|

市场调查报告书

商品编码

1326322

土壤处理市场规模和份额分析 - 增长趋势和预测(2023-2028)Soil Treatment Market Size & Share Analysis - Growth Trends & Forecasts (2023 - 2028) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

土壤处理市场规模预计将从2023年的418.9亿美元增长到2028年的547.8亿美元,预测期内(2023-2028年)复合年增长率为5.51%。

主要亮点

- 土壤处理用于使受污染的土壤可用于农业或其他用途。有助于改善土壤性能和肥力。生物处理或生物修復广泛用于利用细菌分解土壤中的物质来修復土壤中的有机成分,例如燃料和油。

- 生物处理经济但耗时,需要一到几个月的时间来实施。生物修復的适用性取决于污染物、场地条件和目标水平。由于其生态友好的特点,利用微生物过程修復污染土壤已被证明是有效和可靠的,并且该领域可能在未来几年进一步发展。

- 儘管热处理可以快速可靠地修復受污染的土壤,但由于其能源密集型性质和破坏土壤特性的可能性,它被认为是不可持续的。此外,该工艺相对昂贵,因此该细分市场的市场份额较小。中国政府计划到2020年将90%的污染农用地转化为安全农用地。因此,政府认真调查了该国的土壤污染情况,这也是这一时期土壤处理行业增长的推动力。

- 2021年4月,美国农业部(USDA)国家粮食和农业研究所(NIFA)宣布了几项重大计划,帮助农民管理气候变化对其田地和生产的影响,我们已投资约2170万美元。NIFA 还通过农业和食品研究计划 (AFRI) 向 14 项土壤健康拨款投资 630 万美元,向 7 项土壤信号拨款拨款 540 万美元。

土壤处理市场趋势

人均耕地面积减少,粮食需求增加

- 据联合国预计,到2022年11月中旬,世界人口将达到80亿,并在未来30年增加近20亿,从2022年的80亿增至2050年的97亿。随着人口数量的增加,未来几年粮食需求预计将增加一倍。养活不断增长的人口是一个令人担忧的问题。另一方面,工业化和城市化正在减少农业大国的耕地面积。

- 联合国粮食及农业组织(FAO)发布的2050年资源预测显示,全球仅有12%的土地用于农作物生产,农业用地进一步扩张的空间已所剩无几。因此,现有耕地面临着使用土壤处理产品生产更多粮食的压力。

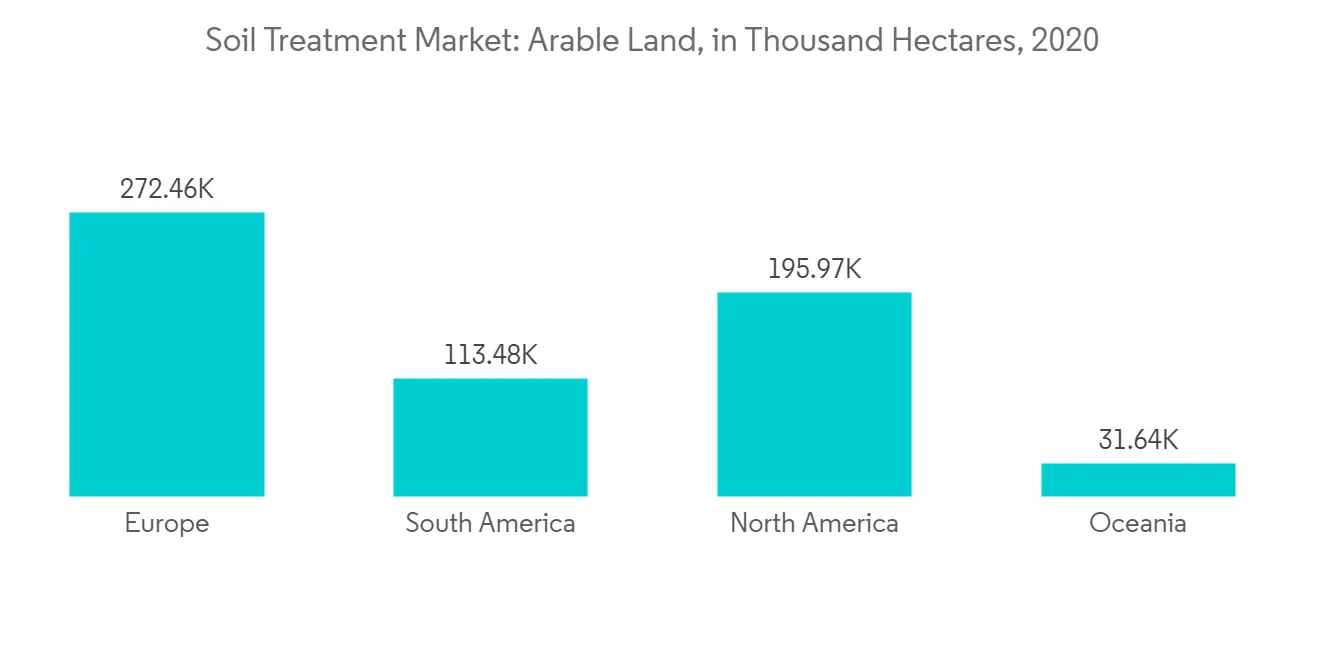

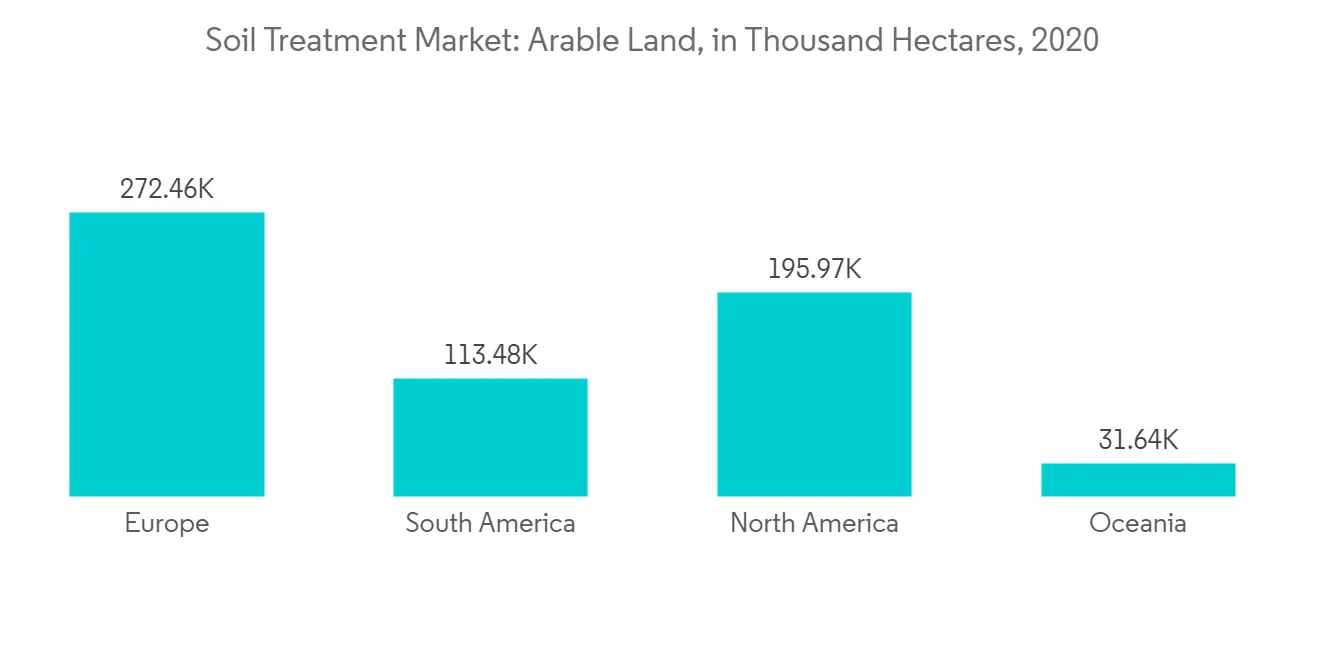

- 据联合国粮农组织统计,北美、欧洲、南亚等发达国家耕地面积减少了5400万公顷。研究预计,耕地面积下降速度将更慢,到2030年将减少至6.08亿公顷,2050年将减少至5.86亿公顷。

- 适当和平衡地使用土壤处理产品可以让我们利用现有的耕地来养活不断增长的人口。

- 除了农业用地减少之外,微量营养素缺乏症在世界范围内也很普遍,亚太地区是受这种缺乏症影响的主要地区之一。超过一半的谷类作物土壤缺锌,约三分之一的耕地土壤缺铁。据估计,40-55% 的土壤中度缺乏锌,25-35% 的土壤中度缺乏硼,约 10-15% 的土壤中度缺乏其他微量营养素。由于土壤中微量营养素大量缺乏,农作物对化肥和农药没有反应,导致产量下降。这个问题可以通过使用 pH 调节器来解决。

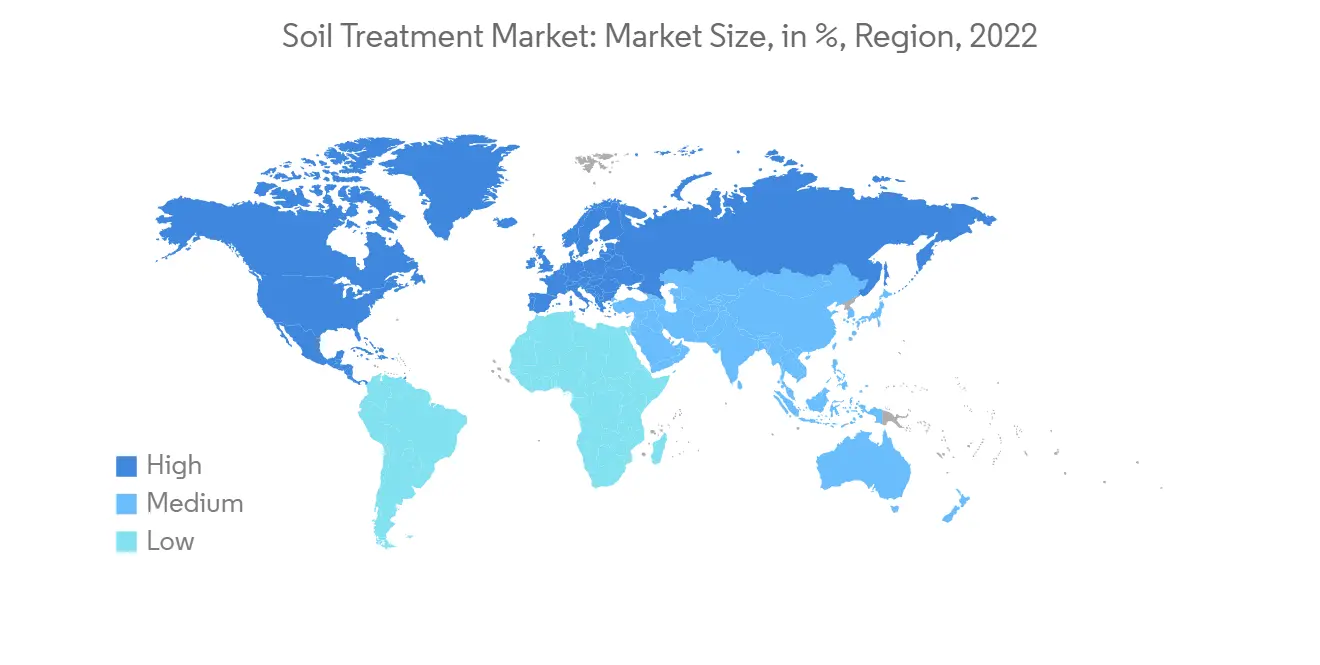

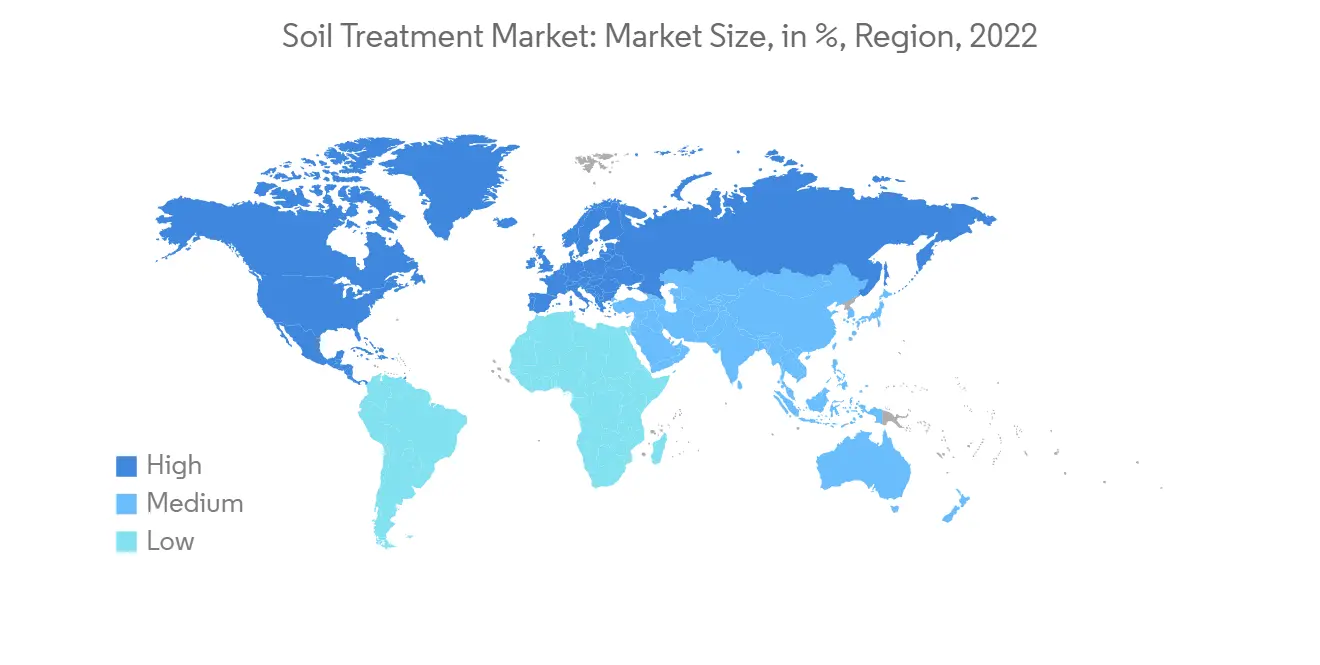

北美主导市场

- 在美国、加拿大、墨西哥等北美国家,人们对土壤污染和修復的担忧日益增加,从而引发了农业土壤处理。土壤是生态系统的重要组成部分,提供广泛的生态系统服务,支持人类福祉和自然系统。土壤是农业生产的基础,为农作物提供养分和水,并支持提供食物、纤维和燃料的植物生长。

- 土壤在水和养分循环中也发挥着重要作用,充当水和污染物过滤器、调节水流并防止侵蚀。美国农业部 (USDA) 制定了一项指令,规定了 2020 年土壤和土壤相关材料的进口和国内运输的植物检疫要求。这包括对土壤和受土壤污染的物品的要求,例如原木和木材、车辆、设备、工具和容器。

- 根据加拿大食品检验局 (CFIA) 的说法,加拿大的土壤非常肥沃且复杂,几乎不可能使其免受这些害虫的侵害。因此,需要采取严格的土壤植物检疫措施,以减少重要土传检疫性害虫传入和传播到加拿大的风险。2021年,加拿大政府将在未来五年内向加拿大食品检验局(CFIA)投资1.626亿美元,每年投资4000万美元,以维护加拿大食品安全体系的完整性,提高食品供应的质量。支持加拿大公司的进出口活动,以保护动植物健康,克服水土流失和全球贸易不稳定。因此,国内对土壤处理有足够的认识,这正在推动该国的市场。

- 在墨西哥,土壤修復受《废物预防和管理法》(LPMW) 的监管,该法规定了当土壤受到危险化学品污染时预防或减少迫在眉睫的健康和环境风险的措施,并需要立即采取清理措施。这些法律建议在国内使用土壤处理产品。

- 墨西哥农药引起的土壤污染是一个严重的问题,各个研究小组正在开发生物策略来评估农药的生物降解性,以及生物减毒方法来处理、修復和使受农药污染的场地变得无害。我们正在开发生物刺激、生物强化和生物强化堆肥方法。这表明日本的土壤处理市场正在迅速扩大。

土壤处理行业概述

研究的市场高度分散,大量公司占据市场份额。然而,Bayer Crop Science AG、Corteva AgriScience、BASF SE、Syngenta、AMVAC Chemical Corporation等公司正在努力增加其市场份额。在全球土壤处理市场中,企业正在将战略併购和业务扩张作为关键战略,同时推出创新产品。除了创新和扩张之外,研发投资和新产品组合的开发也将成为未来几年的关键战略。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 调查范围

第二章研究方法论

第三章执行摘要

第四章市场动态

- 市场概况

- 市场驱动力

- 市场製约因素

- 波特五力分析

- 供应商的议价能力

- 买家和消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

第五章市场细分

- 技术领域

- 理化处理

- 生物处理

- 热处理

- 类型

- 有机添加剂

- pH调节剂

- 土壤保护

- 区域

- 北美

- 美国

- 加拿大

- 墨西哥

- 其他北美

- 欧洲

- 西班牙

- 英国

- 法国

- 德国

- 意大利

- 欧洲其他地区

- 亚太地区

- 中国

- 日本

- 印度

- 澳大利亚

- 韩国

- 亚太其他地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 非洲

- 埃及

- 南非

- 其他非洲

- 北美

第六章 竞争状况

- 最常用的竞争对手策略

- 市场份额分析

- 公司简介

- Bayer CropScience AG

- American Vanguard Corporation

- Syngenta

- BASF SE

- Novozymes AS

- Soil works LLC

- DOWA ECO-SYSTEM Co. Ltd

- Isagro SpA

- ADAMA Ltd(Makhteshim Agan Group)

- Southern Petrochemical Industries Corporation(SPIC)Limited

- SA Lime & Gypsum

- Soil Technologies Corp.

- SWAROOP AGROCHEMICAL INDUSTRIES

- SAINT GOBAIN

- Rallis India Limited

- Ohp Inc.

- Agro phos india limited

- Terracottem Australasia Pty Ltd

- Terramanus Technologies LLC

- KANESHO SOIL TREATMENT SRL/BV

- Platform Specialty Products

- Sardar Bio Chem

- International Rehabilitation and Soil Stabilization Services(IRASSS)

- UPL Limited

- Corteva Agriscience

第七章市场机会与未来趋势

The Soil Treatment Market size is expected to grow from USD 41.89 billion in 2023 to USD 54.78 billion by 2028, at a CAGR of 5.51% during the forecast period (2023-2028).

Key Highlights

- Soil treatment can be used to make contaminated soil usable for agriculture and other purposes. It helps enhance the performance and fertility of the soil. Biological treatment or bioremediation is widely used to remediate soil from organic components like fuel or oils using bacteria to break down the substances in the soil.

- Although biological treatment is economical, it is time-consuming and takes as long as 1 to several months to be carried out. The suitability of bioremediation depends on the contaminants, site conditions, and target levels. Remediation of polluted soil using microbial processes has proven effective and reliable due to its eco-friendly features, and the segment is likely to grow further in the coming years.

- Thermal treatment can remediate contaminated soil rapidly and reliably, but its energy-intensive nature and potential to damage soil properties make it seem less sustainable. The process is also comparatively more expensive; hence, the segment holds a smaller market share. By 2020, the Chinese government had turned 90% of the contaminated farmland into safe agricultural land for crops in China. As such, the government's careful examination of soil pollution in the country gave an impetus for the soil treatment industry to grow during that period.

- In April 2021, the United States Department of Agriculture's (USDA) National Institute of Food and Agriculture (NIFA)invested around USD 21.7 million in several key programs to help agricultural producers manage the impacts of climate change on their lands and production. NIFA also invested USD 6.3 million for 14 Soil Health grants and $5.4 million for seven Signals in the Soil grants through its Agriculture and Food Research Initiative (AFRI).

Soil Treatment Market Trends

Decreasing Per capita Arable Land and Increasing Demand For Food

- According to the United Nations, the global human population reached 8 billion in mid-November 2022 and is expected to increase by nearly 2 billion persons in the next 30 years, from 8 billion in 2022 to 9.7 billion in 2050. With the increasing population levels, the demand for food is projected to double in the years to come. Supplying food to this growing population has become a concern. On the other hand, due to industrialization and urbanization, the area of arable land in major agricultural countries is declining.

- As per the resource outlook for 2050 released by the Food and Agriculture Organization (FAO), only 12% of the global land surface is used for crop production, and there is little scope for further expansion of agricultural land. Hence, there is pressure on the existing arable land to produce more food by using soil treatment products.

- As per the FAO, there is a decline of 54 million hectares of arable land in developed countries in regions like North America, Europe, and South Asia. The projections of this study indicate a further slow decline in the area of arable land to 608 and 586 million hectares in 2030 and 2050, respectively.

- Adequate and balanced use of soil treatment products may help feed the growing population using the available cultivable land.

- In addition to the declining agricultural land, micronutrient deficiency is widespread globally, and Asia-Pacific is one of the major regions affected by this deficiency. Over half of the cereal crop soils are zinc deficient, and around one-third of the cultivated soil is iron deficient. It is estimated that 40-55% of the soils are moderately deficient in zinc, 25-35% in Boron, and approximately 10-15% in other micronutrients. Due to large micronutrient deficiencies in the soil, crops are not responding to fertilizers and pesticides, leading to lesser yield. This issue can be addressed by using Ph adjusters.

North America Dominates the Market

- The increasing concern about soil contamination and remediation in the North American countries like the United States, Canada, and Mexico have triggered soil treatments in the cropland. Soils are a vital component of ecosystems and provide a wide range of ecosystem services that support human well-being and natural systems. Soils are the foundation for agricultural production, providing nutrients and water to crops and supporting the growth of plants that provide food, fiber, and fuel.

- Soils also play a crucial role in water and nutrient cycling, acting as a filter for water and pollutants, regulating water flow, and preventing erosion. The United States Department of Agriculture (USDA) has laid down directives specifying the phytosanitary requirements for the import and domestic movement of soil and soil-related matter during 2020. It includes requirements for soil and items contaminated with soil, such as logs or lumber, vehicles, equipment, tools, and containers.

- According to the Canadian Food Inspection Agency (CFIA), the number and complexity of organisms in the soil in Canada make it nearly impossible for soils to be free of such pests. As a result, strict phytosanitary measures concerning soil are made necessary to limit the risks of the introduction and spread of significant soil-borne quarantine pests into Canada. In the year 2021, the Government of Canada is invested USD 162.6 million in the Canadian Food Inspection Agency (CFIA) over the next five years and USD 40 million per year on an ongoing basis to maintain the integrity of Canada's food safety system, protect the health of plants and animals from safeguarding the food supply, and provide ongoing support to Canadian businesses in their export and import activities to overcome soil erosion, and global trade volatility. Hence, there is adequate awareness in the country about soil treatment, and it is driving the market in the country.

- In Mexico, the remediation of soils is regulated by the Law for the Prevention and Management of Waste (LPMW), under whose provisions it is mandated that when hazardous chemicals contaminate a soil, immediate remedial action to prevent or reduce imminent health risks and the environment must be performed. These laws favor the use of soil treatment products in the country.

- The pesticide soil pollution in Mexico is a serious concern, and different research groups have developed biological strategies for assessing pesticide biodegradation, and bioattenuation, biostimulation, bioaugmentation, and bioaugmentation composting schemes for the treatment, remediation, and detoxification of pesticide-contaminated sites. This suggests that the market for soil treatment is rapidly gaining popularity in the country.

Soil Treatment Industry Overview

The market studied is highly fragmented, with numerous players holding the market share in the market. However, companies such as Bayer Crop Science AG, Corteva AgriScience, BASF SE, Syngenta, and AMVAC Chemical Corporation are some players striving to strengthen their market share in the market. In the global soil treatment market, companies, along with innovative product launches, are also focusing on strategic mergers and acquisitions and expansion as their key adopted strategies. Along with innovations and expansions, investments in R&D and developing novel product portfolios will likely be crucial strategies in the coming years.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Physiochemical Treatment

- 5.1.2 Biological Treatment

- 5.1.3 Thermal Treatment

- 5.2 Type

- 5.2.1 Organic Amendments

- 5.2.2 pH Adjusters

- 5.2.3 Soil Protection

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Spain

- 5.3.2.2 UK

- 5.3.2.3 France

- 5.3.2.4 Germany

- 5.3.2.5 Italy

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 South Korea

- 5.3.3.6 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Africa

- 5.3.5.1 Egypt

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Competitor Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Bayer CropScience AG

- 6.3.2 American Vanguard Corporation

- 6.3.3 Syngenta

- 6.3.4 BASF SE

- 6.3.5 Novozymes AS

- 6.3.6 Soil works LLC

- 6.3.7 DOWA ECO-SYSTEM Co. Ltd

- 6.3.8 Isagro SpA

- 6.3.9 ADAMA Ltd (Makhteshim Agan Group)

- 6.3.10 Southern Petrochemical Industries Corporation (SPIC) Limited

- 6.3.11 SA Lime & Gypsum

- 6.3.12 Soil Technologies Corp.

- 6.3.13 SWAROOP AGROCHEMICAL INDUSTRIES

- 6.3.14 SAINT GOBAIN

- 6.3.15 Rallis India Limited

- 6.3.16 Ohp Inc.

- 6.3.17 Agro phos india limited

- 6.3.18 Terracottem Australasia Pty Ltd

- 6.3.19 Terramanus Technologies LLC

- 6.3.20 KANESHO SOIL TREATMENT SRL/BV

- 6.3.21 Platform Specialty Products

- 6.3.22 Sardar Bio Chem

- 6.3.23 International Rehabilitation and Soil Stabilization Services (IRASSS)

- 6.3.24 UPL Limited

- 6.3.25 Corteva Agriscience