|

市场调查报告书

商品编码

1273396

医疗设备维护市场 - 增长、趋势、COVID-19 影响和预测 (2023-2028)Medical Equipment Maintenance Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

未来几年,医疗设备维修市场预计将以 9.1% 的复合年增长率增长。

大流行的爆发对市场产生了影响。 由于需要关键医疗设备来应对大流行危机,对医疗设备维护产品和服务的需求猛增。 用于诊断和治疗 COVID-19 的各种医疗设备对市场增长产生了积极影响。 在 COVID-19 期间,医院也难以获得维修医疗设备的服务信息。 因此,为应对这种情况,市场参与者采取了一定的战略举措,以在大流行期间保持其市场地位。 例如,2021 年 3 月,iFixit 推出了呼吸机和其他医疗设备的大型维修数据库,以帮助医院在 COVID-19 期间维护和维修关键设备。 因此,市场在大流行期间表现出温和的增长。 然而,随着市场发展的进展、关闭的解除、限制的放鬆以及 COVID-19 病例的减少,市场开始获得动力,预计在预测期内将保持上升趋势。

专注于医疗设备的预防性维护以及医疗保健提供商和政府增加对基础设施的投资是推动市场增长的主要因素。 此外,医疗设备技术的快速进步以及对持续培训和维护需求的增加也刺激了市场增长。 例如,2022 年 7 月,佳能医疗在 ECR2022 上宣布了 Vantage Fortian。 新的 MRI 系统具有创新的工作流程解决方案、图像增强和加速扫描技术,它们共同有助于减少 MRI 程序所需的时间。

同样,2021 年 10 月,阿根廷布宜诺斯艾利斯的 Espaol La Plata 医院购买了模拟 DR 100e 系统,以补充 Agfa 的解决方案组合。 这将使医院能够显着减少床边诊断的数量。 随着主要製造商推出的医疗设备的增加,医疗设备维护服务的需求预计将上升,预计在预测期内市场将出现显着增长。

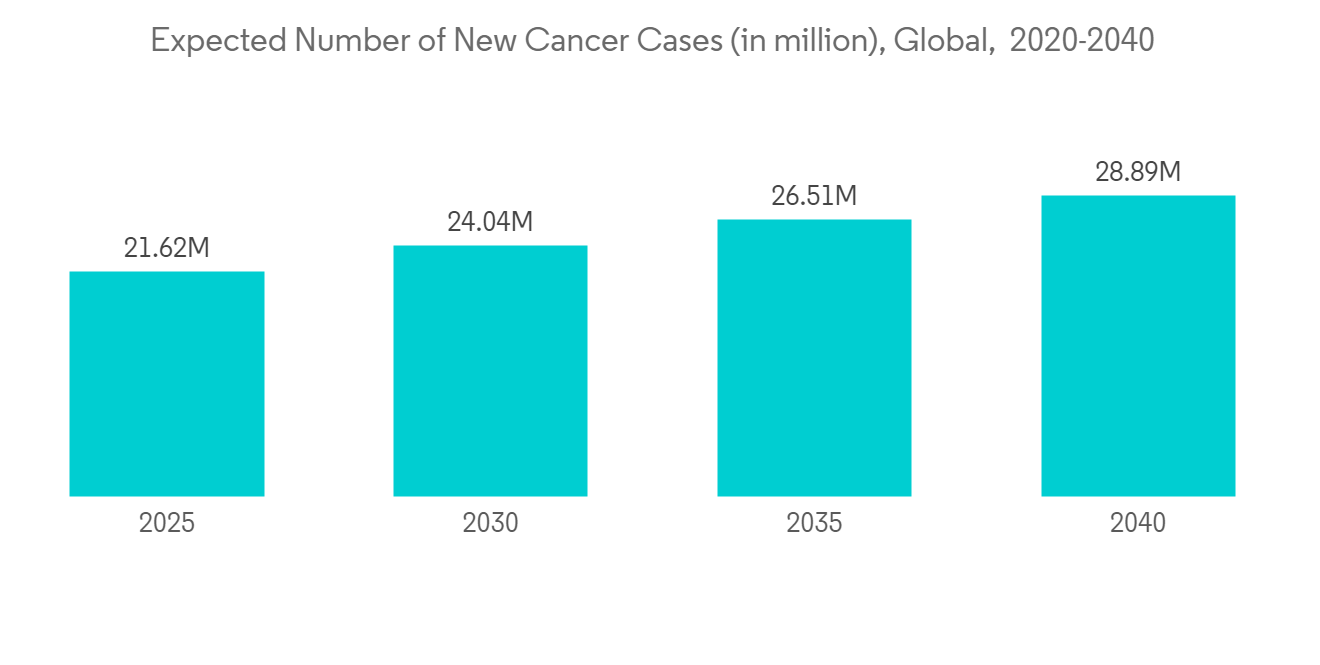

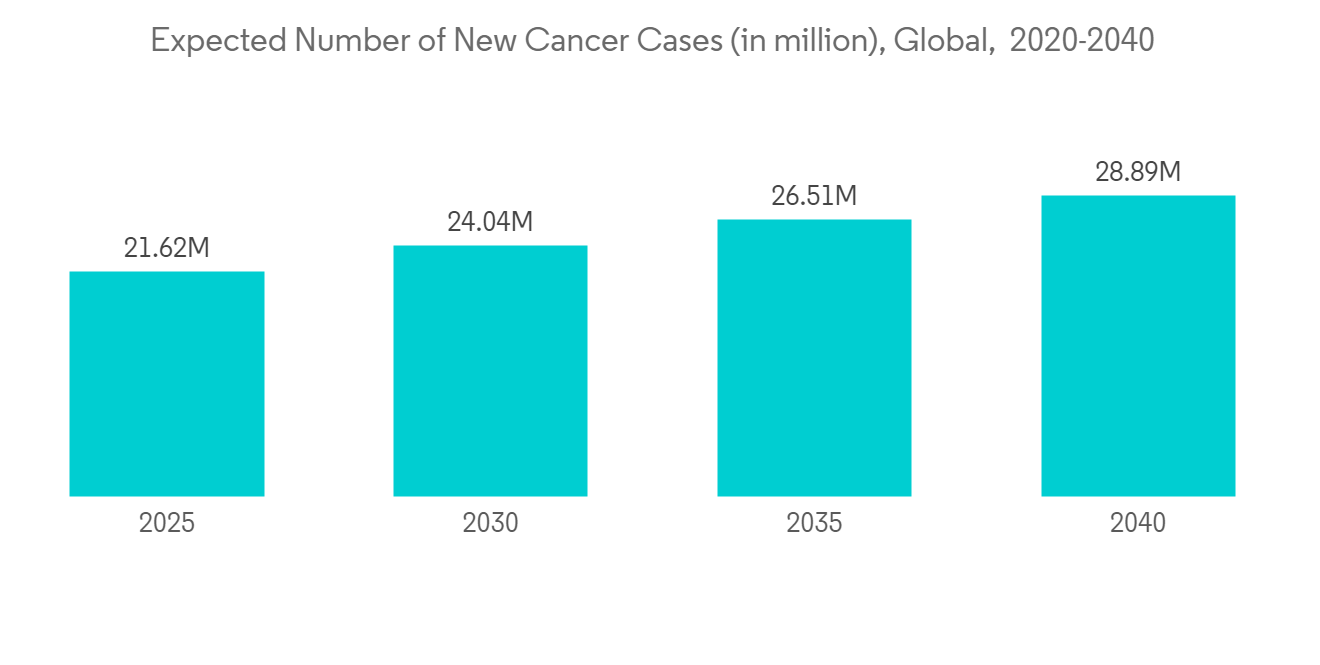

此外,慢性病和生活方式相关疾病患者数量的增加也在推动市场的增长。 例如,根据 2021 年 9 月更新的 CDC 数据,超过三分之二的新发癌症是在 60 岁以上的成年人中诊断出来的。 此外,随着活到老龄的成年人数量不断增加,新发癌症患者也将增加,预计到2050年人数将达到220万以上,其中75岁及以上的成年人增长率最高。报导。 在这种情况下,医疗设备是必备品之一□□,因此医疗设备使用的增加可能会增加对医疗设备维护服务的需求,从而推动预测期内的市场增长。

但是,医疗设备维护的高成本预计会阻碍预测期内的市场增长。

医疗设备维修市场趋势

诊断影像设备领域预计在预测期内将显着增长

所有成像方式,包括计算机断层扫描 (CT) 和核医学成像,都广泛用于各种疾病的诊断。 它还主要用于心脏病、哮喘、癌症和糖尿病等慢性疾病。 因此,它既可用于影像诊断,也可用于影像治疗,在医学领域有着广泛的应用。

不断增长的全球老年人口、不断增加的慢性病和生活方式病是推动这一细分市场增长的主要因素。 例如,根据 IDF 在 2021 年发布的数据,约有 5.37 亿成年人患有糖尿病,预计到 2030 年将有约 6.43 亿人患有糖尿病。 另据报导,每 4 名成年人中就有 3 名患有糖尿病,大约每 2 名成年人中就有 1 名(2.4 亿人)患有未确诊的糖尿病。 同样,根据疾病预防控制中心 2021 年发布的一份报告,大约 5.0% 的成年人被诊断出患有肺气肿、慢性支气管炎和慢性阻塞性肺病 (COPD)。 此外,根据 2022 年 1 月发布的一份 NCBI 报告,全球 40 岁以上人群的 COPD 患病率约为 10.1%。 此外,根据英国NHS 2021年公布的数据,英国约有117万人被确诊为COPD,约占英国总人口的1.9%。 诊断成像设备可用于慢性疾病的早期诊断。

因此,由于上述因素,预计该细分市场在预测期内将出现大幅增长。

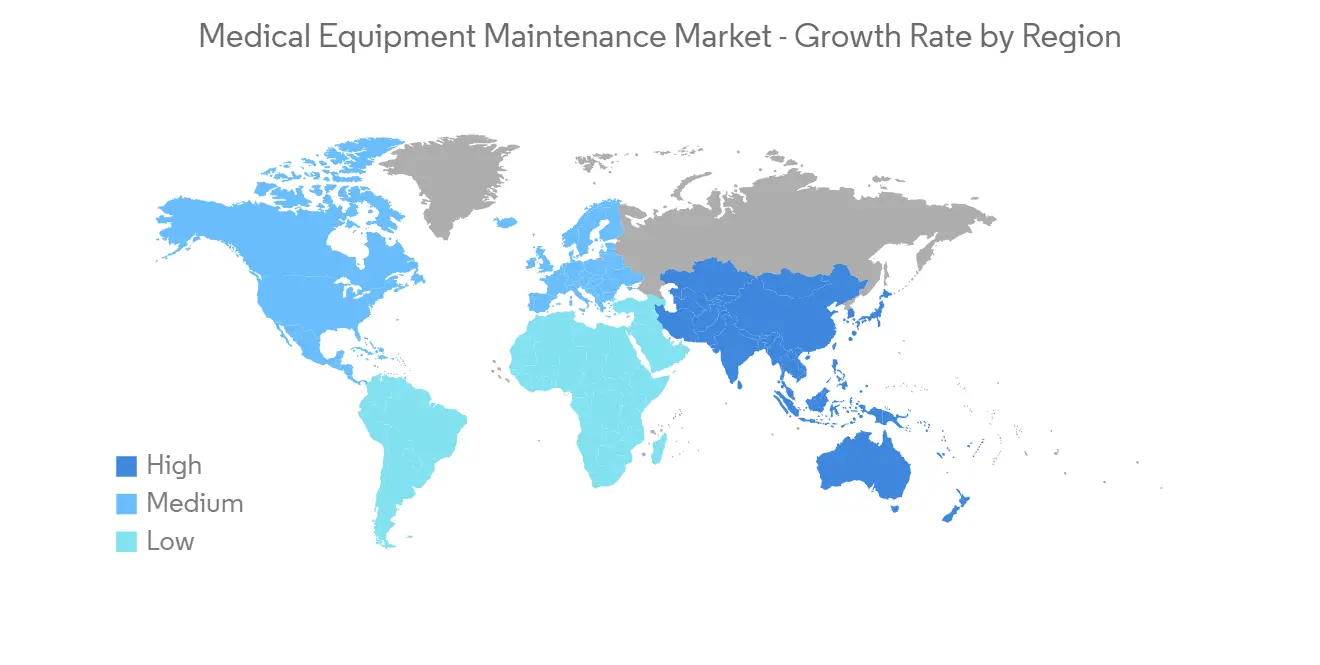

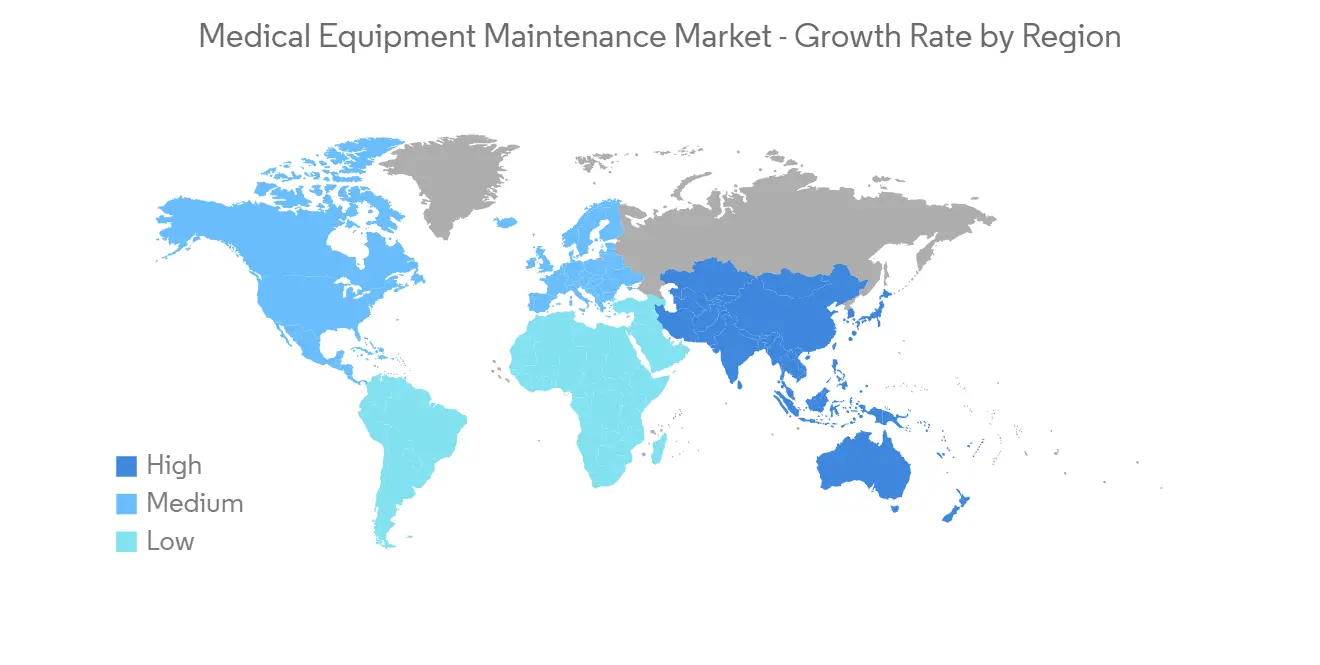

北美预计在预测期内将显着增长。

在预测期内,预计北美将主导整个医疗设备维护市场。 这种增长是由于慢性病不断增加和对医疗设备的需求不断增长等因素造成的。 例如,根据心臟生命基金会 2021 年的一份报告,每年有超过 140 万加拿大人因心力衰竭和心血管疾病住院。 同样,美国心臟协会 2022 年的数据发现,墨西哥 56.1% 的成年人的 LDL-C 或坏胆固醇水平较高,被认为是心血管疾病的主要危险因素。 因此,预计各种疾病患病率的增加将增加对医疗设备的需求,这可能会推动北美地区医疗设备维护服务的使用。

主要产品发布、市场参与者和製造商的集中存在、主要参与者之间的收购和合作以及美国慢性病病例数量的增加是推动该国市场增长的一些因素。 例如,根据美国疾病预防控制中心2021年的数据,美国每年有80.5万人心脏病发作,其中60.5万人是由于第一次心脏病发作,20万人是由于之前的心脏病发作引起的。 同样,根据美国心臟协会的 2021 年期刊,到 2035 年,估计有超过 1.3 亿美国成年人患有某种形式的心脏病。 因此,此类案例证明了该国在预测期内市场的显着增长。

由于这些原因,北美市场有望扩大。

医疗设备维修行业概况

由于原始设备製造商和第三方服务提供商的存在,医疗设备维护市场是分散的。 市场参与者正专注于简化服务准入和区域扩张以增加市场份额。 市场上的主要参与者包括 Siemens AG、Koninklijke Philips NV、Stryker Corporation、Canon Inc.、GE Healthcare 等。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 研究假设和市场定义

- 本次调查的范围

第二章研究方法论

第 3 章执行摘要

第四章市场动态

- 市场概览

- 市场驱动力

- 专注于医疗设备的预防性维护

- 医疗保健提供者和政府增加了对基础设施的投资

- 市场製约因素

- 医疗设备维护成本高

- 波特的五力分析

- 新进入者的威胁

- 买方/消费者议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

- COVID-19 对市场的影响

第 5 章市场细分

- 按产品/服务

- 产品

- 诊断成像设备

- 内窥镜设备

- 手术设备

- 其他产品

- 服务详情

- 预防性维护

- 维护和检查

- 运营和维护

- 产品

- 按服务提供商

- 独立服务机构

- OEM 製造商

- 按地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 意大利

- 西班牙

- 其他欧洲

- 亚太地区

- 中国

- 日本

- 印度

- 澳大利亚

- 韩国

- 其他亚太地区

- 中东和非洲

- 海湾合作委员会

- 南非

- 其他中东和非洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美

第6章竞争格局

- 公司简介

- Alliance Medical Group

- Alpha Source Inc.

- Althea Group

- Aramark

- Canon Inc.

- GE Healthcare

- Koninklijke Philips NV

- Shimadzu Corporation

- Siemens AG

- Stryker Corporation

第7章 市场机会与将来动向

Over the next few years, the market for maintaining medical equipment is expected to register a CAGR of 9.1%.

The outbreak of the pandemic impacted the market. The need for critical medical equipment to tackle the pandemic crisis has sparked a surge in demand for medical equipment maintenance products and services. The broad range of medical devices used in the diagnosis and treatment of COVID-19 positively impacted market growth. In addition, hospitals were having trouble getting service information to fix medical equipment during COVID-19. Thus, to combat such situations, market players adopted certain strategic initiatives to sustain their positions in the market during the pandemic. For instance, in March 2021, iFixit launched a massive repair database for ventilators and other medical devices to help hospitals maintain and fix crucial equipment during COVID-19. Therefore, the market witnessed moderate growth during the pandemic. However, with the positive developments, upliftments of lockdowns, ease of restrictions, and declining cases of COVID-19, the market started to gain momentum and is expected to maintain the upward trend over the forecast period.

The focus on preventive maintenance of medical equipment and rising investments by healthcare providers and governments in infrastructure are the major factors driving market growth. Furthermore, rapid technological advancements in medical equipment and the increased need for continuous training and maintenance are also stimulating market growth. For instance, in July 2022, Canon Medical launched Vantage Fortian at ECR 2022. The new MRI system features innovative workflow solutions, image enhancement, and accelerated scan technology, which together contribute to reducing the time required for MRI procedures.

Similarly, in October 2021, Hospital Espaol La Plata in Buenos Aires, Argentina, acquired an analog DR 100e system to complement its portfolio of Agfa solutions. With this, the hospital can significantly reduce the diagnostic volume of bedside exams. As a result of the increasing number of medical devices launched by key players, the demand for medical equipment maintenance services is expected to rise; thus, significant market growth is anticipated over the forecast period.

In addition, increasing cases of chronic diseases and lifestyle-related disorders are also propelling market growth. For instance, according to CDC data updated in September 2021, more than two-thirds of all new cancers were diagnosed among adults aged 60 and older. It was also reported that as the number of adults living to older ages continues to increase, there will be more new cancer cases, and the number is expected to reach more than 2.2 million by 2050, with the largest percentage increase among adults who are 75 years old or older. In such cases, medical equipment is one of the essential requirements; therefore, increasing use of medical equipment may surge the demand for medical equipment maintenance services, thereby propelling market growth over the forecast period.

However, the high cost of medical equipment maintenance is expected to hinder market growth over the forecast period.

Medical Equipment Maintenance Market Trends

The Imaging Equipment Segment is Expected to Witness Significant Growth Over the Forecast Period

The majority of healthcare professionals favor imaging equipment because it quickly provides a primary diagnosis for all diseases.All the imaging modalities, including computed tomography and nuclear imaging, are extensively used for the diagnosis of various diseases. They are also majorly used in chronic diseases, which include health conditions such as heart disease, asthma, cancer, and diabetes. Therefore, this equipment is being utilized as both a diagnostic imaging and therapeutic modality and has a wide range of applications in the medical field.

The rising geriatric population and increasing rates of chronic diseases and lifestyle-related diseases across the globe are the major factors propelling the segment's growth. For instance, according to the data published by the IDF in 2021, around 537.0 million adults were living with diabetes, and by 2030, around 643.0 million people were expected to live with diabetes. It was also reported that 3 out of 4 adults live with diabetes, and around 1 out of 2 adults (240.0 million) are living with undiagnosed diabetes. Similarly, according to the report published by the CDC in 2021, around 5.0% of adults have been diagnosed with emphysema, chronic bronchitis, or chronic obstructive pulmonary disease (COPD). Furthermore, according to the NCBI report published in January 2022, the global prevalence of COPD is around 10.1% in people aged 40 or older. Furthermore, according to the data published by the NHS U.K. for the year 2021, around 1.17 million people in England were diagnosed with COPD, which constitutes around 1.9% of the population of England. The imaging equipment is helpful in the early diagnosis of chronic diseases.

Therefore, owing to the abovementioned factors, the segment is anticipated to witness considerable growth over the forecast period.

North America is Expected to Witness Considerable Growth Over the Forecast Period

North America is expected to dominate the overall medical equipment maintenance market over the forecast period. The growth is due to factors such as increasing chronic disorders and the growing demand for medical devices. For instance, according to the HeartLife Foundation 2021 report, more than 1.4 million Canadians were admitted to hospitals with the illness each year as a result of heart failure or cardiovascular disease. Similarly, as per the data from the American Heart Association for 2022, in Mexico, 56.1% of adults have high levels of LDL-C, or bad cholesterol, which is thought to be the primary risk factor for cardiovascular disease. Therefore, owing to the increasing prevalence of various diseases, the demand for medical equipment is anticipated to increase, which in turn may propel the use of medical equipment maintenance services in the North American region.

Key product launches, a high concentration of market players or manufacturers' presence, acquisitions and partnerships among major players, and increasing cases of chronic diseases in the United States are some of the factors driving the growth of the market in the country. For instance, according to the 2021 data from the CDC, every year, 805,000 people in the United States have a heart attack; 605,000 of these result in a first-time heart attack, while 200,000 are caused by previous heart attacks. Similarly, as stated by the American Heart Association 2021 journal, it is estimated that by the year 2035, more than 130.0 million adults in the United States will have some type of heart disease. Therefore, such instances indicate considerable market growth in the country over the forecast period.

Therefore, owing to the aforesaid factors, the growth of the studied market is anticipated in the North American region.

Medical Equipment Maintenance Industry Overview

The medical equipment maintenance market is fragmented with the presence of original equipment manufacturers and third-party service providers. Market players are focusing on simplifying service access and expanding regionally to increase their market shares. The key players operating in the market include Siemens AG, Koninklijke Philips NV, Stryker Corporation, Canon Inc., and GE Healthcare, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Defination

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Focus on Preventive Maintenance of Medical Equipment

- 4.2.2 Rising Investments of Healthcare Providers and Governments in Infrastructure

- 4.3 Market Restraints

- 4.3.1 High Cost of Medical Equipment Maintenance

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION (Market Size by Value - USD Million)

- 5.1 By Products and Services

- 5.1.1 Products

- 5.1.1.1 Imaging Equipment

- 5.1.1.2 Endoscopic Devices

- 5.1.1.3 Surgical Equipment

- 5.1.1.4 Other Products

- 5.1.2 Services

- 5.1.2.1 Preventive Maintenance

- 5.1.2.2 Corrective Maintenance

- 5.1.2.3 Operational Maintenance

- 5.1.1 Products

- 5.2 By Service Providers

- 5.2.1 Independent Service Organizations

- 5.2.2 Original Equipment Manufacturers

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle-East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle-East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Alliance Medical Group

- 6.1.2 Alpha Source Inc.

- 6.1.3 Althea Group

- 6.1.4 Aramark

- 6.1.5 Canon Inc.

- 6.1.6 GE Healthcare

- 6.1.7 Koninklijke Philips NV

- 6.1.8 Shimadzu Corporation

- 6.1.9 Siemens AG

- 6.1.10 Stryker Corporation