|

市场调查报告书

商品编码

1273406

□市场 - 增长、趋势、COVID-19 影响和预测 (2023-2028)Naphthalene Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

在预测期内,□市场预计将以超过 3% 的复合年增长率增长。

2020年,COVID-19对市场产生了负面影响,但目前市场估计已达到疫情前水平,预计未来将稳步增长。

主要亮点

- 在预测期内,由于□在纺织工业中的使用增加,预计其需求将会增加。

- 另一方面,预计在预测期内,针对 VOC 排放的严格环境法规会阻碍市场增长。

- 此外,□在建筑领域的新兴应用有望在未来几年成为市场机遇。

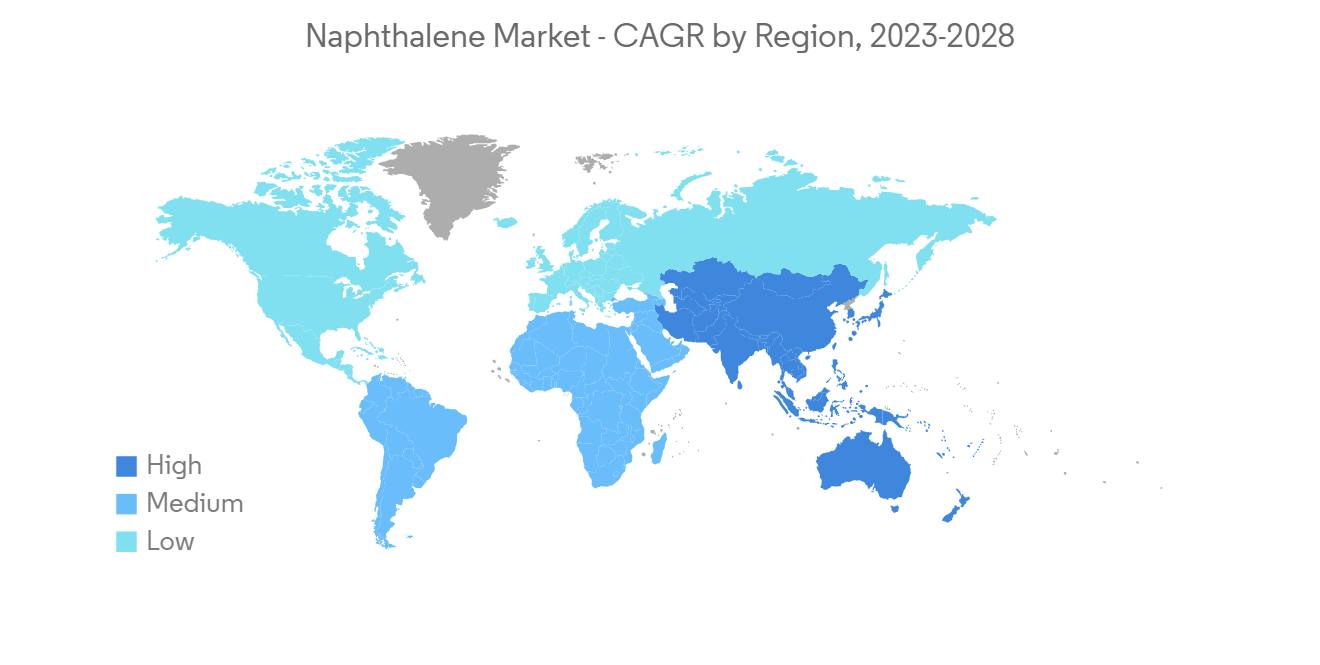

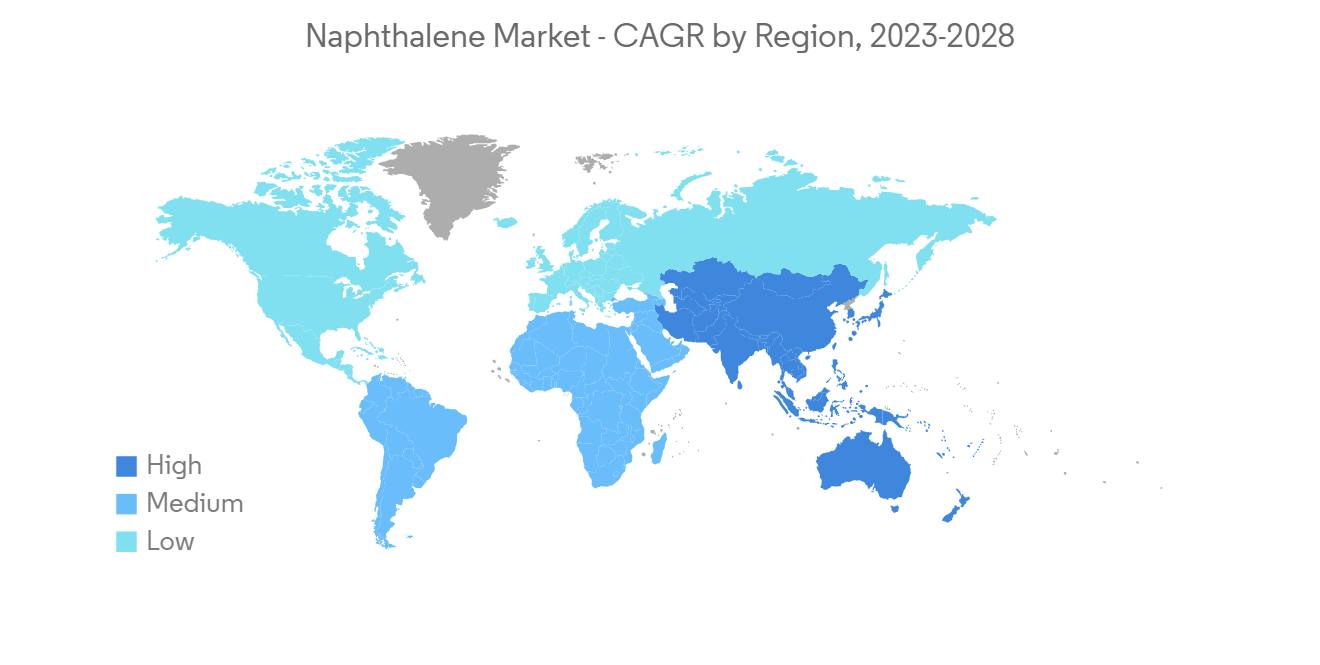

- 亚太地区主导着全球市场,其中印度、中国和其他国家/地区的消费量最大。

□市场趋势

□磺酸盐成主要应用

- □最重要的用途之一是生产□磺酸盐,□磺酸盐可以通过多种不同的方式使用,因为它可以通过湿润的东西传播。

- □磺酸盐用于生产□磺酸盐甲醛 (NSF)。 NSF 用于聚合物混凝土外加剂,以中和水泥颗粒的表面电荷,增加与水泥骨料结合的水量,并降低浆体和混凝土的粘度。

- 它用于製造用于各种个人护理产品的表面活性剂。 □磺酸盐还用于水基清洁剂,如洗髮水、自动洗碗机洗涤剂和工业洗涤剂。

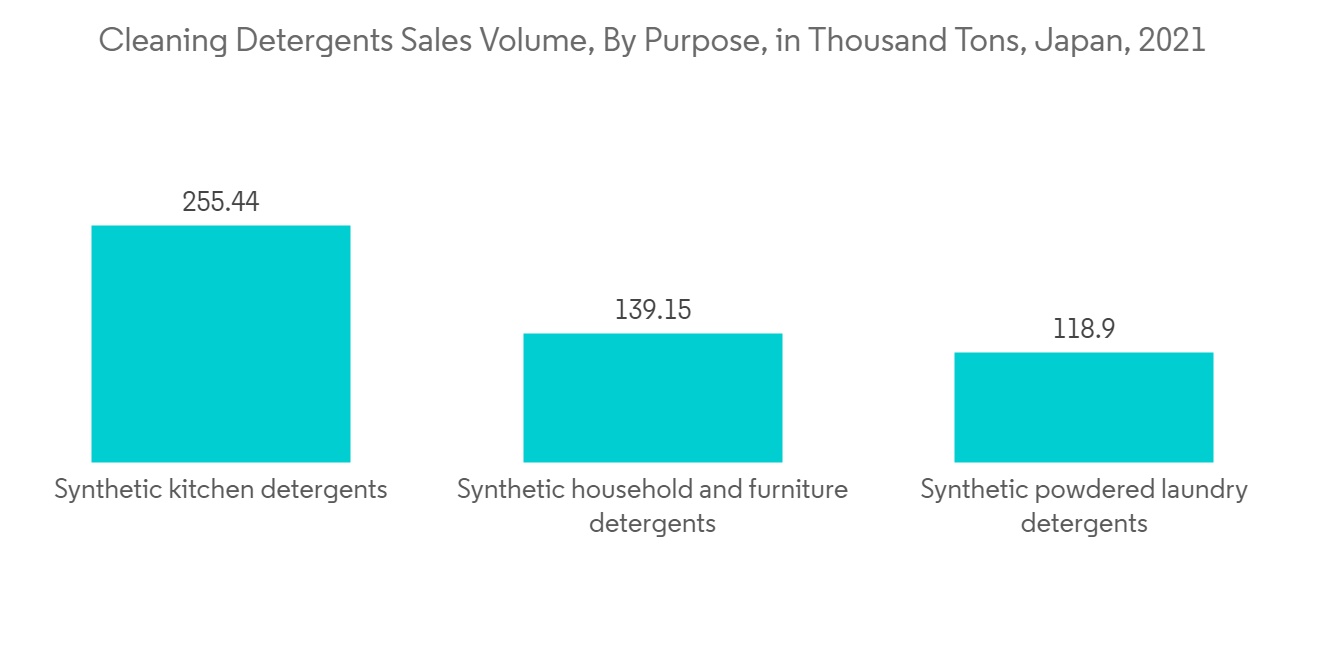

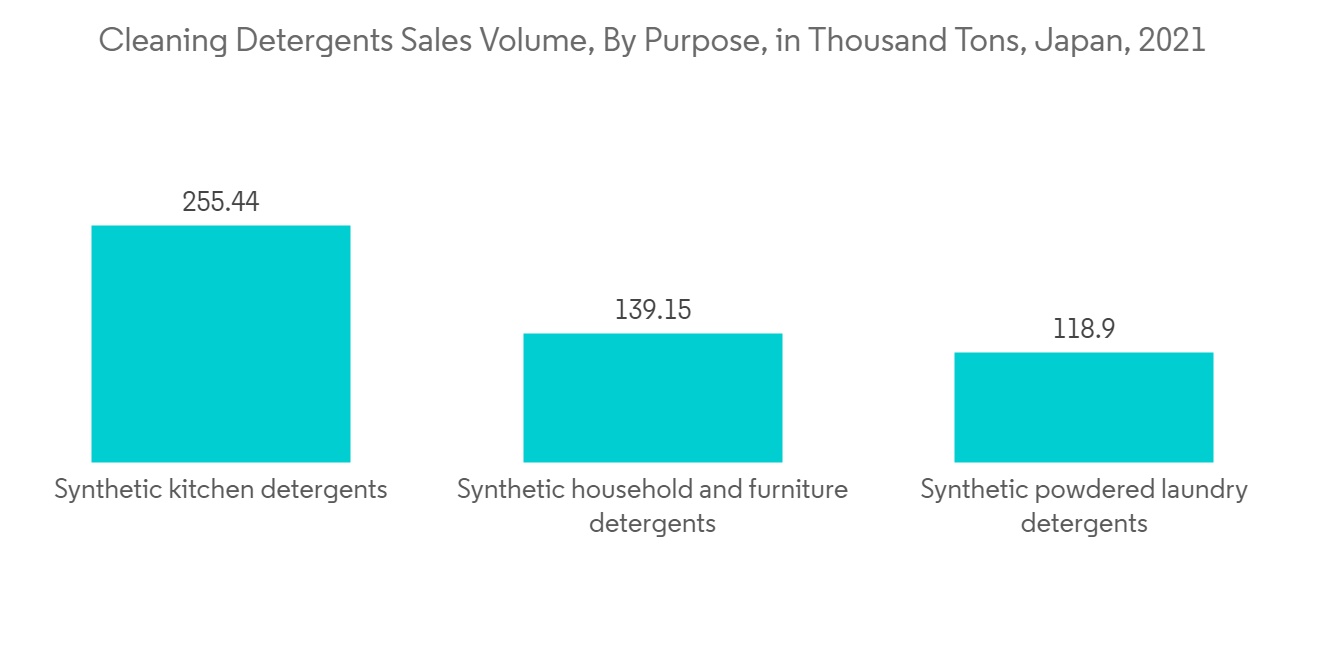

- 根据日本肥皂和洗涤剂协会 (JSDA) 的数据,2021 年日本将售出约 120 万吨清洁剂。 市场的大部分将由合成洗涤剂混合物组成。

- 在售出的 641,000 吨清洁剂中,超过一半是合成洗衣液。 相比之下,肥皂销量约为25,700吨。 因此,□市场将从中受益。

- 由于这些原因,预计□磺酸盐将在预测期内引领市场。

亚太地区主导市场

- 预计亚太地区将占据□市场的大部分,因为中国和印度等国家大量使用□。

- 在中国和印度等亚洲国家/地区,蓬勃发展的建筑业和农业产业是推动该地区市场增长的关键因素之一。

- 大型建设项目已获得批准,尤其是在印度、中国和日本,预计这些项目将推动该地区的□市场。

- 根据中国国家统计局的数据,到 2021 年,中国的建筑业产值将达到约 4 万亿美元。 这将比 2020 年增加 11% 以上,从而增加所研究市场的需求。

- 根据韩国国家统计局的数据,2021 年,国内外本地建筑商将收到总价值 2459 亿美元的建筑订单。 这比上一年有显着增加。

- 印度正在扩大其商业建筑行业。 日本正在进行几个项目。 例如,2022年第一季度,价值9亿美元的“Commerz III商业办公综合体”开工建设。 该项目将在孟买Goregaon建造一座43层的商业办公综合体,允许建筑面积为2,601,28 m2。 该项目计划于 2027 年第四季度完工。 因此,预计在预测期内对□的需求将增加。

- 由于这些原因,预计亚太地区将在未来几年引领市场。

□行业概况

□市场整合。 市场上的主要参与者包括 CARBOTECH、Rain Carbon Inc.、JFE Chemical Corporation、Exxon Mobil Corporation、Epsilon Carbon Private Limited 等(排名不分先后)。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 调查先决条件

- 本次调查的范围

第二章研究方法论

第 3 章执行摘要

第四章市场动态

- 司机

- 扩大 NSF(□磺酸盐甲醛)在混凝土外加剂中的使用

- 扩大在纺织行业的使用

- 约束因素

- 针对 VOC 排放的严格环境法规

- 其他限制

- 工业价值链分析

- 波特的五力分析

- 供应商的议价能力

- 消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第 5 章市场细分(市场规模、价值基础)

- 来源

- 煤焦油

- 石油

- 申请

- 邻苯二甲酸酐

- □磺酸盐

- 低挥发性溶剂

- 驱虫剂

- 杀虫剂

- 其他用途

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 德国

- 法国

- 英国

- 意大利

- 其他欧洲

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙特阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章竞争格局

- 併购、合资、合作、合同等。

- 市场份额 (%)**/排名分析

- 主要参与者的招聘策略

- 公司简介

- CARBOTECH

- DEZA a. s.

- Epsilon Carbon Private Limited

- Exxon Mobil Corporation

- Gautam Zen International

- Quimica del Nalon S.A.

- JFE Chemical Corporation

- Koppers Inc.

- PCC Rokita SA

- Rain Carbon Inc.

- TULSTAR PRODUCTS INC.

- Dong-Suh Chemical Ind. Co., Ltd

第七章市场机会与未来趋势

- 建筑领域的新应用

During the time frame of the forecast, the naphthalene market is expected to register a CAGR of more than 3%. In 2020, COVID-19 had a detrimental effect on the market.However, the market has now been estimated to have reached pre-pandemic levels and is expected to grow steadily in the future.

Key Highlights

- During the forecast period, the demand for naphthalene is likely to rise due to its growing use in the textile industry.

- On the other hand, stringent environmental regulations regarding VOC emissions are expected to hinder market growth during the forecast period.

- Furthermore, new applications of naphthalene in the construction sector are anticipated to act as a market opportunity in the coming years.

- Asia-Pacific dominated the global market, with the largest consumption in countries such as India, China, etc.

Naphthalene Market Trends

Naphthalene Sulfonates to be the Major Application

- One of the most important uses of naphthalene is to make naphthalene sulfonates, which can be used for a variety of things because they can make things wet and spread out.

- Naphthalene sulfonates are used to make naphthalene sulphonate formaldehyde (NSF). NSF is used in polymer-concrete admixtures to neutralize the surface charge on cement particles, which increases the amount of water bound up in cement agglomerations and lowers the viscosity of the paste and concrete.

- They are used in the production of surfactants that are used in a variety of personal care products. Also, naphthalene sulfonates are also used in water-based cleansers such as shampoos, automatic dishwashing detergents, and industrial detergents.

- The Japan Soap and Detergent Association (JSDA) says that in 2021, Japan will sell about 1.2 million tons of cleaning detergents. The majority of the market will be made up of synthetic mixtures.

- Also, more than half of the 641 thousand tons of cleaners that were sold were synthetic liquid laundry detergents. Comparatively, soap sales totaled about 25.7 thousand tons. As a result, the naphthalene market will benefit from this.

- Because of all of these things, naphthalene sulfonate is expected to be the market leader during the period covered by the forecast.

Asia-Pacific to Dominate the Market

- Asia-Pacific is expected to have the most of the naphthalene market because countries like China and India use so much of it.

- The growing construction and agriculture industries of Asian countries like China and India are some of the crucial factors driving market growth in the region.

- The approval of large construction projects, especially in India, China, and Japan, is expected to drive the market for naphthalene in the region.

- The National Bureau of Statistics of China says that the output value of construction works in the country will be around USD 4 trillion in 2021. This represents a more than 11% increase from 2020, which will increase demand for the studied market.

- Statistics Korea also says that in 2021, local builders at home and abroad received construction orders worth a total of USD 245.9 billion. This is a big jump from the previous year.

- India is expanding its commercial construction sector. Several projects have been going on in the country. For instance, the construction of the CommerzIII Commercial Office Complex, worth USD 900 million, started in Q1 2022. The project involves the construction of a 43-story commercial office complex with a permissible floor area of 2,601,28 m2 in Goregaon, Mumbai. The project is expected to be completed in Q4 of 2027. Thus, this is expected to increase the demand for naphthalene during the forecast period.

- For these reasons, it is expected that the Asia-Pacific region will lead the market over the next few years.

Naphthalene Industry Overview

The market for naphthalene is consolidated. Some of the major players in the market include CARBOTECH, Rain Carbon Inc., JFE Chemical Corporation, Exxon Mobil Corporation, and Epsilon Carbon Private Limited, among others (in no particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Use as NSF (naphthalene sulphonate formaldehyde) in Concrete Admixtures

- 4.1.2 Growing Use in Textile Industry

- 4.2 Restraints

- 4.2.1 Stringent Environmental Regulations regarding VOC emissions

- 4.2.2 Other Restraints

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Source

- 5.1.1 Coal Tar

- 5.1.2 Petroleum

- 5.2 Application

- 5.2.1 Phthalic Anhydride

- 5.2.2 Naphthalene Sulfonates

- 5.2.3 Low-Volatility Solvents

- 5.2.4 Moth Repellent

- 5.2.5 Pesticides

- 5.2.6 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.2.4 Rest of North America

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 France

- 5.3.3.3 United Kingdom

- 5.3.3.4 Italy

- 5.3.3.5 Rest of the Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/ Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 CARBOTECH

- 6.4.2 DEZA a. s.

- 6.4.3 Epsilon Carbon Private Limited

- 6.4.4 Exxon Mobil Corporation

- 6.4.5 Gautam Zen International

- 6.4.6 Quimica del Nalon S.A.

- 6.4.7 JFE Chemical Corporation

- 6.4.8 Koppers Inc.

- 6.4.9 PCC Rokita SA

- 6.4.10 Rain Carbon Inc.

- 6.4.11 TULSTAR PRODUCTS INC.

- 6.4.12 Dong-Suh Chemical Ind. Co., Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 New Applications in the Construction Sector