|

市场调查报告书

商品编码

1273488

热稀释导管市场 - 增长、趋势、COVID-19 影响和预测 (2023-2028)Thermodilution Catheter Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

在预测期内,热稀释导管市场的复合年增长率预计为 5.5%。

由于选择性手术(包括心血管疾病的诊断和治疗)的取消,COVID-19 对所研究的市场产生了负面影响。 例如,根据美国国家医学图书馆发表的一篇论文,到2022年3月,美国成人心臟手术数量将减少52.7%,择期手术数量将减少65.5%。 中大西洋地区在早期阶段受 COVID-19 激增的影响最大,总体病例下降 69.7%,选择性病例下降 80.0%。 在 COVID-19 激增之后,全国心臟手术病例数并未恢復到基线水平,表明 COVID-19 相关心臟手术患者短缺。 因此,COVID-19 对心臟护理产生了重大影响,因此,热稀释导管市场也受到了影响。 然而,根据分析,由于 COVID-19 患者数量减少,当前市场正在稳步增长,预计未来几年将呈现类似趋势。

心脏病和中风发病率的上升,以及用于开发心肌梗塞管理新技术的研发活动的增加,对所研究市场的增长产生了积极影响。 例如,根据美国心臟协会 2022 年 1 月发布的“心脏病和中风统计更新情况说明书”,全球有 2.441 亿人患有缺血性心脏病,其中男性多于女性(分别为 1.411 亿和 1.031 亿)。 此外,根据世界卫生组织2021年6月更新的数据,全球约有3350万人患有心房颤动(AFib),这是严重心律失常的代表。 预计心脏病和中风的激增将推动治疗这些疾病所需的热稀释导管的需求,最终推动市场增长。

主要市场参与者的产品批准、发布、合作伙伴关係和收购的增加预计将促进市场增长。 例如,2022 年 7 月,从瑞士苏黎世联邦理工学院 (ETH) 分拆出来的苏黎世公司 Nanoflex Robotics 开发了一种创新导管,用于对中风患者进行快速手术干预。 预计此类市场发展将推动市场增长。

虽然市场呈上升趋势,但新兴市场缺乏熟练的医疗保健专业人员以及难以在患者心臟中定位导管可能会阻碍市场增长。有。

热稀释导管市场趋势

预测期内聚氨酯热稀释导管有望增长

聚氨酯热稀释导管由于其应用范围广、安全、降低患者对乳胶过敏和超敏反应的风险、无刺激性等特点,近年来占据了较大的市场份额,而且这一趋势在预测期间仍将持续期间。预计将继续。 聚氨酯导管也有望在预测期内引领该领域,因为与硅胶导管相比,聚氨酯导管具有更高的机械强度和柔韧性,因此越来越多地被医生采用。 例如,根据 2022 年 7 月在 NCBI 上发表的一篇文章,将 Swan-Ganz 导管或右心导管连接到体外压力传感器,以确定中心静脉压、右心房压、右心室压和肺动脉压. 带稀释传感器的四腔导管。 这些好处,加上热稀释导管用于肺动脉压力监测的迅速增加,可能会增加製造商的需求并推动全球市场。

此外,企业活动的增加和产品创新预计也将在预测期内推动市场增长。 例如,2022 年 3 月,CATHI 将推出一款新的右心导管模拟器,该模拟器提供 CATHI 原始 RHC 模拟器的所有功能,增加了线辅助导航和使用真实液体 (S-HUB) 的可能性,从而允许热稀释发生。

在预测期内,预计北美的热稀释导管市场将出现显着增长。

北美的特点是心脏病发病率上升、人口老龄化、医疗保健基础设施更好、公众和医疗保健利益相关者对可用技术的认识,以及行业参与者在该地区的强大影响力。预计该市场将出现显着增长,因为因素,例如: 例如,根据 CDC 的 2022 年更新,美国 1210 万人可能在 2030 年出现心房颤动。 根据同一消息来源,美国每 34 秒就有一人死于心血管疾病。 到 2020 年,美国将有大约 697,000 人死于心脏病,即五分之一。 由于这种疾病的高负担和严重性,我们预计热稀释导管在该地区的使用会增加。

该地区正在开展各种运动,以挽救受心脏病影响的生命。 例如,美国医疗保险和医疗补助服务中心和疾病预防控制中心正在联合领导全国范围的百万爱心运动。 该活动将于 2022 年 1 月开始,并将持续到 2026 年 12 月。 该倡议的目标是在五年内预防一百万例心脏病发作和中风。 我们相信,这样的努力将加快心脏病的治疗和诊断,以预防中风和其他心脏病,并最终增加热稀释导管用于监测心输出量的使用。预计在预测期内加强该地区的市场.

热稀释导管行业概况

由于少数公司在全球和区域开展业务,因此热稀释导管市场本质上是整合的。 竞争格局包括对具有市场份额的几家知名国际和地区公司的分析。 主要市场参与者包括 Alpha Medical Instruments LLC、Edwards Lifesciences、Teleflex Incorporated、DeRoyal Industries、ICU Medical Inc、Nolato AB、B. Braun SE、Merit Medical Systems Inc、Avicenna Healthcare Solutions、Advanced Lifesciences Pvt Ltd 等。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 调查假设和市场定义

- 本次调查的范围

第二章研究方法论

第 3 章执行摘要

第四章市场动态

- 市场概览

- 市场驱动力

- 心脏病的全球流行和中风发病率的增加

- 启动研发活动以开发心臟卒中管理新技术

- 市场製约因素

- 难以将导管置入患者心臟

- 新兴经济体缺乏熟练的医疗保健专业人员

- 波特的五力分析

- 新进入者的威胁

- 买方/消费者议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

第 5 章市场细分(基于价值的市场规模

- 按材料

- 聚氨酯

- 尼龙

- 其他材料

- 最终用户

- 医院

- 门诊手术中心

- 其他最终用户

- 按地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 意大利

- 西班牙

- 其他欧洲

- 亚太地区

- 中国

- 日本

- 印度

- 澳大利亚

- 韩国

- 其他亚太地区

- 中东和非洲

- 海湾合作委员会

- 南非

- 其他中东和非洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美

第六章竞争格局

- 公司简介

- Alpha Medical Instruments LLC

- Teleflex Incorporated

- Edwards Lifesciences

- DeRoyal Industries

- ICU Medical Inc

- Nolato AB

- B. Braun SE

- Merit Medical Systems Inc

- Advanced Lifesciences Pvt Ltd

第七章市场机会与未来趋势

The thermodilution catheter market is expected to register a CAGR of 5.5% during the forecast period.

The impact of COVID-19 was adverse on the studied market owing to cancellations in elective procedures, including diagnosis and treatment of cardiovascular diseases, which impacted the studied market. For instance, according to an article published by the National Library of Medicine, in March 2022, there was a 52.7% reduction in adult cardiac surgery volume in the United States and a 65.5% reduction in elective cases. The Mid-Atlantic region was most affected by the COVID-19 surge in the initial phase, with a 69.7% reduction in overall case volume and an 80.0% reduction in elective cases. After the COVID-19 surge, nationwide cardiac surgical case volumes did not return to baseline, indicating a COVID-19-associated deficit of cardiac surgery patients. Hence, COVID-19 significantly impacted cardiac treatment and, consequently, the thermodilution catheter market. However, the current market is witnessing stabilized growth owing to the decrease in COVID-19 cases and is expected to project a similar trend over the coming years per the analysis.

The prevalence of cardiac diseases and increased incidences of stroke, as growing research and development activities to develop novel technologies in cardiac stroke management is actively affecting the growth of the studied market. For instance, according to the AHA's Heart Disease & Stroke Statistical Update Fact Sheet, published in January 2022, 244.1 million people were living with ischemic heart disease worldwide and it was more prevalent in males than in females (141.0 and 103.1 million people, respectively). Additionally, according to WHO data updated in June 2021, nearly 33.5 million people worldwide suffer from atrial fibrillation (AFib), the most common type of serious arrhythmia. The surge in cardiac diseases and incidences of stroke is projected to propel the demand for thermodilution catheters, required during the treatment of these diseases which is ultimately projected to boost the market growth.

The increasing product approvals, launches, partnerships, and acquisitions by key market players are projected to augment the market growth. For instance, in July 2022, the Zurich-based company Nanoflex Robotics, a spin-off from the Swiss Federal Institute of Technology in Zurich (ETH), developed an innovative catheter for rapid surgical interventions on stroke patients. Such developments are expected to boost the market growth.

While the market is poised for an upward trend, the lack of skilled healthcare professionals in emerging markets and difficulty in catheter localization in the patient's heart is likely to impede the market growth.

Thermodilution Catheter Market Trends

The Polyurethane Thermodilution Catheters is Expected to Witness Growth Over the Forecast Period

Polyurethane thermodilution catheters accounted for a significant share in recent years and are expected to do so over the forecast period owing to their wide range of applications, safety, reduced risk of patient latex allergy or hypersensitivity, and non-irritant nature. Additionally, an increased adoption rate of polyurethane catheters by doctors due to their enhanced mechanical strength and flexibility compared to silicon catheters is likely to drive the segment over the forecast period. For instance, an article published in NCBI in July 2022 stated that a Swan-Ganz catheter or right heart catheter is a quadruple-lumen catheter with a thermodilution sensor that is attached to a pressure transducer outside the body to identify the central vein pressure right atrial pressure, right ventricular pressure, and pulmonary artery pressure. These advantages and a rapid increase in the adoption of thermodilution catheters for monitoring pulmonary arterial pressure are also expected to increase the demand for manufacturers and propel the global market.

Moreover, rising company activities and product innovations are also expected to propel market growth over the forecast period. For instance, in March 2022, CATHI launched a new Right Heart Catheter simulator offering all the features of CATHI's original RHC simulator, with the additional benefits of wire-assisted navigation and the potential to work with real liquids (S-HUB), thereby allowing thermodilution to be performed.

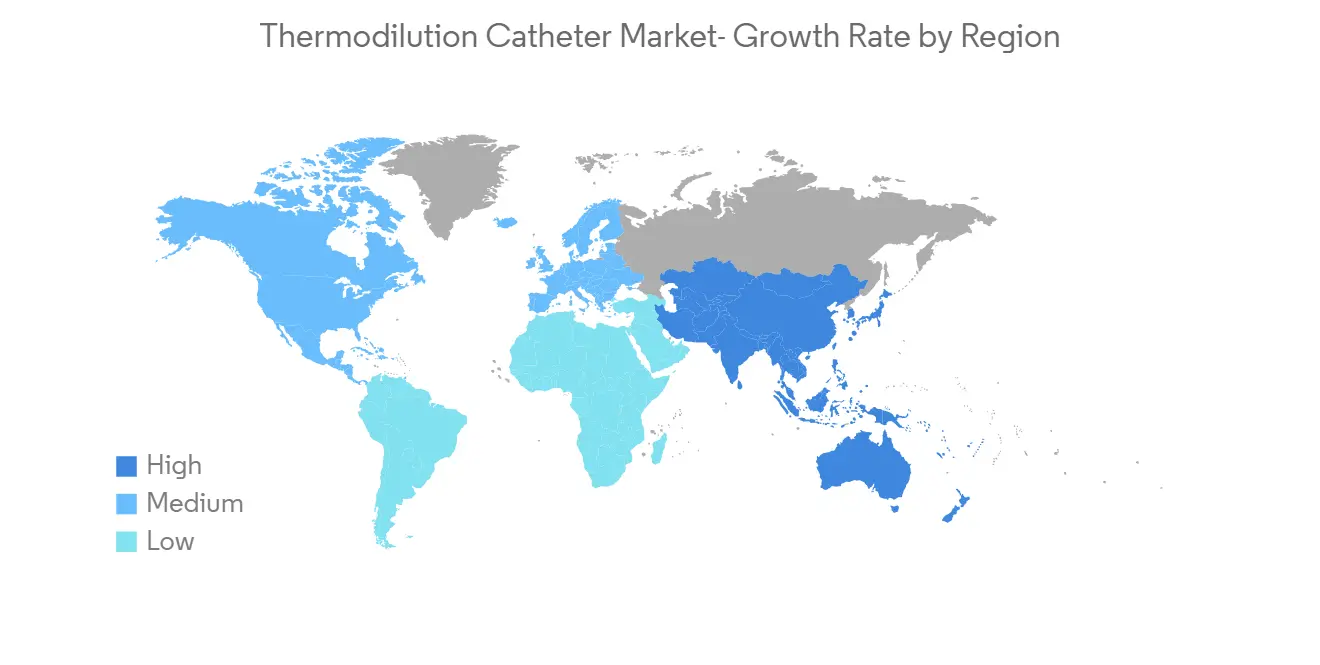

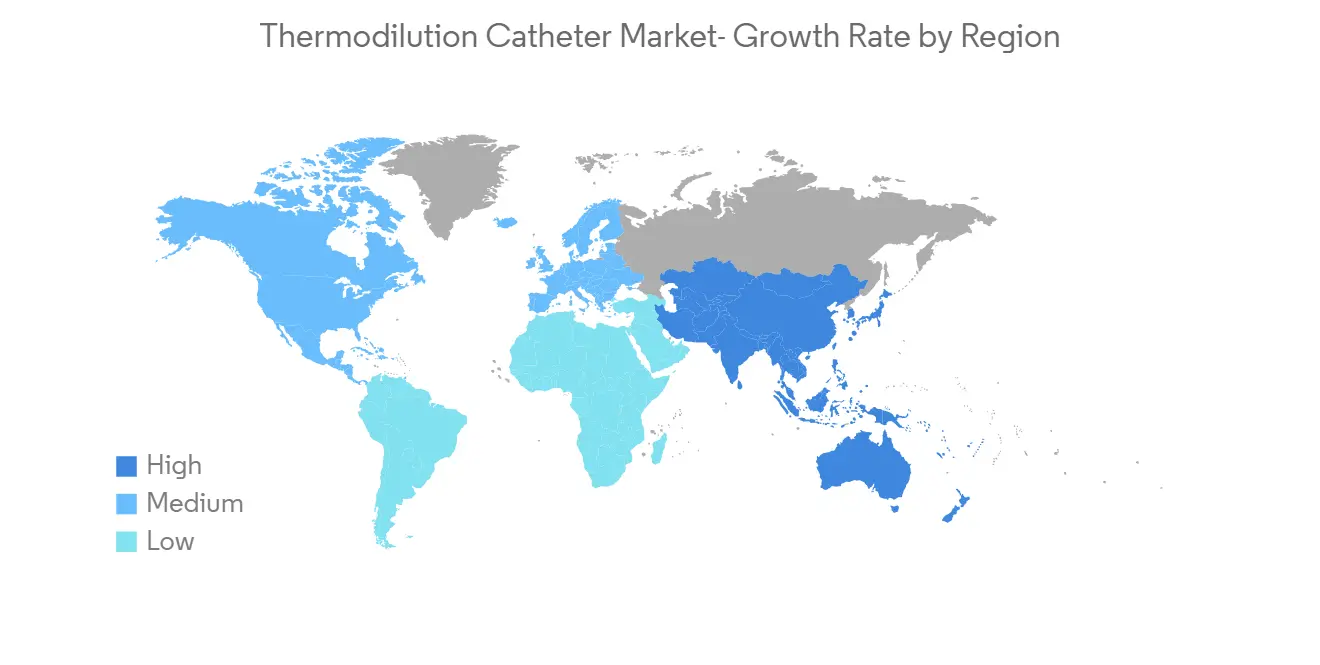

North America is Expected to show a Significant Growth in the Thermodilution Catheter Market Over the Forecast Period.

North America is expected to show significant growth in the market owing to factors such as the rising incidence of cardiac diseases, growing geriatric population, better healthcare infrastructure, awareness among people and healthcare industry stakeholders about available technologies, and the strong presence of industry players in the region. For instance, according to a CDC 2022 update, 12.1 million people in the United States will likely have atrial fibrillation in 2030. As per the same source, one person dies every 34 seconds in the United States from cardiovascular disease. About 697,000 people in the United States died from heart disease in 2020, accounting for 1 in every 5 deaths. Owing to the high burden and severity of the disease, the utility of thermodilution catheters is expected to rise in the region.

Various campaigns are conducted in the region to protect lives impacted by heart diseases. For instance, the Centers for Medicare & Medicaid Services and the CDC in the United States jointly lead the nationwide Million Hearts campaign. The initiative commenced on January 2022 and will continue till December 2026. The goal of the initiative is to prevent 1 million heart attacks and strokes within 5 years. Such initiatives are likely to expedite the treatment and diagnosis of cardiac diseases to prevent strokes and other heart diseases and ultimately boost the usage of thermodilution catheters for monitoring cardiac output, which is projected to enhance the market in the region during the forecast period.

Thermodilution Catheter Industry Overview

The thermodilution catheters market is consolidated in nature due to the presence of a few companies operating globally as well as regionally. The competitive landscape includes an analysis of a few international and local companies that hold market shares and are well known. Some key market players are Alpha Medical Instruments LLC, Edwards Lifesciences, Teleflex Incorporated, DeRoyal Industries, ICU Medical Inc, Nolato AB, B. Braun SE, Merit Medical Systems Inc., Avicenna Healthcare Solutions, Advanced Lifesciences Pvt Ltd, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Global Prevalence of Cardiac Diseases and Increased Incidences of Stroke

- 4.2.2 Growing R&D Activities to Develop Novel Technologies in Cardiac Stroke Management

- 4.3 Market Restraints

- 4.3.1 Difficulty in Catheter Localization in the Patient's Heart

- 4.3.2 Lack of Skilled Healthcare Professionals in Emerging Markets

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Material

- 5.1.1 Polyurethane

- 5.1.2 Nylon

- 5.1.3 Other Materials

- 5.2 By End-User

- 5.2.1 Hospitals

- 5.2.2 Ambulatory Surgical Centers

- 5.2.3 Other End-Users

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United states

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Alpha Medical Instruments LLC

- 6.1.2 Teleflex Incorporated

- 6.1.3 Edwards Lifesciences

- 6.1.4 DeRoyal Industries

- 6.1.5 ICU Medical Inc

- 6.1.6 Nolato AB

- 6.1.7 B. Braun SE

- 6.1.8 Merit Medical Systems Inc

- 6.1.9 Advanced Lifesciences Pvt Ltd