|

市场调查报告书

商品编码

1273532

木材粘合剂市场 - 增长、趋势和预测 (2023-2028)Wood Adhesives Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

在预测期内,木材粘合剂市场预计将以超过 4% 的复合年增长率增长。

COVID-19 对 2020 年的市场产生了负面影响。 但目前估计已达到疫情前水平,市场有望稳步增长。

主要亮点

- 由于建筑活动的增加,预计木材粘合剂市场在预测期内将会增长。

- 另一方面,原材料价格的波动预计会在预测期内阻碍市场。

- 环保型粘合剂的开发有望在未来几年带来市场机遇。

- 亚太地区主导着全球市场,其中中国、印度和日本等国家/地区的消费量最大。

木材粘合剂市场趋势

建筑活动增加导致需求增加

- 粘合剂,也称为胶水、粘液或糊状物,是一种非金属物质,应用于两件物品的一侧或两侧,以将它们粘在一起并防止它们分离。 木胶是专门为粘合木质物质而製成的。

- 木材粘合剂是使用天然和合成原料製造的。 天然粘合剂是从植物和动物的身体中获得的,并且比合成粘合剂弱。

- 随着建筑活动的加强,木材的应用越来越多,木材粘合剂的应用范围也在不断扩大。

- 中国的增长主要是由住宅和商业建筑的快速扩张推动的。 据世界银行称,中国一直在鼓励和支持持续的城市化进程,预计到 2030 年城市化率将达到 70%。

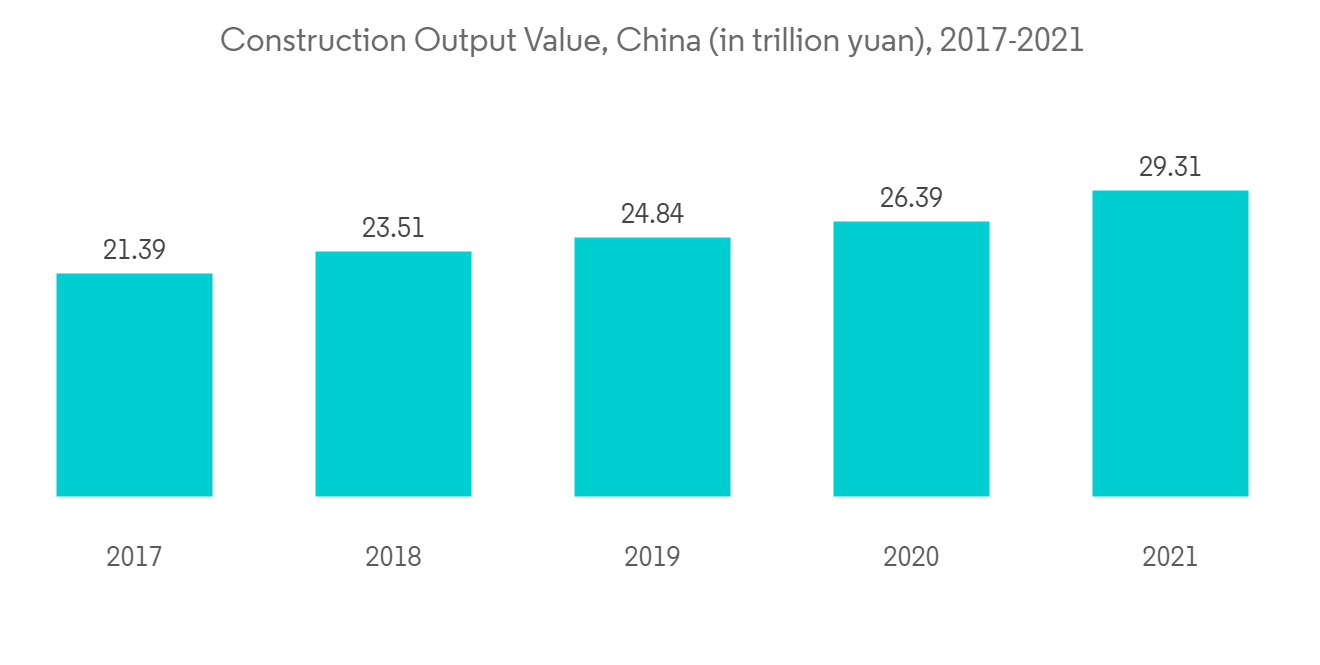

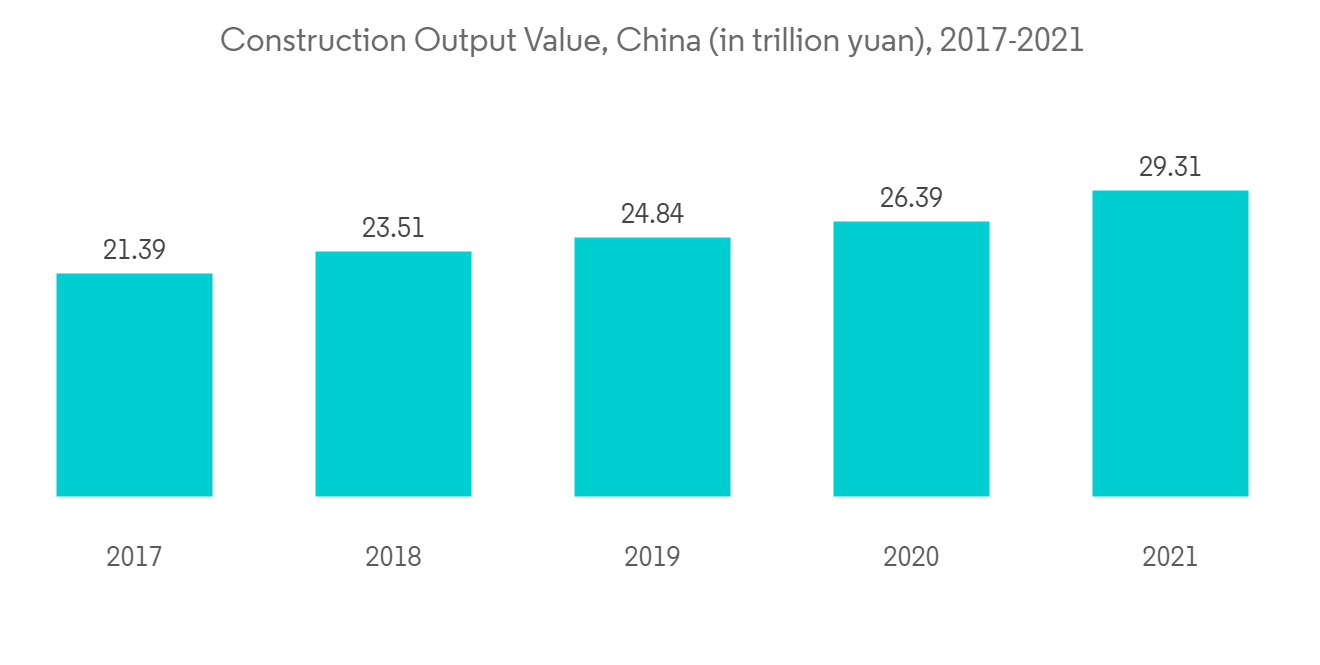

- 此外,根据中国国家统计局的数据,中国的建筑产值将在 2021 年达到顶峰,达到约 4.3 万亿美元。 因此,这些因素往往会增加对木材粘合剂的需求。

- 此外,根据印度房地产行业发布的一份报告,印度还将在未来七年内投资约1.3万亿美元用于住房建设。 预计这将导致建造 6000 万套新房屋。 到 2024 年,经济适用房将增长约 70%。

- 因此,预计在预测期内,全球建筑活动的增加将推动木材粘合剂市场的发展。

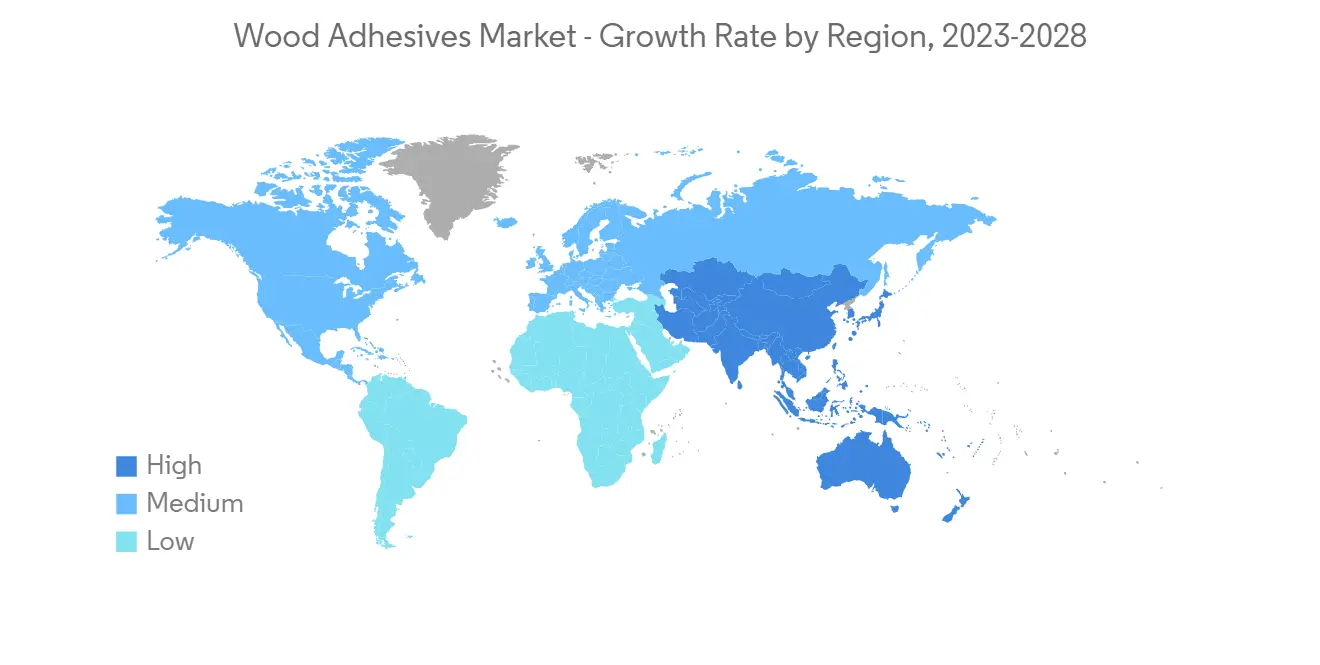

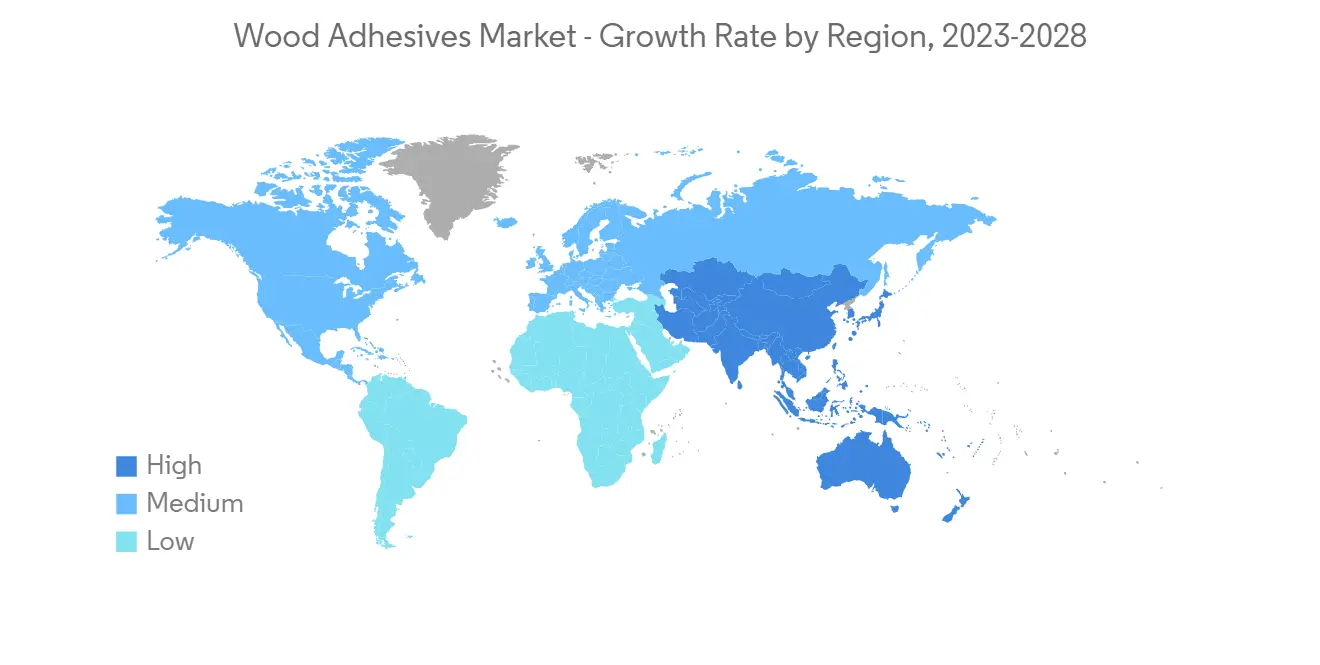

亚太地区主导市场

- 在预测期内,预计亚太地区将主导木材粘合剂市场。 由于中国、印度和日本等国家的建筑业不断发展,该地区木材粘合剂的使用也在增加。

- 最大的木材粘合剂生产商位于亚太地区。 领先的木材粘合剂製造商包括 3M、Sika AG、Henkel AG & Co. KGaA、Pidilite Industries Ltd 和 Jubilant Industries。

- 除家具外,木材粘合剂还用于地板和装饰板、胶合板、橱柜、刨花板、门窗等应用。 因此,随着住房建设的增加,市场有望显着增长。

- 在印度,截至 2021 年 11 月,Pradhan Mantri Awas Yojana Urban (PMAY-U) 已批准 1140.6 万套住房。 其中,893.6 万套住房已获得许可,到 2021 年 11 月将完成 525.5 万套。

- 此外,根据中国国家统计局的数据,2022 年 6 月中国木製家具零售额为 23.9 亿美元,在此期间(2022 年 3 月至 2022 年 6 月)增长了 40%。增加。

- 此外,城市化、房地产开发的增加、强劲的 GDP 增长和经济稳定是促进该地区木製家具增长的其他一些主要因素,从而增加了对木材粘合剂的需求。

- 上述因素,再加上政府的支持,导致对木材粘合剂的需求增加,预计在预测期内该需求将增长。

木材胶粘剂行业概况

全球木材粘合剂市场因其性质而部分分散。 市场参与者包括 3M、Sika AG、Henkel AG &Co.KGaA、Pidilite Industries Ltd 和 Jubilant Industries Ltd(排名不分先后)。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 调查先决条件

- 本次调查的范围

第二章研究方法论

第 3 章执行摘要

第四章市场动态

- 主持人

- 施工高峰导致需求增加

- 其他司机

- 约束因素

- 原材料价格波动

- 其他约束

- 行业价值链分析

- 波特的五力分析

- 供应商的议价能力

- 消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第 5 章市场细分

- 树脂类型

- 自然的

- 合成树脂

- 技术领域

- 溶剂型

- 水性

- 其他技术

- 申请

- 家具

- 胶合板

- 内阁

- 门/窗

- 其他用途

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 意大利

- 其他欧洲

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙特阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章竞争格局

- 併购、合资、合作、合同等。

- 市场份额 (%)**/排名分析

- 主要公司采用的策略

- 公司简介

- 3M

- Aica Kogyo Co.Ltd.

- Akzo Nobel N.V.

- Ashland

- Bostik(Arkema Group)

- Dow

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Jubilant Industries Ltd

- Pidilite Industries Ltd

- Sika AG

第七章市场机会与未来趋势

- 开发环保粘合剂

简介目录

Product Code: 68471

The wood adhesives market is expected to register a CAGR of more than 4% during the forecast period. COVID-19 negatively impacted the market in 2020. However, the market is now estimated to reach pre-pandemic levels and is expected to grow steadily.

Key Highlights

- Due to the increasing construction activity, the wood adhesives market is expected to grow during the forecast period.

- On the other hand, volatility in the price of raw materials is expected to hinder the market during the forecast period.

- Developing eco-friendly adhesives is expected to provide an opportunity for the market in the coming years.

- Asia-Pacific dominated the global market with the most significant consumption from countries such as China, India, and Japan.

Wood Adhesives Market Trends

Growing Demand due to Increasing Construction Activities

- Adhesive, also known as glue, mucilage, or paste, is any non-metallic substance applied to one or both surfaces of two items that bind them together and resists their separation. Wood adhesives are specially made to bind wooden substances.

- Wood adhesives are produced using natural and synthetic sources. Natural glues are obtained from plant or animal bodies with low binding capacity compared to synthetic adhesives.

- The growing construction activity is increasing the wood application, creating the scope for wood adhesives.

- China's growth is fueled mainly by rapid residential and commercial building expansion. According to the world bank, China is encouraging and enduring a continuous urbanization process, with a projected rate of 70% by 2030.

- Also, according to the National Bureau of Statistics of China, the country's construction output peaked in 2021 at about USD 4.3 trillion. As a result, these factors tend to increase the wood adhesive demand.

- Furthermore, according to a report released by the Indian Real Estate Industry, India is also likely to invest around USD 1.3 trillion in housing over the next seven years. It is expected to see the construction of 60 million new homes. Affordable housing availability will likely rise by around 70% in 2024.

- Thus, growing global construction activity is expected to drive the market for wood adhesives over the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region is expected to dominate the market for wood adhesives during the forecast period. With the growing construction sector in countries such as China, India, and Japan, the utilization of wood adhesives is increasing in the region.

- The largest producers of wood adhesives are present in Asia-Pacific. Some leading companies in adhesive wood production are 3M, Sika AG, Henkel AG & Co. KGaA, Pidilite Industries Ltd, and Jubilant Industries.

- Apart from furniture, wood adhesives are also used in flooring & decks, plywood, cabinet, particleboard, windows & doors, and other applications. Thus, the market is expected to grow significantly with growing housing construction.

- In India, the Pradhan Mantri Awas Yojana-Urban (PMAY-U) sanctioned 114.06 lakh houses till November 2021. Of them, 89.36 lakh houses are approved for building, with 52.55 lakhs completed by November 2021.

- Furthermore, according to the National Bureau of Statistics of China, in June 2022, the retail sales of wood furniture in China amounted to USD 2.39 billion, which shows an increase of 40% in the period (March 2022 - June 2022).

- Additionally, urbanization, rising real estate development, robust GDP growth, and economic stability are some of the other key factors contributing to the wood furniture growth in the region, thus increasing the wood adhesive demand.

- The factors above, coupled with government support, are contributing to the increasing demand for wood adhesives and are expected to grow during the forecast period.

Wood Adhesives Industry Overview

The global wood adhesives market is partially fragmented in nature. Some of the major players in the market include 3M, Sika AG, Henkel AG & Co. KGaA, Pidilite Industries Ltd, and Jubilant Industries Ltd, among others (in no particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from the Growing Construction Activity

- 4.1.2 Other Drivers

- 4.2 Restraints

- 4.2.1 Volatility in the Price of Raw Materials

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Resin Type

- 5.1.1 Natural

- 5.1.2 Synthetic

- 5.2 Technology

- 5.2.1 Solvent-based

- 5.2.2 Water-based

- 5.2.3 Other Technologies

- 5.3 Application

- 5.3.1 Furniture

- 5.3.2 Plywood

- 5.3.3 Cabinets

- 5.3.4 Doors and Windows

- 5.3.5 Other Applications

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East & Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Aica Kogyo Co.Ltd.

- 6.4.3 Akzo Nobel N.V.

- 6.4.4 Ashland

- 6.4.5 Bostik (Arkema Group)

- 6.4.6 Dow

- 6.4.7 H.B. Fuller Company

- 6.4.8 Henkel AG & Co. KGaA

- 6.4.9 Jubilant Industries Ltd

- 6.4.10 Pidilite Industries Ltd

- 6.4.11 Sika AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of Eco-friendly Adhesives

02-2729-4219

+886-2-2729-4219