|

市场调查报告书

商品编码

1273409

神经血管通路导管市场 - 增长、趋势、COVID-19 影响和预测 (2023-2028)Neurovascular Access Catheters Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

在预测期内,神经血管通路导管市场预计将以 4.9% 的复合年增长率增长。

COVID-19 对神经血管通路导管市场产生了重大影响,因为在第一波大流行期间许多神经血管手术不得不推迟或取消。 例如,2021 年 2 月发表在 PubMed 上的一篇论文发现,冠状病毒会影响神经系统表现和健康,神经系统患者需要更频繁地住院和出院。这是因为它增加了死亡和残疾的风险。 由于全球封锁,神经系统疾病患者很难接受定期检查和治疗,这对所研究的市场产生了重大影响。 但现在限制已经解除,神经管问题变得越来越普遍,越来越多的人使用神经血管通路导管,因此市场可能会增长。

预计市场增长将受到神经血管疾病增加和神经血管导管技术改进等因素的推动。 例如,根据 2022 年 3 月的前沿文章,全球蛛网膜下腔出血 (SAH) 的估计发病率为每 100,000 人 6.67 例。 每年,SAH 影响约 500,000 人,其中约三分之二生活在低收入和中等收入国家。 此外,神经血管通路导管的技术进步预计将在预测期内推动市场增长。 例如,2022 年 2 月,CERENOVUS 是一家专注于神经血管护理的初创公司,隶属于强生医疗器械公司,该公司宣布推出其下一代球囊导管,用于血管内手术,包括急性缺血性中风患者。导管“ EMBOGUARD”发布。

此外,研究和比较不同的神经血管通路导管应该会在研究期间促进市场的增长。 例如,2022 年 9 月发表在 PubMed 上的一篇论文指出,内径为 0.096 英寸的通路导管可用于通过股动脉和桡动脉进行神经血管手术。 技术成功率高,治疗过程中故障发生率低。

简而言之,神经血管并发症的恶化、更多的神经血管通路导管产品以及研发的增加预计将在未来几年扩大研究中的市场。 然而,生物相容性问题可能会减缓神经血管通路导管的市场增长。

神经血管通路导管市场趋势

预计在预测期内,多腔导管部分将在神经血管通路导管市场中占据显着的市场份额

多腔导管是□□具有多个内部通道(称为腔)的单个导管。 每个内腔都可以连接到不同的静脉注射,并且液体通常会沿着导管在略有不同的位置排出。 由于缺血性中风、狭窄和脑动脉瘤等神经血管疾病患病率上升以及神经血管导管技术进步等因素,预计多腔导管市场将在预测期内扩大。 例如,根据“2022 年全球中风情况说明书”,2022 年全球将报告 12,224,551 例缺血性中风。 根据同一消息来源,每年有超过 1220 万例新中风发生。 在全球范围内,25 岁以上的人中有四分之一会在一生中患中风。 因此,预计缺血性中风病例和使用多腔导管进行治疗会增加,从而推动市场增长。

此外,预计主要製造商增加产品发布、战略联盟和合作伙伴关係将推动市场增长。 例如,Zeus Industrial Products 于 2022 年 2 月在其产品线中添加了 PTFE Sub-Lite-Wall 多腔管。 它具有超薄壁,通过了 USP VI 级生物相容性认证,具有高结构完整性、改进的平面度、高润滑性和出色的介电强度。

因此,由于神经血管并发症的增加、多腔导管产品发布的增加以及研发的增加,预计所研究的细分市场将在预测期内呈现增长。

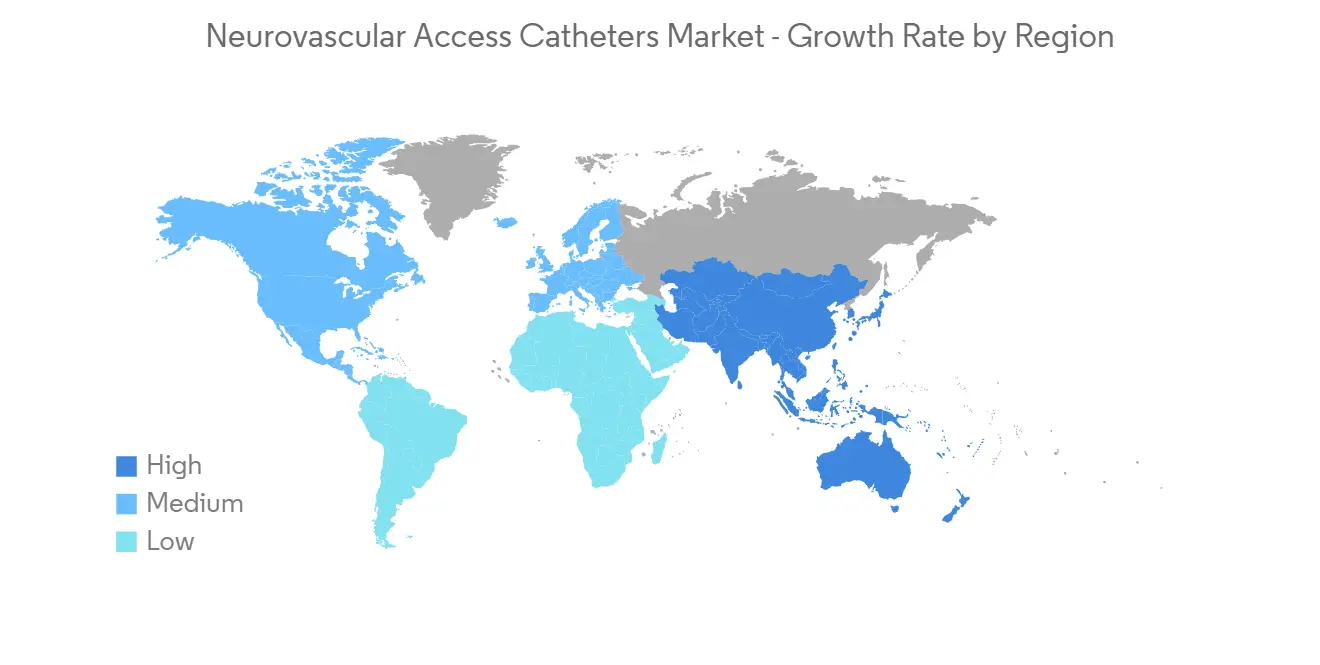

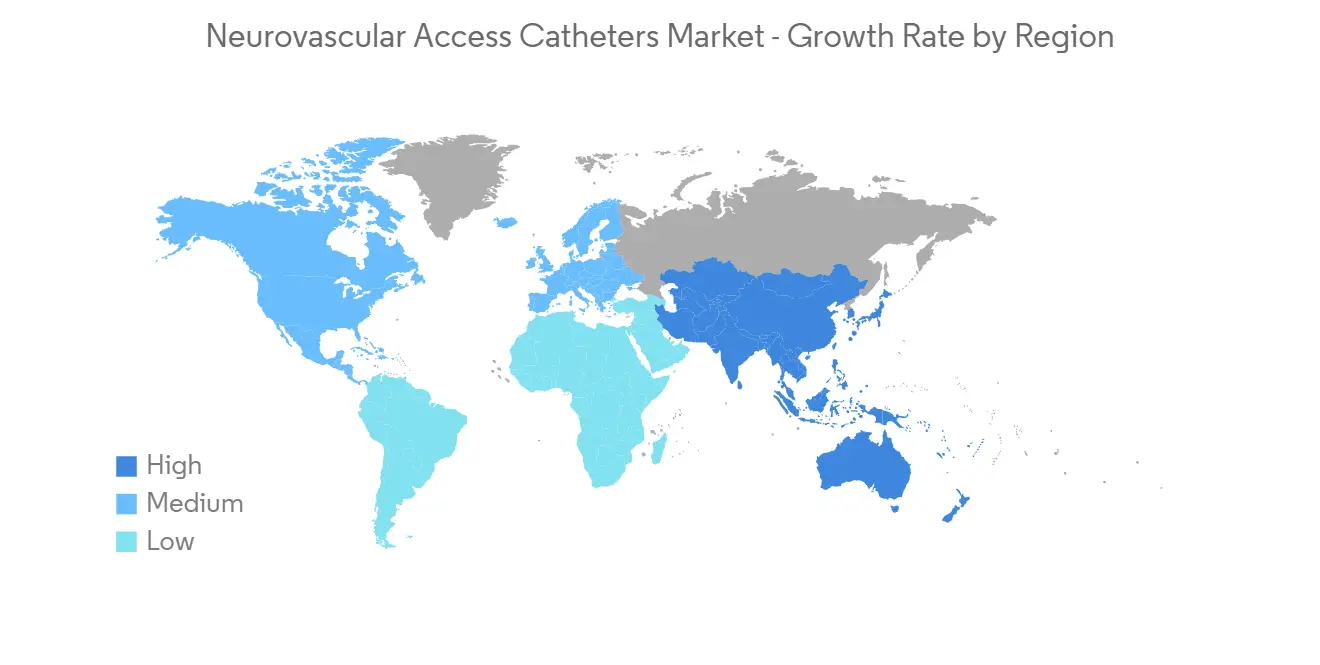

预计北美将占据很大的市场份额,预计在预测期内也会如此

预计北美将占据全球神经血管通路导管市场的很大份额。 这是由于该地区缺血性中风、狭窄和脑动脉瘤等神经血管疾病的流行,神经血管导管插入术的流行率越来越高,诊断率高。

脑动脉瘤基金会 2023 年更新估计,美国估计有 670 万人患有未破裂的脑动脉瘤,其中每 50 人中就有 1 人患有未破裂的脑动脉瘤。 在美国,每年约有 30,000 人患有脑动脉瘤破裂。 每 18 分钟就有一个脑动脉瘤破裂。 因此,脑动脉瘤的高患病率可能会增加神经血管通路导管的采用,从而促进市场增长。 此外,不断增加的产品发布和完善的医疗保健基础设施的存在也为整个区域市场的增长做出了重大贡献。 例如,2022 年 8 月,神经血管设备开发商 Vena Medical 在伦敦健康科学中心(LHSC)、大学医院和渥太华医院(TOH)宣布全球首例使用 Vena BDAC 治疗 5 名患者。 加拿大将率先受益于在患者后院开发的 Vena BDAC 技术,该技术适用于需要机械血栓切除术治疗缺血性中风的患者。 血栓切除术是一种去除血块的微创手术,现在是大血管闭塞引起的急性缺血性中风 (AIS) 患者的标准治疗方法。

随着神经血管疾病变得更加普遍、神经血管通路导管产品的增加以及研发的进步,预计未来几年北美将实现增长。

神经血管通路导管行业概况

神经血管通路导管市场竞争适中,由几家大型企业组成。 就市场份额而言,目前少数大公司占据市场主导地位。 Stryker Corporation、Medtronic Plc、Johnson & Johnson、Integer Holdings Corporation、Biomerics、Penumbra, Inc、Zeus Industrial Products, Inc 和 Imperative Care Inc 是市场领导者。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 调查假设和市场定义

- 本次调查的范围

第二章研究方法论

第 3 章执行摘要

第四章市场动态

- 市场概览

- 市场驱动力

- 神经血管疾病的患病率增加

- 神经血管导管技术进展

- 市场製约因素

- 神经血管通路导管中存在生物相容性问题

- 波特的五力分析

- 新进入者的威胁

- 买方/消费者议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

第 5 章市场细分

- 按产品类型

- 单腔导管

- 双腔导管

- 多腔导管

- 按材料

- 液晶聚合物

- 氟化乙烯丙烯

- 其他材料

- 按地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 意大利

- 西班牙

- 其他欧洲

- 亚太地区

- 中国

- 日本

- 印度

- 澳大利亚

- 韩国

- 其他亚太地区

- 中东和非洲

- 海湾合作委员会

- 南非

- 其他中东和非洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美

第六章竞争格局

- 公司简介

- Stryker Corporation

- Medtronic Plc

- Johnson & Johnson

- Integer Holdings Corporation

- Biomerics

- Penumbra, Inc

- Zeus Industrial Products, Inc

- Imperative Care Inc

- ICU Medical, Inc

- Teleflex Incorporated

第七章市场机会与未来趋势

During the time frame of the forecast, the neurovascular access catheters market is expected to grow at a CAGR of 4.9%.

COVID-19 had a big effect on the market for neurovascular access catheters because many neurovascular surgeries had to be put off or stopped during the first wave of the pandemic. For example, a February 2021 article in PubMed says that coronavirus affects neurological presentations and health status because neurological patients need to stay in the hospital more often and have a higher risk of death and disability when they get out.Due to the global lockdown, it was hard for patients with neurological problems to get regular checks and treatment, which had a big effect on the market studied.But now that the restrictions have been lifted, the market is likely to grow because neurovascular problems are becoming more common and more people are using neurovascular access catheters.

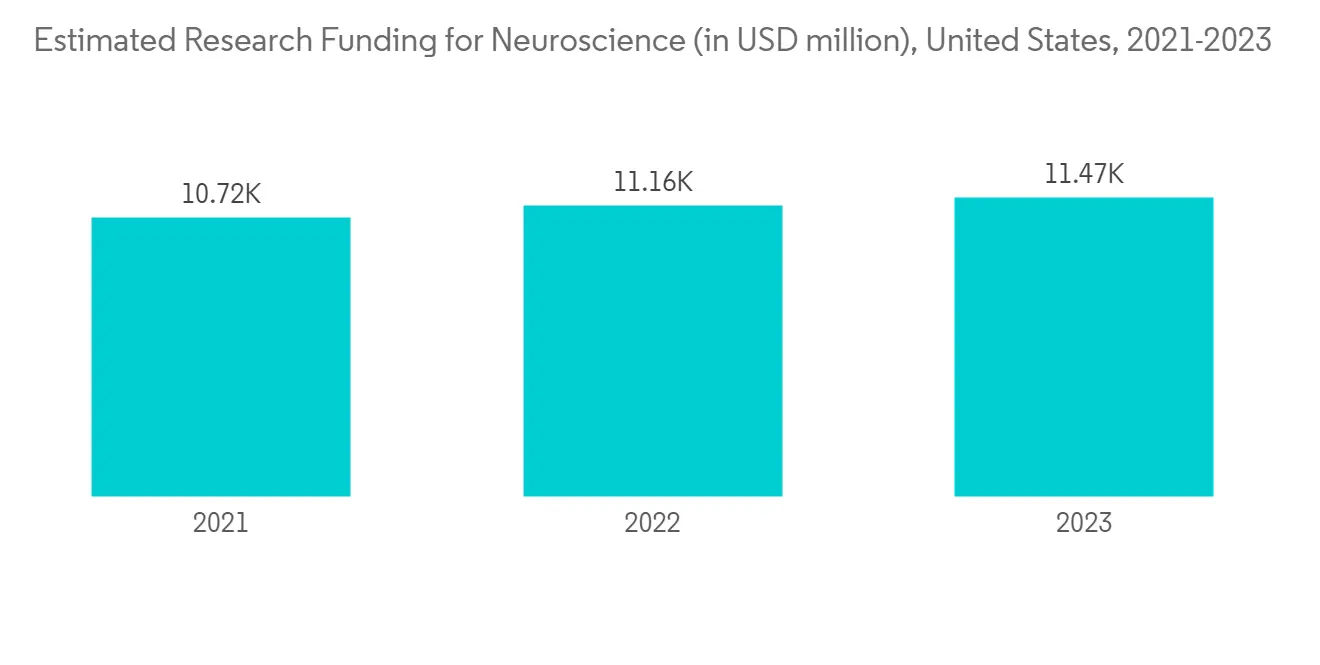

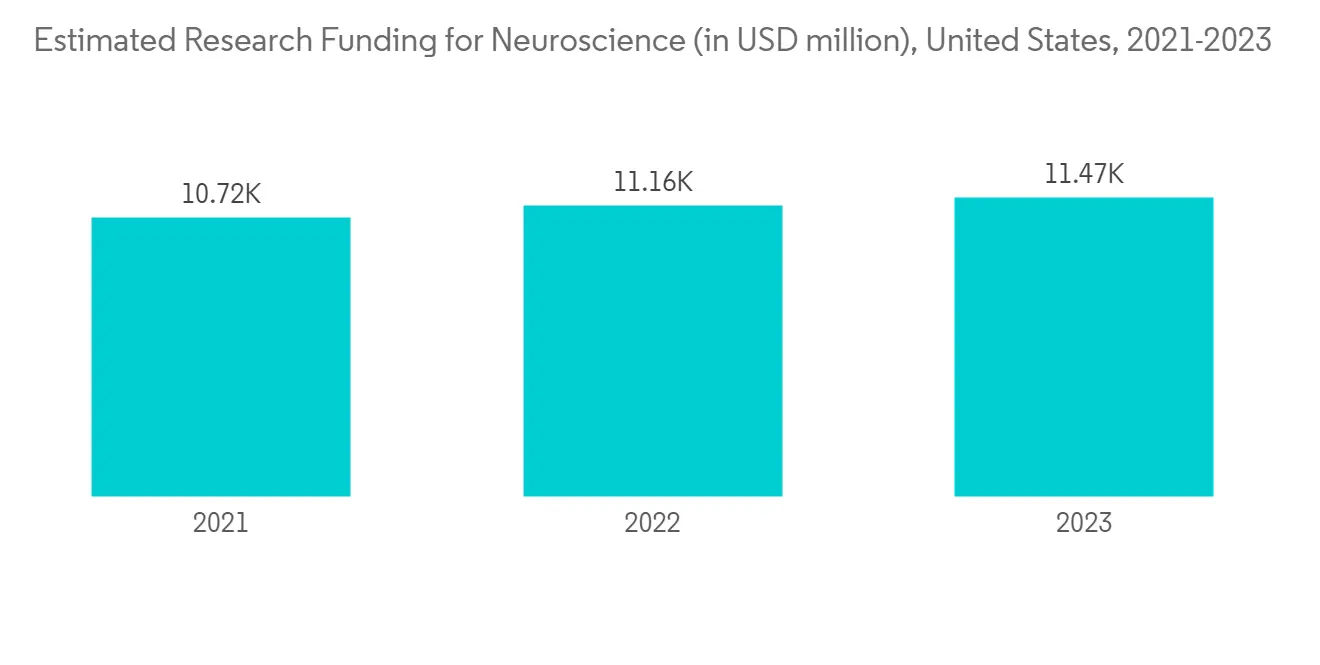

Market growth is likely to be driven by things like the rise of neurovascular diseases and the improvement of neurovascular catheter technology.For example, according to an article in Frontiers from March 2022, the estimated global incidence of subarachnoid hemorrhage (SAH) is 6.67 per 100,000 people. Each year, SAH affects nearly 500,000 people, and nearly two-thirds of these people live in low- and middle-income countries.Furthermore, technological advances in neurovascular access catheters are expected to drive market growth over the forecast period. For instance, in February 2022, CERENOVUS, an emerging company that focuses on neurovascular care and is part of the Johnson & Johnson Medical Device Companies, launched the EMBOGUARD, a next-generation balloon guide catheter to be used in endovascular procedures, including those for patients with acute ischemic stroke.

Also, research studies and comparisons of the different neurovascular access catheters should help the market grow during the study period. For example, a September 2022 article in PubMed said that a 0.096-inch inner diameter access catheter could be used for neurovascular treatments through both the femoral artery and the radial artery. It had a good rate of technical success and a low rate of problems during the procedure.

So, the studied market is likely to grow over the next few years because neurovascular complications are getting worse, more neurovascular access catheter products are coming out, and more research and development is being done. But problems with biocompatibility are likely to slow market growth for neurovascular access catheters.

Neurovascular Access Catheters Market Trends

Multiple Lumen Catheters Segment is Expected to Hold a Notable Market Share in the Neurovascular Access Catheters Market Over the Forecast Period

A multi-lumen catheter is a single catheter that has multiple internal channels (called lumens). Each lumen can be connected to a distinct intravenous infusion, and the fluid will normally emerge at a slightly different place along the catheter. The multi-lumen catheter market is expected to expand during the forecast period due to factors such as the rising prevalence of neurovascular disorders such as ischemic stroke, stenosis, brain aneurysm, and other illnesses, as well as technological advancements in neurovascular catheters. For instance, as per the Global Stroke Fact Sheet 2022, 12,224,551 cases of ischemic stroke were reported in 2022 across the globe. As per the same source, there are over 12.2 million new strokes each year. Globally, one in four people over age 25 will have a stroke in their lifetime. Hence, the rise in cases of ischemic stroke is anticipated, utilizing the multi-lumen catheter for the treatment and thereby promoting the market growth.

Additionally, an increase in product launches, strategic collaborations, and partnerships by the major players is expected to promote market growth. For example, Zeus Industrial Products added PTFE Sub-Lite-Wall multi-lumen tubing to its line of products in February 2022.It has ultrathin walls, is certified USP Class VI biocompatible, has high structural integrity, improved planarity, high lubricity, and excellent dielectric strength.

Thus, due to the rise in neurovascular complications, increase in multi-lumen catheter product launches, and increase in research and development, the studied segment is anticipated to witness growth over the forecast period.

North America is Expected to Hold a Significant Share in the Market and Expected to do Same in the Forecast Period

North America is expected to have a large share of the global market for neurovascular access catheters. This is because neurovascular disorders like ischemic stroke, stenosis, brain aneurysms, and other illnesses are becoming more common, neurovascular catheters are becoming more popular, and the rate of diagnosis is high in this region.

As per the Brain Aneurysm Foundation's 2023 update, an estimated 6.7 million people in the United States have an unruptured brain aneurysm, or 1 in 50 people. About 30,000 people in the United States suffer a brain aneurysm rupture each year. A brain aneurysm ruptures every 18 minutes. Hence, the high prevalence of brain aneurysms is likely to increase the adoption of neurovascular access catheters and thereby boost market growth. Furthermore, increasing product launches and the presence of a well-established healthcare infrastructure are also fueling the growth of the overall regional market to a large extent. For instance, in August 2022, Vena Medical, a developer of neurovascular devices, publicized the successful treatment of the first five patients in the world using the Vena BDAC at the London Health Sciences Centre (LHSC), the University Hospital, and The Ottawa Hospital (TOH). Canada is the first to benefit from the Vena BDAC technology developed right in the patient's backyard for those requiring mechanical thrombectomy during ischemic stroke treatment. Thrombectomy, a minimally invasive procedure to remove a blood clot, is now the standard of care treatment for patients with an acute ischemic stroke (AIS) secondary to a large vessel occlusion.

North America is expected to grow over the next few years because neurovascular diseases are becoming more common, more neurovascular access catheter products are coming out, and more research and development is being done.

Neurovascular Access Catheters Industry Overview

The neurovascular access catheters market is moderately competitive and consists of several major players. In terms of market share, a few of the major players are currently dominating the market. Stryker Corporation, Medtronic Plc, Johnson & Johnson, Integer Holdings Corporation, Biomerics, Penumbra, Inc, Zeus Industrial Products, Inc, and Imperative Care Inc are some of the market leaders.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Prevalence of Neurovascular Disorders

- 4.2.2 Technological Advancements in Neurovascular Catheters

- 4.3 Market Restraints

- 4.3.1 Presence of Biocompatibility Issues with Neurovascular Access Catheters

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD Million)

- 5.1 By Product Type

- 5.1.1 Single Lumen Catheters

- 5.1.2 Double Lumen Catheters

- 5.1.3 Multiple Lumen Catheters

- 5.2 By Material

- 5.2.1 Liquid Crystal Polymer

- 5.2.2 Fluorinated Ethylene Propylene

- 5.2.3 Other Materials

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Stryker Corporation

- 6.1.2 Medtronic Plc

- 6.1.3 Johnson & Johnson

- 6.1.4 Integer Holdings Corporation

- 6.1.5 Biomerics

- 6.1.6 Penumbra, Inc

- 6.1.7 Zeus Industrial Products, Inc

- 6.1.8 Imperative Care Inc

- 6.1.9 ICU Medical, Inc

- 6.1.10 Teleflex Incorporated