|

市场调查报告书

商品编码

1273423

包装涂料市场 - 增长、趋势、COVID-19 影响和预测 (2023-2028)Packaging Coatings Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

预计在预测期内,包装涂料市场的复合年增长率将超过 5%。

主要亮点

- COVID-19 影响了全球包装涂料行业的发展。 然而,大流行期间和之后对包装食品和在线食品配送的需求增加推动了包装涂料的消费。

- 推动市场发展的主要因素是软包装涂料需求的增加以及食品和饮料包装的增加。 另一方面,更严格的监管预计会阻碍市场增长。

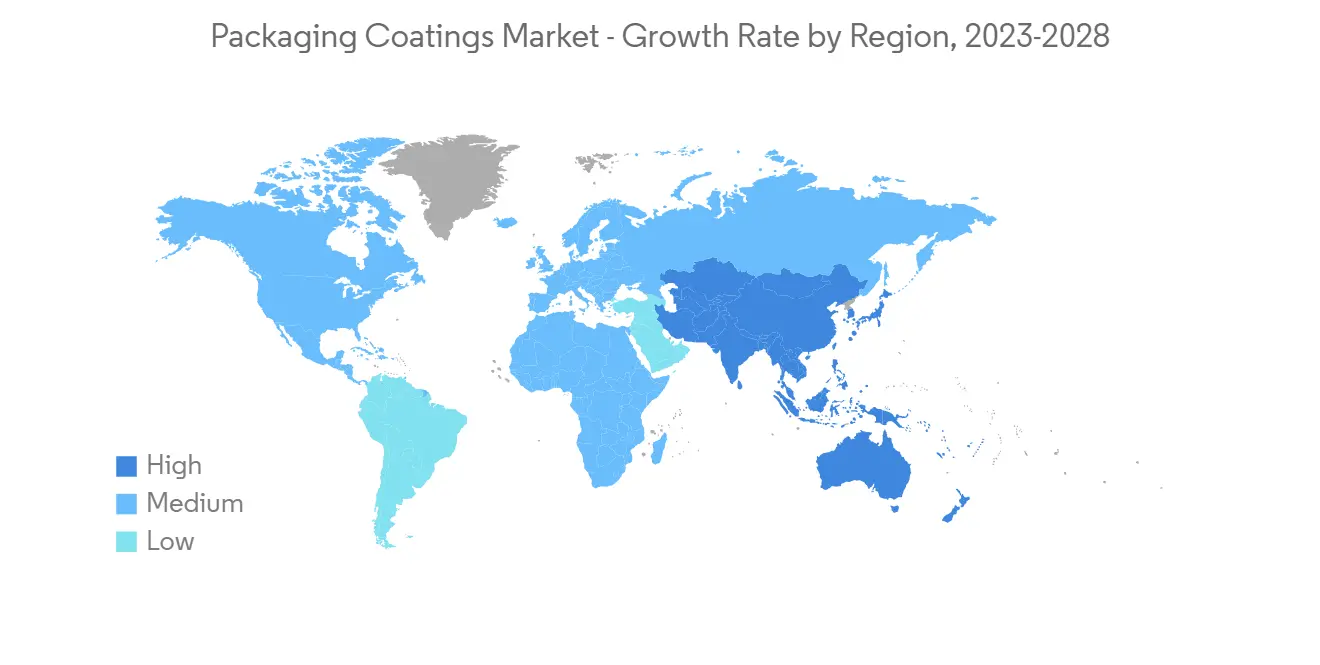

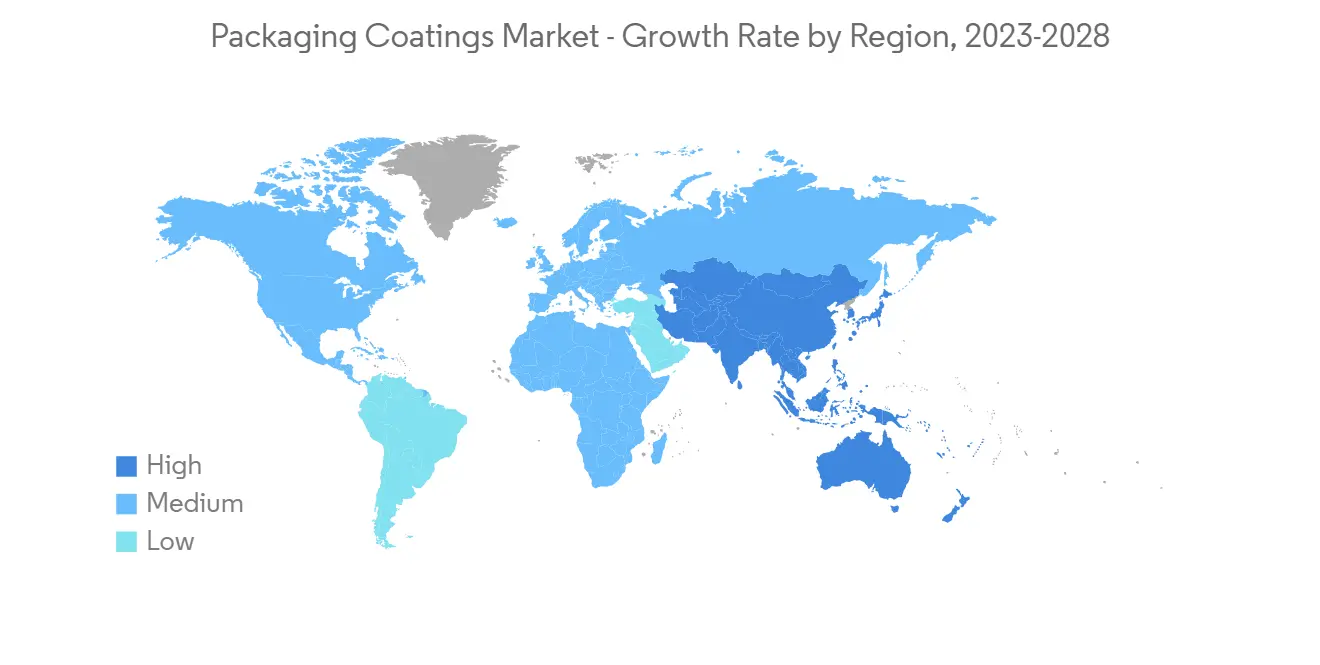

- 此外,向环保涂料的持续转变预计将为未来的市场扩张提供机会。 亚太地区主导着全球市场,中国、印度和日本等国家的消费量最大。

包装涂料的市场趋势

丙烯酸树脂需求扩大

- 丙烯酸树脂分为热塑性塑料和热固性塑料物质。 丙烯酸树脂是以丙烯酸、甲基丙烯酸和其他丙烯酸为原料製造的。 丙烯酸树脂具有优异的透明度和耐久性,用于涂料。

- 由于其作为涂层材料的耐用性和耐候性,被广泛用于饮料罐和食品罐等包装应用。 它还具有防污、防起泡和防裂性能。 由于这些特性,丙烯酸树脂作为涂料被高度评价。

- 高速包装线对涂料的需求不断增加,这推动了固体丙烯酸树脂的使用。 固体丙烯酸树脂具有湿/干附着力、初始耐水性、耐腐蚀/耐化学性、硬度、涂层之间的附着力和优异的外观耐久性等性能,被用作包装涂料。 这些特性使丙烯酸树脂成为饮料罐和固体罐等应用的合适涂料。

- 包装在为各种快速消费品(例如饮料罐、食品罐、瓶盖和气雾剂)增值方面发挥着重要作用。 这个市场增长的主要原因是它在食品和饮料行业中的使用越来越多。

- 由于其创新性和视觉吸引力,包装涂料中使用的丙烯酸通常用于包装 FMCG 产品,吸引了客户的兴趣并增加了便利性。 随着生活方式和消费模式的改变,对包装产品的需求增加,包装行业也在不断发展。

- 丙烯酸树脂涂料目前在油漆和涂料行业中处于领先地位。 丙烯酸树脂涂料以其持久的颜色和对环境条件的耐受性而闻名。 由于环境问题和日益严格的政府法规,该行业正在从溶剂型丙烯酸树脂转向水性丙烯酸树脂。

- 从 2011 年到 2021 年,中国涂料製造业的市场规模每年都在增长,达到 892.5 亿美元的峰值。 2021年中印贸易总额为1256.6亿美元,比2020年增长43.3%。

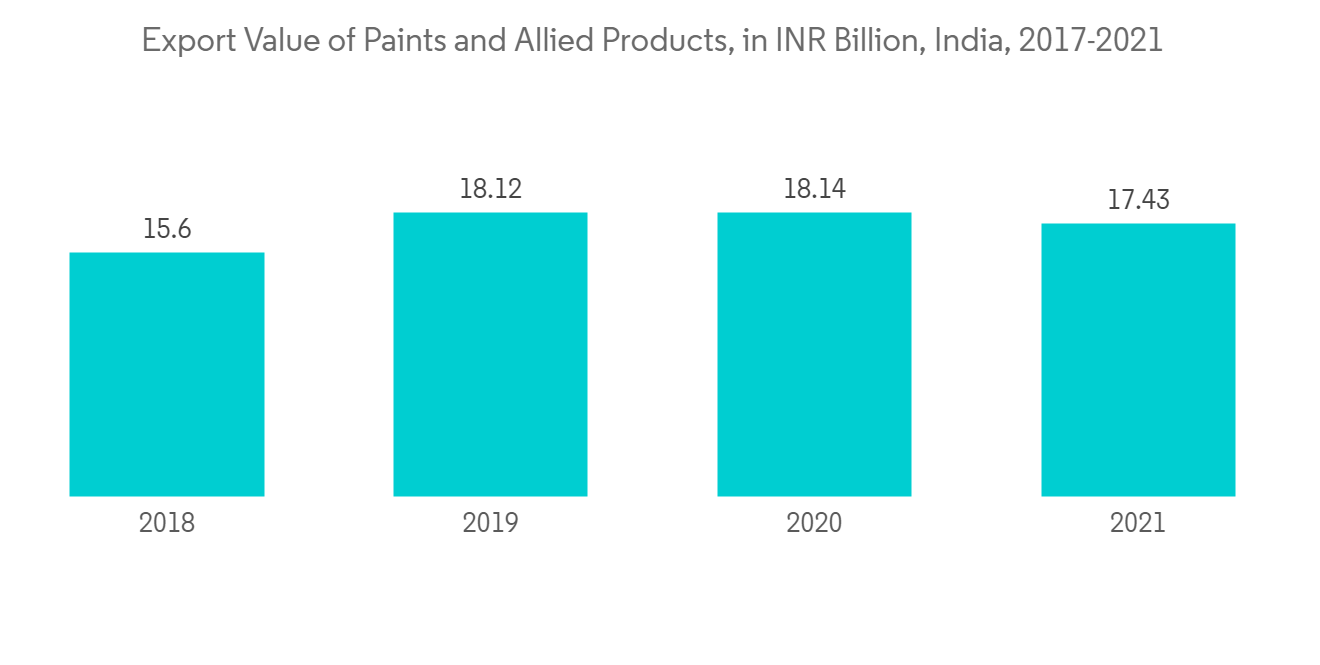

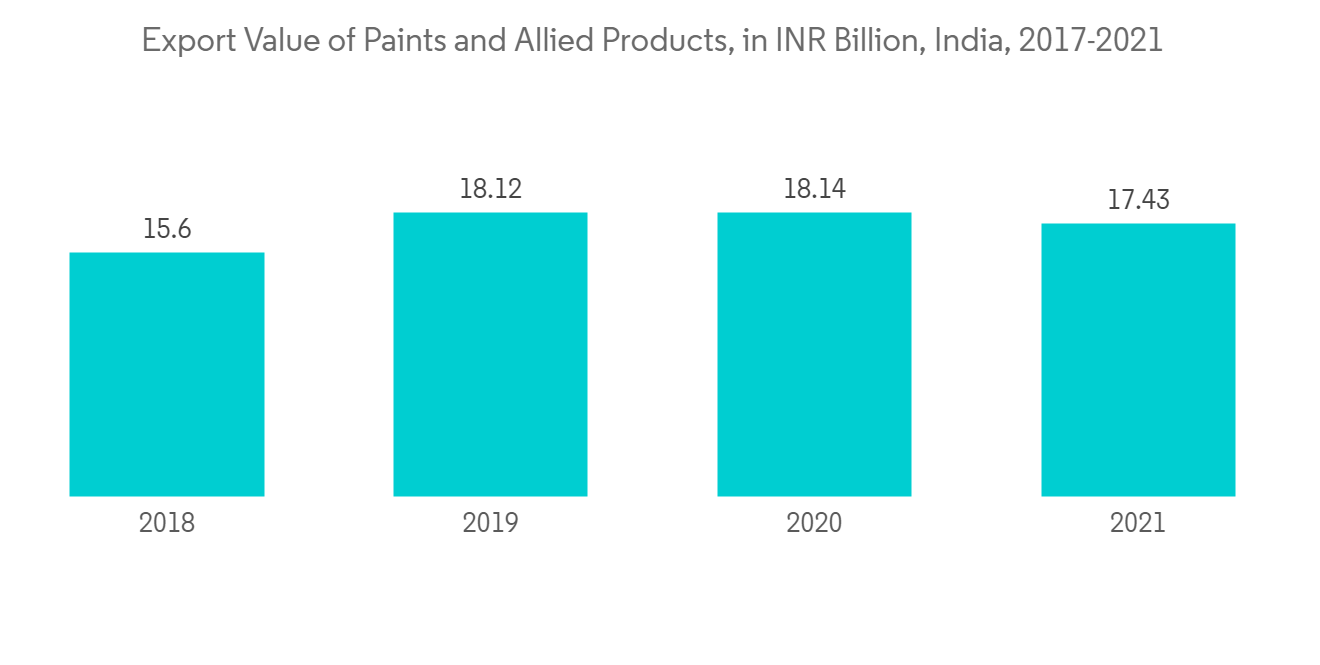

- 此外,2021 年印度涂料行业的贸易额预计将超过 460 亿印度卢比(6.2 亿美元)。 该国油漆及相关产品的出口价值约为 174 亿印度卢比(2.34 亿美元),而进口价值超过 290 亿印度卢比(3.91 亿美元)。

- 印度最大的涂料製造商 Asian Paints 计划投资 96 亿印度卢比(1.28 亿美元)以扩大其位于古吉拉特邦 Ankleshwar 的工厂的产能。 预计丙烯酸树脂的这种正增长将在预测期内增加包装涂料市场的需求。

中国主导亚太

- 中国拥有世界上最大的製造业和最大的消费群。 作为世界上人口最多的国家,中国已成为各种商品的最大消费国。 出于多种原因,包装涂料市场是中国经济增长最快的市场之一。

- 近年来,各种产品对涂料的使用显着增加。 对装饰性和吸引力包装的需求不断增长,导致对包装涂料的需求增加。

- 中国拥有最大的电子商务市场份额。 中国的销售额占所有电子商务销售额的 30% 以上。 中国是世界上增长最快的电子商务市场之一,也是电子商务巨头阿里巴巴的所在地。

- 2021 年,美国对中国的农产品出口将大幅增长,增长 25%,达到创纪录的 329 亿美元。 中国是美国加工食品出口的第五大市场。 2021年出口额将达到21亿美元,同比增长27%。

- 到 2021 年,中国将贡献全球电子商务零售额的一半以上,超过欧洲和美国的总和。

- 电子商务市场的发展导致对包装行业的需求显着增加,进而导致包装涂料行业的需求显着增加。 食品和饮料包装是增长最快的领域之一。

- 6 月份,社会消费品零售总额达到 38742 亿元(5720 亿美元),同比增长 3.1%。 其中,非汽车消费品零售额34192亿元人民币(5050亿美元),增长1.8%。 由于环境污染意识的增强,中国製定了有关有害化学物质(挥发性有机化合物 (VOC) 等)的法规。 这些因素可能会对包装涂料市场产生不利影响。 然而,随着公司迅速适应一系列环保替代品,这些因素因祸得福。

- 上述因素导致预测期内该国包装涂料的消费需求增加。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 调查结果

- 本次调查的假设

- 本次调查的范围

第二章研究方法论

第 3 章执行摘要

第四章市场动态

- 主持人

- 对软包装涂料的需求不断扩大

- 增加食品和饮料包装

- 约束因素

- VOC 排放限制

- 工业价值链分析

- 波特的五力分析

- 供应商的议价能力

- 消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第 5 章市场细分(市场规模:基于金额)

- 树脂

- 环氧树脂

- 亚克力

- 聚氨酯

- 聚烯烃

- 涤纶

- 其他树脂

- 通过使用

- 食品罐头

- 饮料罐

- 气雾剂管

- 瓶盖和封口

- 工业和特殊包装

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 法国

- 英国

- 意大利

- 其他欧洲

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙特阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章竞争格局

- 併购、合资、合作、合同等。

- 市场份额 (%)**/排名分析

- 主要公司采用的策略

- 公司简介

- Axalta Coating Systems

- Akzo Nobel NV

- ALLNEX NETHERLANDS BV

- Arkema Group

- BASF SE

- Berger Paints India Limited

- Chemetall

- Chugoku Marine Paints Ltd

- Diamond Vogel

- DowDuPont

- Evonik Industries AG

- HEMPEL A/S

- Henkel AG & Co. KGaA

- Jotun

- Kansai Paint Co. Ltd

- Masco Corporation

- NIPPONPAINT Co. Ltd

- PPG Industries Inc.

- RPM International Inc.

- SACAL INTERNATIONAL GROUP LTD

- The Sherwin-Williams Company

- Sika AG

- Solvay

- Wacker Chemie AG

- Yip's Chemical Holdings Limited

第七章市场机会与未来趋势

- 快速过渡到环保涂料

- 扩大食品级涂料的研究

简介目录

Product Code: 52777

The packaging coatings market is expected to register a CAGR of more than 5% during the forecast period.

Key Highlights

- COVID-19 impacted the global packaging coatings industry's growth. However, the increased demand for packaged food and online food deliveries during the pandemic and post-pandemic propelled the consumption of packaging coatings.

- The major factors driving the market studied are increasing demand for flexible packaging coatings and rising food and beverage packaging. On the flip side, increasing regulations are expected to hinder the market's growth.

- Swiftly shifting the market to eco-friendly coatings is likely to act as an opportunity in the future. Asia-Pacific dominates the global market, with the largest consumption from countries such as China, India, and Japan.

Packaging Coatings Market Trends

Increasing Demand for Acrylics

- Acrylic resins are segmented into thermoplastic and thermosetting plastic substances. They are produced from acrylic acid, methacrylic acid, or other acryl-based acids. Acrylic resins possess characteristics like excellent transparency and durability and are used in coatings.

- Due to their features like durability and weatherability as coating materials, these resins are used extensively in packaging applications such as beverage cans, food cans, etc. Additionally, they are also resistant to stains, blistering, and cracking. These unique characteristics make acrylic resins a noble choice as a coating material.

- The growing demand for coatings for high-speed packaging lines is enhancing the use of solid acrylics. Solid acrylic resins in packaging coating applications offer properties such as wet and dry adhesion, early water resistance, corrosion and chemical resistance, hardness, good inter-coat adhesion, and excellent exterior durability. These properties make acrylic resin a suitable coating for applications like beverage cans, solid cans, etc.

- Packaging plays a crucial role in adding value to various FMCG products such as beverage and food cans, caps and aerosols, etc. The prime reason for this market's growth is its increasing use in the food and beverage industry.

- Acrylics in packaging coatings are used heavily for packaging FMCG products owing to their innovative and visual appeal for customer attraction and convenience. The growth in lifestyle and consumption patterns has increased the demand for packaged products resulting in a growing packaging industry.

- Acrylic resin coatings are now leading the market of the paints and coatings industry. They are known for their properties of color retention and inertness to environmental conditions. Due to growing environmental concerns and governmental regulations, industries are shifting to waterborne acrylic resins from solvent-based acrylic resins.

- The market value of China's paint manufacturing sector increased annually between 2011 and 2021, reaching a peak of USD 89.25 billion. The total trade between China and India in 2021 stood at USD 125.66 billion, up 43.3% from 2020.

- Furthermore, the trade value of India's paint industry was over INR 46 billion (USD 620 million) in 2021. The value of exported paint and allied products in the country amounted to approximately INR 17.4 billion (USD 234 million) compared to over INR 29 billion (USD 391 million) import value.

- India's largest paint and coating producer, Asian Paints, plans to invest INR 9.60 billion (USD 128 million) to expand the installed capacity at its facility at Ankleshwar in Gujarat. Such positive growth for acrylics will likely increase the demand for the packaging coatings market during the forecast period.

China to Dominate the Asia-Pacific Region

- China has the biggest manufacturing sector in the world and the largest consumer base. Being the most populated country, China makes it the largest consumer of various goods. Owing to various reasons, the packaging coatings market is one of the fastest-growing markets in the Chinese economy.

- The applications of coatings on various products have grown significantly in recent times. The increasing need for decorative and attractive packaging has led to an increase in the demand for coatings for packaging.

- China has the largest share of the e-commerce market. Sales in China account for more than 30% of the total e-commerce sales. China is one of the fastest-growing e-commerce markets in the world, and it is home to the e-commerce giant, Alibaba.

- The United States agricultural exports to China increased significantly in 2021, with a growth of 25% to a record high of USD 32.9 billion. China is the 5th largest market for the export of United States processed foods. Exports in 2021 were valued at USD 2.1 billion, an increase of 27% from the prior year.

- In 2021, China contributed to more than half of the world's e-commerce retail sales, with the sales value surpassing the combined total of Europe and the United States.

- The growth in the e-commerce market led to a huge increase in demand for the packaging industry and, consequently, the packaging coatings industry. Food and beverage packaging is the fastest-growing sector among them.

- In June, the total retail sales of social consumer goods reached CNY 3,874.2 billion (USD 572 billion), an increase of 3.1 percent year-on-year. Among them, the retail sales of consumer goods other than automobiles reached CNY 3,419.2 billion (USD 505 billion), an increase of 1.8 percent. In China, the awareness concerning the environment and pollution led to the formation of regulations related to harmful chemicals (such as volatile organic compounds (VOCs)). Such factors can adversely affect the market for packaging coatings. These factors have also been a blessing in disguise, as companies have quickly adapted to various eco-friendly alternatives.

- The aforementioned factors contribute to the increasing demand for packaging coatings consumption in the country during the forecast period.

Packaging Coatings Industry Overview

The packaging coatings market is consolidated. The major companies include Akzo Nobel NV, PPG Industries Inc., The Sherwin-Williams Company, Henkel AG & Co. KGaA, and Jotun, among others

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Flexible Packaging Coatings

- 4.1.2 Rising Food and Beverage Packaging

- 4.2 Restraints

- 4.2.1 VOC Emission Constraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 By Resin

- 5.1.1 Epoxies

- 5.1.2 Acrylics

- 5.1.3 Polyurethane

- 5.1.4 Polyolefins

- 5.1.5 Polyester

- 5.1.6 Other Resins

- 5.2 By Application

- 5.2.1 Food Cans

- 5.2.2 Beverage Cans

- 5.2.3 Aerosol and Tubes

- 5.2.4 Caps and Closures

- 5.2.5 Industrial and Specialty Packaging

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 France

- 5.3.3.3 United Kingdom

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East & Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East & Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) **/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Axalta Coating Systems

- 6.4.2 Akzo Nobel NV

- 6.4.3 ALLNEX NETHERLANDS BV

- 6.4.4 Arkema Group

- 6.4.5 BASF SE

- 6.4.6 Berger Paints India Limited

- 6.4.7 Chemetall

- 6.4.8 Chugoku Marine Paints Ltd

- 6.4.9 Diamond Vogel

- 6.4.10 DowDuPont

- 6.4.11 Evonik Industries AG

- 6.4.12 HEMPEL A/S

- 6.4.13 Henkel AG & Co. KGaA

- 6.4.14 Jotun

- 6.4.15 Kansai Paint Co. Ltd

- 6.4.16 Masco Corporation

- 6.4.17 NIPPONPAINT Co. Ltd

- 6.4.18 PPG Industries Inc.

- 6.4.19 RPM International Inc.

- 6.4.20 SACAL INTERNATIONAL GROUP LTD

- 6.4.21 The Sherwin-Williams Company

- 6.4.22 Sika AG

- 6.4.23 Solvay

- 6.4.24 Wacker Chemie AG

- 6.4.25 Yip's Chemical Holdings Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Swiftly Shifting Market to Eco-Friendly Coatings

- 7.2 Growing Research on Food Grade Coatings

02-2729-4219

+886-2-2729-4219