|

市场调查报告书

商品编码

1273433

即时护理 (POC) 诊断市场 - 增长、趋势、COVID-19 影响和预测 (2023-2028)Point of Care Diagnostics Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

床旁 (POC) 诊断市场目前价值 380.3 亿美元,预计在预测期内将以 9.8% 的复合年增长率增长。

COVID-19 大流行对 POC 诊断市场的增长产生了重大影响。 例如,2022 年 8 月发表在 Cureus 杂誌上的一篇论文报告说,COVID-19 的出现使得测试对于遏制和缓解目的至关重要,从而导致开发出针对 COVID-19 的快速测试。。 因此,COVID-19 大流行激增了对 POC 诊断的需求。 然而,在目前的情况下,由于 POC 诊断的简便性、可负担性、较低的并发症发生率和快速的周转时间,预计在预测期内对 POC 诊断的需求将显着增长。

慢性病和传染病患病率的上升、对新免疫测定技术和技术进步的监管批准数量的增加,以及家庭护理点设备使用率的上升,都是推动该市场增长的因素。等等。

糖尿病、类风湿性关节炎和疟疾等慢性病和传染病的患病率在全球范围内不断上升,这推动了对 POC 诊断的需求。 例如,2022 年 12 月,世界卫生组织 (WHO) 报告称,疟疾是一种危及生命的疾病,2021 年全球估计有 2.47 亿疟疾病例。确实如此。 同样,NCBI 于 2021 年 5 月发表的一篇论文报告称,2020 年至 2021 年期间,类风湿性关节炎 (RA) 的全球患病率为每 100,000 人 460 人。 因此,全球记录的大量慢性病和传染病增加了对快速诊断的需求,这反过来又增加了对 POC 诊断的需求,推动了调查市场的增长。

此外,在预测期内,对新型免疫测定技术的监管批准数量不断增加、技术进步以及家用 POC 设备使用率的增加预计将补充所研究市场的增长。 例如,2022 年 7 月,BioGX 推出了带有 CE 标誌的 3 基因多重 POC COVID-19 测试。 这些测试利用了 BioGX 公司的 Xfree COVID-19直接 RT-PCR 分析中存在的极其有效的 Xfree 直接样品测试化学,该分析已被美国食品和药物管理局 (USFDA) 批准用于紧急情况。 因此,对新产品发布的监管批准有助于所研究市场的增长。

此外,在 Mylab Discovery Solutions 2022 年 3 月发表的一篇文章中,POC 诊断通常具有独立于实验室基础设施且非常便宜的特点,可以提高诊断的可及性。据悉,它可以大大提高诊断的可及性。改善。 这篇文章还指出,对于生活在医疗保健分布高度异质性的低收入和中等收入国家的人们来说,POC 检测的使用正在增长,作为扩大人群诊断覆盖率的重要工具,从而表明 POC 对检测的需求不断增加,这被认为是推动研究市场增长的因素。

因此,慢性病和传染病的患病率上升,新的监管批准数量不断增加。 然而,市场巨头髮生产品召回、各国政府严格的监管政策以及报销问题等因素预计将在预测期内阻碍 POC 诊断市场的增长。

床旁 (POC) 诊断市场趋势

预计血糖检测在预测期内将显着增长。

血糖测试测量血液中的葡萄糖,是全球最常见的测试之一。 由于全球糖尿病患者数量不断增加以及各公司推出新产品,预计用于血糖检测的 POC 诊断在预测期内将出现显着增长。

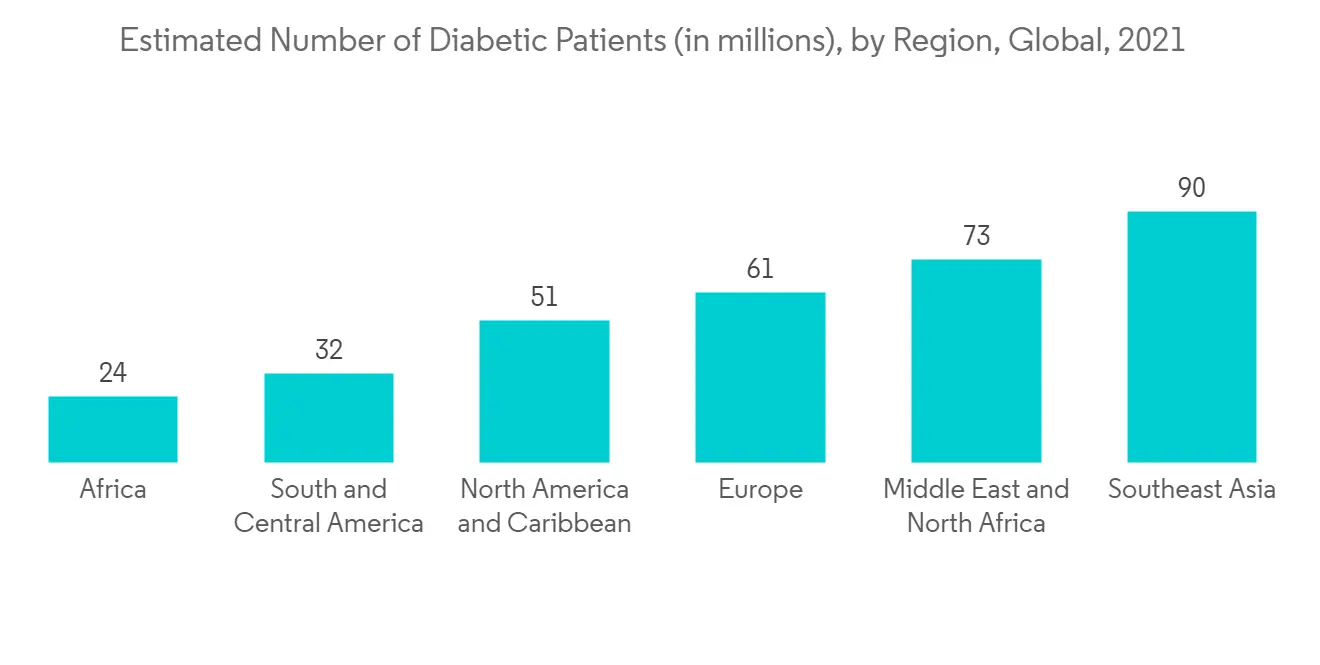

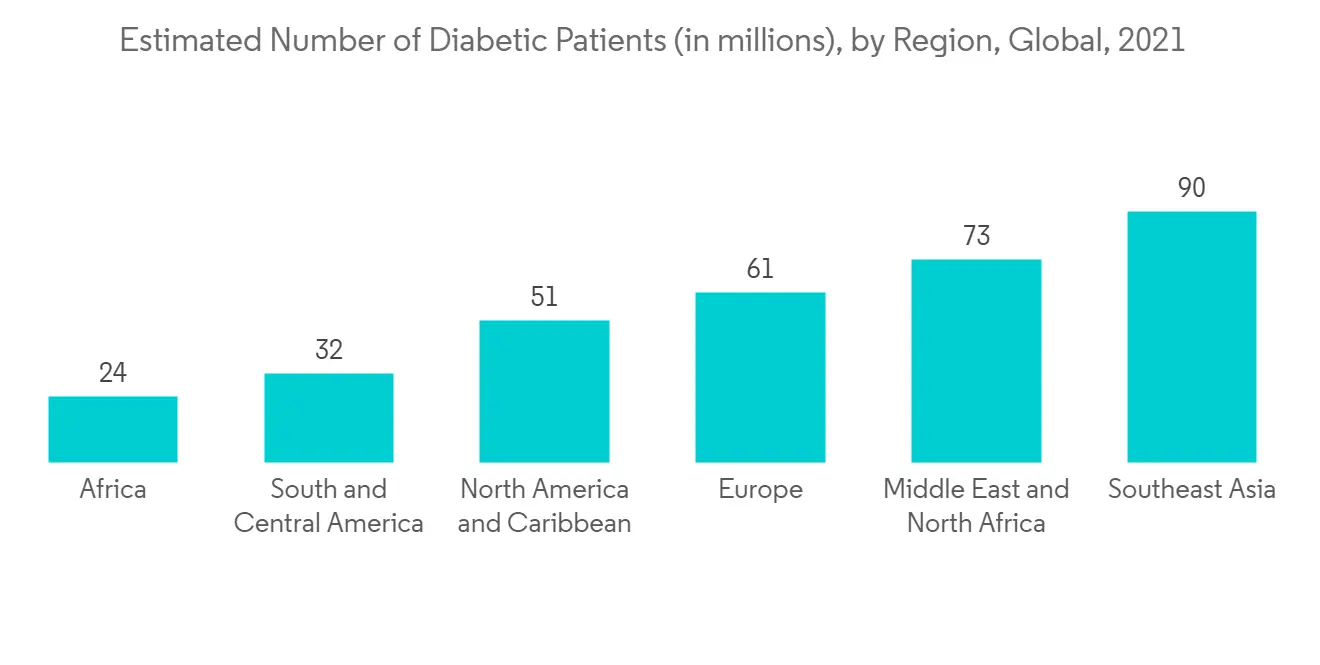

糖尿病患病率的增加和便携式诊断设备的引入预计将促进该细分市场的增长。 例如,国际糖尿病联合会(IDF)报告称,2021年全球20-79岁的成年人中,每10,000人中将有536,600.0人患有糖尿病,而到2030年,这一数字将上升至每1,000人中有642,800.0人。预计将增至到 2045 年每 1000 名成年人中有 783,700.0 人。 因此,越来越多的糖尿病患者受到关注,增加了对快速诊断的需求。 因此,越来越多的糖尿病患者增加了对 POC 诊断的需求。

此外,床旁 (POC) 诊断的引入及其使用的增加正在推动研究领域的增长。 例如,2022 年 5 月,英国医疗保健公司 LumiraDx 製造了一个支持测试菜单的诊断平台,宣布其 HbA1c 测试将获得 CE 标誌,用于在护理点 (POC) 环境中筛查和监测糖尿病患者. 报告已获得。 因此,POC 的推出也有助于所调查市场的增长。

因此,由于糖尿病患者人数的增加和新产品的推出,预计该细分市场在预测期内将出现显着增长。

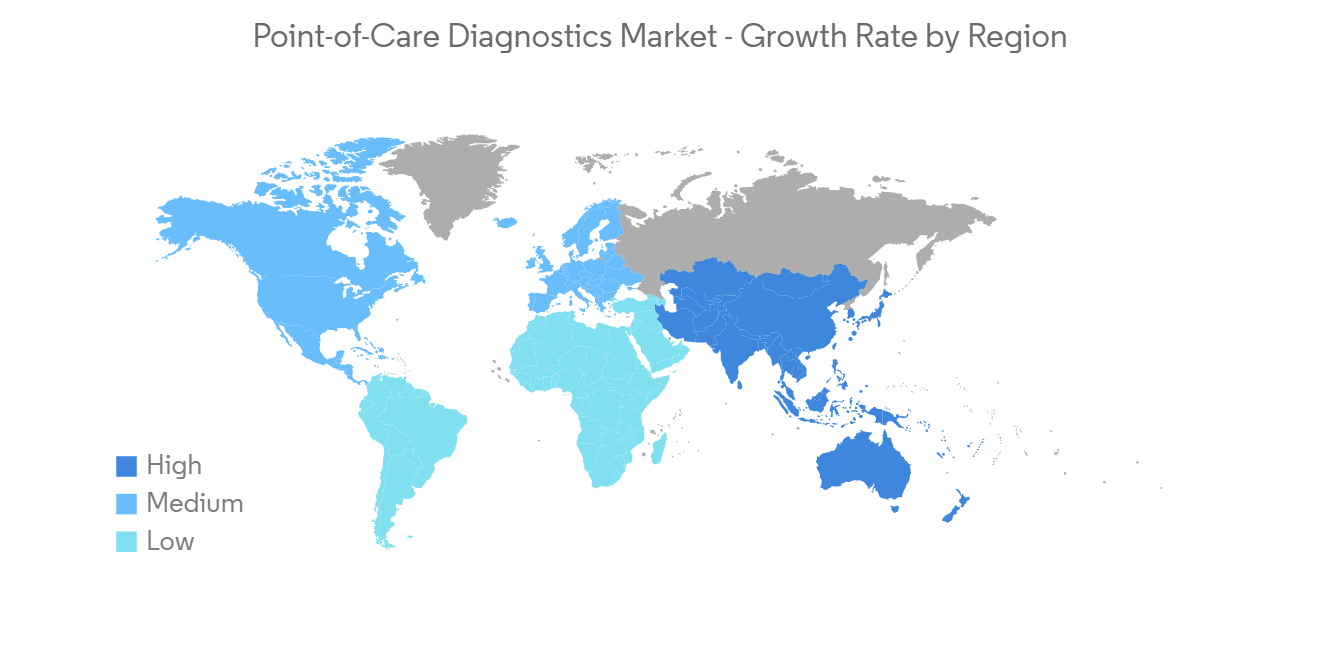

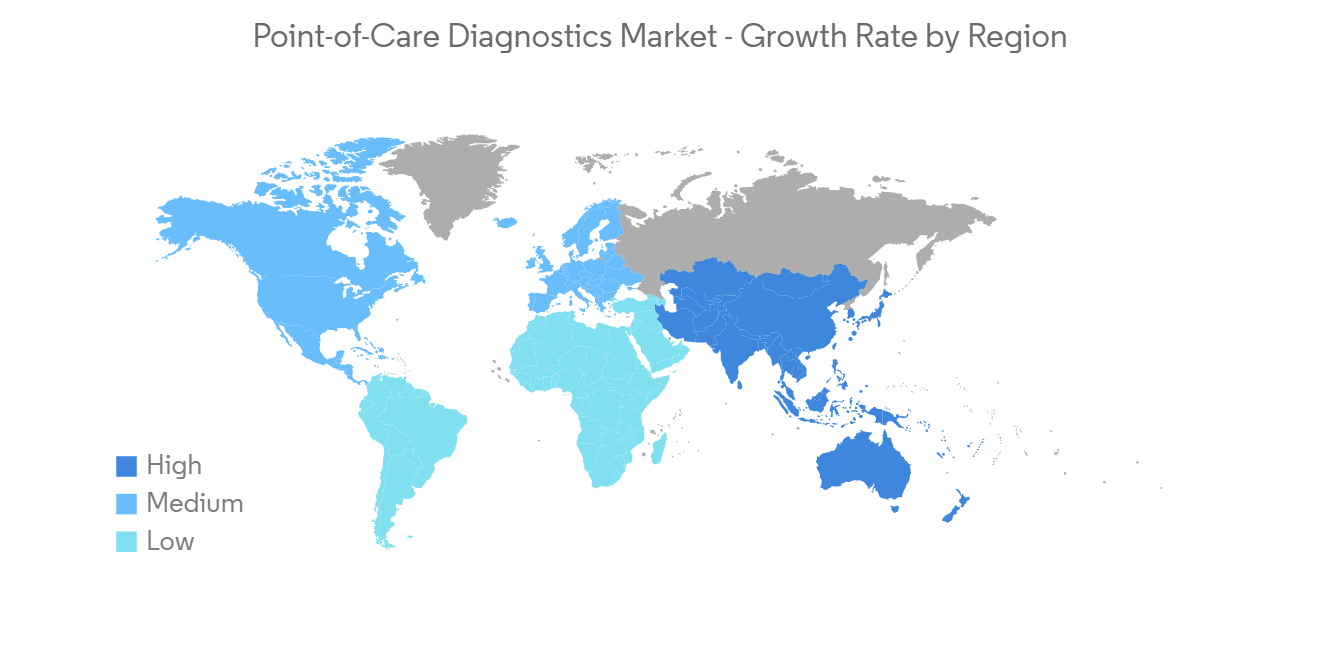

北美预计在预测期内将显着增长。

北美地区包括美国、加拿大和墨西哥。 由于主要市场参与者的存在以及慢性病和传染病发病率的上升,预计该地区在预测期内将出现显着增长。

最近的收购和产品发布促进了所研究市场的增长。 例如,2023 年 1 月,总部位于美国的 Heska Corporation 收购了 MBio Diagnostics, Inc。 Heska Corporation 製造、开发和销售先进的动物诊断和专业保健产品,包括 POC 测试设备。 因此,此类收购正在推动该地区研究市场的增长。

此外,NOWDiagnostic 的 ADEXUSDx hCG Test 将于 2022 年 5 月用于定性检测人全血、血浆或血清中的人绒毛膜促性腺激素 (hCG),并已获得 USFDA 批准,可在美国上市。一个可以完成的测试。 这种免疫测定测试将帮助医疗保健专业人员在各种临床和重症监护环境中及早发现妊娠。 因此,监管机构批准新的 POC 诊断有助于该地区研究市场的增长。

此外,该地区糖尿病和癌症等疾病患病率上升也促进了市场增长。 例如,根据加拿大糖尿病协会 2022 年 3 月发布的一份报告,该国的糖尿病呈积极上升趋势,报告发布时有 1170 万加拿大人患有或未患糖尿病。另有近 570 万加拿大人表示他们患有糖尿病糖尿病前期诊断。 这种日益增加的糖尿病负担增加了对 POC 的需求,推动了被调查市场的增长。

同样,2022 年,国际世界癌症研究基金会 (WCRF) 的一份报告列出了墨西哥诊断出的近 101,703 例癌症病例。 POC 还用于癌症的早期检测,大量癌症患者有助于该地区研究市场的增长。

因此,预计主要市场参与者近期的收购、产品发布和慢性病发病率上升将在预测期内推动该地区的市场增长。

床旁 (POC) 诊断行业概览

床旁 (POC) 诊断市场竞争激烈,由多家大型企业组成。 就市场份额而言,目前少数大公司占据市场主导地位。 主要市场参与者包括 Abbott Laboratories、Siemens Healthineers AG、Danaher Corporation(Beckman Coulter Inc)、Becton、Dickinson and Company、Institution Laboratory、Johnson and Johnson Inc、Nova Biomedical Corporation、Qiagen Inc、F. Hoffmann-La Roche Ltd、Biomeriux SA , ETC。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 调查假设和市场定义

- 本次调查的范围

第二章研究方法论

第 3 章执行摘要

第四章市场动态

- 市场概览

- 市场驱动因素

- 慢性病和传染病的患病率增加

- 新型免疫测定技术获得监管批准的数量增加

- 技术进步和家庭 POC 设备的使用增加

- 市场製约因素

- 产品召回

- 严格的监管政策和报销问题

- 波特五力

- 新进入者的威胁

- 买方/消费者议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

第 5 章市场细分(基于价值的市场规模)

- 按产品分类

- 血糖监测套件

- 心血管代谢监测套件

- 妊娠/生育力测试套件

- 传染病检测试剂盒

- 胆固醇测量条

- 血液学检测试剂盒

- 其他产品

- 最终用户

- 医院和重症监护机构

- 门诊护理

- 研究所

- 其他最终用户

- 按地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 意大利

- 西班牙

- 其他欧洲

- 亚太地区

- 中国

- 日本

- 印度

- 澳大利亚

- 韩国

- 其他亚太地区

- 中东和非洲

- 海湾合作委员会

- 南非

- 其他中东和非洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美

第六章竞争格局

- 公司简介

- Abbott Laboratories

- Siemens Healthineers AG

- Danaher Corporation(Beckman Coulter Inc.)

- Becton, Dickinson and Company

- Instrumentation Laboratory

- Johnson and Johnson Inc.

- Nova Biomedical Corporation

- Qiagen Inc.

- F. Hoffmann-La Roche Ltd.

- Biomeriux SA

第七章市场机会与未来趋势

The point-of-care (POC) diagnostics market size is currently valued at USD 38.03 billion and is expected to register a CAGR of 9.8% during the forecast period.

The COVID-19 pandemic had a significant impact on the growth of the POC diagnostics market. For instance, an article published by the journal Cureus in August 2022 reported that with the emergence of COVID-19, testing became essential for containment and mitigation purposes, and this led to the development of rapid COVID-19 testing. Thus, the COVID-19 pandemic surged the demand for POC diagnostics. However, in the current scenario, due to the ease, affordability, reduced incidence of complications, and faster turn-around times of POC diagnostics, the demand for POC diagnostics is expected to witness significant growth over the forecast period.

The factors that are driving the growth of the studied market are the rising prevalence of chronic and infectious diseases, the increasing number of regulatory approvals for novel immunoassay techniques and technological advancements, and the rising usage of home-based POC devices.

The prevalence of chronic and infectious diseases, such as diabetes, rheumatism, and malaria, is increasing globally, which is propelling the demand for POC diagnostics. For instance, in December 2022, World Health Organization (WHO) reported that malaria is a life-threatening disease, and in the year 2021, there were an estimated 247 million cases of malaria worldwide. Similarly, an article published by NCBI in May 2021, reported that the global prevalence of rheumatoid arthritis (RA) was 460 per 100,000 population during 2020-2021. Thus, a high number of chronic and infectious diseases recorded globally is increasing the demand for rapid diagnostics, thereby increasing the demand for POC diagnostics and thus driving the growth of the studied market.

Moreover, the increasing number of regulatory approvals for novel immunoassay techniques, technological advancements, and the rising usage of home-based POC devices is expected to complement the growth of the studied market over the forecast period. For instance, in July 2022, BioGX launched CE-marked, three-gene multiplex POC COVID-19 test. These tests make use of BioGX's incredibly effective Xfree direct sample testing chemistry, which is present in their Xfree COVID-19 Direct RT-PCR assay, which has been cleared for emergency use by the United States Food and Drug Administration (USFDA). Thus, regulatory approvals for new product launches are contributing to the growth of the studied market.

Furthermore, an article published by Mylab Discovery Solutions in March 2022 reported that POC diagnostics, which are often characterized by being independent of laboratory infrastructure and being highly affordable, can greatly improve the accessibility of diagnostics. The article also quoted that for the people living in low and middle income countries where the healthcare distribution is quite uneven, the use of POC tests is growing as an important tool to increase diagnostic coverage of the population, and thus demand for POC is constantly increasing, thereby driving the growth of the studied market.

Thus, due to the rising prevalence of chronic and infectious diseases, the increasing number of regulatory approvals for novel immunoassay techniques and technological advancements, and the rising usage of home-based POC devices. However, factors such as product recall incidence by the major players in the market, stringent regulatory policies by the governments, and reimbursement issues will impede the growth of the POC diagnostics market during the forecast period.

Point of Care Diagnostics Market Trends

Blood Glucose Testing is Expected to Witness Significant Growth Over the Forecast Period.

A blood glucose test measures the glucose in the blood, and this is one of the most common tests done across the globe. Blood glucose testing POC diagnostics is expected to witness significant growth over the forecast period owing to rising diabetes cases recorded globally and the new product launches of the company.

The growing prevalence of diabetes and the introduction of portable diagnostic equipment are expected to boost segment growth. For instance, in 2021, International Diabetes Federation (IDF) reported that globally in the year 2021, a total of 536,600.0 per 10000 adults aged between (20-79) years were suffering from diabetes, and this number is expected to increase to 642,800.0 per 1000 adults by 2030 and 783,700.0 per 1000 adults by 2045. Thus, rising diabetes cases are a matter of concern, and there is increasing demand for rapid diagnostics. Thus, rising diabetes cases are increasing the demand for POC diagnostics.

Furthermore, the introduction of point-of-care diagnostics and its increasing use is driving the growth of the studied segment. For instance, in May 2022, LumiraDx, a UK-based healthcare company that manufactures a diagnostic platform to support a menu of tests reported that its HbA1c test received a CE mark for the screening and monitoring of people with diabetes in the point of care (POC) setting. Thus, the launch of such POC is also contributing to the growth of the studied market.

Thus, due to the rising diabetes cases and new product launches, the segment is expected to witness significant growth over the forecast period.

North America is Expected to Witness a Significant Growth Over the Forecast Period.

North America region consists of the United States, Canada, and Mexico. The region is expected to witness significant over the forecast period due to the presence of key market players and the rising incidence of chronic and infectious diseases.

The recent acquisition and product launches are contributing to the growth of the studied market. For instance, in January 2023, Heska Corporation, a US-based company and a global provider of advanced veterinary diagnostic and specialty products and solutions, acquired MBio Diagnostics, Inc. Heska Corporation manufactures, develops, and sells advanced veterinary diagnostic and specialty healthcare products, including POC testing instruments. Thus such acquisitions are driving the growth of the studied market in the region.

Additionally, in May 2022, NOWDiagnostic's ADEXUSDx hCG Test was used for the qualitative detection of human chorionic gonadotropin (hCG) in human whole blood, plasma, or serum received the USFDA clearance, and the test available in the United States. This immunoassay test is an early detection aid for pregnancy for healthcare professionals in a variety of clinical and critical care settings. Thus, such clearance of new POC diagnostics by regulatory agencies is contributing to the studied market's growth in the region.

Moreover, the rising prevalence of diseases, such as diabetes and cancer, in the region is contributing to the market's growth. For instance, as per a report by the Canadian Diabetes Association published in March 2022, diabetes is increasing aggressively in the country, and by the time the report was published, stated that 11.7 million Canadians were living with diabetes or prediabetes, among which is nearly more than 5.7 million Canadians were living with diagnosed diabetes. Such an increasing burden of diabetes is increasing the demand for POC and thus driving the growth of the studied market.

Similarly, in the year 2022, the report of the World Cancer Research Fund International (WCRF) stated that nearly 101,703 cancer cases were diagnosed in Mexico. The POC is also used for the early detection of cancer, and the high number of cancer cases contributes to the growth of the studied market in the region.

Thus, the recent acquisition between the key market players, product launches, and the rising incidence of chronic diseases is expected to drive the growth of the market in the region over the forecast period.

Point of Care Diagnostics Industry Overview

The point-of-care diagnostics market is highly competitive and consists of several major players. In terms of market share, few of the major players currently dominate the market. Some of the major players in the market are Abbott Laboratories, Siemens Healthineers AG, Danaher Corporation (Beckman Coulter Inc.), Becton, Dickinson and Company, Instrumentation Laboratory, Johnson and Johnson Inc., Nova Biomedical Corporation, Qiagen Inc., F. Hoffmann-La Roche Ltd., and Biomeriux SA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Prevalence of Chronic and Infectious Diseases

- 4.2.2 Increasing Number of Regulatory Approvals for Novel Immunoassay Techniques

- 4.2.3 Technological Advancements and Rising Usage of Home-based POC Devices

- 4.3 Market Restraints

- 4.3.1 Product Recalls

- 4.3.2 Stringent Regulatory Policies and Reimbursement Issues

- 4.4 Porter Five Forces

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Product

- 5.1.1 Glucose Monitoring Kit

- 5.1.2 Cardio-metabolic Monitoring Kit

- 5.1.3 Pregnancy and Fertility Testing Kit

- 5.1.4 Infectious Disease Testing Kit

- 5.1.5 Cholesterol Test Strip

- 5.1.6 Hematology Testing Kit

- 5.1.7 Other Products

- 5.2 By End User

- 5.2.1 Hospital and Critical Care Setting

- 5.2.2 Ambulatory Care Setting

- 5.2.3 Research Laboratory

- 5.2.4 Other End Users

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Abbott Laboratories

- 6.1.2 Siemens Healthineers AG

- 6.1.3 Danaher Corporation (Beckman Coulter Inc.)

- 6.1.4 Becton, Dickinson and Company

- 6.1.5 Instrumentation Laboratory

- 6.1.6 Johnson and Johnson Inc.

- 6.1.7 Nova Biomedical Corporation

- 6.1.8 Qiagen Inc.

- 6.1.9 F. Hoffmann-La Roche Ltd.

- 6.1.10 Biomeriux SA