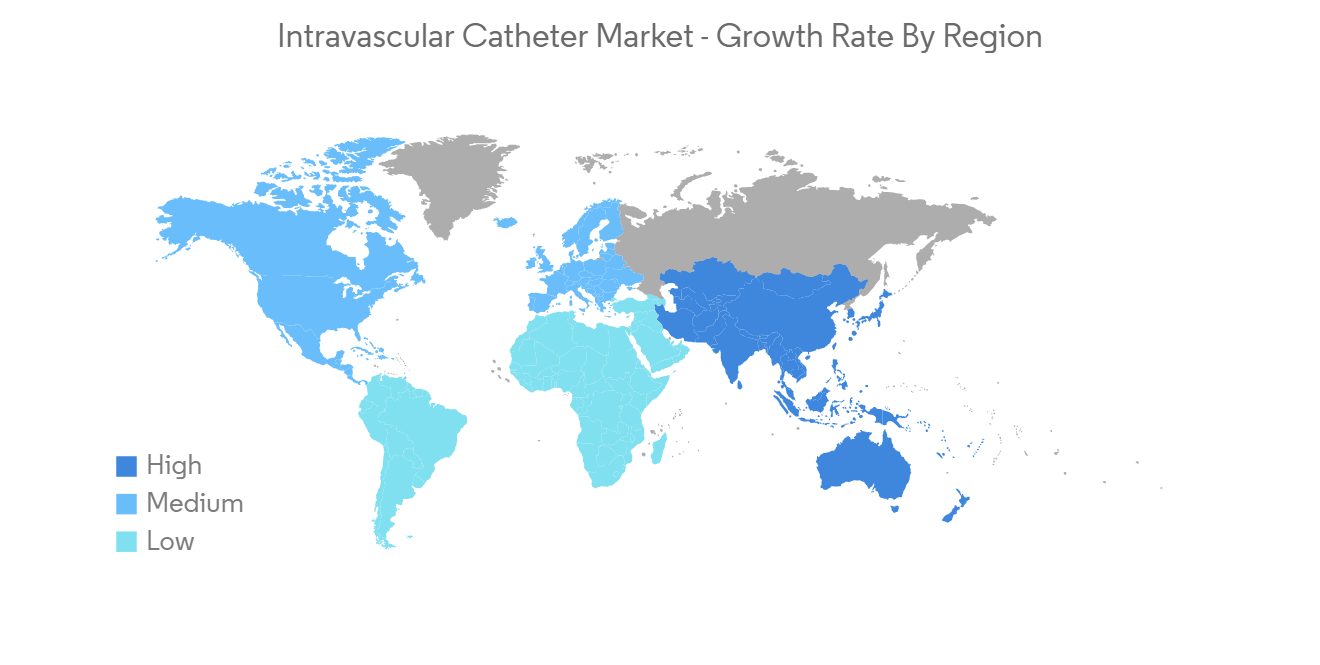

North America is expected to hold a major share of the market, and it is predicted to continue the same growth trend over the forecast period. The major factors fuelling the market growth in the region are the increasing prevalence of chronic diseases and the growing number of product approvals.

Cardiovascular disease is one of the major causes of healthcare burden. According to the January 2023 update by the University of California, cardiovascular disease or disorders of blood vessels is the foremost cause of disability and mortality among men and women in the United States. In addition, as per July 2022 data released by Health Canada, about 1 in 12 (or 2.6 million) Canadian adults age 20 and over live with diagnosed heart disease every year. This high prevalence of diseases is anticipated to increase hospital admissions requiring treatments followed by vascular catheterization and vein access. Thereby, it is expected to drive market growth in the region.

Furthermore, several market players are engaged in implementing strategic initiatives such as product innovations and other activities, which are also contributing to the market's growth in the region. For instance, in April 2022, Shockwave Medical, a California-based company, launched its Shockwave M5+peripheral intravascular lithotripsy (IVL) catheter post receiving a CE mark and Food and Drug Administration (FDA) clearance. In addition, in July 2022, Intravascular Imaging Incorporated launched its 3 Fr NIRF-IVUS (Near-Infrared Fluorescence Intravascular Ultrasound) imaging catheter for human coronary imaging. In collaboration with the Massachusetts General Hospital, the catheter was designed and tested ex-vivo in human coronary arteries and in vivo in preclinical studies. These developments are expected to significantly contribute to the competitiveness in the market, augmenting the demand for ICs within the region. Hence, the market is expected to witness significant growth during the forecast period due to the abovementioned factors.

Intravascular Catheter Industry Overview

The market is highly competitive and comprises many players engaged in activities such as medical device manufacturing, raw material supply, sales and distribution, and many other services. Therefore there is an increase in the number of companies investing in emerging nations that drives the market growth in such regions. The market is also influenced by ongoing mergers and acquisitions among major market players. Boston Scientific Corporation, Becton, Dickinson and Company (C. R. Bard, Inc), B. Barun, Cook Medical, and McKesson Corporation are a few major players.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Cases of Target Diseases Such as Cardiovascular, Urological and Other Diseases

- 4.2.2 Rapid Improvement in Intravascular Catheter Technology

- 4.2.3 Increasing Number of Catheterization Laboratories

- 4.3 Market Restraints

- 4.3.1 Side effects Associated with the Catheters

- 4.3.2 Lack of Reimbursement

- 4.4 Porter Five Forces

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Product

- 5.1.1 Short Peripheral Intravascular Catheters (PIVC)

- 5.1.2 Integrated/Closed PIVC

- 5.2 By Application

- 5.2.1 Oncology

- 5.2.2 Gastroenterology

- 5.2.3 Cardiology

- 5.2.4 Urology

- 5.2.5 Other Applications

- 5.3 By End User

- 5.3.1 Hospitals and Clinics

- 5.3.2 Homecare Setting

- 5.3.3 Others

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Boston Scientific Corporation

- 6.1.2 Becton, Dickinson and Company (C. R. Bard, Inc)

- 6.1.3 Medline Industries, Inc

- 6.1.4 Cook Medical

- 6.1.5 Edwards Life Sciences Corporation

- 6.1.6 Johnson & Johnson

- 6.1.7 McKesson Corporation

- 6.1.8 Medtronic PLC

- 6.1.9 Smiths Medical

- 6.1.10 Terumo Corporation

- 6.1.11 B. Barun

- 6.1.12 Angiplast Pvt. Ltd.