|

市场调查报告书

商品编码

1273377

异戊二烯市场 - 增长、趋势、COVID-19 影响和预测 (2023-2028)Isoprene Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

在预测期内,异戊二烯市场的复合年增长率预计将超过 5%。

主要亮点

- COVID-19 对市场产生了各种影响。 由于对医疗呼吸机的需求不断增长,聚异戊二烯的市场需求急剧扩大。 另一方面,封锁和旅行限制减少了轮胎行业的需求,使市场陷入困境。 然而,市场正处于復苏轨道上,预计在预测期内将继续保持这一轨道。

- 电动汽车和自动驾驶的全球趋□□势正在推动对创新轮胎设计和生产的需求,并倾向于加速异戊二烯市场的增长。 然而,对用于製造橡胶的合成化学品的更严格监管以及替代材料不断增长的潜力可能会限制未来几年对异戊二烯的需求。

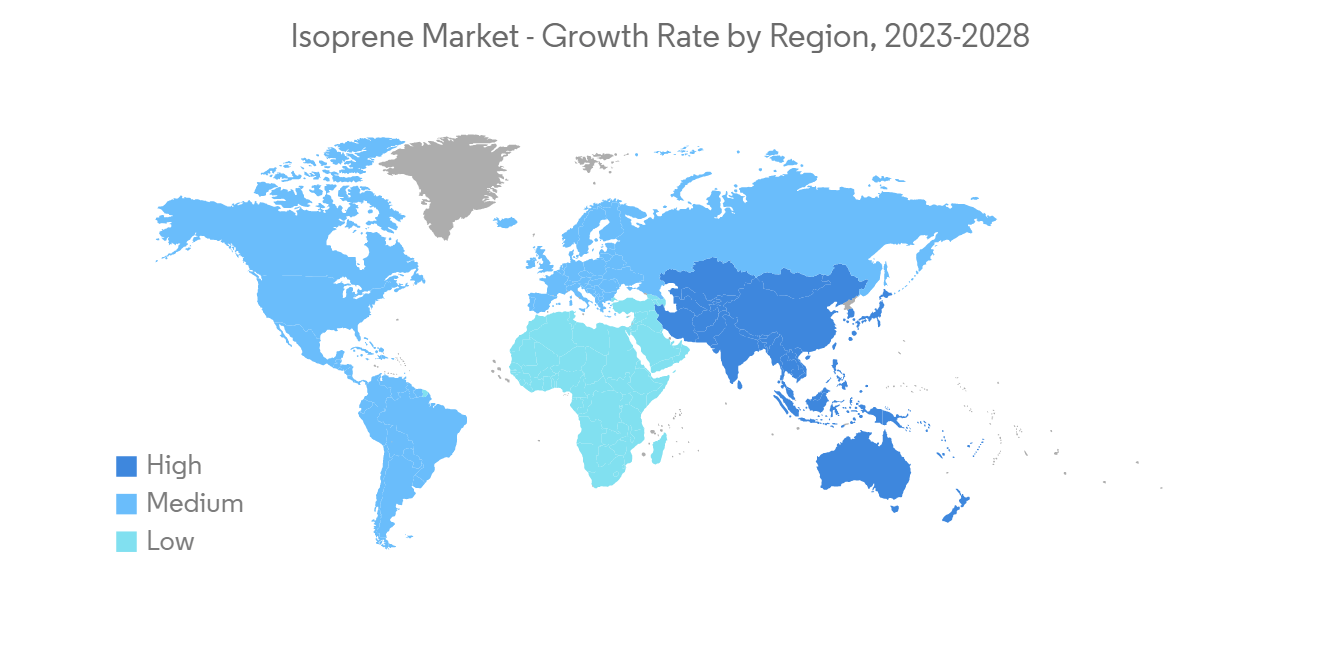

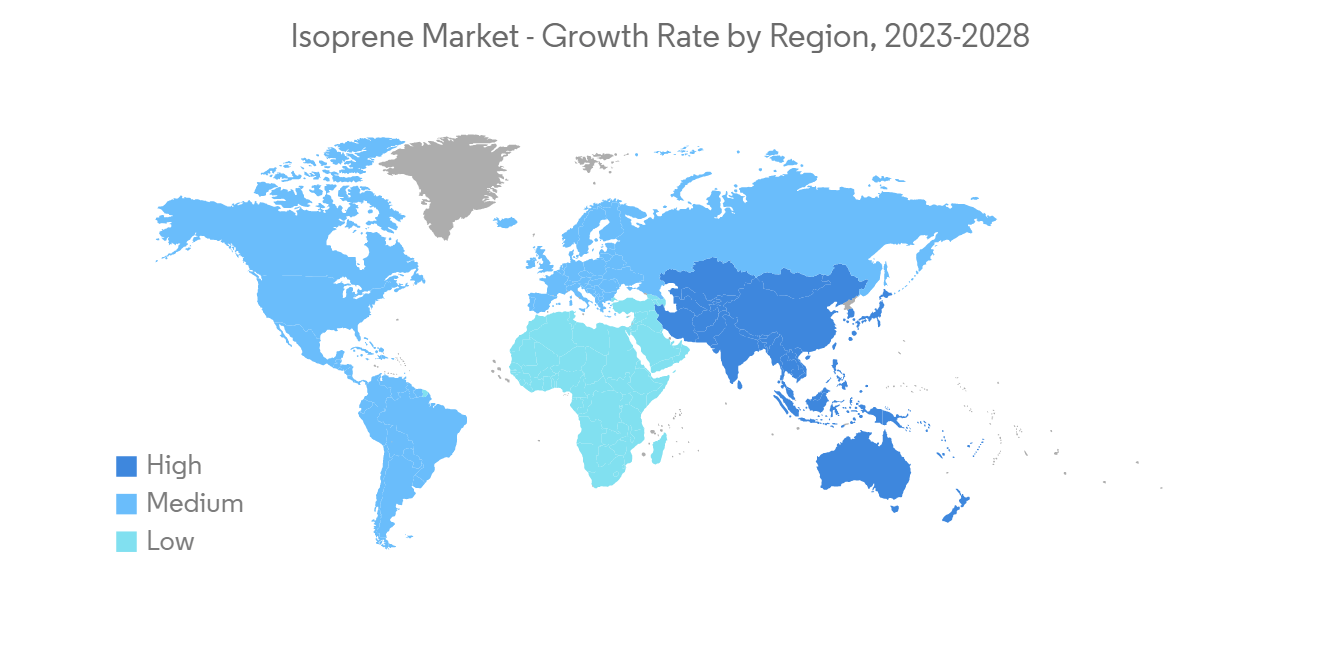

- 将异戊二烯的应用扩展到广泛的医疗保健组件中有望为所研究的市场创造机会。 亚太地区主导市场,预计在预测期内将实现最高的复合年增长率 (CAGR)。

异戊二烯市场趋势

汽车行业对轮胎的需求不断增长

- 在异戊二烯市场中,轮胎和轮胎零部件部分占据了最高的市场份额。 异戊二烯因其柔韧性、拉伸强度和撕裂强度等特性而成为轮胎製造领域中广泛使用的材料。

- 根据美国轮胎製造商协会 (USTMA) 的数据,2022 年美国的轮胎总出货量将达到约 3.421 亿条,比 2021 年和 2019 年的出货量分别增长约 2% 和 3%。 2021年轮胎总出货量约为3.35亿条。

- 此外,根据美国轮胎协会的数据,与 2021 年相比,乘用车轮胎、轻型卡车轮胎和卡车轮胎的 OE(原始设备)出货量将分别增长 4.8%、4.8% 和 7.8%。 ,共增加250万。

- 欧洲轮胎和橡胶製造商协会 (ETRMA) 代表欧盟约 4,400 家公司,直接僱用约 370,000 名员工。 ETRMA 的企业成员占全球总营业额的 70%,在欧盟和候选国家拥有 86 家轮胎製造厂和 16 个研究中心,拥有强大的製造和研究实力。

- ETRMA 在其 2022 年第三季度的季度报告中表示,消费者更换轮胎的总销量为 5800 万条,同比下降 10%。 预计 2022 年的总销量将增长 1%,达到约 1.75 亿台。

- 根据《普利司通 2023 年报告》,2021 年全球轮胎产量约为 178 万吨,较上年增长约 18%。 市场领先者是米其林,占有 14.8% 的市场份额,其次是普利司通,占 12.5%,固特异占 8.4%。

- 总体而言,上述所有因素都影响了轮胎生产,预计这将进一步影响氯丁橡胶市场。

亚太地区主导市场

- 作为最大的轮胎生产国,亚太地区占据了全球市场份额。 在亚太地区,印度、中国、日本等国家已成为汽车、商用车等汽车工业的最大生产国。

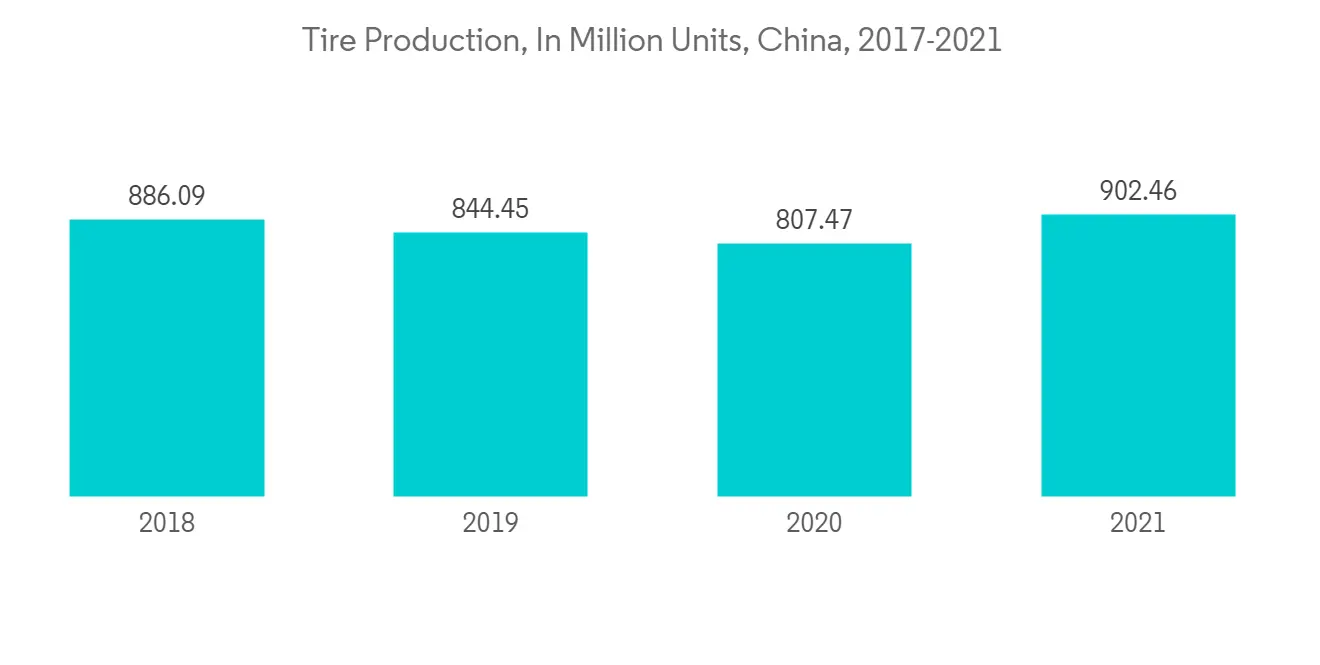

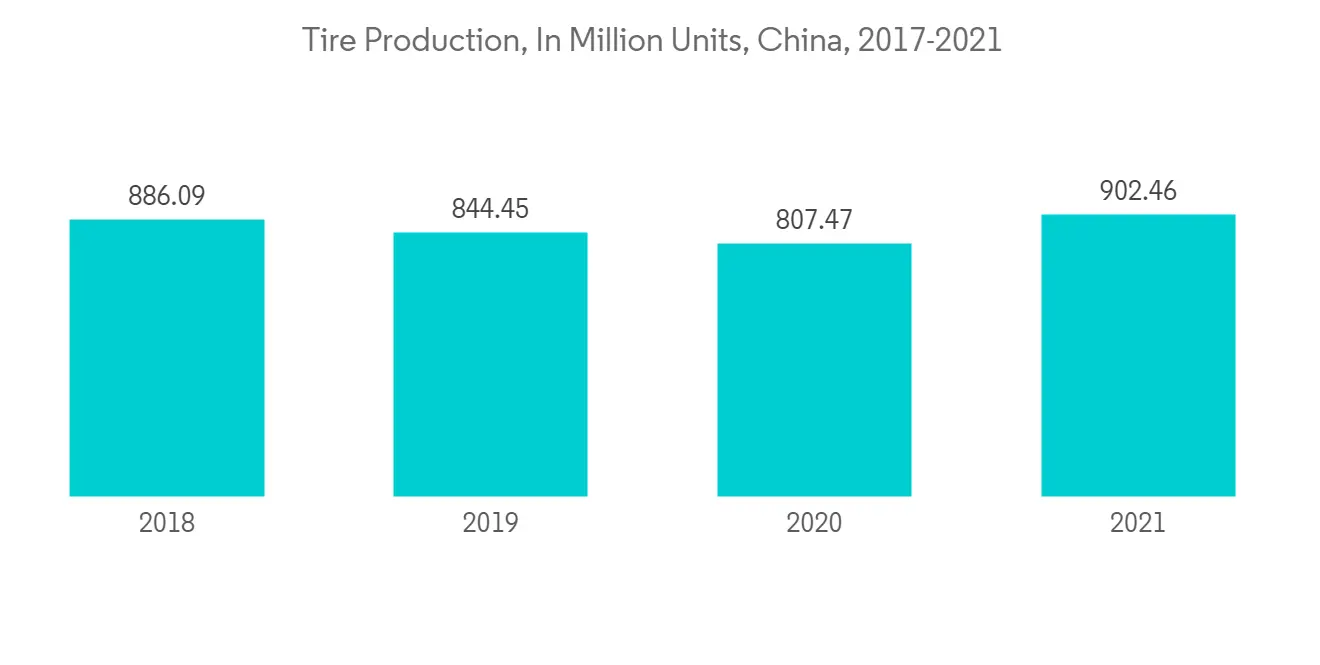

- 预计到 2025 年,中国轮胎年产量将达到 7.04 亿条,其中乘用车子午线轮胎 5.27 亿条,卡车和客车子午线轮胎 1.48 亿条,卡车斜交轮胎 2900 万条,超大型工业轮胎 20,000 条,农用轮胎 1200 万条,以及 54,000 条飞机轮胎。 到2025年,中国摩托车轮胎年产量将达到1.207亿条,自行车轮胎将达到4.2亿条。

- 日本拥有世界上最大的橡胶工业之一,2019 年合成橡胶产量超过 153 万吨。 就橡胶原料消费总量而言,仅次于中国和美国,居世界第三位。

- 根据国际能源署 (IEA) 的数据,2019 年,中国生产了约 110 万辆电动汽车,而日本则达到约 40,000 辆。IEA 表示。 对创新轮胎的需求不断增长,以很好地支持自动驾驶和电动汽车,这往往会增加对异戊二烯的需求。

- 中国拥有世界上最大的医疗保健行业之一。 2019 年,医疗市场规模达到 7.82 万亿元人民币(1.1 万亿美元),比上年增长 10%。 此外,国家“十三五”规划将健康和创新放在首位,预计在预测期内将增加对医疗器械製造业的投资。 预计这将促进该国治疗慢性病和与年龄有关的疾病的高科技医疗设备的生产,这可能会在未来几年增加对异戊二烯的需求。

- 印度政府减少了医疗设备的进口并增加了医疗设备的成本,特别是高端医疗设备,如癌症诊断、呼吸机系统、呼吸分离器、医学成像、导管、超声扫描和聚合□链反应( PCR) 技术。我们正在努力增加我们产品的本地生产。

- 基于这些因素,预计该地区的异戊二烯市场在预测期内将稳定增长。

异戊二烯行业概况

异戊二烯市场因其性质而部分整合。 市场参与者包括 Chevron Phillips Chemical Company LLC、中国石油化工集团公司、LyondellBasell Industries Holdings BV、Kuraray & 和 Lotte Chemical Corporation。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 调查先决条件

- 本次调查的范围

第二章研究方法论

第 3 章执行摘要

第四章市场动态

- 主持人

- 电动汽车和自动驾驶的发展趋势

- 其他司机

- 约束因素

- 严格控制使用的合成化学品

- 工业价值链分析

- 波特的五力分析

- 供应商的议价能力

- 消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第 5 章市场细分

- 通过使用

- 轮胎

- 医疗保健

- 服装/鞋类

- 其他用途

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 意大利

- 法国

- 其他欧洲

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙特阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章竞争格局

- 併购、合资、合作、合同等。

- 市场份额 (%)/排名分析

- 主要公司采用的策略

- 公司简介

- Chevron Phillips Chemical Company LLC

- China Petrochemical Corporation(SINOPEC)

- Dow

- Eneos Corporation

- JSR Corporation

- Kuraray Co. Ltd.

- Lotte Chemical Corporation

- LyondellBasell Industries Holdings BV

- Pon Pure Chemicals Group

- Shell PLC

- Zibo Luhua Hongjin New Material Group Co., Ltd

第七章市场机会与未来趋势

- 将应用扩展到广泛的医疗保健组件

简介目录

Product Code: 66082

The isoprene market is projected to register a CAGR of more than 5% during the forecast period.

Key Highlights

- COVID-19 had a mixed market influence. The market demand for polyisoprene expanded dramatically as the need for healthcare ventilators increased. On the other hand, the market suffered a decline in demand from the tire industry due to lockdowns and travel restrictions. However, the market has picked up speed and will likely continue on this trajectory during the forecast period.

- The growing trends of electric mobility and autonomous driving are propelling the demand for innovative tire design and production, which tends to upsurge the growth of the isoprene market globally. However, strict control on synthetic chemicals used to make rubbers tends to increase the growth potential of substitute materials, which may limit the demand for isoprene in the next years.

- Isoprene's increasing application in a wide range of healthcare components is projected to present an opportunity for the market studied. The Asia-Pacific region is expected to dominate the market and is likely to witness the highest compound annual growth rate (CAGR) during the forecast period.

Isoprene Market Trends

Increasing Demand for Tires in the Automobile Industry

- The tire and tire components segment covers the highest market share in the isoprene market. Isoprene is widely used in the manufacturing of tires, owing to its properties, such as flexibility, tensile strength, and tear strength, making it the material of choice in the tire manufacturing sector.

- According to the US Tire Manufacturers Association (USTMA), the total tire shipment in the US was around 342.1 million units in 2022, approximately 2% and 3% more than shipments in the years 2021 and 2019, respectively. The total tire shipment in 2021 was about 335 million units.

- The USTMA also stated that compared with 2021, original equipment (OE) shipments for passenger, light truck, and truck tires increased by 4.8%, 4.8%, and 7.8%, respectively, with a total increase of 2.5 million units.

- The European Tire and Rubber Manufacturers Association (ETRMA) represents roughly 4.400 enterprises in the EU, employing approximately 370.000 people directly. ETRMA corporate members account for 70% of total global sales and have a strong manufacturing and research presence in the EU and candidate countries, with 86 tire manufacturing units and 16 R&D centers.

- In its quarterly report for the third quarter of 2022, the ETRMA stated that a total of 58 million units of replacement consumer tires were sold , a 10% decline from the third quarter of the previous year. The overall sales for the year 2022 increased by 1%, which is estimated to be around 175 million units.

- According to the Bridgestone report 2023, the global tire production in 2021 was valued at approximately 1,780,000 tons, an increase of about 18% compared to the previous year. The key player in this market is Michelin, holding 14.8% of the market share, followed by Bridgestone and Goodyear, with 12.5% and 8.4%, respectively.

- Overall, all the aforementioned factors have impacted tire production, which is further expected to affect the neoprene market.

The Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region dominates the global market share, as Asia-Pacific is the largest manufacturer of tires. In the Asia-Pacific region, countries such as India, China, Japan, etc., are the largest producers of the automotive industry, including cars and commercial vehicles.

- China is projected to produce 704 million tires per year by 2025, including 527 million passenger radial tires, 148 million truck/bus radial tires, 29 million bias truck tires, 20,000 extra-large industrial tires, 12 million agricultural tires, and 54,000 aircraft tires. In addition, China will produce 120.7 million motorcycle tires and 420 million bicycle tires annually by 2025.

- Japan possesses one of the largest rubber industries in the world, with a production volume of over 1.53 million metric tons of synthetic rubber in 2019. Furthermore, the country is ranked third in the world, only behind China and the United States, in terms of the total amount of rubber material consumed.

- According to the International Energy Agency (IEA), the electric vehicles in China and Japan reached about 1.1 million units, and 0.04 million units, respectively, in 2019, whereas in 2020, IEA stated a global production of about 2.3 million units. The growing demand for innovative tires to provide enough support to autonomous and electric vehicles tends to increase the demand for isoprene.

- China has one of the largest healthcare sectors in the world. In 2019, the medical market reached CNY 7.82 trillion (USD 1.1 trillion), an increase of 10% compared to the previous year. Moreover, the country's 13th five-year plan prioritized health and innovation, which is expected to increase investments in the medical device manufacturing sector during the forecast period. This, in turn, is expected to raise the production of high-tech medical equipment to treat chronic and age-related diseases in the country, which may increase the demand for isoprene in the coming years.

- The Indian government has started initiatives to decrease the imports of medical devices and increase the local production of medical devices, particularly higher-end products that include cancer diagnostics, ventilator systems, breathing separators, medical imaging, catheter, ultrasonic scans, and polymerase chain reaction (PCR) technologies.

- Due to all such factors, the market for isoprene in the region is expected to have a steady growth during the forecast period.

Isoprene Industry Overview

The isoprene market is partially consolidated in nature. Some major players in the market include Chevron Phillips Chemical Company LLC, China Petrochemical Corporation, LyondellBasell Industries Holdings BV, Kuraray & Co Ltd., and Lotte Chemical Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Trends of Electric Mobility and Autonomous Driving

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Strict Control on Synthetic Chemicals Used

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 By Application

- 5.1.1 Tires

- 5.1.2 Healthcare

- 5.1.3 Apparel and Footwear

- 5.1.4 Other Applications

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 Italy

- 5.2.3.4 France

- 5.2.3.5 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Rest of Middle-East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Chevron Phillips Chemical Company LLC

- 6.4.2 China Petrochemical Corporation (SINOPEC)

- 6.4.3 Dow

- 6.4.4 Eneos Corporation

- 6.4.5 JSR Corporation

- 6.4.6 Kuraray Co. Ltd.

- 6.4.7 Lotte Chemical Corporation

- 6.4.8 LyondellBasell Industries Holdings BV

- 6.4.9 Pon Pure Chemicals Group

- 6.4.10 Shell PLC

- 6.4.11 Zibo Luhua Hongjin New Material Group Co., Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Application in a Wide Range of Healthcare Components

02-2729-4219

+886-2-2729-4219