|

市场调查报告书

商品编码

1273405

粘膜喷雾设备市场——增长、趋势和预测 (2023-2028)Mucosal Atomization Devices Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

粘膜喷雾设备市场预计在预测期内的复合年增长率约为 7.25%。

在早期阶段,COVID-19 大流行对社区、行业和市场产生了负面影响,包括粘膜喷雾装置。 例如,国际过敏和免疫学檔案馆在 2021 年 1 月进行的一项调查发现,只有 13% 的医生继续使用非处方吸入剂提取物进行皮肤点刺试验,而 31% 的医生很少进行皮肤点刺试验。 然而,所有人都被发现继续服用治疗哮喘和过敏性鼻炎的药物,包括吸入皮质类固醇、长效 BETA2 受体激动剂、孟鲁司特钠、抗组胺药和鼻用类固醇。 超过 92% 的医生表示,他们开出吸入器作为对 COVID-19 患者的紧急反应。 在目前的情况下,随着法规的放鬆,由于粘膜喷雾装置在药物输送方面的优势,市场预计会随着粘膜喷雾装置的采用而增长。 例如,根据 2022 年 2 月发表在 eBioMedicine 上的一篇论文,粘膜免疫可以在粘膜和全身水平诱导免疫反应。 九种针对不同粘膜感染的疫苗已获准供人类使用,其中八种为口服疫苗,一种为鼻内 (IN) 疫苗,均为全病毒疫苗。

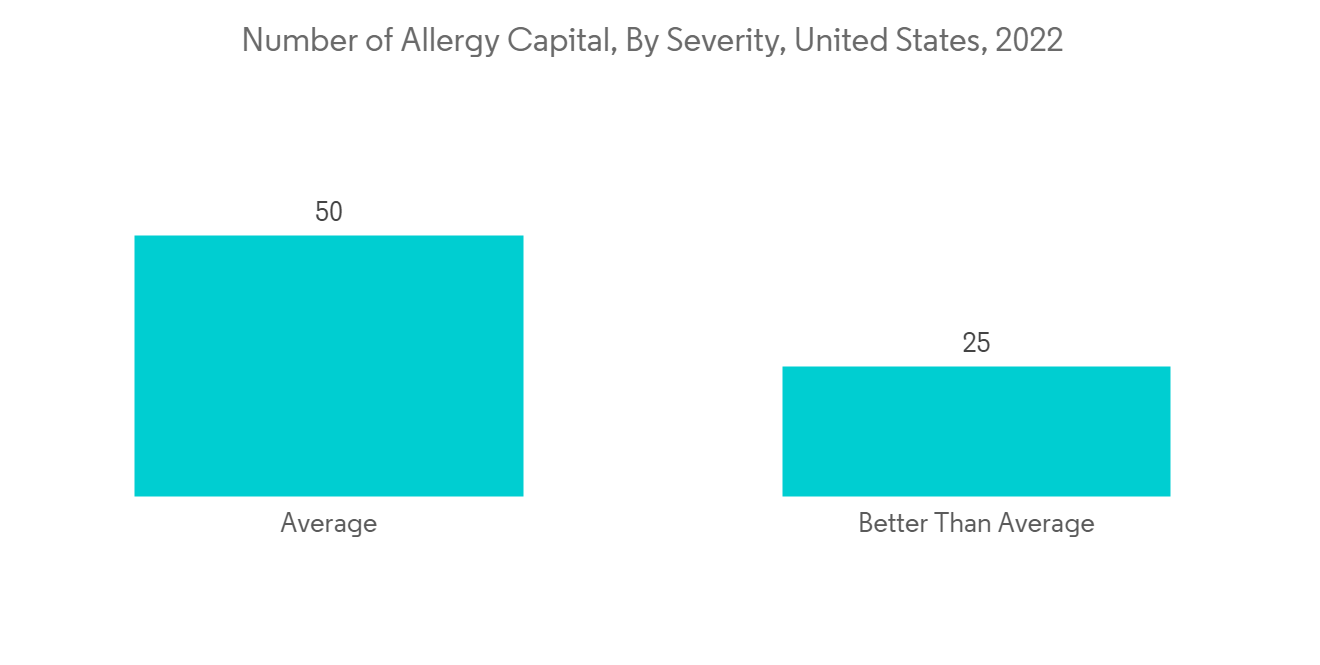

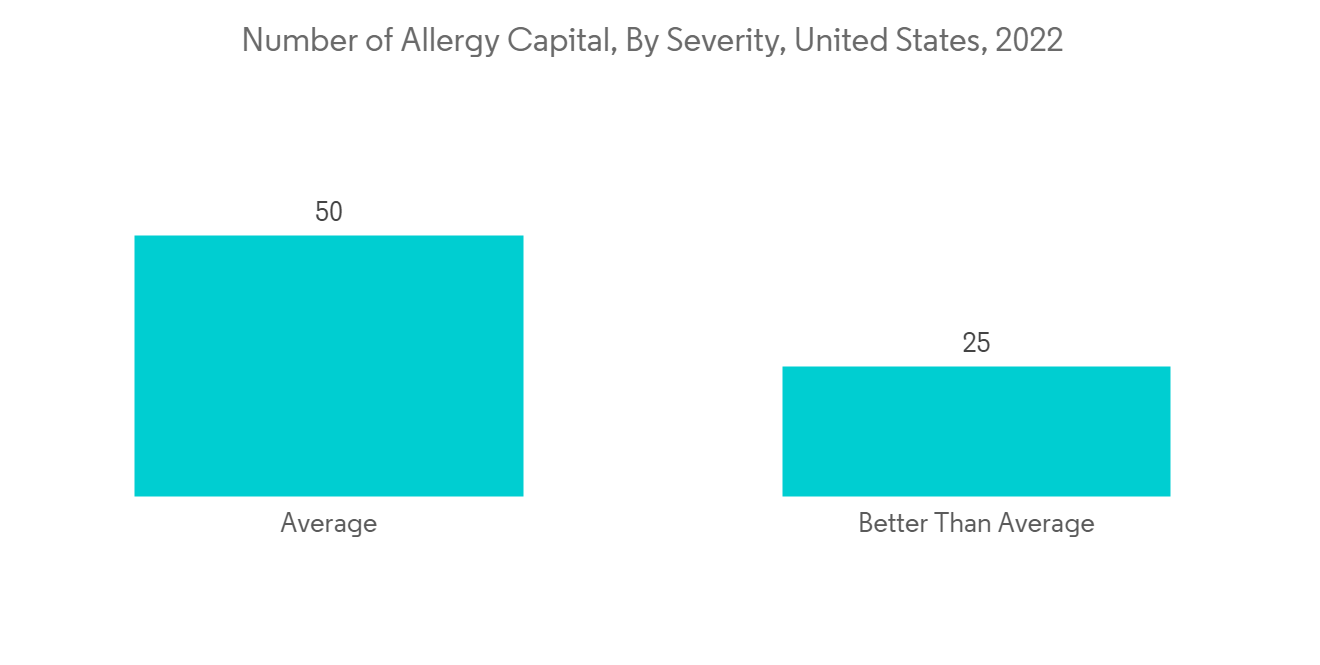

市场增长的主要驱动力是过敏性鼻炎、鼻窦炎和其他目标疾病在全球范围内日益流行。 例如,根据 2022 年过敏资本报告,最常见的过敏性疾病之一是季节性过敏性鼻炎,通常称为“花粉热”。 在美国,大约 7.7% 的成年人和 7.2% 的儿童被诊断患有季节性过敏性鼻炎。 同样,根据欧洲议会 2022 年 6 月的更新,过敏是欧洲最常见的慢性非传染性疾病之一。 到 2022 年,欧洲将有约 1.5 亿人患有过敏性鼻炎、哮喘、特应性湿疹和食物过敏等过敏性疾病。 因此,预计全球范围内越来越多的过敏性疾病将增加对粘膜喷雾装置的需求,从而推动市场的增长。

粘膜雾化器可以更快地将药物输送到血液中,从而减少治疗剂对相关医学问题起作用所需的时间。 因为这些药物直接进入血液,它们避免了首过代谢并提供更快的结果。 此外,人群中癫痫患病率的增加导致引入粘膜雾化装置,以便在紧急情况下通过鼻腔快速输送药物。 例如,2021 年 3 月发表在 Taylor 和 Francis 上的一篇论文证实,咪达唑仑粘膜鼻腔喷雾剂被迅速吸收,有助于阻止癫痫发作/癫痫症成人和儿童的癫痫发作活动。 这证明了患者通过粘膜雾化装置对咪达唑仑鼻喷雾剂的耐受性,预计将增加对咪达唑仑鼻喷雾剂治疗癫痫患者的需求并推动市场增长。

此外,粘膜雾化设备的技术进步和发展预计将促进市场增长,因为它们增加了便利性并促进了设备的采用。 例如,2021 年 10 月,Alcove Manufacturing and Distribution Inc. 和 Pulmodyne Inc. 合作扩大分销、整合製造并继续联合研究新型雾化技术。 通过这一新的合作伙伴关係,Pulmodyne 通过现有渠道销售了 EZ-Spray 雾化系统。 除了销售之外,合作伙伴关係旨在进一步创新该领域,这种关係将使两家经验丰富的公司能够快速优化产品设计。

在这些新兴市场的发展中,预计药物过量的副作用会抑制市场的增长。

粘膜雾化器市场趋势

气体推动的粘膜喷雾装置预计将成为预测期内增长最快的部分

气动或推进式药物输送系统是最早开发的系统之一。 气体或空气筒直接或通过管系统间接连接到喷枪,为喷射器活塞提供动力。 当触发器被致动时,活塞被释放,产生穿过鼻腔、面颊腔和气管的药物射流。 气体泵送具有非常灵活的优点。 由于液化气体种类繁多,一个容器可以承受各种压力。 因此,可以使用一台仪器管理各种输送选项,包括粘度(高达 300 cP 和更高的新技术)、剂量体积和主要容器差异。

此外,由于城市化、工业化以及随之而来的生活方式的快速变化,空气污染物的迅速增加导致因空气污染引起的过敏症增加,如哮喘和过敏性鼻炎。 例如,根据IQAir 2022年3月发布的《世界空气质量报告》,印度是全球117个国家、地区和领土中污染第五大的国家。 2021年,印度PM2.5年均值将达到58.1微克/立方米(microg/m3)。 因此,随着空气中过敏原的增加,治疗需求预计会增加,这被认为将推动预测期内的市场增长。

此外,燃气动力或推进式药物输送系统的技术进步和研发不断增加,预计将推动该领域的增长。 例如,2021 年 1 月,Impel 的 5O5(b)(2) 新药申请( NDA ) INP104 启动,使用 Impel 专有的精确嗅觉递送( POD )技术将双氢麦角胺直接给药到血管丰富的上鼻腔。 (DHE) 用于成人有或无先兆偏头痛的急性治疗。

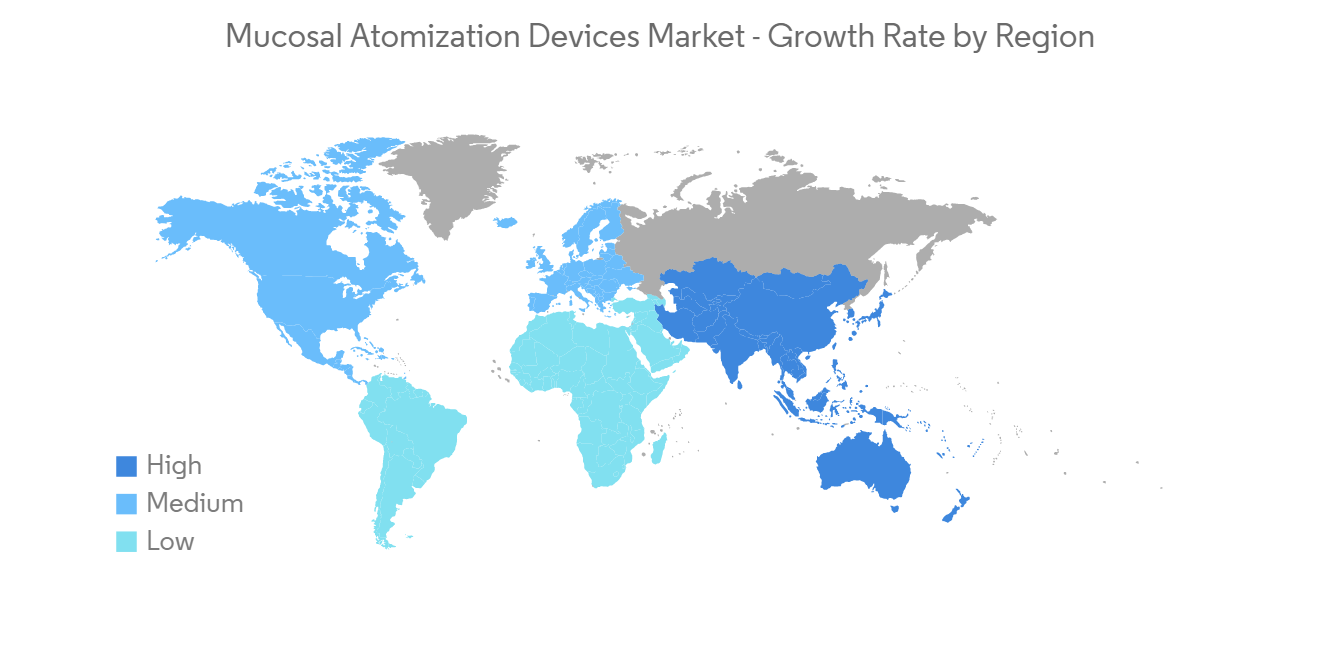

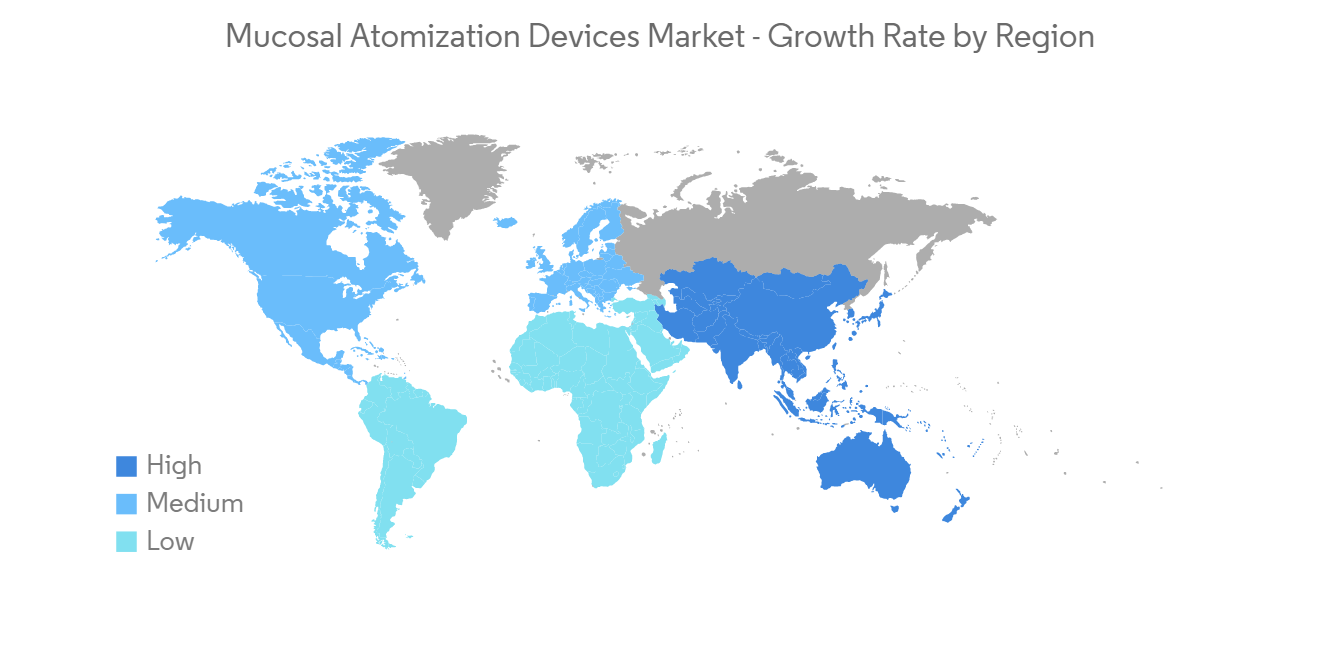

预计在预测期内北美将占据很大的市场份额

由于主要参与者的存在、过敏性鼻炎和鼻窦炎的高患病率以及完善的医疗保健基础设施等因素,预计北美在预测期内将占据全球市场的很大份额。 例如,根据 2022 年 AAFA 过敏之都报告,宾夕法尼亚州斯克兰顿在美国排名第一的最差过敏之都。 此外,根据 2021 年加拿大哮喘报告,每天有 317 名加拿大人新诊断出患有哮喘。 超过 850,000 名 14 岁以下的儿童患有哮喘,使其成为加拿大儿童中最常见的慢性疾病之一。 因此,在预测期内,越来越多的哮喘和过敏性疾病病例将增加对粘膜喷雾装置的需求。

此外,技术进步和使用粘膜雾化设备的临床开发增加预计将推动市场增长。 例如,根据 2023 年 1 月发表在 PubMed 上的一篇论文,研究人员发现 M2-deficient single copies (M2SRs) 可能对高度漂移的 H3N2 流感病毒株的感染提供实质性保护。我已经证明这是不可能的。 在这项研究中,给药使用粘膜喷雾装置(MAD301;Teleflex),并製备最终稀释液并通过吸入 1 mL 一次性聚丙烯注射器进行鼻内给药。

粘膜喷洒器行业概况

粘膜雾化器市场竞争适中,参与者众多。 目前主导市场的公司包括 Teleflex Incorporated、DeVilbiss Healthcare LLC、Becton、Dickinson and Company、Cook Group (Cook Medical) 和 Medica Holdings。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 调查假设和市场定义

- 本次调查的范围

第二章研究方法论

第 3 章执行摘要

第四章市场动态

- 市场概览

- 市场驱动因素

- 过敏性鼻炎、鼻窦炎和其他目标疾病的患病率增加

- 粘膜雾化器技术进展

- 市场製约因素

- 药物过量引起的副作用

- 波特的五力分析

- 新进入者的威胁

- 买方/消费者议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

第 5 章市场细分

- 按产品类型

- 气体推进

- 电气

- 最终用户

- 医院

- 医务室

- 其他最终用户

- 按地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 意大利

- 西班牙

- 其他欧洲

- 亚太地区

- 中国

- 日本

- 印度

- 澳大利亚

- 韩国

- 其他亚太地区

- 世界其他地区

- 北美

第六章竞争格局

- 公司简介

- Teleflex Incorporated

- DeVilbiss Healthcare LLC

- Becton, Dickinson and Company

- Cook Group

- Medica Holdings

- Integra LifeSciences

- BVM Meditech Private Limited

- Life-Assist Inc.

- BTME Group Limited(MEDTREE)

第七章市场机会与未来趋势

The mucosal atomization devices market is projected to record a CAGR of nearly 7.25% over the forecast period.

During the initial phase, the COVID-19 pandemic adversely affected communities, industries, and markets, including mucosal atomization devices. For instance, as per a survey conducted by the International Archives of Allergy and Immunology in January 2021, only 13% of physicians continued skin prick testing with commercial inhalant extracts, while 31% of physicians performed skin pricking tests in rare cases. However, all the respondents were observed to be continuing their asthma and allergic rhinitis medication, including inhaled corticosteroids, long-acting Beta-2-agonists, Montelukast sodium, antihistamines, and nasal steroids. Over 92% of physicians reported prescribing inhaled medication to COVID-19 patients for instances of emergency management. In the current scenario, as the restrictions eased, the market is anticipated to witness growth because of the increase in the adoption of mucosal atomization devices due to the advantages offered by the devices in drug delivery. For instance, as per the article published in February 2022 in eBioMedicine journal, immune responses at the mucosal and systemic levels may be induced via mucosal immunization. Nine vaccines against different mucosal infections have been licensed for human use, including eight provided orally and one given intranasally (IN), all of which are complete viral vaccines.

The major factor contributing to the market growth is the increase in the prevalence of allergic rhinitis, sinus, and other target diseases across the world. For instance, as per the Allergy Capital Report 2022, one of the most common allergic conditions is seasonal allergic rhinitis, often called "hay fever." About 7.7% of adults and 7.2% of children have been diagnosed with seasonal allergic rhinitis in the United States. Similarly, as per the June 2022 update from European Parliament, allergies are among the most common chronic non-communicable diseases in Europe. In 2022, about 150 million people in Europe live with an allergic condition, such as allergic rhinitis, asthma, atopic eczema, or a food allergy. Hence, the rise in allergy diseases across the globe is anticipated to increase the demand for mucosal atomization devices, thereby driving market growth.

Mucosal atomization devices help in faster delivery of medication in the bloodstream, thus reducing the time for therapeutics to act on the concerned medical issue. As these drugs directly enter the bloodstream, they avoid first-pass metabolism and offer quicker results. Further, the increasing number of epilepsy cases among the population is increasing the adoption of mucosal atomization devices to quickly administer the drug intranasally in emergencies. For instance, according to an article published in Taylor and Francis, in March 2021, it had been observed that midazolam mucosal nasal spray rapidly absorbs, in adult and pediatric patients with seizures/epilepsy, and helps in terminating the seizure activity. This shows the viable tolerability of midazolam nasal spray through mucosal atomization devices in the patients which is expected to increase the demand for midazolam nasal spray for treating patients with epilepsy, thereby propelling the market growth.

Moreover, technological advancements and developments in mucosal atomization devices are expected to boost market growth since they increase convenience and thereby lead to the adoption of the devices. For instance, in October 2021, Alcove Manufacturing and Distribution Inc. and Pulmodyne Inc. collaborated to expand distribution, consolidate manufacturing, and continue cooperative research of novel atomization technologies. With this new partnership, Pulmodyne distributed the EZ-Spray Atomization System through its existing channels. In addition to distribution, the partnership seeks to innovate further in the space, and this relationship will allow the two experienced companies to optimize product designs quickly.

In the midst of these developments, side effects due to the overdose of drugs are expected to restrain the market growth.

Mucosal Atomization Devices Market Trends

Gas-propelled Mucosal Atomization Device is Expected to be a Fastest Growing Segment Over the Forecast Period

Gas-powered or propelled drug delivery systems were among the first developed systems. They use gas or an air cartridge attached to the gun either directly or indirectly through a tubing system to deliver power to the injector piston. When the trigger is activated, it releases the piston and creates a jet stream of medicant through the nasal and buccal passages and the trachea. Gas-propelled delivery offers the benefit of being extremely flexible. Owing to the variety of liquefied gases available, it's possible to provide a complete spectrum of pressure ranges within a single container format. This allows a single-device system to manage a variety of delivery options, including different viscosities (up to 300 cP and much higher with a new variation on the technology), injection volumes, and primary containers.

Furthermore, due to the rapid rise in urbanization, industrialization, and the resultant lifestyle changes, a steep rise in air pollutants has been observed to increase the number of allergies caused by air pollution, such as asthma, allergic rhinitis, and others. For instance, according to the World Air Quality Report, published by IQAir, in March 2022, India is the fifth most polluted country among 117 countries, regions, and territories around the world. The annual average PM2.5 levels reached 58.1 micrograms per cubic meter (micro-g/m3) in 2021, in India. Thus, with the rising airborne allergens, the need for treatment is expected to increase which in turn is expected to promote market growth over the forecast period.

Moreover, the rise in technological advances and research and developments in gas-powered or propelled drug delivery systems are expected to boost segment growth. For instance, in January 2021, the FDA accepted Impel's 5O5 (b)(2) New Drug Application (NDA) for INP104, a dihydroergotamine mesylate (DHE) delivered directly into the vascular-rich upper nasal space using Impel's proprietary Precision Olfactory Delivery (POD) technology, which is used for the acute treatment of migraine headaches with or without aura in adults.

North America Anticipated to Hold a Significant Share in the Market Over the Forecast Period

North America is expected to hold a significant market share in the global market throughout the forecast period due to factors such as the presence of key players, the high prevalence of allergic rhinitis and sinus in the region, and the established healthcare infrastructure. For instance, as per the AAFA allergy capital report 2022, Scranton in Pennsylvania ranked first for the worse-than-average allergy capital among others in the United States. Furthermore, as per the Asthma Canada 2021 report, every day, 317 Canadians are newly diagnosed with asthma. More than 850,000 children under the age of 14 have asthma, making it one of the most common chronic diseases among children in Canada. Hence, the rise in asthma and allergic disease cases increases the demand for mucosal atomization devices over the forecast period.

Moreover, the rise in technological advancements and clinical development utilizing mucosal atomization devices are likely to drive market growth. For instance, as per the article published in January 2023 in PubMed, the researchers demonstrated that the M2-deficient single replication (M2SR) might provide substantial protection against infection with highly drifted strains of H3N2 influenza. The study utilized a mucosal atomization device (MAD301; Teleflex) for dose administration and prepared the final diluted product, which was drawn into 1-mL disposable polypropylene syringes for intranasal delivery.

Mucosal Atomization Devices Industry Overview

The mucosal atomization devices market is moderately competitive and consists of several players. Some of the companies currently dominating the market are Teleflex Incorporated, DeVilbiss Healthcare LLC, Becton, Dickinson and Company, Cook Group (Cook Medical), and Medica Holdings.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Prevalence of Allergic Rhinitis, Sinus, and Other Target Diseases

- 4.2.2 Technological Advancement in Mucosal Atomization Devices

- 4.3 Market Restraints

- 4.3.1 Side Effects Due to Overdose

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value- USD Million)

- 5.1 By Product Type

- 5.1.1 Gas-propelled

- 5.1.2 Electrical

- 5.2 By End User

- 5.2.1 Hospitals

- 5.2.2 Clinics

- 5.2.3 Other End Users

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Teleflex Incorporated

- 6.1.2 DeVilbiss Healthcare LLC

- 6.1.3 Becton, Dickinson and Company

- 6.1.4 Cook Group

- 6.1.5 Medica Holdings

- 6.1.6 Integra LifeSciences

- 6.1.7 BVM Meditech Private Limited

- 6.1.8 Life-Assist Inc.

- 6.1.9 BTME Group Limited (MEDTREE)