|

市场调查报告书

商品编码

1273476

特种气体市场 - 增长、趋势和预测 (2023-2028)Specialty Gas Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

在预测期内,特种气体市场预计将以超过 4% 的复合年增长率增长。

主要亮点

- COVID-19 对 2020 年的市场产生了负面影响。 不过,预计市场将在2022年达到疫情前的水平,并继续保持稳定增长。

- 特种气体市场的增长预计将受到以下因素的推动:半导体设备和平板显示器的製造需求增加,以及它们用作高科技薄膜等离子增强化学气相沉积 (PECVD) 的清洁气体.

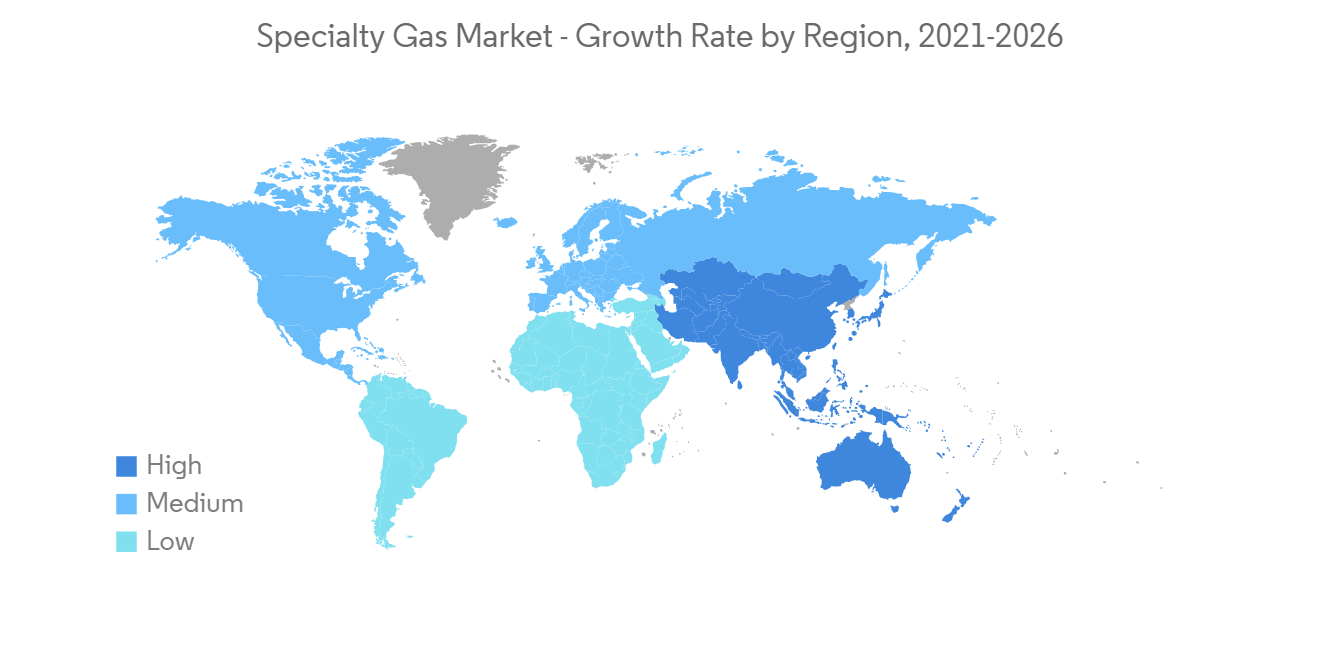

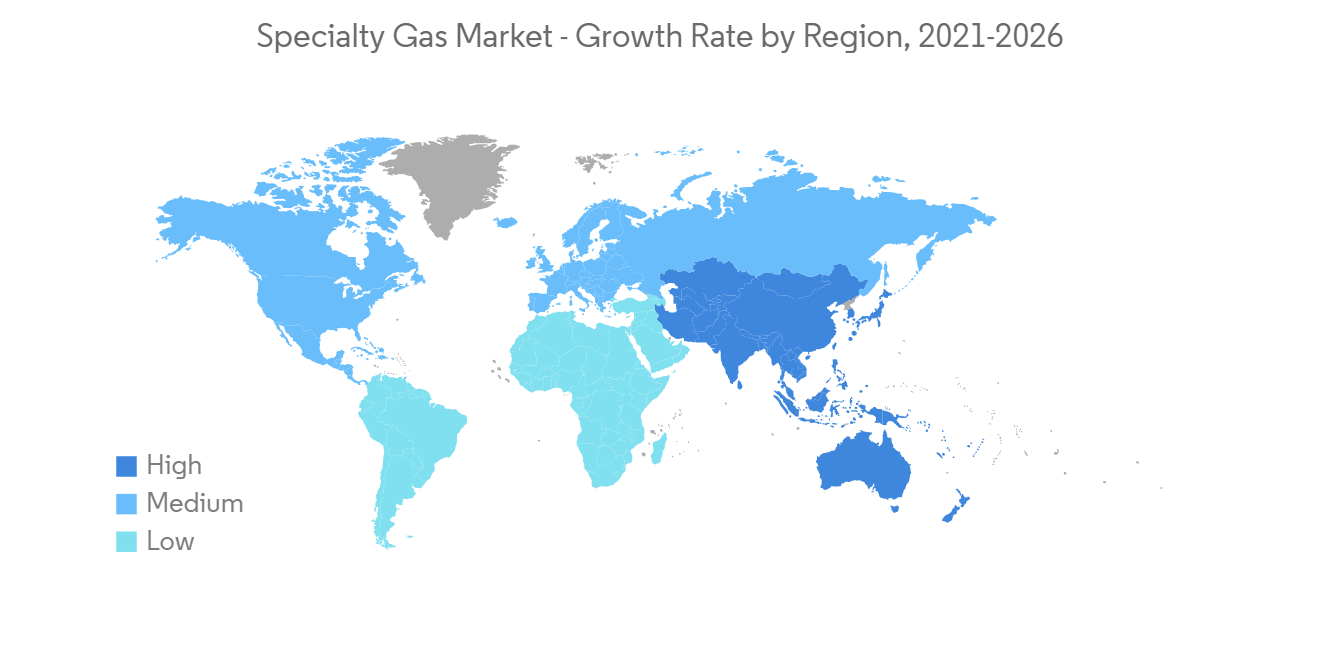

- 严格的环境法规以及特种气体生产和质量控制方面的法规预计会阻碍市场增长。 预计在预测期内,製药或生物技术领域的应用将成为市场机遇。 亚太地区主导着全球市场,中国、印度和日本等国家的消费量最大。

特种气体市场趋势

电子驱动特种气体市场

- 在电子行业中,发光二极管 (LED) 是特种气体的主要应用之一,与传统照明相比,具有能耗更低、使用寿命更长等优势。需求不断增长。 氨用于氮化物基薄膜和外延晶体。 超高纯度外延晶体对于 LED 应用很重要。

- 此外,用于製造个人电脑和智能手机的半导体数量持续增加,推动了特种气体市场的增长。 多年来,由于对移动电话、便携式计算设备、游戏机和其他个人电子产品的需求不断增长,全球消费电子行业经历了快速增长。

- 中国拥有世界上最大的电子产品生产基地。 电线、电缆、计算设备和其他个人设备等电子产品的电子产品增长最快。 该国满足国内对电子产品的需求,并向其他国家出口电子产品,导致市场增长显着。

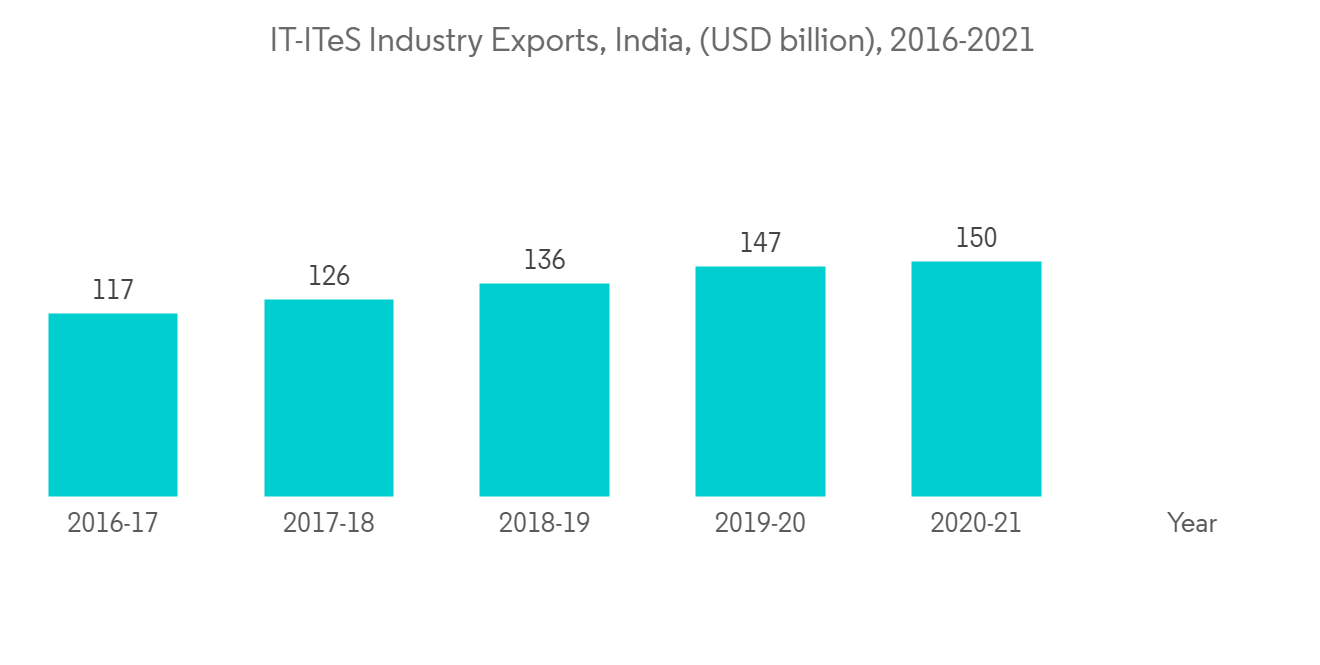

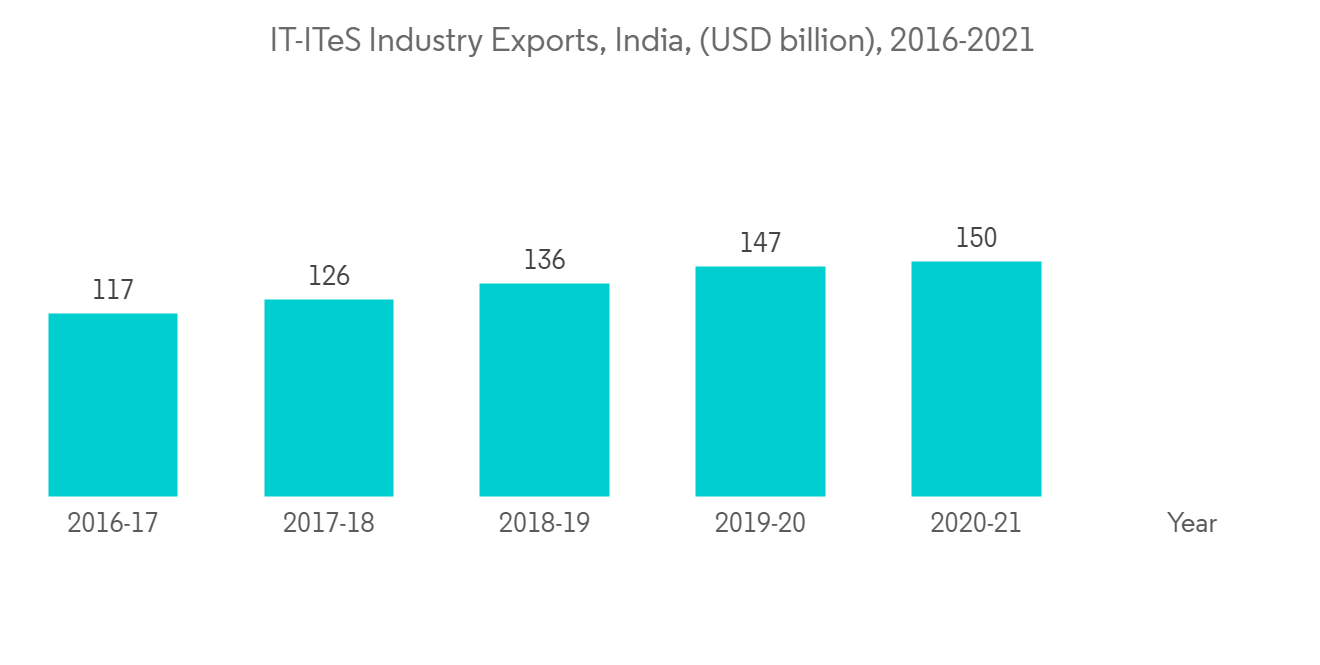

- 此外,印度的电子行业是世界上发展最快的行业之一。 根据电子和 IT 部的一项名为 "扩大和深化电子製造业的行动呼吁" 的研究,印度希望到 2026 年从电子製造业中赚取 3000 亿美元。

- 根据印度品牌资产基金会 (IBEF) 的数据,印度在 2022 年 9 月出口了价值 20.907 亿美元的电子产品,同比增长 71.99%。 该行业的主要出口项目包括手机、消费电子(电视、音响)、IT硬件(笔记本电脑、平板电脑)、工业电子、汽车电子等,支撑着市场的增长。。

- 上述所有因素预计将在预测期内推动特种气体市场。

亚太地区主导市场

- 亚太地区预计将成为预测期内增长最快的特种气体市场,因为该地区蓬勃发展的电子、汽车和医疗保健行业等广泛使用特种气体。.

- 就需求而言,该地区的电子产品在消费电子产品领域的增长率最高。 随着中产阶级可支配收入的增加,对电子产品的需求预计将稳步增长,从而推动所研究的市场。

- 根据中国国家统计局 (NBS) 的数据,2021 年中国电子製造业整体利润同比增长 38.9%,这对市场增长产生了积极影响。

- 此外,根据日本电子资讯技术产业协会 (JEITIA) 的数据,日本电子行业的总产值到 2021 年将增长约 10%,达到约 1000 亿美元。 该领域包括电子产品和组件,以及消费电子和工业电子产品。

- 此外,中国汽车行业的扩张预计将有利于特种气体的需求。 根据国际汽车製造商组织 (OICA) 的数据,中国是最大的汽车生产国。 2021 年仅中国就将生产 26,082,220 辆汽车。

- 因此,预计在预测期内,各行业不断增长的需求将推动该地区的市场。

特种气体行业概况

特种气体市场本质上是部分整合的。 市场参与者包括 Linde plc、Air Liquide、Messer Group GmbH、Showa Denko K.K. 和 Air Products and Chemicals, Inc.。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第 1 章介绍

- 调查先决条件

- 本次调查的范围

第 2 章研究方法论

第 3 章执行摘要

第 4 章市场动态

- 促进因素

- 电子行业的广泛应用

- 医疗保健领域的需求不断扩大

- 抑制因素

- 严格的环境法规、对特种气体生产和质量控制的限制

- 其他限制

- 工业价值链分析

- 波特的五力分析

- 供应商的议价能力

- 消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第 5 章市场细分

- 类型

- 高纯度气体

- 惰性气体

- 碳基气体

- 卤素气体

- 其他类型

- 最终用户行业

- 汽车相关

- 电子产品

- 医疗/保健

- 食物和饮料

- 石油和天然气

- 其他最终用户行业

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 德国

- 英国

- 意大利

- 法国

- 其他欧洲

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙特阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第 6 章竞争格局

- 併购、合资、合作、合同等。

- 市场份额 (%)/排名分析

- 主要公司采用的策略

- 公司简介

- Air Liquide

- Air Products and Chemicals, Inc.

- Coregas

- Iwatani Corporation of America

- Linde plc

- MESA Specialty Gases & Equipment

- Messer Group GmbH

- Mitsui Chemicals, Inc.

- Norco Inc.

- SHOWA DENKO K.K.

- YUEYANG KAIMEITE ELECTRONIC AND SPECLALTY RARE GASES CO.

- ILMO Products Company

第 7 章市场机会与未来趋势

- 在製药和生物技术领域的应用

简介目录

Product Code: 68249

The specialty gas market is projected to register a CAGR of more than 4% during the forecast period.

Key Highlights

- COVID-19 negatively impacted the market in 2020. However, the market reached pre-pandemic levels in 2022 and is expected to grow steadily in the future.

- The growth of the specialty gas market is anticipated to be driven by the increasing demand in manufacturing semiconductor devices and flat panel displays and its usage as a cleaning gas for plasma-enhanced chemical vapor deposition (PECVD) for high-tech thin films.

- Stringent environmental regulations and restrictions on specialty gas production and quality control are expected to hinder the market growth. Applications in the pharmaceutical or biotechnology sector are expected to act as opportunities for the market during the forecast period. The Asia-Pacific region dominates the global market, with the largest consumption from countries such as China, India, and Japan.

Specialty Gas Market Trends

Electronics Sector to Drive the Specialty Gas Market

- In the electronics industry, light-emitting diodes (LEDs) are one of the major applications of specialty gas, which find major consumer demand due to their advantages like lower energy consumption and longer operating life than other traditional lighting sources. Ammonia is used in nitride-based thin films and epitaxial crystals. In the application of LEDs, ultra-high purity of epitaxial crystals is critical.

- Furthermore, semiconductors utilized in the production of personal computers (PCs) and smartphones are constantly increasing, thus propelling the growth of the specialty gas market. The global consumer electronics industry has been growing rapidly worldwide over the years, owing to the consistently increasing demand for cellular phones, portable computing devices, gaming systems, and other personal electronic devices.

- China has the world's largest electronics production base. Electronic products, such as wires, cables, computing devices, and other personal devices, recorded the highest growth in electronics. The country serves the domestic demand for electronics and exports electronic output to other countries, thus providing huge market growth.

- Also, the Indian electronics industry is one of the fastest-growing industries globally. According to "A Call to Action for Broadening and Deepening Electronics Manufacturing," a study by the Ministry of Electronics and IT, India wants to make USD 300 billion from electronics manufacturing by 2026.

- According to India Brand Equity Foundation (IBEF), India exported USD 2,009.07 million worth of electronics in September 2022, up 71.99% year-over-year. Key export items in this industry include mobile phones, consumer electronics (TV and audio), IT hardware (laptops, tablets), industrial electronics, and auto electronics, supporting the market growth.

- All the aforementioned factors are expected to drive the specialty gas market during the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific is expected to be the fastest-growing specialty gas market during the forecast period due to the wide consumption of specialty gases in the electronics, automotive, healthcare industries, etc., which are among the booming sectors in the region.

- Electronic products in the region have the highest growth rates in the consumer electronics segment of the market in terms of demand. With the increase in the disposable incomes of the middle-class population, the demand for electronic products is projected to increase steadily, thereby driving the market studied.

- According to the National Bureau of Statistics (NBS) of China, the overall profit of China's electronics manufacturing businesses increased by 38.9% year-on-year in 2021, thus positively impacting the market's growth.

- Furthermore, according to Japan Electronics and Information Technology Industries Association (JEITIA), the overall production value of the Japan electronics sector increased by almost 10% to around USD 100 billion in 2021. The sector includes electronic devices and components, as well as consumer and industrial electronic equipment.

- Additionally, the expansion of the automotive segment in China is anticipated to benefit the demand for specialty gas. According to the International Organization of Motor Vehicle Manufacturers (French: Organisation Internationale des Constructeurs d'Automobiles) (OICA), China is the largest producer of automobiles. The country alone produced 2,60,82,220 units of vehicles in 2021.

- Thus, the rising demand from various industries is expected to drive the market in the region during the forecast period.

Specialty Gas Industry Overview

The specialty gas market is partially consolidated in nature. Some of the players in the market are Linde plc, Air Liquide, Messer Group GmbH, Showa Denko K.K., and Air Products and Chemicals, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Wide Applications in the Electronics Industry

- 4.1.2 Increasing Demand from the Healthcare Sector

- 4.2 Restraints

- 4.2.1 Stringent Environmental Regulations and Restrictions on Specialty Gas Production and Quality Control

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 High-purity Gases

- 5.1.2 Noble Gases

- 5.1.3 Carbon Gases

- 5.1.4 Halogen Gases

- 5.1.5 Other Types

- 5.2 End-User Industry

- 5.2.1 Automotive

- 5.2.2 Electronics

- 5.2.3 Medical and Healthcare

- 5.2.4 Food and Beverage

- 5.2.5 Oil and Gas

- 5.2.6 Other End-User Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.2.4 Rest of North America

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Aregentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Air Liquide

- 6.4.2 Air Products and Chemicals, Inc.

- 6.4.3 Coregas

- 6.4.4 Iwatani Corporation of America

- 6.4.5 Linde plc

- 6.4.6 MESA Specialty Gases & Equipment

- 6.4.7 Messer Group GmbH

- 6.4.8 Mitsui Chemicals, Inc.

- 6.4.9 Norco Inc.

- 6.4.10 SHOWA DENKO K.K.

- 6.4.11 YUEYANG KAIMEITE ELECTRONIC AND SPECLALTY RARE GASES CO.

- 6.4.12 ILMO Products Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Use in the Pharmaceutical or Biotechnology Sector

02-2729-4219

+886-2-2729-4219