|

市场调查报告书

商品编码

1273376

异氰酸酯市场增长、趋势、COVID-19 的影响和预测 (2023-2028)Isocyanates Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

在预测期内,异氰酸酯市场预计将以超过 6% 的复合年增长率增长。

由于生产设施暂时关闭和供应链中断,COVID-19 对异氰酸酯行业产生了负面影响。 然而,油漆和涂料市场对异氰酸酯的需求推动了疫情后的消费。

主要亮点

- 市场研究的主要驱动力之一是聚氨酯泡沫应用的巨大增长。

- 但是,原材料短缺和价格上涨可能会限制市场增长。

- 生物基异氰酸酯的更高效率有望成为未来市场增长的机遇。

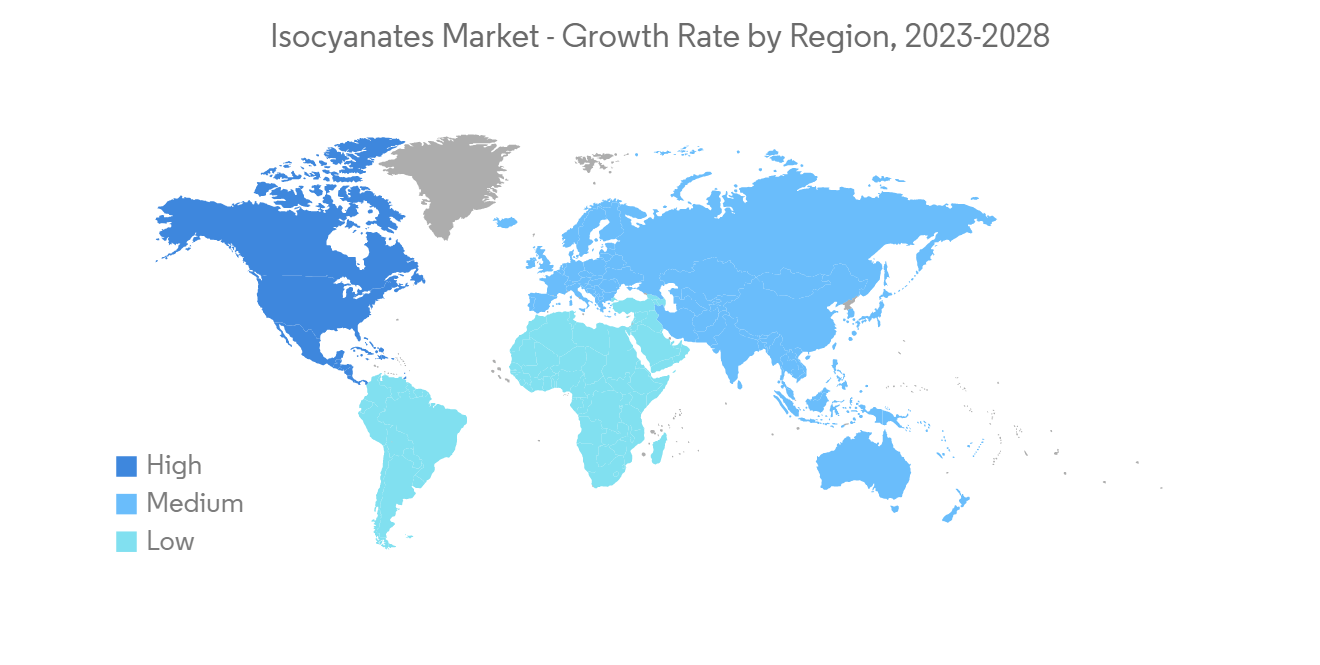

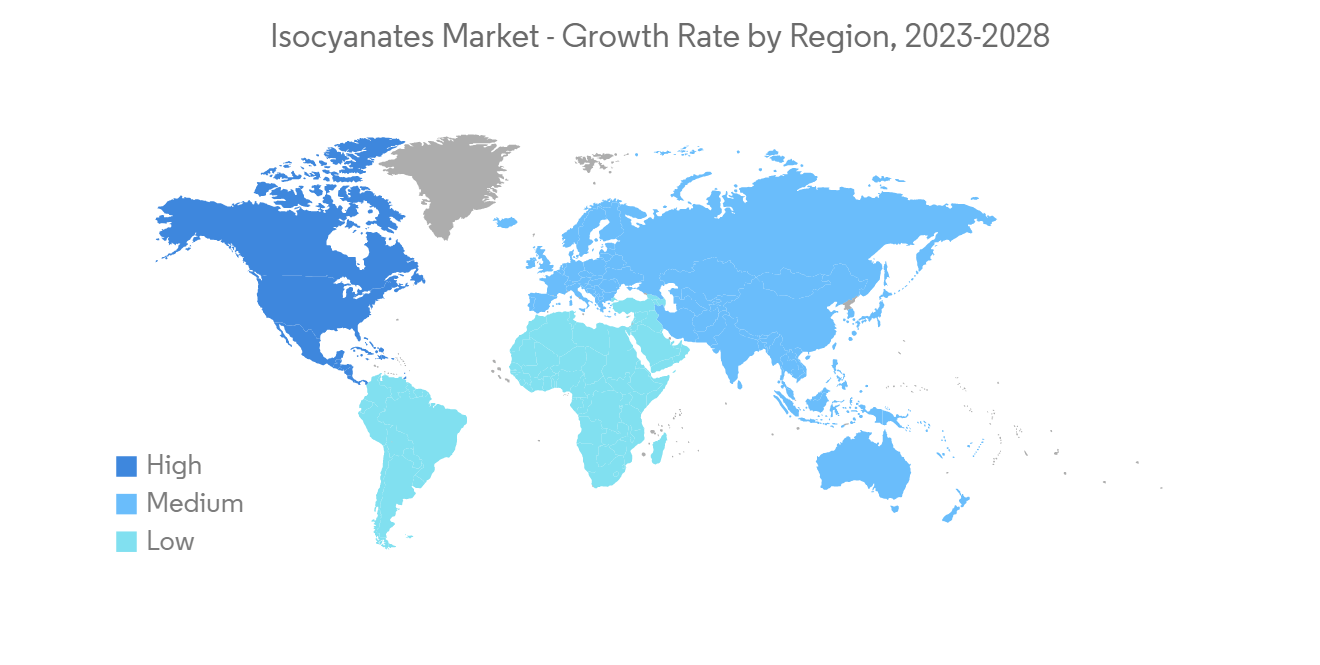

- 由于工业化程度不断提高,亚太地区在异氰酸酯市场占据主导地位,预计在预测期内将呈现高速增长。

异氰酸酯市场趋势

建筑施工主导市场

- 建筑业是异氰酸酯市场中最大的最终用户行业,用于各种家庭、商业和工业应用。

- 异氰酸酯的最大用途之一是将硬质 PU 泡沫用作墙壁和屋顶隔热材料、隔热板以及门窗周围的缝隙填充物。

- 零能耗建设的推广是聚氨酯市场的主要推动力,推动了异氰酸酯市场的发展。 亚洲有很多保温不良的建筑,尤其是在东南亚、中国和印度等新兴市场。 因此,建筑隔热材料的发展潜力巨大。

- 中国政府正在大力投资基础设施建设。 2022年1-3月,全国房地产开发投资27765亿元人民币(4320亿美元),同比增长0.7%。 住宅投资为20,761亿元人民币(3,230亿美元),增长0.7%。

- 印度政府拨款 10 万卡罗尔(1,305.7 亿美元)加强基础设施部门,大力推动基础设施部门发展。 2021 年 11 月,亚洲开发银行 (ADB) 批准了 2.5 亿美元的贷款,用于支持国家工业走廊发展计划 (NICDP) 的製定。 这是用于建设横跨 17 个州的 11 条工业走廊的 5 亿美元贷款的一部分。

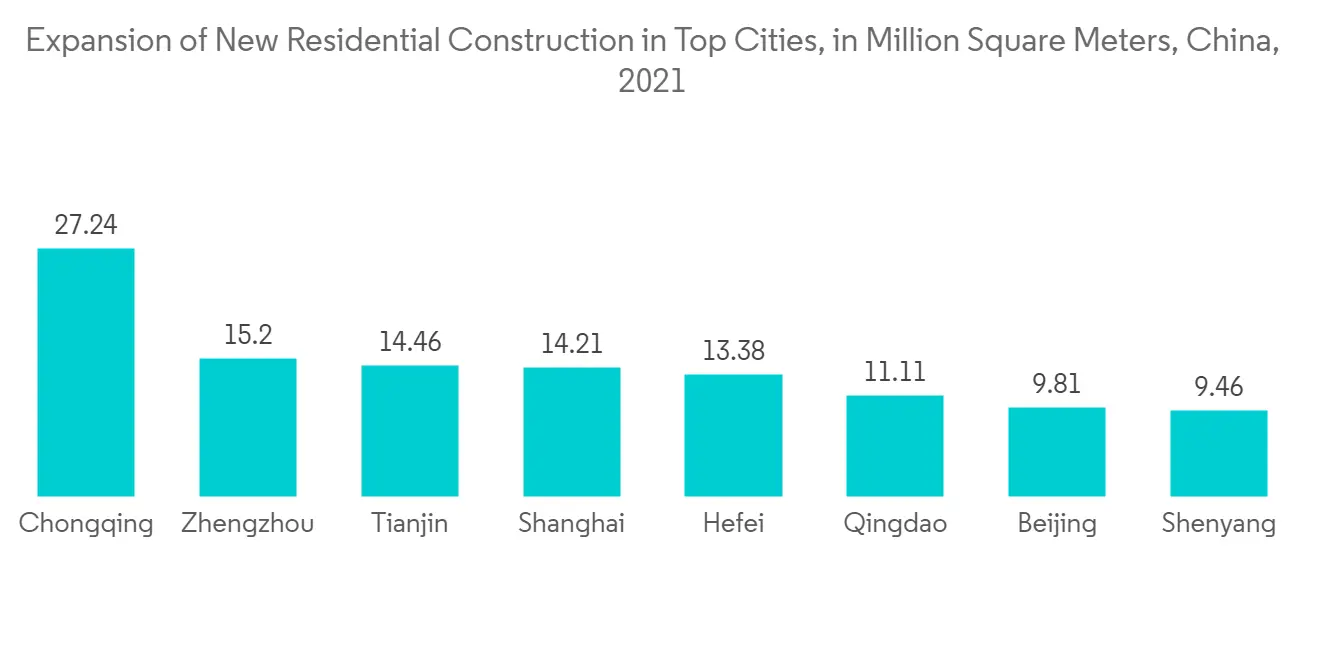

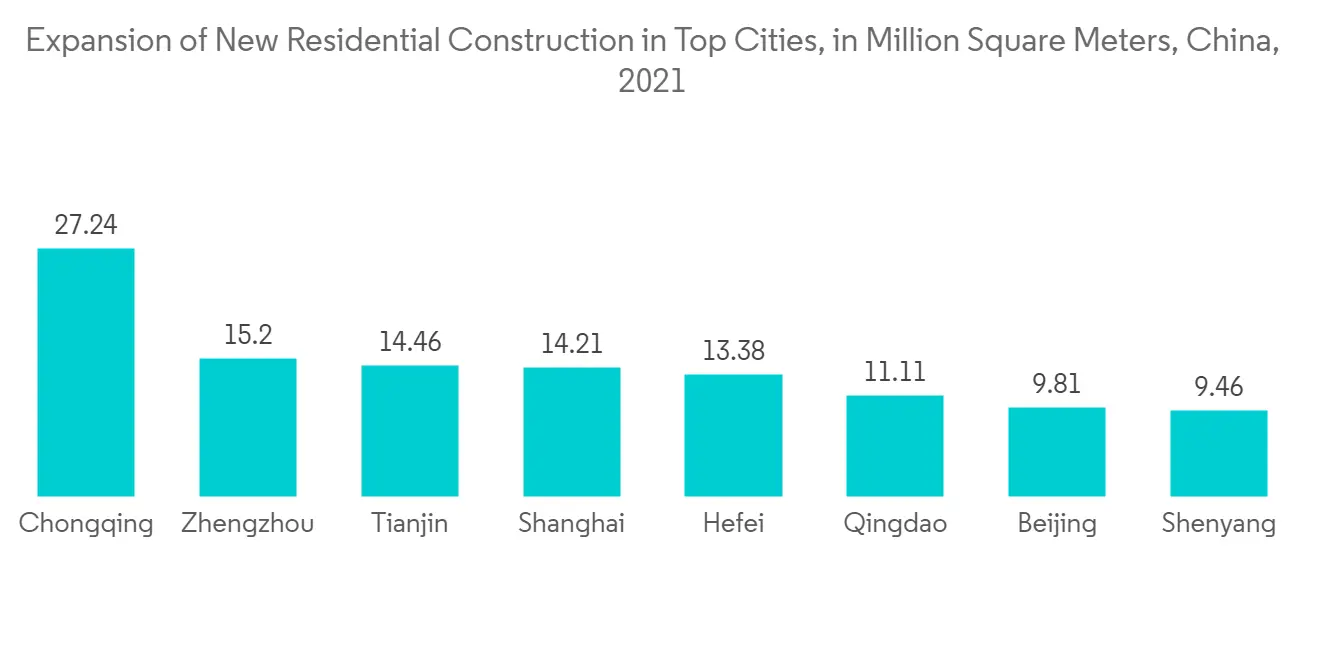

- 2021年重庆市新建住宅房地产开发麵积将达到约2724万平方米,同年全国新建住宅房地产总面积将超过2.38亿平方米.

- 预计所有地区的长期需求都将增长,尤其是在计划进行大规模建设和基础设施开发的南美洲和亚洲。

- 因此,由于上述原因,预计建筑行业将在预测期内主导市场。

亚太地区主导市场

- 在亚太地区,中国是世界上最大的聚氨酯产品生产国和消费国。 MDI主要用于中国聚氨酯及其製品,广泛用于生产硬泡和软泡。

- 聚氨酯还用于汽车、家具和内饰以及鞋类行业。 随着这些行业的发展,MDI 市场有望在预测期内增长。

- 在印度,随着中产阶级的壮大、可支配收入的增加、城市化进程的加快,以及基础设施投资的有力补充,作为 MDI 主要应用的聚氨酯正面临有利机遇。

- 在日本,聚氨酯产量正在增加。 聚氨酯产量的增加以及建筑、汽车和家具行业需求的增加预计将推动异氰酸酯市场的增长。

- 随着世界半导体持续短缺,日本 2022 年的新车销量降至 420 万辆,为 1977 年以来的最低水平。 此外,根据日本汽车经销商协会和日本轻型汽车和摩托车协会的数据,2022 年日本将售出 4,201,321 辆新车。

- 去年,印度汽车行业的国内乘用车年销量创下历史新高。 2022年国内销量同比增长23.1%至379.3万辆和37.93万辆。

- 此外,到 2030 年,印度可能会引领共享出行,为电动汽车和自动驾驶汽车提供机会。 印度政府预计,到 2023 年,汽车行业将吸引 8-100 亿美元的国内外投资。

- 因此,亚太地区很可能在预测期内主导市场。

异氰酸酯行业概况

由于全球市场份额被几家公司瓜分,异氰酸酯市场部分整合。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 调查结果

- 本次调查的假设

- 本次调查的范围

第二章研究方法论

第 3 章执行摘要

第四章市场动态

- 主持人

- 聚氨酯泡沫应用的大幅增长

- 增加亚太地区的工业化活动

- 建筑行业的需求增加

- 约束因素

- 原材料短缺和价格上涨

- 危险性质

- 工业价值链分析

- 波特的五力分析

- 供应商的议价能力

- 消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 价格趋势

- 监管政策分析

第 5 章市场细分(市场规模:基于数量)

- 类型

- MDI

- TDI

- 脂肪族

- 其他

- 用法

- 硬质泡沫

- 软质泡沫

- 油漆和涂料

- 粘合剂和密封剂

- 弹性体

- 活页夹

- 其他用途

- 最终用户行业

- 建筑/施工

- 汽车相关

- 医疗保健

- 家具

- 其他最终用途行业(航空航天、电子、船舶等)

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 法国

- 英国

- 意大利

- 其他欧洲

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙特阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章竞争格局

- 併购、合资、合作、合同等。

- 市场份额**/排名分析

- 主要公司采用的策略

- 公司简介

- Anderson Development Company

- Asahi Kasei Chemicals

- BASF SE

- BorsodChem

- China National Bluestar(Group)Co. Ltd

- Chemtura Corp.

- Covestro

- DowDuPont Inc.

- Evonik Industries

- Hebei Cangzhou Dahua Group

- Kemipex

- Korea Fine Chemical Co., Ltd

- Kumho

- MITSUI CHEMICALS AMERICA, INC.

- Perstorp

- Tosoh Corporation

- Vencorex

- Yantai Sanjiang Chemical Industry Material Co. Ltd

第七章市场机会与未来趋势

- 增加製造商的研发投资

- 高效生物基异氰酸酯

The isocyanates market is expected to grow at a CAGR of over 6% during the forecast period.

COVID-19 impacted the isocyanates industry negatively due to the temporary shutdown of the production facilities and the supply chain disruption. However, the demand for isocyanates in the paints and coatings market propelled the consumption post-pandemic.

Key Highlights

- One of the major factors driving the market study is the huge growth in the polyurethane foam application.

- However, shortages and increased prices of raw materials are likely to restrain the market's growth.

- High-efficiency of bio-based isocyanates is likely to act as an opportunity for market growth in the future.

- Asia-Pacific dominated the isocyanates market due to increased industrialization and is likely to witness a high growth rate during the forecast period.

Isocyanates Market Trends

Building and Construction to Dominate the Market

- Building & construction is the largest end-user industry for the isocyanates market, where it is used in various household, commercial, and industrial applications.

- One of the largest applications of isocyanates is using rigid PU foam as wall and roof insulation, insulated panels, and gap fillers for the space around doors and windows.

- Promoting zero-energy buildings continues to be the major driver for the PU market, thereby driving the isocyanates market. Numerous buildings are poorly insulated in Asia, especially in the developing markets of Southeast Asia, China, and India. Thus, depicting immense growth potential for thermal insulation materials in buildings.

- The government in China is investing heavily in infrastructure development. From January to March 2022, the national investment in real estate development was CNY 2,776.5 billion (USD 432 billion), a year-on-year increase of 0.7%. Among them, the residential investment was CNY 2,076.1 billion (USD 323 billion), an increase of 0.7%.

- The government of India gave a massive push to the infrastructure sector by allocating INR 10 lakh crore (USD 130.57 billion) to enhance the infrastructure sector. In November 2021, the Asian Development Bank (ADB) approved a USD 250 million loan to support the National Industrial Corridor Development Programme (NICDP) development. It is a part of the USD 500-million loan to build 11 industrial corridors bridging 17 states.

- In 2021, the floor space of newly constructed residential real estate in Chongqing amounted to almost 27.24 million sq m. In the same year, the total expanse of new residential real estate in China exceeded 238 million sq m.

- Longer-term demand is expected to grow across all regions, with particular strength in South America and Asia, where major construction and infrastructure improvement projects are planned.

- Hence, for the reasons above, the building and construction sector will likely dominate the market during the forecast period.

Asia-Pacific to Dominate the Market

- In Asia-Pacific, China is the world's largest producer and consumer of polyurethane products. MDI is primarily used for polyurethanes and their products in China which is widely used in rigid and flexible foam manufacturing.

- Polyurethane is also used in the automotive, furniture and interior, and footwear industries. With these industry growths, the MDI market is expected to grow over the forecast period.

- Polyurethane, MDI's primary application in India, is witnessing a boom in opportunities, with the expanding middle class, increasing disposable incomes, and rising urbanization, supplemented strongly by investments in infrastructure.

- In Japan, polyurethane production is on the rise. This increased polyurethane production and increasing demand from the construction, automotive, and furniture industries will likely augment the market growth for isocyanates.

- Sales of new cars in Japan dropped to 4.2 million in 2022, the lowest level since 1977, as the global semiconductor shortage continued. Additionally, as per Japan Automobile Dealers Association and Japan Light Motor Vehicle and Motorcycle Association, 4,201,321 new cars were sold in the country in 2022.

- The Indian automobile industry had its highest-ever annual domestic passenger vehicle sales last year. A total of 3.793 million or 37.93 lakh units were sold in the country in 2022, 23.1% higher than the preceding year.

- Moreover, India could lead in shared mobility by 2030, providing electric and autonomous vehicle opportunities. The Government of India expects the automobile sector to attract USD 8-10 billion in local and foreign investments by 2023.

- Hence, Asia-Pacific is likely to dominate the market during the forecast period.

Isocyanates Industry Overview

The isocyanate market is partly consolidated as the global market share is divided among a few companies. Some of the key players in the market include Dow, BASF SE, Evonik Industries, Tosoh Corporation, and Mitsui Chemicals, Inc., among others (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Huge Growth in the Polyurethane Foam Application

- 4.1.2 Increase in Industrialization Activities in Asia-Pacific

- 4.1.3 Increasing Demand from the Construction Industry

- 4.2 Restraints

- 4.2.1 Shortage and Increased Price of Raw Material

- 4.2.2 Hazardous in Nature

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Price Trend

- 4.6 Regulatory Policy Analysis

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 MDI

- 5.1.2 TDI

- 5.1.3 Aliphatic

- 5.1.4 Others

- 5.2 Application

- 5.2.1 Rigid Foam

- 5.2.2 Flexible Foam

- 5.2.3 Paints & Coatings

- 5.2.4 Adhesives & Sealants

- 5.2.5 Elastomers

- 5.2.6 Binders

- 5.2.7 Other Applications

- 5.3 End-user Industry

- 5.3.1 Building & Construction

- 5.3.2 Automotive

- 5.3.3 Healthcare

- 5.3.4 Furniture

- 5.3.5 Other End-use Industries (Aerospace, Electronics, Water Vessels, etc.)

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 France

- 5.4.3.3 United Kingdom

- 5.4.3.4 Italy

- 5.4.3.5 Rest of the Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East & Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East & Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Anderson Development Company

- 6.4.2 Asahi Kasei Chemicals

- 6.4.3 BASF SE

- 6.4.4 BorsodChem

- 6.4.5 China National Bluestar (Group) Co. Ltd

- 6.4.6 Chemtura Corp.

- 6.4.7 Covestro

- 6.4.8 DowDuPont Inc.

- 6.4.9 Evonik Industries

- 6.4.10 Hebei Cangzhou Dahua Group

- 6.4.11 Kemipex

- 6.4.12 Korea Fine Chemical Co., Ltd

- 6.4.13 Kumho

- 6.4.14 MITSUI CHEMICALS AMERICA, INC.

- 6.4.15 Perstorp

- 6.4.16 Tosoh Corporation

- 6.4.17 Vencorex

- 6.4.18 Yantai Sanjiang Chemical Industry Material Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Investments by the Manufactures in R&D Activities

- 7.2 High-Efficiency Bio-based Isocyanates