|

市场调查报告书

商品编码

1273460

单层市场 - COVID-19 的增长、趋势、影响和预测 (2023-2028)Single-ply Membranes Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

在预测期内,单层膜市场预计将以超过 9% 的复合年增长率增长。

主要亮点

- 2020 年 COVID-19 大流行影响了整个单层膜市场。 然而,亚太地区建筑活动的增加推动了对单层膜的需求。

- 推动市场发展的主要因素是欧洲对轻型和高速建筑屋面材料的需求增加、北美私人建筑支出增加以及亚太地区新兴国家对建筑行业的投资增加。 . 预计原材料价格波动将阻碍市场增长。

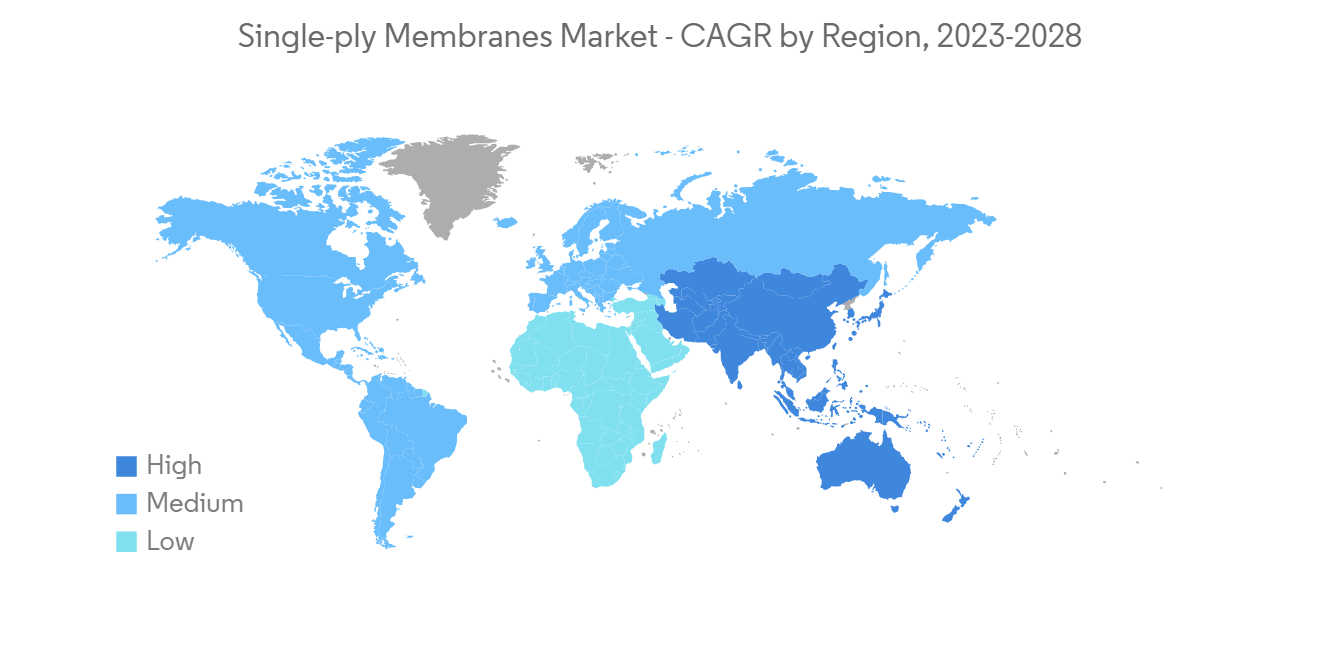

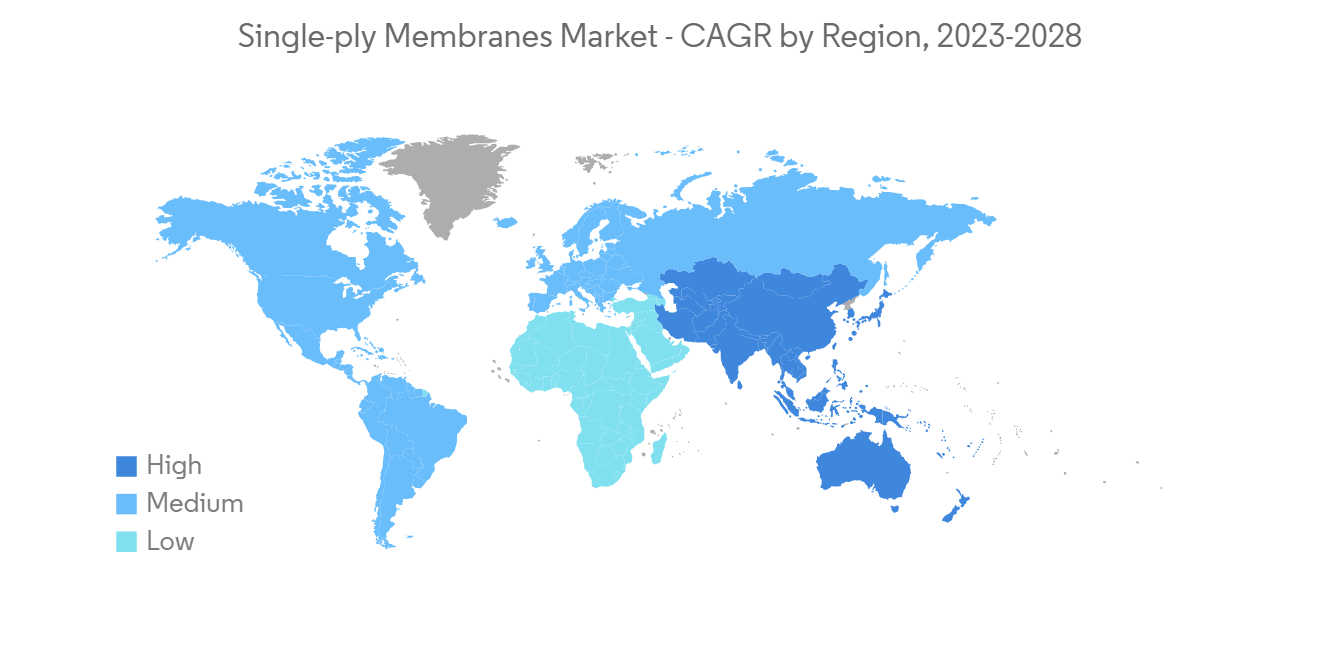

- 亚太地区使用量的增加可能会在未来带来机遇。 北美是单层膜最大的市场,消费量最大的国家是美国和加拿大。

单层市场趋势

热塑性聚烯烃 (TPO) 主导市场

- 热塑性聚烯烃 (TPO) 是一种单一的屋顶薄膜,是市场上发展最快的商业屋顶系统之一。 聚丙烯基塑料和乙烯/丙烯橡胶材料。 TPO 是通过混合塑料和橡胶製成的。 它具有热粘合性、易修復性、柔韧性和白色(因为它反射近 90% 的阳光)等许多优点。

- TPO 可以很容易地从低坡度建造到高坡度。 它受欢迎的另一个原因是它对紫外线、臭氧和环境化学物质具有很高的抵抗力。 由于这些优点,这些膜最常用于北美地区的住宅屋顶。 由于住宅建设的增加,美国、中国和印度等国家对这些膜的需求显着增加。

- 在美国,由于人口增长和消费者收入增加,过去几年对新房的需求持续增长。 2021年,公共部门将在住房建设项目上支出约93亿美元,与2020年相比略有下降。 此外,2021年新房竣工133.7万套,比2020年增长4%。

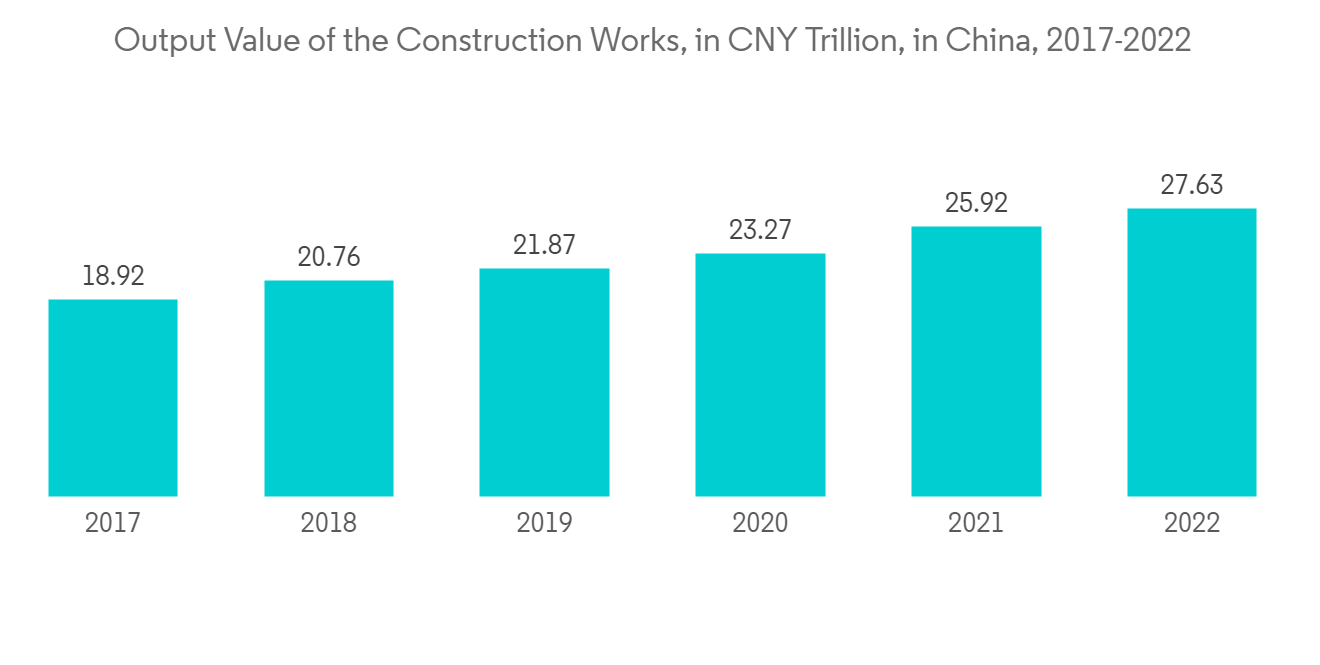

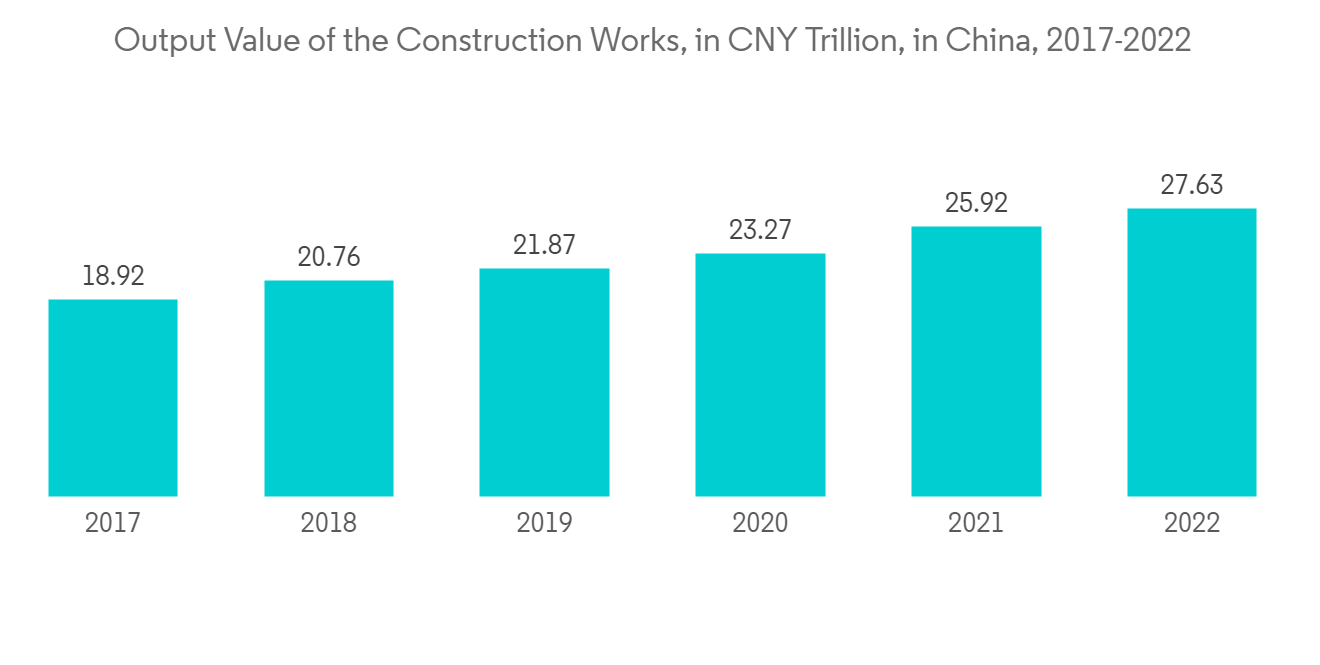

- 中国的建筑业正在稳步增长。 到2021年,总产值将达到4.8万亿美元左右。 随着城镇化进程的加快,2022年中国建筑业产值将达到4.58万亿美元,超过2021年。

- 这些趋势预计将推动热塑性聚烯烃在房屋建筑中的消费,从而推动整体市场增长。

北美主导市场

- 北美在全球市场中的份额最高。 在美国、加拿大和墨西哥等国家,由于建筑业的发展和轻量化、更快速度等施工技术的使用,对这些屋面防水卷材的需求量越来越大。

- 随着新建住宅和公共建筑的增加,建筑业逐年增加。 美国代表着世界上最大的经济体。 由于多年来私人建筑支出的增加,住宅和非住宅部门都在增长。

- 建筑业是美国经济的主要贡献者。 该行业僱用了超过 760 万人,拥有超过 745,000 名雇主,每年建造价值约 1.4 万亿美元的结构。

- 2021 年,美国建筑业的价值约为 1.6 万亿美元。 据估计,到 2025 年将超过 2 万亿美元。 私人建筑支出将在 2022 年继续增长,几乎是公共部门建筑支出的四倍。

- 此外,商业建筑在经济衰退期间大幅下滑,到 2022 年将达到 1150 亿美元,恢復到经济衰退前的水平。 仓库和私人办公室是美国最常见的商业建筑类型。

- 随着住宅和非住宅建筑行业需求的增加,预计在预测期内对单层膜的需求将快速增长。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 调查先决条件

- 本次调查的范围

第二章研究方法论

第 3 章执行摘要

第四章市场动态

- 主持人

- 欧洲对轻型和高速建筑屋面材料的需求不断增长

- 北美私人建筑支出增加

- 扩大对亚太地区新兴国家建筑业的投资

- 阻碍因素

- 原材料价格波动

- 其他限制

- 工业价值链分析

- 波特的五力分析

- 供应商的议价能力

- 消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第 5 章市场细分(市场规模:基于金额)

- 类型

- 三元乙丙橡胶 (EPDM)

- 热塑性聚烯烃 (TPO)

- 聚氯乙烯 (PVC)

- 改性沥青

- 其他类型

- 用法

- 住宅

- 商业设施

- 公共设施

- 基础设施

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 意大利

- 法国

- 其他欧洲

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙特阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章竞争格局

- 併购、合资、合作、合同等。

- 市场份额 (%)**/排名分析

- 主要公司采用的策略

- 公司简介

- BMI Group(Icopal)

- Carlisle SynTec Systems

- Dow

- Duro-Last Inc.

- Firestone Building Products Company LLC

- GAF

- Godfrey Roofing Inc.

- Johns Manville

- Kingspan Group

- Owens Corning

- Sika AG

- Versico Roofing Systems

第七章市场机会与未来趋势

- 在亚太地区的使用范围扩大

- 其他商业机会

简介目录

Product Code: 64757

The market for single-ply membranes is expected to register a CAGR of over 9 % during the forecast period.

Key Highlights

- The COVID-19 pandemic impacted the overall single-ply membranes market in 2020. However, the upsurge in construction activities in the Asia-Pacific region propelled the demand for single-ply membranes.

- Major factors driving the market are the growing demand for lighter and faster construction roofing materials in Europe, rising private construction expenditure in the North American region, and increasing investments in the construction sector in emerging economies of Asia-pacific. Fluctuating prices of raw materials are expected to hinder the market's growth.

- Increasing usage in the Asia-Pacific region is likely to act as an opportunity in the future. North America is the largest market for single-ply membranes, with the largest consumption from countries such as the United States and Canada.

Single-ply Membranes Market Trends

Thermoplastic Polyolefin (TPO) to dominate the market

- Thermoplastic Polyolefin (TPO) is a single-ply roofing membrane that is one of the fastest-growing commercial roofing systems on the market. It is a polypropylene-based plastic and ethylene/propylene rubber material. TPO is manufactured by blending plastic and rubber. It has various advantages, such as heat weldability, ease to repair, flexibility, and white color (due to which almost 90% of the sun rays are reflected).

- TPO can be easily installed on both low and high-slope surfaces. It has become popular because it can resist the sun's ultraviolet rays, ozone, and environmental chemicals. Owing to all these advantages, these membranes are most commonly used in roofing houses in the North American region. With the increasing construction of houses in the countries such as the United States, China, India, etc., the demand for these membranes is increasing significantly.

- The demand for new homes in the United States has been increasing consistently over the past few years, owing to the country's growing population and rising consumer incomes. In 2021, the public sector spent nearly USD 9.3 billion on residential construction projects, a slight decrease compared to 2020. Additionally, 1,337 thousand units new housing units were completed in 2021, a 4% increase from 2020.

- China's construction work sector is growing steadily. It reached a total output value of about USD 4.08 trillion in 2021. Due to rapid urbanization, China's construction industry generated an output of USD 4.58 trillion in 2022, exceeding its value in 2021.

- These aforementioned trends are projected to boost the consumption of thermoplastic polyolefin in residential construction, propelling the overall market growth.

North America to Dominate the Market

- North American region dominated the global market accounting for the highest share. With the growing construction industry and the usage of lightweight and faster construction techniques in countries such as the United States, Canada, and Mexico, the demand for these roofing membranes is increasing.

- The construction is increasing gradually year by year with the increasing number of new homes and public buildings. The United States represents the world's largest economy in the world. The residential and non-residential sectors witnessed growth due to increased private construction spending over the years.

- Construction is a major contributor to the United States economy. The sector employs more than 7.6 million people, has over 745,000 employers, and builds structures valued at nearly USD 1.4 trillion annually.

- In 2021, the United States construction sector was valued at around USD 1.6 trillion. It is estimated to reach over USD 2 trillion in 2025. Spending on private construction continued to grow in 2022 and was nearly four times larger than construction spending in the public sector.

- Furthermore, commercial construction returned to pre-recession figures, with a value of USD 115 billion in 2022, following a notable decline during the recession. The most frequent kinds of commercial construction started in the United States were warehouses and private offices.

- With the increase in demand from the residential and non-residential construction industry, the demand for single-ply membranes is expected to increase rapidly during the forecast period.

Single-ply Membranes Industry Overview

The global single-ply membranes market is fragmented. The major companies include Dow, Duro-Last Inc., BMI Group (Icopal), GAF, and Firestone Building Products Company LLC., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand for Lighter and Faster Construction Roofing Materials in Europe Region

- 4.1.2 Rising Private Construction Expenditure in the North America Region

- 4.1.3 Increasing Investments in Construction Sector in Emerging Economies of Asia-Pacific

- 4.2 Restraints

- 4.2.1 Fluctuating Prices of Raw Materials

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Ethylene Propylene Diene Monomer (EPDM)

- 5.1.2 Thermoplastic Polyolefin (TPO)

- 5.1.3 Poly Vinyl Chloride (PVC)

- 5.1.4 Modified Bitumen

- 5.1.5 Other Types

- 5.2 Application

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.2.3 Institutional

- 5.2.4 Infrastructural

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 BMI Group(Icopal)

- 6.4.2 Carlisle SynTec Systems

- 6.4.3 Dow

- 6.4.4 Duro-Last Inc.

- 6.4.5 Firestone Building Products Company LLC

- 6.4.6 GAF

- 6.4.7 Godfrey Roofing Inc.

- 6.4.8 Johns Manville

- 6.4.9 Kingspan Group

- 6.4.10 Owens Corning

- 6.4.11 Sika AG

- 6.4.12 Versico Roofing Systems

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Usage in the Asia-Pacific Region

- 7.2 Other Opportunities

02-2729-4219

+886-2-2729-4219