|

市场调查报告书

商品编码

1273381

夹层玻璃市场 - 增长、趋势和预测 (2023-2028)Laminated Glass Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

在预测期内,夹层玻璃市场的复合年增长率预计将超过 5%。

2020年,COVID-19对市场产生了负面影响,但目前市场估计已达到疫情前水平,预计未来将稳步增长。

主要亮点

- 推动市场增长的主要因素是夹层玻璃在建筑领域越来越多地用于代替砖块,以及建筑物对安全、隔热和隔音的需求不断增加。

- 由于製造过程中涉及许多步骤,夹层玻璃的生产成本高于普通窗户,预计这会阻碍市场增长。

- 此外,人口向城市地区迁移的趋势预计将为夹层玻璃市场提供进一步的增长机会。

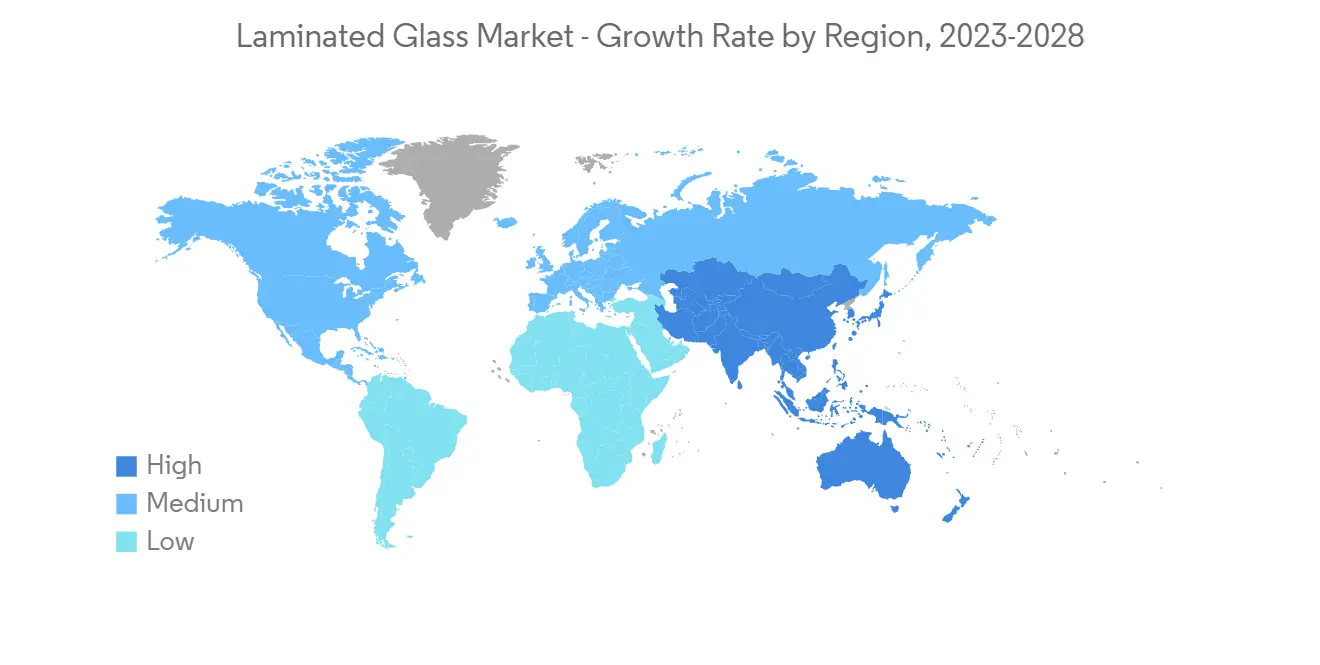

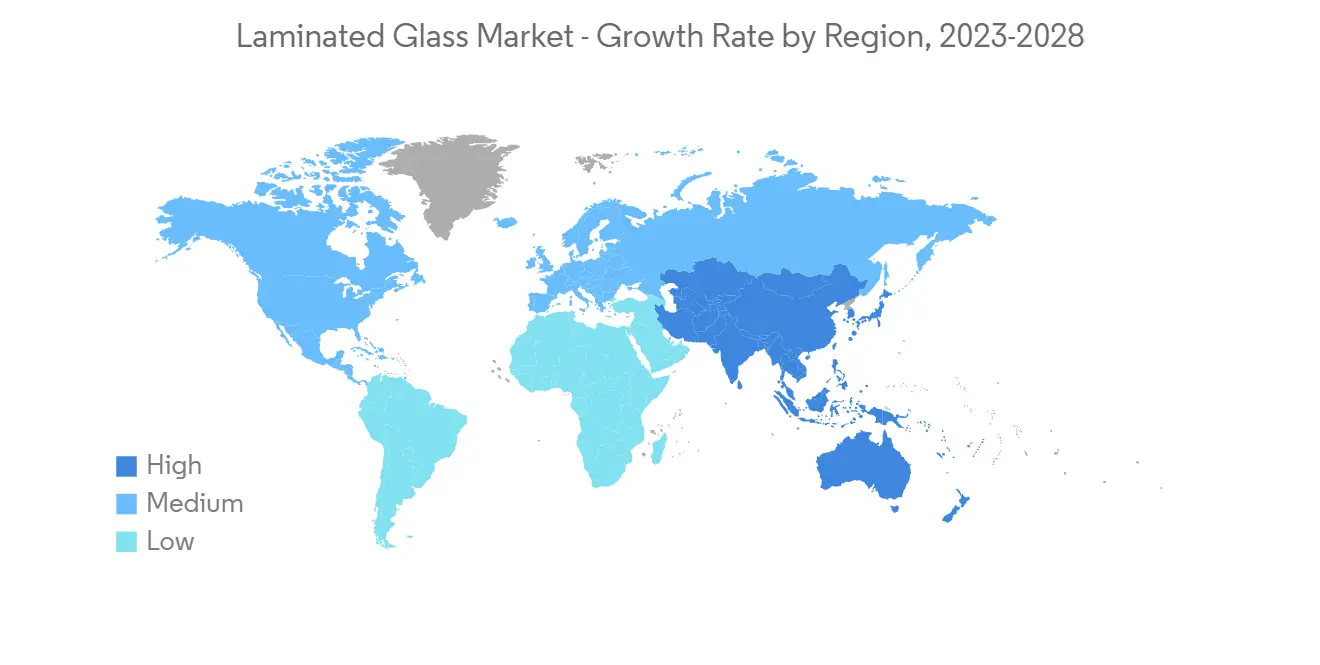

- 亚太地区的增长速度最快,因为中国、印度和日本等国家/地区越来越多。

夹层玻璃市场趋势

汽车行业的高需求

- 夹层玻璃的应用具有多种优势。 主要优点包括安全、隔音、防碎和防风雨。

- 汽车製造商长期以来一直在挡风玻璃上使用夹层玻璃,以提高吸音效果,并提高红外线和紫外线反射率。

- 豪华车使用夹层玻璃作为背光源,并使用嵌入式钨丝进行除霜。 侧面玻璃夹层始于奥迪 A8(1994 年)、梅赛德斯 S 级(1996 年)和沃尔沃 S80 等流行的乘用车车型。

- 因此,汽车行业对夹层玻璃的需求预计会随着汽车产量的增加而增加。

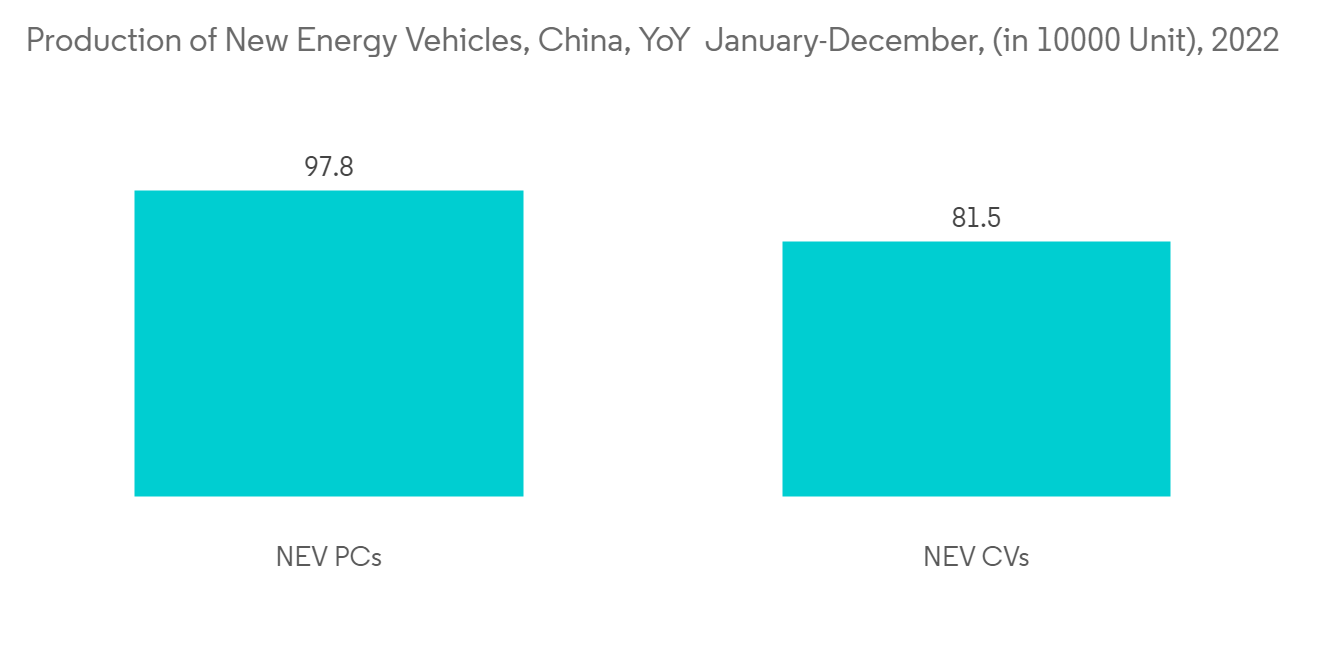

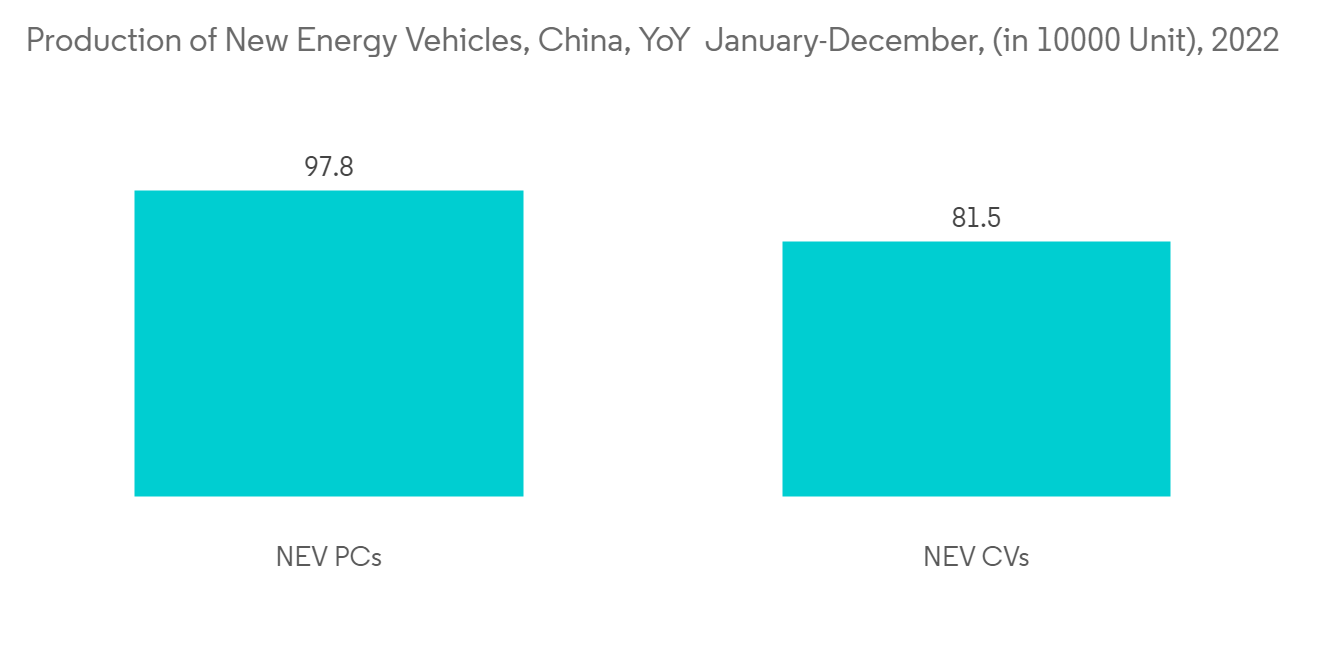

- 根据中国汽车工业协会的数据,2022 年 12 月,中国新能源乘用车产量同比增长 97.8%。

- 此外,2022 年 12 月,中国新能源商用车产量同比增长 81%。 因此,预计汽车市场的扩张将在预测期内提振夹层玻璃的需求。

- 因此,上述因素预计会在预测期内减缓市场增长。

预计亚太地区将主导市场。

- 由于中国高度发达的汽车工业和多年来对建筑业发展的持续投资,预计亚太地区将主导市场。

- 中国的汽车製造业是世界上最大的。 据中国汽车工业协会预测,2022年10月中国汽车出口33.7万辆,较9月增长12.3%,同比增长46%。

- 此外,根据印度汽车製造商协会发布的最新数据,该国的乘用车产量显着增加。 例如,2021-2022年乘用车产量将达到3,650,698辆,较2020-21年增长19%。

- 在经济快速增长、快速城市化和基础设施资本支出增加的背景下,亚太地区的建筑业在过去几年中持续稳定增长。 进军亚太地区的外国公司数量不断增加,对新办公楼、办公楼和生产基地的需求不断增加。

- 中国的大部分增长来自蓬勃发展的住宅和商业建筑行业。 中国正在鼓励和推进城镇化进程,到 2030 年城镇化率将达到 70%,支持市场的增长。

- 此外,中国的建筑业产出将在 2021 年达到顶峰,达到约 4.3 万亿美元。 因此,这些因素往往会增加该地区对夹层玻璃的需求。

预计所有这些因素都将对该地区未来几年的市场增长产生重大影响。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 调查先决条件

- 本次调查的范围

第二章研究方法论

第 3 章执行摘要

第四章市场动态

- 主持人

- 用结构玻璃代替砖块的应用增加

- 其他司机

- 约束因素

- 製造成本高

- 其他限制

- 工业价值链分析

- 波特的五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第 5 章市场细分(市场规模:基于金额)

- 类型

- 聚乙烯醇缩丁醛 (PVB)

- Sentry Glass Plus (SGP)

- 乙烯醋酸乙烯酯 (EVA)

- 其他类型

- 最终用户行业

- 汽车

- 建筑/施工

- 电子产品

- 其他最终用户行业

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 意大利

- 其他欧洲

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙特阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章竞争格局

- 併购、合资、合作、合同等。

- 市场份额 (%)** 分析/排名分析

- 主要公司采用的策略

- 公司简介

- AGC Inc.

- Asahi India Glass Limited

- CARDINAL GLASS INDUSTRIES, INC

- Central Glass Co., Ltd.

- Fuyao Group

- GSC GLASS LTD

- Guardian Industries Holdings

- Nippon Sheet Glass Co. Ltd.

- Saint-Gobain

- Stevenage Glass Company Ltd.

- Taiwan Glass Ind. Corp.

第七章市场机会与未来趋势

- 向城市地区迁移的人口

The laminated glass market is projected to register a CAGR of more than 5% during the forecast period.

In 2020, COVID-19 had a detrimental effect on the market.However, the market has now been estimated to have reached pre-pandemic levels and is expected to grow steadily in the future.

Key Highlights

- The rising application of laminated glass in replacing bricks in the construction sector and the growing need for safety and thermal and isolation properties in buildings are the key factors for the market's growth.

- Production of laminated glass is more expensive than regular windows because a lot of steps are involved in the manufacturing process, which is expected to hinder market growth.

- Also, the trend of people moving to cities is expected to give the laminated glass market more chances to grow.

- Asia-Pacific has the highest growth rate because countries like China, India, and Japan are getting more and more of what they want.

Laminated Glass Market Trends

High Demand from the Automotive Segment

- The application of laminated glass offers various benefits. Some of the key advantages are security, sound reduction, resistance to shattering, and protection from adverse weather conditions.

- Automobile manufacturers have been using laminated glass since long ago for windshields, enhancements in sound absorption, and infrared and UV radiation reflectiveness.

- High-end cars use laminated backlights with embedded tungsten wires for defrosting purposes. The use of laminated side glass started with popular passenger car models such as the Audi A8 (1994), followed by the Mercedes S class (1996), and the Volvo S80.

- Therefore, with rising automobile production, the demand for laminated glass in the automotive industry is expected to rise.

- According to the China Association of Automobile Manufacturing, the production of New Energy Passenger Vehicles in the country witnessed a year-on-year increase of 97.8% in December 2022.

- Further, the production of new-energy commercial vehicles in the country witnessed a year-on-year increase of 81% in December 2022. Thus, the expanding automotive market is expected to increase the demand for laminated glass during the forecast period.

- Hence, owing to the above-mentioned factors, the market is expected to witness a decline in growth during the forecast period.

The Asia-Pacific Region is Expected to Dominate the Market

- Asia-Pacific is expected to dominate the market due to the highly developed automotive sector in China and the continuous investments made in the region through the years to advance the construction sector.

- The Chinese automotive manufacturing industry is the largest in the world. According to the China Association of Automobile Manufacturing, in 2022, China's automobile exports grew 12.3 percent from September to 337,000 units in October, a 46 percent increase over the previous year.

- Furthermore, according to the latest data published by the Society of Indian Automobile Manufacturers, the country witnessed a significant increase in the production of passenger vehicles. For instance, the production of passenger vehicles reached 3,650,698 for the FY 2021-2022, representing an increase of 19% compared to the FY 2020-21.

- The Asia-Pacific construction industry has been growing steadily over the past few years, thanks to fast-growing economies, rapid urbanization, and more money being spent on infrastructure. Foreign companies are moving into the Asia-Pacific region more and more, which has led to a need for new offices, buildings, production houses, etc.

- Most of China's growth comes from the fast growth of the residential and commercial building industries. China is encouraging and going through a process of urbanization that will reach 70% by 2030. thus supporting market growth.

- Also, China's construction output peaked in 2021 at a value of about USD 4.3 trillion yuan. As a result, these factors tend to increase the demand for laminated glass in the region.

All of these things are expected to have a big effect on the growth of the market in the region over the next few years.

Laminated Glass Industry Overview

The laminated glass market is partially consolidated in nature. Some of the major players in the market include Saint-Gobain, AGC Inc., Guardian Industries Holdings, Nippon Sheet Glass Co., Ltd, and Fuyao Group, among others (in no particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Application in Replacement of Bricks with Structural Glass

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 High Cost of Manufacturing

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Polyvinyl Butyral (PVB)

- 5.1.2 Sentryglas Plus (SGP)

- 5.1.3 Ethylene-vinyl Acetate (EVA)

- 5.1.4 Other Types

- 5.2 End-user Industry

- 5.2.1 Automotive

- 5.2.2 Building and Construction

- 5.2.3 Electronics

- 5.2.4 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) **Analysis/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AGC Inc.

- 6.4.2 Asahi India Glass Limited

- 6.4.3 CARDINAL GLASS INDUSTRIES, INC

- 6.4.4 Central Glass Co., Ltd.

- 6.4.5 Fuyao Group

- 6.4.6 GSC GLASS LTD

- 6.4.7 Guardian Industries Holdings

- 6.4.8 Nippon Sheet Glass Co. Ltd.

- 6.4.9 Saint-Gobain

- 6.4.10 Stevenage Glass Company Ltd.

- 6.4.11 Taiwan Glass Ind. Corp.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Population Migration to Urban Areas

![夹层玻璃市场:趋势、机遇、竞争对手分析 [2023-2028]](/sample/img/cover/42/1284990.png)