|

市场调查报告书

商品编码

1273483

手术夹市场 - 增长、趋势、COVID-19 影响和预测 (2023-2028)Surgical Clips Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

预计手术夹市场在预测期内的复合年增长率为 5.2%。

由于全球范围内的手术取消,COVID-19 对所研究的市场产生了重大影响。 例如,根据 JAMA 网络上发表的一篇研究论文,2021 年 12 月,在 2020 年第一个停工期间进行了 458,469 次手术,而大流行前的同期进行了 905,444 次手术。 所有外科专家都限制了手术的实施,并优先考虑必要的手术。 然而,随着限制解除和手术步伐加快,市场在大流行后期復苏。 在未来 4-5 年内,由于外科手术的增加,市场预计将呈现稳定增长。

此外,世界上手术数量的增加、世界老年人口的激增以及全球医疗保健支出的激增都对所研究市场的增长产生了积极影响。

根据经济合作与发展组织 (OECD) 于 2022 年 8 月更新的数据,2021 年在部分欧洲国家(例如葡萄牙、丹麦、爱尔兰和挪威)进行的手术(包括心血管手术)分别为 94.87、49.33 、32.84 和 21.5(千)。 新兴欧洲国家如此庞大的手术数量将导致预测期内手术夹市场的采用率增加。

此外,外科手术的高发率也有望推动市场增长。 例如,根据 2021 年 11 月发表的一项研究,腹腔镜胆囊切除术是美国最常见的腹部外科手术,每年进行超过 750,000 例手术。 在某些外科手术中,手术夹最常用作缝合线的替代品,尤其是在接受胆囊切除术的患者中。 因此,高手术负担有望推动市场增长。

此外,心血管疾病和其他慢性疾病负担的增加(建议必须进行手术)以及老年人口的增加预计将推动所研究市场的增长。 例如,根据美国癌症协会的《2022年癌症统计》,预计2022年美国将新增1918030名癌症患者,609360人死于癌症。 根据《2022年世界人口展望》报告,到2022年世界人口预计将达到80亿。 高癌症负担和不断增长的老年人口需要外科手术来治疗癌症和其他慢性疾病,这推动了外科手术夹的可用性,从而增加了市场增长假设

因此,由于慢性病和老年人口增加等因素,市场预计在分析期间将会增长。 然而,欠发达国家的低需求和与手术夹相关的并发症可能会阻碍市场增长。

手术夹的市场趋势

连接夹部分预计在预测期内占据重要的市场份额

市场对结扎夹的需求正在增加,预计在预测期内会进一步增加。 结扎夹市场的增长主要是由于手术数量的增加和老年人口负担的增加。 这些夹子专门用于绑扎管状结构,用于在开腹手术和腹腔镜手术中结扎器官和动脉。

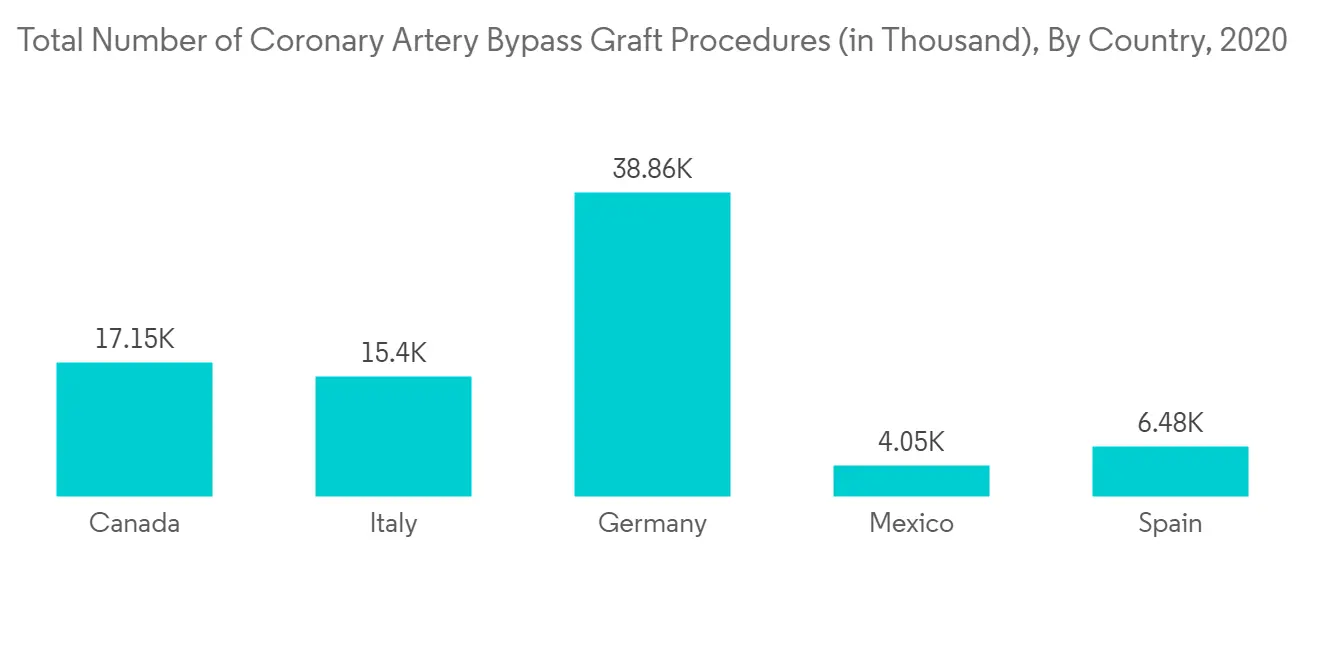

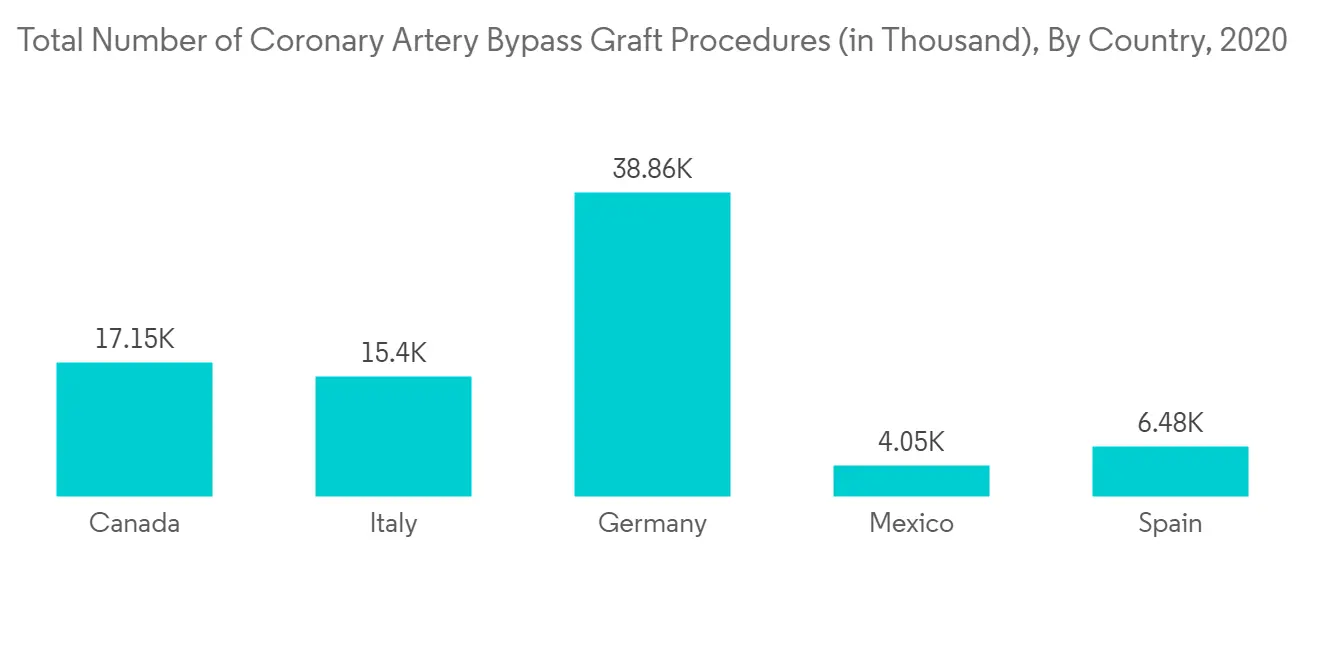

根据阿拉巴马大学伯明翰分校 2021 年 4 月的数据,美国每年大约进行 350,000 例 CABG 手术。 随着该国心血管疾病负担的增加,预计手术数量会增加,从而推动所研究的细分市场的增长。

此外,据估计,癌症的高患病率将推动这一细分市场的增长,因为大多数患者都会接受某种形式的手术来治疗癌症。 例如,根据 2021 年 11 月的加拿大癌症统计报告,估计有五分之二的加拿大人在其一生中会被诊断出患有癌症。 它预测,到 2021 年,估计将有 229,200 名加拿大人被诊断出患有癌症。 因此,估计癌症的高患病率将推动使用结扎夹进行手术干预。

因此,由于癌症和心血管疾病的高负担等因素,所研究的市场预计在预测期内将出现细分市场增长。

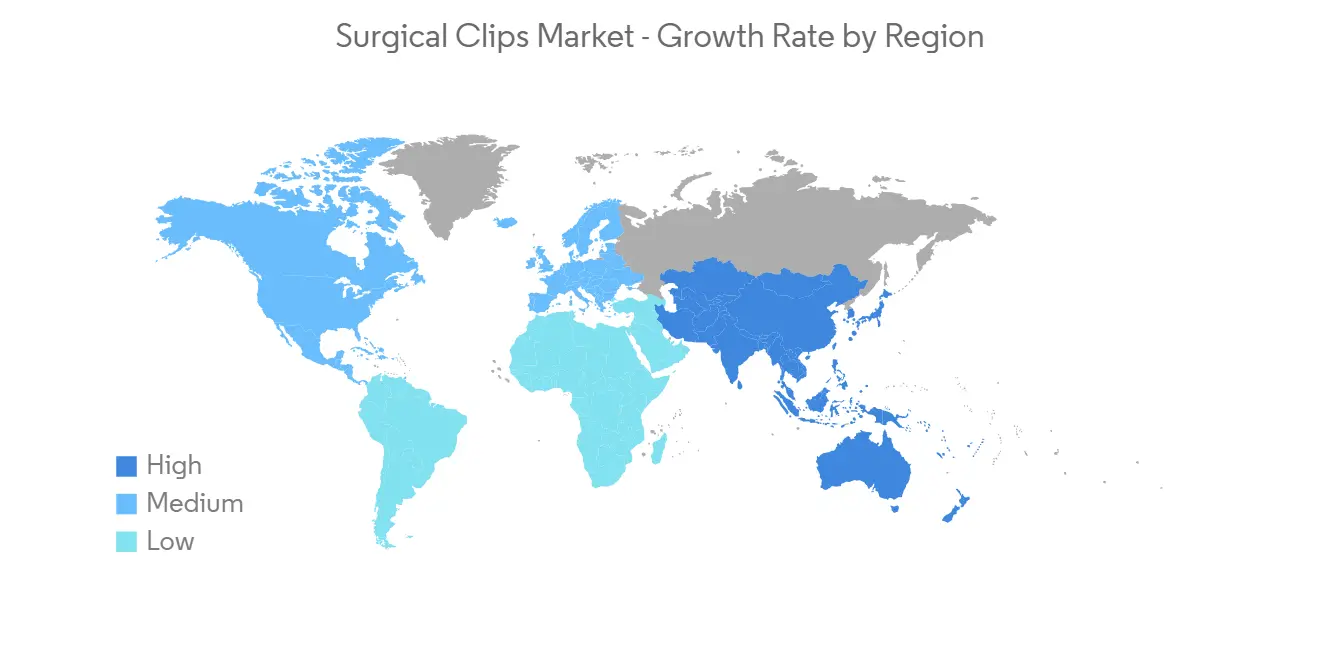

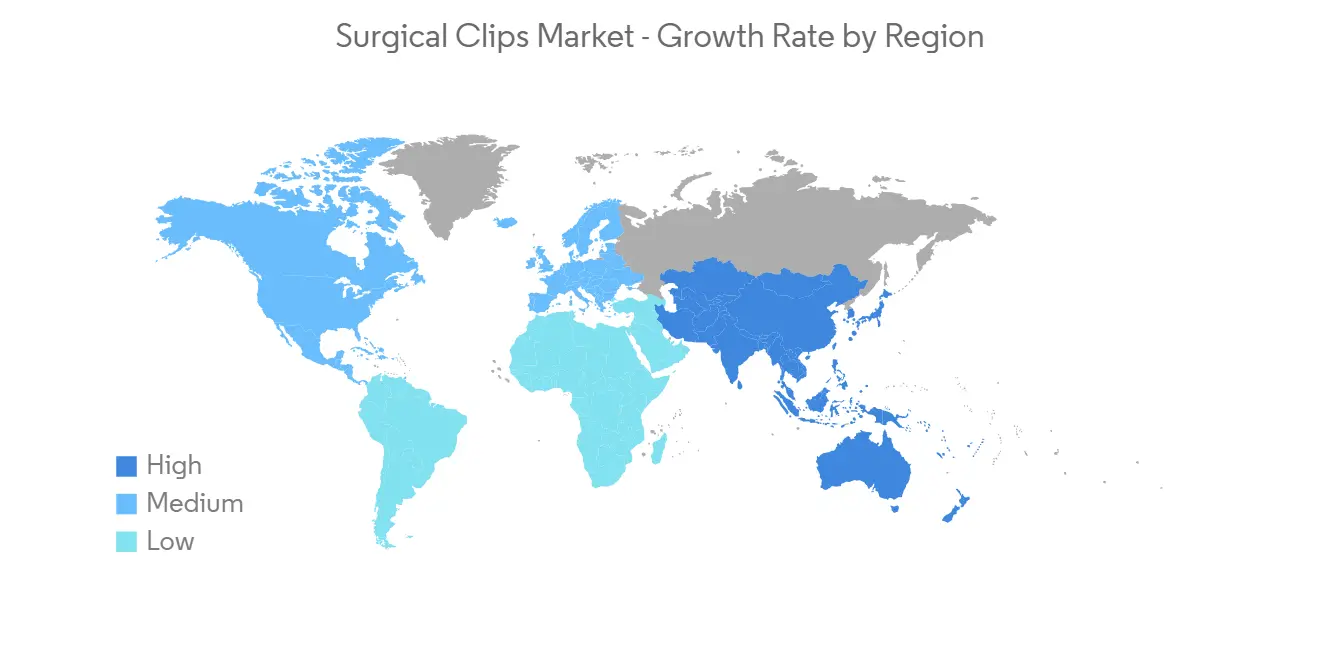

预计在预测期内北美将占据重要的市场份额

北美受慢性病发病率上升、老年人口不断增加、医疗保健基础设施更好、公共和医疗保健行业利益相关者对可用技术的认识以及该地区市场参与者高度集中的推动。预计该地区将拥有庞大的市场份额由于以下因素:

根据发表于加拿大肠道研究学会并于 2021 年 9 月更新的一篇论文,憩室病是由沿胃肠道形成的小囊状突起引起的。 它影响了 5% 的 40 岁以下西方成年人口,在 60 岁以上的人群中上升到 50%,在 85 岁以上的人群中上升到 65%。 据报导,便秘影响了 15% 的加拿大人口,但 13% 的 30-64 岁人群和 23% 的 65-93 岁人群受到影响,使其成为老年人中非常常见的病症。 美国癌症协会报告称,2022 年美国估计将有 106,180 例结肠癌新病例。 由于阑尾炎和结肠癌等胃肠道疾病在老年人群中的负担很高,因此通常需要进行外科手术,并在手术过程中使用手术夹,从而推动了研究市场的增长。

此外,政府机构的高医疗保健支出也有助于市场增长。 例如,根据加拿大健康信息研究所 2021 年的一篇文章,加拿大的医疗保健总支出将在 2021 年上升到超过 3080 亿美元。 预计高昂的医疗保健成本将为该地区的各种外科手术创造增长机会,最终推动市场增长。

因此,由于手术程序和新产品批准的增加,预计在预测期内北美的手术夹市场将会增长。

手术夹行业概况

手术夹市场竞争适中,由几家大型企业组成。 目前主导市场的公司包括 Ackermann Medical GmbH & Co.、B. Braun SE、Boston Scientific Corporation、Edwards Lifesciences Corporation、Johnson & Johnson Services, Inc.、Lemaitre Vascular Inc.、Medtronic PLC、Scanlan International、Teleflex Incorporated. 等.

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 调查假设和市场定义

- 本次调查的范围

第二章研究方法论

第 3 章执行摘要

第四章市场动态

- 市场概览

- 市场驱动力

- 全球外科手术数量增加

- 世界老龄化人口正在增加

- 全球医疗保健支出增加

- 市场製约因素

- 欠发达国家的需求下降

- 与手术夹相关的并发症

- 波特五力

- 新进入者的威胁

- 买方/消费者议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

第 5 章市场细分(市场规模、价值)

- 按类型

- 结扎夹

- 动脉瘤夹

- 其他类型

- 按材料

- 钛

- 聚合物

- 其他材料

- 按手术类型

- 自动手术夹

- 手动手术剪辑

- 按地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 意大利

- 西班牙

- 其他欧洲

- 亚太地区

- 中国

- 日本

- 印度

- 澳大利亚

- 韩国

- 其他亚太地区

- 中东和非洲

- 海湾合作委员会

- 南非

- 其他中东和非洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美

第6章竞争格局

- 公司简介

- Ackermann Medical GmbH & Co.

- B. Braun SE

- Boston Scientific Corporation

- Edwards Lifesciences Corporation

- Johnson & Johnson Services, Inc.

- Lemaitre Vascular Inc.

- Medtronic PLC

- Scanlan International

- Teleflex Incorporated

- Grena Ltd

- Stapleline Medizintechnik GmbH

- Cook Medical

第7章 市场机会与将来动向

The surgical clips market is expected to register a CAGR of 5.2% over the forecast period.

COVID-19 had a profound impact on the studied market owing to the cancellations of surgical procedures worldwide. For instance, according to a research article published in the JAMA Network, in December 2021, there were 458,469 surgical procedures performed during the first shutdown period in 2020 compared to 905,444 surgical during the equivalent period in pre-pandemic. All surgical specialists limited their surgical practices and prioritized the necessary surgeries. However, the market recovered in the later phase of the pandemic as the restrictions were lifted and surgical procedures gained pace. The market is expected to show stable growth over the next 4-5 years due to the rising surgical interventions.

In addition, the increase in the number of surgical procedures worldwide, the surge in the global geriatric population, and the surge in healthcare expenditure worldwide are actively affecting the growth of the studied market.

According to the Organization for Economic Co-operation and Development (OECD) data updated in August 2022, the number of surgeries, including cardiovascular surgeries performed in some European countries such as Portugal, Denmark, Ireland, and Norway in 2021 includes 94.87, 49.33, 32.84, 21.5 (in thousand). Such a huge number of surgeries in developed European countries will lead to increased adoption of the surgical clips market over the forecast period.

Also, the high incidence of surgical procedures is expected to propel the market growth. For instance, according to a study published in November 2021, laparoscopic cholecystectomy is the most common abdominal surgical treatment in the United States, with over 750,000 performed annually. Surgical clips are most commonly used as an alternative to suturing for ligation in patients undergoing several surgical procedures, especially cholecystectomies. Hence, the high burden of surgical procedures is expected to propel the market growth.

Moreover, the growing burden of cardiovascular diseases and other chronic conditions (where surgery is being suggested as mandatory) and the increasing elderly population is expected to drive the studied market's growth. For instance, according to the American Cancer Society Cancer Statistics 2022, 1,918,030 new cancer cases and 609,360 cancer deaths are predicted to occur in the United States in 2022. Also, according to the world population prospect 2022 report, the world's population is projected to reach 8 billion in 2022. The high burden of cancer and the rising geriatric population require surgical procedures for treating cancer and other chronic diseases, which is estimated to propel the utility of surgical clips, thereby augmenting the market growth.

Therefore, owing to the factors such as the rising prevalence of chronic diseases and the geriatric population, the studied market is anticipated to witness growth over the analysis period. However, the poor demand in underdeveloped countries and complications associated with surgical clips will likely impede the market growth.

Surgical Clips Market Trends

The Ligating Clips Segment is Expected to Hold a Significant Market Share Over the Forecast Period

The demand for ligating clips is increasing in the market and is estimated to rise further during the forecast period. The growth of the ligating clips market is majorly attributed to the increasing number of surgeries and the growing burden of the geriatric population. These clips are made specifically for tying tubular structures and are used in both open and laparoscopic surgery to ligate organs and blood arteries.

According to the April 2021 data of the University of Alabama at Birmingham, every year, about 350,000 CABG surgeries are performed in the United States. This high number of procedures is expected to increase with the country's rising burden of cardiovascular diseases and boost growth in the studied segment.

Furthermore, the high prevalence of cancer is estimated to propel the segment's growth as the majority of patients undergo some type of surgery to treat their cancer. For instance, according to the Canadian Cancer Statistics November 2021 report, an estimated 2 in 5 Canadians are likely to be diagnosed with cancer in their lifetime. It stated that an estimated 229,200 Canadians was predicted to be diagnosed with cancer in 2021. Thus the high prevalence of cancer is estimated to propel the usage of ligating clips for surgical interventions.

Therefore, due to the factors such as the high burden of cancer and cardiovascular disorders, the market studied is expected to grow in the segment over the forecast period.

North America is Expected to Hold a Significant Market Share Over The Forecast Period

North America is expected to hold a significant market share owing to factors such as the rising incidence of chronic diseases, growing geriatric population, better healthcare infrastructure, awareness among people and healthcare industry stakeholders about available technologies, and the high concentration of market players in the region.

According to an article published in the Canadian Society of Intestinal Research and updated in September 2021, diverticular disease occurs when small sac-like protrusions develop along the gastrointestinal tract. It affects 5% of the western adult population younger than 40 years of age but affects 50% of those aged 60 years and above and rises to 65% in those aged 85 years and above. It is also reported that constipation affects 15% of the Canadian population but is much more common in older individuals, affecting 13% of those aged 30-64 years and 23% of those aged 65-93 years. Also, as per the American Cancer Society report, there will be an estimated 106,180 new colon cancer cases in the United States in 2022. The high burden of gastrointestinal diseases such as appendicitis and colon cancer among the older population commonly requires surgical procedures, which use surgical clips during the process and propel the growth of the studied market.

Additionally, the high healthcare expenditure by government bodies contributes to market growth. For instance, as per the Canadian Institute of Health Information 2021 article, total health expenditure in Canada rose to over USD 308 billion in 2021. The high healthcare expenditure is expected to create growth opportunities for various surgical interventions in the region, which is ultimately expected to propel the market growth.

Thus, owing to the increasing number of surgical procedures and new product approvals, the surgical clips market is expected to grow over the forecast period in North America.

Surgical Clips Industry Overview

The surgical clips market is moderately competitive and consists of a few major players. Some of the companies currently dominating the market are Ackermann Medical GmbH & Co., B. Braun SE, Boston Scientific Corporation, Edwards Lifesciences Corporation, Johnson & Johnson Services, Inc., Lemaitre Vascular Inc., Medtronic PLC, Scanlan International, Teleflex Incorporated, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increase in the Number of Surgical Procedures Worldwide

- 4.2.2 Surge in the Global Geriatric Population

- 4.2.3 Surge in Healthcare Expenditure Worldwide

- 4.3 Market Restraints

- 4.3.1 Poor Demand in the Underdeveloped Countries

- 4.3.2 Complications Associated with Surgical Clips

- 4.4 Porter Five Forces

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD Million)

- 5.1 By Type

- 5.1.1 Ligating Clips

- 5.1.2 Aneurysm Clips

- 5.1.3 Other Types

- 5.2 By Material Type

- 5.2.1 Titanium

- 5.2.2 Polymer

- 5.2.3 Other Material Types

- 5.3 By Surgery Type

- 5.3.1 Automated Surgery Clips

- 5.3.2 Manual Surgery Clips

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Ackermann Medical GmbH & Co.

- 6.1.2 B. Braun SE

- 6.1.3 Boston Scientific Corporation

- 6.1.4 Edwards Lifesciences Corporation

- 6.1.5 Johnson & Johnson Services, Inc.

- 6.1.6 Lemaitre Vascular Inc.

- 6.1.7 Medtronic PLC

- 6.1.8 Scanlan International

- 6.1.9 Teleflex Incorporated

- 6.1.10 Grena Ltd

- 6.1.11 Stapleline Medizintechnik GmbH

- 6.1.12 Cook Medical