|

市场调查报告书

商品编码

1273410

下一代网络市场——增长、趋势和预测 (2023-2028)Next Generation Network Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

在预测期内,下一代网络市场预计将以 7.3% 的复合年增长率增长。

主要亮点

- 随着下一代网络的演进和未来网络的进一步演进,信息和通信基础设施架构正在迅速变化,以满足快速扩展的 ICT 支持的服务和应用的需求。

- 技术发展和下一代网络部署的进步对公共网络运营商来说至关重要。以具有竞争力的价格提供一系列增值服务是在这个竞争激烈的市场中脱颖而出、生存甚至发展的有效创新方式。

- 此外,应用、服务和网络的融合有望塑造电信行业的未来。面对如此快速的市场变化,运营商需要将现有网络基础设施升级到下一代平台,以跟上当前市场趋势并满足对高级网络需求的预期增长。

- 企业带宽需求每年以超过 50% 的速度增长。随着国际带宽价格的逐步下降,国际互联网、公用电话和交换语音网络的容量将成倍增加。此外,带宽需求以及企业对数字工作场所(灵活工作、云、统一通信、协作)的需求是采用新技术的主要要求。

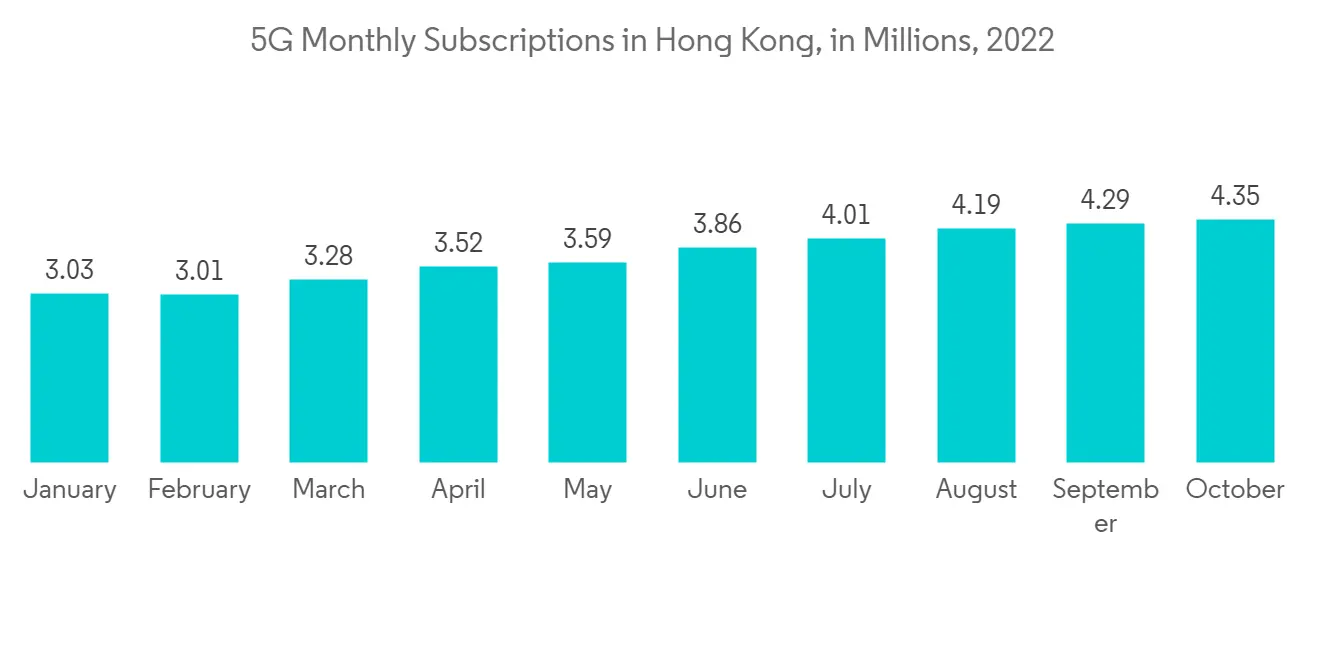

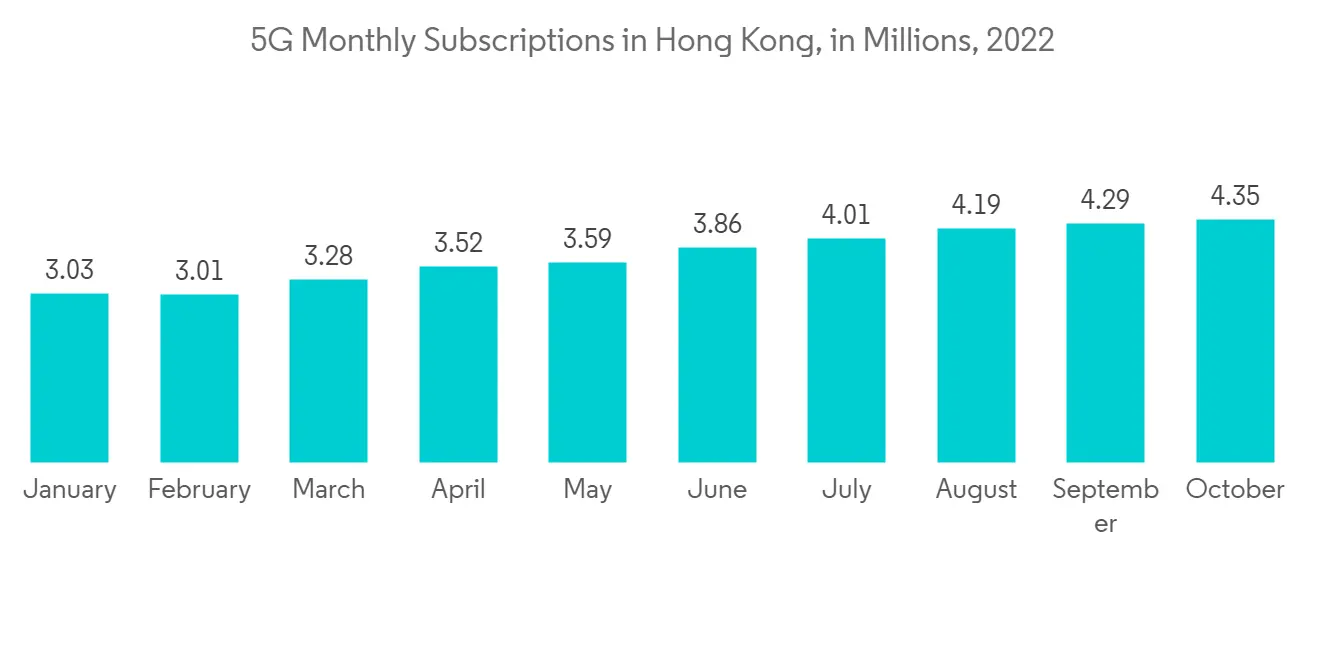

- 此外,全球多家电讯服务供应商已宣布推出5G,这是推动市场的另一主要因素。例如,2022 年 11 月,T-Mobile 推出了强大的固定无线接入 (FWA) 产品,利用 4G 和 5G 移动网络实现家庭连接。因此,自推出 5G 网络以来,T-Mobile 在市场上越来越成功。

- 此外,例如,UAE拥有世界上最快的 5G 和固定宽带数据速度。5G在该国的普及率正在上升。此外,这种速度是由于增加了对光纤网络而不是传统铜线网络的投资。随着越来越多的人在家工作并花更多的时间上网娱乐和其他目的,对更快的互联网连接的需求也越来越大。

- 冠状病毒流行加剧了网络流量。儘管网络流量激增,而且宽带的重要性在一夜之间得到全球认可,但服务提供商仍警告投资者註意这一流行病的财务影响。此外,在此期间,网络覆盖范围和兼容设备的可用性受到限制。随着运营商加速5G和光纤网络的部署,各大智能手机厂商纷纷推出多款支持5G的智能手机新品。因此,5G 将在 2020 年席捲全球。

下一代网络市场趋势

通信服务提供商有望实现显着增长

- 下一代网络提供单一网络,可以将电话呼叫、网络会话和视频会议信息从源传输到目的地。此外,这些解决方案还提供增值服务,例如实时和非实时交易和内容服务。此外,它还可以提供具有端到端服务质量的宽带能力。灵活的架构和低成本使其成为运营商的有效解决方案。

- 随着 5G 网络的推出,智能手机 OEM 和运营商正在迅速为这一转变做准备。同样,世界各地的运营商都在升级他们的产品和服务,以在下一代网络市场建立据点。

- 全球数据流量的爆炸式增长催生了对高效、大容量 IP 网络的需求。因此,多个地区的运营商都在大量部署下一代网络来管理不断增长的数据流量。

- 2022 年 9 月,中国ZTE与泰国移动运营商 AIS 联合启动了 5G 创新中心,以促进该地区基础设施的升级,助推该国的数字经济。

- 此外,2022 年 2 月,墨西哥电信监管机构授权 America Movil 的 Telcel 提供 5G 服务,为拉丁美洲最大的商用 5G 网络铺平了道路。

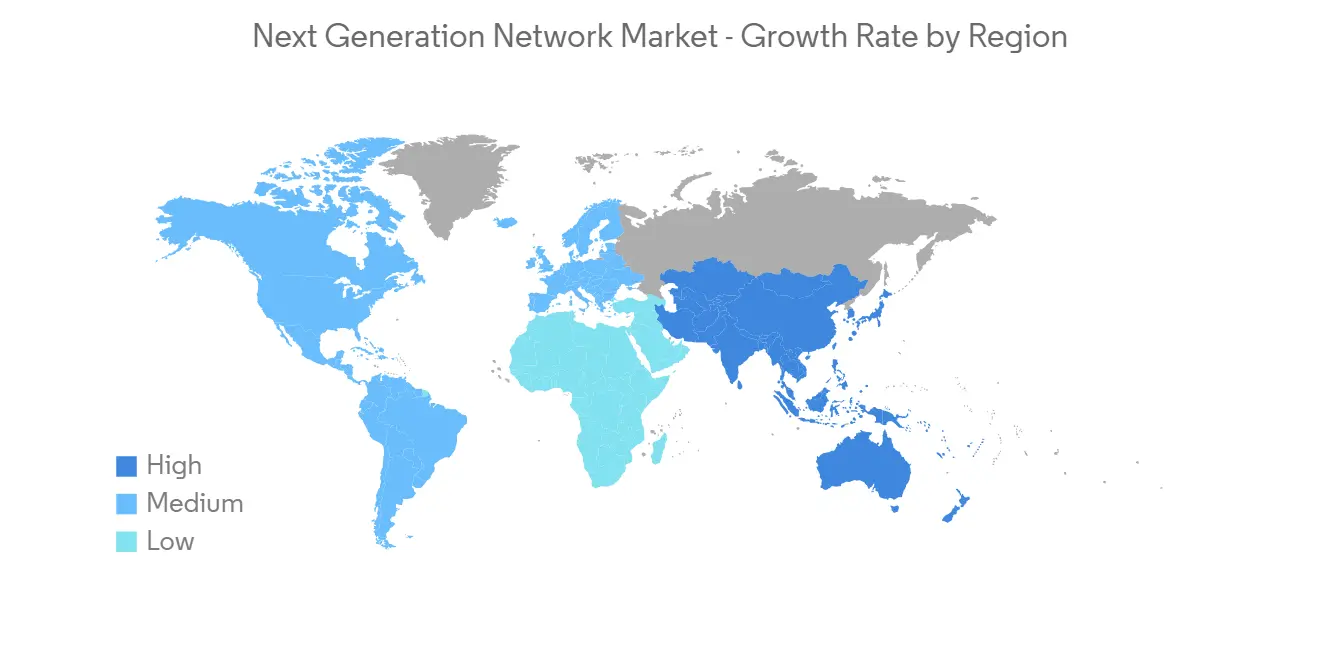

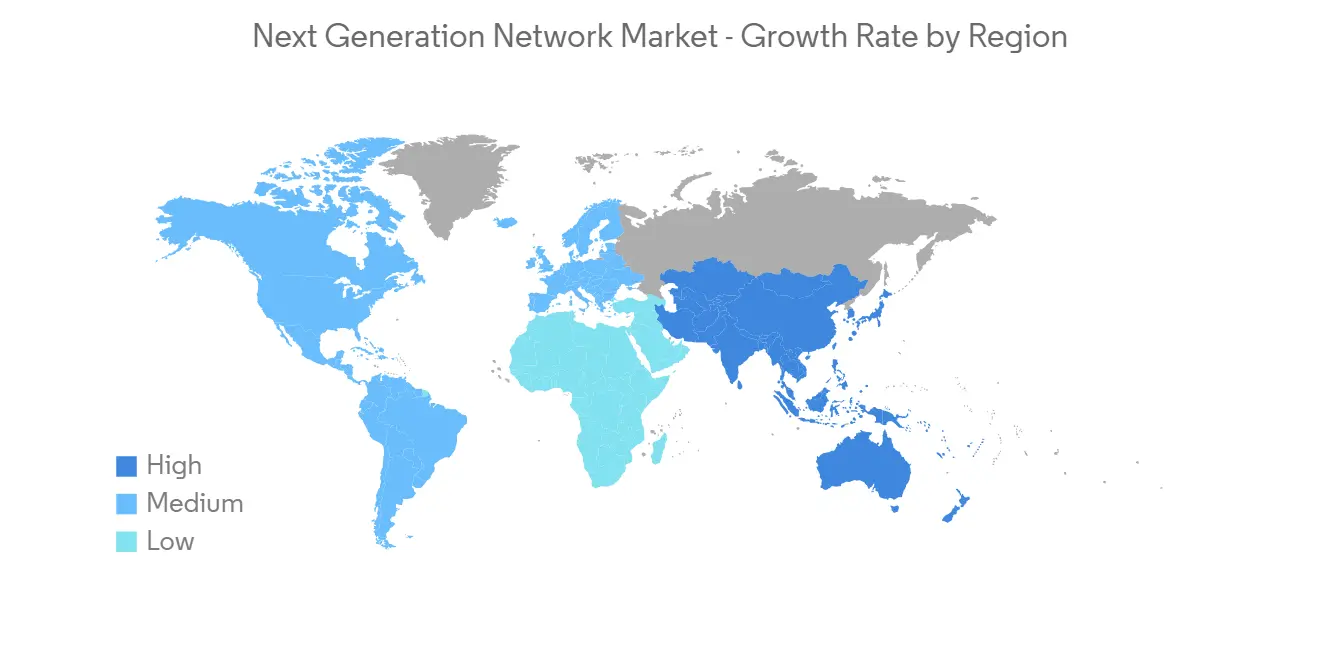

预计北美将出现强劲增长

- 由于技术的快速升级和在美国和加拿大等国家的广泛采用,预计北美地区下一代网络市场将出现显着增长。

- 该地区是全球主要组织的主要枢纽。不断扩大的零售业和物联网 (IoT) 的增长也推动了该地区对下一代网络的需求。

- 根据 Cisco 的最新报告 Visual Networking Index,智能家居将在未来几年显着推动物联网连接的增长。到 2022 年,该地区的平均家庭将拥有九台设备,其中视频功能占所有设备和连接的近一半 (48%)。

- 与其他地区相比,预计该地区对机器对机器通信、联网汽车和人工智能等先进技术的需求增长最快,从而为网络提供商提供重要的增长机会。

- 例如,2022 年 10 月,SaskTel 宣布在 Moose Jaw 推出其 5G 无线网络。SaskTel 的 5G 网络提供闪电般的数据速度和卓越的连接性,继续为萨斯喀彻温省的连接设定新标准。

- 2022 年 9 月,NEC 公司在新泽西州新普罗维登斯成立了北美 5G 创新部门,以扩大产品开发并满足全球对开放式 RAN 解决方案日益增长的需求。

下一代网络产业概况

由于国内外多家有影响力的公司的存在,下一代网络市场竞争激烈。市场竞争较低,主要参与者似乎正在采取产品创新、战略合作伙伴关係、併购等战略,主要是为了扩大产品组合和扩大地理范围。市场参与者包括Cisco Systems, Huawei Technologies, ZTE, Ericsson。

2022 年 9 月,全球数字生态系统推动者 Tata Communications 在印度浦那启动了专用的私有 5G 世界中心 (CoE),以加速企业的工业 4.0 应用和能力。这个新的 CoE 是一个敏捷、安全的室内设施,用于测试和原型製作行业用例。Tata Communications 在汽车、金属和采矿、机场和港口、製造、物流和医疗保健领域开髮用例。

此外,2022 年 3 月,国际领先的移动互联网通信、企业和消费者技术解决方案供应商中兴通讯将在西班牙巴塞罗那举行的世界移动通信大会上展示一系列全新的 5G 产品和解决方案。新技术和解决方案体现了ZTE致力于建立最简单、最节能的5G网络,以一体化专网加速行业数字化转型,简化复杂网络运营的坚定承诺。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 本次调查范围

第二章研究方法论

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动力

- 对高速通信服务的需求不断增长

- 市场製约因素

- 与基础设施相关的高成本

- 波特五力分析

- 新进入者的威胁

- 买方/消费者议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- COVID-19对下一代网络市场的影响

第五章市场细分

- 提供

- 硬件

- 软件

- 服务

- 最终用户

- 电信运营商

- 互联网服务提供商

- 政府机构

- 区域

- 北美

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第六章竞争格局

- 公司简介

- Cisco Systems, Inc.

- Huawei Technologies Co., Ltd.

- ZTE Corporation

- Ciena Corporation

- IBM Corporation

- Samsung Electronics Co., Ltd.

- NEC Corporation

- Juniper Networks, Inc.

- Nokia Corporation

- Telefonaktiebolaget LM Ericsson

第七章投资分析

第八章市场潜力

The next generation network market is expected to register a CAGR of 7.3% during the forecast period.

Key Highlights

- The architecture of the information and communication infrastructures is rapidly changing to accommodate the requirements of the rapidly growing ICT-enabled services and applications, along with the evolution of next-generation networks and further advancements in future networks.

- The increasing technological development and deployment of the next-generation network are most important for public network carriers. It can be an effective and innovative way for them to differentiate themselves by offering various value-added services at a lower price point and survive and even prosper in this highly competitive market.

- It is also anticipated that the convergence of applications, services, and networks will shape the telecom sector's future. This rapid change in the market is also forcing the network carriers to update their existing network infrastructure to a next-generation platform to meet the current market trends and satisfy the expected increase in demand for advanced networks.

- The corporates' demand bandwidth is increasing by over 50% each year. Also, the amount of capacity deployed on the international internet, public, and switched voice networks doubles as international bandwidth prices gradually decline. Moreover, the bandwidth demands, alongside the organizations, demand for the digital workplace (flexible working, cloud, unified communications, and collaboration) is, also creating a huge requirement for new technologies to be implemented.

- The market is also witnessing the launch of 5G from multiple telecom service providers across the globe, which is also one of the major factors driving the market. For instance, in November 2022, T-Mobile strongly emphasized fixed wireless access (FWA) products, utilizing its 4G and 5G mobile networks to deliver in-home connectivity. As a result, T-Mobile has experienced increasing success in this market since launching its 5G network.

- Also, for instance, UAE has some of the fastest 5G and fixed broadband data speeds worldwide. The country's 5G penetration is rising. Furthermore, the speed is due to increased investment in fiber networks rather than legacy copper networks. The growing number of individuals working from home and more time spent on the internet for entertainment and other uses has raised the need for faster internet connections.

- The coronavirus outbreak intensified the network traffic. Despite this surge in network traffic and global recognition of broadband's overnight significance, service providers warned investors of the financial impact of the pandemic. Also, during that time, network coverage and the availability of compatible devices were restricted. As telecoms sped up their 5G and fiber network rollouts, major smartphone makers launched many new 5G-ready smartphones. Therefore, 5G ramped up in 2020 globally.

Next Generation Network Market Trends

Telecom Service Providers are Expected to Witness Significant Growth

- The next-generation network offers a single network capable of carrying information for a phone call, web session, or video conference from the source to the destination. Further, these solution offers value-added service such as real-time and non-real-time transaction and content services. Moreover, these also provide broadband capabilities with end-to-end quality of service. Flexible architecture and low costs make it an effective solution for telecom operators.

- With 5G networks soon to be rolled out, smartphone original equipment manufacturers (OEMs) and telecom players are rapidly gearing toward the shift. Likewise, telecom service providers across the globe are upgrading their product offerings and services to gain a stronghold in the next generation network market.

- The rapidly increasing data traffic across the globe is creating a demand for effective and high-capacity IP-based networks. As a result, telecommunication operators in multiple regions are primarily adopting next-generation networks to manage this increasing data traffic.

- In September 2022, China's ZTE and Thailand's mobile operator AIS jointly launched a 5G innovation center to facilitate local infrastructure upgrades and advance the country's digital economy.

- Further, in February 2022, Mexico's telecoms regulator authorized Telcel, an arm of America Movil, to provide 5G services, opening the path for Latin America's largest commercial 5G network.

North America is Expected to Witness Significant Growth

- The North American region is expected to witness significant growth in the next-generation network market, owing to fast technological improvement and widespread adoption in countries such as the United States and Canada.

- The region is a primary hub for all major organizations across the world. In addition, the expansion of the retail industry and the growth of the Internet of Things (IoT) are also driving the demand for next-generation networks in the region.

- According to Cisco's recent Visual Networking Index report, smart homes will significantly drive IoT connection development in the following years. By 2022, an average home in the region had nine devices, with video capability accounting for approximately half (48%) of all devices and connections.

- The increase in the demand for advanced technologies, such as machine-to-machine communication, connected cars, and artificial intelligence, is highest in the region compared to other regions; hence is anticipated to offer massive opportunities for the network providers to grow.

- For instance, in October 2022, SaskTel announced the launch of their 5G wireless network in Moose Jaw. By offering ultra-fast data speeds and good connections, SaskTel's 5G network continues to establish a new standard for connectivity in Saskatchewan.

- In September 2022, NEC Corporation created a North American 5G innovation unit in New Providence, New Jersey, to expand product development and cater to the growing global demand for open RAN solutions.

Next Generation Network Industry Overview

The next generation network market is highly competitive owing to the presence of several prominent players in the market running their operations in domestic and international markets. The market appears to be moderately competitive, with the major players adopting strategies such as product innovation, strategic partnerships and mergers, and acquisitions primarily to widen their product portfolio and expand their geographic reach. Some of the major players in the market are Cisco Systems, Inc., Huawei Technologies, ZTE Corp., and Ericsson, among others.

In September 2022, Tata Communications, a global digital ecosystem enabler, launched a dedicated private 5G Global Centre of Excellence (CoE) in Pune, India, to accelerate Industry 4.0 applications and capabilities for enterprises. This new CoE is an agile, secure indoor facility to test and trial industry use cases. Tata Communications has developed use cases across automotive, metals and mining, airports and seaports, manufacturing, logistics, and healthcare sectors.

Further, in March 2022, ZTE Corporation, a major international supplier of mobile internet telecommunications, corporate, and consumer technology solutions, introduced an array of new 5G products and solutions at the Mobile World Congress in Barcelona, Spain. The new technologies and solutions demonstrate ZTE's strong commitment to establishing the simplest 5G network with energy efficiency, accelerating industry digital transformation with all-in-one private networks, and operating complicated networks with simplicity.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Demand for High-Speed Services

- 4.3 Market Restraints

- 4.3.1 High Costs Related to the Infrastructure

- 4.4 Porters Five Force Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Impact of COVID-19 on the Next-generation Network Market

5 MARKET SEGMENTATION

- 5.1 Offering

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Services

- 5.2 End User

- 5.2.1 Telecom Service Providers

- 5.2.2 Internet Service Providers

- 5.2.3 Government

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Latin America

- 5.3.5 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles*

- 6.1.1 Cisco Systems, Inc.

- 6.1.2 Huawei Technologies Co., Ltd.

- 6.1.3 ZTE Corporation

- 6.1.4 Ciena Corporation

- 6.1.5 IBM Corporation

- 6.1.6 Samsung Electronics Co., Ltd.

- 6.1.7 NEC Corporation

- 6.1.8 Juniper Networks, Inc.

- 6.1.9 Nokia Corporation

- 6.1.10 Telefonaktiebolaget LM Ericsson