|

市场调查报告书

商品编码

1851028

软体定义广域网路:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Software-Defined Wide Area Network - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

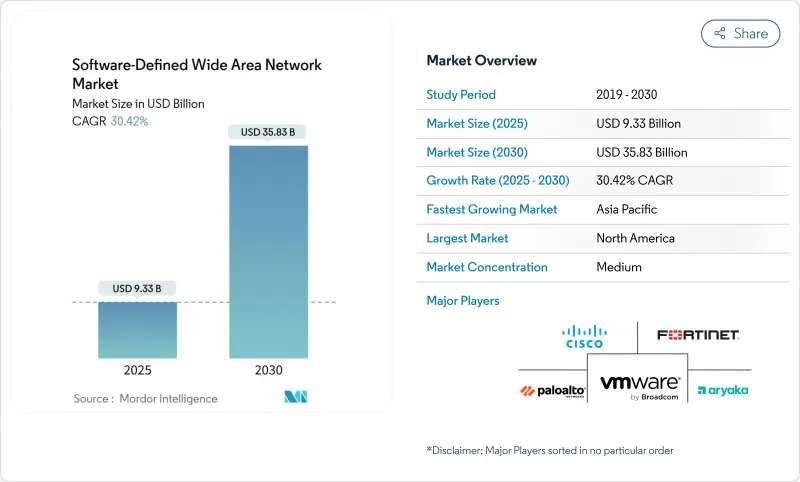

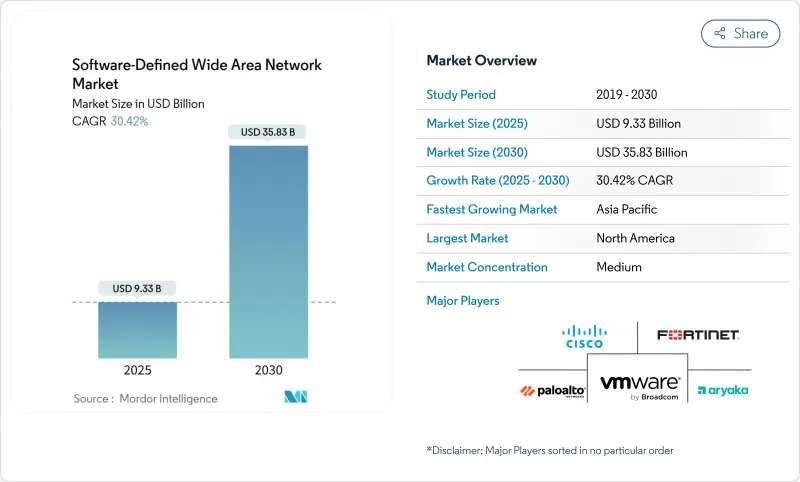

软体定义广域网路市场规模预计在 2025 年达到 93.3 亿美元,预计到 2030 年将达到 358.3 亿美元,预测期(2025-2030 年)复合年增长率为 30.42%。

这一前景反映了从传统 MPLS 向云端原生架构的重大转变,后者能够支援分散式办公室、AI主导的工作负载和 5G 流量。企业决策者正在优先考虑直连云端、整合安全性和应用程式感知路由,这促使供应商在其产品中嵌入自动化和机器学习功能。云端超大规模资料中心业者与通讯业者之间的伙伴关係,透过将高容量存取、网路切片和託管安全服务捆绑在基于结果的服务模式中,正在加速云端原生架构的普及。同时,儘管人才短缺和资料平面安全问题在短期内限制了云端原生架构的普及,但随着企业追求频宽效率和营运敏捷性,其长期发展势头依然强劲。

全球软体定义广域网路市场趋势与洞察

云端中心应用程式的爆炸性成长

向SaaS和云端原生工作负载的快速转型正促使企业重新设计其广域网,以实现对分散式应用程式的零延迟存取。 Salesforce采用Prisma SD-WAN后,在不增加通讯成本的情况下,可用频宽提高了五倍。如今,企业需要能够即时识别、分类和确定数千种云端服务的优先顺序的策略引擎,从而将商业模式从基于容量的协定转向基于体验的协定。超大规模资料中心业者正在积极回应:Google云端与Lumen合作,为5万个地点提供400Gbps光纤,并整合云端广域网路和SD-WAN编配,以支援AI工作负载。随着买家倾向于选择能够跨多重云端连接运算、储存和广域网路的单一供应商解决方案,整合进程正在加速。软体定义广域网路市场将继续受益于云端策略和网路策略的这种整合。

混合/远距办公主导的广域网路敏捷性

持续的混合办公模式需要弹性链路、零接触配置和整合安全功能,将企业网路架构扩展到任何终端。儘管在许多市场,MPLS 配置仍然需要 40 週或更长时间,但 SD-WAN 能够利用宽频、4G 和卫星网络,透过主动-主动路径选择,在几天内完成分支机构的部署。 T-Mobile 正与 Palo Alto Networks 合作推出託管式 SASE,将 5G 高阶存取与云端安全相结合,为企业提供从总部到家庭办公室的弹性频宽和一致的策略。这种对敏捷性的需求正在推动软体定义广域网路 (SD-WAN) 市场快速成长,尤其是在拥有多个分支机构的跨国企业中。

资料平面安全与控制平面攻击面

分店直接遭受网路入侵会扩大威胁面。 IFIC银行将新一代防火墙与SD-WAN边缘结合,降低了40%的监控成本,并且能够满足严格的监管审核。控制平面遭到破坏仍然是一个重大风险,因为单一配置错误就可能在整个网路中传播。因此,供应商正在跨编排通道整合零信任状态检查、安全硬体模组和双向TLS。安全审查可能会延缓一些部署进程,但最终会透过增强人们对编配定义广域网路市场的信心来推动其普及。

细分市场分析

预计2024年,云端託管覆盖网路将占据软体定义广域网路(SWAN)市场48%的份额,届时SWAN市场规模将达到45亿美元,到2030年将以33.2%的复合年增长率成长。企业倾向于采用按需付费模式,以降低资本支出,并提供与IaaS和SaaS环境的无缝连接。自建平台在严格监管的行业中占据主导地位,但其普及受到硬体更新周期和生态系统规模有限的限制。混合架构将本机控制器执行个体与公共云端结合,既满足资料驻留需求,又能利用全球存取点(POP)实现规模化扩充。

随着云端部署密度和 API 整合深度的不断提升,厂商之间的竞争日益激烈。博通公司将 VMware VeloCloud 与赛门铁克边缘节点集成,体现了向分散式、云端优先架构的转型,这种架构能够以线速实现安全性和服务品质保障。买家正在寻找能够自动发现云端应用、透过 Terraform 编排策略并与服务网格整合的解决方案。这些功能使得云端采用成为软体定义广域网路市场的关键成长引擎。

2024年,软体定义广域网路(SD-WAN)市场规模将达61亿美元,其中解决方案营收占高达65%。早期采用者正从概念验证硬体套装转向全面託管的SD-WAN部署。整合、策略设计和全天候监控需要许多企业缺乏的专业技能。因此,咨询和生命週期管理在合约总价值中所占的份额越来越大。

Zayo等供应商已与SSE领导者Netskope合作,在单一服务等级协定(SLA)下提供安全边缘和连线服务。这种成长趋势表明,长期差异化将更多地取决于平台开放性和服务创新,而非专有硬件,从而强化软体定义广域网路市场的混合价值获取模式。

软体定义广域网路市场报告按部署类型(本地部署、云端部署、混合部署)、组件(解决方案和服务)、组织规模(大型企业和中小企业)、最终用户行业垂直领域(医疗保健、银行、金融服务和保险、零售和消费者服务、製造业、运输和物流、IT 和通讯等)以及地区进行细分。

区域分析

到2024年,北美将占据软体定义广域网路(SWAN)市场规模的55%,这反映出云端运算的日益普及、风险资金筹措的活跃以及网路安全法规的日益严格。 Verizon 59亿美元的MPLS减损损失表明,软体主导的迭加网路正在加剧传统传输方式的经济困境。美国补贴安全网路闸道的计画将进一步刺激市场需求,而加拿大和墨西哥也将受益于跨国汽车和零售公司的跨国整合。目前,该地区正转向SASE融合,促使供应商将防火墙即服务和零信任认证整合到所有SWAN产品中。

亚太地区是成长最快的地区,预计到2030年将以32.6%的复合年增长率成长。积极的5G部署为企业提供了全新的选择,可以将蜂窝网路和宽频网路整合到一个可程式设计的迭加网路中。新加坡电信将于2024年在其企业级SD-WAN边缘之上扩展消费级5G网路切片功能,凸显了通讯业者推动该地区5G普及的雄心。中国的智慧製造群、印度的IT外包中心以及东协高速成长的数位经济将汇聚一堂,创造数十亿美元的需求。本地系统整合商将与全球OEM厂商合作,提供合规性和语言本地化服务,从而拓展软体定义广域网路的市场。

儘管监管体系较为分散,欧洲仍展现出巨大的市场潜力。欧盟委员会的「数位十年」计画旨在2030年向下一代连接技术投入2000亿欧元,其中软体定义广域网路(SD-WAN)将成为跨境资料流的核心要素。技能短缺问题依然严峻,光是德国预计到2026年就将面临78万名资讯通讯技术(ICT)专业人员的缺口。沃达丰英国等业者正透过咨询服务来应对这项挑战,将碳排放报告与安全边缘设计结合。因此,欧洲的监管法规和永续性要求正在发挥成熟供应商的优势,推动软体定义广域网路市场的稳定成长。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 以云端为中心的应用程式爆发式成长

- 混合/远距办公主导的广域网路敏捷性

- MPLS成本削减和频宽优化

- 人工智慧驱动的自修復路线优化

- 5G网路切片与SD-WAN融合

- 与环境、社会和治理 (ESG) 相关的碳排放优化路线的需求

- 市场限制

- 资料平面安全与控制平面攻击面

- SD-WAN架构人才短缺

- 专有迭加的锁定风险

- CPE供应链瓶颈

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 透过部署模式

- 前提

- 云

- 杂交种

- 按组件

- 解决方案

- 服务

- 按组织规模

- 大公司

- 小型企业

- 按最终用户行业划分

- 卫生保健

- BFSI

- 零售和消费者服务

- 製造业

- 运输与物流

- 资讯科技和电信

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 义大利

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 亚太其他地区

- 中东和非洲

- 中东

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Cisco Systems

- Fortinet

- VMware(Broadcom)

- Aryaka Networks

- Versa Networks

- HPE Aruba

- Nokia(Nuage Networks)

- Huawei

- Tata Communications

- Ericsson

- Cato Networks

- Palo Alto Networks

- Silver Peak(HPE)

- Masergy(Comcast)

- Juniper Networks

- Citrix Systems

- Zscaler

- Riverbed Technology

- Check Point Software

- Barracuda Networks

- ATandT Business

- Telstra

第七章 市场机会与未来展望

The Software-Defined Wide Area Network Market size is estimated at USD 9.33 billion in 2025, and is expected to reach USD 35.83 billion by 2030, at a CAGR of 30.42% during the forecast period (2025-2030).

This outlook reflects the decisive shift from legacy MPLS to cloud-native architectures that sustain distributed workforces, AI-driven workloads, and 5G traffic. Enterprise decision makers are prioritizing direct-to-cloud connectivity, integrated security, and application-aware routing, pushing vendors to embed automation and machine learning across offerings. Partnerships between cloud hyperscalers and telecom carriers accelerate adoption by bundling high-capacity access, network slicing, and managed security under outcome-based service models. Meanwhile, talent shortages and data-plane security concerns temper near-term rollouts, yet the long-run trajectory remains strong as enterprises pursue bandwidth efficiency and operational agility.

Global Software-Defined Wide Area Network Market Trends and Insights

Cloud-centric Application Explosion

Rapid migration to SaaS and cloud-native workloads reshapes WAN design as enterprises target latency-free access to distributed applications. Salesforce increased available bandwidth fivefold after adopting Prisma SD-WAN without raising telecom costs. Enterprises now demand policy engines that identify, classify, and prioritise thousands of cloud services in real time, shifting commercial models from capacity-based to experience-level agreements. Hyperscalers are responding: Google Cloud teamed with Lumen to deliver 400 Gbps fibre to 50,000 locations, embedding Cloud WAN and SD-WAN orchestration for AI workloads. Consolidation accelerates as buyers favour single-vendor stacks that bridge compute, storage, and wide-area connectivity across multi-cloud estates. The Software-Defined Wide Area Network market continues to benefit from this alignment of cloud and network strategies.

Hybrid/Remote-work-driven WAN Agility

Permanent hybrid work models require resilient links, zero-touch provisioning, and integrated security that extend corporate fabrics to any endpoint. MPLS provisioning still runs 40-plus weeks in many markets, whereas SD-WAN enables branch turn-ups in days using broadband, 4G, and satellite for active-active path selection. T-Mobile collaborated with Palo Alto Networks to launch a managed SASE offer that marries 5G Advanced access with cloud security, giving enterprises elastic bandwidth and consistent policy from headquarters to home offices. Demand for such agility keeps the Software-Defined Wide Area Network market on a steep adoption curve, especially among multinational corporations with volatile site counts.

Data-plane Security and Control-plane Attack Surface

Direct internet breakouts at branch sites enlarge the threat canvas. IFIC Bank mitigated exposure by combining next-generation firewalls with its SD-WAN edge, lowering monitoring costs by 40% while satisfying strict regulatory audits. Control-plane compromise remains a material risk because a single misconfiguration can propagate network-wide. Vendors are therefore integrating zero-trust posture checks, secure hardware modules, and mutual TLS across orchestration channels. Security diligence slows some rollouts, yet ultimately lifts adoption by increasing confidence in the Software-Defined Wide Area Network market.

Other drivers and restraints analyzed in the detailed report include:

- MPLS Cost-out and Bandwidth Optimisation

- AI-driven Self-healing Route Optimisation

- Shortage of SD-WAN Architecture Talent

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cloud-hosted overlays captured 48% of the Software-Defined Wide Area Network market share in 2024, equal to USD 4.5 billion of the Software-Defined Wide Area Network market size, and are set to expand at 33.2% CAGR to 2030. Enterprises favour consumption-based models that remove capex and provide frictionless links into IaaS and SaaS environments. Premise-based platforms persist in highly regulated sectors but face slower uptake due to hardware refresh cycles and smaller ecosystems. Hybrid designs blend controller instances on-premises with public cloud to satisfy data residency while leveraging global POPs for scale.

Vendor competition increasingly revolves around cloud footprint density and API integration depth. Broadcom's unification of VMware VeloCloud with Symantec edge nodes exemplifies the pivot to distributed, cloud-first fabrics capable of enforcing security and quality of service at line-rate. Buyers seek solutions that auto-discover cloud apps, adjust policies via Terraform, and integrate with service meshes. These capabilities keep cloud deployment the primary growth engine in the Software-Defined Wide Area Network market.

Solutions generated 65% of revenue in 2024, equating to USD 6.1 billion of Software-Defined Wide Area Network market size, while services posted the steeper 32.45% CAGR outlook. Early adopters have transitioned from proof-of-concept hardware bundles to full-scale managed SD-WAN estates. Integration, policy design, and 24 X 7 monitoring demand specialist skills that many enterprises lack. Consulting and lifecycle management, therefore, account for a rising share of total contract value.

Providers like Zayo partner with SSE leader Netskope to deliver secure edge plus connectivity as a single SLA, illustrating how services envelop technology to deliver outcomes. The growth trajectory signals that long-term differentiation will hinge on platform openness and service innovation more than on proprietary hardware, reinforcing hybrid value capture in the Software-Defined Wide Area Network market.

The Software-Defined Wide Area Network Market Report is Segmented by Deployment Mode (Premise, Cloud, Hybrid), Component (Solutions and Services), Organisation Size (Large Enterprises and Small and Medium Enterprises), End-User Industry (Healthcare, BFSI, Retail and Consumer Services, Manufacturing, Transport and Logistics, IT and Telecom, and Others), and Geography.

Geography Analysis

North America accounted for 55% of the Software-Defined Wide Area Network market size in 2024, reflecting advanced cloud adoption, robust venture funding, and proactive cyber regulations. Verizon's USD 5.9 billion MPLS impairment illustrates how software-driven overlays cannibalise legacy transport economics. US federal programs that subsidise secure internet gateways further stimulate demand, while Canada and Mexico benefit from cross-border integrations by auto and retail multinationals. The region now pivots to SASE convergence, pushing vendors to bundle firewall-as-a-service and zero-trust authentication into every Software-Defined Wide Area Network market offer.

Asia Pacific represents the fastest expanding theatre, pacing at 32.6% CAGR to 2030. Aggressive 5G rollouts give enterprises clean-sheet options to bond cellular with broadband under programmable overlays. Singtel extended consumer-grade 5G network slicing on top of its enterprise SD-WAN edge in 2024, underscoring how carrier ambition propels regional uptake. China's smart-manufacturing clusters, India's IT outsourcing hubs, and ASEAN's hyper-growth digital economy converge to create multi-billion-dollar incremental demand. Local system integrators partner with global OEMs to tailor compliance and language localisation, broadening the Software-Defined Wide Area Network market footprint.

Europe delivers a sizeable volume despite fragmented regulations. The European Commission's Digital Decade aims to channel EUR 200 billion into next-gen connectivity by 2030, making SD-WAN a core element for cross-border data flow. Skills shortages remain acute; Germany alone expects a gap of 780,000 ICT professionals by 2026. Operators like Vodafone UK respond with advisory practices that fuse carbon reporting and secure edge design. Consequently, Europe's layered regulatory and sustainability demands play to the strengths of mature vendors, reinforcing steady growth in the Software-Defined Wide Area Network market.

- Cisco Systems

- Fortinet

- VMware (Broadcom)

- Aryaka Networks

- Versa Networks

- HPE Aruba

- Nokia (Nuage Networks)

- Huawei

- Tata Communications

- Ericsson

- Cato Networks

- Palo Alto Networks

- Silver Peak (HPE)

- Masergy (Comcast)

- Juniper Networks

- Citrix Systems

- Zscaler

- Riverbed Technology

- Check Point Software

- Barracuda Networks

- ATandT Business

- Telstra

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Cloud-centric application explosion

- 4.2.2 Hybrid/remote-work-driven WAN agility

- 4.2.3 MPLS cost-out and bandwidth optimization

- 4.2.4 AI-driven self-healing route optimisation

- 4.2.5 5G network slicing and SD-WAN convergence

- 4.2.6 ESG-linked carbon-aware routing demand

- 4.3 Market Restraints

- 4.3.1 Data-plane security and control-plane attack surface

- 4.3.2 Shortage of SD-WAN architecture talent

- 4.3.3 Proprietary overlay lock-in risks

- 4.3.4 CPE supply-chain bottlenecks

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Deployment Mode

- 5.1.1 Premise

- 5.1.2 Cloud

- 5.1.3 Hybrid

- 5.2 By Component

- 5.2.1 Solutions

- 5.2.2 Services

- 5.3 By Organization Size

- 5.3.1 Large Enterprises

- 5.3.2 Small and Medium Enterprises

- 5.4 By End-user Industry

- 5.4.1 Healthcare

- 5.4.2 BFSI

- 5.4.3 Retail and Consumer Services

- 5.4.4 Manufacturing

- 5.4.5 Transport and Logistics

- 5.4.6 IT and Telecom

- 5.4.7 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Spain

- 5.5.3.5 Italy

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 United Arab Emirates

- 5.5.5.1.2 Saudi Arabia

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Cisco Systems

- 6.4.2 Fortinet

- 6.4.3 VMware (Broadcom)

- 6.4.4 Aryaka Networks

- 6.4.5 Versa Networks

- 6.4.6 HPE Aruba

- 6.4.7 Nokia (Nuage Networks)

- 6.4.8 Huawei

- 6.4.9 Tata Communications

- 6.4.10 Ericsson

- 6.4.11 Cato Networks

- 6.4.12 Palo Alto Networks

- 6.4.13 Silver Peak (HPE)

- 6.4.14 Masergy (Comcast)

- 6.4.15 Juniper Networks

- 6.4.16 Citrix Systems

- 6.4.17 Zscaler

- 6.4.18 Riverbed Technology

- 6.4.19 Check Point Software

- 6.4.20 Barracuda Networks

- 6.4.21 ATandT Business

- 6.4.22 Telstra

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment