|

市场调查报告书

商品编码

1273431

颜料市场 - COVID-19 的增长、趋势、影响和预测 (2023-2028)Pigments Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

在预测期内,全球颜料市场预计将以超过 6% 的复合年增长率增长。

COVID-19 对 2020 年的市场产生了负面影响。 颜料需求受到全球供应链中断以及油漆和涂料、塑料和纺织品等许多终端用户行业需求减少的拖累。 然而,随着消费者在家的时间增加、对房屋装修的关注度增加以及住宅建筑行业的复苏,市场出现反弹。 由于人们对清洁和卫生的关注度越来越高,防护和消毒涂料的需求量很大。

主要亮点

- 从中期来看,亚太地区油漆和涂料行业不断增长的需求以及中东和亚太地区持续的工业发展是推动市场发展的关键因素。

- 另一方面,严格的政府法规和 COVID-19 大流行的不利影响等因素预计会阻碍市场增长。

- 对可靠的商业产品(例如 3D 打印材料)的需求不断增长可能会成为未来的机遇。

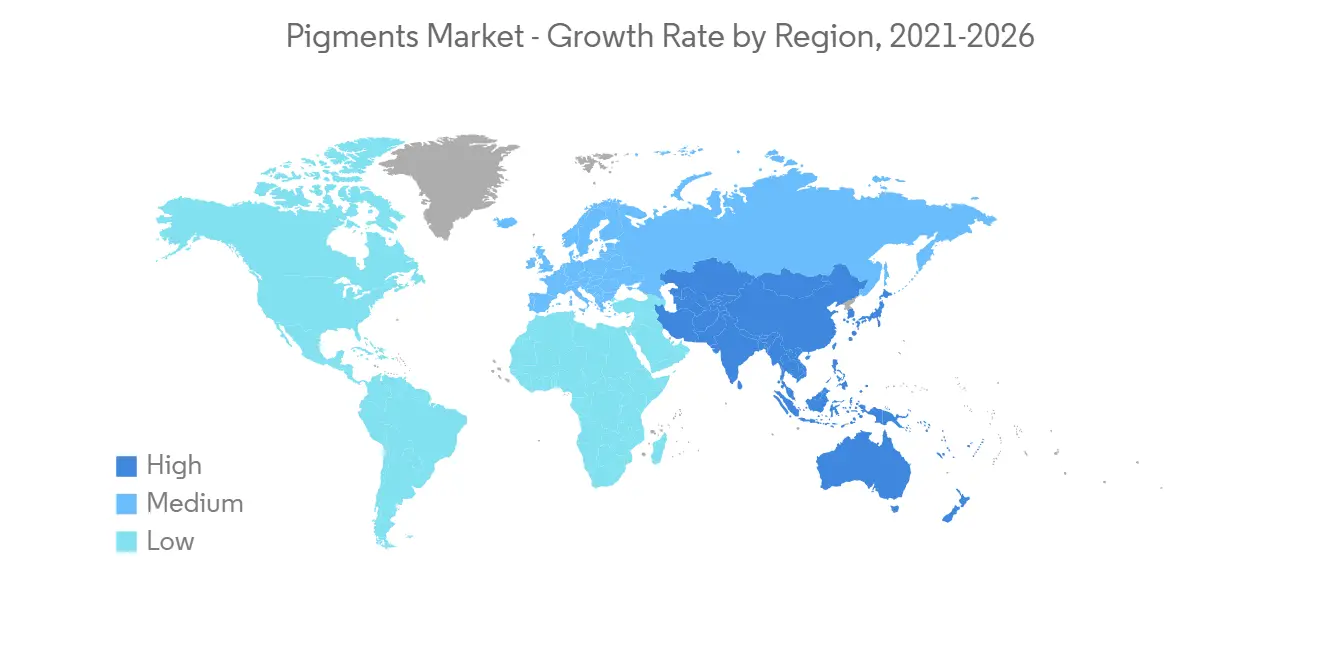

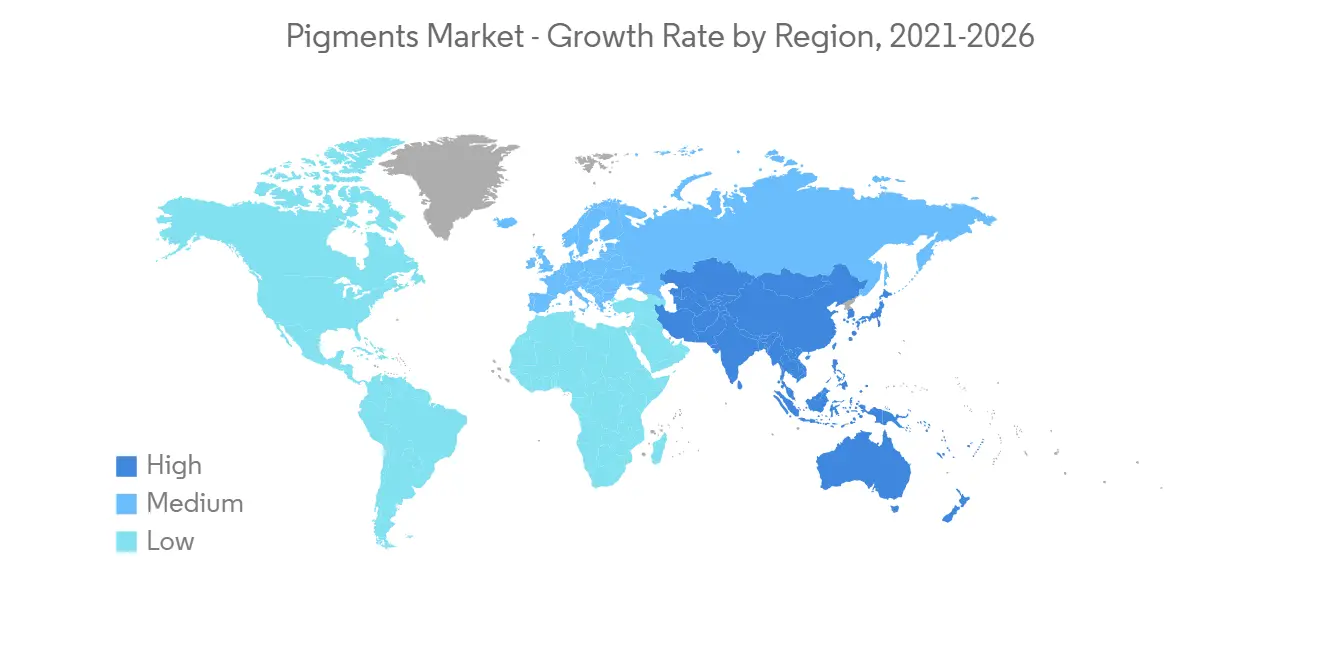

- 亚太地区主导着全球市场,其中中国、印度和日本等国家/地区的消费最为突出。

颜料市场趋势

油漆和涂料行业的需求增加

- 颜料主要用于油漆和涂料的生产。 这些颜料旨在满足最严苛的要求,同时不会影响涂层性能。

- 在建筑行业,建筑和装饰涂料在其生产过程中消耗了大量颜料。 因此,亚太地区建筑和基础设施活动的增加是颜料市场的主要驱动力。

- 此外,汽车行业在汽车的内部和外部部件上使用油漆和涂料来赋予它们保护和吸引力。 用于汽车金属零件和塑料车辆零件。

- 使用汽车漆的主要原因是为了避免各种侵蚀性环境因素,如阳光、腐蚀性物质、酸雨、高/低温衝击、石头、紫外线、洗车、飞沙等,以保护汽车零件。 这些涂料用于汽车车身修理厂和维修中心,为车辆重新喷漆。

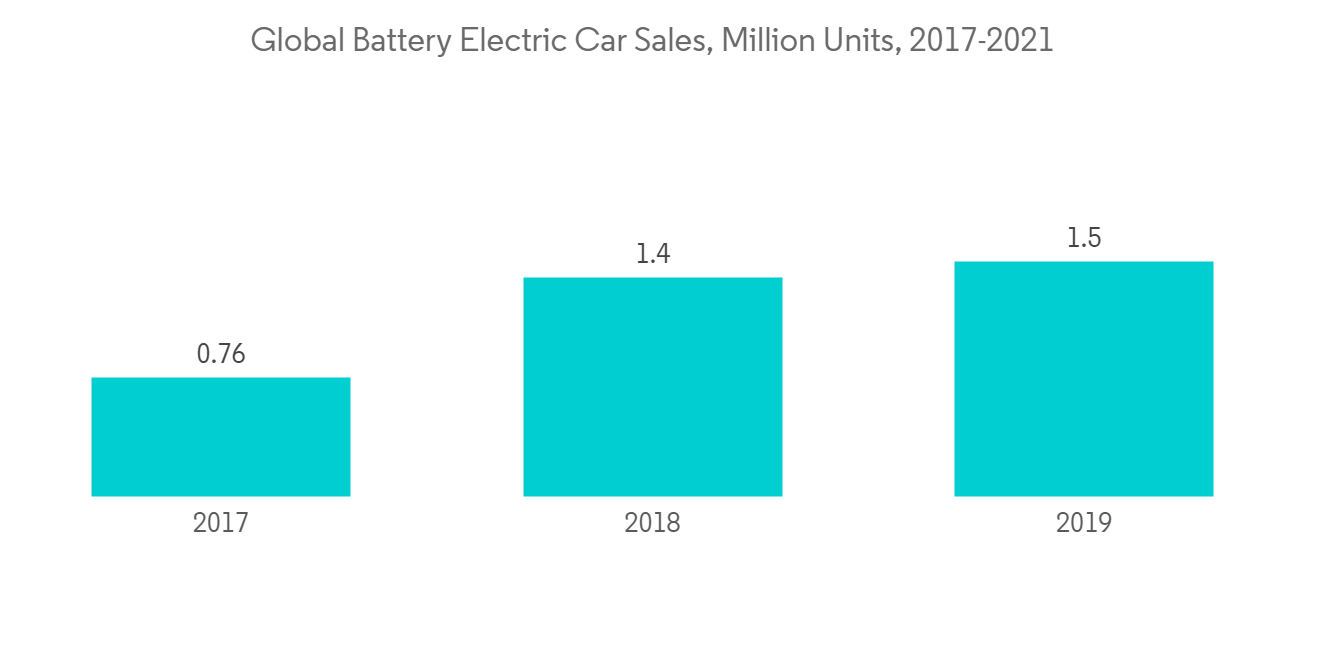

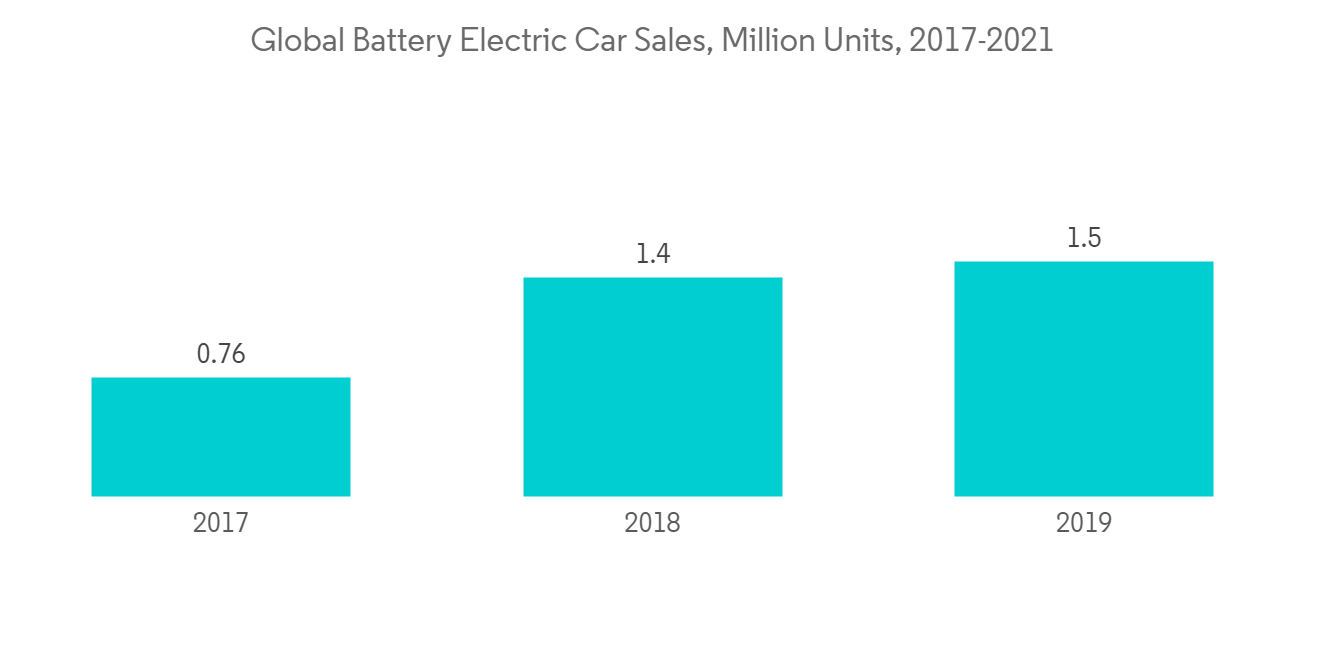

- 在电动汽车领域,正在开发专门用于电动汽车的新型涂料和涂层剂。 这些油漆和涂料必须能够承受电动机产生的高温,并提供腐蚀和其他环境保护。 它还需要很高的审美。 据国际能源署(IEA)预测,2021年纯电动汽车销量有望达到470万辆,同比增长135%。

- 然而,随着人们对汽油和柴油汽车造成的环境污染的担忧日益加剧,预计电动汽车生产将在未来五年内恢復,这可能会提振预测期内所研究市场的需求。

- 预计这些因素将对未来几年的市场增长产生重大影响。

亚太地区主导市场

- 亚太地区主导着市场,这主要是由于中国和印度的建筑需求增加。

- 在中国,政府正在增加用于建设保障性住房设施以满足住房需求的支出。 在印度,基础设施领域已成为政府重点关注的领域之一。

- 在到 2025 年的未来五年内,中国将在重大建设项目上投资 1.43 万亿美元。 根据国家发改委 (NDRC) 的数据,上海计划在未来三年内投资 387 亿美元。 同时,广州新签基建项目16个,投资额80.9亿美元。

- 在中国,人口趋势预计将继续刺激住房建设的增长。 家庭收入水平的提高和农村向城市的迁移预计将继续推动该国住房建筑行业的需求。

- 印度仍是一个新兴经济体,建筑业是该国蓬勃发展的行业之一。 基础设施部门是印度经济增长的重要支柱。 政府正在作出各种努力,适时发展优良的基础设施。

- 在印度,政府将在未来几年推动住房领域的一些项目。 政府的“人人有房”计划旨在到 2022 年为城市贫困人口建造超过 2000 万套经济适用房,这将大大推动住房建设。 智慧城市使命是政府承担的又一重大工程,将在全国建设100多个智慧城市,实现国家快速城镇化。 2021-22 财年预算包括 7.784 亿美元(6,450 印度卢比)的智慧城市任务,而 2020-21 财年的修订预算为 4.103 亿美元(3,400 印度卢比)。

- 2021 年 3 月,印度议会通过立法成立国家基础设施和发展融资银行 (NaBFID),这是一家规模 25 亿美元的发展金融机构,旨在为印度的基础设施项目提供资金。

- 因此,所有此类建筑活动和适当的政府措施预计将促进该地区的建筑活动,进一步增加对油漆和涂料的需求,从而增加对颜料的需求。我来了。

颜料行业概览

颜料市场整合,前五名占据较大份额。 主要公司有 DIC Corporation、The Chemours Company、Venator Materials PLC、KRONOS Worldwide Inc. 和 Clariant。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 调查先决条件

- 本次调查的范围

第二章研究方法论

第 3 章执行摘要

第四章市场动态

- 主持人

- 亚太地区油漆和涂料行业的需求不断扩大

- 中东和亚太地区持续的工业发展

- 纺织行业的稳定需求

- 约束因素

- 严格的政府法规

- 其他限制

- 工业价值链分析

- 波特的五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 专利分析

第 5 章市场细分

- 产品类型

- 无机物

- 氧化钛

- 氧化锌

- 其他产品类型

- 有机

- 特种颜料和其他产品类型

- 无机物

- 用法

- 油漆和涂料

- 纺织品

- 油墨

- 塑料

- 皮革

- 其他用途

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 意大利

- 法国

- 西班牙

- 其他欧洲

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙特阿拉伯

- 南非

- 阿拉伯联合酋长国

- 其他中东和非洲地区

- 亚太地区

第六章竞争格局

- 併购、合资、合作、合同等。

- 市场排名分析

- 主要公司采用的策略

- 公司简介

- ALTANA AG

- Clariant

- DIC Corporation

- KRONOS Worldwide Inc.

- LANXESS

- Lomon Billions

- Merck KGaA

- Pidilite Industries Ltd

- Sudarshan Chemical Industries Limited

- The Chemours Company

- Tronox Holdings plc

- Venator Materials PLC

第七章市场机会与未来趋势

- 转向环保产品

- 对 3D 打印材料等高可靠性产品的需求不断增加

The global pigments market is projected to register a CAGR of over 6% during the forecast period.

COVID-19 had a negative impact on the market in 2020. The disruption in the worldwide supply chain, combined with lower demand from numerous end-user industries such as paints and coatings, plastics, textiles, and others, hampered pigment demand. However, the market recovered as consumers spent more time at home and focused on home remodeling projects, and the residential construction sector recovered. Protective and sanitizing coatings are in high demand due to growing concerns about cleanliness and hygiene.

Key Highlights

- In the medium term, the significant factors driving the market studied are rising demand from the paints and coatings industry in Asia-Pacific and consistent industrial developments in the Middle East and Asia-Pacific regions.

- On the flip side, factors such as stringent government regulations and the negative impact of the COVID-19 pandemic are expected to hinder the growth of the market studied.

- Rising demand for reliable commercial products, like 3d printing material, will likely act as an opportunity in the future.

- Asia-Pacific dominated the market worldwide, with the most significant consumption from countries such as China, India, and Japan.

Pigments Market Trends

Increasing Demand from the Paints and Coatings Industry

- Pigments are majorly used in paints and coatings production. These are engineered, enabling them to withstand challenging demands without compromising the coating performance.

- In the construction industry, architectural and decorative coatings account for the enormous consumption of pigments in their production. Thus, rising construction and infrastructure activities in Asia-Pacific are significant drivers for the pigment market.

- Furthermore, in the automotive sector, paints and coatings are used in the interior and exterior parts of the vehicle, as they impart protection and appeal to the cars. They are used on metallic pieces and plastic vehicle components of automobiles.

- The primary reason for using automotive coatings is to protect the vehicle parts against various aggressive environmental agents, such as sunlight, corrosive materials, and environmental effects, such as acid rain, hot-cold shocks, stone chips, UV radiation can washing, and blowing sand. These coatings are used in automotive body shops and repair centers for vehicle refinishing.

- The electric car sector is driving the development of new paints and coatings explicitly intended for electric vehicles. These paints and coatings must endure the high temperatures electric motors produce while providing corrosion and other environmental protection. They must also be able to deliver a high level of aesthetic appeal. According to the International Energy Agency, battery electric vehicle sales will reach 4.7 million units in 2021, representing a 135% increase over the previous year.

- However, with growing concerns about environmental pollution from petrol and diesel-based vehicles, the production of electric cars is expected to pick up over the next five years, likely driving the demand for the market studied over the forecast period.

- All the above factors are expected to impact market growth in the coming years significantly.

Asia-Pacific to Dominate the Market

- Asia-Pacific dominated the market, primarily due to the increasing demand for construction activities in China and India.

- In China, government spending is increasing on constructing affordable housing facilities to cater to the housing demand. In India, the infrastructure sector is one of the major focus areas for the government.

- China is investing USD 1.43 trillion in significant construction projects in the next five years till 2025. According to National Development and Reform Commission (NDRC), the Shanghai plan includes an investment of USD 38.7 billion in the next three years. In contrast, Guangzhou signed 16 new infrastructure projects with an investment of USD 8.09 billion.

- In China, demographics in the country are expected to continue to spur the growth in residential construction. Rising household income levels and the population migrating from rural to urban areas are expected to continue to drive demand for the residential construction sector in the country.

- India is still a developing economy; the construction sector is one of the booming industries in the country. The infrastructure sector is an essential pillar for the growth of the Indian economy. The government is taking various initiatives to ensure the country's time-bound creation of excellent infrastructure.

- In India, the government is pushing numerous projects in the next few years in the residential segment. The government's 'Housing for All' initiative aims to build more than 20 million affordable homes for the urban poor by 2022, which will significantly boost residential construction. The smart cities mission is another major project undertaken by the government, which will construct more than 100 smart cities all over the country to achieve rapid urbanization in the country. In the 2021-22 budget, the smart cities mission includes USD 778.4 million (INR 6,450 crore) against USD 410.3 million (INR 3,400 crore) in the 2020-21 revised estimates.

- In March 2021, the Indian Parliament passed legislation to establish the National Bank for Financing Infrastructure and Development (NaBFID), a USD 2.5 billion development finance institution to fund infrastructure projects in India.

- Thus, all such construction activities and suitable government measures are expected to boost the construction activities in the region, which is further projected to grow the demand for paint and coating, thereby increasing the demand for pigments.

Pigments Industry Overview

The pigment market is consolidated with the top five players accounting for significant market share. The major companies include DIC Corporation, The Chemours Company, Venator Materials PLC, KRONOS Worldwide Inc., and Clariant.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from the Paints and Coatings Industry in Asia-Pacific

- 4.1.2 Consistent Industrial Developments in Middle-East and Asia-Pacific Regions

- 4.1.3 Consistent Demand from the Textile Industry

- 4.2 Restraints

- 4.2.1 Stringent Government Regulations

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Patent Analysis

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Inorganic

- 5.1.1.1 Titanium Dioxide

- 5.1.1.2 Zinc Oxide

- 5.1.1.3 Other Product Types

- 5.1.2 Organic

- 5.1.3 Specialty Pigments and Other Product Types

- 5.1.1 Inorganic

- 5.2 Application

- 5.2.1 Paints and Coatings

- 5.2.2 Textiles

- 5.2.3 Printing Inks

- 5.2.4 Plastics

- 5.2.5 Leather

- 5.2.6 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Spain

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 United Arab Emirates

- 5.3.5.4 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ALTANA AG

- 6.4.2 Clariant

- 6.4.3 DIC Corporation

- 6.4.4 KRONOS Worldwide Inc.

- 6.4.5 LANXESS

- 6.4.6 Lomon Billions

- 6.4.7 Merck KGaA

- 6.4.8 Pidilite Industries Ltd

- 6.4.9 Sudarshan Chemical Industries Limited

- 6.4.10 The Chemours Company

- 6.4.11 Tronox Holdings plc

- 6.4.12 Venator Materials PLC

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Shifting Focus toward Eco-friendly Products

- 7.2 Rising Demand for Reliable Commercial Products, like 3D Printing Material