|

市场调查报告书

商品编码

1273506

兽医牙科设备市场——增长、趋势和预测 (2023-2028)Veterinary Dental Equipment Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

在预测期内,兽医牙科设备市场的复合年增长率预计为 7.7%。

COVID-19 对兽医牙科设备市场产生了重大影响,因为兽医就诊次数减少,兽医对农场和收容所的牙科就诊次数也最少。 例如,根据美国兽医协会 2021 年 9 月发布的一份报告,由于 COVID-19,兽医诊所正在经历 18 个多月的艰难时期,许多兽医正在经历它带来的现实生活后果。改变。 兽医院作为必需品运营,在疫情爆发的最初几个月只接诊急诊病例。 这对兽医牙科设备产生了重大影响。 现在,随着宠物和动物的管制放鬆和牙科疾病的增加,市场有望增长。

如上所述,兽医牙周病 (PD) 患病率的上升是市场的主要推动力。 牙龈疾病通常从一颗牙齿开始并从那里发展。 在第一阶段牙周病中,狗会出现牙龈炎的症状。 在第 2 阶段,近 25% 的牙齿已经与牙龈分离,在第 3 和第 4 阶段,牙龈组织可能会退缩,露出牙根。 根据 2022 年 12 月发表在 MDPI 杂誌上的一篇文章,由于犬类帕金森病的流行及其与潜在局部和全身影响的关联,需要更好地管理宠物动物的这种情况。强调资助的重要性新的牙科手术、预防措施和医学疗法

此外,对伴侣动物牙科疾病的研究越来越多,也增加了对兽医牙科设备的需求。 例如,在 2021 年 1 月发表在 Plos One 上的一篇文章中,有一项研究分析了九种细菌组合与 PD 组之间的进展关联。 T. denticola 显示与 PD2 和 PD3 组之间的进展密切相关。 P. intermedia 还显示出与 PD2 和 PD4 之间的进展密切相关。

此外,在预测期内,全球兽医牙科设备或耗材的产品发布有力地推动了市场增长。 例如,2022 年 8 月,关节保健品品牌 Yumove 推出了 Dental Care Sticks。 当您的爱犬咀嚼时,软质中心会释放出来,针对导致口臭和牙菌斑的细菌。

虽然预计市场表现良好,但动物设备的高成本可能会限制市场增长。

兽医牙科设备的市场趋势

在预测期内,兽医牙科X光设备细分市场预计将占据较大的市场份额

兽医牙科 X 光片(伦琴)是动物牙齿的图像,兽医牙医使用它来评估动物的口腔健康。 这些 X 射线产生低辐射水平的内齿和牙龈图像,帮助牙医识别动物口腔保健等问题。 由于动物牙齿疾病增加、研发增加以及动物保健投资增加等因素,预计兽医牙科 X 射线领域在预测期内将见证市场增长。

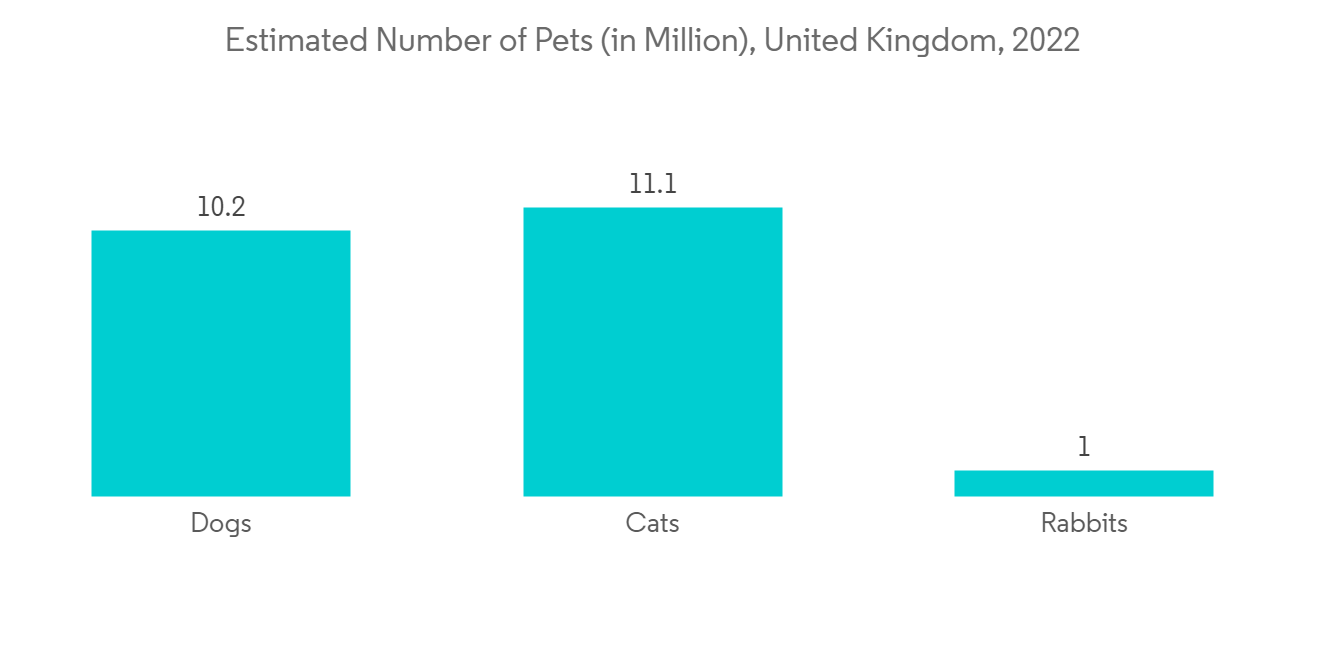

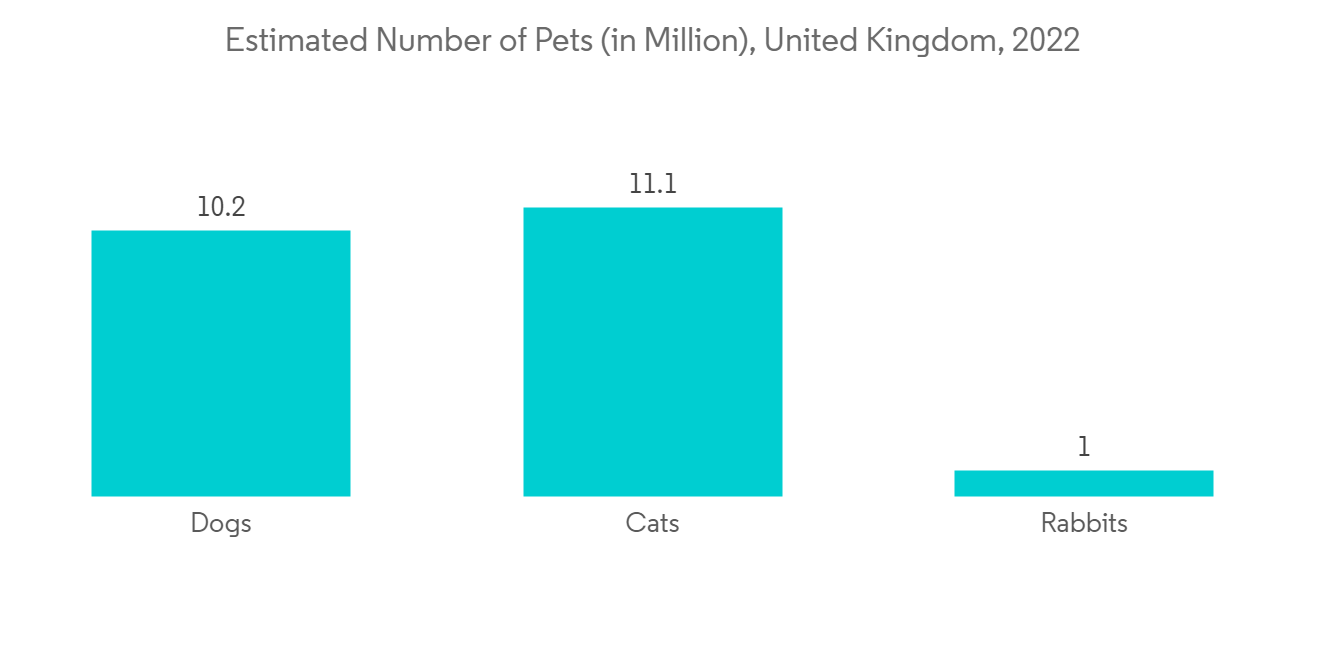

例如,根据宠物食品製造商协会 (PFMA) 的数据,自 COVID-19 疫情开始以来,2021 年英国有 320 万户家庭养了宠物。 根据 PFMA 的 Pet Population 2022 数据,预计 2022 年宠物数量为 3490 万隻,其中狗为 1300 万隻,猫为 1200 万隻。 宠物拥有量的增加预计将增加医疗保健支出和兽医牙科通道的利用率,预计这将导致预测期内的市场增长。

此外,预计在预测期内,兽医牙科 X 射线产品的更多发布、战略收购和合作将有助于市场增长。 例如,2022 年 12 月,Vets4Pets Bristol 购买了一台名为 Gnasher 的新型牙科 X 光机。 它使用数字图像来准确检测牙科疾病,使诊所能够加强其提供的牙科服务。

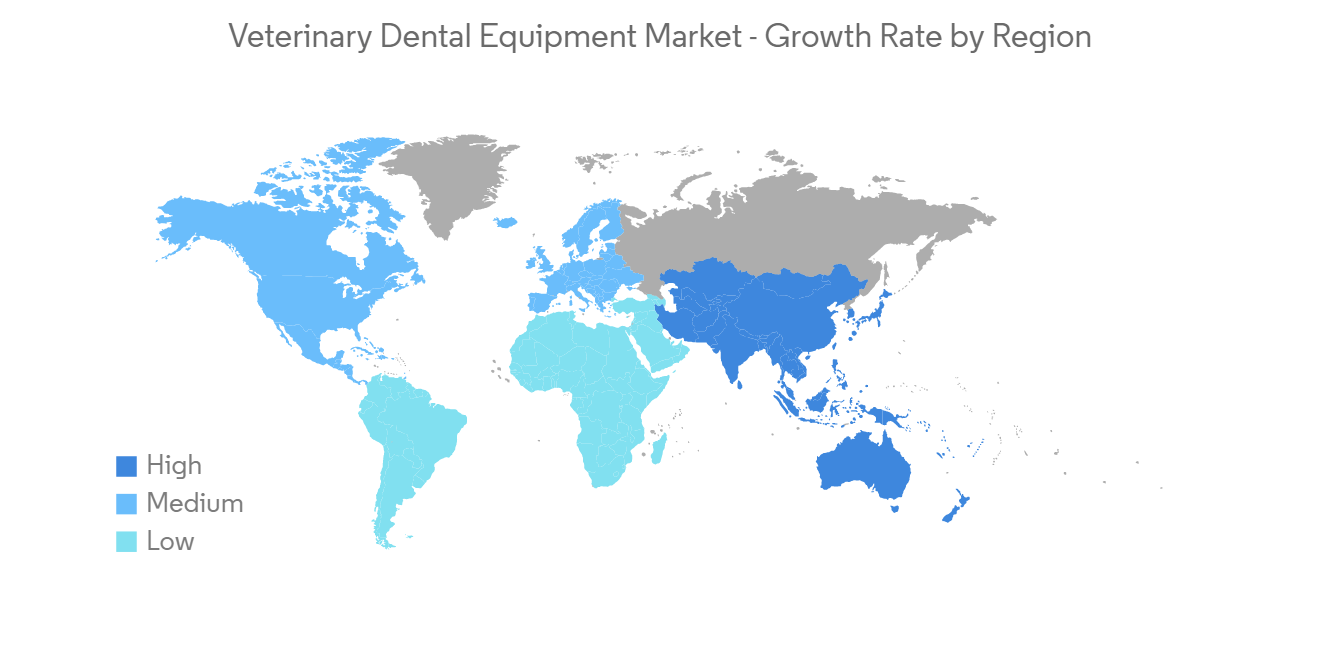

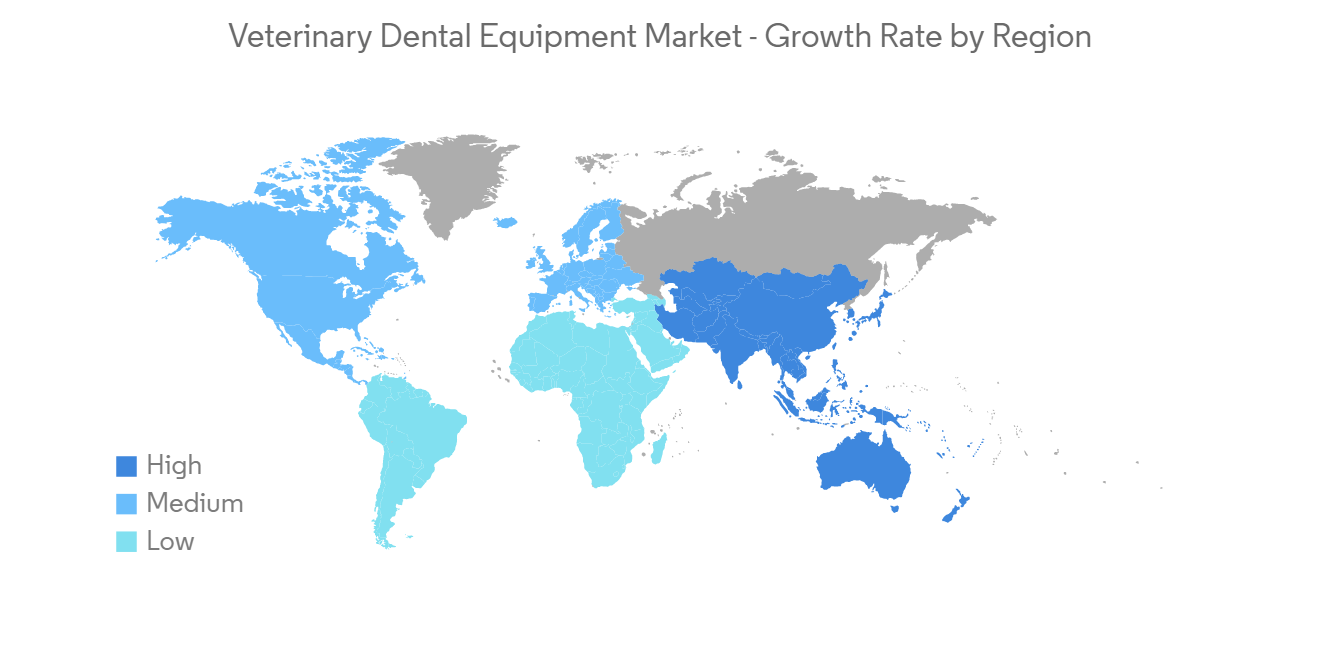

预计在预测期内北美将占据很大的市场份额

由于宠物牙周病患病率上升、伴侣动物医疗保健成本增加以及该地区兽医牙科服务的可用性高,北美在兽医牙科设备市场占有很大的市场份额。预计。 例如,根据美国宠物用品协会(APPA)进行的2021-2022年全国宠物拥有量调查,70%的美国家庭拥有宠物,相当于9050万户家庭。 2019 年至 2020 年间,约有 6900 万美国家庭养狗,4530 万家庭养猫。 随着宠物数量的增加,人们可能会更加关注健康问题,包括口腔护理。 这可能会在预测期内推动市场增长。

此外,根据北美宠物健康保险协会 (NAPHIA) 2022 年的报告,美国的宠物保险总覆盖率将从 2020 年的 23.2% 增加到 2021 年的 28.3%。 考虑到投保宠物的数量不断增加,预计宠物主人将关注宠物的舒适度,例如适当的药物治疗和牙科疾病诊断,这将推动市场增长。 此外,2022 年 1 月,人类动物关係研究所 (HABRI) 与硕腾合作,委託对包括墨西哥在内的 9 个国家的 18,145 名狗和猫主人以及 1,357 名小动物兽医进行了研究。 进行这项研究是为了更好地了解世界各地的宠物主人和兽医如何看待和影响人与动物之间的关係。 根据一项调查,全球 85% 的宠物主人表示他们会为动物的健康花钱(如果他们需要兽医护理)。 因此,预计宠物主人对宠物保健的兴趣日益浓厚,这将导致他们也考虑口腔健康,这有望在预测期内推动市场增长。

此外,研究区域主要参与者的产品发布、合作伙伴关係和战略收购预计将推动市场增长。 例如,2021 年 4 月,Flight Dental Systems 与兽医供应公司 Eikemeier Veterinary Technology for Life 合作进入兽医市场。

兽医牙科设备行业概况

兽医牙科设备市场竞争适中,由几家大型企业组成。 就市场份额而言,一些主要参与者主导着市场。 主要市场参与者包括 Dentalaire Products International、iM3、Dispomed、Midmark Corporation、MAI Animal Health、Integra LifeSciences Corporation、Acteon Group、TECHNIK Veterinary Ltd 和 Cislak manufacturing。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 调查假设和市场定义

- 本次调查的范围

第二章研究方法论

第 3 章执行摘要

第四章市场动态

- 市场概览

- 市场驱动力

- 宠物牙周病患病率增加

- 兽医牙科设备技术进步

- 市场製约因素

- 兽医牙科器械成本高

- 波特的五力分析

- 新进入者的威胁

- 买方/消费者议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

第 5 章市场细分(基于价值的市场规模)

- 按设备类型

- 牙科诊所

- 牙科 X 光设备

- 牙科电动装置

- 牙科激光

- 牙科电外科仪器

- 其他设备

- 按消耗品

- 牙科材料

- Prophy 产品

- 其他消耗品

- 按地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 意大利

- 西班牙

- 其他欧洲

- 亚太地区

- 中国

- 日本

- 印度

- 澳大利亚

- 韩国

- 其他亚太地区

- 中东和非洲

- 海湾合作委员会

- 南非

- 其他中东和非洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美

第6章竞争格局

- 公司简介

- Dentalaire Products International

- iM3

- Dispomed

- Midmark Corporation

- MAI Animal Health

- EICKEMEYER

- Integra LifeSciences Corporation

- Acteon Group

- TECHNIK Ltd

- Cislak manufacturing

第7章 市场机会与将来动向

The veterinary dental equipment market is expected to register a CAGR of 7.7% during the forecast period.

COVID-19 had a significant impact on the veterinary dental equipment market owing to the reduced veterinary consultation and minimal dental visits by the vet to the farms and shelters. For instance, as per a report published by American Veterinary Medical Association in September 2021, veterinarian practices experienced a difficult 18+ months as a result of COVID-19, and many veterinarians adjusted to the real changes it brought about. Veterinary clinics saw only urgent cases in the early months of the epidemic as they ran as necessary enterprises. This significantly impacted the veterinary dental equipment. Now that restrictions have been lifted, and there is an increase in dental diseases in pets and animals, the market is expected to grow.

As mentioned above, the rising prevalence of veterinary periodontal diseases (PD) is a major driver of the market. Periodontal disease usually begins around one tooth and progresses from there. In stage 1 of periodontal disease, dogs show symptoms of gingivitis. In stage 2, nearly 25 percent of the teeth separate from the gums, and in the later stages 3 and 4 the gum tissue recedes, and the roots of the teeth may be exposed. As per an article published in December 2022 in the MDPI journal, the significant prevalence of PD in dogs and its link to potential local and systemic implications highlight the importance of funding new dental procedures, preventative measures, and medical therapies to better manage this condition in pet animals.

Furthermore, the increase in dental disease studies in pet animals raises the demand and need for veterinary dental equipment. For instance, as per the article published in January 2021 in the Plos One journal, a study analyzed the association between a combination of nine bacteria and the progression between the PD groups. T. denticola showed a strong association with progression between PD2 and PD3 groups. P. intermedia also showed a reliable association with progression between PD2 and PD4.

Additionally, veterinary dental equipment or consumables product launches across the globe are highly supporting the growth of the market over the forecast period. For instance, in August 2022, Yumove, the joint supplement brand, launched Dental Care Sticks. As the dog chews, a soft center is released, which targets the bacteria which cause bad breath and plaque.

While the market is believed to perform well, the high cost of veterinary equipment is likely to restrain the market growth.

Veterinary Dental Equipment Market Trends

The Veterinary Dental X-ray Systems Segment is Expected to Hold a Significant Market Share Over the Forecast Period

Veterinary dental X-rays (radiographs) are images of animal teeth that a veterinary dentist uses to evaluate the oral health of the animal. These x-rays are used with low levels of radiation to capture images of the interior teeth and gums, which help the dentist identify problems and other aspects of animal oral healthcare. The veterinary dental X-rays segment is expected to witness growth in the market over the forecast period owing to the factors such as an increase in dental diseases in animals, a rise in research and development, and an increase in investment in the healthcare of animals.

For instance, as per the Pet Food Manufacturer's Association (PFMA), in 2021, 3.2 million households in the United Kingdom acquired a pet since the start of the COVID-19 pandemic. And as per PFMA Pet Population 2022 data, the estimated number of pets in 2022 was likely to be 34.9 million, among which 13 million were dogs, and 12 million were cats. This rise in the adoption of pets is expected to increase healthcare expenditure and veterinary consultation, which utilizes veterinary dental rays, leading to market growth over the forecast period.

Moreover, an increase in veterinary dental X-ray product launches, strategic acquisitions, and collaboration is expected to contribute to the market growth over the forecast period. For instance, in December 2022, Vets4Pets Bristol acquired a new dental X-ray machine named Gnasher. It uses digital imaging to accurately detect dental diseases, enabling the practice to enhance its dental service offering.

North America is Expected to Hold a Significant Share in the Market in the Forecast Period

North America is expected to hold a significant market share in the veterinary dental equipment market due to a rise in the prevalence of periodontal disease in pets, rising companion animal healthcare expenditure, and the high availability of veterinary dental services in this region. For instance, according to the 2021-2022 National Pet Owners Survey conducted by the American Pet Products Association (APPA), 70% of United States households owned a pet, which equates to 90.5 million homes. In addition, during 2019-20, around 69 million United States households owned a dog, and 45.3 million families owned a cat. As the number of pets increases, people are likely to be more focused on their health matters, including oral care. This can potentially increase the market growth over the forecast period.

Furthermore, as per the North American Pet Health Insurance Association (NAPHIA) 2022 report, the percentage of total insured pets in the United States increased from 23.2% in 2020 to 28.3% in 2021. Considering the increase in insured pets, pet owners are anticipated to focus on the comfort of pets by providing proper medications and dental disease diagnosis, thereby boosting the market growth. Moreover, in January 2022, the Human Animal Bond Research Institute (HABRI) in partnership with Zoetis commissioned a survey of 18,145 dog and cat owners and 1,357 small animal veterinarians from nine countries, including Mexico. The survey was commissioned to gain a deeper understanding of how the human-animal bond was perceived and impacts behavior among pet owners and veterinarians worldwide. According to the survey, 85% of pet owners worldwide said they would spend money on their animal's health if it required extensive veterinarian care. Hence, due to the increase in concern shown by pet owners in the case of pet healthcare, they are likely to consider their oral health as well, which is expected to boost the market growth over the forecast period.

Additionally, product launches, collaborations, and strategic acquisitions by key players in the studied region are expected to advance market growth. For instance, in April 2021, Flight Dental Systems entered the veterinary market through a partnership with a veterinarian supply company, Eickemeyer Veterinary Technology for Life.

Veterinary Dental Equipment Industry Overview

The veterinary dental equipment market is moderately competitive and consists of several major players. In terms of market share, a few major players dominate the market. Some of the leading market players include Dentalaire Products International, iM3, Dispomed, Midmark Corporation, MAI Animal Health, Integra LifeSciences Corporation, Acteon Group, TECHNIK Veterinary Ltd, and Cislak manufacturing.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Prevalence of Periodontal Disease in Pets

- 4.2.2 Technological Advancements in Veterinary Dental Equipments

- 4.3 Market Restraints

- 4.3.1 High Cost of Veterinary Dental Equipments

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD Million)

- 5.1 By Equipment Type

- 5.1.1 Dental Stations

- 5.1.2 Dental X-Ray Systems

- 5.1.3 Dental Powered Units

- 5.1.4 Dental Lasers

- 5.1.5 Dental Electrosurgical Units

- 5.1.6 Other Equipment Types

- 5.2 By Consumables

- 5.2.1 Dental Supplies

- 5.2.2 Prophy Products

- 5.2.3 Other Consumables

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 Middle East and Africa

- 5.3.4.1 GCC

- 5.3.4.2 South Africa

- 5.3.4.3 Rest of Middle East and Africa

- 5.3.5 South America

- 5.3.5.1 Brazil

- 5.3.5.2 Argentina

- 5.3.5.3 Rest of South America

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Dentalaire Products International

- 6.1.2 iM3

- 6.1.3 Dispomed

- 6.1.4 Midmark Corporation

- 6.1.5 MAI Animal Health

- 6.1.6 EICKEMEYER

- 6.1.7 Integra LifeSciences Corporation

- 6.1.8 Acteon Group

- 6.1.9 TECHNIK Ltd

- 6.1.10 Cislak manufacturing