|

市场调查报告书

商品编码

1273378

高岭土市场 - COVID-19 的增长、趋势、影响和预测 (2023-2028)Kaolin Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

在预测期内,高岭土市场的复合年增长率预计将低于 4%。

COVID-19 对 2020 年的市场产生了负面影响。 然而,现在估计市场已达到大流行前的水平,预计未来将稳定增长。

主要亮点

- 由于环保意识增强和纸浆价格上涨,造纸行业使用更多高岭土。 这一点,连同对高品质陶瓷日益增长的需求,正在推动市场增长。

- 采矿和采用其他替代品的高成本和法规预计会阻碍市场增长。

- 此外,卫生洁具需求的增长预计将成为未来几年的市场机遇。

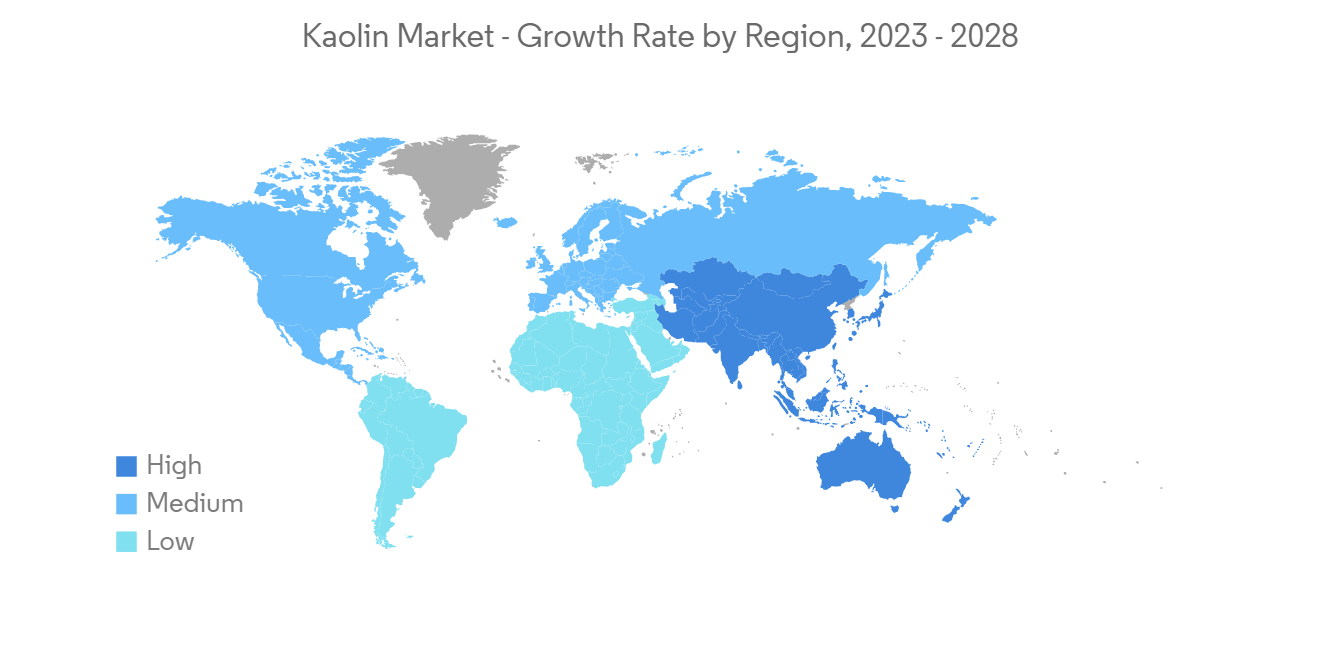

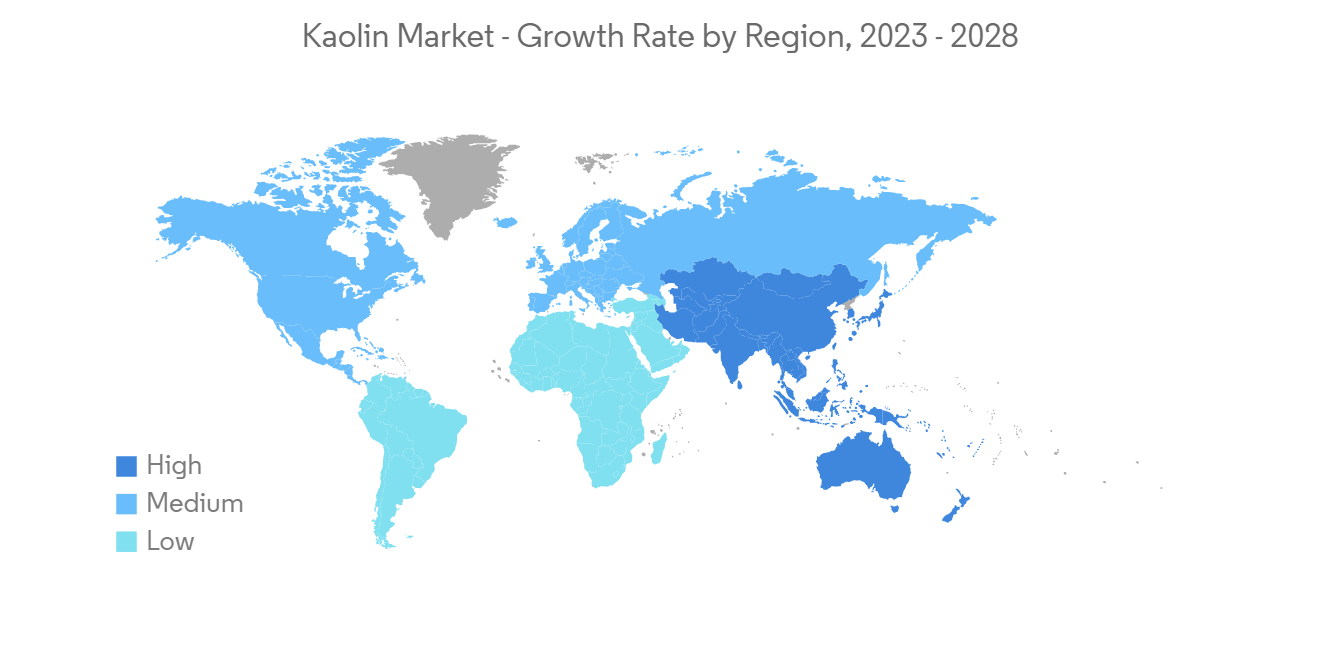

- 亚太地区主导着全球市场,中国、印度和日本等国家/地区是最大的消费者。

高岭土市场趋势

造纸和陶瓷行业的需求不断扩大

- 高岭土主要用于造纸工业,使纸张更光滑、更白,并在纸张的间隙中充当填料。

- 通过使用高岭土,可以赋予纸张表面吸墨性和不透明性,并获得耦合等特性以覆盖表面。可以表现出各种印刷颜色。

- 高岭土的不透明度对于造纸工业来说是一个非常重要的特性。 高岭土可用于赋予纸张特性,例如亮度、光泽和粘度。 根据明尼苏达州自然资源部 (DNR) 的数据,大约 60% 的高岭土专门用于造纸行业。

- 在陶瓷领域,高岭土用于白瓷产品、绝缘体和耐火材料。 高岭土具有出色的成型性,可增加陶瓷产品的干烧强度、尺寸稳定性和光滑的表面光洁度。

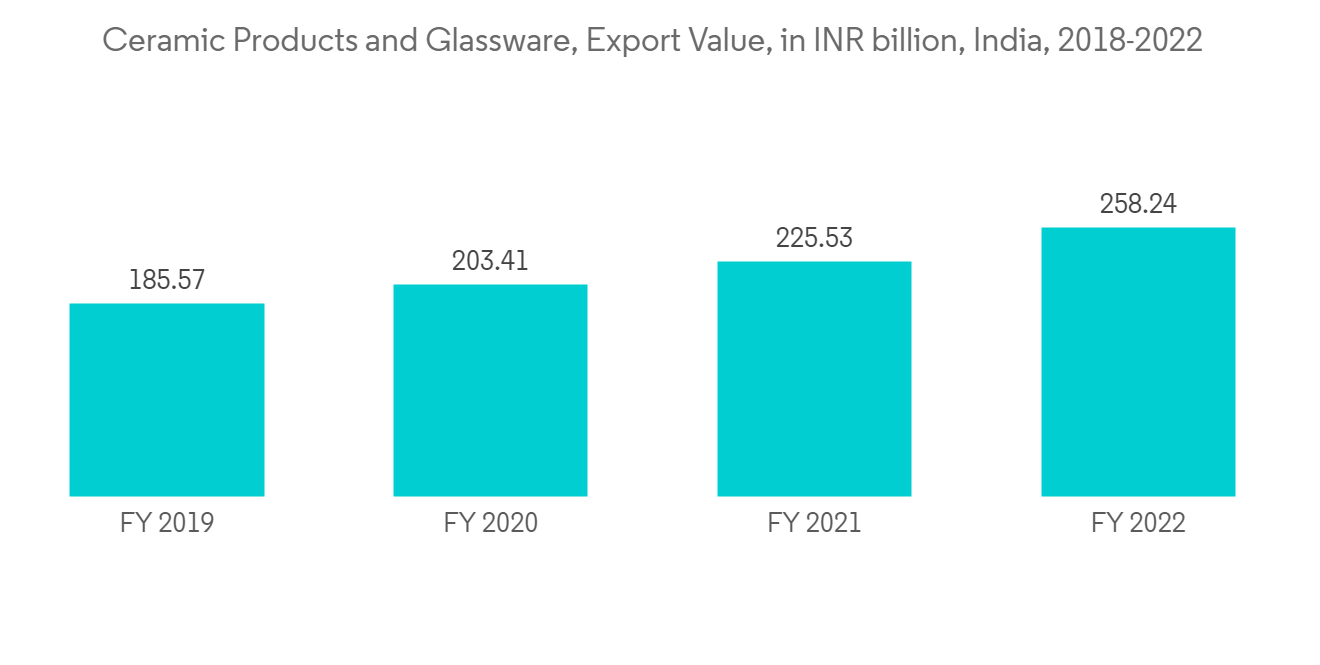

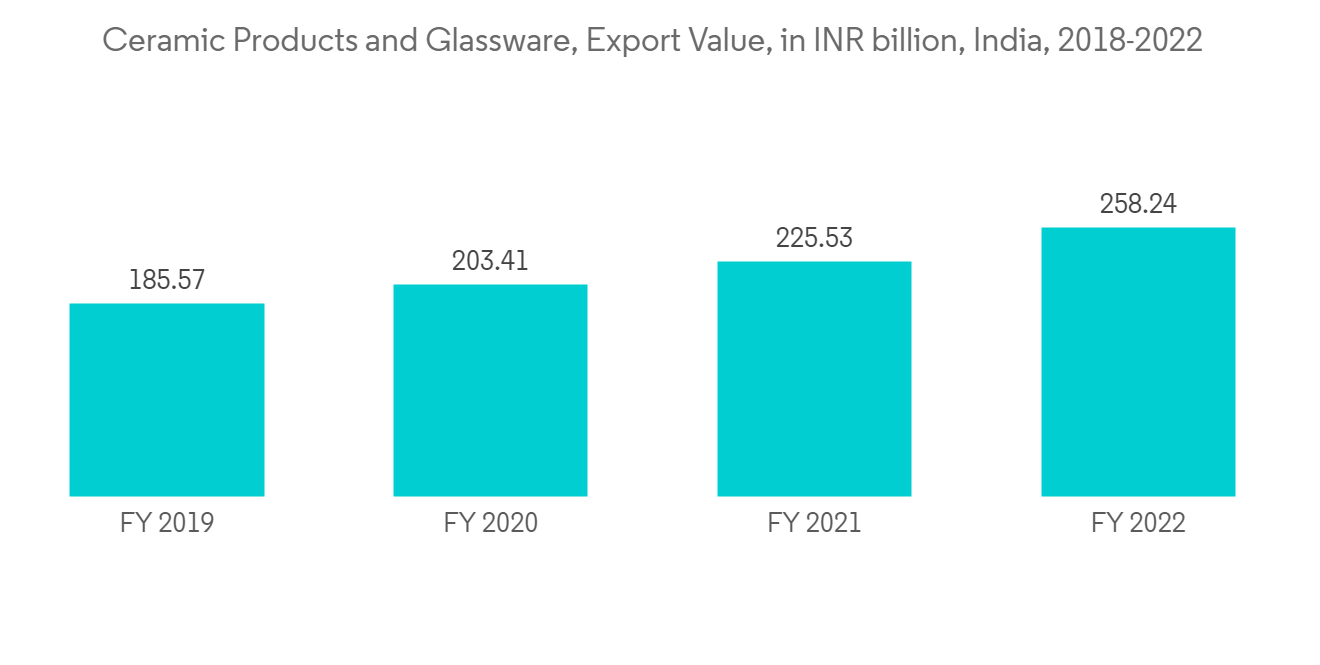

- 根据印度储备银行的数据,印度将在 2022 年出口超过 32.8 亿美元(2582.4 亿印度卢比)的陶瓷和玻璃器皿,以支持市场的增长。

- 此外,根据联合国粮食及农业组织的数据,2021 年美国将生产 6750 万吨纸和纸板,比上一年增长近 2%。 美国是世界第二大纸和纸板生产国。

- 因此,由于上述因素,预计在预测期内对高岭土的需求将显着增加。

亚太地区主导市场

- 亚太地区在中国和印度拥有高度发达的陶瓷工业和纸及纸板生产,以及多年持续投资发展塑料和橡胶技术领域。因此,预计将占据主导地位全球市场。

- 中国和印度的陶瓷工业正在发展,高岭土的使用也在增加。 尤其是卫浴、餐具、瓷砖等产品,近年增长不俗。 据陶瓷世界网报导,中国目前是世界第一大瓷砖生产国,其次是印度。

- 在亚太地区,高岭土主要用于造纸行业,因为生产纸张和纸板需要纸浆。

- 根据中国国家统计局的数据,2022 年 9 月中国生产了约 1160 万吨加工纸和纸板产品,与 2022 年 8 月相比增长了约 8%。

- 近年来,由于高岭土具有耐磨性、尺寸稳定性和化学惰性等特性,其在油漆、橡胶、塑料、医药、粘合剂和水泥等领域的使用显着增加。

- 根据橡胶委员会的数据,到 2022 年,印度的天然橡胶消费量将超过 120 万吨,年增长率为 13%。 到2021年,印度将成为世界第二大天然橡胶消费国。 因此,它将极大地促进该地区的市场增长。

- 因此,预计在预测期内,各种应用需求的增加将推动该地区对高岭土的需求。

高岭土产业概况

高岭土市场最初是部分合併的。 市场参与者包括 BASF SE、SCR-Sibelco NV、EICL、Quartz Works GmbH、Imerys 等(排名不分先后)。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 调查先决条件

- 本次调查的范围

第二章研究方法论

第 3 章执行摘要

第四章市场动态

- 主持人

- 在陶瓷和耐火材料中的应用扩展

- 造纸和橡胶行业的需求不断扩大

- 约束因素

- 替换为其他替代品

- 其他限制

- 工业价值链分析

- 波特的五力分析

- 买家的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第 5 章市场细分(市场规模:基于金额)

- 用法

- 橡胶

- 陶瓷

- 论文

- 塑料

- 绘画

- 其他用途

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 意大利

- 其他欧洲

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙特阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章竞争格局

- 併购、合资、合作、合同等。

- 市场份额 (%) 分析**/市场排名分析

- 主要公司采用的策略

- 公司简介

- BASF SE

- EICL

- Imerys

- KaMin LLC

- Koalin AD

- KERAMOST, a.s.

- I-Minerals

- Quartz Works GmbH

- SCR-Sibelco NV

- Thiele Kaolin Company

第七章市场机会与未来趋势

- 卫生洁具需求不断扩大

简介目录

Product Code: 69420

The kaolin market is projected to register a CAGR of less than 4% during the forecast period.

The COVID-19 negatively impacted the market in 2020. However, the market has now been estimated to have reached pre-pandemic levels and is expected to grow steadily in the future.

Key Highlights

- The paper industry uses more kaolin because people are becoming more aware of the environment and the price of pulp is going up.This, along with the growing need for high-quality ceramics, is driving market growth.

- High costs and regulations in mining and the adoption of other substitutes are expected to hinder market growth.

- Further, growing demand for sanitary ceramics is expected to act as a market opportunity in the coming years.

- The Asia-Pacific region dominated the market around the world, with countries like China, India, and Japan being the biggest consumers.

Kaolin Market Trends

Growing Demand from Paper and Ceramics Industries

- Kaolin is primarily used in the paper industry; it makes paper smoother and whiter, and it also acts as a filler in the interstices of the sheet.

- The use of kaolin supports gaining properties such as adding ink receptivity and opacity to the paper sheet and coupling to coat the surface, which in turn supports producing sharp photographic illustrations and bright printed colors.

- Kaolin has perfect opacity, which is an extremely important property for the paper industry. The use of kaolin gives brightness, gloss, and viscosity properties to paper. According to the Minnesota Department of Natural Resources (DNR), U.S.A., about 60% of kaolin is used only by the paper industry.

- In ceramics, kaolin is used for whiteware products, insulators, and refractories. Kaolin has excellent molding properties and adds dry and fired strength, dimensional stability, and a smooth surface finish to the ceramic products.

- According to the Reserve Bank of India, India exported ceramic and glassware goods worth more than USD 3.28 billion (INR 258.24 billion) in the fiscal year 2022 thus supporting market growth.

- Further, according to the Food and Agriculture Organization of the United Nations, in 2021, the United States produced 67.5 million metric tons of paper and paperboard, a nearly 2% increase over the previous year. The United States is the world's second-largest producer of paper and paperboard.

- Therefore, owing to the above-mentioned factors, the demand for kaolin is expected to increase significantly during the forecast period.

Asia Pacific Region to Dominate the Market

- Asia-Pacific is expected to dominate the global market owing to the highly developed ceramic sector and paper and paperboard production in China and India, coupled with the continuous investments made in the region to advance the plastic and rubber technology sectors through the years.

- The growing ceramic industry in China and India increases the utilization of kaolin. Especially products like sanitaryware, tableware, and tiles had decent growth in recent years. According to the Ceramic World Web, China stands first globally, followed by India, in ceramic tile manufacturing in the current scenario.

- In Asia-Pacific, the major usage of kaolin is in the paper industry because of the cost and limitations of pulp in the production of paper and paperboard.

- According to the National Bureau of Statistics of China, around 11.6 million metric tons of processed paper and cardboard were produced in China in September 2022, reflecting an increase of nearly 8% compared to August 2022.

- Recently, the usage of kaolin in paints, rubber, plastics, medicines, adhesives, and cement sectors has been significantly growing due to its abrasion resistance, dimensional stability, and chemical inertness properties.

- According to the Rubber Board, in FY 2022, India consumed more than 1.2 million metric tons of natural rubber, an increase of 13% annually. In 2021, India will be the world's second-largest user of natural rubber. thus boosting market growth significantly in the region.

- Thus, the increasing demand from various applications is likely to surge the demand for kaolin in the region during the forecast period.

Kaolin Industry Overview

The kaolin market is partially consolidated in nature. Some of the major players in the market include BASF SE, SCR-Sibelco NV, EICL, Quartz Works GmbH and Imerys, among others (in no particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Applications in Ceramics and Refractories

- 4.1.2 Growing Demand from Paper and Rubber Industries

- 4.2 Restraints

- 4.2.1 Replacement by Other Subsitutes

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Application

- 5.1.1 Rubber

- 5.1.2 Ceramics

- 5.1.3 Paper

- 5.1.4 Plastics

- 5.1.5 Paintings

- 5.1.6 Other Applications

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 France

- 5.2.3.4 Italy

- 5.2.3.5 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Rest of Middle-East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis **/Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BASF SE

- 6.4.2 EICL

- 6.4.3 Imerys

- 6.4.4 KaMin LLC

- 6.4.5 Koalin AD

- 6.4.6 KERAMOST, a.s.

- 6.4.7 I-Minerals

- 6.4.8 Quartz Works GmbH

- 6.4.9 SCR-Sibelco NV

- 6.4.10 Thiele Kaolin Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Demand for Sanitary Ceramics

02-2729-4219

+886-2-2729-4219