|

市场调查报告书

商品编码

1273543

整个手腕置换市场 - 增长、趋势、COVID-19 影响和预测 (2023-2028)Total Wrist Replacement Market - Growth, Trends, and Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

在预测期内,整个腕关节置换市场预计将以 3.5% 的复合年增长率增长。

COVID-19 的爆发对整个腕关节置换市场产生了重大影响。 这是由于在大流行的早期阶段对选择性和非紧急手术实施了严格的规定。 例如,2022 年 1 月发表在 Bone and Joint Open 上的一篇论文指出,与 2021 年相比,手部和创伤服务减少了 32%,手部创伤手术减少了 41%。事实一直如此。 大流行期间手术量和患者涌入的减少对市场产生了显着影响。 然而,在放宽严格的封锁程序后,大流行后时期手腕手术的恢復预计将有助于市场的增长。

推动整个腕关节置换市场增长的主要因素是人口老龄化加剧、类风湿性关节炎和骨关节炎患病率增加以及骨折和事故数量增加。 例如,根据 2022 年 9 月发表的 NCBI 文章,北欧和北美类风湿性关节炎的发病率分别为每 10 万人 24 例和 36 例。 同样,2021 年发表的另一篇 NCBI 论文指出,2021 年全球骨关节炎患病率将增加 8.5% 至 9.3%。 论文还指出,2021 年骨关节炎的区域患病率北美为 22.5%,西欧为 7.2%,中亚为 8.4%,北中东和非洲为 12.8%。 骨关节炎和类风湿性关节炎的流行预计将推动全腕置换手术的需求,并在预测期内促进市场增长,因为它增加了腕关节置换的可能性。

另一方面,预计产品开发和批准的增加将推动预测期内所研究市场的增长。 例如,2021 年 5 月,骨科植入物公司宣布美国食品和药物管理局批准并商业推出其腕部骨折电镀技术 DRPx 系统。 此外,在 2021 年 5 月,特殊外科医院的外科医生开发了一种手腕植入物 KninematX,这是一种全手腕置换系统。 同一位外科医生还用这种植入物进行了腕关节置换手术。

然而,手腕重建手术的高成本预计会阻碍预测期内的市场增长。

全腕关节置换市场趋势

预计在预测期内,全腕关节置换术将实现健康增长

全腕关节置换术,也称为全腕关节置换术 (TWF),是一种通过融合前臂骨骼和腕小骨来稳定或固定腕关节的外科手术。 该手术可减轻严重手腕受伤后的疼痛。 如果休息、药物、注射和物理治疗等保守治疗不能缓解疼痛,医生可能会建议进行全腕关节置换术。

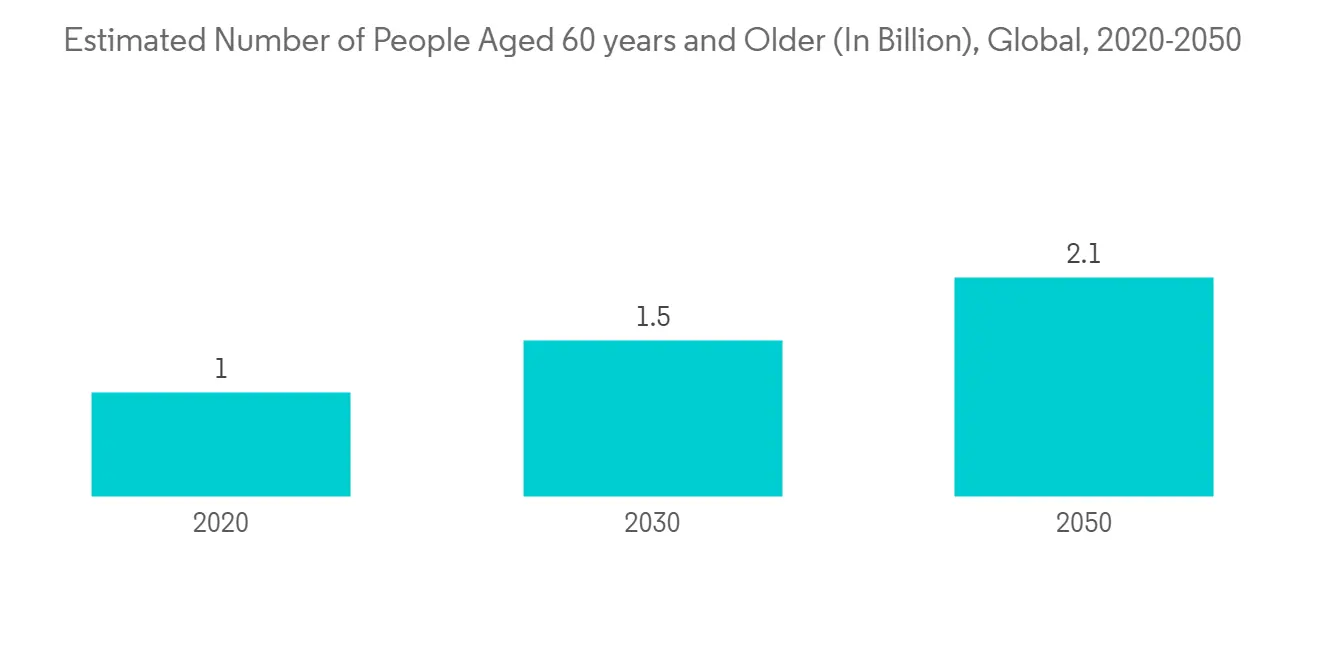

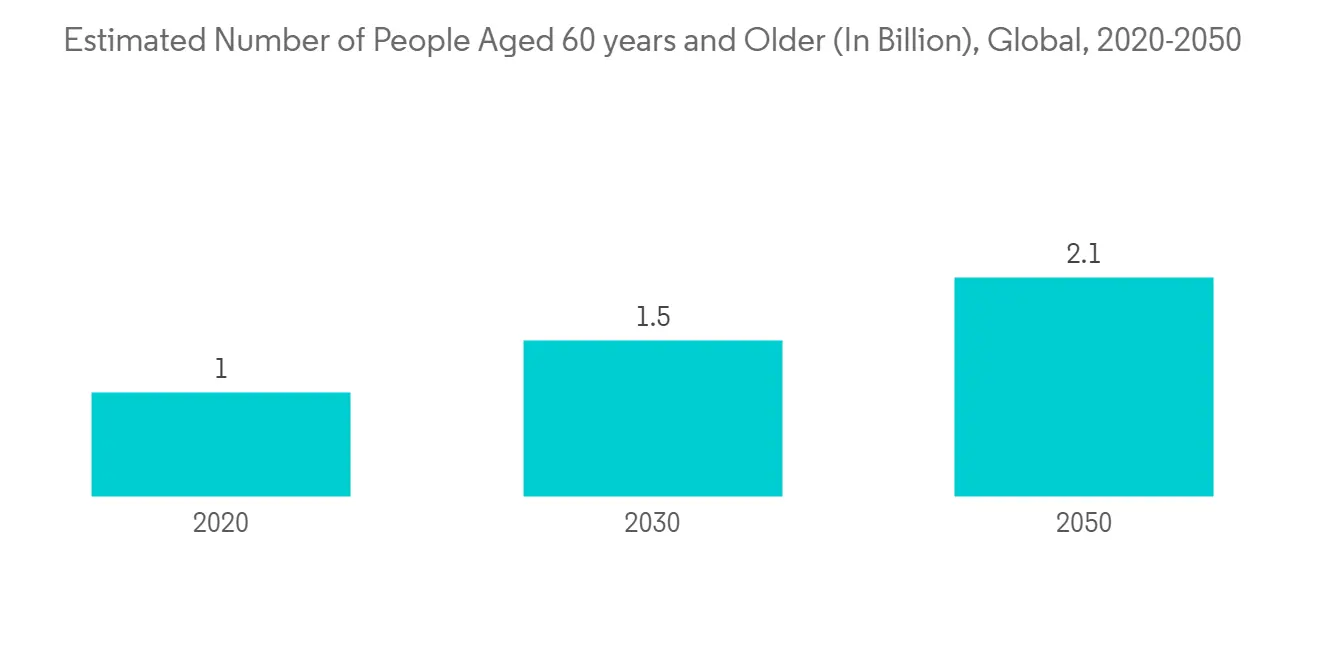

随着容易患关节炎的老年人口增加以及手臂受伤的增加,预计在整个预测期内,全腕关节置换手术的使用将保持健康的需求和供应。 例如,根据世界卫生组织2021年10月的报告,60岁以上的人口预计将从2020年的10亿增长到2050年的21亿,老年人更容易患关节炎和癌症。由于由于对骨质疏鬆症等肌肉骨骼疾病的易感性,预计在整个预测期内对全腕融合手术的需求将增加。 此外,骨关节炎被认为是65岁以上人群中最常见的关节疾病之一。 因此,预计老年人口的增加将推动对全腕融合的需求,从而促进研究领域的增长。

此外,主要参与者正在努力开发新颖的产品和技术。 例如,2021 年 10 月,Tyber Medical LLC 宣布其扩展的解剖电镀系统系列(包括手腕固定板)已获得美国食品和药物管理局的许可。 此外,2021 年 9 月,全球联合保存公司 Anika Therapeutics, Inc. 将在旧金山举行的 ASSH(美国手外科学会)2021 年年会上展示 WristMotionTotal Wrist Arthroplasty (TWA) 系统。宣布它已经发布。

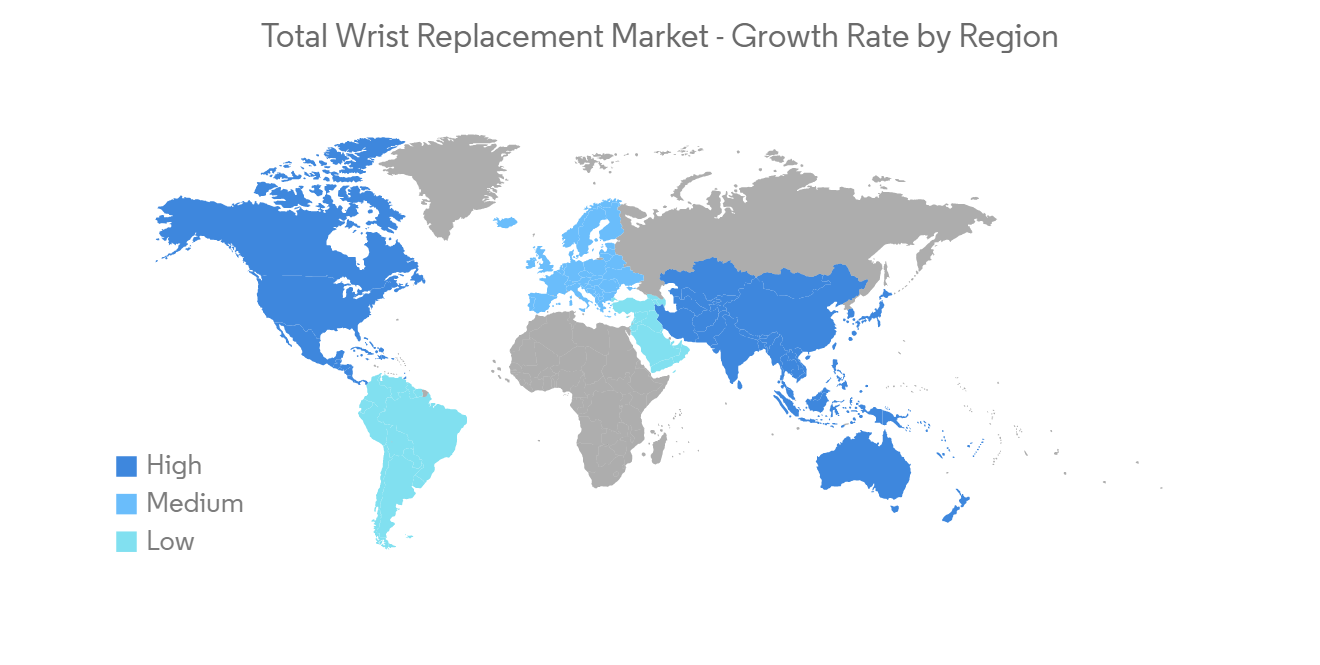

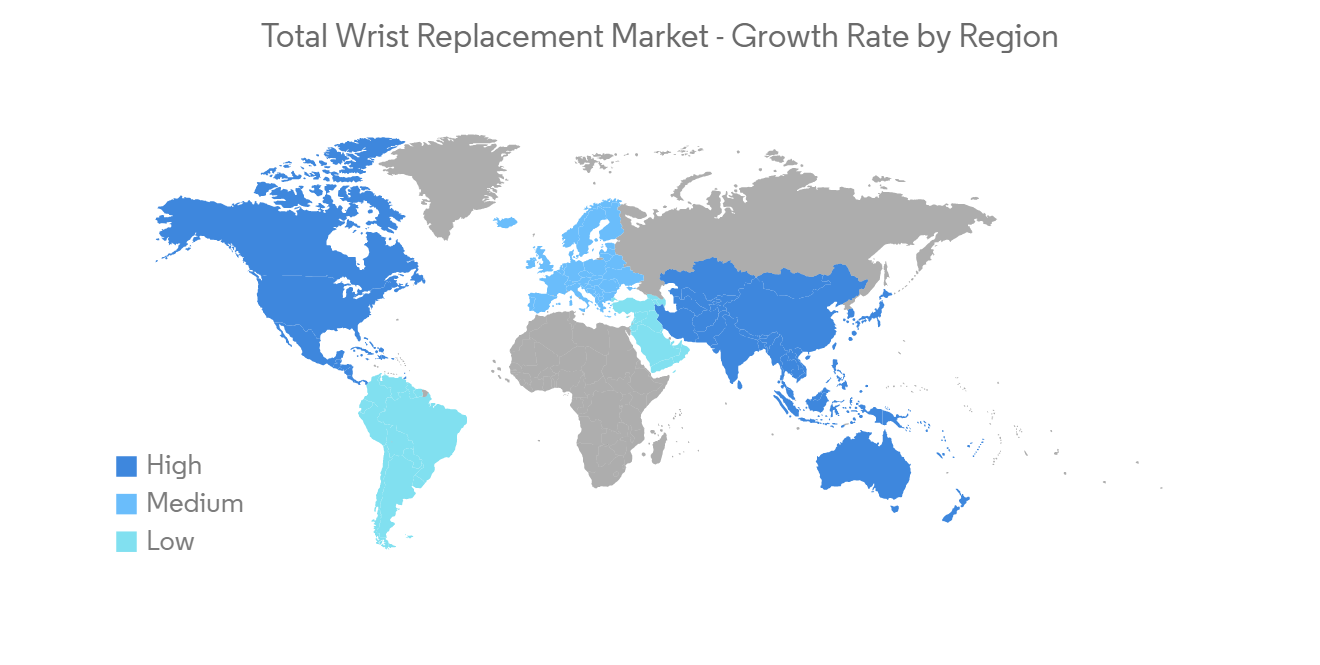

预计在预测期内北美将占据很大的市场份额

北美在整个腕关节置换市场中占有很大份额,预计在预测期内将呈现类似趋势。 随着手臂受伤的增加,该地区的关节炎病例也在增加,预计主要市场参与者的存在也将为该地区的市场增长做出贡献。

例如,2022 年 7 月在 NCBI 发表的一篇论文指出,美国大约每 7 人中就有 1 人患有腕关节炎,到 2022 年将达到该国人口的 13.6%。事实已经如此。 同样,俄亥俄州立大学 2021 年的一篇论文报告称,美国每年有 600 万人遭受骨折之苦。 文章还指出,骨折占美国每年肌肉骨骼损伤的 16%。 超过 40% 的骨折发生在家中。 同样,2021 年 1 月发表的一篇 NCBI 文章指出,到 2021 年,超过 16.5% 的加拿大人(约 480 万人)将被卫生专业人员诊断出患有各种形式的关节炎。 因此,关节炎和骨折发病率的增加预计将推动北美对全腕关节置换手术的需求,推动市场增长。

此外,该地区手腕置换手术总数的增加预计将为该地区提供有利可图的机会,从而推动市场增长。 例如,2021 年 4 月,Extremity Medical 公布了首例使用 KinematX 全腕置换装置的手术病例。 KinematX 是一种掌骨植入物,旨在模仿腕关节炎患者和其他人的自然运动范围。

因此,越来越多的人采用全腕置换手术以及关节炎患病率的增加预计将促进该地区的市场增长。

全腕关节置换行业概览

市场竞争激烈,进入市场的公司众多,因此比较分散。 该市场的主要参与者包括 Zimmer Biomet、Integra Lifesciences Holdings Corporation、Johnson and Johnson、Stryker Corporation 和 Acumed LLC。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

内容

第一章介绍

- 调查假设和市场定义

- 本次调查的范围

第二章研究方法论

第 3 章执行摘要

第四章市场动态

- 市场概览

- 市场驱动力

- 关节炎和骨质疏鬆症的发病率随年龄增长而增加

- 提高对治疗手腕损伤的认识并增加可支配收入

- 市场製约因素

- 手腕重□□建手术费用高昂

- 波特的五力分析

- 新进入者的威胁

- 买方/消费者议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

第 5 章市场细分

- 按技术

- 全腕关节置换术 (TWR)

- 腕关节固定术 (TWF)

- 按地区

- 北美

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 意大利

- 西班牙

- 其他欧洲

- 亚太地区

- 中国

- 日本

- 印度

- 澳大利亚

- 韩国

- 其他亚太地区

- 中东和非洲

- 海湾合作委员会

- 南非

- 其他中东和非洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美

第六章竞争格局

- 公司简介

- Small Bone Innovations

- Zimmer Biomet

- Integra Lifesciences Holdings Corporation

- Johnson and Johnson

- Acumed LLC

- Medartis

- Stryker Corporation

- DJO Global

- Anika Therapeutics Inc.

- Skeletal Dynamics

- CONMED Corporation

- Extremity Inc

第七章市场机会与未来趋势

The total wrist replacement market is expected to register a CAGR of 3.5% over the forecast period.

The outbreak of COVID-19 has significantly impacted the total wrist replacement market. This was due to the strict regulations imposed on elective and non-urgent surgeries during the initial stages of the pandemic. For instance, the article published in Bone and Joint Open journal in January 2022 mentioned a 32% reduction in hand and trauma services, and the surgical procedures on hand trauma were reduced by 41% compared to 2021. Such reduction in the surgical volume and patient inflow during the pandemic had a notable impact on the market. However, the resumption of wrist surgeries during the post-pandemic period after the relaxation of strict lockdown procedures is expected to contribute to the market's growth.

The key factors propelling the growth of the total wrist replacement market are the increasing aging population, the increasing prevalence of rheumatoid and osteoarthritis, and the increase in fracture and accident cases. For instance, according to the NCBI article published in September 2022, the incidence of rheumatoid arthritis in Northern Europe and Northern America was 24 and 36 cases per 100,000 people, respectively. Similarly, another NCBI article published in 2021 mentioned that globally, osteoarthritis prevalence increased by 8.5%-9.3% in 2021. The article also mentioned that the regional prevalence of osteoarthritis was 22.5% in North America, 7.2% in Western Europe, 8.4% in Central Asia, and 12.8% in North Africa and the Middle East in 2021. Such prevalence of osteoarthritis and rheumatoid arthritis, which increase the possibility of wrist replacement, is expected to drive the demand for total wrist replacement, thereby contributing to the market's growth over the forecast period.

On the other hand, rising product developments and approvals are expected to drive the growth of the studied market over the forecast period. For instance, in May 2021, the Orthopaedic Implant Company announced the United States Food and Drug Administration clearance and commercial launch of its wrist fracture plating technology, the DRPx System. Additionally, in May 2021, Hospital for Special Surgery surgeon developed a wrist implant, KninematX, total wrist arthroplasty system. The surgeon also performed wrist-replacement surgery using this implant.

However, the high costs involved in wrist reconstruction surgeries are expected to hinder market growth during the forecast period.

Total Wrist Replacement Market Trends

Total Wrist Fusion Surgery is Expected to Witness a Healthy Growth Over the Forecast Period

Total wrist arthrodesis, also known as total wrist fusion (TWF), is a surgical procedure in which the wrist joint is stabilized or immobilized by fusing the forearm bone with the small bones of the wrist. This procedure relieves the pain after severe trauma to the wrist. The doctor may recommend total wrist arthrodesis when conservative treatments such as rest, medications, injections, and physical therapy do not relieve the pain.

With the growing geriatric population prone to develop arthritis and increasing arm injury, the use of total wrist fusion is expected to observe healthy demand and supply throughout the forecast period. For instance, as per the October 2021 report of the World Health Organization, the population of people of age 60 years or more is expected to increase from 1 billion in 2020 to 2.1 billion by 2050, and as the older population is more prone to musculoskeletal disorders, such as arthritis and osteoporosis, the demand for total wrist fusion is expected to increase over the forecast period. Moreover, osteoarthritis is considered one of the most prevalent articular diseases among the population above the age of 65 years. Thus, the rising geriatric population is expected to drive the demand for total wrist fusion, thereby contributing to the growth of the studied segment.

Additionally, major players are engaged in the development of novel products and technologies. For instance, in October 2021, Tyber Medical LLC announced it had received the United States Food and Drug Administration clearance for its expanded line of anatomical plating systems, including wrist fusion plates. Moreover, in September 2021, Anika Therapeutics, Inc., a global joint preservation company, announced its WristMotionTotal Wrist Arthroplasty (TWA) System was launched at the American Society for Surgery of the Hand (ASSH) 2021 annual meeting in San Francisco.

North America is Expected to Hold a Significant Share in the Market Over the Forecast Period

North America is expected to hold a major share of the total wrist replacement market and is expected to show the same trend over the forecast period. The rising arthritis cases along with increasing arm injuries in this region along with the presence of major market players are expected to contribute to the growth of the market in this region.

For instance, the article published in NCBI in July 2022, mentioned that about one in seven people had wrist arthritis in the United States which was 13.6% of the country's population in 2022. Similarly, an article published by the Ohio State University, in 2021, reported that 6 million people in the United States broke a bone each year. The article also mentioned that fractures account for 16% of all musculoskeletal injuries in the United States annually. More than 40% of fractures occur at home. Likewise, the NCBI article published in January 2021, mentioned that over 16.5% of Canadians, around 4.8 million people had been diagnosed with various forms of arthritis by health professionals in 2021. Therefore, the increasing incidence of arthritis and bone fractures is expected to drive the demand for total wrist replacement in North America, thereby fueling the growth of the market.

Also, the rising total wrist replacement surgeries in this region is expected to provide lucrative opportunities in this region, thereby driving the growth of the market. For instance, in April 2021, Extremity Medical announced the first surgical case using KinematX total wrist device. KinematX is a mid carpal implant designed to mimic the natural range of motion in patients with wrist arthritis and others.

Thus, the rising arthritis cases along with the increasing adoption of total wrist replacement surgeries among the population is expected to contribute to the growth of the market in this region.

Total Wrist Replacement Industry Overview

The market studied is moderately competitive and fragmented due to many market players. Some major players in this market include Zimmer Biomet, Integra Lifesciences Holdings Corporation, Johnson and Johnson, Stryker Corporation, and Acumed LLC, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Incidences of Arthritis and Osteoporosis Increase With the Age

- 4.2.2 Increasing Awareness about the Available Treatments for Wrist Injuries and Increase in Disposable Income

- 4.3 Market Restraints

- 4.3.1 High Costs Involved in Wrist Reconstruction Surgeries

- 4.4 Porter's Five Force Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Technology

- 5.1.1 Total Wrist Replacement (TWR)

- 5.1.2 Total Wrist Fusion (TWF)

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Mexico

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 United Kingdom

- 5.2.2.3 France

- 5.2.2.4 Italy

- 5.2.2.5 Spain

- 5.2.2.6 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 Japan

- 5.2.3.3 India

- 5.2.3.4 Australia

- 5.2.3.5 South Korea

- 5.2.3.6 Rest of Asia-Pacific

- 5.2.4 Middle East and Africa

- 5.2.4.1 GCC

- 5.2.4.2 South Africa

- 5.2.4.3 Rest of Middle East and Africa

- 5.2.5 South America

- 5.2.5.1 Brazil

- 5.2.5.2 Argentina

- 5.2.5.3 Rest of South America

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Small Bone Innovations

- 6.1.2 Zimmer Biomet

- 6.1.3 Integra Lifesciences Holdings Corporation

- 6.1.4 Johnson and Johnson

- 6.1.5 Acumed LLC

- 6.1.6 Medartis

- 6.1.7 Stryker Corporation

- 6.1.8 DJO Global

- 6.1.9 Anika Therapeutics Inc.

- 6.1.10 Skeletal Dynamics

- 6.1.11 CONMED Corporation

- 6.1.12 Extremity Inc