|

市场调查报告书

商品编码

1273495

扁桃体和腺样体切除术产品市场 - 增长、趋势、COVID-19 影响和预测 (2023-2028)Tonsil and Adenoid Removal Products Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

在预测期内,扁桃体和腺样体切除术产品市场的复合年增长率预计为 7.3%。

COVID-19 大流行最初对扁桃体和腺样体切除术产品市场产生了重大影响。 实施封锁以及推迟非紧急手术和非 COVID 相关治疗减少了 2020 年扁桃体和腺样体手术的数量。 由于 COVID-19 的高风险,各种耳鼻喉科服务受到限制,仅优先考虑必要的手术和程序。 例如,2022 年 2 月发表在《头颈杂誌》(Journal of Head and Neck) 上的一项研究发现,大流行使德国扁桃体手术的数量减少了多达 82%。 根据 2021 年 7 月发表在 Journal Laryngoscope Investigative Otolaryngology 上的一项研究,随着大流行期间择期手术的延误和取消。 据说 COVID-19 封锁降低了儿童和其他人扁桃体感染的发生率,也导致儿童鼓膜切开术和扁桃体手术的数量减少。 然而,即使在大流行期间,也允许并进行严重病例的扁桃体手术。 例如,在 2020 年 5 月发表在《欧洲耳鼻咽喉头颈疾病年鑑》上的一项研究中,扁桃体切除术和腺样体切除术在患有严重阻塞性睡眠呼吸暂停的成年人中毫不拖延地进行了。我是。 然而,随着封锁的解除和非 COVID 紧急情况下选择性措施的恢復,市场有望恢復其 COVID 前的正常步伐。 例如,2022 年 2 月,新南威尔士州政府宣布恢復非紧急择期手术,将患者在私立医院的住院时间增加到大流行前活动水平的 85%。 此外,2022 年 5 月,纽约州卫生部 (DOH) 宣布在医院、办公室外科诊所、诊断和治疗中心以及门诊手术中心重新开放非紧急程序和非紧急择期手术。我们更新了指南。

随着 COVID 的解除以及非紧急和择期手术在全球范围内的恢復,预计市场将以更稳定的速度增长。

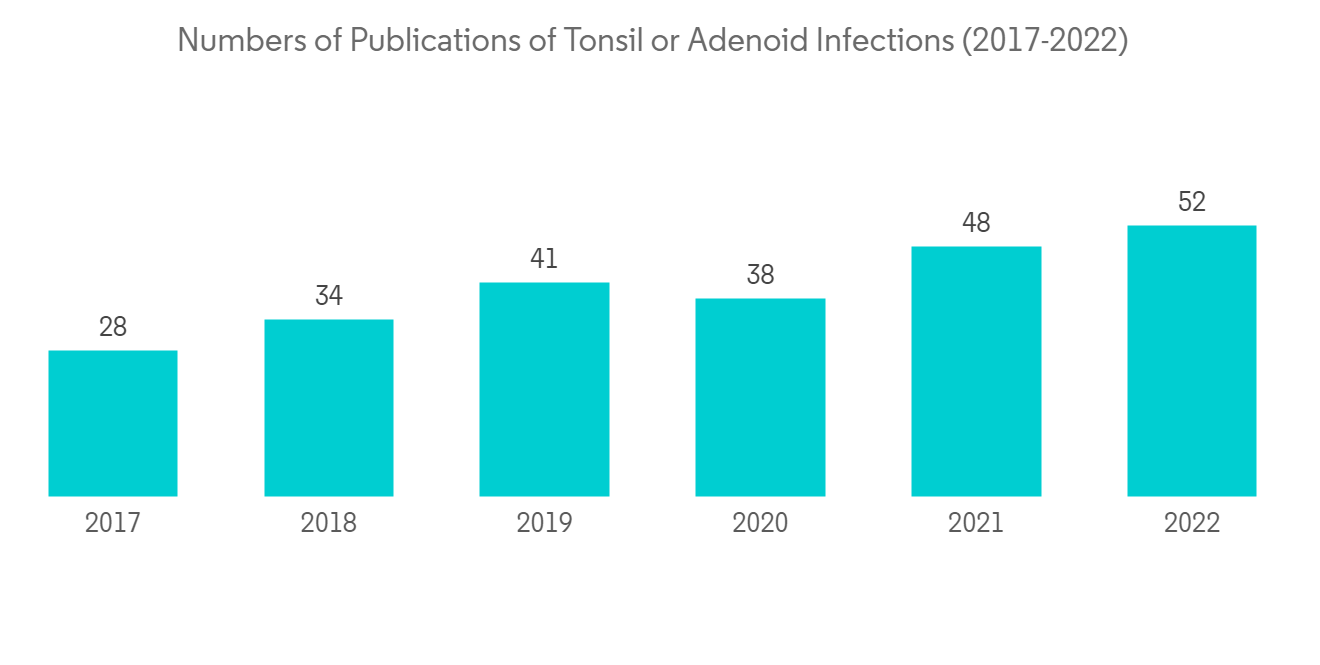

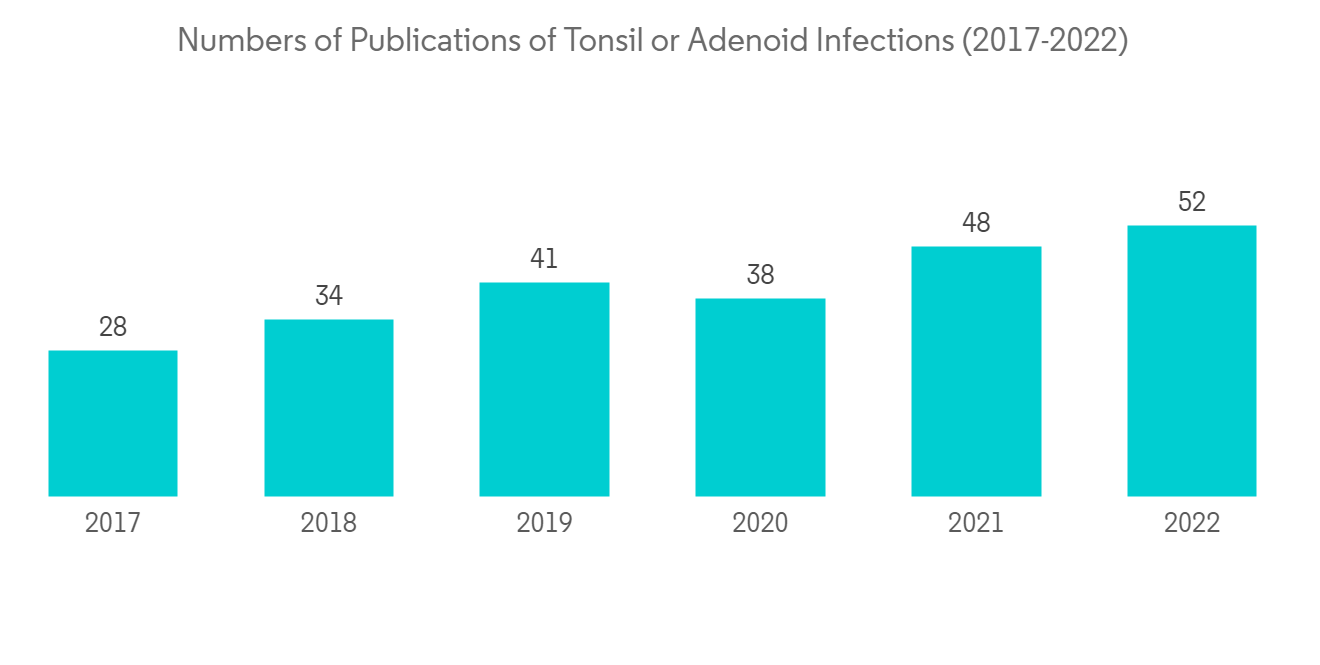

此外,扁桃体和腺样体感染的增加也在推动市场增长。 2022 年 6 月发表在《柳叶刀》杂誌上的一项研究发现,计算得出的儿童 A 组链球菌咽部感染的合併发生率为每 100 隻幼崽咽炎和 A 组溶血 82.2 次。链球菌每 100 小牛年发生 22.1 次。 2022 年 12 月发表在《自然》杂誌上的一项研究警告说,2022 年 12 月英国超过 13 名儿童的死亡人数可能导致致命的猩红热引起的 A 型链球菌病例激增。强调。 根据 2021 STAT Pearls,腺样体增生在儿童中的患病率为 34.5%。

因此,由于扁桃体和腺样体感染的流行率不断上升,预计研究市场在分析期间将出现增长。 然而,与手术相关的并发症可能会阻碍市场增长。

扁桃体腺样体切除产品市场趋势

Coblation 部分预计在预测期内将显着增长

Coblation 是一种受控的精密外科手术,它使用冷射频波和盐水去除腺样体和扁桃体组织。 与传统的腺样体-扁桃体切除术相比,该手术有几个优点。 与传统的腺样体/扁桃体切除术相比,低温消融具有出血少、疼痛少的优点,常用于小儿腺样体/扁桃体切除术的治疗。 多项研究支持该手术的安全性和有效性,尤其是在治疗儿童扁桃体和腺样体方面。 2022 年 3 月发表在 Springer Nature Cureus 上的一项研究发现,消融技术可改善手术期间和手术后的结果。 该技术延迟了术后出血和术后疼痛,并在镇痛给药、饮食和扁桃体组织恢復方面提供了良好的效果。 2020 年 8 月发表在《国际儿科耳鼻喉科杂誌》上的一项研究强调了低温囊内扁桃体切除术治疗阻塞性睡眠呼吸暂停儿童復发性扁桃体炎的安全性和有效性。底部。 2022 年 2 月在 Research Square 发表的一项研究强调了冷却技术在腺样体扁桃体手术中的安全性和有效性,减少了自限性出血并将失血量控制在 0.7%。 该手术还消除了再次进行扁桃体手术的需要。

由于消融技术的良好术后效果及其在小儿腺样体和扁桃体手术中的广泛应用,预计该领域在预测期内将出现显着增长。

北美有望主导门诊康復中心市场

由于扁桃体、腺样体和呼吸道感染的高患病率以及大量手术等因素,预计北美将主导市场。 美国的呼吸道感染负担也很高。 根据国家人口统计系统-2020年死亡数据,慢性下呼吸道疾病(包括哮喘)导致的死亡人数超过152657人。 据美国肺臟协会称,截至 2022 年 11 月,美国将有超过 1250 万成年人患有慢性阻塞性肺病。 该国每年进行大量腺样体和扁桃体手术。 根据国家生物技术信息中心的数据,截至 2022 年 8 月,美国每年将进行超过 50 万例扁桃体切除手术。 该地区的呼吸道感染患病率也很高,这也有助于对扁桃体和腺样体器官进行手术干预。 根据美国疾控中心2023年2月公布的数据,从2022年到2023年2月,美国将报告超过2500万例与流感相关的疾病,超过28万例住院治疗,以及1.7万例因流感死亡。 化脓性链球菌(A 组链球菌)是一种引起扁桃体炎的细菌,每年在美国感染超过 11,000 至 24,000 人,并引起链球菌和脓疱疮等感染。

因此,预计扁桃体、腺样体和呼吸道感染的高患病率将推动北美地区监测市场的增长。

扁桃体和腺样体切除术产品行业概况

扁桃体和腺样体切除术产品市场竞争激烈,因为多家公司在全球和区域开展业务。 竞争格局包括几家拥有全球和区域份额的知名企业,包括美敦力、博士伦公司、奥林巴斯美国、New Med Instruments、medelecsurgical、Smith&Nephew、Advin Health Care、Deluxe Scientific Surgico Pvt Ltd、Integra LifeSciences、EON Meditech。我对公司进行分析。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 调查假设和市场定义

- 本次调查的范围

第二章研究方法论

第 3 章执行摘要

第四章市场动态

- 市场概览

- 市场驱动力

- 扁桃体和腺样体感染增加

- 呼吸道感染增加

- 市场製约因素

- 与手术相关的并发症

- 波特五力

- 新进入者的威胁

- 买方/消费者议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

第 5 章市场细分(基于价值的市场规模)

- 按产品类型

- 扁桃体切除产品

- 镊子

- 线环

- 剪刀

- 腺样体去除剂

- 微型清创器

- 扁桃体切除产品

- 按技术

- 电动手术刀 (ECT)

- 消融

- 和谐女

- 其他技术

- 按地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 意大利

- 西班牙

- 其他欧洲

- 亚太地区

- 中国

- 日本

- 印度

- 澳大利亚

- 韩国

- 其他亚太地区

- 中东和非洲

- 海湾合作委员会

- 南非

- 其他中东和非洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美

第6章竞争格局

- 公司简介

- Medtronic

- BAUSCH & LOMB INCORPORATED.

- Olympus America

- New Med Instruments

- medelecsurgical

- Smith&Nephew

- Advin Health Care

- Deluxe Scientific Surgico Pvt Ltd

- Integra LifeSciences

- EON Meditech

第7章 市场机会与将来动向

The tonsil & adenoid removal products market is expected to register a CAGR of 7.3% over the forecast period.

The COVID-19 pandemic has had a substantial impact on the tonsil & adenoid removal products market initially. The imposition of lockdown and delay of non-urgent surgeries and non-COVID disease treatment decreased the number of tonsil and adenoid procedures in 2020. The high risk of COVID-19 led to prioritizing only critical surgeries and procedures, which restricted various otolaryngology services. For instance, in a study published in the Journal of Head and Neck in February 2022, the number of tonsil surgery decreased by up to 82% in Germany due to the pandemic. According to a study published in the Journal Laryngoscope Investigative Otolaryngology in July 2021, along with the delay and cancellation of elective surgeries during a pandemic. The COVID-19 lockdown decreased the incidence rates of tonsil infections, such as in children, which also led to a decrease in the volume of tympanostomies and tonsil surgeries in children. However, even during the pandemic, severe cases of tonsil surgeries were allowed and performed. For instance, in a study published in the European Annals of Otorhinolaryngology, Head and Neck Diseases in May 2020, tonsillectomy and adenoidectomy were performed without any delay in the case of severe obstructive sleep apnea syndrome in adults. Although, with the lifting of the lockdown and the resumption of the non-COVID, non-urgent, and elective procedures, the market is expected to regain its normal pace as it was in pre-COVID. For instance, in February 2022, the New South Wales Government announced the resumption of non-urgent elective surgeries and increased the overnight stay of the patients by 85% of pre-pandemic activity levels in the private hospitals. Further, in May 2022, the New York State Department of Health (DOH) announced the updated guideline for the resumption of nonurgent procedures and non-essential elective surgeries in hospitals, office-based surgery practices, diagnostic and treatment centers, and ambulatory surgery centers.

The market is expected to grow further at a stable pace with the lifting of the lockdown and the resumption of the non-COVID, non-urgent, and elective procedures globally.

Further, the increasing cases of tonsil and adenoid infections are also boosting the market's growth. According to a study published in the Lancet in June 2022, the pooled incidence rate of the group A Streptococcus throat infection calculated for children was 82.2 episodes per 100 child years for sore throat and 22.1 episodes per 100 child years for Strep A sore throat. A study published in Journal Nature in December 2022 has underlined the risk of the surging case of strep A after the death of over 13 children in the United Kingdom in the month of December 2022, which causes deadly scarlet fever. According to the STAT Pearls in 2021, the condition of adenoid hypertrophy has a prevalence rate of 34.5% in children.

Therefore, owing to the increasing prevalence of tonsil and adenoid infections, the studied market is anticipated to witness growth over the analysis period. However, the complication associated with the surgeries is likely to impede the market growth.

Tonsil and Adenoid Removal Products Market Trends

The Coblation Segment is Expected to Witness Significant Growth Over the Forecast Period

Coblation, also known as controlled ablation, is a controlled and precise surgical procedure for the removal of the adenoid and tonsil tissue by using low-temperature radiofrequency and a saline solution. The technique has several advantages over traditional adenotonsillectomy procedures. The coblation technique is highly adopted for the management of adenoid and tonsil infections in children because of its advantage of lower bleeding and pain, as compared to traditional adenotonsillectomy procedures. Several studies have supported the safety and efficacy of the technique for tonsil and adenoid procedures, especially in children. According to a study published in the Springer Nature Cureus in March 2022, the coblation technique offers improved outcomes during surgery and post-surgery recovery. The technique caused delayed hemorrhage and post-operative pain after the surgery and offered favorable outcomes in the delivery of analgesia, diet, and tonsillar tissue recovery. A study published in the International Journal of Pediatric Otorhinolaryngology in August 2020 highlighted the safety and efficacy of the coblation intracapsular tonsillectomy for recurrent tonsillitis in children with the condition of obstructive sleep apnea. A study published in Research Square in February 2022 highlighted the safety and efficacy of the coblation technique for adenotonsillar surgery, which reduced self-limited bleeding and controlled blood loss by 0.7%. The procedure also eliminated the need for another tonsillar surgery.

With the desirable post-operative outcome of the coblation technique and its wide usage in pediatric adenoid and tonsil procedures, the segment is expected to witness significant growth over the forecast period.

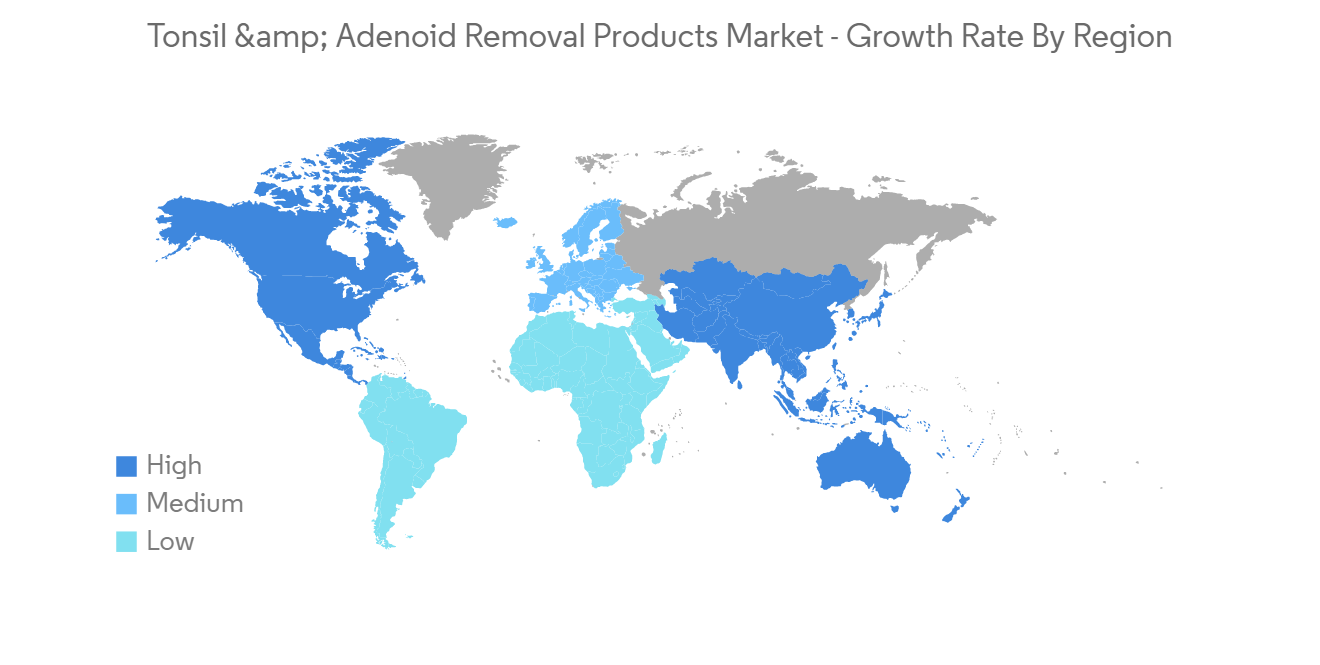

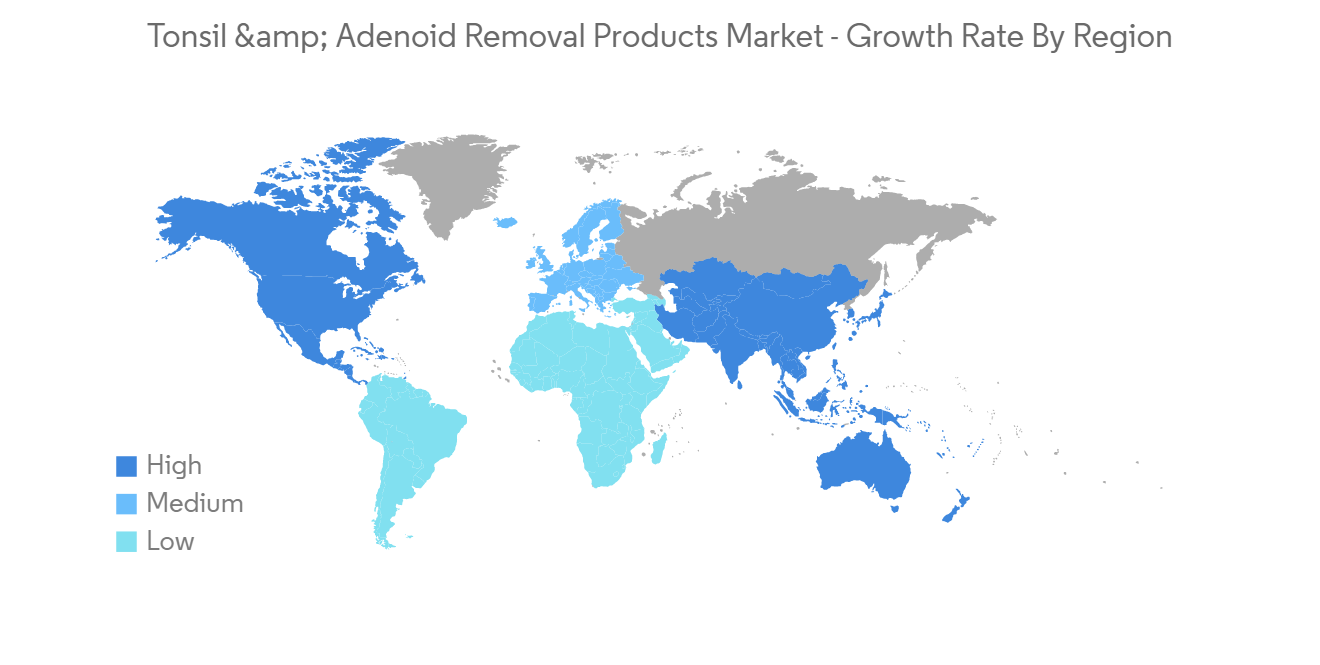

North America is Expected to Dominate the Outpatient Rehabilitation Centers Market

North America is expected to dominate the market owing to factors such as a high prevalence of tonsil, adenoid, and respiratory infections and a high volume of surgical procedures in the region. The United States has a high burden of respiratory infections as well. According to the National Vital Statistics System - Mortality Data in 2020, over 152,657 deaths happened due to chronic lower respiratory diseases (including asthma). According to the American Lung Association, in November 2022, over 12.5 million adults in the United States are living with the condition of chronic obstructive pulmonary disease. The country has a high volume of surgical procedures of adenoid and tonsil procedures performed every year. According to the National Center for Biotechnology Information, in August 2022, over 500,000 procedures of tonsillectomies were performed every year in the United States. The region also has a high prevalence of respiratory infections which also contributes to the surgical interventions of the tonsil and adenoid organs. According to data published by the CDC in February 2023, over 25 million cases of influenza-associated illnesses, over 280,000 hospitalizations, and 17,000 deaths were reported due to influenza in the United States in the year 2022 and till February 2023. The tonsilitis-causing bacterium Streptococcus pyogenes (group A Streptococcus) affects over 11,000-24,000 individuals, with the Group A streptococcal causing infections such as strep throat and impetigo in the United States each year.

Therefore, owing to the high prevalence of tonsil, adenoid, and respiratory infections, it is expected to boost the growth of the studied market in the North America Region.

Tonsil and Adenoid Removal Products Industry Overview

The tonsil & adenoid removal products market is moderately competitive in nature due to the presence of several companies operating globally as well as regionally. The competitive landscape includes an analysis of several international as well as local companies which hold market shares and are well known, including Medtronic, BAUSCH & LOMB INCORPORATED, Olympus America, New Med Instruments, medelecsurgical, Smith&Nephew, Advin Health Care, Deluxe Scientific Surgico Pvt Ltd, Integra LifeSciences, and EON Meditech.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Infecton in Tonsils and Adenoid

- 4.2.2 Increasing number of Respiratory Tract Infection

- 4.3 Market Restraints

- 4.3.1 Complication Associated with the Surgeries

- 4.4 Porter Five Forces

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Product Type

- 5.1.1 Tonsils Removal Products

- 5.1.1.1 Forceps

- 5.1.1.2 Wire loop

- 5.1.1.3 Scissors

- 5.1.2 Adenoid Removal Products

- 5.1.2.1 Microdebrider

- 5.1.1 Tonsils Removal Products

- 5.2 By Technology

- 5.2.1 Electrocautery (ECT)

- 5.2.2 Coblation

- 5.2.3 Harmonic scalpel

- 5.2.4 Other Technologies

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Medtronic

- 6.1.2 BAUSCH & LOMB INCORPORATED.

- 6.1.3 Olympus America

- 6.1.4 New Med Instruments

- 6.1.5 medelecsurgical

- 6.1.6 Smith&Nephew

- 6.1.7 Advin Health Care

- 6.1.8 Deluxe Scientific Surgico Pvt Ltd

- 6.1.9 Integra LifeSciences

- 6.1.10 EON Meditech