|

市场调查报告书

商品编码

1273508

动物传染病诊断市场——增长、趋势、COVID-19 的影响和预测 (2023-2028)Veterinary Infectious Disease Diagnostics Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

在预测期内,兽医传染病诊断市场预计将以 7.5% 的复合年增长率增长。

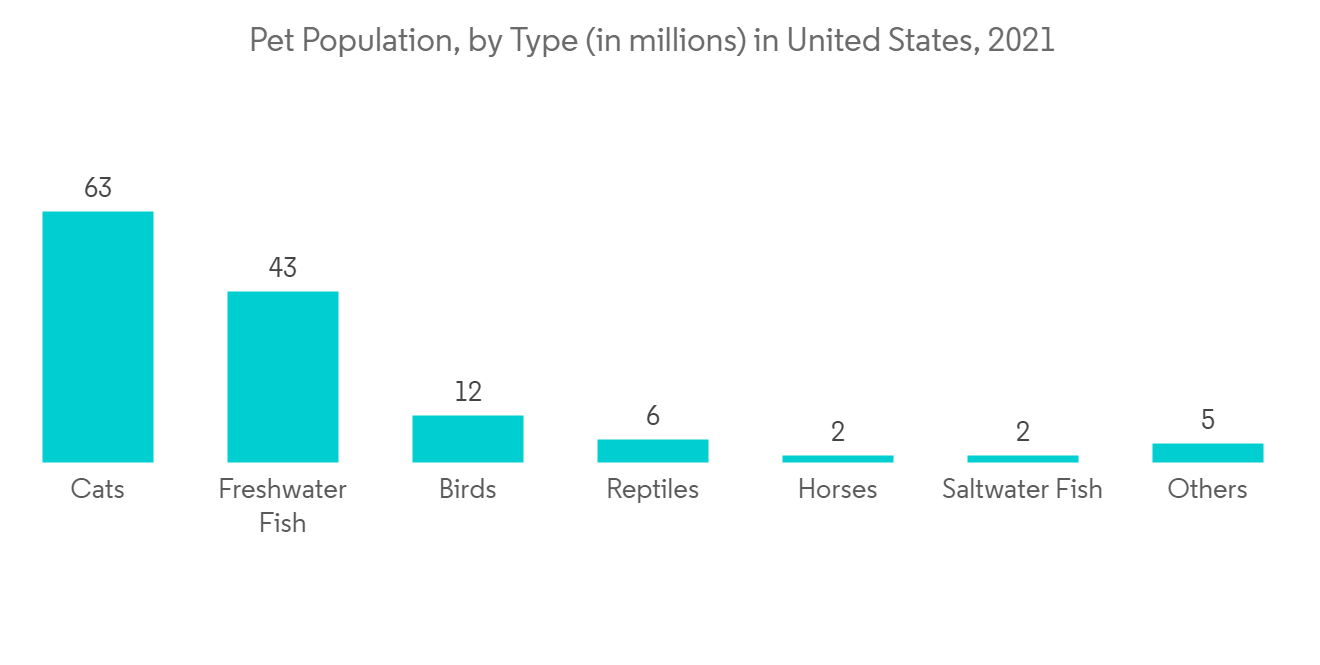

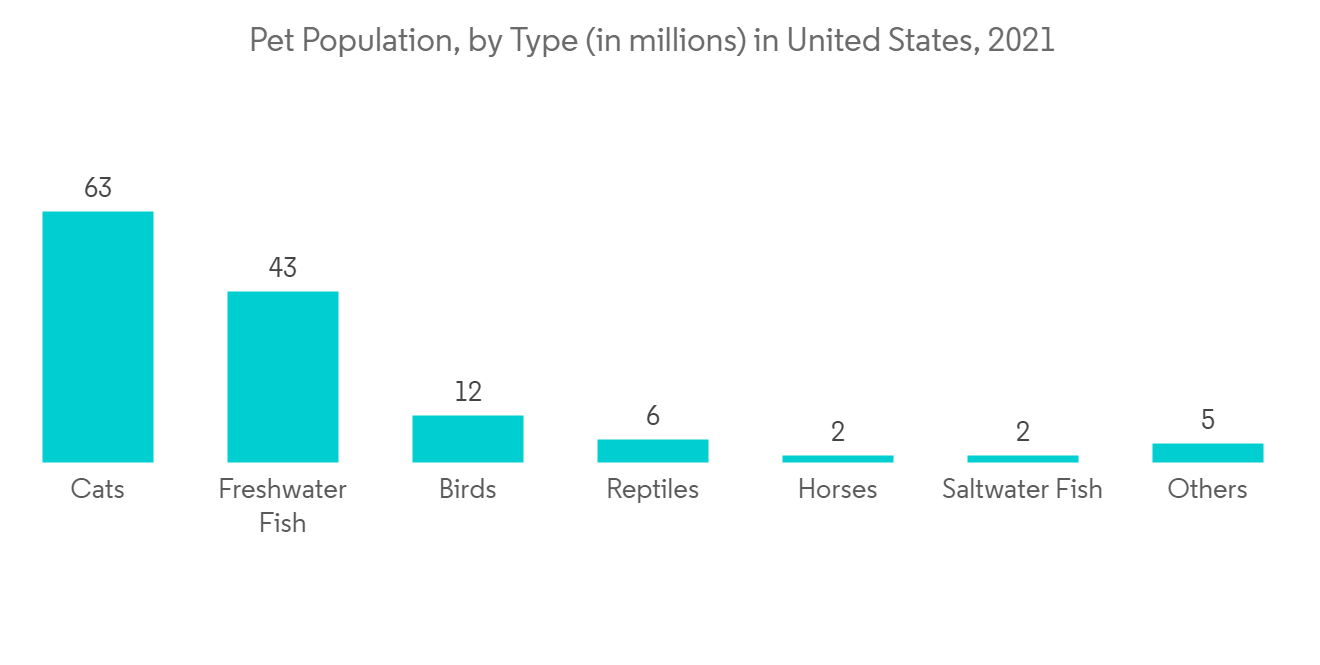

在 COVID-19 大流行期间,兽医传染病诊断市场受到了一定程度的影响,因为大多数国家和州都将宠物护理/动物护理视为一项基本服务。 因此,在大流行期间增长并未明显放缓。 大多数国家/地区将兽医医院视为必不可少的业务,这使它们能够在与大流行相关的限制和关闭的情况下继续提供服务。 然而,在大流行的头几个月,一些兽医医院和诊所发现许多关键地区的宠物护理合规性有所下降。 但随着封锁解除,兽医服务在一定程度上恢復了。 例如,AmerisourceBergen Corporation 2020 报告称,自 2020 年 12 月以来,许多动物医院服务已显示出显着改善的迹象。 此外,大流行导致宠物收养激增,例如,保险研究委员会 2020 年 10 月的一份报告称,在 COVID-19 大流行期间,近三分之一的美国人 (30%) 失去了一隻宠物。收养了一个孩子. 2021 年 3 月,根据美国宠物用品协会的数据,美国约有 67% 的家庭拥有宠物,代表约 8490 万户家庭。 宠物拥有量的增加预计将很快增加对动物传染病诊断的采购和需求。

推动市场增长的某些因素包括先进动物诊断设备的日益普及、宠物保险需求的增加以及伴侣动物数量的增加。 北美宠物健康保险协会 (NAPHIA) 表示,2020 年,美国的宠物健康保险显示总保费为 19.9 亿美元。 从 2016 年到 2020 年,该市场的复合年增长率约为 24.2%。 2020年12月,投保宠物总数达到340万隻。

根据 NAPHIA 的数据,北美大约有 20 家宠物保险公司。 随着宠物保险的增加,主人越来越倾向于带他们的宠物进行诊断测试。 同样,人畜共患疾病的兴起也是增加诊断检测以防止疾病传播的重要原因。 根据世界自然基金会 2020 年 8 月发表的一篇研究论文,60.3% 的新发疾病是人畜共患的。

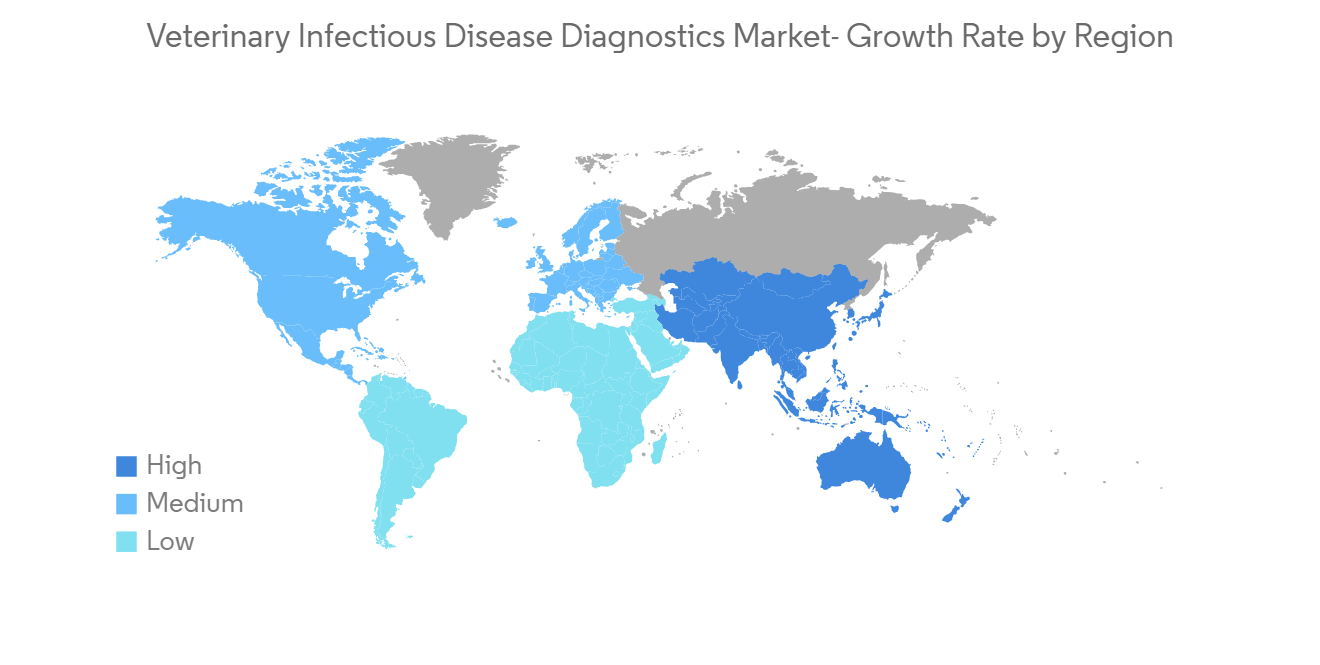

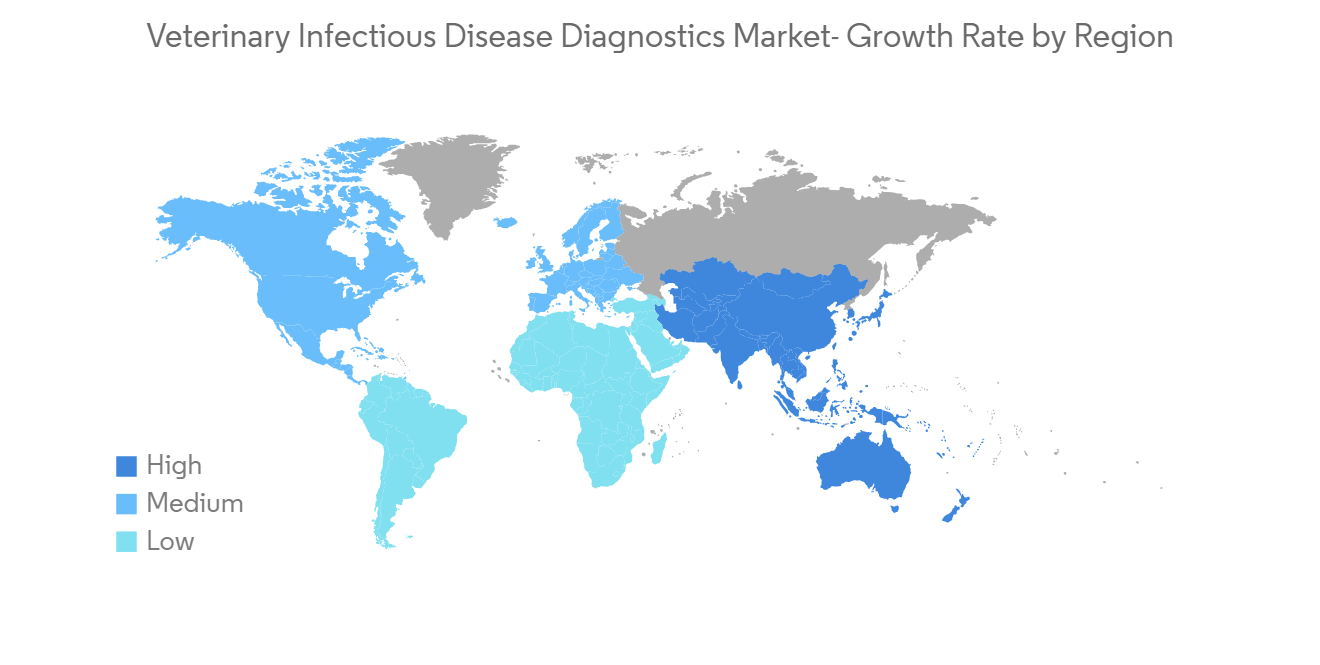

此外,大多数传染病起源于野生动物,然后传播给伴侣动物和人类。 这是亚太地区面临的主要挑战之一,因为大多数人畜共患疾病都起源于亚太地区。 一个典型的例子是 COVID-19。 在欧洲,许多国家製定了支持伴侣动物的有利立法。 着名的例子包括 2014 年法国国民议会委员会法、2012 年捷克共和国民法典、2006 年英国动物福利法、2004 年奥地利宪法、2002 年德国宪法和 2002 年 10 月 4 日的瑞士法案。 这些法律导致了对动物诊断的有利方法,推动了它们数量的积极增长。 因此,家庭和农场中伴侣动物的增加有望在预测期内为市场带来正增长。

因此,由于上述因素,该市场有望在分析期内实现增长。 然而,宠物护理的高成本可能会阻碍市场增长。

兽医传染病诊断市场趋势

免疫诊断领域预计在预测期内增长

该细分市场的主导地位主要是由于免疫测定在传染病检测中的使用越来越多、新型检测的开发、自动化趋势的增加、健康和健身意识的提高以及与设备相关的并发症的减少等因素造成的,这些因素包括:作为

例如,根据 2021 年 5 月版临床微生物学手册,免疫测定可适用于检测实验室中跨学科的分析物,并且通常比其他诊断方法更具成本效益。 在临床微生物学实验室中,免疫测定通常用作确认测试。 因此,免疫测定结果通常不作为诊断的唯一依据。 但对于某些传染病如莱姆病、隐球菌性脑膜炎、梅毒等,免疫法检测抗体和抗原是确诊感染的主要手段。 免疫测定法因其易用性、快速性和通常的高特异性而越来越多地用于即时检测。

以前,兽医感染/病原体的诊断已使用多种技术进行,包括□联免疫吸附测定 (ELISA)、中和、琼脂凝胶免疫扩散和补体固定,使用抗体和它依赖于检测病原体的方法由文化。 然而,近年来,改进的基于免疫测定的诊断测试已经发展到以更高的准确性和更少的时间和精力取代传统方法。 例如,2021 年 4 月,为分子和免疫兽医测试开发完整解决方案的全球领导者 INDICAL 从勃林格殷格翰手中收购了 Svanova 产品组合。 这通过作为目标抗原的特定蛋白质的生产得到增强,并且通过新的和先进的生物技术技术(例如基因克隆和表达载体的使用)使之成为可能。 由于这些因素,预计市场将在预测期内增长。

此外,研究合作的增加、实验室的增加以及製药和生物技术公司对研发 (R&D) 的直接和间接投资增加等因素增加了产品需求,推动了未来几年的市场增长。支持增长。

北美有望主导脱毛器市场

由于宠物保险的增加、伴侣动物的增加以及该地区可用的先进诊断设备,预计北美将在全球兽医传染病诊断市场中占据重要的市场份额。 根据美国宠物用品协会 2020-2021 年的调查,大约有 6520 万户家庭养狗,4330 万户养猫,580 万户养鸟,530 万户养小动物,180 万户养马。我来了。 由于人与动物的相互作用增加,人畜共患疾病迅速传播,因此数量的增加将需要更多的诊断测试。 根据美国宠物用品协会 2020-2021 年的研究,美国家养犬的平均年基本费用为外科兽医 429 美元和定期检查 213 美元。 这使 2020-2021 年美国宠物行业总支出达到约 823.1 亿美元。 支出的增加表明宠物主人愿意对他们的宠物进行诊断测试。 由于这些因素,预计未来几年市场将出现显着增长。

此外,不断增加的研发活动和有利的医疗保健基础设施的存在极大地促进了整个区域市场的增长。 例如,2021 年 9 月,国际传染病学会(联合国的一部分)在传染病的不同领域提供各种资助。 大部分资金用于动物的传染病诊断。 同样,美国通过 2010 年 10 月与动物疾病诊断研究培训中心(乌克兰)签署的一项长期协议,资助该地区的临床研究(特别是动物健康研究、诊断和培训)。 由于这些因素,预计市场将在预测期内进入增长期。

兽医传染病诊断行业概况

兽医传染病诊断市场适度整合,少数主要参与者竞争激烈。 就市场份额而言,目前少数大公司占据市场主导地位。 目前主导市场的公司包括 Biomerieux S.A.、Heska Corporation、IDEXX Laboratories, Inc.、IDVet、Indical Bioscience、Neogen Corporation、Randox Laboratories, Ltd.、Thermo Fisher Scientific Inc、Virbac 和 Zoetis, Inc.。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 调查先决条件

- 本次调查的范围

第二章研究方法论

第 3 章执行摘要

第四章市场动态

- 市场概览

- 市场驱动因素

- 先进的兽医诊断设备

- 对宠物保险的需求不断增长

- 伴侣动物数量增加

- 市场製约因素

- 宠物护理费用高

- 波特的五力分析

- 新进入者的威胁

- 买方/消费者议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

第 5 章市场细分

- 按技术

- 免疫诊断学

- 分子诊断

- 其他

- 动物类型

- 伴侣动物

- 食用动物

- 按传染病类型

- 细菌感染

- 病毒感染

- 寄生虫感染

- 其他

- 最终用户

- 参考实验室

- 动物实验室/诊所

- 护理点/内部测试

- 其他

- 按地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 意大利

- 西班牙

- 其他欧洲

- 亚太地区

- 中国

- 日本

- 印度

- 澳大利亚

- 韩国

- 其他亚太地区

- 中东和非洲

- 海湾合作委员会

- 南非

- 其他中东和非洲地区

- 南美洲

- 乙拉吉尔

- 阿根廷

- 其他南美洲

- 北美

第六章竞争格局

- 公司简介

- Biomerieux S.A.

- Heska Corporation

- IDEXX Laboratories, Inc.

- IDVet

- Indical Bioscience

- Neogen Corporation

- Randox Laboratories, Ltd.

- Thermo Fisher Scientific Inc.

- Virbac

- Zoetis, Inc.

第七章市场机会与未来趋势

The Veterinary Infectious Disease Diagnostics Market is projected to register a CAGR of 7.5% during the forecast period.

During the COVID-19 pandemic, the veterinary infectious disease diagnostics market was moderately affected, as most countries and their states treat pet care/ animal care as an essential service. Therefore, the growth wasn't significantly declined during the pandemic. Since most countries treat veterinary practices as essential businesses, this allows the services to remain open even during pandemic-related restrictions and shutdowns. Still, some veterinary hospitals and clinics experienced a drop in pet care compliance in many key areas during the first few months of the pandemic. However, veterinary services resumed to some extent as the lockdown lifted. For instance, AmerisourceBergen Corporation 2020 reported that since December 2020, many veterinary services had shown signs of significant improvement. Moreover, the pandemic has seen a surge in pet adoption; for instance, according to the Insurance Research Council's October 2020 report, during the COVID-19 pandemic, nearly one in three (30 percent) of Americans adopted a pet. In March 2021, According to American Pet Products Association, around 67% of United States households own a pet, which is about 84.9 million homes. This increase in pet adoption is expected to increase the procurement and demand for veterinary infectious disease diagnoses soon.

Certain factors that are driving the market growth include increasing advanced diagnostic devices for animals, growing demand for pet insurance, and an increasing companion animal population. The North American Pet Health Insurance Association (NAPHIA) states that in 2020, pet health insurance for the United States showed gross written premiums of USD 1.99 billion. The market has been growing at an average annual growth rate of around 24.2% from 2016 to 2020. In December 2020, the total number of pets insured reached 3.4 million.

According to NAPHIA, around 20 pet insurance companies are in the North American region. With the increase in pet insurance, owners are more likely to take their pets for diagnostic testing. Similarly, the rise in zoonotic diseases is also one of the key reasons to increase diagnostic tests as it prevents diseases from spreading. According to the world wildlife fund research paper published in August 2020, 60.3% of all new emerging diseases are zoonoses.

Additionally, most infectious diseases originate in wildlife and are further spread to the companion animals and humans. This is one of the key issues in the Asia Pacific region, as most of the zoonotic diseases originate from the region. One of the notable examples is COVID-19. In Europe, many countries have favorable laws to support companion animals. The Commission Laws of the French National Assembly in 2014, the Czech Republic Civil Code of 2012, the United Kingdom Animal Welfare Act of 2006, the Austrian Constitution in 2004, the German Constitution in 2002, and Switzerland's Law of October 4, 2002, are a few notable examples. Due to these laws, there is a favorable approach to the diagnosis of animals, which incites a positive growth in the number of these animals. Hence, the increasing number of companion animals in households and farms will show positive growth for the market during the forecast period.

Therefore, owing to the aforementioned factors, the studied market is anticipated to witness growth over the analysis period. However, high pet care costs is likely to impede market growth.

Veterinary Infectious Disease Diagnostics Market Trends

The Immunodiagnostics segment is Expected to Witness Growth Over the Forecast Period

The dominance of this segment is mainly attributed to factors such as the increasing use of immunoassays in infectious disease testing, the development of novel tests, the rising trend of automation, increasing awareness about health and fitness, and reduce complications associated with the instruments.

For instance, in May 2021, as per the Manual of Clinical Microbiology, 11th Edition, immunoassays can be adapted for detecting analytes across laboratory disciplines and are often more cost-effective than other diagnostic methods. In the clinical microbiology laboratory, immunoassays often serve as confirmatory tests. Therefore, the results are typically not intended to be used as the sole basis for a diagnosis. However, for certain infectious diseases, including Lyme disease, cryptococcal meningitis, and syphilis, antibody and antigen detection by immunoassays is the primary means by which the infection is established. Due to their ease of use, rapid turnaround time, and generally high specificity, immunoassays are increasingly becoming available for point-of-care testing.

Earlier, the diagnostics for veterinary infectious diseases/pathogens have relied on methods for detecting the pathogen by antibodies or culture, using various techniques, such as Enzyme-linked Immunosorbent Assay (ELISA), neutralization, agar gel immunodiffusion, and complement fixation. However, in the past few years, improved immunoassay-based diagnostics tests have evolved and have replaced the more traditional methods, resulting in improved accuracy while requiring less time and effort. For instance, in April 2021, INDICAL, a global leader in developing complete solutions for molecular and immunological veterinary testing, acquired the Svanova product portfolio from Boehringer Ingelheim. This is enhanced by the production of specific proteins which serve as target antigen and makes it possible with new advanced biotechnological methods, such as the cloning of genes and the use of expression vectors. Due to these factors, the market will grow during the forecast period.

Furthermore, factors such as growing research collaborations, an increasing number of research laboratories, and growing direct and indirect investments in research and development (R&D) by pharmaceutical and biotechnology companies will increase product demand, fueling the market's growth in the coming years.

North America is Expected to Dominate the Hair Removal Devices Market

North America is expected to hold a major market share in the global veterinary infectious disease diagnostics market due to rising pet insurance, increased companion animals, and advanced diagnostic devices available in the region. According to the American Pet Products Association survey 2020-2021, around 65.2 million households own dogs, 43.3 million own cats, 5.8 million own birds, 5.3 million own small animals, and 1.8 million own horses, among others. This increasing number requires more diagnostic tests as zoonotic diseases can spread quickly due to more human and animal interactions. According to the American Pet Products Association survey 2020-2021, the basic annual expenses for dogs in an average United States household come to USD 429 for a Surgical vet and USD 213 for a routine visit. This puts the total United States pet industry expenditures around USD 82.31 billion in 2020-2021. The rise in expenditure shows a willingness in owners to go for diagnostic tests with their pets. Due to these factors, the market will show significant growth in the upcoming years.

Moreover, an increase in research and development activities and the presence of favorable healthcare infrastructure are fueling the growth of the overall regional market to a large extent. For instance, in September 2021, the International Society for Infectious Diseases (part of the United Nations) provides various grants in different fields of infectious diseases. Many of the grants are offered to veterinary infectious diagnostics. Similarly, the United States has a long-term agreement with Research Training Center for Animal Disease Diagnostics (Ukraine) which was signed on October 2010 to provide funding for clinical research (specifically for research, diagnostics, and training for animal health) in that region. Due to these factors, the market will see a growth period during the forecast period.

Veterinary Infectious Disease Diagnostics Industry Overview

The Veterinary Infectious Disease Diagnostics Market is moderately consolidated and competitive and consists of a few major players. In terms of market share, a few of the major players are currently dominating the market. Some companies currently dominating the market are Biomerieux S.A., Heska Corporation, IDEXX Laboratories, Inc., IDVet, Indical Bioscience, Neogen Corporation, Randox Laboratories, Ltd., Thermo Fisher Scientific Inc., Virbac and Zoetis, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Advanced Diagnostic Devices for Animals

- 4.2.2 Growing Demand for Pet Insurance

- 4.2.3 Increasing Companion Animal Population

- 4.3 Market Restraints

- 4.3.1 High Pet Care Costs

- 4.4 Porter's Five Force Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Technology

- 5.1.1 Immunodiagnostics

- 5.1.2 Molecular Diagnostics

- 5.1.3 Others

- 5.2 By Animal Type

- 5.2.1 Companion Animals

- 5.2.2 Food Producing Animals

- 5.3 By Infection Type

- 5.3.1 Bacterial Infections

- 5.3.2 Viral Infections

- 5.3.3 Parasitic Infections

- 5.3.4 Others

- 5.4 By End User

- 5.4.1 Reference Laboratories

- 5.4.2 Veterinary Laboratories and Clinics

- 5.4.3 Point of Care/In House Testing

- 5.4.4 Others

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Biomerieux S.A.

- 6.1.2 Heska Corporation

- 6.1.3 IDEXX Laboratories, Inc.

- 6.1.4 IDVet

- 6.1.5 Indical Bioscience

- 6.1.6 Neogen Corporation

- 6.1.7 Randox Laboratories, Ltd.

- 6.1.8 Thermo Fisher Scientific Inc.

- 6.1.9 Virbac

- 6.1.10 Zoetis, Inc.

![兽医感染疾病诊断市场:趋势、机会与竞争分析 [2023-2028]](/sample/img/cover/42/1341993.png)