|

市场调查报告书

商品编码

1637806

无线资产管理 -市场占有率分析、产业趋势与统计、成长预测(2025-2030)Wireless Asset Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

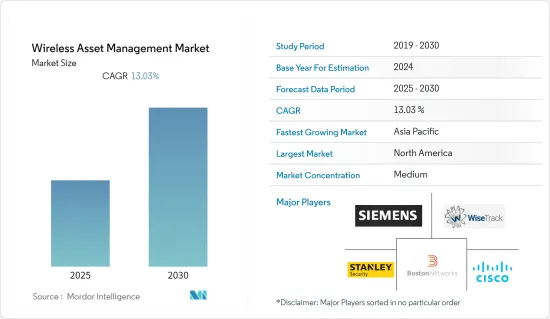

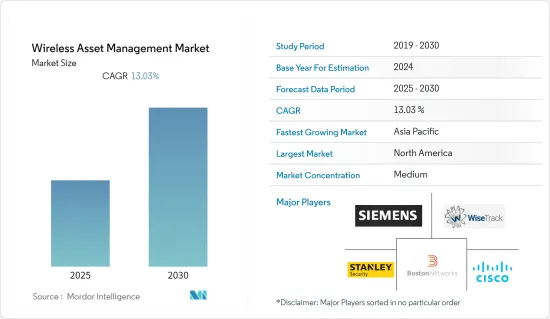

无线资产管理市场预计在预测期内复合年增长率为 13.03%

主要亮点

- 用于无线资产管理的 RTLS 解决方案拓展了业务可能性,对于运输服务、饭店和医疗保健等多元化组织具有巨大价值。 RTLS 资产管理系统将 RFID 标籤附加到资产上,并即时识别资产组的储存位置。

- 无线资产管理可最大限度地降低安全性和诈欺风险,有效管理容量和可用性,并在整个组织内自动进行扣回争议帐款。来自组织和非国家行为者的网路威胁是市场的主要限制因素。然而,公司正在逐步实施新的解决方案来提高资产利用率。

- 无线资产管理市场的关键驱动因素是对可携式监控和管理解决方案以提高营运效率的需求不断增长。借助研究,企业正在专注于无线技术的应用,以提高资产管理水准。按时获取资讯可以提高业务效率。电脑、笔记型电脑和行动装置用于监控。

- 实施无线资产管理系统的高昂初始成本预计将阻碍市场扩张。由于它是一个创新系统,因此缺乏对其操作和效益的了解和经验。预计这将进一步限制市场成长。此外,目前系统还存在各种相容性问题。

- COVID-19的传播使无线资产管理市场受益。 COVID-19 为各种企业带来了额外的障碍。 COVID-19 的爆发凸显了采用数位技术并利用软体资产管理解决方案和服务的功能来提高业务生产力的重要性。此外,疫情过后,全球数位化进程不断推进,市场快速成长。

无线资产管理市场趋势

物理资产监控应用领域预计将占据主要市场占有率

- 实体资产监控的数位化预计将提高市场占有率,而积体电路技术的快速进步正在推动数位市场的发展。 GPS 和地理标记功能、生物识别功能、自主智慧型手机功能等是这些产品的一些特殊功能。 GPS 追踪透过实现距离追踪和测量即时位置来促进实体资产监控。

- 物联网和3D列印等颠覆性技术正在推动可穿戴标籤与物联网技术的集成,这可以进一步增强可穿戴标籤的功能。据思科系统公司称,去年北美和亚太地区使用的连网型穿戴式装置预计将占全球穿戴 5G 连接的约 70%。

- 此外,爱立信表示,今年全球近距离物联网 (IoT) 设备数量达到 166 亿台。未来四年,这一数字预计将增至 224 亿。今年广域物联网设备将达到 32 亿台,预计未来四年将达到 52 亿台。

- 在 LF 和 HF 频段工作的标籤在无线电波长下工作。根据频宽使用的频率,阅读器和标籤之间的讯号传输可以采用多种不同且不相容的方式进行。这些标籤还可以提供电子商品监控 (EAS) 和自助结帐功能,以实现自动感知,从而促进库存系统。

亚太地区预计将成为成长最快的市场

- 由于该地区越来越多地采用各种技术进步以及该地区新兴经济体的重大贡献,预计亚太地区将在预测期内呈现最高的成长率。该地区几乎所有最终用户行业中物联网和人工智慧的采用迅速增加,预计将成为一个巨大的推动力。

- 物联网预计在未来几年将经历巨大成长,而行动技术将在促进行业成长方面发挥关键作用。许多先进产业领域位于大都会圈,其组成和深度因地区而异。根据思科系统的数据,上年度亚太地区连接的穿戴式装置数量约为 3.11 亿个。

- 而且,印度是亚洲市场最具活力的新兴国家之一。智慧先进製造和快速转型中心 (SAMARTH) Udyog Bharat 4.0倡议旨在提高印度製造业对製造 4.0 的认识,并使相关人员能够应对与製造环境中资产监控相关的挑战。该地区资产追踪应用的进步正在推动市场成长。

- IBEF预计,印度电商市场规模预计将从2017年的385亿美元成长到2026年的2,000亿美元。上述新兴市场的发展预计将在预测期内推动市场成长。

- 此外,韩国政府决定在2025年在国内建造3万座智慧工厂,并根据智慧工厂部署和推进策略设定了目标。此外,随着向有组织零售的转变,电子商务的倍增率预计将推动该地区的市场发展。

- 因此,为加速各地区产业数位化的采用而增加的政府援助和合作,增强了对无线资产管理解决方案的需求。

无线资产管理产业概览

无线资产管理市场高度细分,主要参与者包括 Cisco Systems Inc.、Siemens AG、AeroScout Inc.、Boston Networks Ltd. 和 TVL Inc. (WiseTrack)。市场参与企业正在采取联盟和收购等策略来加强其产品供应并获得可持续的竞争优势。

- 2022 年 12 月 - 思科在亚太地区推出新的中小企业计划,以提高合作伙伴的销售效率和盈利。合作伙伴 Deal Express 计画以领先折扣的方式为中小型企业提供客製化的、重点突出的产品组合,使思科合作伙伴能够快速为中小型企业达成交易。这使得合作伙伴无需获得符合该计划资格的合约的批准。它还透过提供最优惠的价格和促销来改善客户体验,透过可预测的定价提高合作伙伴的盈利,并让中小型企业更轻鬆、更快速地达成交易。为此,思科定期分析历史定价和竞争资料,并更改快速通道价格,为中小型企业提供最佳的前期投资。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

- 技术简介

- COVID-19 对市场的影响

第五章市场动态

- 市场驱动因素

- 扩展可携式监控和管理解决方案的应用

- 资产追踪应用的进步和营运效率的提高

- 市场限制因素

- 初始设定期间需要大量投资

- 与现有系统的同步和相容性问题

第六章 市场细分

- 按类型

- 硬体

- 软体

- 按用途

- 实体资产监控

- 自动化库存管理

- 精准维护管理

- 防损

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- Cisco Systems Inc.

- Siemens AG

- AeroScout Inc.

- Boston Networks Ltd

- TVL Inc.(WiseTrack)

- Intelligent Insites Inc.

- ASAP Systems

- Teletrac Inc.

- Moog Inc.

- Verizon Communications Inc.

第八章投资分析

第九章 市场机会及未来趋势

简介目录

Product Code: 47421

The Wireless Asset Management Market is expected to register a CAGR of 13.03% during the forecast period.

Key Highlights

- RTLS solutions for wireless asset management would increase business potential and is incredibly valuable for various organizations, such as transportation services, hospitality, healthcare, and others. The RTLS asset management system is attached to the asset with RFID tags to locate where the group of assets is stored and located on a real-time basis.

- Wireless asset management minimizes security and fraud risks, effectively manages capacity and availability, and automates chargebacks across the organization. Cyber threats from organized and non-state actors are a major constraint for the market. However, companies are gradually adopting new solutions to improve their asset utilization.

- A key driver for the Wireless Asset Management Market is the growing need for portable monitoring and management solutions to improve operational efficiency. With the help of research, organizations focus on applying wireless technologies to improve asset operating levels. Obtaining information on time boosts operational productivity. Computers, laptops, and mobile devices are used for monitoring.

- The high initial expenses of adopting wireless asset management systems are projected to hinder market expansion. As an innovative system, there is a lack of knowledge and experience about its operation and advantages. This is expected to limit the market growth further. Furthermore, there are various compatibility difficulties with the current system.

- The proliferation of COVID-19 benefitted the wireless asset management market. COVID-19 has posed additional obstacles for various businesses. The COVID-19 outbreak has underlined the importance of embracing digital technologies and utilizing the capabilities of software asset management solutions and services to boost operational productivity. Post-pandemic also, the market is growing rapidly with the increased digitization throughout the globe.

Wireless Asset Management Market Trends

Physical Asset Monitoring Application Segment is Expected to Hold Significant Market Share

- Digitalization across physical asset monitoring is expected to boost its market share and rapid advances in integrated circuit technology are boosting the digital market. GPS & geotagging capability, biometric functionality, and autonomous smartphone functionality are some of the exclusive features of these products. GPS tracking enables distance tracking and measures real-time location, fueling physical asset monitoring.

- IoT and 3D printing, among other disruptive technologies, are boosting wearable tags that are integrated with IoT technology which can further enhance the functionality of wearable tags, where one device can serve all the purposes rather than multiple apps and devices. According to Cisco Systems, Connected wearables used in North America and Asia Pacific are together forecast to account for approximately 70 percent of the wearable 5G connections worldwide in the previous year.

- Moreover, according to Ericsson, the number of short-range internet of things (IoT) devices reached 16.6 billion worldwide in the current year. That number is forecast to increase to 22.4 billion by the next four years. The wide-area IoT devices amounted to 3.2 billion in the current year and are predicted to reach 5.2 billion by the next four years.

- Tags working on LF and HF bands work in terms of radio wavelength. Depending on the frequency used by the band, signaling between the reader and the tag is done in several different incompatible ways. These tags also provide electronic article surveillance (EAS), where self-checkout can be made for automatic identification to ease inventory systems.

Asia Pacific is Expected to be the Fastest Growing Market

- Asia-Pacific is expected to witness the highest growth rate over the forecast period, owing to the increasing adoption of various technological advancements in the region and the region's emerging economies' significant contributions. The rapid increase in IoT and AI adoption in almost every end-user industry in the area is expected to be a substantial driver.

- IoT is predicted to undergo massive growth in the coming years, with mobile technologies playing a vital role in enabling the industry to grow. The advanced industries sector is highly metropolitan and varies considerably in its composition and depth across the regions. According to Cisco systems, the number of connected wearable devices in the Asia Pacific region was approximately 311 million in the previous year.

- Further, India is one of the strongest emerging economies in the Asian markets. The Smart Advanced Manufacturing and Rapid Transformation Hub (SAMARTH) Udyog Bharat 4.0 initiative aimed at enhancing awareness about manufacturing 4.0 within the Indian manufacturing industry and helping stakeholders address the challenges related to asset monitoring in the manufacturing environment. The advancement in asset-tracking applications in the region drives market growth.

- According to the IBEF, the Indian e-commerce market is expected to grow to USD 200 billion by 2026 from USD 38.5 billion in 2017. The above developments would boost the market's growth during the forecast period.

- Moreover, The Korean government has decided and set targets to build 30,000 smart factories around the country by 2025, in line with its Smart Factory Roll-out and Advancement Strategy. Additionally, with the transition toward organized retailing, multifold growth of e-commerce is expected to drive the development of the region's market.

- Therefore, the growing government aid to boost the adoption of digitalization in various regional industries and collaborations bolstered the demand for wireless asset management solutions.

Wireless Asset Management Industry Overview

The wireless asset management market is highly fragmented with the presence of major players like Cisco Systems Inc., Siemens AG, AeroScout Inc., Boston Networks Ltd, and TVL Inc. (WiseTrack). Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- December 2022 - Cisco introduced a new SMB program in the Asia Pacific to increase partner sales productivity and profitability. Because it offers an upfront discount on a focused portfolio customized for SMBs, the Partner Deal Express program enables Cisco's partners to conduct faster transactions for SMBs. This eliminates the requirement for partners to obtain clearance for agreements that fit under this program. It also provides the best price and promotions to improve customer experience and boosts partner profitability through predictable pricing, making SMB deals/transactions easier and faster to close. To do this, Cisco regularly analyzes historical pricing and competitive data and alters Fast Track (price) to deliver the best upfront savings for SMBs.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industrial Value Chain Analysis

- 4.4 Technological Snapshot

- 4.5 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Application of Portable Monitoring and Management Solution

- 5.1.2 Advancement in the Asset Tracking Applications with Improved Operational Efficiency

- 5.2 Market Restraints

- 5.2.1 High Investment is Required during Initial Setup

- 5.2.2 Synchronization and Compatibility Issue with the Existing System

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Hardware

- 6.1.2 Software

- 6.2 By Application

- 6.2.1 Physical Asset Monitoring

- 6.2.2 Automate Inventory Control

- 6.2.3 Precise Maintenance Management

- 6.2.4 Loss Prevention

- 6.2.5 Other Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Cisco Systems Inc.

- 7.1.2 Siemens AG

- 7.1.3 AeroScout Inc.

- 7.1.4 Boston Networks Ltd

- 7.1.5 TVL Inc. (WiseTrack)

- 7.1.6 Intelligent Insites Inc.

- 7.1.7 ASAP Systems

- 7.1.8 Teletrac Inc.

- 7.1.9 Moog Inc.

- 7.1.10 Verizon Communications Inc.

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219