|

市场调查报告书

商品编码

1273390

镁合金市场 - 增长、趋势和预测 (2023-2028)Magnesium Alloy Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

在预测期内,镁合金市场预计将保持在 4% 左右的复合年增长率。

市场受到 COVID-19 的负面影响。 政府当局为减缓病毒传播而采取的措施导致供应链中断和停工,对市场产生了不利影响。 因此,COVID-19爆发带来的这些影响和不确定性对镁合金市场造成了拖累。 然而,市场已经回升势头,预计将在未来几年復苏。

主要亮点

- 为减轻重量而增加的工程零件生产活动是市场增长的主要驱动力。

- 相反,与镁合金腐蚀和焊接相关的问题预计会阻碍市场增长。

- 镁合金在人造人体植入物和医疗设备中的增长机会可被视为市场增长的机会。

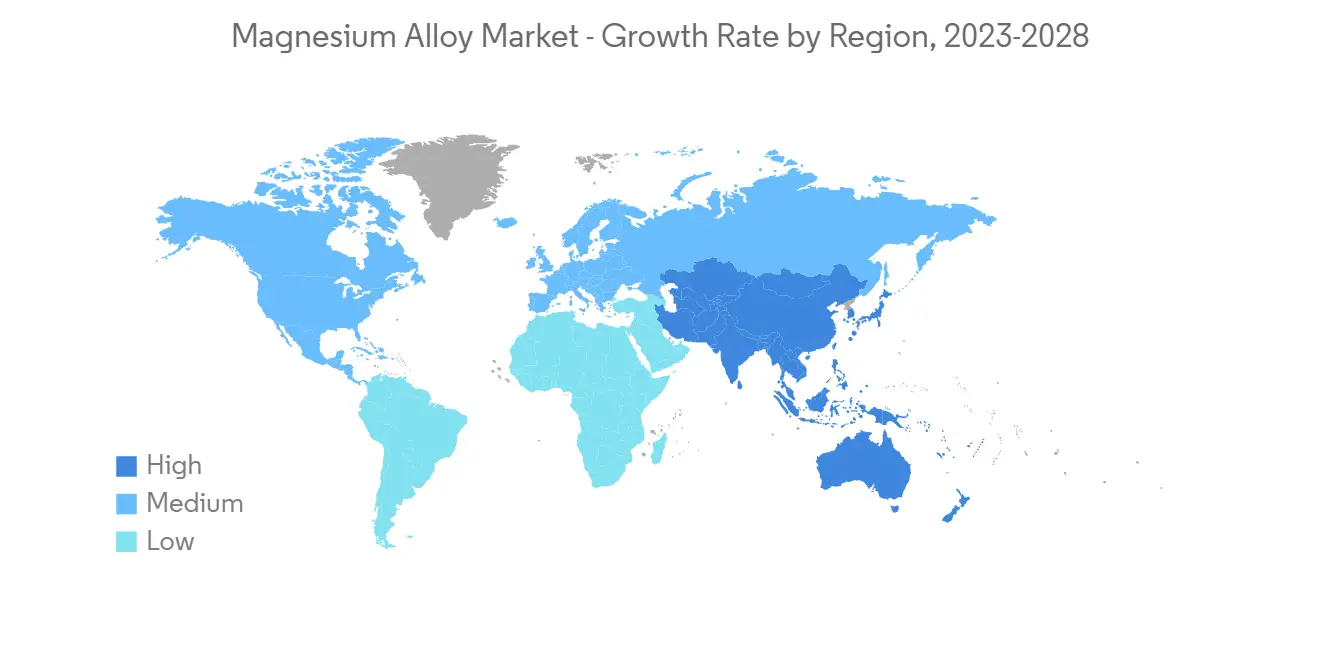

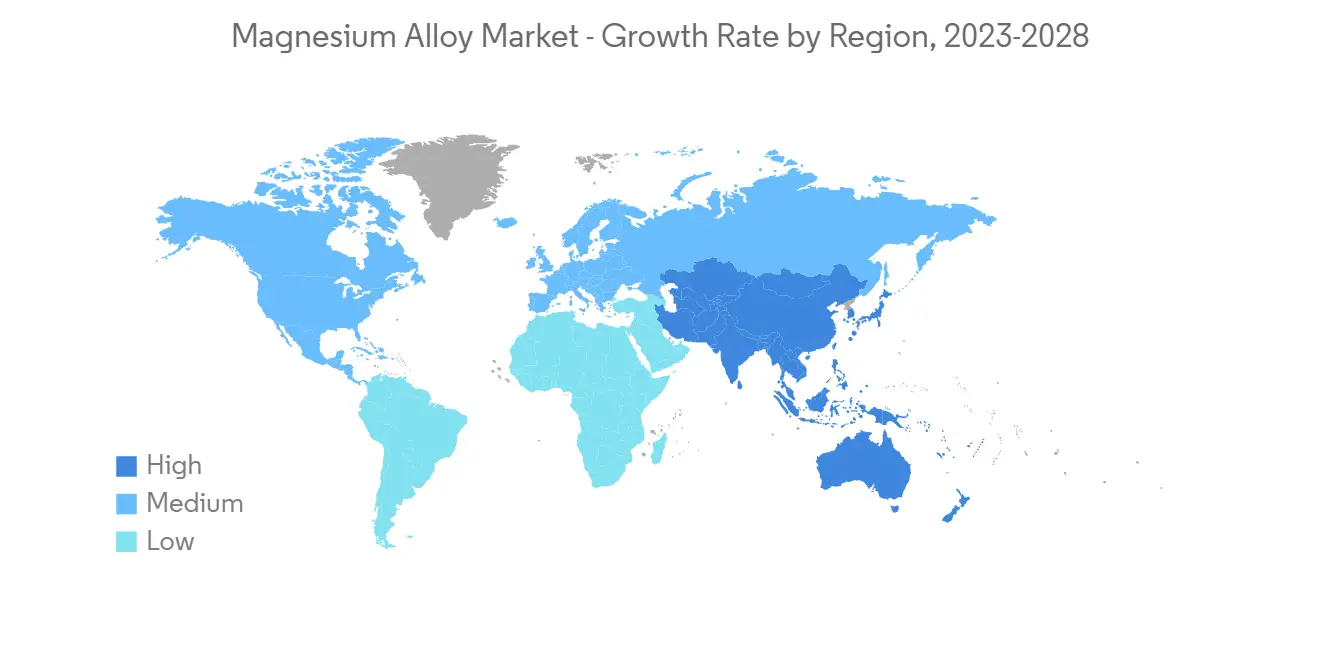

- 亚太地区在全球占据主导地位,其中最大的消费来自中国和印度。

镁合金市场趋势

汽车和航空航天行业的需求增加

- 镁合金的应用带来了各种优势。 它用于製造发动机缸体和车轮,尤其有助于减轻跑车的重量。

- 汽车製造商在生产过程中使用镁合金来提高车辆的燃油经济性和性能。 镁合金优选用于汽车发动机缸体,因为它们耐高温。

- 根据 OICA 的数据,2021 年全球汽车产量将达到 8010 万辆,比上一年的 7760 万辆增长 4%。

- 许多主要汽车製造商,包括奥迪、梅赛德斯-奔驰、福特、捷豹、菲亚特和起亚汽车公司,已经在其汽车中用镁合金取代了钢和铝。 2022 年,奥迪股份公司在全球交付了 1,212,275 辆汽车,销售额达到 469.8 亿美元。

- 镁合金具有最高的抗拉强度,从其他锻造合金中脱颖而出。 镁锌锆合金主要用于专业解决方案,而含钍合金则用于高温工作。

- 例如,ZK60 合金用于需要高强度和抗动态载荷的飞机部件。 Luxfer MEL Technologies 製造的 Elektron 43 镁合金已经过美国联邦航空管理局 (FAA) 广泛的可燃性测试,用于飞机座椅框架。

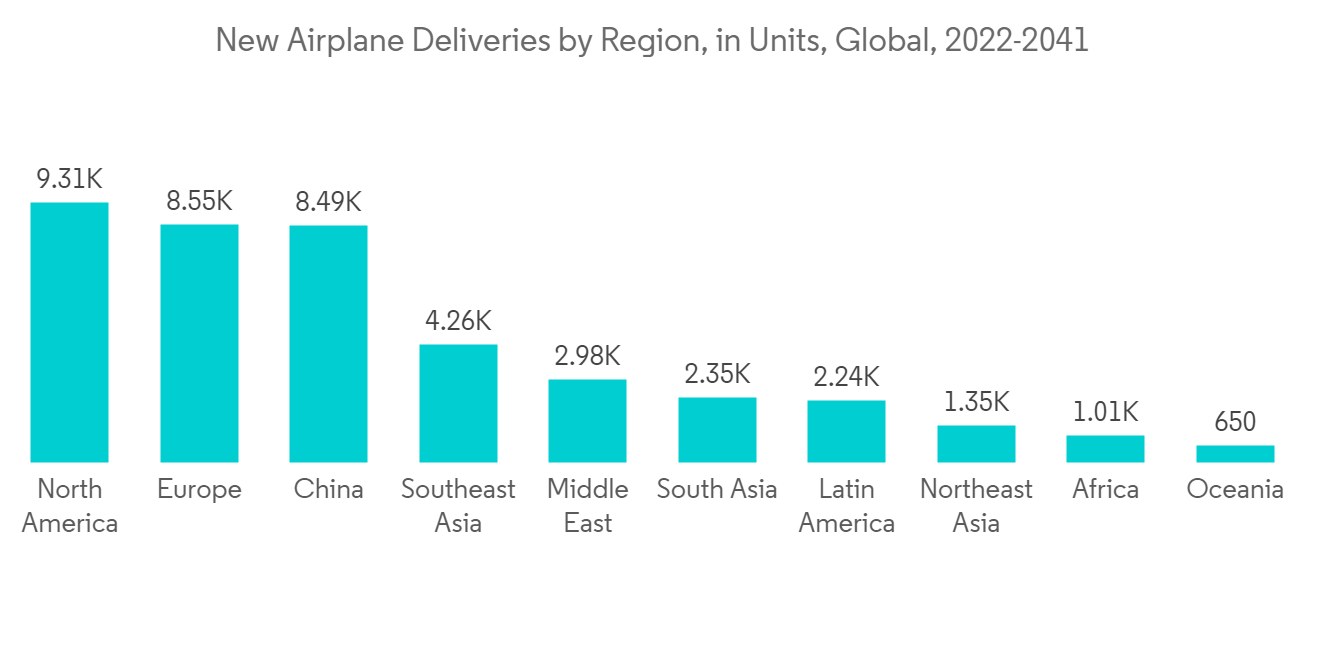

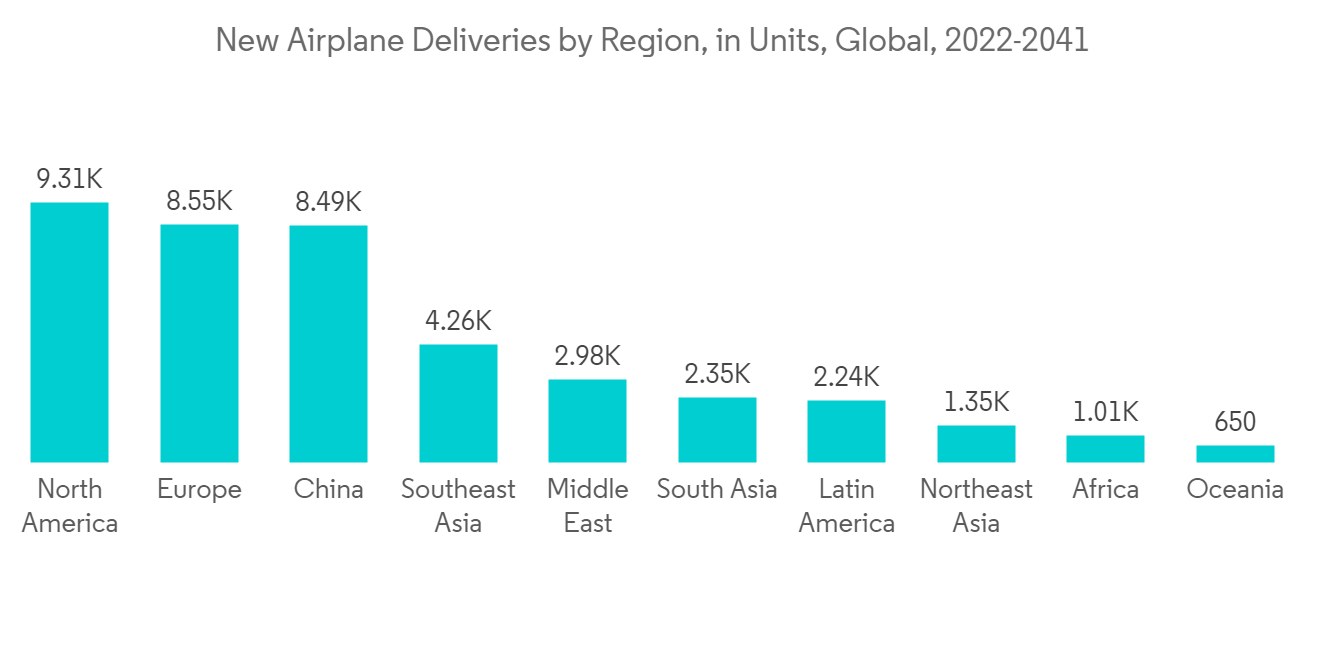

- 由于航空客运量和贸易业务航空运输的增加,对民用飞机的需求不断增长,这引发了镁合金的生产。 例如,在北美,根据波音商业展望2022-2041,到2041年将有9310架新飞机交付,占市场服务1.045万亿美元。

- 这些变动预计将在预测期内推动对镁合金的需求。

亚太地区主导市场

- 由于中国高度发达的汽车工业和最近开创性的航空航天零部件生产,预计亚太地区将主导全球市场。 此外,中国大陆、台湾和韩国拥有完善的电子产品生产基地,包括相机、手机、笔记本电脑和便携式媒体设备的製造。

- 根据 JEITA(日本电子资讯技术产业协会)的数据,到 2022 年 11 月,电子行业的总产值将达到 70.9834 亿美元。 2022 年 12 月,日本电子产品出口额达 83.9545 亿美元。

- 在印度,电子市场的需求不断增长,市场规模也在迅速扩大。 2022 年 12 月,印度电子产品出口收入为 166.7 亿美元,而 2021 年同月为 109.9 亿美元。 印度和中国电子和消费电子市场的增长可能会推动亚太市场的进一步增长。

- 根据美国国际贸易委员会的数据,中国是市场领导者,拥有数量庞大的镁合金製造业,因此向欧洲和北美出口了大量镁合金。

- 根据中国出口数据,前三大镁合金出口国是中国,出货量为 8,955 件,其次是德国,出货量为 2,844 件,韩国位居第三,出货量为 2,724 件。

- 2023年2月,重庆万盛经济开发区投资1.44亿美元的高性能镁合金生产基地和镁铝合金研发中心项目开工建设。

- 此外,中国、印度和其他东盟国家的各种製造业的增长预计将支持未来对镁合金的需求。

镁合金行业概况

镁合金市场部分整合,少数主要参与者控制着很大一部分。 主要公司包括海镁特工业有限公司、Advanced Magnesium Alloys Corporation (AMACOR)、US Magnesium LLC 和 Smiths Advanced Metals。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第 1 章介绍

- 调查先决条件

- 本次调查的范围

第 2 章研究方法论

第 3 章执行摘要

第 4 章市场动态

- 促进因素

- 减肥需求增加

- 对电子设备铸件的需求增加

- 抑制因素

- 与镁合金的腐蚀和焊接有关的问题

- 与替代品竞争

- 工业价值链分析

- 波特的五力分析

- 供应商的议价能力

- 消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第 5 章市场细分(市场规模:基于数量)

- 按类型

- 铸造合金

- 锻造合金

- 按最终用户行业

- 航空航天

- 汽车

- 医疗

- 电子产品

- 其他最终用户行业

- 区域资讯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 意大利

- 法国

- 其他欧洲

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙特阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第 6 章竞争格局

- 併购、合资、合作、合同等。

- 市场份额 (%)**/排名分析

- 主要公司采用的策略

- 公司简介

- Advanced Magnesium Alloys Corporation(AMACOR)

- Canada Magnesium

- Dead Sea Magnesium Ltd

- Hydro Magnesium

- Ka Shui International Holdings Ltd

- MAGONTEC GROUP

- m-tec powder

- Nippon Kinzoku

- Rima Group

- Shanghai Regal Magnesium Limited Company

- Smiths Advanced Metals

- US Magnesium LLC

第 7 章市场机会与未来趋势

- 镁合金在人工关节和医疗器械中的普及

The magnesium alloy market is expected to register a CAGR of approximately 4% during the forecast period.

The market was negatively impacted due to COVID-19. Due to supply chain disruptions, work stoppages because of the measures imposed by governmental authorities to slow the virus spread negatively impacted the market. Hence, such impact and uncertainties due to the COVID-19 outbreak acted as a stumbling block for the magnesium alloy market. However, the market gained momentum and is expected to recover in the coming years.

Key Highlights

- The increasing production activities of engineering components for weight reduction is the major driving factor for the market growth.

- Conversely, issues associated with the corrosion and welding of magnesium alloys are expected to hinder the market growth.

- The rise in popularity of magnesium alloys in artificial human implants and medical devices is an opportunity for the market's growth.

- Asia-Pacific dominated the globe, with the most significant consumption from China and India.

Magnesium Alloy Market Trends

Increasing Demand from the Automotive and Aerospace Manufacturing Industries

- Magnesium alloy applications offer various benefits. They are employed in the engine block and wheel production, which, in turn, supports weight reduction, especially for sports cars.

- Automotive manufacturers use magnesium alloys in production to increase automobiles' fuel efficiency and performance. Magnesium alloys are resistant to higher temperatures, making them the preferred choice in the engine blocks of automobiles.

- According to the OICA, in 2021, global vehicle production reached 80.1 million units, an increase of 4% from the previous year's production of 77.6 million units.

- Many large automotive manufacturers, like Audi, Mercedes-Benz, Ford, Jaguar, Fiat, and Kia Motors Corporation already replaced steel and aluminum with magnesium alloys in their vehicles. In the fiscal year 2022, AUDI AG delivered 1,212,275 vehicles worldwide and earned a revenue of USD 46.98 billion.

- Magnesium alloy exhibits the highest tensile strength, distinguishing it from other wrought alloys. Magnesium-Zinc-Zirconium alloys are mainly used for specialist solutions, whereas thorium-containing alloys are used for work at elevated temperatures.

- For instance, ZK60 alloy is used for aircraft parts that require high strength and resistance to dynamic loads. Elektron 43 magnesium alloy manufactured by Luxfer MEL Technologies underwent extensive flammability testing by the Federal Aviation Administration (FAA) to be used in the aircraft seat frames.

- The growing demand for commercial aircraft due to increasing air passengers and air transport for trade operations triggered the production of magnesium alloys. For instance, in North America, according to the Boeing Commercial Outlook 2022-2041, the total deliveries of new airplanes accounted for 9,310 units by 2041, with a market service value of USD 1,045 billion.

- These developments are expected to boost the demand for magnesium alloy over the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific is expected to dominate the global market, owing to China's highly developed automotive sector and the developing production of aerospace components in recent years. China, Taiwan, and South Korea include substantial electronic production bases for manufacturing cameras, cell phones, laptops, and portable media devices.

- According to JEITA (Japan Electronics and Information Technology Industries Association), in November 2022, the total production of the electronics industry reached USD 7,098.34 million. In December 2022, Japan exported electronics worth USD 8,395.45 million.

- In India, the electronics market witnessed a growth in demand, with market size increasing rapidly. India's electronic goods exports fetched USD 16.67 billion in December 2022, compared to USD 10.99 billion in the same month of 2021. The growing electronics and appliances market in India and China may push further Asian-Pacific market growth.

- According to the US International Trade Commission, China leads the market and exports many magnesium alloys to Europe and North America because of the country's vast number of magnesium alloy manufacturing industries.

- According to China Export Data, the top 3 exporters of Magnesium alloy are China with 8,955 shipments, followed by Germany with 2,844, and South Korea at the 3rd spot with 2,724 shipments.

- In February 2023, Chongqing Wansheng Economic Development Zone started the construction of a high-performance Mg-alloy production base and Mg-Al alloy R&D center projects with an investment of USD 144 million.

- Moreover, the growth of various manufacturing industries in China, India, and other ASEAN countries is expected to support the demand for magnesium alloys in the future.

Magnesium Alloy Industry Overview

The magnesium alloy market is partially consolidated, with a few major players dominating a significant portion. Some major companies are Magontec Industry Ltd, Advanced Magnesium Alloys Corporation (AMACOR), US Magnesium LLC, and Smiths Advanced Metals.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Need for Weight Reduction

- 4.1.2 Increasing Demand for Castings in Electronic Applications

- 4.2 Restraints

- 4.2.1 Issues Associated with the Corrosion and Welding of Magnesium Alloys

- 4.2.2 Competition from Substitutes

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 By Type

- 5.1.1 Cast Alloys

- 5.1.2 Wrought Alloys

- 5.2 By End-user Industry

- 5.2.1 Aerospace

- 5.2.2 Automotive

- 5.2.3 Medical

- 5.2.4 Electronics

- 5.2.5 Other End-user Industries

- 5.3 By Geography

- 5.3.1 Asia Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) ** /Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Advanced Magnesium Alloys Corporation (AMACOR)

- 6.4.2 Canada Magnesium

- 6.4.3 Dead Sea Magnesium Ltd

- 6.4.4 Hydro Magnesium

- 6.4.5 Ka Shui International Holdings Ltd

- 6.4.6 MAGONTEC GROUP

- 6.4.7 m-tec powder

- 6.4.8 Nippon Kinzoku

- 6.4.9 Rima Group

- 6.4.10 Shanghai Regal Magnesium Limited Company

- 6.4.11 Smiths Advanced Metals

- 6.4.12 US Magnesium LLC

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rise in Popularity of Magnesium Alloys in Artificial Human Implants and Medical Devices