|

市场调查报告书

商品编码

1851784

虚拟私人网路:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Virtual Private Network - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

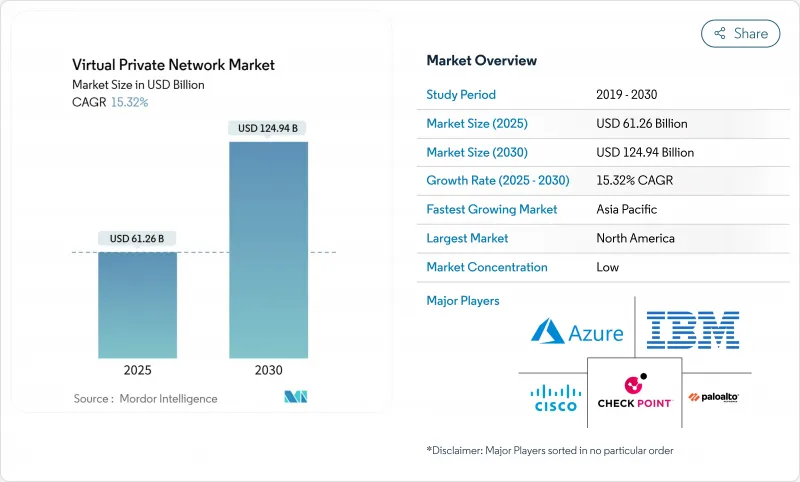

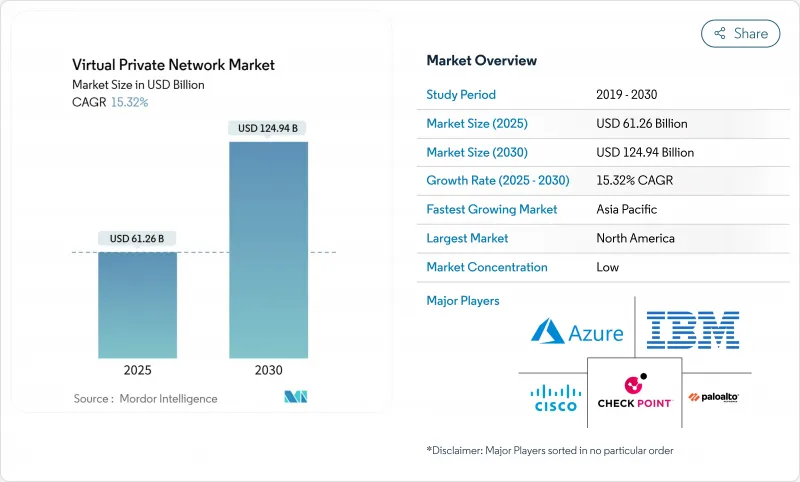

预计到 2025 年,虚拟专用网路市场规模将达到 612.6 亿美元,到 2030 年将达到 1,249.4 亿美元,年复合成长率为 15.32%。

此次扩张的驱动力来自于混合办公模式的安全需求、勒索软体持续带来的压力,以及向整合网路和安全功能的安全存取服务边缘 (SASE) 平台的转变。虽然硬体设备在许多部署中仍然占据核心地位,但云端服务正在加速发展,以消除本地瓶颈并简化管理。零信任网路存取 (ZTNA) 模型正在取代传统的集中器,从而缩小攻击面并改善使用者体验。物联网 (IoT) 工厂中设备数量的增加、5G 的部署以及卫星宽频的普及,都使得加密连线对新站点和新地区的需求不断增长。竞争优势正向那些能够将人工智慧驱动的威胁侦测、后量子加密和统一策略管理结合的供应商转移。

全球虚拟专用网路市场趋势与洞察

混合办公模式越来越依赖安全的远端存取。

工作模式的改变正将 VPN 连线提升至业务关键层面。纽约市教育局已将超过 100 万用户和 200 万台设备迁移到零信任框架,并报告称,拦截的威胁数量增加了 40%,而攻击数量减少了 15%。企业正越来越多地采用云端原生 SASE 平台,这些平台可将流量直接路由到应用程序,从而消除传统集中器带来的延迟和修补程式维护负担。

物联网设备的激增需要加密连接

工业网路如今需要精细化的、基于身分的存取控制。思科的安全设备存取 (SEA) 解决方案取代了普遍存在的 VPN 隧道,实现了对操作技术资源的精细化、零信任控制。在广东大学,中国移动的 5G VPN 支援 2 万同时上线用户,下行速度比传统解决方案提升了 10 倍。

VPN/SASE管理人员短缺推高整体拥有成本

对熟练工程师的需求远超供应,促使企业转向託管服务。服务提供者报告称,员工人事费用已接近总营运支出的30%,而客户则转向能够减少人工维护的整合式SASE服务。

细分市场分析

到2024年,硬体设备将占虚拟私人网路(VPN)市场的43.5%,为大规模远端存取部署提供支援。该领域的韧性与本地部署合规性要求较高的地区较长的更新周期密切相关。然而,可在超大规模云端上快速部署的容器化闸道和虚拟防火墙正推动软体领域实现15.9%的概念验证。涵盖託管营运和实施计划的服务收入与SASE转型同步成长,如今已成为组件支出的第三大支柱。企业继续将用于本地性能的硬体与用于扩展覆盖范围的软体网关相结合,这体现的是共存而非替代。

到2024年,託管式服务将占据虚拟私人网路(VPN)市场的24.7%。这些服务将持续更新、威胁情报来源和全天候监控整合到一个可预测的订阅模式中。同时,随着越来越多的企业需要确定性的延迟来实现混合云端和关键任务协作,MPLS VPN正在经历復兴,其复合年增长率(CAGR)高达16.9%。云端VPN和更广泛的SASE套件将IPsec、SD-WAN和防火墙即服务(FSaaS)整合到统一的编配中,从而减少了策略的蔓延。 IPsec VPN对于遵循既定通讯协定认证的国防和政府机构仍然至关重要,而新兴的WireGuard解决方案则强调精简的程式码库和接近线速的吞吐量。

虚拟私人网路市场按元件(硬体、软体、服务)、类型(託管/管理型、IPsec VPN、MPLS VPN 等)、部署模式(云端、本地部署)、最终用户产业(银行、金融服务和保险、医疗保健和生命科学、IT 和通讯等)以及地区进行细分。市场预测以美元计价。

区域分析

北美仍将是最大的区域贡献者,预计到2024年将占虚拟私人网路(VPN)市场收入的27.1%。零信任试点计画的早期应用和严格的资讯揭露法规正在维持市场支出的成长动能。联邦和州政府的专案正在加速从IPsec集中器到以身分为中心的SASE节点的升级,而超大规模资料中心的高密度PoP(存取点)分布则有助于维持分散式使用者的低延迟。

亚太地区是成长最快的地区,复合年增长率达16.3%。大规模数位化计画以及网路保险的广泛应用,正迫使企业更好地保护其云端工作负载和行动工作人员的安全。中国某大学的一项试验显示,行动VPN的效能比5G独立组网提升了10倍。印度金融监管机构强制要求与外包处理中心建立加密连接,这将进一步加速VPN的普及应用。

在欧洲, 《一般资料保护规则)正在稳步实施。企业倾向于选择在本地设有资料中心的供应商以确保资料主权,许多供应商也正在为其 VPN 服务添加预防资料外泄功能以符合法规要求。德国和法国的政府计划在新的远端存取采购中明确要求供应商具备后量子时代的能力。同时,在中东和非洲,星链 (Starlink) 的部署正在推进,旨在将宽频网路扩展到农村地区,VPN 服务也被用于保护新兴的电子商务和电子政府流量。在拉丁美洲,巴西的银行和墨西哥的零售商正在部署託管 VPN 服务,以应对本地人才短缺的问题。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 混合办公模式越来越依赖安全的远端存取。

- 物联网设备的激增需要加密连接

- 勒索软体造成的损失日益增加,推动了对零信任网路的投入

- 云端原生应用程式的普及推动了对云端VPN和SASE的需求。

- 资料保护条例(GDPR、CPRA、LGPD)的推出将推动企业采用 VPN。

- 新兴地区卫星宽频的普及释放了新的VPN用户群

- 市场限制

- VPN/SASE管理人员短缺推高整体拥有成本

- 与 SDP 和 ZTNA 方案相比,性能/延迟损失

- 监管机构加强对消费者VPN日誌记录行为的审查

- 超过400个零售VPN品牌之间的价格战挤压了利润空间

- 供应链分析

- 监管环境

- 技术展望(Wireguard、后量子时代、SASE融合)

- 波特五力模型

- 新进入者的威胁

- 买方/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 评估市场的宏观经济因素

第五章 市场规模与成长预测

- 按组件

- 硬体

- 软体

- 服务

- 按类型

- 託管/管理

- IPsec VPN

- MPLS VPN

- 云端 VPN/SASE

- 其他的

- 透过部署模式

- 云

- 本地部署

- 按最终用户行业划分

- BFSI

- 医疗保健和生命科学

- 资讯科技和电讯

- 政府和公共部门

- 製造业和工业

- 零售与电子商务

- 教育

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 荷兰

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲和纽西兰

- 亚太其他地区

- 中东和非洲

- 中东

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Cisco Systems Inc.

- Microsoft Corp.(Azure)

- Palo Alto Networks Inc.

- Check Point Software Technologies Ltd.

- IBM Corp.

- Nord Security(NordVPN)

- Kape Technologies PLC(ExpressVPN, CyberGhost)

- Avast sro(AVG Secure)

- Fortinet Inc.

- Juniper Networks Inc.

- OpenVPN Inc.

- Citrix Systems Inc.

- Array Networks Inc.

- NetMotion Software Inc.(Absolute Secure Access)

- Golden Frog GmbH(VyprVPN)

- Cloudflare Inc.(Cloudflare One/WARP)

- Google LLC(Google VPN)

- McAfee LLC

- Sophos Ltd.

- F5 Inc.(BIG-IP APM)

- Zscaler Inc.(Zscaler Private Access)

- Barracuda Networks Inc.

- Perimeter 81 Ltd.

- Tailscale Inc.

- WireGuard Development Team

第七章 市场机会与未来展望

The virtual private network market generated USD 61.26 billion in 2025 and is forecast to reach USD 124.94 billion by 2030, advancing at a 15.32% CAGR.

Expansion stems from hybrid-workforce security requirements, persistent ransomware pressure, and firm migration toward Secure Access Service Edge (SASE) platforms that merge networking and security functions. Hardware appliances still anchor many deployments, yet cloud-delivered services accelerate because they remove on-premises bottlenecks and simplify administration. Zero-trust network access (ZTNA) models are replacing legacy concentrators, trimming attack surfaces and enhancing user experience. Growing device footprints in Internet of Things (IoT) factories, 5G deployments, and satellite broadband roll-outs extend encrypted connectivity requirements into new sites and geographies. Competitive advantage is shifting to vendors that integrate AI-driven threat detection, post-quantum encryption, and unified policy management.

Global Virtual Private Network Market Trends and Insights

Rising Hybrid-Workforce Dependence on Secure Remote Access

Shifts in work patterns have elevated VPN connectivity to business-critical status. The New York City Department of Education migrated more than 1 million users and 2 million devices to a zero-trust framework and reported a 15% reduction in attacks alongside a 40% increase in blocked threats. Enterprises increasingly adopt cloud-native SASE platforms that route traffic directly to applications, eliminating the latency and patching burdens found in traditional concentrators.

Proliferation of IoT Devices Requiring Encrypted Connectivity

Industrial networks now demand granular, identity-based access. Cisco's Secure Equipment Access replaces broad VPN tunnels with fine-grained, zero-trust controls for operational technology resources. At Guangdong University, China Mobile's 5G VPN delivered ten-fold downlink speed versus legacy solutions while supporting 20,000 concurrent users.

Talent Shortage in VPN/SASE Administration Inflating Total Cost of Ownership

Demand for skilled engineers exceeds supply, pushing organizations toward managed services. Providers report staffing outlays approaching 30% of total operating expense, steering customers to integrated SASE offerings that reduce manual upkeep.

Other drivers and restraints analyzed in the detailed report include:

- Escalating Ransomware Losses Driving Zero-Trust Network Spending

- Cloud-Native Application Adoption Boosting Demand for Cloud VPN and SASE

- Performance and Latency Penalties Versus SDP and ZTNA Alternatives

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hardware appliances accounted for 43.5% of the virtual private network market in 2024, underpinning many large-scale remote access roll-outs. Segment resilience is tied to long refresh cycles in sectors with on-premises compliance mandates. Yet software is growing at a 15.9% CAGR, fueled by containerized gateways and virtual firewalls that deploy in minutes on hyperscale clouds. Supply-chain tightness around semiconductors catalyzed adoption of cloud-hosted images such as pfSense Plus on AWS and Azure, accelerating proofs of concept. Services revenue, spanning managed operations and implementation projects, scales in tandem with SASE transitions and currently forms the third pillar of component spend. Organizations continue to blend hardware for on-site performance with software gateways to extend reach, signalling coexistence rather than replacement.

Hosted and managed offerings secured 24.7% of virtual private network market share in 2024 as enterprises shifted maintenance burdens to specialists. These services integrate continuous updates, threat intelligence feeds, and 24X7 monitoring within predictable subscription models. Meanwhile, MPLS VPN shows a renaissance, pacing at 16.9% CAGR as firms require deterministic latency for hybrid cloud and mission-critical collaboration. Cloud VPN and broader SASE suites converge IPsec, SD-WAN, and firewall-as-a-service under unified orchestration, trimming policy sprawl. IPsec VPN remains essential for defense and government entities adhering to established protocol accreditation, while emerging WireGuard solutions emphasize streamlined code bases and near-line-rate throughput.

Virtual Private Network Market is Segmented by Component (Hardware, Software, Services), Type (Hosted/Managed, Ipsec VPN, MPLS VPN and More), Deployment Mode (Cloud, On-Premise), End-User Industry (BFSI, Healthcare and Life Sciences, IT and Telecom and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America remained the largest regional contributor with 27.1% of virtual private network market revenue in 2024. Spending momentum is sustained by early zero-trust pilots and stringent breach disclosure regulations. Federal and state programs accelerate upgrades from IPsec concentrators to identity-centric SASE nodes, while hyperscalers' dense PoP distribution keeps latency low for dispersed users.

Asia-Pacific delivers the fastest expansion at 16.3% CAGR. Massive digitization programs, combined with rising cyber insurance uptake, push enterprises to secure cloud workloads and mobile workforces. Trials in Chinese universities demonstrate ten-fold performance gains for mobile VPN on 5G stand-alone networks. India's financial regulators now require encrypted connectivity for outsourced processing centers, further catalyzing adoption.

Europe maintains steady progress under General Data Protection Regulation enforcement. Enterprises prefer providers with in-region data centers to ensure sovereignty, and many layer VPN with data-loss prevention for compliance. Government projects in Germany and France specify post-quantum readiness in new remote access procurement. Meanwhile, Middle East and Africa benefit from Starlink roll-outs that extend broadband to rural districts; VPN services ride on top to protect emerging e-commerce and e-government traffic. Latin America gains traction as Brazilian banks and Mexican retailers embrace managed VPN to bypass local talent shortages.

- Cisco Systems Inc.

- Microsoft Corp. (Azure)

- Palo Alto Networks Inc.

- Check Point Software Technologies Ltd.

- IBM Corp.

- Nord Security (NordVPN)

- Kape Technologies PLC (ExpressVPN, CyberGhost)

- Avast s.r.o. (AVG Secure)

- Fortinet Inc.

- Juniper Networks Inc.

- OpenVPN Inc.

- Citrix Systems Inc.

- Array Networks Inc.

- NetMotion Software Inc. (Absolute Secure Access)

- Golden Frog GmbH (VyprVPN)

- Cloudflare Inc. (Cloudflare One / WARP)

- Google LLC (Google VPN)

- McAfee LLC

- Sophos Ltd.

- F5 Inc. (BIG-IP APM)

- Zscaler Inc. (Zscaler Private Access)

- Barracuda Networks Inc.

- Perimeter 81 Ltd.

- Tailscale Inc.

- WireGuard Development Team

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising hybrid-workforce dependence on secure remote access

- 4.2.2 Proliferation of IoT devices requiring encrypted connectivity

- 4.2.3 Escalating ransomware losses driving zero-trust network spending

- 4.2.4 Cloud-native application adoption boosting demand for Cloud VPN and SASE

- 4.2.5 Emergence of privacy regulations (GDPR, CPRA, LGPD) spurring corporate VPN roll-outs

- 4.2.6 Satellite broadband expansion in emerging regions unlocking new VPN user bases

- 4.3 Market Restraints

- 4.3.1 Talent shortage in VPN/SASE administration inflating total cost of ownership

- 4.3.2 Performance/latency penalties versus SDP and ZTNA alternatives

- 4.3.3 Heightened regulatory scrutiny on consumer VPN logging practices

- 4.3.4 Commodity pricing wars among 400+ retail VPN brands squeezing margins

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook (WireGuard, Post-Quantum, SASE Convergence)

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assesment of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Services

- 5.2 By Type

- 5.2.1 Hosted / Managed

- 5.2.2 IPsec VPN

- 5.2.3 MPLS VPN

- 5.2.4 Cloud VPN / SASE

- 5.2.5 Others

- 5.3 By Deployment Mode

- 5.3.1 Cloud

- 5.3.2 On-premise

- 5.4 By End-User Industry

- 5.4.1 BFSI

- 5.4.2 Healthcare and Life Sciences

- 5.4.3 IT and Telecom

- 5.4.4 Government and Public Sector

- 5.4.5 Manufacturing and Industrial

- 5.4.6 Retail and E-Commerce

- 5.4.7 Education

- 5.4.8 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Netherlands

- 5.5.3.5 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia and New Zealand

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 United Arab Emirates

- 5.5.5.1.2 Saudi Arabia

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Info, Market Share, Products and Services, Recent Developments)

- 6.4.1 Cisco Systems Inc.

- 6.4.2 Microsoft Corp. (Azure)

- 6.4.3 Palo Alto Networks Inc.

- 6.4.4 Check Point Software Technologies Ltd.

- 6.4.5 IBM Corp.

- 6.4.6 Nord Security (NordVPN)

- 6.4.7 Kape Technologies PLC (ExpressVPN, CyberGhost)

- 6.4.8 Avast s.r.o. (AVG Secure)

- 6.4.9 Fortinet Inc.

- 6.4.10 Juniper Networks Inc.

- 6.4.11 OpenVPN Inc.

- 6.4.12 Citrix Systems Inc.

- 6.4.13 Array Networks Inc.

- 6.4.14 NetMotion Software Inc. (Absolute Secure Access)

- 6.4.15 Golden Frog GmbH (VyprVPN)

- 6.4.16 Cloudflare Inc. (Cloudflare One / WARP)

- 6.4.17 Google LLC (Google VPN)

- 6.4.18 McAfee LLC

- 6.4.19 Sophos Ltd.

- 6.4.20 F5 Inc. (BIG-IP APM)

- 6.4.21 Zscaler Inc. (Zscaler Private Access)

- 6.4.22 Barracuda Networks Inc.

- 6.4.23 Perimeter 81 Ltd.

- 6.4.24 Tailscale Inc.

- 6.4.25 WireGuard Development Team

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment