|

市场调查报告书

商品编码

1273499

碳化钨市场 - 增长、趋势、COVID-19 影响和预测 (2023-2028)Tungsten Carbide Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

在预测期内,碳化钨市场预计将以每年约 3.5% 的速度温和增长。

COVID-19 疫情对碳化钨市场产生了各种影响。 一方面,来自医疗行业的需求拉动了市场的大幅增长,而另一方面,其他行业也受到了全州停工和严格限制的负面影响。

主要亮点

- 由于全球製造业的发展,对 c 的需求也在增加。 碳化钨废料也是可回收的,作为一种可用于所有应用的高价值合金,对市场产生了积极影响。

- 另一方面,碳化钨的使用带来的毒性限制了市场的扩张。

- 商业领域对自动阀门不断增长的需求可能会支持所研究市场的增长。

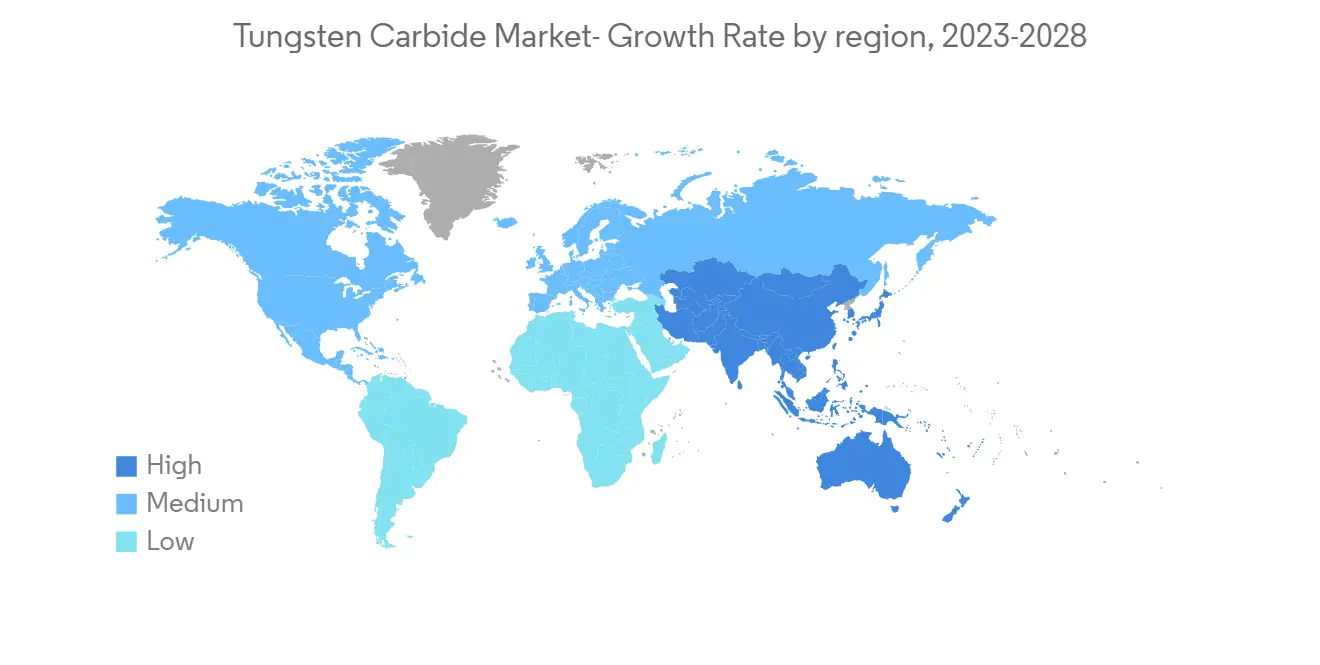

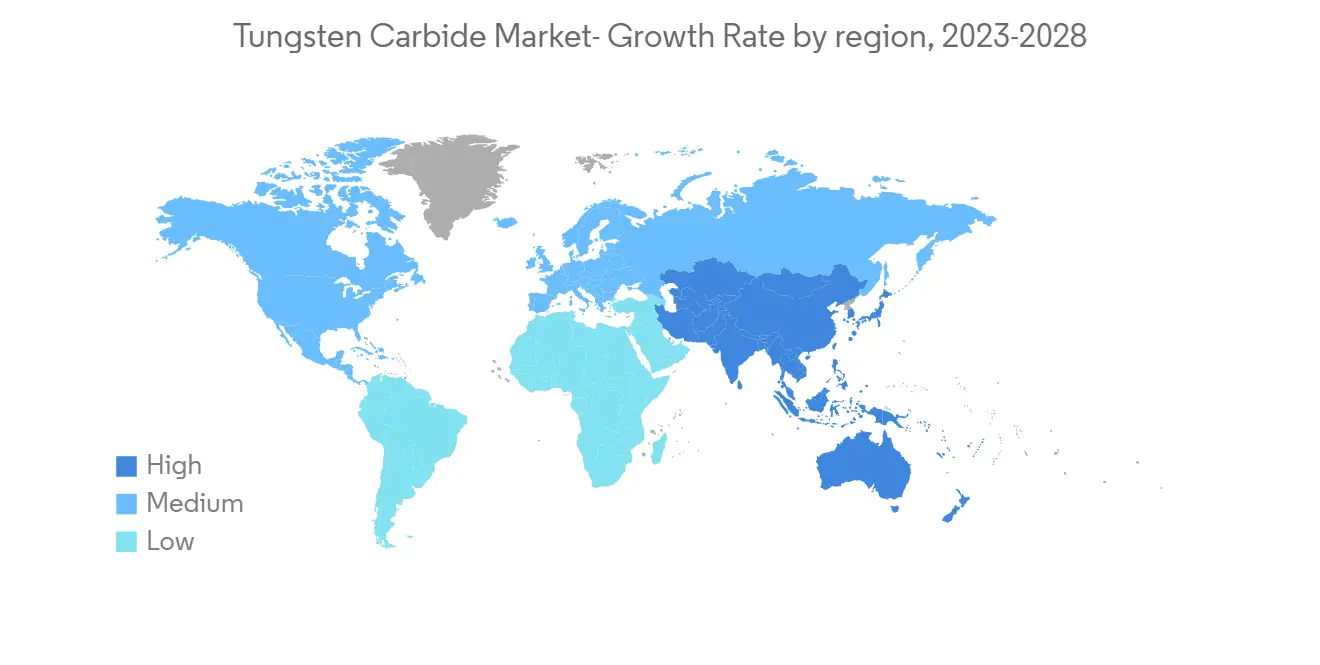

- 预计亚太地区在未来五年内将占据最大份额和最高复合年增长率。

碳化钨市场趋势

硬质合金推动市场增长

- 硬质合金是一种粉末冶金材料,由碳化钨颗粒和富含金属钴的粘合剂组成。

- 硬质合金具有耐磨、耐挠曲、抗拉、抗压、高温耐磨等独特的物理机械性能,我来了。

- 用于製造玻璃瓶、铝罐、塑料管、钢丝、铜丝等的工具都是由硬质合金製成的。 其他应用包括切削金属、加工木材、塑料、复合材料、软陶瓷、无屑成型(热和冷)、采矿和建筑、结构件、耐磨件和军用零件。

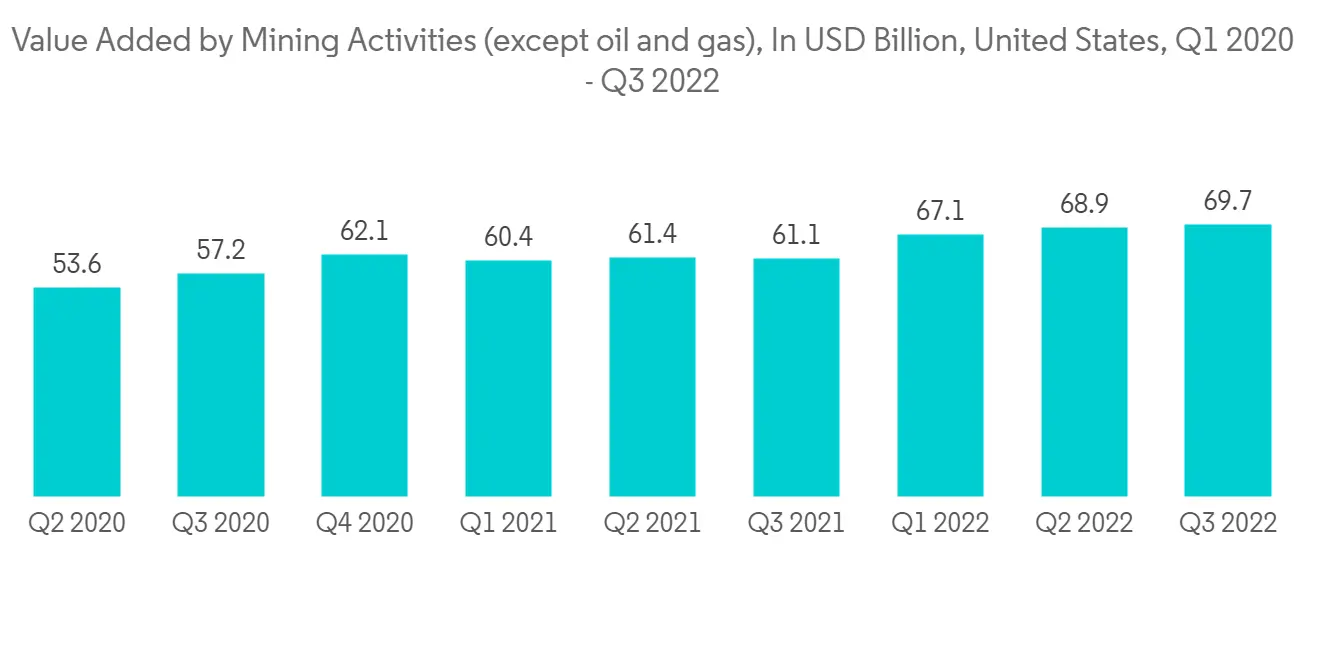

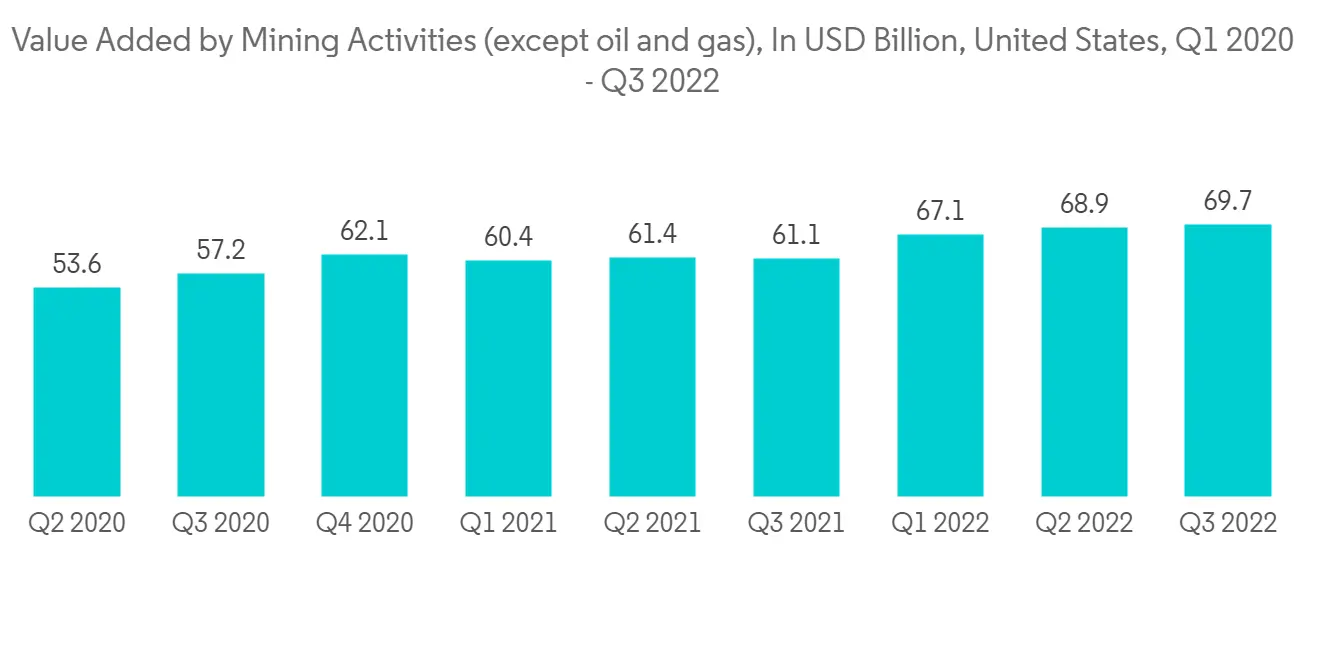

- 根据经济分析局的数据,2022 年前三季度美国的建筑业总增加值约为 2.98 万亿美元,比去年同期增长约 5%。 硬质合金的主要功能是用于工业工具,提供其他材料所没有的特性。

- 此外,采矿业的增加值在 2022 年前三季度强劲增长约 30%,与去年同期相比达到约 1.49 万亿美元。

- 硬质合金市场预计在预测期内会增长,因为硬质合金所拥有的特性使其比其他工具更具优势,从而导致各种应用的需求增加。

亚太地区主导市场

- 亚太地区是全球碳化钨市场中最大的区域市场。 由于中国、印度和日本等国家的汽车、建筑和金属加工行业的需求不断增长,该市场对碳化钨有需求。

- 亚太地区主导着全球市场份额。 中国、印度和日本等国家运输活动的增加增加了该地区碳化钨的使用。

- 中国是最大的汽车生产国和消费国。 中国汽车工业协会报告称,与上年相比,2022年中国汽车销量将增长2.1%左右。 2022 年售出约 2686 万辆汽车,而 2021 年售出 2627 万辆汽车。

- 菲律宾统计局还在其 2022 年年度报告中表示,该国 GDP 同比增长 7.6% 很大程度上得益于汽车和摩托车的维修。 该行业是最重要的贡献者,贡献了约 8.7% 的整体增长。

- 根据日本电子信息技术产业协会 (JEITA) 的估计,截至 2022 年 11 月,日本电子行业的总产值将达到约 10.1 万亿日元(845 亿美元),同比增加了 100.7.%。 与上一年相比,截至 11 月,日本的电子产品出口增长了近 15%。

- 此外,日本的矿业包括规模不大的煤炭和有色金属采矿部门、重要的工业矿物采矿部门以及黑色金属/有色金属和工业矿物初级矿物加工部门。

- 因此,製造活动的增加、汽车行业的增加以及电子行业的兴起都促进了硬质合金和其他应用的增长,预计在预测期内将推动硬质合金市场的增长。

碳化钨行业概况

全球碳化钨市场是分散的。 主要公司包括(排名不分先后)Umicore、CERATIZIT S.A.、Extramet Products, LLC、Kennametal Inc. 和 American Elements。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 调查结果

- 本次调查的假设

- 本次调查的范围

第二章研究方法论

第 3 章执行摘要

第四章市场动态

- 主持人

- 扩大碳化钨在各个最终用户行业中的应用

- 碳化钨的可重现特性

- 约束因素

- 碳化钨毒性

- 其他抑製剂

- 工业价值链分析

- 波特的五力分析

- 供应商的议价能力

- 消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第 5 章市场细分

- 申请

- 硬质合金

- 涂层

- 合金

- 最终用户

- 航空航天与国防

- 汽车

- 采矿和建筑

- 电子产品

- 其他(医疗、运动等)

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 意大利

- 法国

- 其他欧洲

- 世界其他地方

- 南美洲

- 中东和非洲

- 亚太地区

第六章竞争格局

- 併购、合资、合作、合同等。

- 市场份额/排名分析

- 主要公司采用的策略

- 公司简介

- American Elements

- Buffalo Tungsten Inc.

- CERATIZIT S.A.

- China Tungsten

- CY Carbide Mfg. Co., Ltd.

- Extramet Products, LLC.

- Federal Carbide Company

- Guangdong Xianglu Tungsten Co., Ltd.

- H.C. Starck Tungsten GmbH

- Jiangxi Yaosheng Tungsten Co., Ltd.

- Kennametal Inc.

- Sandvik AB

- Sumitomo Electric Industries, Ltd.

- Umicore

第七章市场机会与未来趋势

- 对自动阀门的需求不断扩大

During the forecast period, the market for tungsten carbide is expected to register a moderate rate of about 3.5% per year.

The COVID-19 epidemic had a mixed influence on the tungsten carbide market. On the one hand, demand from the medical sector caused a significant increase in the market, but on the other hand, the market suffered a negative influence from other industries due to statewide lockdowns and stringent limitations.

Key Highlights

- Growth in manufacturing activities across the globe is generating demand for tungsten carbide. Along with it, tungsten carbide scrap can be recycled, making it an extremely valuable alloy for all sorts of applications and thus positively influencing the market.

- On the other hand, toxicity brought on by the use of tungsten carbide restricts market expansion.

- The increasing demand for automatic valves in the business world is probably going to support the growth of the market under study.

- The Asia-Pacific region is expected to have the biggest share of the market and the highest CAGR over the next five years.

Tungsten Carbide Market Trends

Cement Carbide to Drive the Market Growth

- Cemented carbide is a powdered metallurgical material composed of tungsten carbide particles and a binder rich in metallic cobalt.

- Cement carbide is considered the best material choice and is often used because of its unique physical and mechanical properties, such as abrasion resistance, deflection resistance, tensile strength, compressive strength, and high-temperature wear resistance.

- The tools that are used to make glass bottles, aluminum cans, plastic tubes, steel wires, and copper wires are made of cemented carbide.Some of the other uses include metal cutting, machining of wood, plastics, composites, soft ceramics, chipless forming (hot and cold), mining and construction, structural parts, wear parts, and military components.

- According to the Bureau of Economic Analysis, the total value added by the construction industry in the United States in the first three quarters of 2022 was around USD 2,980 billion, which was roughly 5% higher than the previous year for the same period. The primary function of cement carbide is in the tools used in industry to provide properties that no other material can provide.

- The mining industry also saw a major upsurge of approximately 30% in the value added by the industry in the first three quarters of 2022, which was about USD 1,490 billion compared with the previous year for the same period.

- Due to the properties that it possesses, which give it an edge over other tools and thus increase demand from various applications, the market for cement carbide is projected to grow over the forecast period.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific represents the largest regional market for the global tungsten carbide market. There is demand for tungsten carbide in the market as a result of the growing demand for the automotive, construction, and metalworking industries in countries like China, India, and Japan.

- The Asia-Pacific region dominated the global market share. With growing transportation activities in countries such as China, India, and Japan, the usage of tungsten carbide is increasing in the region.

- China is the largest producer and consumer of automotive vehicles. The China Association of Automobile Manufacturers reports that, compared to the prior year, China's automobile sales increased by about 2.1% in 2022. In comparison to the 26.27 million automobiles sold in 2021, around 26.86 million were sold in 2022.

- In its annual report for 2022, the Philippine Statistics Authority also said that the country's 7.6% GDP growth over the previous year was helped a lot by the maintenance of cars and motorbikes. The sector was the most important contributor, providing approximately 8.7% of overall growth.

- The overall production value of the electronics sector in Japan was estimated by the Japan Electronics and Information Technology Industries Association (JEITA) to be around JPY 10.1 trillion (84.5 billion USD) as of November 2022, which is roughly 100.7% of the value from the previous year. When compared to the previous year, Japanese electronics exports increased by nearly 15% up until November.

- Furthermore, the mineral industry in Japan comprises a modest coal and nonferrous metals mining sector, a significant mining sector of industrial minerals, and a primary minerals-processing sector of ferrous and nonferrous metals and industrial minerals.

- Thus, the growing manufacturing activities, the increasing automobile industry, and the rising electronics sector are instrumental in the growth of cemented carbide and other applications, which in turn would boost the market for tungsten carbide during the forecast period.

Tungsten Carbide Industry Overview

The global tungsten carbide market is fragmented. The major companies include (not in any particular order) Umicore, CERATIZIT S.A., Extramet Products, LLC, Kennametal Inc., and American Elements, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Applications of Tungsten Carbide in Various End-user Industries

- 4.1.2 Recylable Property of Tungsten carbide

- 4.2 Restraints

- 4.2.1 Toxicity of Tungsten carbide

- 4.2.2 Other Restraints

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Application

- 5.1.1 Cemented carbide

- 5.1.2 Coatings

- 5.1.3 Alloys

- 5.2 End-user

- 5.2.1 Aerospace & Defense

- 5.2.2 Automotive

- 5.2.3 Mining & Construction

- 5.2.4 Electronics

- 5.2.5 Others (Medical, Sports, etc.)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle East & Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share/Ranking Analysis**

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 American Elements

- 6.4.2 Buffalo Tungsten Inc.

- 6.4.3 CERATIZIT S.A.

- 6.4.4 China Tungsten

- 6.4.5 CY Carbide Mfg. Co., Ltd.

- 6.4.6 Extramet Products, LLC.

- 6.4.7 Federal Carbide Company

- 6.4.8 Guangdong Xianglu Tungsten Co., Ltd.

- 6.4.9 H.C. Starck Tungsten GmbH

- 6.4.10 Jiangxi Yaosheng Tungsten Co., Ltd.

- 6.4.11 Kennametal Inc.

- 6.4.12 Sandvik AB

- 6.4.13 Sumitomo Electric Industries, Ltd.

- 6.4.14 Umicore

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increase in Demand for Automatic Valves