|

市场调查报告书

商品编码

1273379

实验室离心机市场 - 增长、趋势和预测 (2023-2028)Laboratory Centrifuge Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

在预测期内,实验室离心机市场预计将以 5.0% 的复合年增长率註册。

COVID-19 的庞大患者群体和实验室离心机的潜在短缺正在推动实验室离心机市场的增长。 例如,2022 年 2 月 NCBI 的一篇论文报告称,在 COVID-19 大流行期间,对离心机分离唾液成分以检测冠状病毒的需求显着增加。 然而,在目前的情况下,预计实验室离心机的需求相对于大流行开始可能会趋于稳定。 然而,随着其他 SARS-CoV-2 毒株的出现,在所研究的市场期内,对离心机的需求可能会增加。

推动市场增长的因素是该病的高患病率、研发活动投资的增加以及技术进步。 离心主要用于诊断某些传染病,例如 HIV。 离心增强了 HIV-1 感染母亲所生儿童血浆中 HIV-1 p24 抗原的检测。 全球报告的 HIV 病例数量不断增加,预计将增加对离心机的需求。 例如,联合国艾滋病规划署在 2022 年报告称,到 2021 年全球将有 3840 万人感染艾滋病毒,其中 85% 的人将进行自我诊断。 由于离心机还用于分离生物体液中的病原体和寄生虫,因此 HIV 的高流行率可能会增加对用于样品诊断的离心机的需求,从而增加所研究市场的规模,预计将促进增长。

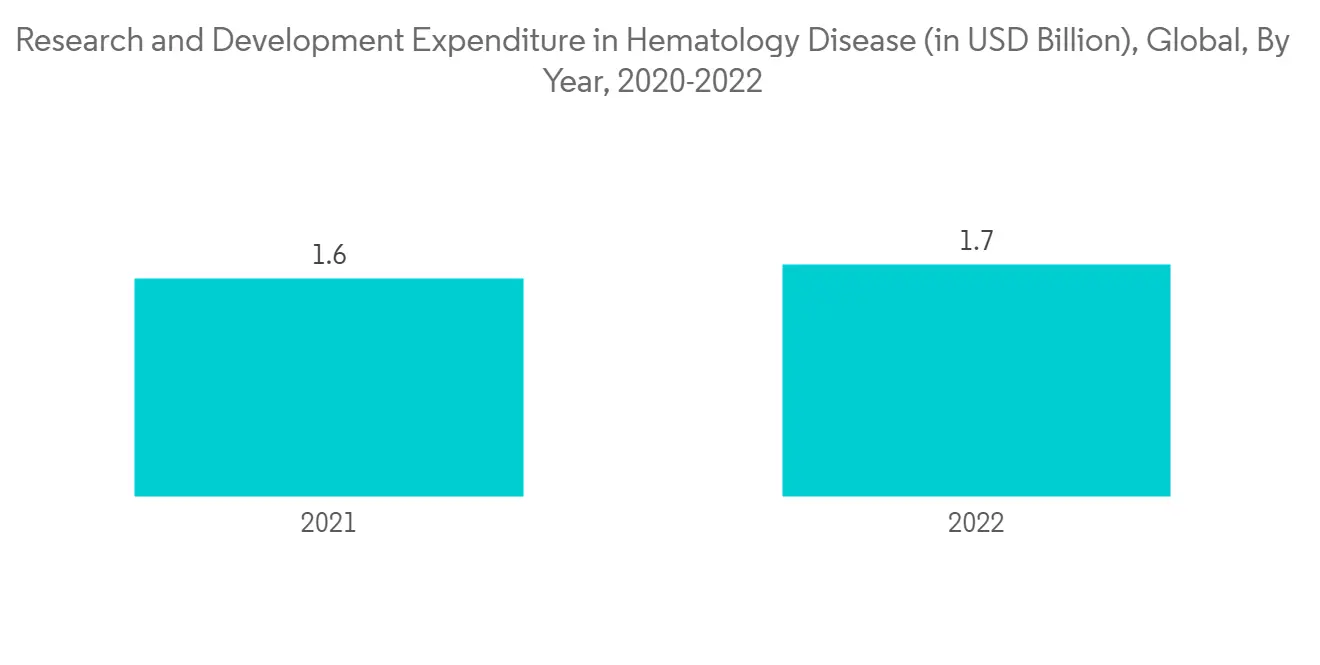

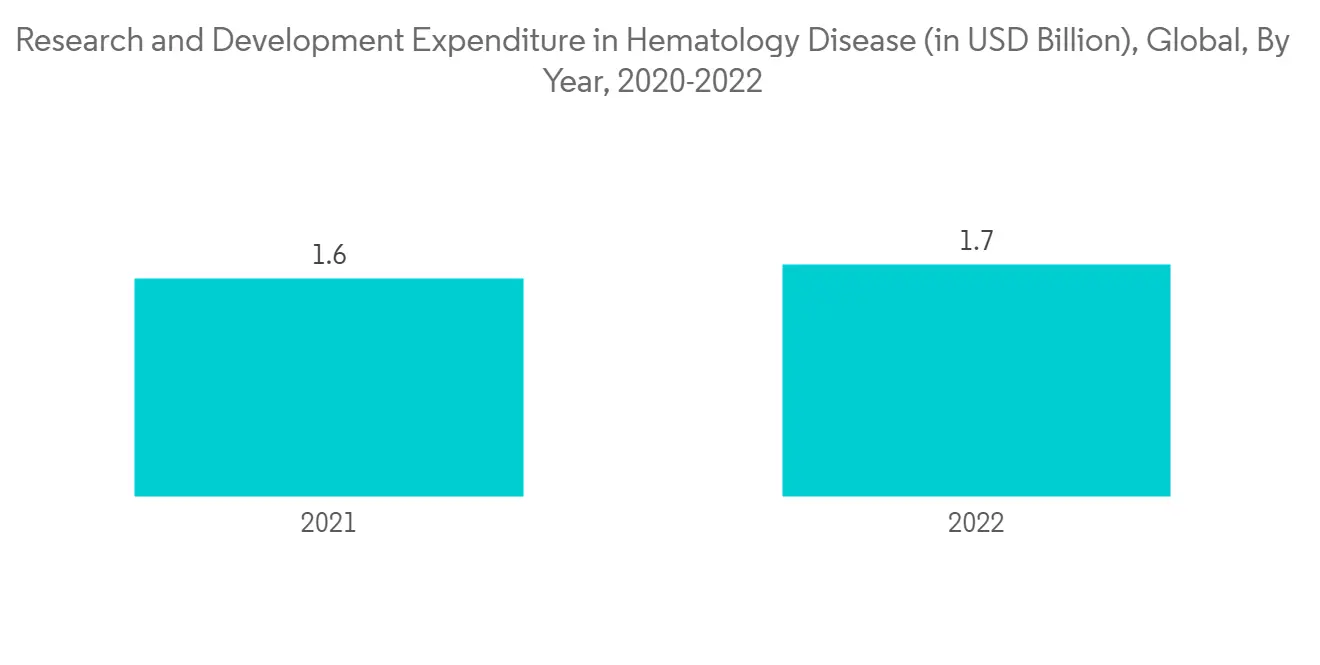

此外,增加对製药和生物技术研发部门的投资也有助于所研究市场的增长。 例如,2022 年 5 月,国家卫生统计中心 (NCHS) 估计,2021 年全球将有 78.47 亿美元用于生物技术研发,到 2022 年底将达到 81.42 亿美元。我正在报告。 研发投入的增加带动了新药的开发,离心机用于生产氨基酸、苯甲酸、苯、硫、次氯酸钙、六氯环己烷、胰岛素、青霉素、淀粉等各种用于药物开发的中间体。分离物体。 因此,生物技术领域投资的增加导致研发活动的增加,从而增加了对实验室离心机的需求并推动了研究市场的增长。

近年来,实验室离心机市场的一些主要参与者推出了集成了先进转子和其他功能的离心机。 例如,2021 年 4 月,Eppendorf AG(德国)推出了多功能离心机 5910 Ri,它提供了增强和简化离心分离的高级功能。 该离心机是流行的 Centrifuge 5910 R 的后继产品,具有创新的触摸屏界面、远程监控以及可选连接到新的 VisioNize 数字实验室套件,无需更换转子、转子桶或适配器。它具有独特的通用转子,接受 50mL 锥形管、板和 250mL 瓶。 因此,新推出的离心机采用了更好的技术并提供了更好的结果,从而促进了所研究市场的增长。

虽然该市场有望表现良好,但高昂的设备成本和较长的设备使用寿命可能会减缓市场发展。

实验室离心机市场趋势

预计在预测期内,按型号划分的台式离心机细分市场将出现显着增长。

台式离心机是专为在密封腔室中安全操作产品而设计的台式离心机。 它易于操作,并具有自动锁定係统,可单手快速更换转子,以实现应用的多功能性和最大吞吐量。 这些离心机的设计最大限度地减少了打开和关闭盖子时的潜在夹点,电动盖子闩锁提供了额外的保护。 由于台式离心机的成本效益、易用性和色谱、沉淀、过滤等的多功能性,预计在预测期内台式离心机将显着增长。

台式离心机的易用性和兼容性正在推动该领域的发展。 例如,国家医学图书馆在 2021 年 7 月发表的一篇文章称,台式离心机因其有限的空间和多功能性而成为实验室使用的首选。。 该文章还报告说,设计特点、样品体积小、处理速度快和 RCF 高,使这款离心机得到广泛应用,有助于该细分市场的增长。

此外,新产品的推出也推动了这一细分市场的增长。 例如,2021年6月,Kubota Corporation(日本)推出了USD 500T台式离心机和S500FR落地式冷冻离心机。

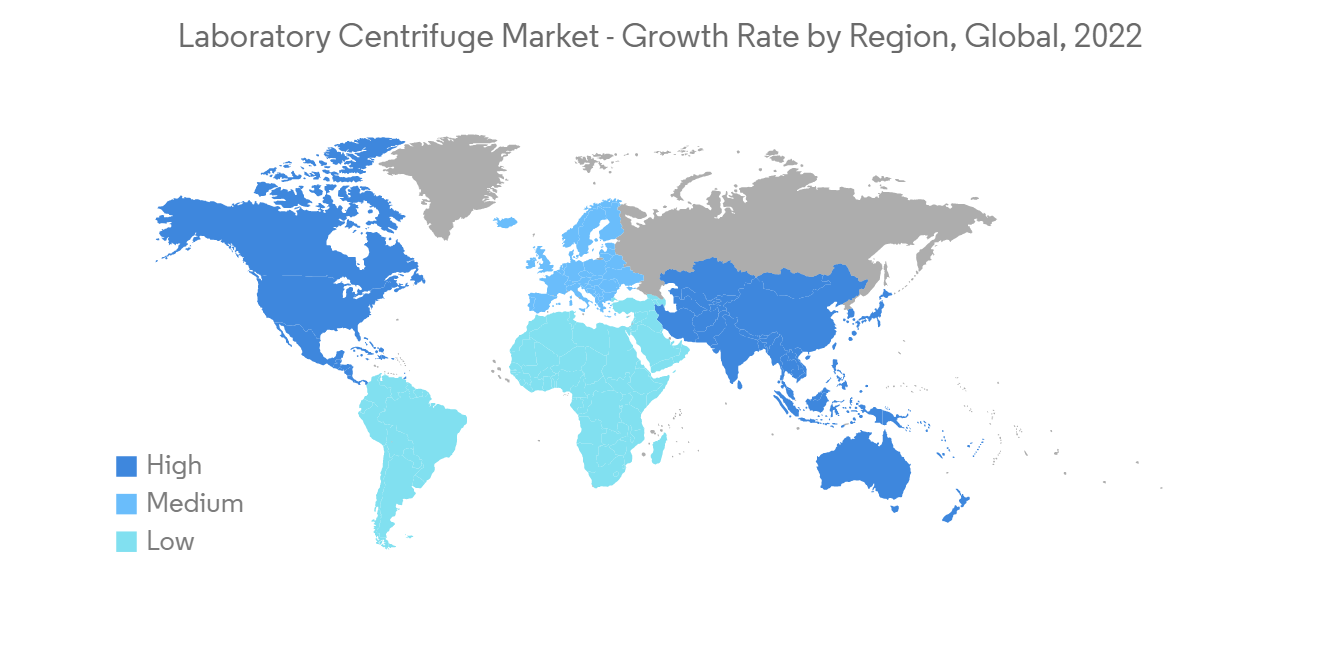

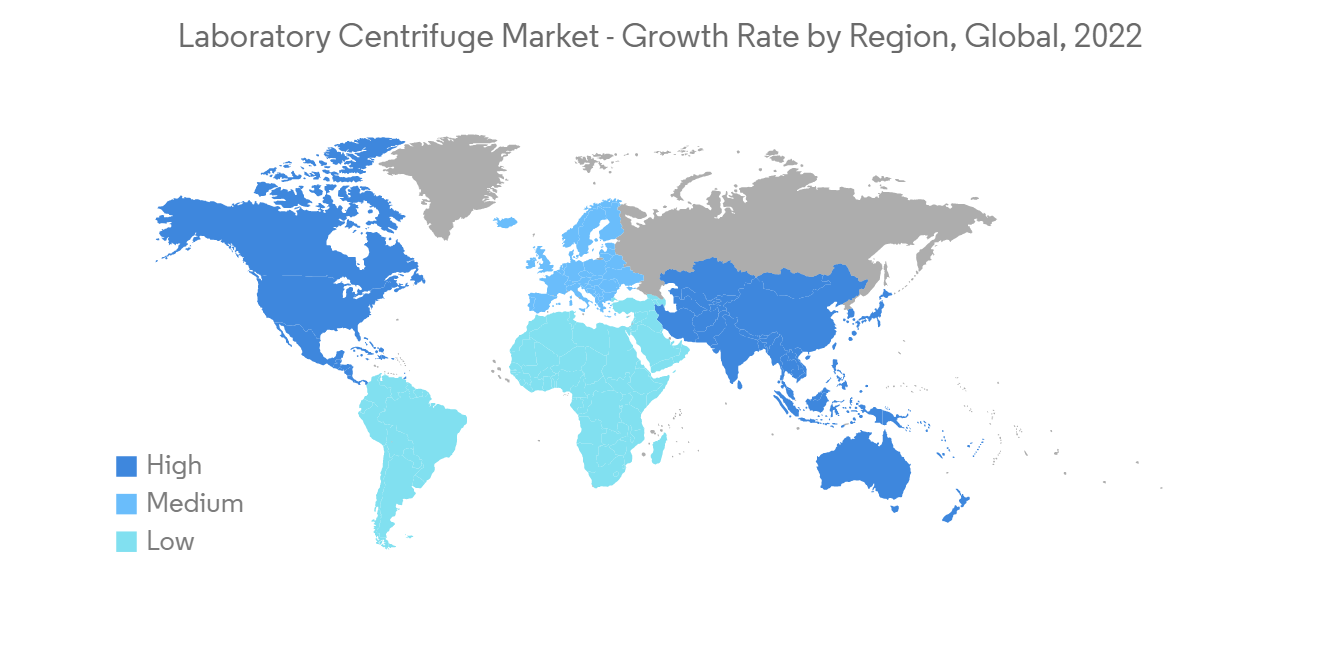

北美预计在预测期内将显着增长。

由于疾病的增加以及诊断和治疗意识的提高,预计北美在预测期内将出现显着增长。 此外,由于主要市场参与者的存在,产品发布、合併、合作伙伴关係和收购进一步推动了该地区的市场增长。

北美国家报告的结核病高发病率增加了离心机在样本诊断中的使用。 大量结核病患者正在推动该国的市场增长,因为最佳的结核病检测通常包括痰液离心和肉汤培养。 例如,2022 年 11 月发表的一篇 NCBI 论文发现,2021 年努纳武特地区(加拿大)将诊断出 77 例活跃的结核病病例,比前一年增加一倍多。

同样,在 2022 年 5 月,墨西哥政府报告称,在 2020 年至 2021 年期间,有超过 90,000 人被诊断出感染了 HIV。

此外,技术发展、合作伙伴关係、兼併、收购和新产品发布正在推动该地区该市场的增长。 例如,2021 年 6 月,Quest Diagnostics 完成了对 Mercy 的 Outreach Laboratory Services 业务的收购。 该交易旨在增加获得创新、高质量、负担得起的实验室服务的机会,以在整个中西部提供简化的患者护理。 收购完成后,Quest 将可以立即访问堪萨斯州、阿肯色州、密苏里州和俄克拉荷马州广泛的医疗保健专业人员网络。

实验室离心机行业概况

实验室离心机市场是分散的,由几家大型企业组成。 Andreas Hettich GmbH & Co. KG、Danaher Corporation(Beckman Coulter, Inc)、Eppendorf AG、Thermo Fisher Scientific Inc、HERMLE Labortechnik GmbH、KUBOTA Corporation、Sartorius AG、NuAire、Sigma Laborzentrifugen GmbH、Qiagen NV。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 调查假设和市场定义

- 本次调查的范围

第二章研究方法论

第 3 章执行摘要

第四章市场动态

- 市场概览

- 市场驱动因素

- 疾病流行率高

- 增加研发投资

- 技术进步

- 市场製约因素

- 设备成本高

- 设备寿命长

- 波特的五力分析

- 新进入者的威胁

- 买方/消费者议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

第 5 章市场细分

- 按产品类型

- 设备

- 微型离心机

- 超速离心机

- 多用途离心机

- 配饰

- 管

- 转子

- 离心桶

- 离心瓶

- 盘子

- 设备

- 按型号

- 落地式离心机

- 台式离心机

- 按使用目的

- 临床离心机

- 临床前离心机

- 通用离心机

- 通过使用

- 微生物学

- 纤维素组学

- 蛋白质组学

- 诊断

- 基因组学

- 地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 意大利

- 西班牙

- 其他欧洲

- 亚太地区

- 中国

- 日本

- 印度

- 澳大利亚

- 韩国

- 其他亚太地区

- 中东和非洲

- 海湾合作委员会

- 南非

- 其他中东和非洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美

第六章竞争格局

- 公司简介

- Andreas Hettich GmbH & Co. KG

- Danaher Corporation(Beckman Coulter, Inc.)

- Eppendorf AG

- Thermo Fisher Scientific Inc.

- HERMLE Labortechnik GmbH

- KUBOTA Corporation

- Sartorius AG

- NuAire

- Sigma Laborzentrifugen GmbH

- Qiagen NV

第七章市场机会与未来趋势

The laboratory centrifuge market is expected to register a CAGR of 5.0% over the forecast period.

The large patient pool of COVID-19, along with the possible shortage of laboratory centrifuges, has fuelled the growth of the laboratory centrifuges market. For instance, an article published by the NCBI in February 2022 reported that during the COVID-19 pandemic, the demand for centrifuges significantly increased to separate the components of saliva for coronavirus detection. However, in the current scenario, it is anticipated that the demand for laboratory centrifuges may stabilize compared to the beginning of the pandemic. Still, with the emergence of other SARS-CoV-2 strains, the demand for centrifuges may increase over the studied market period.

The factors driving the growth of the studied market are the high prevalence of diseases, increasing investment in R&D activity, and technological advancements. Centrifugation is mainly used in the diagnosis of certain infectious diseases like HIV. Centrifugation improves the detection of HIV-1 p24 antigen in plasma from children born to mothers infected with HIV-1. The rising cases of HIV reported globally are expected to increase the demand for centrifuges. For instance, in 2022, UNAIDS reported that globally, 38.4 million people were living with HIV in the year 2021 and 85% of these people get diagnosed themselves. Since the centrifuge is also employed in the separation of pathogens and parasites in biological fluids, so the high incidence of HIV may increase the demand for centrifuges for sample diagnosis and thus be expected to drive the growth of the studied market.

Moreover, the increasing investment in pharmaceutical and biotechnology R&D sectors is also contributing to the growth of the studied market. For instance, in May 2022, National Center for Health Statistics (NCHS) reported that globally USD 7,847 million were invested in biotechnology R&D in the year 2021 and is expected to reach USD 8,142 million by the end of 2022. The increase in R&D investment will lead to the development of new drugs, and the centrifuge machinery is suited for separating amino acids, benzoic acid, benzene, sulfur, calcium hypochloride, hexachlorocyclohexane, insulin, penicillin, starch, and various other intermediate products used in drug development. Thus, increasing investments in the biotechnology sector are leading to increasing R&D activity, which is increasing the demand for laboratory centrifuges, thereby driving the growth of the studied market.

In recent years, certain key players in the laboratory centrifuges market have launched centrifuges integrated with advanced rotors and other features. For instance, in April 2021, Eppendorf AG (Germany) launched its Multipurpose Centrifuge 5910 Ri, which offers advanced features to enhance and simplify centrifugation. This centrifuge is the successor to the popular Centrifuge 5910 R. It offers an innovative touchscreen interface, an optional connection to the new VisioNize Digital Lab Suite for remote monitoring, and the unique Universal rotor, which allows 50 mL conical tubes, plates, and 250 mL bottles without the need to change the rotor, rotor buckets, or adapters. Thus, the new centrifuge launches are incorporated with better technology, delivering better results and thereby driving the growth of the studied market.

While the market is expected to perform well, the high equipment cost and long equipment lifespans may slow down its development.

Laboratory Centrifuge Market Trends

Benchtop Centrifuges Segment By Model Type is Expected to Witness Significant Growth Over the Forecast Period.

Benchtop centrifuges are engineered with benchtops to operate the product safely in the closed chamber. These are simple to operate and are accommodated with the auto-lock system to quickly exchange rotors with one hand for application versatility and maximum throughput. The design of these centrifuge minimizes potential pinch points while opening and closing the lid, and a motorized lid latch provides extra protection. Benchtop centrifuge is expected to witness significant growth over the forecast period owing to its cost-effective, easy-to-use, and versatile nature for chromatography, sedimentation, and filtration of samples.

The ease and compatibility of benchtop centrifuges are driving the growth of this segment. For instance, an article published by the National Library of Medicine in July 2021 reported that benchtop centrifuges are preferred for laboratory purposes as they require limited space and are used in various applications. The article also reported the design, small samples, fast processing, and high RCF features make this centrifuge widely used and thus contribute to the growth of this segment.

Furthermore, new product launches are also fueling the growth of this segment. For instance, in June 2021, KUBOTA Corporation (Japan) launched the Benchtop Centrifuge USD 500T and Floor-Standing Refrigerated Centrifuge S500FR.

North America is Expected to Witness a Significant Growth Over the Forecast Period.

North America is expected to witness significant growth over the forecast period owing to the increasing prevalence of diseases and rising awareness about diagnosis and treatment. Also, product launches, mergers, partnerships, and acquisitions due to the presence of the key market players further fuel the growth of this market in the region.

The high incidence of tuberculosis (TB) reported in North American countries is increasing the use of centrifuges for diagnosing the samples. Optimal tuberculosis testing usually involves sputum centrifugation followed by broth culture, and thus the high number of TB cases is driving the growth of the market in the country. For instance, an article published by the NCBI in November 2022 reported that there were 77 active cases of tuberculosis diagnosed in Nunavut (Canada) in 2021, more than twice as many as the year before.

Similarly, in May 2022, the Government of Mexico reported that more than 90 thousand people were diagnosed with HIV during 2020-2021.

Moreover, technological developments and partnerships, mergers, acquisitions, and new product launches are driving the growth of this market in the region. For instance, in June 2021, Quest Diagnostics completed the acquisition of Mercy's Outreach Laboratory Services business. The transaction aims to increase access to innovative, high-quality, and affordable laboratory services to provide reasonable patient care throughout the Midwest. Upon completing the acquisition, Quest will gain immediate access to a broader network of healthcare professionals in Kansas, Arkansas, Missouri, and Oklahoma.

Laboratory Centrifuge Industry Overview

The laboratory centrifuge market is fragmented and consists of several major players. In terms of market share, some of the prominent market participants are Andreas Hettich GmbH & Co. KG, Danaher Corporation (Beckman Coulter, Inc.), Eppendorf AG, Thermo Fisher Scientific Inc., HERMLE Labortechnik GmbH, KUBOTA Corporation, Sartorius AG, NuAire, Sigma Laborzentrifugen GmbH, and Qiagen NV.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 High Prevalence of Diseases

- 4.2.2 Increasing Investment in R&D Activity

- 4.2.3 Technological Advancements

- 4.3 Market Restraints

- 4.3.1 High Equipment Cost

- 4.3.2 Long Equipment Lifespans

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Product Type

- 5.1.1 Equipment

- 5.1.1.1 Microcentrifuges

- 5.1.1.2 Ultracentrifuges

- 5.1.1.3 Multipurpose Centrifuges

- 5.1.2 Accessories

- 5.1.2.1 Tubes

- 5.1.2.2 Rotors

- 5.1.2.3 Centrifuge Buckets

- 5.1.2.4 Centrifuge Bottles

- 5.1.2.5 Plates

- 5.1.1 Equipment

- 5.2 By Model Type

- 5.2.1 Floor-Standing Centrifuges

- 5.2.2 Benchtop Centrifuges

- 5.3 By Intended Use

- 5.3.1 Clinical Centrifuges

- 5.3.2 Preclinical Centrifuges

- 5.3.3 General Purpose Centrifuges

- 5.4 By Application

- 5.4.1 Microbiology

- 5.4.2 Cellomics

- 5.4.3 Proteomics

- 5.4.4 Diagnostics

- 5.4.5 Genomics

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Andreas Hettich GmbH & Co. KG

- 6.1.2 Danaher Corporation (Beckman Coulter, Inc.)

- 6.1.3 Eppendorf AG

- 6.1.4 Thermo Fisher Scientific Inc.

- 6.1.5 HERMLE Labortechnik GmbH

- 6.1.6 KUBOTA Corporation

- 6.1.7 Sartorius AG

- 6.1.8 NuAire

- 6.1.9 Sigma Laborzentrifugen GmbH

- 6.1.10 Qiagen NV