|

市场调查报告书

商品编码

1273484

手术包市场 - 增长、趋势、COVID-19 影响和预测 (2023-2028)Surgical Kits Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

在预测期内,手术包市场预计将以 8.3% 的复合年增长率增长。

大流行的突然开始迫使许多手术被推迟,导致 COVID-19 暂时对市场产生不利影响。 根据 JAMA Network 于 2021 年 12 月发布的一份报告,在第一次择期手术暂停期间,美国的整体外科手术率下降了 48.0%。 外科手术的减少也导致对手术包的需求减少。 因此,预计 COVID-19 大流行期间外科手术的减少将对市场扩张产生负面影响。 然而,在大流行后时期,推迟的手术恢復了,这有望在未来几年推动市场增长。

主要亮点

- 由于全球手术数量的增加以及对微创手术的需求增加,预计手术套件市场将稳步增长。

- 根据 CDC 2022 年发布的最新报告,美国有 1820 万成年人患有冠状动脉疾病,其中约 70% 的患者接受了手术。 因此,执行的程序增加了住院人数,对市场的增长做出了重大贡献。 同样,根据 2022 年 OECD 统计数据,2021 年丹麦有 13,815 例髋关节置换术,约有 12,465 例剖腹产手术。

- 此外,根据 2021 年 8 月发布的 CDC 报告,每年有近 800,000 名患者因跌倒受伤入院,其中最常见的是髋部骨折。. 因此,手术方法被用来解决上述健康问题。 这导致手术入院人数增加,推动了手术包市场的增长。

- 但是,外科手术的高成本和不利的法规预计会阻碍外科手术包市场的增长。

手术包的市场趋势

预计在预测期内增长的一次性手术器械

- 一次性手术器械是医疗设施中常用的消耗品之一。 本手术器械仅供一次性或临时使用。 医疗保健专业人员正在从可重复使用的器械转向一次性器械,以避免因清洁和再处理不当而对患者造成危害。

- 例如,根据 GWS Surgicals LLP 于 2021 年 12 月发布的一份报告,对所有变量进行分析表明,从保护患者的角度来看,一次性医疗设备在各个方面都优于可重复使用的设备。结果很明确。 因此,由于手术器械引起医院感染的风险较低,一次性手术包在外科手术中发挥着重要作用。

- 此外,一次性试剂盒比可重复使用的试剂盒更具成本效益,对医护人员和患者都有好处。 例如,根据上述消息来源,从长远来看,一次性(一次性)手术器械更具成本效益。 因此,世界各地的医院都在采用一次性手术器械。 因此,由于一次性手术器械相对于可重复使用手术器械的优势和成本效益,预计在预测期内将推动市场发展。

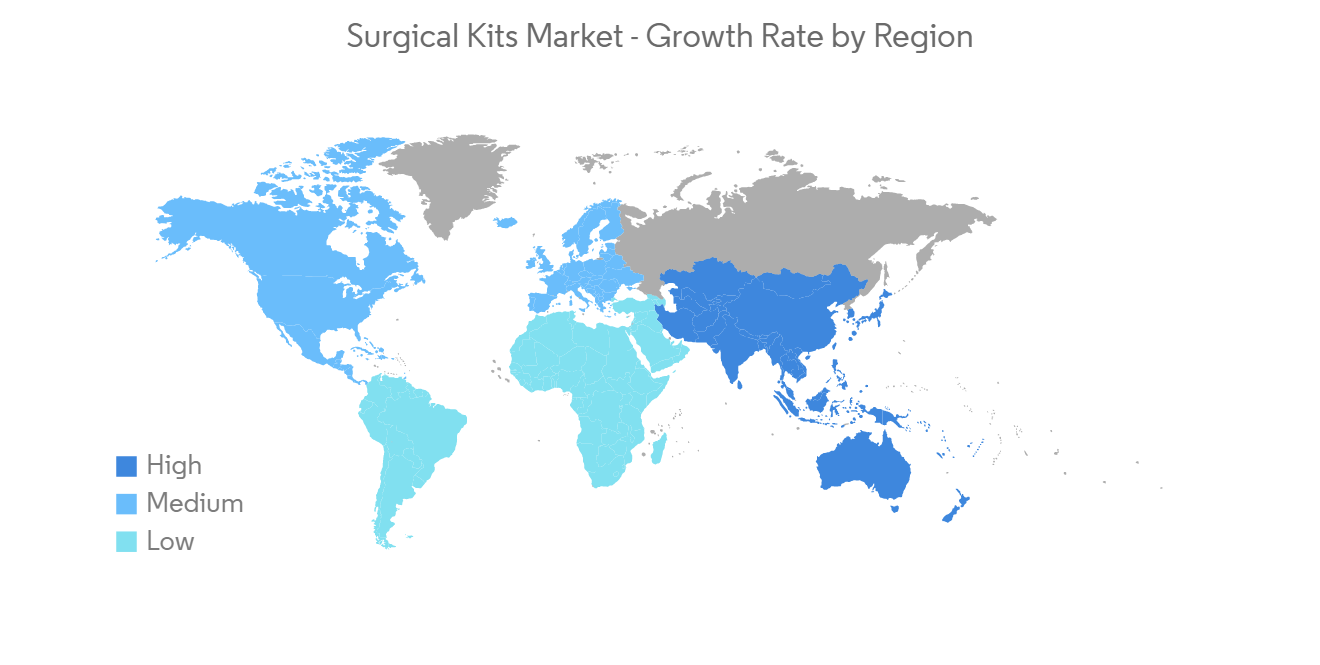

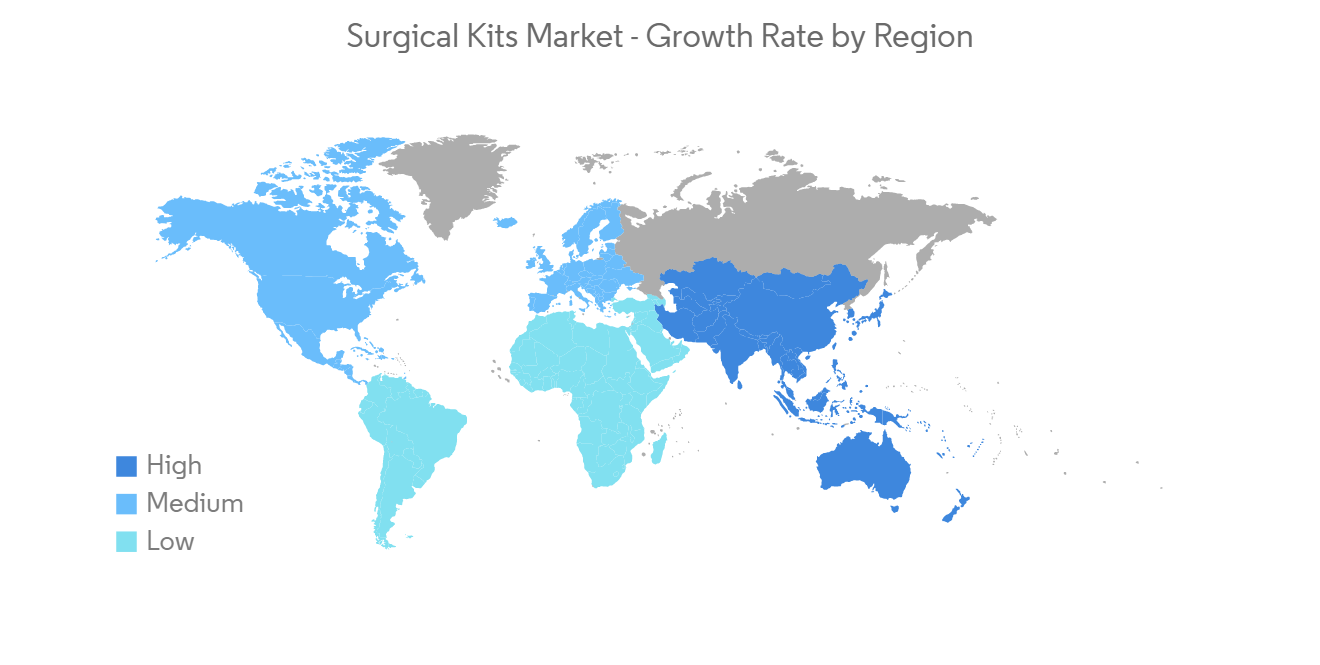

预计在预测期内北美将主导市场

- 由于技术的持续发展和微创手术的兴起,美国已成为北美领先的手术包国内市场。 北美的增长主要受到新技术的采用、人口老龄化、良好的监管框架和高人均收入的推动。

- 增长的主要驱动力之一是外科手术数量的增加。 据 AAFPRS 成员称,2021 年手术和非手术面部整形手术的总数急剧增加。 估计 2021 年将进行 140 万次外科和非外科手术,整形外科医生平均比 2020 年多进行 600 次手术,增长 40%。 因此,外科手术的增加增加了该地区对手术包的需求,在研究期间推动了市场。

- 此外,外科领域的新进展和发展将在预测期内推动市场增长。 例如,2022 年 8 月,微创骨科手术机器人领域的新兴领导者 Point Robotics 的微创手术机器人 POINT Kinguide 机器人辅助手术系统获得了美国 FDA 的 510(k) 许可。 Point Robotics 是一种手持式机器人框架,带有并联机械手,适用于骨科应用。

- 因此,由于上述因素,预计该行业在预测期内将出现显着增长。

手术包行业概况

手术包市场竞争激烈,在当地的影响力很强。 然而,一些大公司在世界所有地区提供产品。 由于手术包价格低廉,也有新进入者,预计未来会占据相当大的份额。 主要公司包括 B. Braun SE、Boston Scientific Corporation、Cardinal Health、Johnson & Johnson Services, Inc、KCWW、Medtronic、Novartis AG(Alcon Laboratories Inc)、Stryker、Smith & Nephew 和 Zimmer Biomet。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 调查假设和市场定义

- 本次调查的范围

第二章研究方法论

第 3 章执行摘要

第四章市场动态

- 市场概览

- 市场驱动力

- 全球外科手术数量增加

- 对微创手术的需求不断增长

- 提高对医院获得性感染的认识

- 市场製约因素

- 手术费用高

- 不利的监管情况

- 波特的五力分析

- 新进入者的威胁

- 买方/消费者议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

第 5 章市场细分

- 按产品分类

- 手术缝合线和订书机

- 手持手术设备

- 镊子/抹刀

- 牵开器

- 扩张器

- 抓手

- 辅助设备

- 其他手持手术设备

- 电外科设备

- 按类型

- 一次性手术器械

- 可重复使用的手术器械

- 通过使用

- 整形外科

- 神经外科

- 泌尿科

- 妇产科

- 胸外科

- 骨科

- 心血管外科

- 其他用途

- 地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 意大利

- 西班牙

- 其他欧洲

- 亚太地区

- 中国

- 日本

- 印度

- 澳大利亚

- 韩国

- 其他亚太地区

- 中东和非洲

- 海湾合作委员会

- 南非

- 其他中东和非洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美

第六章竞争格局

- 公司简介

- B. Braun SE

- Boston Scientific Corporation

- Cardinal Health

- Johnson & Johnson Services Inc.

- KCWW

- Medtronic

- Novartis AG(Alcon Laboratories Inc.)

- Stryker

- Smith & Nephew

- Zimmer Biomet

第7章 市场机会未来动向

The surgical kits market is expected to register a CAGR of 8.3% over the forecast period. The abrupt start of the pandemic forced many surgeries to be postponed, which temporarily had a detrimental effect on the market due to COVID-19. As per the report published by JAMA Network in December 2021, in the United States, the overall rate of surgical procedures fell by 48.0% during the first shutdown of elective surgeries. This decline in surgical procedures led to decreased demand for surgical kits as well. Thus, the decline in surgical procedures during the COVID-19 pandemic is anticipated to have a detrimental effect on the market's expansion. However, during the post-pandemic period, the postponed surgeries resumed, which is expected to boost the market's growth in the coming future.

Key Highlights

- The surgical kits market is expected to witness robust growth due to the rising number of surgical procedures worldwide and the increasing demand for minimally invasive surgeries across the world.

- According to the updated report published by CDC in 2022, 18.2 million adults in the United States had coronary artery disease, and about 70% of these patients underwent surgery. Hence, the procedures performed have increased hospital admissions, which significantly helps in the growth of the market. Similarly, as per the OECD statistics for 2022, the number of hip replacement procedures in Denmark in 2021 was 13,815, and cesarean section procedures were approximately 12,465.

- Furthermore, according to a CDC report published in August 2021, every year, approximately 800,000 patients are admitted to hospitals with fall-related injuries, the most common of which is a hip fracture. Hence, surgical methods are to be followed to fix the above-stated health concerns. This leads to an increase in hospital admissions for surgeries and drives the growth of the surgical kits market.

- However, the high cost of surgical procedures and unfavorable regulatory scenarios are expected to hamper the growth of the surgical kits market.

Surgical Kits Market Trends

Disposable Surgical Equipment Expected to Witness Growth Over the Forecast Period

- Disposable surgical equipment is one of the commonly used supplies in medical establishments. This surgical equipment is intended for one-time or temporary use. Healthcare professionals are switching from reusable instruments to disposables to avoid the hazards of improper cleaning and reprocessing of surgical kits, which pose a threat to patients.

- For instance, as per the report published by GWS Surgicals LLP in December 2021, it is clear from analyzing all the variables that, in terms of patient protection, disposable medical equipment outperform reusable ones in every way. Thus disposable surgical kits play a key role in surgical procedures due to the lower risk of hospital-acquired infections through the surgical instruments.

- Moreover, disposable kits are cost-effective compared to reusable ones, which are beneficial for healthcare professionals and patients. For instance, as per the above-mentioned source, single-use (disposable) surgical equipment is more cost-effective in the long term. Hence, hospitals around the world are adopting disposable surgical instruments. Thus, disposable surgical equipment is expected to drive the market over the forecast period due to its advantages and cost-effectiveness over reusable surgical equipment.

North America Expected to Dominate the Market Over the Forecast Period

- The United States emerged as the key domestic market for surgical kits in North America on account of the continuous technological developments and the rising uptake of minimally invasive surgeries. The growth in North America was primarily driven by the adoption of new technologies, the growing aging population, favorable regulatory framework, and high per capita income.

- One of the major growth-driven factors is the rising number of surgical procedures. According to AAFPRS members, in 2021, the total number of surgical and non-surgical facial plastic surgery treatments increased dramatically. An estimated 1.4 million surgical and non-surgical procedures were done in 2021, with plastic surgeons performing an average of 600 more procedures than they did in 2020, a 40% increase. Thus the rise in surgical procedures increases the demand for surgical kits in the region, which drives the market over the study period.

- Moreover, the new advancements and developments in the field of surgery will help the market to grow over the forecast period. For instance, in August 2022, Point Robotics, a rising leader in the field of minimally invasive orthopedic surgical robots, received 510(k) clearance from the FDA in the United States for its minimally invasive surgical robot POINT Kinguide Robotic-Assisted Surgical System. Point Robotics is a hand-held robot framework equipped with a parallel manipulator for orthopedic applications.

- Hence, the segment is expected to witness significant growth over the forecast period due to the abovementioned factors.

Surgical Kits Industry Overview

The market for surgical kits is highly competitive, with an active presence of local players. However, a few major players are providing products across all regions worldwide. Due to the low prices of surgical kits, some new companies are also penetrating the market and are expected to hold a substantial share in the future. The major players include B. Braun SE, Boston Scientific Corporation, Cardinal Health, Johnson & Johnson Services, Inc, KCWW, Medtronic, Novartis AG (Alcon Laboratories Inc.), Stryker, Smith & Nephew, and Zimmer Biomet.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Number of Surgical Procedures Worldwide

- 4.2.2 Rising Demand for Minimally Invasive Surgeries

- 4.2.3 Rise in the Awareness About Hospital-Acquired Infection

- 4.3 Market Restraints

- 4.3.1 High Cost of Surgical Procedures

- 4.3.2 Unfavorable Regulatory Scenario

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Product

- 5.1.1 Surgical Sutures and Staplers

- 5.1.2 Handheld Surgical Devices

- 5.1.2.1 Forceps and Spatulas

- 5.1.2.2 Retractors

- 5.1.2.3 Dilators

- 5.1.2.4 Graspers

- 5.1.2.5 Auxiliary Instruments

- 5.1.2.6 Other Handheld Surgical Devices

- 5.1.3 Electrosurgical Devices

- 5.2 By Type

- 5.2.1 Disposable Surgical Equipment

- 5.2.2 Reusable Surgical Equipment

- 5.3 By Application

- 5.3.1 Plastic and Reconstructive Surgeries

- 5.3.2 Neurosurgery

- 5.3.3 Urology

- 5.3.4 Obstetrics and Gynecology

- 5.3.5 Thoracic Surgery

- 5.3.6 Orthopedic

- 5.3.7 Cardiovascular Surgery

- 5.3.8 Other Applications

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 B. Braun SE

- 6.1.2 Boston Scientific Corporation

- 6.1.3 Cardinal Health

- 6.1.4 Johnson & Johnson Services Inc.

- 6.1.5 KCWW

- 6.1.6 Medtronic

- 6.1.7 Novartis AG (Alcon Laboratories Inc.)

- 6.1.8 Stryker

- 6.1.9 Smith & Nephew

- 6.1.10 Zimmer Biomet