|

市场调查报告书

商品编码

1273509

兽医 X 射线市场 - COVID-19 的增长、趋势、影响和预测 (2023-2028)Veterinary X-Ray Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

在预测期内,动物 X 射线市场预计将以 6.4% 的复合年增长率增长。

COVID-19 在全球大流行期间对市场产生了巨大影响。 大流行期间宠物拥有量显着增加,导致兽药增加,这反过来又推动了兽医 X 射线市场的增长。 例如,2021 年 5 月,美国防止虐待动物协会 (ASPCA) 发布了新数据,报告称自 COVID-19 危机开始以来,近五分之一的家庭养了猫或狗。 在大流行中,对宠物健康的日益关注影响了对动物放射照相市场的需求。 此外,对动物 X 射线的需求将继续保持,预计将在预测期内对动物 X 射线市场的增长产生显着影响。

动物供应医院数量增加、宠物拥有率上升以及动物健康支出等主要因素预计将推动市场增长。 例如,根据《欧洲宠物食品行业公布的数据:Facts and Figures 2022》报告,2021 年德国将有大约 1030 万隻狗和 1670 万隻猫,2021 年英国将有 1200 万隻狗和 1200 万隻狗。 . 据报导有 12,000,000 隻猫。 此外,根据2022年3月发表在Acta Scientific Veterinary Sciences上的一篇论文,印度的社区犬种群数量约为620万人,预计到2023年底宠物犬种群数量将达到约3100万隻.它已经。 世界上饲养的宠物数量的这种增加预计将推动对兽医 X 射线的需求并促进市场的增长。

此外,各主要市场参与者越来越多地推出创新产品,预计也将有助于市场的增长。 例如,2021 年 2 月,富士胶片推出了兽医 X 光室“VXR”。 该 X 射线室的创新设计旨在帮助兽医过渡到高质量、低剂量的 X 射线,并提供价格合理、用途广泛、易于使用且易于安装的系统。

但是,与 X 射线设备相关的高成本以及缺乏适当的报销政策预计会阻碍市场增长。

兽用 X 光市场趋势

在预测期内,数字 X 射线部分预计将占据兽医 X 射线市场的很大份额

数字 X 射线是一种以数字方式获取图像的射线照相术。 优势包括避免化学处理的时间效率、使用低辐射的数字传输以及提高图像质量的能力。 数字兽医 X 射线的增长主要是由于兽医意识的提高以及随着动物疾病负担的增加对先进诊断系统的需求不断增长。 动物关节炎、癌症等疾病的日益流行预计将推动对数字 X 射线的需求,从而促进研究领域的增长。

根据 IVF 杂誌 2021 年 5 月发表的一篇文章,骨关节炎每年影响 20% 的 1 岁以上的狗和 80% 的 8 岁以上的狗。 另一方面,根据 2022 年 5 月发表的一篇 NCBI 论文,恶性肿瘤的终生患病率随着犬类体型的增加而增加。 中型、标准型、大型和巨型犬的年龄调整流行率分别为 1.65、2.92、3.67 和 2.99。 宠物慢性病负担如此之高,预计将提振数字 X 光市场的需求,并推动该领域的增长。

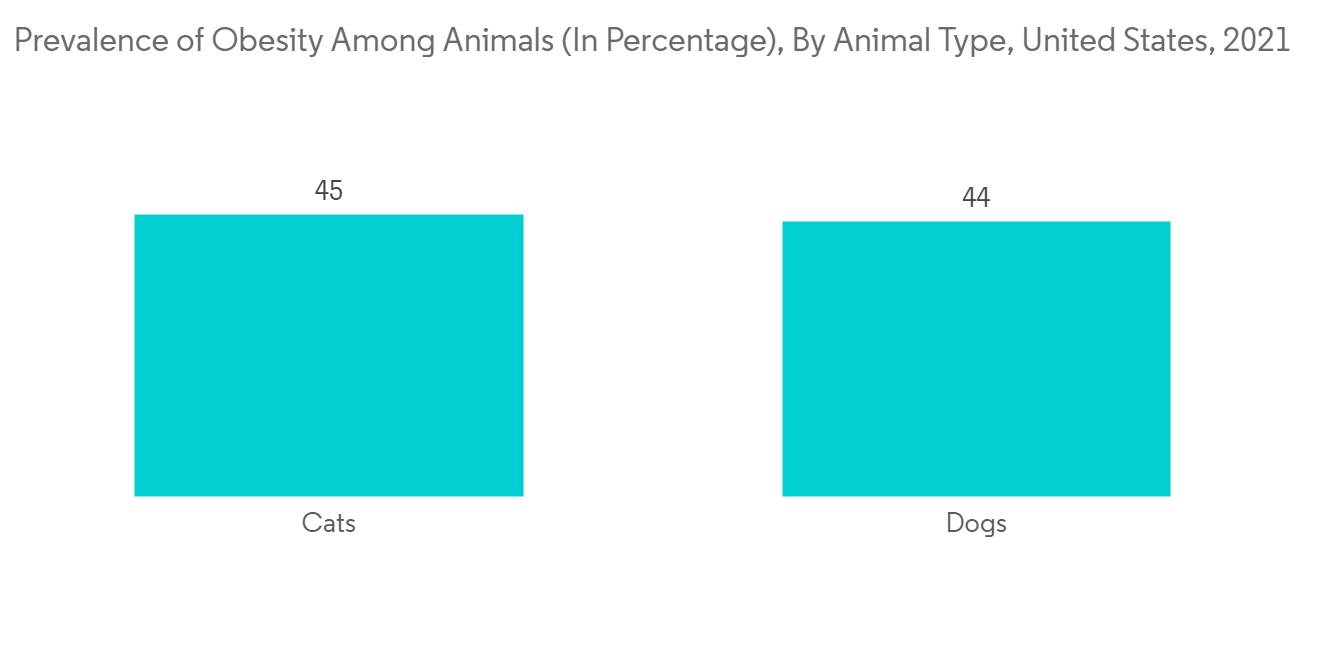

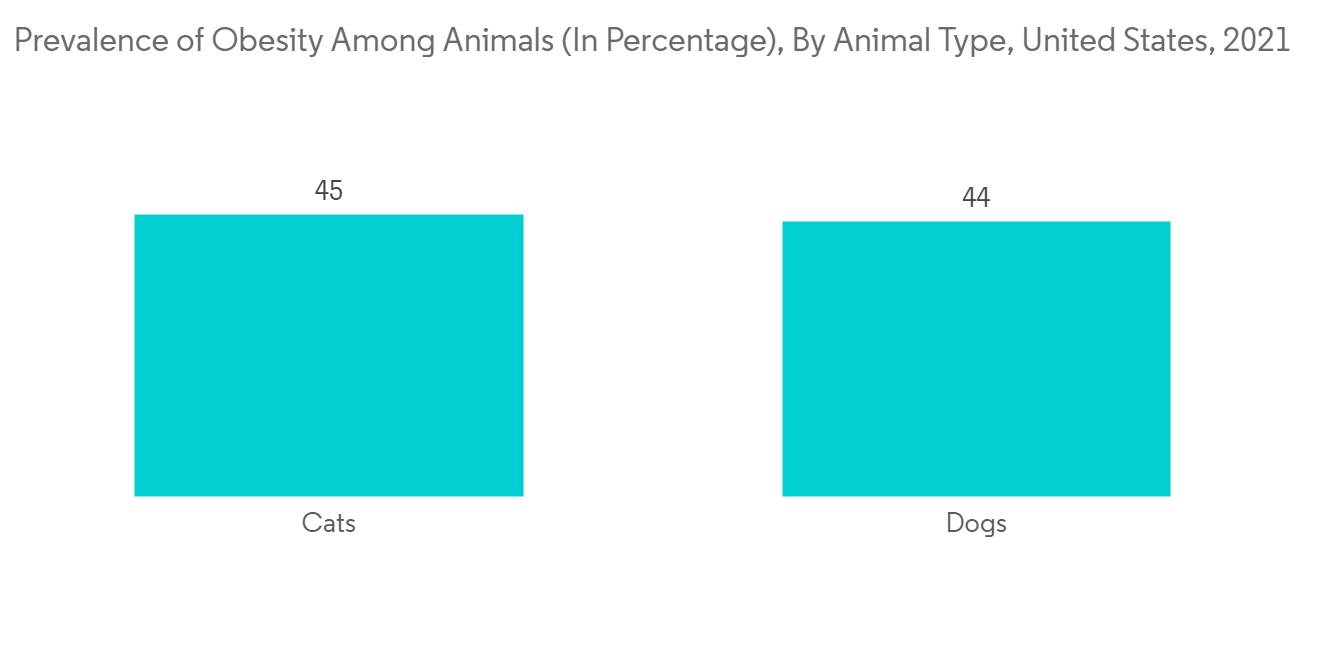

此外,动物肥胖症的增加也有望促进数字 X 射线领域的增长。 例如,根据宠物肥胖预防协会 2021 年的数据,美国 2021 年狗的肥胖患病率为 44%,猫的肥胖患病率为 45%。 因此,预计此类动物肥胖患病率的上升也将推动对数字 X 射线的需求,从而促进研究领域的增长。

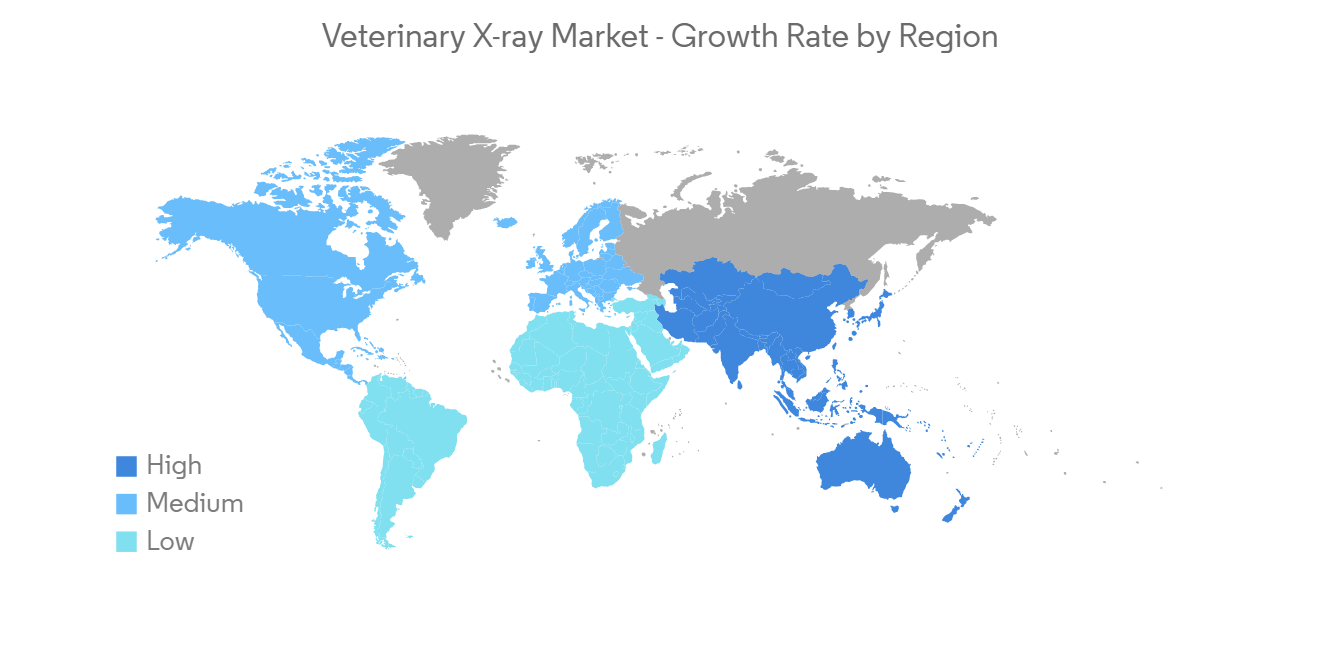

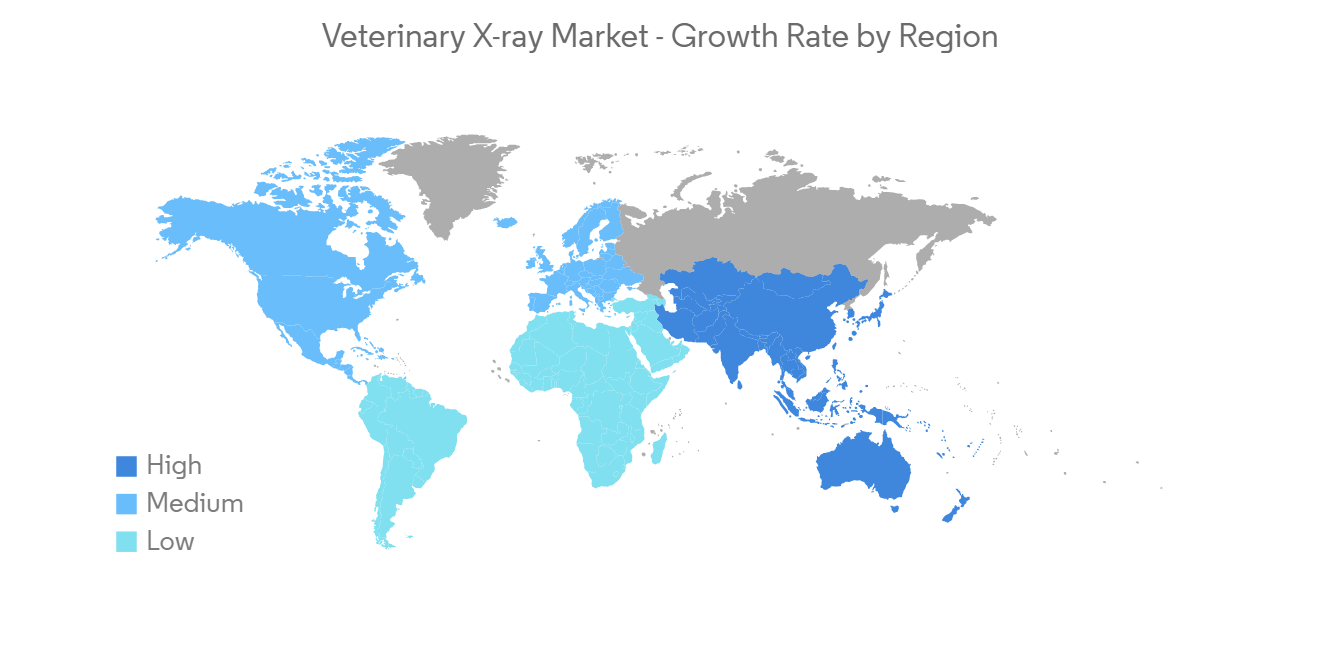

预计在预测期内北美将占据很大的市场份额

由于宠物数量的增加和主要市场参与者的存在,预计北美将在市场中占有重要份额。 此外,由于市场进入者实施战略举措和动物疾病负担增加等因素,预计兽用 X 射线市场将增长。

例如,根据美国宠物用品协会 (APPA) 进行的 2021-2022 年全国宠物主人调查,到 2021 年,大约 70% 的美国家庭将拥有一隻宠物,而这归功于猫。相当于 90.5万户家庭,包括 4530 万和 6900 万隻狗。 此外,预计到 2021 年美国拥有小动物的家庭数量将达到 620 万(根据同一数据)。 高宠物拥有率正在推动研究市场的增长。 此外,根据 2021 年动物癌症基金会的数据,美国每年有 6500 万隻狗和 3200 万隻猫被诊断出患有癌症。 此外,每年约有 600 万例宠物癌症诊断。 同样,2021 年 9 月发表的一篇 NCBI 论文发现,牙周病是加拿大兽医实践中常见的问题,据报导犬类的平均患病率为 9.3% 至 18.2%,而对麻醉犬的详细检查报告显示,牙周病的患病率高得多牙周病患病率在 44% 到 100% 之间,预计将有助于增长。

此外,各种组织在北美提供动物 X 射线设备的融资活动不断增加,预计也将促进市场增长。 例如,2022 年 8 月,夏威夷岛动物医院获得 Bob Lenny Parsons 的 150 万美元资助,用于支持美国 Ann Barash Ryan 动物医院的最后改造。 医院还设有手术场所和 X 光机等诊断设备。

因此,由于上述因素(例如宠物拥有量增加、动物疾病增加以及融资活动增加),市场预计在预测期内将出现显着增长。

兽用 X 射线行业概览

兽医 X 射线市场竞争激烈,许多主要参与者主导着市场。 Fujifilm Holdings、Toshiba、Siemens Healthnias、GE Healthcare、OR Technology 和 Konica Minolta 等主要市场参与者的存在正在加剧竞争。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 调查假设和市场定义

- 本次调查的范围

第二章研究方法论

第 3 章执行摘要

第四章市场动态

- 市场概览

- 市场驱动力

- 宠物拥有量增加,兽医费用增加

- 增加动物医院的数量

- 市场製约因素

- 兽医 X 光设备和程序的高成本

- 兽医手术报销不足

- 波特的五力分析

- 新进入者的威胁

- 买方/消费者议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

第 5 章市场细分(市场规模:金额)

- 按技术

- 直接射线照相繫统

- 计算机放射成像系统

- 基于胶片的射线照相繫统

- 按类型

- 数字X光

- 模拟X光

- 交通工具

- 固定式

- 便携式

- 按动物类型

- 小动物

- 大型动物

- 通过使用

- 骨科

- 神经学

- 肿瘤科

- 心脏病学

- 其他应用

- 地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 意大利

- 其他欧洲

- 亚太地区

- 中国

- 日本

- 印度

- 澳大利亚

- 韩国

- 其他亚太地区

- 中东和非洲

- 海湾合作委员会

- 南非

- 其他中东和非洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美

第6章竞争格局

- 公司简介

- Fujifilm Holdings Corporation

- Heska Corporation

- Canon Inc

- Siemens Healthineers

- General Electric Company

- OR Technology

- DRE Veterinary(Avante Animal Health)

- JPI Healthcare

- Konica Minolta

- Carestream Health

- Idexx Corporation

- Examion

- Sedecal

第7章 市场机会与将来动向

The Veterinary X-ray Market is poised to grow at a CAGR of 6.4% over the forecast period.

COVID-19 had a significant impact on the market over the pandemic period across the world. Pet adoption has increased significantly during the pandemic, which has resulted in increased animal health care, and, thus, drives the growth of the veterinary x-ray market. For instance, in May 2021, The American Society for the Prevention of Cruelty to Animals (ASPCA) released new data which reported that nearly one in five households acquired a cat or dog since the beginning of the COVID-19 crisis. Such adoptions amid the pandemic increased the focus on pet health, impacting the demand for the veterinary X-ray market. In Addition, the demand for veterinary X-rays is expected to remain intact and lead to a notable impact on the growth of the veterinary x-ray market during the forecast period.

The major factors, such as increasing veterinary products hospitals, rise in pet adoption, and animal health expenditure, are expected to drive the market's growth. For instance, According to the data published by the European Pet Food Industry: Facts and Figures 2022 report, around 10,300,000 dogs and 16,700,000 cats were reported in Germany in 2021, and 12,000,000 dogs and 12,000,000 cats were reported in the United Kingdom in 2021. Also, an article published in Acta Scientific Veterinary Sciences in March 2022 stated that India has approximately 6.2 million of the community dog population, and it is estimated that the population of pet dogs is likely to reach around 31 million by the end of the year 2023. Such increasing pet adoption worldwide is expected to drive the demand for veterinary X-rays, thereby contributing to the market's growth.

Additionally, the increasing launches of innovative products by various key market players are expected to contribute to the market's growth. For instance, in February 2021, Fujifilm launched VXR veterinary X-ray room. The innovative design of this X-ray room is targeted at veterinarians transitioning to high-quality, low-dose X-rays with an affordable, versatile, easy-to-use, and easy-to-install system.

However, the high cost associated with the x-ray devices and the lack of proper reimbursement policies are expected to hinder the market growth.

Veterinary X-ray Market Trends

Digital X-Ray Segment is Expected to Witness a Major Share in Studied Market Over the Forecast Period

Digital X-ray is a form of X-ray in which images are acquired digitally. Advantages include time efficiency through bypassing chemical processing and the ability to digitally transfer and enhance quality images using low radiation. The growth in the digital animal X-ray is mainly due to the increasing awareness among vets and the growing need for advanced systems to diagnose the increasing disease burden in animals. The rising prevalence of diseases such as arthritis, cancer, and others among animals is expected to drive the demand for digital X-rays, thereby contributing to the growth of the studied segment.

As per the article published in IVF Journal in May 2021, osteoarthritis affects 20% of dogs older than one year and 80% of dogs over eight annually. On the other hand, according to an NCBI article published in May 2022, the lifetime prevalence of malignant tumors increased with increasing dog size class. The age-adjusted prevalence for medium, standard, large, and giant dogs were 1.65, 2.92, 3.67, and 2.99, respectively. Such a high burden of chronic diseases among pets is expected to drive the demand for the digital x-ray market, fueling segment growth.

Moreover, rising obesity among animals is also expected to contribute to the growth of the digital x-ray segment. For example, according to Association for Pet Obesity Prevention data in 2021, the prevalence of obesity in dogs was 44%, and among cats was 45% in 2021 in the United States. Thus such rising obesity prevalence among animals is also expected to drive the demand for the digital x-ray, thereby contributing to the growth of the studied segment.

North America is Expected to Hold Significant Share in the Market Over the Forecast Period

North America is expected to have a notable share in the market owing to the rising pet adoptions along with the presence of key market players. The market for veterinary X-rays is also expected to grow owing to the factors, such as the implementation of strategic initiatives by the market players, and the growing burden of diseases in animals.

For instance, according to the 2021-2022 National Pet Owners Survey, conducted by the American Pet Products Association (APPA), in 2021, around 70% of United States households own a pet, which equates to 90.5 million homes, including 45.3 million cats and 69 million dogs. As per the same source, the number of United States households having small animals is 6.2 million in 2021. The high pet adoption is augmenting the growth of the market studied. Furthermore, as per the Animal Cancer Foundation data in 2021, 65 million dogs and 32 million cats in the United States are diagnosed with cancer annually. Moreover, approximately 6 million cancer diagnoses are made in pets every year. Likewise, per an NCBI article published in September 2021 titledPeriodontal disease is a frequent problem seen in veterinary practices in Canada and reported an average prevalence of 9.3% to 18.2% within the dog population, while the detailed examinations of anesthetized dogs report a much higher prevalence of periodontal disease between 44% and 100%. Such increasing prevalence of various diseases among animals is expected to drive the demand for veterinary X-rays, thereby contributing to the growth of the market.

Additionally, the rising funding activities by various organizations in order to provide veterinary x-ray facilities in North America are also expected to contribute to the growth of the market. For instance, in August 2022, the Hawaii Island Humane Society was awarded USD 1.5 million from Bob Renee Parsons to support the final renovations of the Anne Barasch Ryan Animal Hospital in the United States. The hospital included surgical sites and diagnostic equipment such as X-ray machines.

Thus, due to the above-mentioned factors, such as rising pet adoption, increasing diseases among animals, and rising funding activities, the market is expected to witness significant growth during the forecast period.

Veterinary X-ray Industry Overview

The Veterinary X-ray market is highly competitive, with many key players dominating the market. The presence of major market players, such as Fujifilm Holdings Corporation, Toshiba Corporation, Siemens Healthineers, GE Healthcare, OR Technology, and Konica Minolta, are intensifying the competition.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Pet Adoption and Animal Health Expenditure

- 4.2.2 Rise in Number of Veterinary Hospitals

- 4.3 Market Restraints

- 4.3.1 High Cost of Veterinary X-ray devices and Procedures

- 4.3.2 Lack of Reimbursement of Veterinary Procedures

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size - Value in USD million)

- 5.1 By Technology

- 5.1.1 Direct Radiography Systems

- 5.1.2 Computed Radiography Systems

- 5.1.3 Film-based Radiography Systems

- 5.2 By Type

- 5.2.1 Digital X-ray

- 5.2.2 Analog X-ray

- 5.3 By Mobility

- 5.3.1 Stationary

- 5.3.2 Portable

- 5.4 By Animal Type

- 5.4.1 Small Animals

- 5.4.2 Large Animals

- 5.5 By Application

- 5.5.1 Orthopedics

- 5.5.2 Neurology

- 5.5.3 Oncology

- 5.5.4 Cardiology

- 5.5.5 Other Applications

- 5.6 Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Spain

- 5.6.2.5 Italy

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 Austalia

- 5.6.3.5 South Korea

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 GCC

- 5.6.4.2 South Africa

- 5.6.4.3 Rest of Middle East and Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Fujifilm Holdings Corporation

- 6.1.2 Heska Corporation

- 6.1.3 Canon Inc

- 6.1.4 Siemens Healthineers

- 6.1.5 General Electric Company

- 6.1.6 OR Technology

- 6.1.7 DRE Veterinary (Avante Animal Health)

- 6.1.8 JPI Healthcare

- 6.1.9 Konica Minolta

- 6.1.10 Carestream Health

- 6.1.11 Idexx Corporation

- 6.1.12 Examion

- 6.1.13 Sedecal