|

市场调查报告书

商品编码

1273411

NGS 样品製备市场增长、趋势和预测 (2023-2028)NGS Sample Preparation Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

在预测期内,NGS 样本製备市场预计将以 12.4% 的复合年增长率增长。

COVID-19 大流行的爆发正在影响 NGS 样本製备市场。 世界范围内冠状病毒感染人数不断增加,因此有必要开发有效且快速的测序技术,以重建 SARS-CoV-2 的基因组序列,SARS-CoV-2 是 COVID-19 的病原体。我是。 它不仅在开发诊断性分子测试方面很重要,而且在製定有效的策略和战略以减缓大流行的传播方面也很重要。 例如,2020 年 8 月,Helix Laboratories 获得了美国 FDA 紧急使用授权,可以进行基于 NGS 的 COVID-19 测试,以检测上呼吸道标本中的 SARS-CoV-2 刺突蛋白基因。 这种下一代测序仪已应用于 COVID-19 研究,极大地促进了 SARS-CoV-2 的原始追踪。

由于下一代测序 (NGS) 样品製备在大流行中发挥了重要作用,市场经历了正增长,预计在预测期内将继续保持上升趋势。

由于传染病的流行和 NGS 平台的技术进步,测序成本下降是推动市场增长的主要因素。 随着传染病变得越来越普遍,NGS 测序技术已经进入病毒学领域,应用范围很广,包括从宏基因组样本中检测新病毒、重建整个或接近完整的病毒基因组序列,以及病毒进化和亚种分析. 选择的方法正在迅速变化。 例如,根据 WHO 2022 年 8 月的流感更新,120 个国家、地区或区域国家流感中心 (NIC) 和其他国家流感实验室已向 FluNet 提交了数据,直到 24 日。 在此期间,世卫组织全球流感监测和反应系统 (GISRS) 实验室分析了超过 145,086 个样本。 在流感病毒检测呈阳性的 6,449 人中,97.7% 患有甲型流感,2.3% 患有乙型流感。 相似地, 根据世界卫生组织 2021 年报告,全球每年估计有 2100 万人感染伤寒。

此外,据疾病预防控制中心称,黄热病每年影响 30,000 人,其中 90.0% 发生在非洲。 因此,预计在预测期内,全球传染病数量的增加将推动市场增长。

主要和小型参与者发布的新 NGS 技术推动了市场增长。 NGS技术以其成本低、测序效率高等优点,已经取代了传统的测序方法。 例如,据 Illumina 称,自 2021 年人类基因组计划完成以来,下一代测序 (NGS) 的成本已大幅下降。 Illumina 帮助降低了 NGS 的成本,使 1000 美元的人类基因组成为可能。 因此,预计新产品的推出将在预测期内推动市场增长。

然而,NGS 样品製备设备的高成本以及与 NGS 样品製备相关的严格法规可能会阻碍市场增长。

NGS 样本製备的市场趋势

NGS 可以快速对数百或数千个基因或整个基因组进行测序。

NGS 检测的基因突变广泛应用于疾病诊断、预后、治疗决策和患者随访。

下一代测序极大地改变了癌症的研究和治疗。 使用基于 NGS 的基因组测序对癌症患者的个体基因组进行 NGS,已成为最快、成本最低的方法之一。 例如,2021 年 8 月,肿瘤内科专业机构欧洲肿瘤学会 (ESMO) 发布了第一份关于对转移性癌症患者使用下一代测序 (NGS) 的建议。 根据 ESMO 的建议,NGS 可能是结直肠癌中聚合□链反应 (PCR) 的替代方法。 通过对数百万个 DNA 读数进行测序,NGS 非常适合同时识别多个基因及其突变,以促进治疗决策。 因此,用于药物开发的下一代测序样品製备的采用有望增加。

技术进步、主要参与者增加的产品批准和发布、合作伙伴关係和协作也在推动诊断行业的增长。 例如,2021 年 2 月,QIAGEN 和 INOVIO 扩大了合作,使用 INOVIO 的 VGX-3100 下一代测序 (NGS) 为晚期宫颈发育不良创建伴随诊断。 此外,2020 年 8 月,Guardant Health Inc .获得了美国食品药品监督管理局(FDA)对 Guardant360 CDx 的批准,该产品在一项诊断测试中使用了液体活检和 NGS 两种组合技术。 因此,增加与 NGS 诊断相关的产品批准和产品发布可能会为该行业带来新的机遇,从而在预测期内实现大幅增长。

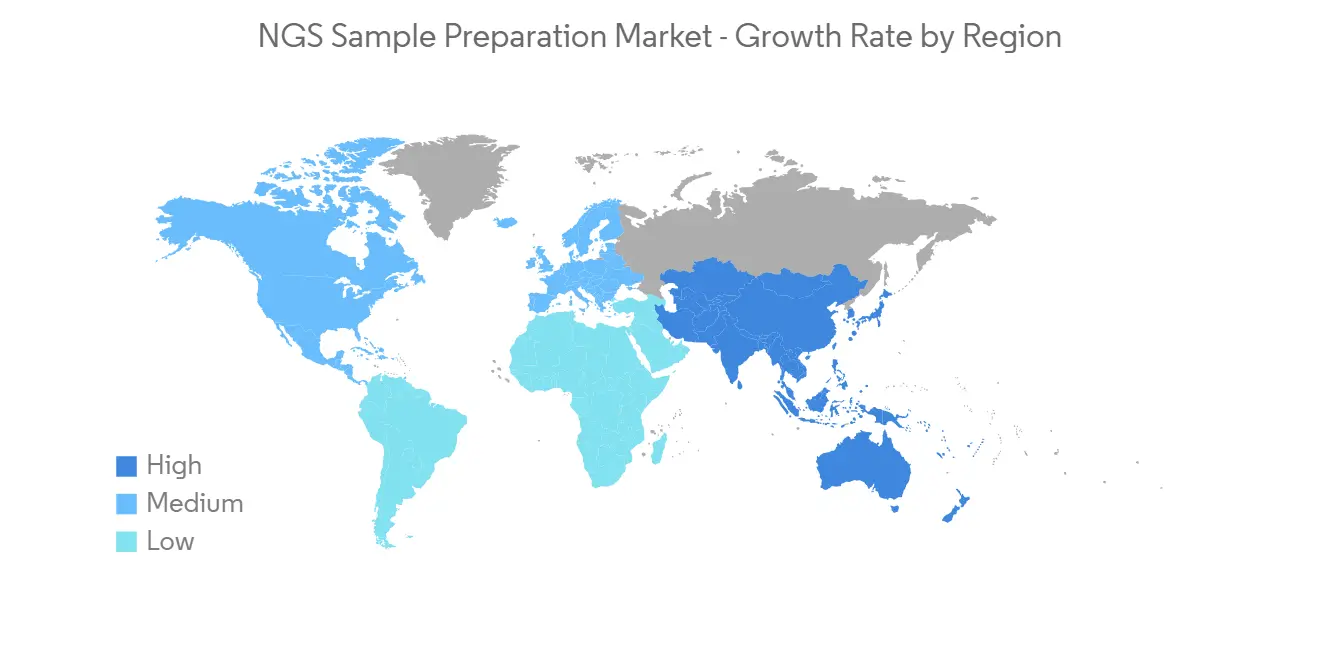

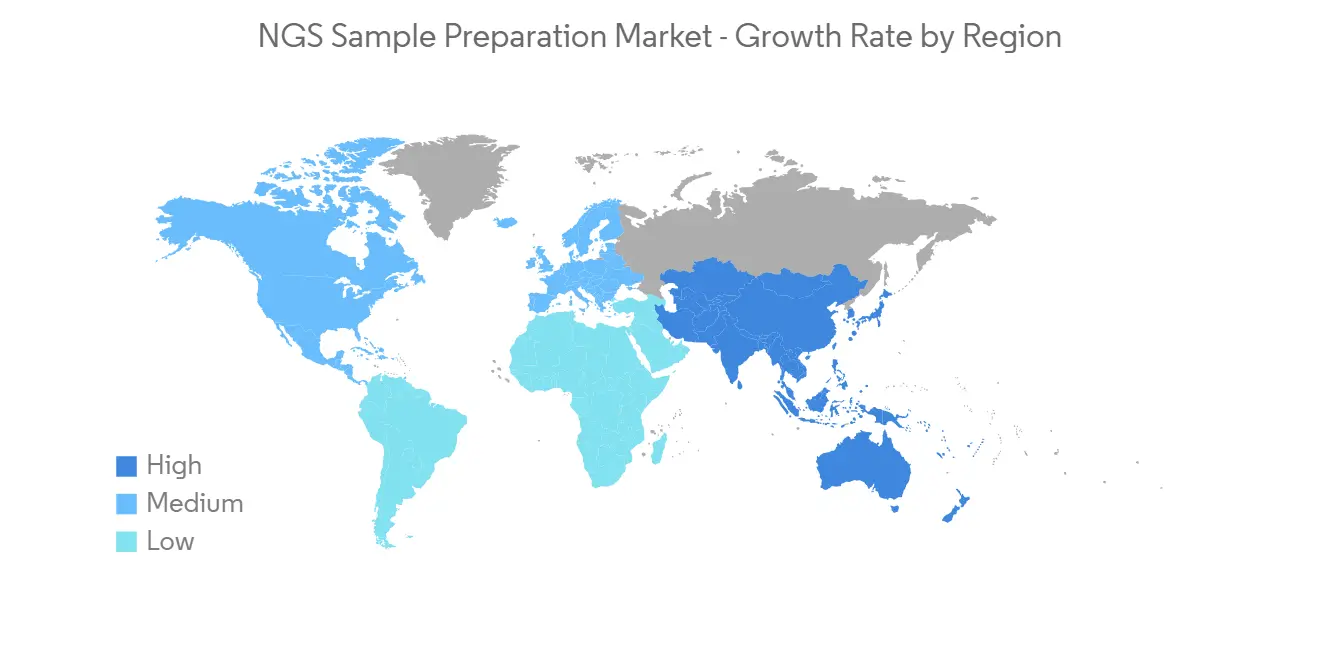

预计在预测期内北美将显着增长

北美市场预计将经历显着的市场增长,原因是该地区对用于识别健康差异的诊断工具的需求不断增长,以及传染病和慢性病的负担不断增加。

主要市场参与者的技术进步、产品发布、合作伙伴关係和收购的增加导致北美市场增长加快。 例如,2022 年 1 月,Illumina 与范德比尔特大学医学中心 (VUMC) 的子公司 Nashville Biosciences LLC 宣布,利用 Illumina 的新一代测序 (NGS) 平台进行大规模基因组分析,并建立临床基因组资源,将引领签订多年协议以加速药物开发。 这些努力有望推动北美 NGS 样品製备市场的增长。

主要产品发布、集中的市场参与者和製造商存在、主要参与者之间的收购和合作伙伴关係、来自联邦和私人参与者的资金增加、美国非政府和政府机构对 NGS 技术的采用是推动 NGS 增长的因素之一该国的 NGS 样品製备市场。 例如,2021 年 4 月,安捷伦科技收购了 Resolution Biosciences,后者是基于下一代测序 (NGS) 的精准肿瘤学解决方案研究和商业化的领导者。 同样,2020 年 1 月,美国情报高级研究计划活动向布罗德研究所、哈佛大学和 DNA Scripts 拨款 2300 万美元。 这两个组织已经合作了四年多,以探索将□促 DNA 合成技术和 NGS 整合到一台仪器中的可能性。 因此,这种积极的发展预计将在预测期内推动美国市场的增长。

NGS样品製备行业概览

由于在全球和区域运营的参与者数量较少,NGS 样本製备市场略有整合。 竞争格局包括对具有市场份额的知名国际和本地参与者的分析,包括 Illumina, Inc.、Agilent Technologies, Inc.、Bio-Rad Laboratories, Inc. 和 Thermo Fisher Scientific Inc.、Qiagen N.V.、PerkinElmer Inc.、 F.Hoffmann-La Roche Ltd、BGI Genomics、DNASTAR、Eurofins Scientific、Danaher Corporation (Beckman Coulter)、Macrogen Inc.、Integrated DNA Technologies, Inc. (Swift Biosciences Inc.)、Genomatix 和 Helix OpCo, LLC。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 调查假设和市场定义

- 本次调查的范围

第二章研究方法论

第 3 章执行摘要

第四章市场动态

- 市场概览

- 市场驱动因素

- 传染病发病率上升

- 降低测序成本

- NGS 平台的技术进步

- 市场製约因素

- NGS 样品製备设备成本高

- 与 NGS 样品製备相关的严格规定

- 波特的五力分析

- 新进入者的威胁

- 买方/消费者议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

第 5 章市场细分(市场规模、价值)

- 按产品类别

- 试剂和耗材

- 工作站

- 通过申请

- 诊断

- 药物发现

- 其他用途

- 最终用户

- 医院和诊所

- 製药和生物技术公司

- 其他最终用户

- 地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 意大利

- 西班牙

- 其他欧洲

- 亚太地区

- 中国

- 日本

- 印度

- 澳大利亚

- 韩国

- 其他亚太地区

- 中东和非洲

- 海湾合作委员会

- 南非

- 其他中东和非洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美

第六章竞争格局

- 公司简介

- Illumina, Inc.

- Agilent Technologies, Inc.

- Bio-Rad Laboratories, Inc.

- Thermo Fisher Scientific Inc.

- Qiagen N.V.

- PerkinElmer Inc.

- F. Hoffmann-La Roche Ltd

- BGI Genomics

- DNASTAR

- Eurofins Scientific

- Danaher Corporation(Beckman Coulter)

- Macrogen Inc.

- Integrated DNA Technologies, Inc.(Swift Biosciences Inc.)

- Genomatix

- Helix OpCo, LLC.

第七章市场机会与未来趋势

The NGS sample preparation market is expected to register a CAGR of 12.4% over the forecast period.

The outbreak of the COVID-19 pandemic has impacted the NGS sample preparation market. The increasing coronavirus cases worldwide led to the need to develop effective and quick sequencing technologies to rebuild the genomic sequence of SARS-CoV-2, which was the etiological agent of COVID-19. It was critical in the development of diagnostic molecular tests as well as the development of efficient tactics and strategies to slow the spread of the pandemic. For instance, in August 2020, Helix Laboratory received the U.S. FDA emergency use authorization for NGS based COVID-19 test, which is designed to detect the SARS-CoV-2 spike protein gene in upper respiratory specimens. This next-generation sequencing was applied

for the study of COVID-19 and has greatly promoted SARS-CoV-2 original tracking. Since next-generation sequencing (NGS) sample preparation played a vital role during the pandemic, thus the market witnessed positive growth and is expected to continue the upward trend over the forecast period.

The rising infectious disease prevalence reduced sequencing cost, and technical advancement in NGS platforms are the major factors propelling the market growth. With the increasing prevalence of infectious diseases, NGS sequencing technologies have swiftly become the method of choice in virology for a wide range of applications, including the detection of novel viruses from metagenomic samples, reconstruction of whole or almost complete viral genome sequences, and viral evolution and subspecies analysis. For instance, as per the WHO August 2022 Influenza Update, National Influenza Centers (NICs) and other national influenza laboratories from 120 countries, regions, or territories submitted data to FluNet from 11 July 2022 to 24 July 2022. Over 145,086 samples were analyzed by the WHO Global Influenza Surveillance and Response System (GISRS) laboratories during that time. Among the 6,449 people who tested positive for influenza viruses, 97.7% had influenza A, and 2.3% had influenza B.

Similarly, according to the WHO report 2021, each year, typhoid fever is estimated to affect 21 million people worldwide. Similarly, according to the CDC, 30,000 cases of yellow fever occur annually, out of which 90.0% occur in Africa. Therefore, increasing cases of infectious diseases across the globe is anticipated to propel market growth over the forecast period.

The key and small players' launch of new NGS technologies drive market growth. NGS technologies have replaced traditional sequencing methods because of the low cost and high sequencing efficiency. For instance, according to Illumina, in 2021, the cost of next-generation sequencing (NGS) has decreased dramatically since the completion of the Human Genome Project. Illumina has helped reduce the cost of NGS, enabling the USD 1000 human genome. Therefore, new product launches are expected to surge the market growth over the forecast period.

However, the high costs of NGS sample preparation equipment and strict regulation associated with NGS Sample preparation are likely to impede the market growth.

NGS Sample Preparation Market Trends

Diagnostics Segment is Expected to Witness Considerable Growth Over the Forecast Period

NGS can sequence hundreds and thousands of genes or whole genomes quickly. The sequence variants/mutations detected by NGS have been widely used for disease diagnosis, prognosis, therapeutic decision, and follow-up of patients.

The research and treatment of cancer have been transformed by next-generation sequencing to a great extent. The NGS of individual cancer-patient genomes is carried out using NGS base genomic sequencing, and it has emerged as one of the fastest and less expensive methods. For instance, in August 2021, the European Society for Medical Oncology (ESMO), the medical oncology professional organization, launched its first recommendations on the use of next-generation sequencing (NGS) for patients with metastatic cancers. According to ESMO recommendations, NGS could be an alternative to Polymerase Chain Reaction (PCR) in colon cancers. NGS can be suitable for identifying multiple genes and their mutations concurrently by sequencing millions of DNA reads and driving therapeutic decision-making. This is projected to increase in adoption of next-generation sequencing sample preparation for drug development.

The advancements in technology, increasing product approvals and launches, partnerships, and collaborations by key players are also driving growth in the diagnostics segment. For instance, in February 2021, QIAGEN and INOVIO expanded their partnership to create a companion diagnostic using next-generation sequencing (NGS) for INOVIO's VGX-3100 for advanced cervical dysplasia. Furthermore, in Aug 2020, Guardant Health Inc. received the United States Food and Drug Administration (FDA) approval for Guardant360 CDx, which uses two combined technology, Liquid biopsy, and NGS, in one diagnostic test. Hence, the increasing product approval related to NGS diagnostic and product launches may create new opportunities for the segment, owing to which considerable segment growth is anticipated over the forecast period.

North America is Expected to Witness Significant Growth Over the Forecast Period

North America is expected to witness considerable market growth owing to factors such as the rising need for diagnostics tools for identifying health disparities, and the rising burden of infectious diseases and chronic diseases in the region. The increasing technological advancement, product launches, partnerships, and acquisitions by the key market players are leading to an increase in market growth in North America. For instance, in January 2022, Illumina Inc. and Nashville Biosciences LLC, a subsidiary of Vanderbilt University Medical Center (VUMC), entered a multi-year agreement to accelerate medicines development through large-scale genomics and the establishment of a clinical-genomic resource using Illumina's next-generation sequencing (NGS) platforms. Such initiatives are expected to drive the growth of the NGS sample preparation market in North America.

Key product launches, high concentration of market players or manufacturer's presence, and acquisition & partnerships among major players, and increased funding from the federal government and private players, as well as increased adoption of NGS technology by non-government and government bodies in the United States, are some of the factors driving the growth of the NGS sample preparation market in the country. For instance, in April 2021, Resolution Bioscience, a leader in the research and commercialization of next-generation sequencing (NGS)-based precision oncology solutions, has been acquired by Agilent Technologies. Similarly, in January 2020, in the United States, the Intelligence Advanced Research Projects Activity provided USD 23.0 million to the Broad Institute and Harvard University, and DNA Script. The organizations have been working together to explore the possibility of combining the enzymatic DNA synthesis technology and NGS into a single instrument for more than four years. Therefore, such positive developments are anticipated to boost the market growth in the United States over the forecast period.

NGS Sample Preparation Industry Overview

The NGS sample preparation market is slightly consolidated due to the presence of a few players operating globally and regionally. The competitive landscape includes an analysis of a few international as well as local companies which hold market shares and are well known, including Illumina, Inc., Agilent Technologies, Inc., Bio-Rad Laboratories, Inc., Thermo Fisher Scientific Inc., Qiagen N.V., PerkinElmer Inc., F.Hoffmann-La Roche Ltd, BGI Genomics, DNASTAR, Eurofins Scientific, Danaher Corporation (Beckman Coulter), Macrogen Inc., Integrated DNA Technologies, Inc. (Swift Biosciences Inc.), Genomatix, and Helix OpCo, LLC among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Prevalence of Infectious Diseases

- 4.2.2 Reduced Cost of Sequencing

- 4.2.3 Technical Advancement in NGS Platforms

- 4.3 Market Restraints

- 4.3.1 High Costs of NGS Sample Preparation Equipment

- 4.3.2 Strict Regulation Associated with NGS Sample Preparation

- 4.4 Porter's Five Force Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD Million)

- 5.1 By Product Class

- 5.1.1 Reagent and Consumables

- 5.1.2 Workstations

- 5.2 By Applications

- 5.2.1 Diagnostics

- 5.2.2 Drug Discovery

- 5.2.3 Other Applications

- 5.3 End User

- 5.3.1 Hospitals and Clinics

- 5.3.2 Pharmaceutical and Biotechnology Companies

- 5.3.3 Other End Users

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Illumina, Inc.

- 6.1.2 Agilent Technologies, Inc.

- 6.1.3 Bio-Rad Laboratories, Inc.

- 6.1.4 Thermo Fisher Scientific Inc.

- 6.1.5 Qiagen N.V.

- 6.1.6 PerkinElmer Inc.

- 6.1.7 F. Hoffmann-La Roche Ltd

- 6.1.8 BGI Genomics

- 6.1.9 DNASTAR

- 6.1.10 Eurofins Scientific

- 6.1.11 Danaher Corporation (Beckman Coulter)

- 6.1.12 Macrogen Inc.

- 6.1.13 Integrated DNA Technologies, Inc. (Swift Biosciences Inc.)

- 6.1.14 Genomatix

- 6.1.15 Helix OpCo, LLC.