|

市场调查报告书

商品编码

1273400

二氯甲烷市场 - COVID-19 的增长、趋势、影响和预测 (2023-2028)Methylene Chloride Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

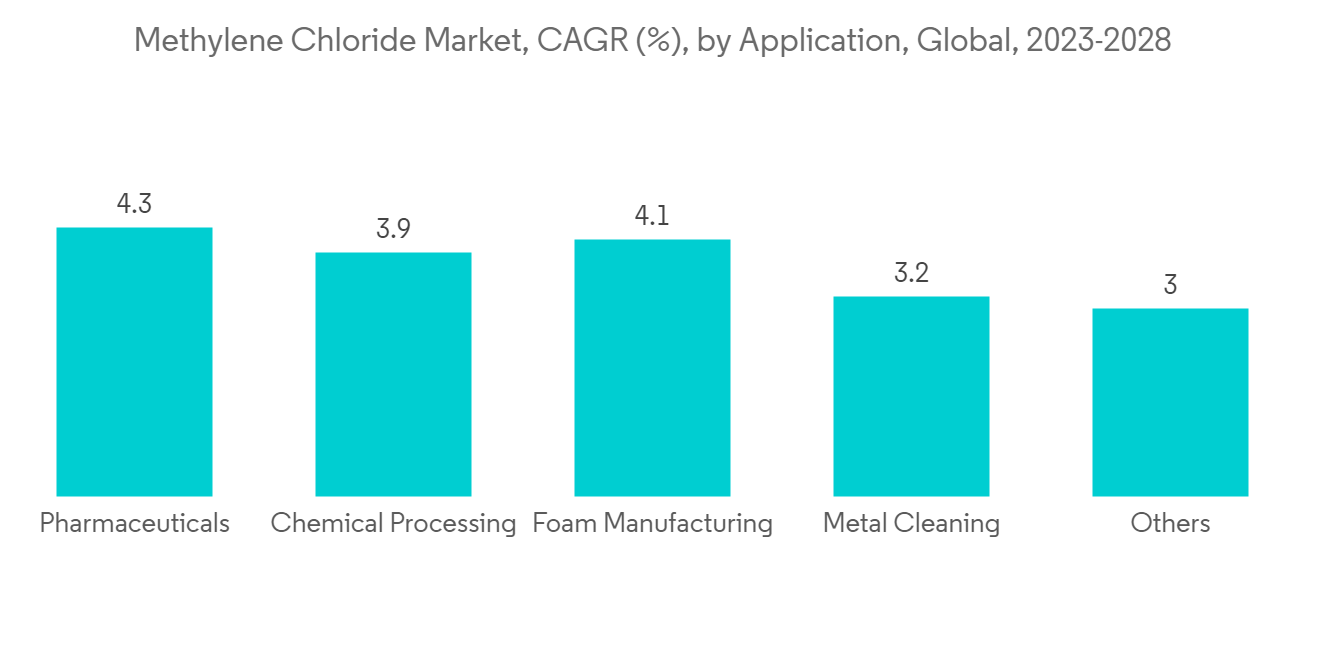

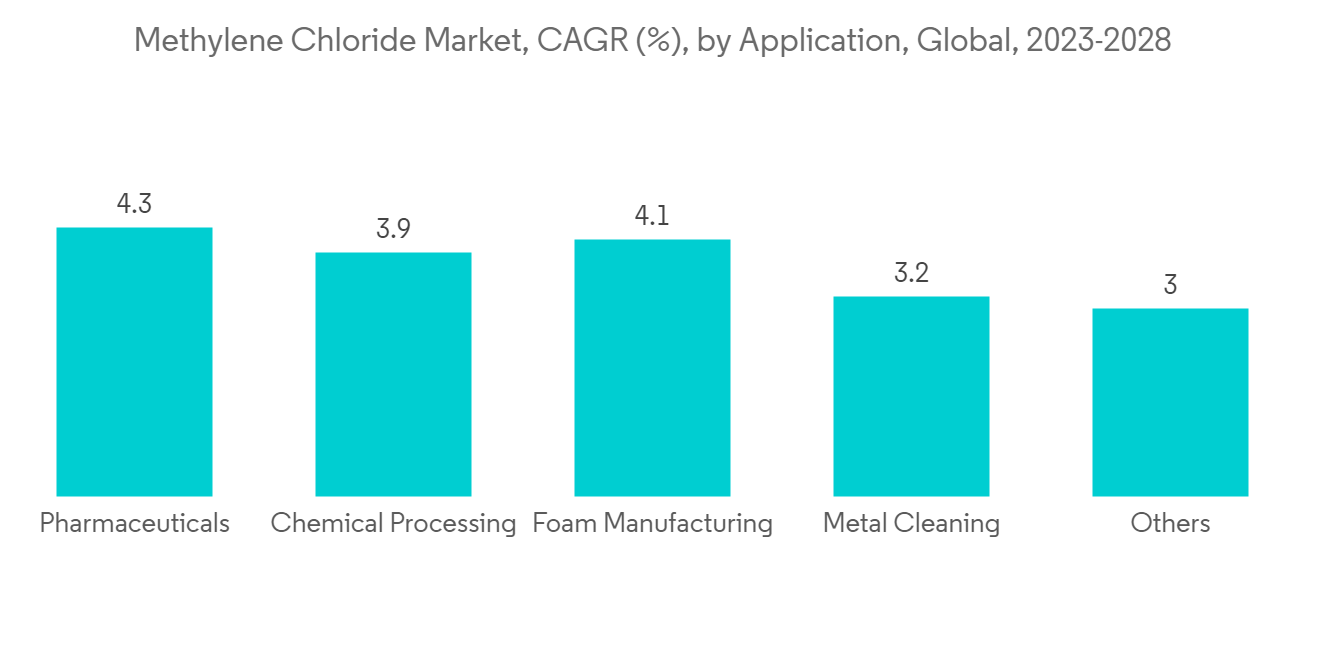

在预测期内,全球二氯甲烷市场预计将以超过 4% 的复合年增长率增长。

由于油漆和涂料行业的需求不断增长,预计该市场将会扩大。

主要亮点

- 油漆和涂料行业不断增长的需求预计将推动市场增长。

- 但是,二氯甲烷有毒,在多个国家/地区受到管制。

- 二氯甲烷在製冷剂市场已经成熟,预计未来几年仍将保持需求。

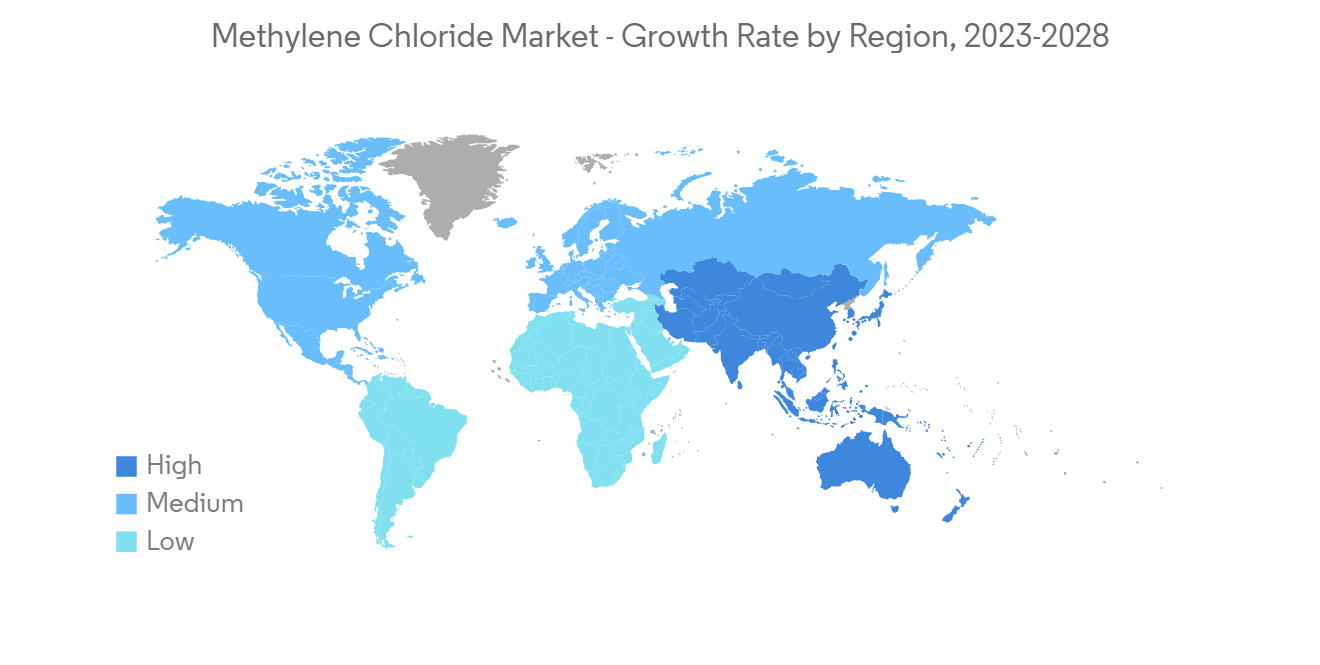

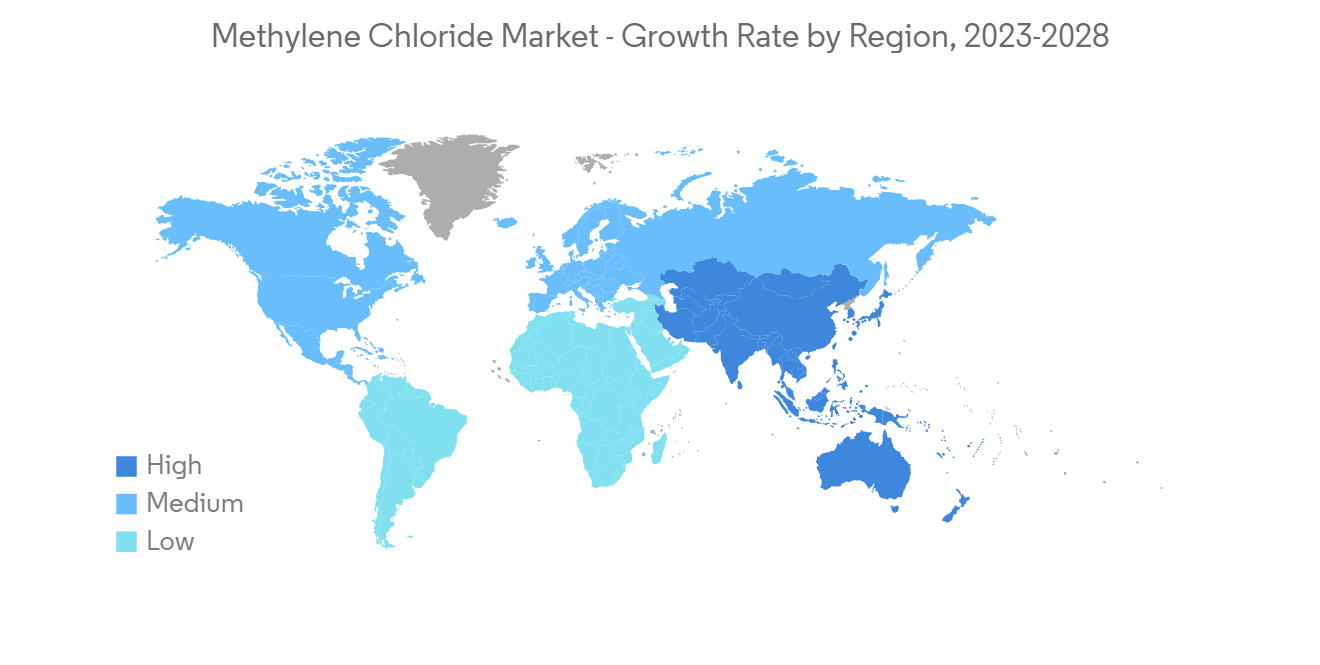

- 亚太地区主导市场,预计在预测期内将继续保持这一势头。

二氯甲烷市场趋势

製药行业的需求增加

- 二氯甲烷,也称为二氯甲烷 (DCM),在製药应用中用作溶剂,主要用于提取多种化合物以及生产抗生素和维生素。 也用作片剂的包衣剂。

- 在经历了全球製药行业动荡的一年之后,该行业的基本业绩和前景良好。 儘管 COVID-19 药物促进了许多公司的发展,但许多其他公司仍然相对不受大流行的某些影响。

- 定期开发、批准和销售新药,导致市场显着增长。 其他市场驱动因素包括人口老龄化,因为老年人人均使用更多的药物,以及慢性病患病率和治疗的增加。 大多数国家的人口都在老龄化。 根据世界卫生组织 (WHO) 的数据,到 2030 年,六分之一的人将超过 60 岁。

- 到 2025 年,製药行业预计将达到约 1.7 万亿美元,年增长率为 8%。

- 这是由于美国、中国和印度等国家/地区的中产阶级不断壮大、人口老龄化、收入增加以及城市化进程加快所致。

- 美国的医疗保健行业是该国最先进的行业之一。 据药物研究与製造商协会(PhRMA)称,美国公司研发了世界上一半以上的药物,并拥有大多数新药的知识产权。

- 因此,预计製药行业的增长将在预测期内推动对二氯甲烷的需求。

亚太地区主导市场

- 预计在预测期内,亚太地区将成为最大的二氯甲烷市场。

- 预计中国、印度和日本等主要新兴国家/地区的需求会增加。

- 该地区对油漆和涂料的需求正在增加。 汽车和建筑行业在油漆和涂料的消费中占有很大份额。

- 亚太地区包含世界上最重要的建筑市场,其中以印度、中国和东南亚国家/地区为首。 生活水平提高、人均收入增加、工业化和基础设施发展是这些国家建筑活动增长的主要驱动力。

- 此外,亚太地区的外国直接投资率很高,主要是在印度和中国,这是由于其製造成本低、劳动力廉价和客户群广泛。 该地区有利的经济环境推动了对酒店、购物中心、摩天大楼和体育场馆的需求。

- 中国政府设立了一个 770 亿美元的国家基础设施投资基金,以振兴基础设施,以应对中国经济增长停滞的局面。 2021年中国建筑业产值为4.54万亿美元。

- 另一方面,根据 Invest India 报告,在旨在改造 100 个城市的智慧城市任务和经济适用房计划的支持下,到 2025 年印度的建筑业价值将达到 1.4 万亿美元。预计将达到

- 在印度,从 2000 年 4 月到 2021 年 9 月,流入建设和开发部门(乡镇、住房、建筑基础设施、建设和开发项目)和建筑(基础设施)活动的外国直接投资各达 261 亿美元。6000 万美元和美国259.5 亿美元。

- 在中国和印度等国家/地区,由于政府的举措和製造商的投资,药品生产正在扩大。 预计将促进药品生产研究市场的消费。

- 医药行业是中国经济持续发展的主要行业之一。 加入世界贸易组织(WTO)以来,中国医药工业发展迅速。 据国家统计局数据,2021年医药行业产值将达到5110亿美元。

- 印度在全球製药领域占有重要地位。 据印度品牌资产基金会称,印度製药业供应了全球 50% 以上的各种疫苗需求、40% 的美国仿製药需求和 25% 的英国药品总需求。 在全球范围内,印度在药品生产方面排名第三,在价值方面排名第十四。 国内製药业拥有 3,000 家製药公司和大约 10,500 台製造设备的网络。

- 因此,在这种发展的背景下,预计亚太地区对二氯甲烷的需求在预测期内将会增长。

二氯甲烷行业概况

全球二氯甲烷市场本质上是分散的。 市场上的主要参与者包括 Nouryon、Olin Corporation、Oxy Chemical Corp.、Shin-Etsu Chemical、Tokuyama Corporation 等。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 调查先决条件

- 本次调查的范围

第二章研究方法论

第 3 章执行摘要

第四章市场动态

- 主持人

- 油漆和涂料行业的需求增加

- 其他司机

- 约束因素

- 二氯甲烷的有害影响

- 行业价值链分析

- 波特的五力分析

- 供应商的议价能力

- 消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第 5 章市场细分

- 用法

- 脱漆剂

- 医药

- 化学处理

- 聚苯乙烯泡沫塑料生产

- 金属清洗

- 其他用途

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 意大利

- 法国

- 其他欧洲

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙特阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章竞争格局

- 併购、合资、合作、合同等。

- 市场份额 (%)/排名分析

- 主要公司采用的策略

- 公司简介

- AGC Chemicals

- Dow

- Kem One

- Nouryon

- Olin Corporation

- Oxy Chemical Corp

- PJSC Khimprom

- Shin-Etsu Chemical Co. Ltd

- Spectrum Chemical Manufacturing Corp

- Tokuyama Corporation

第七章市场机会与未来趋势

简介目录

Product Code: 69255

The global market for methylene chloride is expected to register a CAGR of more than 4% during the forecast period. The market is expected to increase due to the rising demand from the paints and coatings industry.

Key Highlights

- The increasing demand from the paints and coatings industry likely promotes market-studied growth.

- However, owing to the harmful effects, methylene chloride is regulated across various significant countries.

- Methylene chloride will likely remain mature in the refrigerant market, maintaining its demand in the coming years.

- Asia-Pacific dominated the market and may continue its dominance during the forecast period.

Methylene Chloride Market Trends

Increasing Demand from Pharmaceutical Industry

- Methylene chloride, also called Dichloromethane (DCM), is a solvent in pharmaceutical applications, mainly used to extract several compounds and produce antibiotics and vitamins. It is also used as a tablet-coating agent.

- While the pharmaceutical industry had a mixed year globally, the underlying performance and outlook for the sector are positive. COVID-19 therapeutics boosted the growth of many companies, while most others remained relatively immune to some of the pandemic's effects.

- New medications are being developed, approved, and marketed regularly, resulting in significant market growth. Other market growth drivers include the aging population, as seniors use more medicines per capita, and the prevalence and treatment of chronic diseases are increasing. Most countries' population profiles are becoming older. According to the World Health Organization (WHO), one in every six people will be over 60 by 2030.

- The pharmaceutical industry is expected to reach about USD 1,700 billion by 2025, with an annual growth rate of 8%.

- It is, moreover, owing to the growing middle class, aging, rising incomes, and increasing urbanization in countries such as the United States, China, and India.

- The healthcare sector in the United States is one of the most advanced sectors in the country. According to the Pharmaceutical Research and Manufacturers Association (PhRMA), US firms conduct over half the world's R&D in pharmaceuticals and hold the intellectual property rights on most new medicines.

- Therefore, the increasing pharmaceutical industry is expected to propel the methylene chloride demand during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is expected to account for the largest market for methylene chloride during the forecast period.

- Higher demand is expected from the major developing countries, such as China, India, Japan, and others.

- Paints and coatings demand is increasing in the region. The automotive and construction industry contributes to a significant share in the consumption of paints and coatings.

- Asia-Pacific includes the most prominent construction market globally, led by India, China, and various Southeast Asian countries. The main driving factors for the construction activities growth in these countries are increasing living standards, higher per capita income, industrialization, infrastructural development, etc.

- Moreover, the Asia-Pacific region, with low manufacturing costs, cheap labor sourcing, and an extensive customer base, includes a substantial inflow of FDI, with India and China being the primary beneficiaries. The region's favorable economic climate boosted the demand for hotels, shopping malls, high-rise buildings, and stadiums.

- The Chinese government built a state infrastructure investment fund worth USD 77 billion to revive its infrastructure to combat China's stunted economic growth. The construction output in China was valued at USD 4.54 trillion in 2021.

- On the other hand, as per the Invest India Report, India's construction industry is heading to reach USD 1.4 trillion market size by 2025, supported by schemes about the smart city mission targeting the transformation of 100 cities and affordable housing.

- In India, FDI in the construction development sector (townships, housing, built-up infrastructure, and construction development projects) and construction (infrastructure) activities amounted to USD 26.16 billion and USD 25.95 billion, respectively, between April 2000 and September 2021.

- Pharmaceutical production in countries like China and India is growing due to government initiatives and manufacturers' investments in the sector. It is expected to boost the consumption of the market studied in pharmaceutical production.

- The pharmaceutical sector is one of the key industries in China's continued economic development. From joining the World Trade Organization, China's pharmaceutical industry rapidly progressed. According to the National Bureau of Statistics, the pharmaceutical sector generated USD 511 billion in 2021.

- India occupies an important position in the global pharmaceutical sector. According to the Indian Brand Equity Foundation, the Indian pharmaceutical sector supplies over 50% of the global demand for various vaccines, 40% of the US generic drug demand, and 25% of the total UK drug demand. Globally, India ranks 3rd in pharmaceutical production volume and 14th in value. The domestic pharmaceutical industry includes a network of 3,000 pharmaceutical companies and approximately 10,500 production units.

- Hence, with such trends, the methylene chloride demand in the Asia-Pacific region is expected to grow during the forecast period.

Methylene Chloride Industry Overview

The global methylene chloride market is fragmented in nature. The major players in the market include Nouryon, Olin Corporation, Oxy Chemical Corp., Shin-Etsu Chemical Co. Ltd., and Tokuyama Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from Paints and Coatings Industry

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Harmful Effects of Methylene Chloride

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Application

- 5.1.1 Paint Remover

- 5.1.2 Pharmaceuticals

- 5.1.3 Chemical Processing

- 5.1.4 Foam Manufacturing

- 5.1.5 Metal Cleaning

- 5.1.6 Other Applications

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 Italy

- 5.2.3.4 France

- 5.2.3.5 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Rest of Middle-East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AGC Chemicals

- 6.4.2 Dow

- 6.4.3 Kem One

- 6.4.4 Nouryon

- 6.4.5 Olin Corporation

- 6.4.6 Oxy Chemical Corp

- 6.4.7 PJSC Khimprom

- 6.4.8 Shin-Etsu Chemical Co. Ltd

- 6.4.9 Spectrum Chemical Manufacturing Corp

- 6.4.10 Tokuyama Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219