|

市场调查报告书

商品编码

1273439

发电机租赁市场 - 增长、趋势、COVID-19 影响和预测 (2023-2028)Power Generator Rental Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

预计在预测期内,发电机租赁市场的复合年增长率将超过 5.2%。

市场受到 COVID-19 的负面影响。 市场现在处于大流行前的水平。

主要亮点

- 发电机租赁市场的驱动因素包括与新购买发电机相关的成本以及石油和天然气以及建筑等各个行业的重大市场发展。

- 但是,电网的扩张和可再生能源项目的兴起预计会抑制市场增长。

- 随着人口的增长,预计各个领域的项目都会增加以满足日常生活的需求,例如能源、商业和住宅空间以及製造设备。 例如,到 2030 年,世界人口估计将达到近 85 亿,这可能会使全球建筑支出增加到 175 亿美元。 不断上涨的建筑成本意味着全球发电机租赁市场的潜在增长。

- 北美是发电机租赁市场的重要区域。 该地区的发电机租赁市场预计将主要受到计划停电、各行业新项目安装、自然灾害和季节性电力需求高峰的推动。

发电机租赁市场趋势

石油和天然气行业的发电机显示显着增长

- 石油和天然气行业在发电机租赁市场占有很大份额。 由于大多数项目位于偏远地区,并且油田的预期深度各不相同,因此需要能够在恶劣环境中运行的大容量发电机。

- 发电机可作为钻井作业和备用电源的动力源。 钻井作业需要大量的动力来移动设备。 在紧急情况和灾难期间,发电机可作为石油和天然气设施的备用电源。

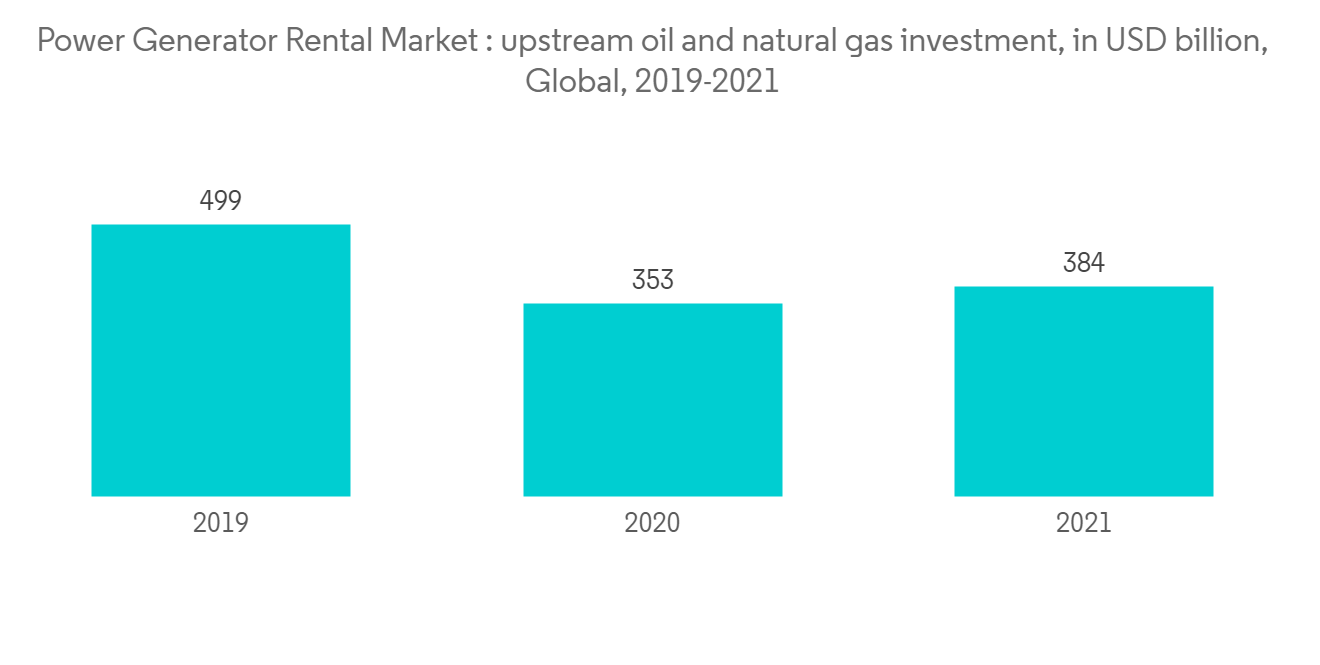

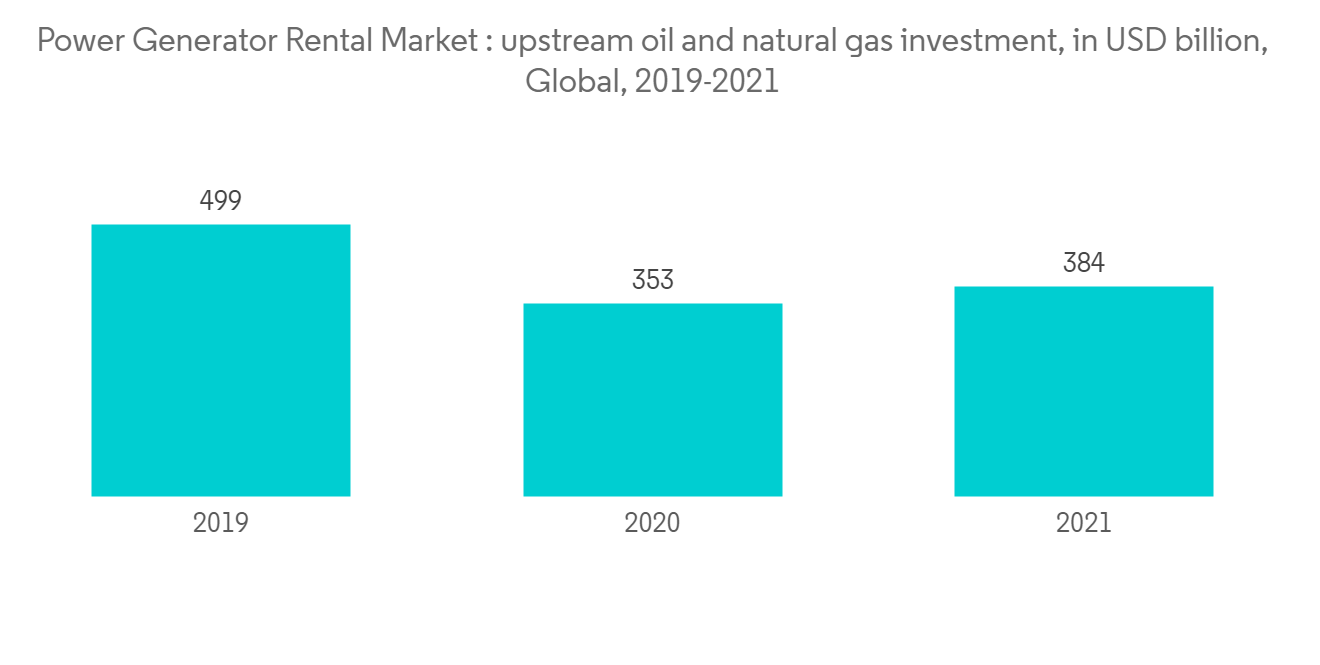

- 根据 IEA 的数据,2021 年上游石油和天然气投资将达到 3840 亿美元。 上游预计在预测期内以每年 8.8% 的速度增长,这有望推动石油和天然气行业的发电机市场,因为钻井和钻探需要大量电力。

- 一般来说,石油和天然气行业最喜欢用于油田装配的带有两个轴承的 6 极 1,200rpm 交流发电机。 发电机中的交流发电机还必须承受电动机在启动时造成的高达 25-30% 的电压降。

- 在预测期内,由于勘探和生产 (E&P) 活动的支出增加,预计石油和天然气行业将推动发电机租赁市场的发展。 到 2025 年,石油和天然气行业预计将投资近 7000 亿美元,这可能会带动发电机租赁市场。

北美有望成为主要市场

- 北美髮电机租赁市场预计将显着增长,其中柴油发电机是最主要的部分。 然而,随着减少碳排放的环境政策的加强,人们对替代燃料发电机的兴趣越来越大。

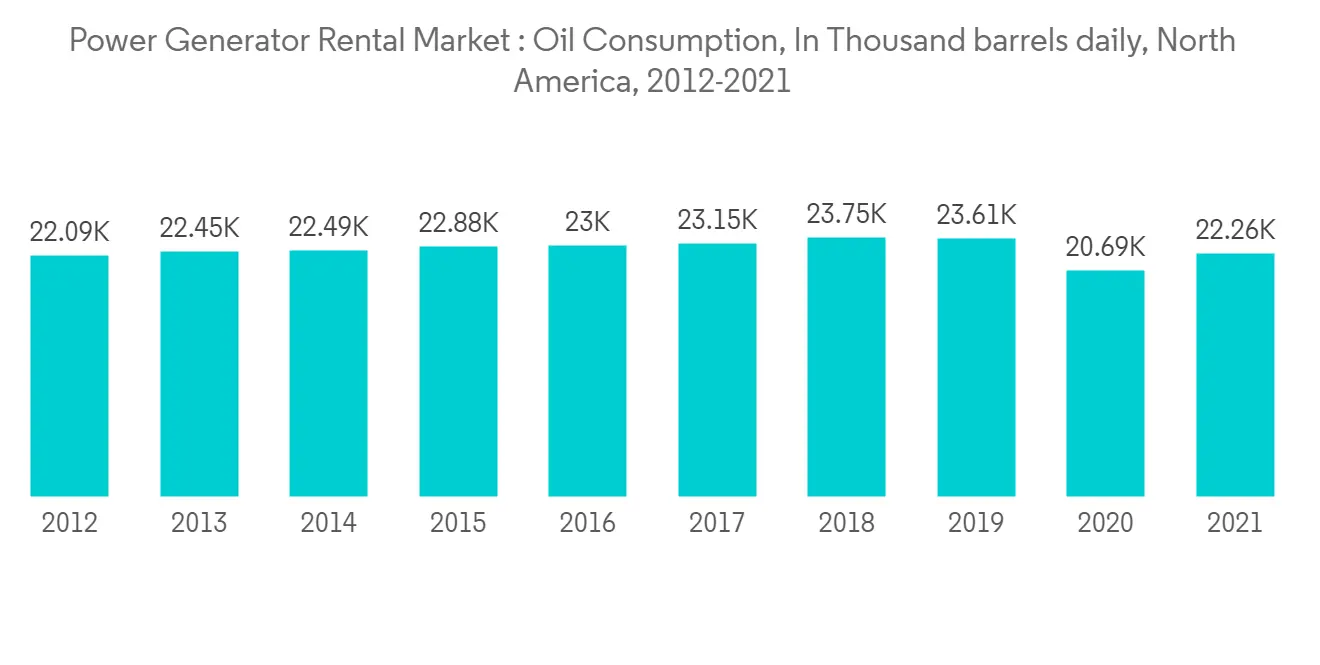

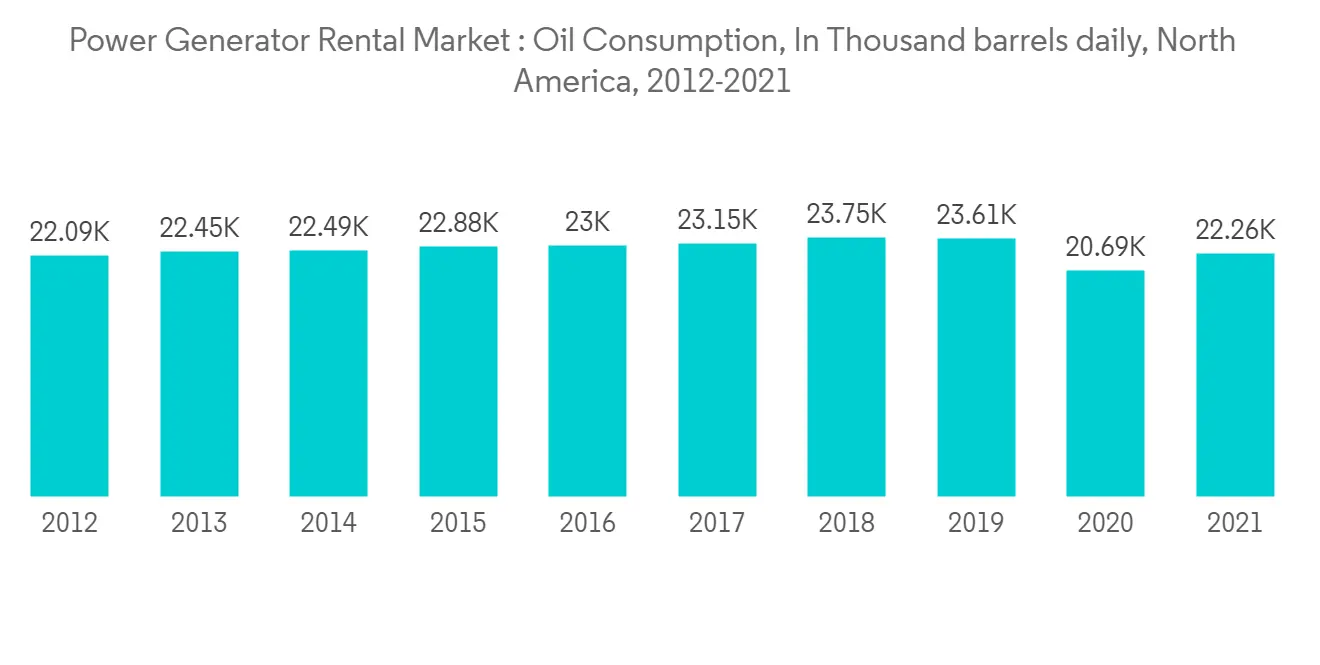

- 石油和天然气行业的上游和下游流程需要大量电力。 北美石油消费的同比增长创造了石油生产需求,预计将在预测期内推动发电机租赁市场。 2021年北美石油消费总量将达到2226.4万桶/日,年增长率为7.6%。

- 美国是使用天然气发电机打造更清洁环境的主要国家之一。 由于运行期间的低故障率,该国高度依赖天然气发电机。 天然气发电机通常每千瓦运行可节省 1,000 美元至 3,000 美元。

- 不断增长的能源需求、基础设施项目和接触电力需求是推动北美髮电机租赁市场发展的一些关键因素。 美国石油和天然气行业预计将成为预测期内的市场驱动力,预计投资额约为 2.5 亿美元。

- 在预测期内,该地区建筑业的投资预计将超过 1 万亿美元。 该行业的增长预计将进一步推动发电机租赁市场以及石油和天然气行业。

发电机租赁行业概览

发电机租赁市场是分散的。 市场参与者(排名不分先后)包括阿特拉斯·科普柯(印度)有限公司、康明斯公司、Ashtead Group PLC、Modern Hiring Service、United Rentals Inc.、Herc Rentals Inc.、Generac Power Systems、Wacker Neuson Group 和 Wartsila Corporation 以及很快。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 调查范围

- 市场定义

- 调查先决条件

第 2 章执行摘要

第三章研究方法论

第 4 章市场概述

- 简介

- 发电机租赁市场到 2028 年

- 近期趋势和发展

- 政府法规和政策

- 市场动态

- 司机

- 约束因素

- 行业供应链分析

- 波特的五力分析

- 供应商的议价能力

- 消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

第 5 章市场细分

- 最终用户

- 石油和天然气

- 建筑

- 矿业

- 製造业

- 数据中心

- 其他最终用户

- 按地区

- 北美

- 亚太地区

- 欧洲

- 南美洲

- 中东和非洲

第六章竞争格局

- 併购、合资企业、合作、合同

- 主要参与者采用的策略

- 公司简介

- Atlas Copco(India)Ltd

- Wartsila Corporation

- Wacker Neuson Group

- Generac Power Systems

- Herc Rentals Inc.

- United Rentals Inc.

- Modern Hiring Service

- Ashtead Group PLC

- Cummins Inc.

- Aggreko Energy Rental India Private Ltd

第7章 市场机会与未来动向

The power generator rental market is expected to record a CAGR of greater than 5.2% during the forecast period.

The market was negatively impacted by COVID-19. Presently, the market has reached pre-pandemic levels.

Key Highlights

- The drivers for the power generator rental market include the cost associated with purchasing new generators and tremendous developments in various sectors, such as oil and gas, construction, etc.

- However, the expansion of power distribution networks and rising development in renewable energy projects are expected to act as a restraint for the market's growth.

- With the rising population, projects from different sectors are expected to increase to meet the requirements, like energy, commercial and residential space, and manufacturing units, for daily needs. For instance, the global population is estimated to reach nearly 8.5 billion by 2030, which may boost global construction spending to USD 17.5 billion. Growth in construction implies a high possibility of an increase in the worldwide power generator rental market.

- North America is a significant region for the power generator rental market. It is estimated that scheduled power shutdowns, new projects installations for various industries, and enplanements, such as natural disasters and seasonal peak power demand, may primarily drive the regional power generator rental market.

Power Generator Rental Market Trends

Power Generators in the Oil and Gas Industry to Witness Significant Growth

- The oil and gas industry has a prominent share in the power generator rental market. With most of the projects located in remote areas, with different anticipated oilfield depths, power generators with high capacity that can work in rigorous environments are required.

- Power generators act as a power supply for both drilling and digging and power backup activities. During drilling and digging, huge power is required to operate the equipment. Power generators act as a power backup to the oil and gas facilities during any emergency or disaster.

- According to IEA, in 2021, oil and gas upstream investment accounted for USD 384 billion. With an annual growth rate of 8.8%, upstream is expected to increase during the forecast period, which, in turn, may drive the power generators market in the oil and gas industry as drilling and digging require a large amount of power.

- Typically, six poles of 1,200 rpm alternators, with two bearings for assembling on an oilfield, are most preferable in the oil and gas industry. The generator's alternator should also withstand voltage dips as large as 25-30% that an electric motor can cause while starting.

- During the forecast period, the oil and gas industry is expected to boost the power generator rental market, as expenditure for exploration and production (E&P) activities is increasing. By 2025, the oil and gas industry is expected to have nearly USD 700 billion in investment, which may drive the power generator rental market.

North America is Expected to Become a Significant Market

- North America's power generator rental market is estimated to grow significantly, with diesel generators being the most dominating segment. However, with tightening environmental policies to reduce carbon footprints, the focus on alternate fuel generators is increasing.

- The oil and gas industry requires a huge amount of power for its upstream and downstream processes. Oil consumption in North America is increasing Y-o-Y, thus creating demand for oil production, which, in turn, is expected to drive the power generator rental market during the forecast period. In 2021, total North American oil consumption accounted for 22,264 thousand barrels daily with an annual growth rate of 7.6%.

- The United States is one of the prominent countries that use natural gas power generators to have a cleaner environment. The country highly relies on natural gas generators due to their less failure during operation. Natural gas generators typically save USD 1,000 per kilowatt to USD 3,000 per kilowatt during operation.

- Growing demand for energy, infrastructure projects, and requirement for contact power are a few primary factors driving the North American power generator rental market. The US oil and gas sector is expected to see an investment of around USD 250 million, which is anticipated to drive the market during the forecast period.

- The region's construction sector is expected to exceed USD 1 trillion in investment during the forecast period. The sector's growth is anticipated to further boost the rental generator market, along with the oil and gas industry.

Power Generator Rental Industry Overview

The power generator rental market is fragmented. Some of the key players in the market (not in a particular order) include Atlas Copco (India) Ltd, Cummins Inc., Ashtead Group PLC, Modern Hiring Service, United Rentals Inc., Herc Rentals Inc., Generac Power Systems, Wacker Neuson Group, and Wartsila Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Power Generator Rental Market in USD million, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Industry Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By End User

- 5.1.1 Oil and Gas

- 5.1.2 Construction

- 5.1.3 Mining

- 5.1.4 Manufacturing

- 5.1.5 Data Centers

- 5.1.6 Other End Users

- 5.2 By Geography

- 5.2.1 North America

- 5.2.2 Asia-Pacific

- 5.2.3 Europe

- 5.2.4 South America

- 5.2.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Atlas Copco (India) Ltd

- 6.3.2 Wartsila Corporation

- 6.3.3 Wacker Neuson Group

- 6.3.4 Generac Power Systems

- 6.3.5 Herc Rentals Inc.

- 6.3.6 United Rentals Inc.

- 6.3.7 Modern Hiring Service

- 6.3.8 Ashtead Group PLC

- 6.3.9 Cummins Inc.

- 6.3.10 Aggreko Energy Rental India Private Ltd